Before we go any further, we need to nail down a couple of key concepts. First, just what, exactly, do we mean by personal finances? Finance itself concerns the flow of money from one place to another, and your personal finances concern your money and what you plan to do with it as it flows in and out of your possession. Essentially, then, personal financeThe application of financial principles to the monetary decisions of an individual or a family. is the application of financial principles to the monetary decisions that you make either for your individual benefit or for that of your family.

Second, as we suggested in the previous section of this chapter—and as we’ll insist in the rest of it—monetary decisions work out much more beneficially when they’re planned rather than improvised. Thus our emphasis on financial planningThe process of managing your personal finances to meet goals that you’ve set for yourself or your family.—the ongoing process of managing your personal finances in order to meet goals that you’ve set for yourself or your family.

Financial planning requires you to address several questions, some of them relatively simple:

Others will require some investigation and calculation:

Still others will require some forethought and forecasting:

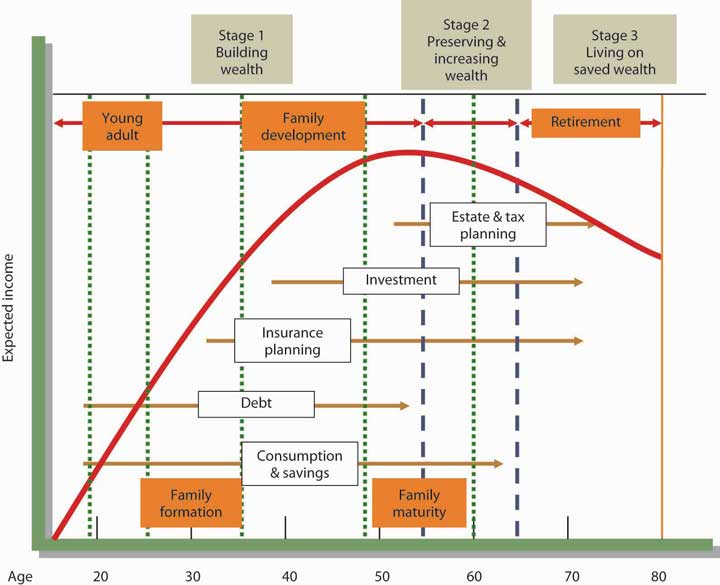

Another question that you might ask yourself—and certainly would do if you were a professional in financial planning—is something like: “How will my financial plans change over the course of my life?” Figure 14.4 "Financial Life Cycle" illustrates the financial life cycle of a typical individual—one whose financial outlook and likely outcomes are probably a lot like yours.This section is based on Arthur J. Keown, Personal Finance: Turning Money into Wealth, 4th ed. (Upper Saddle River, NJ: Pearson Education, 2007), 8–11. As you can see, our diagram divides this individual’s life into three stages, each of which is characterized by different life events (such as beginning a family, buying a home, planning an estate, retiring). At each stage, too, there are recommended changes in the focus of the individual’s financial planning:

Figure 14.4 Financial Life Cycle

At each stage, of course, complications can set in—say, changes in such conditions as marital or employment status or in the overall economic outlook. Finally, as you can also see, your financial needs will probably peak somewhere in stage 2, at approximately age fifty-five, or ten years before typical retirement age.

Until you’re eighteen or so, you probably won’t generate much income; for the most part, you’ll be living off your parents’ wealth. In our hypothetical life cycle, however, financial planning begins in the individual’s early twenties. If that seems like rushing things, consider a basic fact of life: this is the age at which you’ll be choosing your career—not only the sort of work you want to do during your prime income-generating years, but also the kind of lifestyle you want to live in the process.See Arthur J. Keown, Personal Finance: Turning Money into Wealth, 4th ed. (Upper Saddle River, NJ: Pearson Education, 2007), 11.

What about college? Most readers of this book, of course, have decided to go to college. If you haven’t yet decided, you need to know that college is an extremely good investment of both money and time.

Table 14.1 "Education and Average Income", for example, summarizes the findings of a recent study conducted by the U.S. Census Bureau.U.S. Census Bureau, “One-Third of Young Women Have Bachelor’s Degrees” (U.S. Department of Commerce, January 10, 2008), http://www.census.gov/Press-Release/www/releases/archives/education/011196.html (accessed September 18, 2008). A quick review shows that people who graduate from high school can expect to increase their average annual earnings by about 49 percent over those of people who don’t, and those who go on to finish college can expect to generate 82 percent more annual income than that. Over the course of the financial life cycle, families headed by those college graduates will earn about $1.6 million more than families headed by high school graduates who didn’t attend college. (With better access to health care—and, studies show, with better dietary and health practices—college graduates will also live longer. And so will their children.)

Table 14.1 Education and Average Income

| Education | Average income | Percentage increase over next-highest level |

|---|---|---|

| High school dropout | $20,873 | — |

| High school diploma | $31,071 | 48.9% |

| College degree | $56,788 | 82.8% |

| Advanced higher-education degree | $82,320 | 45.0% |

Source: Adapted from U.S. Census Bureau, “One-Third of Young Women Have Bachelor’s Degrees” (U.S. Department of Commerce, January 10, 2008), http://www.census.gov/Press-Release/www/releases/archives/education/011196.html (accessed September 18, 2008).

And what about the debt that so many people accumulate to finish college? For every $1 that you spend on your college education, you can expect to earn about $35 during the course of your financial life cycle.See Katharine Hansen, “What Good Is a College Education Anyway?” Quintessential Careers (2008), http://www.quintcareers.com/college_education_value.html (accessed September 18, 2008). At that rate of return, you should be able to pay off your student loans (unless, of course, you fail to practice reasonable financial planning).

Naturally, there are exceptions to these average outcomes. You’ll find English-lit majors stocking shelves at 7-Eleven, and you’ll find college dropouts running multibillion-dollar enterprises. Microsoft cofounder Bill Gates dropped out of college after two years, as did his founding partner, Paul Allen. Current Microsoft CEO Steve Ballmer finished his undergraduate degree but quit his MBA program to join Microsoft (where he apparently fit in among the other dropouts in top management). It’s always good to remember, however, that though exceptions to rules (and average outcomes) occasionally modify the rules, they invariably fall far short of disproving them: in entrepreneurship as in most other walks of adult life, the better your education, the more promising your financial future. One expert in the field puts the case for the average person bluntly: educational credentials “are about being employable, becoming a legitimate candidate for a job with a future. They are about climbing out of the dead-end job market.”John G. Ramsay, Perlman Center for Learning and Teaching, quoted by Katharine Hansen, “What Good Is a College Education Anyway?” Quintessential Careers (2008), http://www.quintcareers.com/college_education_value.html (accessed September 18, 2008).

Finally, does it make any difference what you study in college? To a perhaps surprising extent, not necessarily. Some career areas, such as engineering, architecture, teaching, and law, require targeted degrees, but the area of study designated on your degree often doesn’t matter much when you’re applying for a job. If, for instance, a job ad says, “Business, communications, or other degree required,” most applicants and hires will have those “other” degrees. When poring over résumés for a lot of jobs, potential employers look for the degree and simply note that a candidate has one; they often don’t need to focus on the particulars.See J. D. Roth, “The Value of a College Education,” MSN Money, February 4, 2008, http://blogs.moneycentral.msn.com/smartspending/archive/2008/02/04/the-value-of-a-college-education.aspx (accessed September 18, 2008).

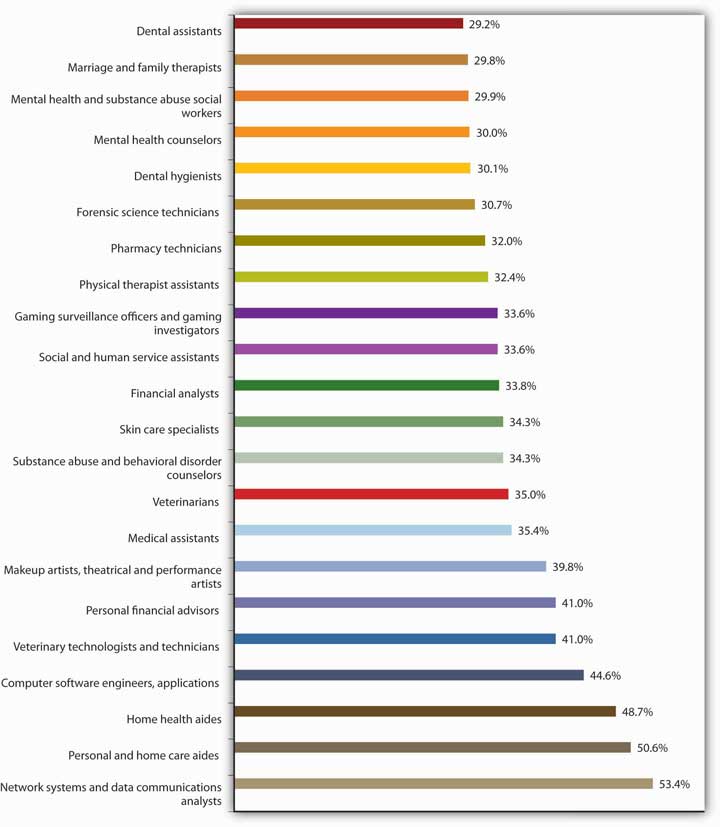

This is not to say, however, that all degrees promise equal job prospects. Figure 14.5 "Top 25 Fastest-Growing Jobs, 2006–2016", for example, summarizes a U.S. Bureau of Labor Statistics projection of the thirty fast-growing occupations for the years 2006–2016. Veterinary technicians and makeup artists will be in demand as never before, but as you can see, occupational prospects are fairly diverse.

Figure 14.5 Top 25 Fastest-Growing Jobs, 2006–2016

Source: Data from U.S. Bureau of Labor Statistics, “The 30 Fastest-Growing Occupations, 2006–2016” (Washington, DC, December 4, 2007), Table 6, at http://data.bls.gov/cgi-bin/print.pl/news.release/ecopro.t06.htm (September 20, 2008).

Nor, of course, do all degrees pay off equally. In Table 14.2 "College Majors and Average Annual Earnings", we’ve extracted the findings of a study conducted by the National Science Foundation on the earnings of individuals with degrees in various undergraduate fields. Clearly, some degrees—notably in the engineering fields—promise much higher average earnings than others. Chemical engineers, for instance, can earn nearly twice as much as elementary school teachers, but there’s a catch: if you graduate with a degree in chemical engineering, your average annual salary will be about $67,000 if you can find a job related to that degree; if you can’t, you may have to settle for as much as 40 percent less.Daniel Penrice, “Major Moolah: Adding Up the Earnings Gaps in College Majors,” N.U. Magazine, January 1999, http://www.northeastern.edu/magazine/9901/labor.html (accessed September 18, 2008). (Supermodel Cindy Crawford cut short her studies in chemical engineering because there was more money to be made on the runway.)

Table 14.2 College Majors and Average Annual Earnings

| Major | Average Earnings with Bachelor’s Degree | Major | Average Earnings with Bachelor’s Degree |

|---|---|---|---|

| Chemical engineering | $67,425 | History | $45,926 |

| Aerospace engineering | $65,649 | Biology | $45,532 |

| Computer engineering | $62,527 | Nursing | $45,538 |

| Physics | $62,104 | Psychology | $43,963 |

| Electrical engineering | $61,534 | English | $43,614 |

| Mechanical engineering | $61,382 | Health technology | $42,524 |

| Industrial engineering | $61,030 | Criminal justice | $41,129 |

| Civil engineering | $58,993 | Physical education | $40,207 |

| Accounting | $56,637 | Secondary education | $39,976 |

| Finance | $55,104 | Fine arts | $38,857 |

| Computer science | $52,615 | Philosophy | $38,239 |

| Business management | $52,321 | Dramatic arts | $37,091 |

| Marketing | $51,107 | Music | $36,811 |

| Journalism | $46,835 | Elementary education | $34,564 |

| Information systems | $46,519 | Special education | $34,196 |

Sources: Daniel Penrice, “Major Moolah: Adding Up the Earnings Gaps in College Majors,” N.U. Magazine (January 1999), http://www.northeastern.edu/magazine/9901/labor.html (accessed September 18, 2008). Data from Paul Harrington and Andrew Sum, “The Post-College Earnings Experiences of Bachelor Degree Holders in the U.S.: Estimated Economic Returns to Major Fields of Study,” in Learning and Work on Campus and on the Job: The Evolving Relationship between Higher Education and Employment, ed. S. Reder, B. A. Holland, and M. P. Latiolais (in preparation).

In short, when you’re planning what to do with the rest of your life, it’s a good idea to check into the fine points and realities, as well as the statistical data. If you talk to career counselors and people in the workforce, you might be surprised by what you learn about the relationship between certain college majors and various occupations. Onetime Hewlett-Packard CEO Carly Fiorina majored in medieval history and philosophy.

Let’s revisit one of the facts included in the earlier discussion: for every $1 that you spend on your college education, you can expect to earn about $35 during the course of your financial life cycle. And let’s say you’re convinced (as you should be) that getting a college degree is a wise financial choice. You still have to deal with the cost of getting your degree. We’re sure this won’t come as a surprise: attending college is expensive—tuition and fees have gone up sharply, the cost of books has skyrocketed, and living expenses have climbed. Many students can attend college only if they receive some type of financial aid. Though the best way to learn what aid is available to you is to talk with a representative in the financial aid office at your school, this section provides an overview of the types of aid offered to students. Students finance their education through scholarships, grants, education loans, and work-study programs.Denise Witmer, “The Basics of Financial Aid for College,” About.com, http://parentingteens.about.com/od/collegeinfo/a/financial_aid.htm (accessed August 30, 2008). We’ll explore each of these categories of aid:

As was highlighted earlier, your financial life cycle begins at the point when you choose a career. Building your career takes considerable planning. It begins with the selection of a major in college and continues through graduation as you enter the workforce full time. You can expect to hold a number of jobs over your working life. If things go as they should, each job will provide valuable opportunities and help you advance your career. A big challenge is getting a job offer in your field of interest, evaluating the offer, and (if you have several options) selecting the job that’s right for you.This section is based in part on sections 13 and 14 of the Playbook for Life by The Hartford. The Playbook can be found on line at http://www.playbook.thehartford.com.

Most likely your college has a career center. The people working there can be a tremendous help to you as you begin your job search. But most of the work has to be done by you. Like other worthwhile projects, your job search project will be very time-consuming. As you get close to graduation, you’ll need to block out time to work on this particularly important task.

The first step is to prepare a résuméA document that provides a summary of educational achievements and relevant job experience., a document that provides a summary of educational achievements and relevant job experience. Its purpose is to get you an interview. A potential employer will likely spend less than a minute reviewing your résumé, so its content should be concise, clear, and applicable to the job for which you’re applying. For some positions, the person in charge of hiring might read more than a hundred résumés. If you don’t want your résumé kicked out right away, be sure it contains no typographical or grammatical errors. Once you’ve completed your résumé, you can use it to create different versions tailored to specific companies you’d like to work for. Your next step is to write a cover letterA document accompanying your résumé that explains why you’re sending your résumé and highlights your qualifications., a document accompanying your résumé that explains why you’re sending your résumé and highlights your qualifications. You can find numerous tips on writing résumés and cover letters (as well as samples of both) online. Be sure your résumé is accurate: never lie or exaggerate in a résumé. You could get caught and not get the job (or—even worse—you could get the job, get caught, and then get fired). It’s fairly common practice for companies to conduct background checks of possible employees, and these checks will point out any errors. In effect, says one expert, “you jeopardize your future when you lie about your past.”Kim Isaacs, “Lying on Your Resume: What Are the Career Consequences?,” Monster.com, http://career-advice.monster.com/resume-writing-basics/Lying-on-Your-Resume/home.aspx (accessed August 30, 2008).

After writing your résumé and cover letter, your next task is to create a list of companies you’d like to work for. Use a variety of sources, including your career services office and company Web sites, to decide which companies to put on your list. Visit the “career or employment” section of the company Web sites and search for specific openings.

You could also conduct a general search for positions that might be of interest to you, by doing the following:

Once you spot a position you want, send your résumé and cover letter (tailored to the specific company and job). Follow up in a few days to be sure your materials got to the right place, and offer to provide any additional information. Keep notes on all contacts.

When you’re invited for an interview, visit to the company’s Web site and learn as much as you can about the company. Practice answering questions you might be asked during the interview, and think up a few pertinent questions to ask your interviewer. Dress conservatively—males should wear a suit and tie and females should wear professional-looking clothes. Try to relax during the interview (though everyone knows this isn’t always easy). Your goal is to get an offer, so let the interviewer learn who you are and how you can be an asset to the company. Send a thank-you note (or thank-you e-mail) to the interviewer after the interview.

Let’s be optimistic and say that you did quite well in your interviews, and you have two job offers. It’s a great problem to have, but now you have to decide which one to accept. Salary is important, but it’s clearly not the only factor. You should consider the opportunities the position offers: will you learn new things on the job, how much training will you get, could you move up in the organization (and if so, how quickly)? Also consider quality of life issues: how many hours a week will you have to work, is your schedule predictable (or will you be asked to work on a Friday night or Saturday at the last minute), how flexible is your schedule, how much time do you get off, how stressful will the job be, do you like the person who will be your manager, do you like your coworkers, how secure is the job, how much travel is involved, where’s the company located, and what’s the cost of living in that area? Finally, consider the financial benefits you’ll receive. These could include health insurance, disability insurance, flexible spending accounts, and retirement plans. Let’s talk more about the financial benefits, beginning with health insurance.

The financial life cycle divides an individual’s life into three stages, each of which is characterized by different life events. Each stage also entails recommended changes in the focus of the individual’s financial planning:

To conduct a general search for positions that might be of interest to you, you could:

When comparing job offers, consider more than salary. Also of importance are quality of life issues and benefits. Common financial benefits include health insurance, disability insurance, flexible spending accounts, and retirement plans.

(AACSB) Analysis

Think of the type of job you’d like to have. Describe the job and indicate how you’d go about getting a job offer for this type of job. How would you evaluate competing offers from two companies? What criteria would you use in selecting the right job for you?