Did you ever think about how much data you yourself generate? Just remember what you went through to start college. First, you had to fill out application forms asking you about test scores, high school grades, extracurricular activities, and finances, plus demographic data about you and your family. Once you’d picked a college, you had to supply data on your housing preferences, the curriculum you wanted to follow, and the party who’d be responsible for paying your tuition. When you registered for classes, you gave more data to the registrar’s office. When you arrived on campus, you gave out still more data to have your ID picture taken, to get your computer and phone hooked up, to open a bookstore account, and to buy an on-campus food-charge card. Once you started classes, data generation continued on a daily basis: your food card and bookstore account, for example, tracked your various purchases, and your ID tracked your coming and going all over campus. And you generated grades.

And all these data apply to just one aspect of your life. You also generated data every time you used your credit card and your cell phone. Who uses all these data? How are they collected, stored, analyzed, and distributed in organizations that have various reasons for keeping track of you?

To answer such questions, let’s go back to our Harrah’s example. As we’ve seen, Harrah’s collects a vast amount of data. Its hotel system generates data when customers make reservations, check in, buy food and beverages, purchase stuff at shops, attend entertainment events, and even relax at the spa. In the casino, customers apply for rewards programs, convert cash to chips (and occasionally chips back to cash), try their luck at the tables and slots, and get complimentary drinks. Then, there are the data generated by the activities of the company itself: employees, for instance, generate payroll and benefits data, and retail operations generate data every time they buy or sell something. Moreover, if we added up all these data, we’d have only a fraction of the amount generated by the company’s gaming operations.

How does Harrah’s handle all these data? First of all, it captures and stores them in several databasesElectronic collection of related data accessible to various users.—electronic collections of related data that can be accessed by various members of the organization. Think of databases as filing cabinets that can hold massive amounts of organized information, such as revenues and costs from hotel activities, casino activities, and events reservations at each of Harrah’s facilities.

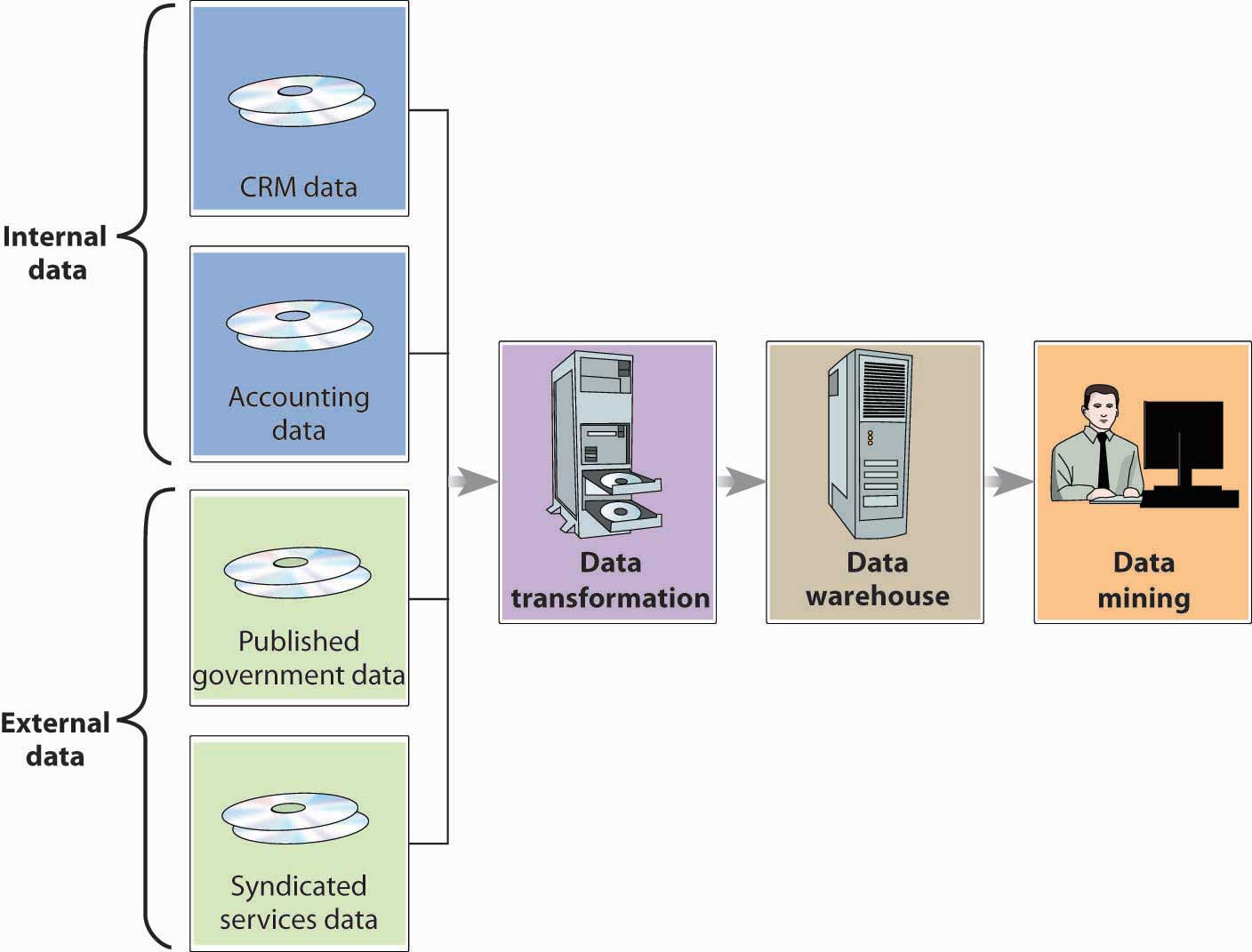

What if Harrah’s wants to target customers who generate a lot of revenue, by using a program designed to entice return visits? How would it identify and contact these people? Theoretically, it could search through the relevant databases—those that hold customer-contact information (such as name and address) and information about customer activity in the company’s hotels, casinos, and entertainment venues. It would be a start, perhaps, but it wouldn’t be very efficient. First of all, it would be time-consuming. Plus, what if the same data weren’t stored in a similar fashion in each database? In that case, it would be quite hard to combine the data in a meaningful way. To address this problem, Harrah’s managers will rely on a system like the one illustrated in Figure 15.4 "The Data Mining Process", which calls for moving all the relevant data into a data warehouseCentralized database that stores data from several databases so they can be easily analyzed.—a centralized database in which data from several databases are consolidated and organized so that they can be easily analyzed.

Figure 15.4 The Data Mining Process

With the data in one central location, management can find out everything it needs to about a particular group of customers. It can also use the data to address some pretty interesting questions. Why do people come to our casinos? How can we keep customers coming back? How can we increase the number of visits per customer? How can we increase the amount they spend on each visit? What incentives (such as free dinners, hotel rooms, or show tickets) do our customers like most? To come up with answers to these questions, they’ll perform a technique called data miningTechnique used to search and analyze data to reveal patterns and trends that can be used to predict future behavior.—the process of searching and analyzing large amounts of data to reveal patterns and trends that can be used to predict future behavior.

By data-mining its customer-based data warehouse, Harrah’s management can discover previously unknown relationships between the general behavior of its customers and that of a certain group of customers (namely, the most profitable ones). Then, it can design incentives to appeal specifically to those people who will generate the most profit for the company.

To get a better idea of how data mining works, let’s simplify a description of the process at Harrah’s. First, we need to know how the casino gathered the data to conduct its preliminary analysis. Most customers who play the slots use a Harrah’s player’s card that offers incentives based on the amount of money that they wager on slot machines, video poker, and table games.Harrah’s, “Total Rewards,” http://www.harrahs.com/total_rewards/overview/overview.jsp (accessed June 2, 2006). To get the card, a customer must supply some personal information, such as name, address, and phone number. From Harrah’s standpoint, the card is extremely valuable because it can reveal a lot about the user’s betting behavior: actual wins and losses, length of time played, preferred machines and coin denominations, average amount per bet, and—most important—the speed with which coins are deposited and buttons pushed.Robert L. Shook, Jackpot! Harrah’s Winning Secrets for Customer Loyalty (Hoboken, NJ: John Wiley & Sons, 2003), 228–29. As you can see from Figure 15.4 "The Data Mining Process", Harrah’s primary data source was internal—generated by the company itself rather than provided by an outside source—and drew on a marketing database developed for customer relationship management (CRM).

What does the casino do with the data that it’s mined? Harrah’s was most interested in “first trippers”—first-time casino customers. In particular, it wanted to know which of these customers should be enticed to return. By analyzing the data collected from player’s-card applications and from customer’s actual play at the casino (even if for no more than an hour), Harrah could develop a profile of a profitable customer. Now, when a first-timer comes into any of its casinos and plays for a while, Harrah’s can instantly tell whether he or she fits the profitable-customer profile. To lure these people back for return visits, it makes generous offers of free or reduced-rate rooms, meals, entertainment, or free chips (the incentive of choice for Harrah’s preferred customers). These customers make up 26 percent of all Harrah’s customers and generate 82 percent of its revenues. Surprisingly, they’re not the wealthy high rollers to whom Harrah’s had been catering for years. Most of them are regular working people or retirees with available time and income and a fondness for slots. They generally stop at the casino on the way home from work or on a weekend night and don’t stay overnight. They enjoy the thrill of gambling, and you can recognize them because they’re the ones who can’t pump coins in fast enough.Gary Loveman, “Diamonds in the Data Mine,” Harvard Business Review, May 2003, 3.

(AACSB) Analysis

Harrah’s uses data mining to identify its most profitable customers and predict their future behavior. It then designs incentives to appeal specifically to these customers. Do you see any ethical problems with this process? Is it ethical to encourage people to gamble? Explain your answer.