1

Financial reporting rules for financial accounting are set forth by which of the following?

Choose one answer.

|

a. International Standards Committee |

||

|

b. Financial Accounting Standards Board |

||

|

c. World Bank |

||

|

d. United States Federal Reserve |

Question 2

Which of the following covers a stated period of time and reports the company's revenues, expenses, and net income?

Choose one answer.

|

a. Balance sheet |

||

|

b. Statement of cash flows |

||

|

c. Statement of retained earnings |

||

|

d. Income statement |

Question 3

Fill in the blanks. _________________ accounting involves preparing reports for external use, while __________________ accounting provides information for internal management.

Choose one answer.

|

a. managerial, financial |

||

|

b. external, internal |

||

|

c. financial, managerial |

||

|

d. cash, accrual |

Question 4

All of the following are types of assets EXCEPT:

Choose one answer.

|

a. bonds. |

||

|

b. cash. |

||

|

c. prepaid payments. |

||

|

d. inventory. |

Question 5

Complete the following statement. Under the revenue recognition principle, revenues should be earned and realized:

Choose one answer.

|

a. before they are spent. |

||

|

b. before they are recognized. |

||

|

c. after they are recognized. |

||

|

d. after they are spent. |

Question 6

Expenses must match with related expenses, in accordance with which of the following principles?

Choose one answer.

|

a. Balancing principle |

||

|

b. Cash accrual principle |

||

|

c. Revenue-expense principle |

||

|

d. Matching principle |

Question 7

Fill in the blank. Happy Burger purchases a $40,000 food truck to expand its business. The owner calculates the useful life of the food truck to be 15 years, after which it will be completely depreciated. In this scenario, depreciation would be considered a(n) __________ item.

Choose one answer.

|

a. tangible |

||

|

b. accrued |

||

|

c. estimated |

||

|

d. recorded |

Question 8

Fill in the blanks. In T-accounts, credits are listed _________________, while debits are listed ________________.

Choose one answer.

|

a. on the right side, on the left side |

||

|

b. on the left side, on the right side |

||

|

c. next to the balance, below the balance |

||

|

d. above the balance, next to the balance |

Question 9

Fill in the blanks. You collect $1,000 in cash from a customer. This entry would be recorded as a ________________ on the _________________ side of a T-account.

Choose one answer.

|

a. credit, right |

||

|

b. credit, left |

||

|

c. debit, left |

||

|

d. debit, right |

Question 10

The owner's interest in a corporation would be recorded under what category on the Balance Sheet?

Choose one answer.

|

a. Assets |

||

|

b. Shareholder's Equity |

||

|

c. Liabilities |

||

|

d. Expenses |

Question 11

Things of value owned by a business are also known as?

Choose one answer.

|

a. Cash |

||

|

b. Equity |

||

|

c. Accounts Receivables |

||

|

d. Assets |

Question 12

What are the two types of adjusting entries commonly identified in financial accounting?

Choose one answer.

|

a. Deferred and accrued items |

||

|

b. Accrued and depreciated items |

||

|

c. Deferred and prepaid items |

||

|

d. Depreciated and prepaid items |

Question 13

Which of the following accurately presents the fundamental accounting equation?

Choose one answer.

|

a. Assets + Liability + Equity = Capital |

||

|

b. Assets - Liability = Equity |

||

|

c. Assets + Liability - Equity = Net Income |

||

|

d. Assets = Liability + Equity |

Question 14

Which of the following best defines a liability?

Choose one answer.

|

a. Expenses paid by a business |

||

|

b. Pre-paid payments received by a business |

||

|

c. Debt owed by a business |

||

|

d. Stock issued by a business |

Question 15

Which of the following contribute to shareholder's equity?

Choose one answer.

|

a. Cash paid in by investors |

||

|

b. Retained earnings |

||

|

c. Assets |

||

|

d. Both A and B |

Question 16

Which of the following is an example of a liability?

Choose one answer.

|

a. Prepaid interest |

||

|

b. Cash |

||

|

c. Accounts receivable |

||

|

d. Accounts payable |

Question 17

Which of the following are steps in the accounting cycle?

Choose one answer.

|

a. Analyze transactions, journalize transactions, and post entries |

||

|

b. Post entries, track adjustments, and record post-closing information |

||

|

c. List source documents, correct transactions, and calculate post-closing entries |

||

|

d. Post transactions, track source documents, and balance entries |

Question 18

Fill in the blank. The fundamental difference between indirect and direct cash flow statements is how _____________ activities are recorded.

Choose one answer.

|

a. operating |

||

|

b. investing |

||

|

c. financing |

||

|

d. revenue |

Question 19

Income and expense accounts are examples of what type of account, and why?

Choose one answer.

|

a. Temporary accounts, because they are closed at the end of an accounting period |

||

|

b. Temporary accounts, because they are only recorded once |

||

|

c. Permanent accounts, because the amounts are accrued over time |

||

|

d. Permanent accounts, because they are carried over from one accounting cycle to the next |

Question 20

Sip and Slurp is a local convenient store that has opened its first store. The owners have decided to record all transactions when they occur, even if cash is not exchanged. What type of accounting system is being used by this company?

Choose one answer.

|

a. Exchange accounting |

||

|

b. Cash accounting |

||

|

c. Cash-accrual accounting |

||

|

d. Accrual accounting |

Question 21

To prepare a balance sheet from T-accounts, you should do which of the following?

Choose one answer.

|

a. Add all account balances, and keep the running total. |

||

|

b. Use the trial balances from all T-accounts related to balance sheet items. |

||

|

c. Only use the trial balances for revenue accounts. |

||

|

d. Only use the trial balances for expense accounts. |

Question 22

To prepare an income statement from T-accounts, you should do which of the following?

Choose one answer.

|

a. Close revenue accounts with credit balances to a special temporary account. |

||

|

b. Close revenue accounts with debit balances to a special temporary account. |

||

|

c. Close expense accounts with debit balances to a special temporary account. |

||

|

d. Both A and C |

Question 23

Which of the following best describes what pro forma statements are and what information they convey?

Choose one answer.

|

a. Pro forma statements are public financial statements used to determine a company's profitability. |

||

|

b. Pro forma statements are estimated financial statements that are often used for business plans or to forecast future cash requirements. |

||

|

c. Pro forma statements are historical records used to determine the company's debt to equity ratio. |

||

|

d. Pro forma statements are abbreviated balance sheets and only given to the company's owners. |

Question 24

Which of the following would be a transaction recorded on the statement of cash flows?

Choose one answer.

|

a. A company receives $150,000 in credit card late payments for the current fiscal year. |

||

|

b. A company writes off over $1 million in bad debt expenses. |

||

|

c. A company spends $10,000 to acquire a competitor company. |

||

|

d. A company receives a tax notice from the IRS to pay $15,000 in back taxes. |

Question 25

Which scenario is an example that may lead to a non-recurring item on the income statement?

Choose one answer.

|

a. A company purchases a new van paid in cash. |

||

|

b. A company acquires a rival and offers more than the asking price. |

||

|

c. Two companies merge and open a new warehouse. |

||

|

d. A company decides to discontinue a product line and closes several factories as a result. |

Question 26

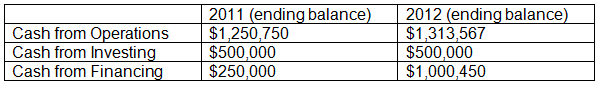

XYZ Enterprise had the following balances on its statement of cash flows. What can be concluded about its business activities between 2011 and 2012?

Choose one answer.

|

a. The company’s operations are in decline. |

||

|

b. The company invested heavily in a new million dollar warehouse. |

||

|

c. The company took out a loan for $750,450. |

||

|

d. The company sold their large equipment for $250,000 in 2011. |

Question 27

When closing T-accounts, which of the following steps must be taken?

Choose one answer.

|

a. Add all account balances, and keep the running total. |

||

|

b. Reduce only revenue accounts to zero, and keep expense balances unchanged. |

||

|

c. Reduce only dividend account balances to zero, and keep expense and revenue balances unchanged. |

||

|

d. Reduce revenue, expense, and dividend account balances to zero. |

Question 28

Complete the following statement. The direct write-off method can only be used if the bad debt is:

Choose one answer.

|

a. material and will not significantly alter the financial statements. |

||

|

b. material and will significantly alter the financial statements. |

||

|

c. immaterial and will significantly alter the financial statements. |

||

|

d. immaterial and will not significantly alter the financial statements. |

Question 29

Helping Hands, a construction company, recorded the following for the current fiscal year: $220,000 in credit sales; $125,000 in cash sales; a $350,000 ending accounts receivable balance; and a $145,000 ending accounts payable balance. What is the accounts receivable turnover for Helping Hands?

Choose one answer.

|

a. 0.36 |

||

|

b. 0.63 |

||

|

c. 0.66 |

||

|

d. 0.86 |

Question 30

Ice Ice Cream, a new ice cream restaurant, allows customers to order food and pay with their Ice Ice Cream credit card. Currently there are 5 customers who have an outstanding balance that has not been paid for 9 months or more. What should the company do about these unreceived funds?

Choose one answer.

|

a. Take the customers to small claims court. |

||

|

b. Continue to collect the balances owed for another 48 months. |

||

|

c. Consider writing off the balances as a bad debt expense. |

||

|

d. Reduce the balance owed to encourage customers to pay their bill. |

Question 31

Which of the following statements regarding how writing off a bad debt expense affects a company's accounts receivable balance is true?

Choose one answer.

|

a. Writing off a bad debt expense will increase a company's accounts receivable balance. |

||

|

b. Writing off a bad debt expense will decrease a company's accounts receivable balance. |

||

|

c. Writing off a bad debt expense will eliminate a company's accounts receivable balance. |

||

|

d. Writing off bad debt does not affect a company's accounts receivable balance. |

Question 32

A customer purchases a computer from your retail store. The selling price is $1,200. The customer pays $200 in cash and charges the remaining balance on the store's credit card. The $1,000 charged would be recorded in which account?

Choose one answer.

|

a. Accounts payable |

||

|

b. Accounts receivable |

||

|

c. Credit payable |

||

|

d. Liability |

Question 33

Community Builders is a local company that builds pine wood sheds to sell to homeowners. On February 15th, the company purchased $1,000 of pine wood ($1.25 per wood plank), and then the company purchased $850 more inventory when prices fell in April to $0.85 per wood plank. In the first 6 months of the current fiscal year, Community Builders sold 30 sheds (each shed uses 40 wood planks). What is the LIFO reserve for this inventory?

Choose one answer.

|

a. 180 |

||

|

b. 240 |

||

|

c. 300 |

||

|

d. 410 |

Question 34

Complete the following statement. The fundamental difference between FIFO and LIFO cost assumptions is:

Choose one answer.

|

a. which inventory is used first and which is used last. |

||

|

b. the way a company makes its final product. |

||

|

c. the way that the inventory that gets sold is priced. |

||

|

d. the way a company calculates its depreciation. |

Question 35

How are LIFO inventory numbers converted into FIFO inventory numbers?

Choose one answer.

|

a. Add the LIFO reserve and the LIFO inventory numbers. |

||

|

b. Add the FIFO reserve and the LIFO inventory numbers. |

||

|

c. Subtract the LIFO reserve and the LIFO inventory numbers. |

||

|

d. Subtract the FIFO reserve and the LIFO inventory numbers. |

Question 36

Which of the following best describes the difference between merchandising and manufacturing firms?

Choose one answer.

|

a. Manufacturing firms purchase raw materials to make products, whereas merchandising firms purchase finished goods to sell to customers. |

||

|

b. Merchandising firms purchase raw materials to make products, whereas manufacturing firms purchase finished goods to sell to customers. |

||

|

c. Both manufacturing and merchandising firms purchase raw materials, but manufacturing firms sell to other businesses, while merchandising firms sell to individual customers. |

||

|

d. Merchandising firms keep excess inventory in a warehouse, whereas manufacturing firms do not keep any excess inventory. |

Question 37

Which of the following is NOT a type of inventory reporting method for a merchandising firm?

Choose one answer.

|

a. First in, last out |

||

|

b. Last in, first out |

||

|

c. First in, first out |

||

|

d. Weighted average cost |

Question 38

You purchase a shipment of inventory on January 31st and another shipment March 15th of the same year. If you use the January 31st inventory first and record its price, then what type of inventory reporting method are you most likely using?

Choose one answer.

|

a. Weighted Average Cost |

||

|

b. LIFO reserve |

||

|

c. LIFO |

||

|

d. FIFO |

Question 39

Which of the following are needed to generate an income statement for a merchandising firm?

Choose one answer.

|

a. Revenues, cost of goods sold, and expenses |

||

|

b. Cost of goods sold, inventory, and expenses |

||

|

c. Expenses, pre-paid payments, and inventory |

||

|

d. Cost of goods sold, raw materials, and expenses |

Question 40

Fill in the blanks. Depreciation is to ________________ as amortization is to __________________.

Choose one answer.

|

a. inventory, patents |

||

|

b. assets, liabilities |

||

|

c. tangible assets, intangible assets |

||

|

d. property, equipment |

Question 41

How is impairment loss recorded in a T-account for a piece of machinery equipment?

Choose one answer.

|

a. Credit impairment loss, debit accumulated depreciation, debit equipment, and credit equipment |

||

|

b. Debit impairment loss, credit accumulated depreciation, debit equipment, and credit equipment |

||

|

c. Debit impairment loss, debit accumulated depreciation, credit equipment, and credit equipment |

||

|

d. Debit impairment loss, debit accumulated depreciation, debit equipment, and credit equipment |

Question 42

Using, straight-line depreciation, how much depreciation would be recorded each year for the value loss for a $10,000 school bus with a useful life of 15 years?

Choose one answer.

|

a. $150.00 |

||

|

b. $666.67 |

||

|

c. $1000.00 |

||

|

d. $1250.25 |

Question 43

Fill in the blanks. A company is able to _____________ the cost of acquiring a resource if the resource will provide the company with a tangible benefit for more than one fiscal year. Companies _________ costs that provide only one fiscal year's worth of benefits.

Choose one answer.

|

a. expense, capitalize |

||

|

b. capitalize, expense |

||

|

c. depreciate, expense |

||

|

d. amortize, capitalize |

Question 44

How are indefinite-life intangible assets recorded on a company's balance sheet?

Choose one answer.

|

a. Indefinite-life intangible assets are depreciated by using straight-line or double declining balance methods. |

||

|

b. Indefinite-life intangible assets are written off after 10 years. |

||

|

c. Indefinite-life intangible assets are amortized like other intangible assets. |

||

|

d. Indefinite-life intangible assets are not amortized; instead, they are evaluated periodically for impairment. |

Question 45

Which of the following are examples of identified intangible assets?

Choose one answer.

|

a. Cash and goodwill |

||

|

b. Goodwill and accounts receivable |

||

|

c. Copyrights and land |

||

|

d. Intellectual property and copyrights |

Question 46

Which of the following best describes goodwill?

Choose one answer.

|

a. The name, sign, symbol, or design that immediately identifies a company's product or service |

||

|

b. Something of future or potential value |

||

|

c. An intangible value attached to a company resulting mainly from the company's management skill or know-how and a favorable reputation with customers |

||

|

d. A responsibility that a company needs to fulfill long-term |

Question 47

Why would a company want to capitalize an intangible asset?

Choose one answer.

|

a. An intangible asset will provide the company with tangible benefits for one fiscal year. |

||

|

b. An intangible asset will provide the company with tangible benefits for more than one fiscal year. |

||

|

c. An intangible asset will eventually be converted into a tangible asset. |

||

|

d. Intangible assets cannot be capitalized. |

Question 48

Which of the following is NOT an example of an intangible asset?

Choose one answer.

|

a. Equipment |

||

|

b. Goodwill |

||

|

c. Copyrights |

||

|

d. Patents |

Question 49

Complete the following statement. A bond issued with a coupon rate higher than the current interest rate is said to be issued at:

Choose one answer.

|

a. a premium. |

||

|

b. a discount. |

||

|

c. par. |

||

|

d. a declining rate. |

Question 50

How are bond prices calculated?

Choose one answer.

|

a. Take the average of the present values of all expected coupon payments, and divide the present value of the par value at maturity. |

||

|

b. Use the sum of the future values of all expected coupon payments, and add the future value of the par value at maturity. |

||

|

c. Use the sum of the present values of all expected coupon payments, and add the present value of the par value at maturity. |

||

|

d. None of the above |

Question 51

Fill in the blank. A loan that has a payment life of 10 years is considered to be a(n) _______________ liability.

Choose one answer.

|

a. current |

||

|

b. long-term |

||

|

c. definite-life |

||

|

d. indefinite-life |

Question 52

Fill in the blank. Toys-A-Bunch's 2012 financial statements were recently released to the public. Revenues totaled $14.8 million, current assets totaled $21.89 million, current liabilities totaled $3.45 million, and long-term liabilities remained unchanged at $5.35 million. Toys-A-Bunch's ________ ratio was found to be 6.34.

Choose one answer.

|

a. quick |

||

|

b. current |

||

|

c. working |

||

|

d. gross profit |

Question 53

In 2011, Utility Queen recorded an EBIT (Earning before Income Tax) of $505,000; accounts receivables balance of $500,000; $25,000 in interest expenses; and $315,000 in long-term debt. What was the company's interest coverage ratio for 2011?

Choose one answer.

|

a. 0.05 |

||

|

b. 12.6 |

||

|

c. 14.6 |

||

|

d. 20.2 |

Question 54

In 2012, company AlphaBites generated a total revenue of $125,000 with $500,000 of total assets on the company's financial statements. The total overall expense for the fiscal year was recorded as $88,500. What was the asset turnover for this firm?

Choose one answer.

|

a. 0.015 |

||

|

b. 0.073 |

||

|

c. 0.22 |

||

|

d. 0.25 |

Question 55

In 2012, Utility Queen recorded an EBIT (Earning before Income Tax) of $535,000; $1.35 million in shareholder's equity; an accounts payable balance of $250,000; and $385,000 in total liabilities. What was the company's debt-to-equity ratio for 2011?

Choose one answer.

|

a. 0.29 |

||

|

b. 0.33 |

||

|

c. 0.40 |

||

|

d. 1.54 |

Question 56

Toys-A-Bunch's 2012 financial statements were recently released to the public. Revenues totaled $14.8 million, current assets totaled $21.89 million, current liabilities totaled $3.45 million, and long-term liabilities remained unchanged at $5.35 million. What is Toys-A-Bunch's working capital?

Choose one answer.

|

a. $11.45 million |

||

|

b. $16.54 million |

||

|

c. $18.44 million |

||

|

d. $27.89 million |

Question 57

Which of the equations is commonly used to determine a company's long-term solvency?

Choose one answer.

|

a. Long-Term Debt ÷ Current Assets |

||

|

b. Total Debt ÷ Total Assets |

||

|

c. Current Debt x Total Liabilities |

||

|

d. (Equity + Total Debt) ÷ Total Assets |

Question 58

In 2012, company AlphaBites generated a total revenue of $125,000 with $500,000 of total assets on the company's financial statements. The total overall expense for the fiscal year was recorded as $88,500. What was the ROA for this firm?

Choose one answer.

|

a. 4.5% |

||

|

b. 6.1% |

||

|

c. 7.3% |

||

|

d. 10.2% |

Question 59

Historical financial statement ratios are often used to generate future financial statements when financial analysts conduct which of the following?

Choose one answer.

|

a. Pro-forma estimation |

||

|

b. Vertical analysis |

||

|

c. Financial statement forecasting |

||

|

d. Comparative analysis |

Question 60

Platinum Enterprises, Inc. had a net income in 2010 of $1.2 million. In 2011, operations suffered after several plants were destroyed following an earthquake, and net income dropped to $650,000. How would this affect the return on equity ratio for 2011? (Assume shareholders' equity remains constant.)

Choose one answer.

|

a. The return on equity would decrease by 35.5%. |

||

|

b. The return on equity would decrease by 45.8%. |

||

|

c. The return on equity would increase by 25.2%. |

||

|

d. The return on equity would increase by 37.6%. |

Question 61

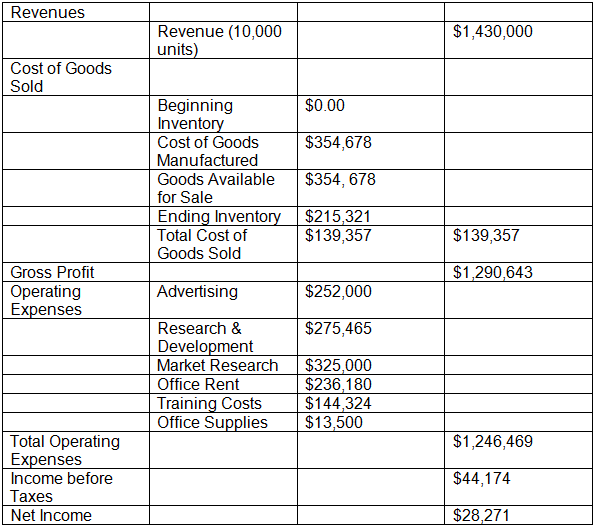

Review the following income statement for ABCD Builders. What can be concluded from the financial data?

Choose one answer.

|

a. The company’s operating expenses are higher due to the decrease in inventory held. |

||

|

b. The company saw a net gain in profit due to the increase in inventory held. |

||

|

c. The company discontinued operations that resulted in a higher cost of good sold. |

||

|

d. The company is generating a low net income due to the high operating expenses. |

Question 62

Which of the following is NOT a ratio that can be calculated to determine a company's profitability?

Choose one answer.

|

a. Inventory turnover |

||

|

b. Profit margin |

||

|

c. Return on equity |

||

|

d. Return on assets |

Question 63

A financial analyst examined the financial statements of a company from fiscal years: 2009, 2010, 2011, and 2012. This would be an example of which type of financial statement analysis?

Choose one answer.

|

a. Historical analysis |

||

|

b. Vertical analysis |

||

|

c. Horizontal analysis |

||

|

d. Comparative analysis |