Reading this chapter will help you do the following:

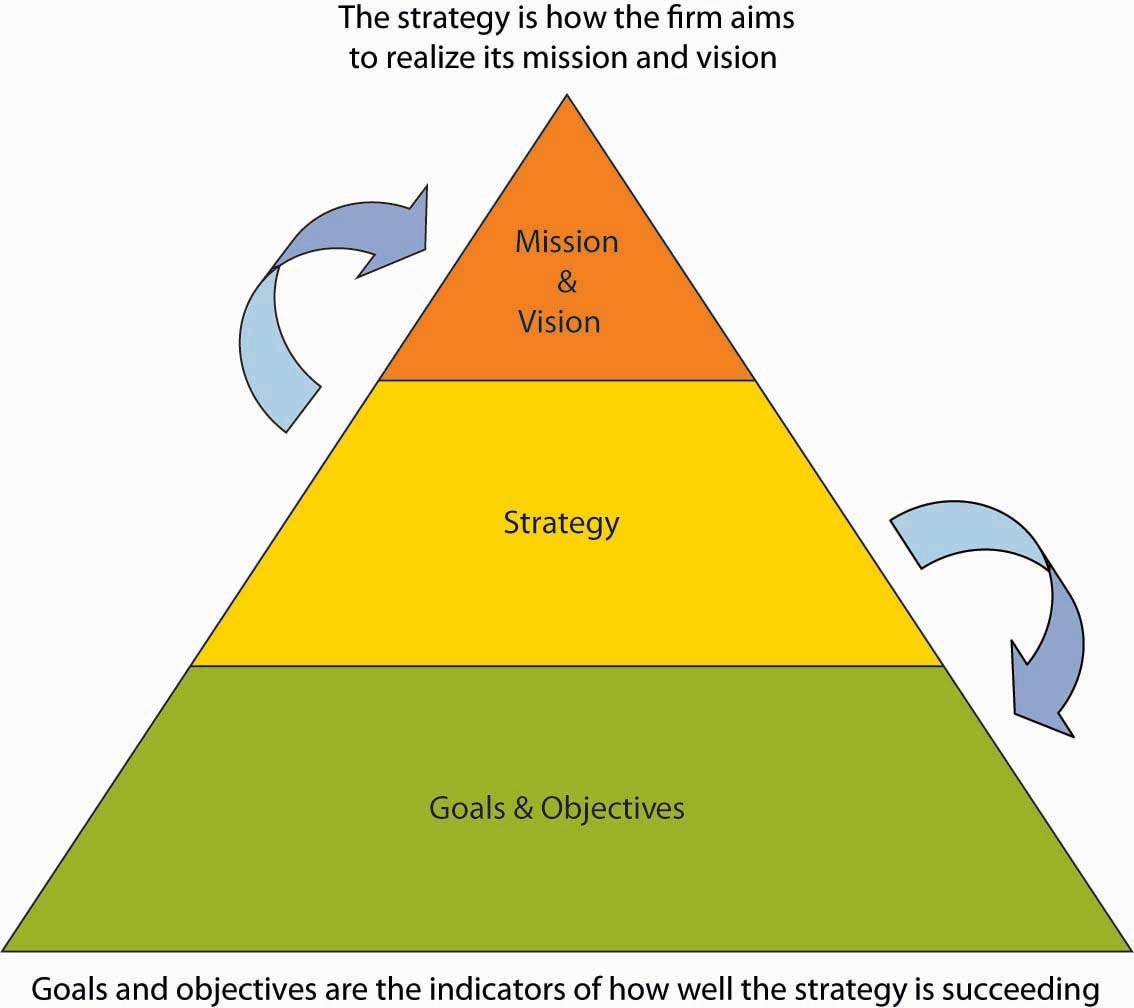

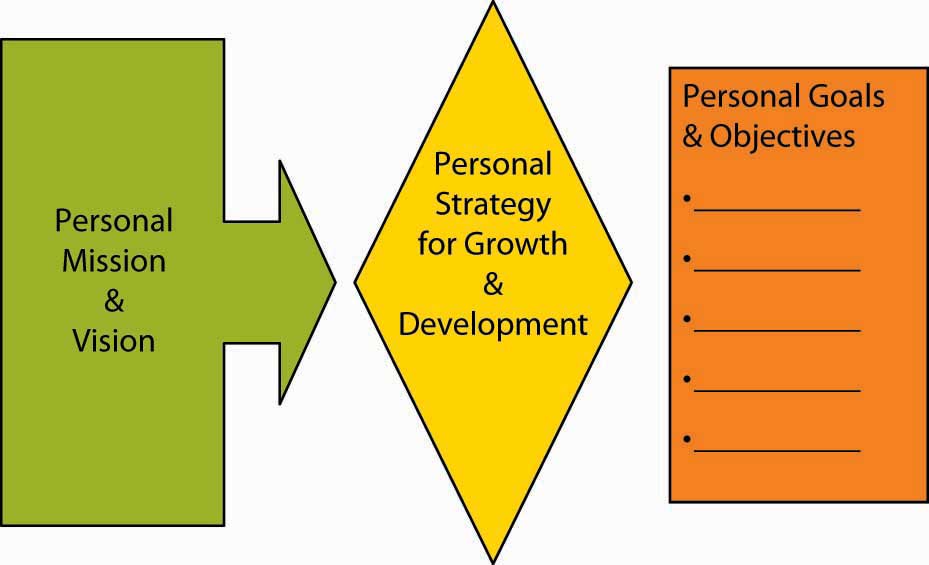

Strategic management, strategizing for short, is essentially about choice—in terms of what the organization will do and won’t do to achieve specific goals and objectives, where such goals and objectives lead to the realization of a stated mission and vision. Strategy is a central part of the planning function in P-O-L-C. Strategy is also about making choices that provide an organization with some measure of competitive advantage or even a sustainable competitive advantage. For the most part, this chapter emphasizes strategy formulation (answers to the “What should our strategy be?” question) as opposed to strategy implementation (answers to questions about “How do we execute a chosen strategy?”). The central position of strategy is summarized in the following figure. In this chapter, you will learn about strategic management and how it fits in the P-O-L-C framework. You will also learn some of the key internal and external analyses that support the development of good strategies. Finally, you will see how the concept of strategy can be applied to you personally, in addition to professionally.

Figure 5.2 The P-O-L-C Framework

Figure 5.3 Where Strategy Fits in “Planning”

Figure 5.4 Unnamed Publisher Cofounder, Jeff Shelstad

Source: Used by permission from Unnamed Publisher Inc.

Two textbook publishing industry veterans, Jeff Shelstad and Eric Frank, started Unnamed Publisher, a privately held company, in 2007 to be a new and disruptive model for the college textbook market. Traditional business textbook publishers carry a portfolio of 5 to 10 titles per subject and charge premium prices for new textbooks, an average of $1,000 in textbooks for a college student’s first year, according to a recent General Accounting Office (GAO) report. FWK’s strategy aims to turn the traditional model on its head by providing online textbook access free to students (http://www.gone.2012books.lardbucket.org). FWK earns revenues by selling students the digital textbooks in alternate formats, print and audio initially, and also by selling highly efficient and mobile study aids. Despite the fact that professors have rated the academic quality of FWK textbooks as equal to or higher than that of textbooks from traditional publishers, the cost to students is a fraction of current market prices due to the efficiencies of the FWK business model. Moreover, with FWK’s open-source platform, instructors who adopt FWK books for their classes are able to pick and choose the material provided to their students, even if it is from earlier versions of textbooks that have since been revised.

Shelstad and Frank founded FWK because they believed that big publishers would continue to experiment and innovate, and enjoy the advantages of scale, capital, content, and brand. But the FWK founders also believed that the pace and nature of change by the big publishers of the textbook industry would remain modest and marginal, held back by an inflexible go-to market strategy, with a reflexive (and shortsighted) exercise of pricing power, outdated business models, intransigent channel partners, existing contracts, and a fear of price cannibalization, as well as the traditional culture and organizational barriers.

To seize this perceived market opportunity, FWK designed a strategy based on publishing textbooks around the three main pillars of books that are (1) free, (2) open, and (3) authored by highly respected authors. Ultimately students (or parents) pay for books. Between a publisher and the student is a gatekeeper—the instructor. The first step to revenue is to convince the gatekeeper to assign (“adopt”) an FWK textbook instead of other choices. Only then does FWK establish a relationship with the gatekeeper’s students and earn the opportunity to monetize those relationships through the sale of print books, study aids, user-generated content, and corporate sponsorship. FWK’s strategy, therefore, aims to provide a compelling value proposition to instructors to maximize adoptions and, thus, student relationships.

How is FWK’s strategy working so far? Through the start of 2010, the FWK strategy has proven effective. New customers and books come online daily and the growth trends are positive. Its first term (fall of 2009), FWK had 40,000 students using its textbooks. This has continued to rise. Several new projects are under way in international business, entrepreneurship, legal environment, and mathematical economics. Media attention to the fledgling FWK has generally been favorable. Social media experts also gave the company accolades. For example, Chris Anderson devoted a page to the FWK business model in his bestselling book Free. Moreover, early user reviews of the product were also very positive. For instance, an instructor who adopted Principles of Management noted, “I highly recommend this book as a primary textbook for…business majors. The overall context is quite appropriate and the search capability within the context is useful. I have been quite impressed [with] how they have highlighted the key areas.” At the same time, opportunities to improve the Web interface still existed, with the same reviewer noting, “The navigation could be a bit more user friendly, however.” FWK uses user input like this to better adjust the strategy and delivery of its model. This type of feedback led the FWK design squad to improve its custom Web interface, so that instructors can more easily change the book. Only time will tell if the $11 million invested in FWK by 2010 will result in the establishment of a new titan in textbook publishing or will be an entrepreneurial miss.

Case written by [citation redacted per publisher request]. Based on information from United States Government Accountability Office. (2005, July). College textbooks: Enhanced offering appear to drive recent price increases (GAO-05-806). Retrieved April 22, 2010, from http://www.gao.gov/cgi-bin/getrpt?GAO-05-806; Unnamed Publisher Web site: http://www.gone.2012books.lardbucket.org; Community College Open Textbook Collaborative. (2009). Business reviews. Retrieved April 22, 2010, from http://www.collegeopentextbooks.org/reviews/business.html; Personal interviews with Jeff Shelstad and Eric Frank.

Figure 5.6

Source: Porter, M. E. (1980). Competitive Strategy. New York: Free Press.

As you already know, the P-O-L-C framework starts with “planning.” You might also know that planning is related to, but not synonymous with, strategic management. Strategic managementWhat an organization does to achieve its mission and vision. reflects what a firm is doing to achieve its mission and vision, as seen by its achievement of specific goals and objectives.

A more formal definition tells us that the strategic management processA comprehensive and ongoing management process aimed at formulating and implementing effective strategies; it is a way of approaching business opportunities and challenges such that the firm achieves its vision and mission. “is the process by which a firm manages the formulation and implementation of its strategy.”Carpenter, M. A., & Sanders, W. G. (2009). Strategic management (p. 8). Upper Saddle River, NJ: Pearson/Prentice-Hall. The strategic management process is “the coordinated means by which an organization achieves its goals and objectives.”Carpenter, M. A., & Sanders, W. G. (2009). Strategic management (p. 10). Upper Saddle River, NJ: Pearson/Prentice-Hall. Others have described strategy as the pattern of resource allocation choices and organizational arrangements that result from managerial decision making.Mintzberg, H. 1978. Patterns in strategy formulation. Management Science, 24, 934–949. Planning and strategy formulationSynonymous with business planning and strategic planning. The set of processes involved in creating or determining the strategies of the organization; it focuses on the content of strategies. sometimes called business planning, or strategic planning, have much in common, since formulation helps determine what the firm should do. Strategy implementationThe methods by which strategies are operationalized or executed within the organization; it focuses on the processes through which strategies are achieved. tells managers how they should go about putting the desired strategy into action.

The concept of strategy is relevant to all types of organizations, from large, public companies like GE, to religious organizations, to political parties.

If vision and mission are the heart and soul of planning (in the P-O-L-C framework), then strategy, particularly strategy formulation, would be the brain. The following figure summarizes where strategy formulation (strategizing) and implementation fit in the planning and other components of P-O-L-C. We will focus primarily on the strategy formulation aspects of strategic management because implementation is essentially organizing, leading, and controlling P-O-L-C components.

Figure 5.7 Strategizing in P-O-L-C

You see that planning starts with vision and mission and concludes with setting goals and objectives. In-between is the critical role played by strategy. Specifically, a strategy captures and communicates how vision and mission will be achieved and which goals and objectives show that the organization is on the right path to achieving them.

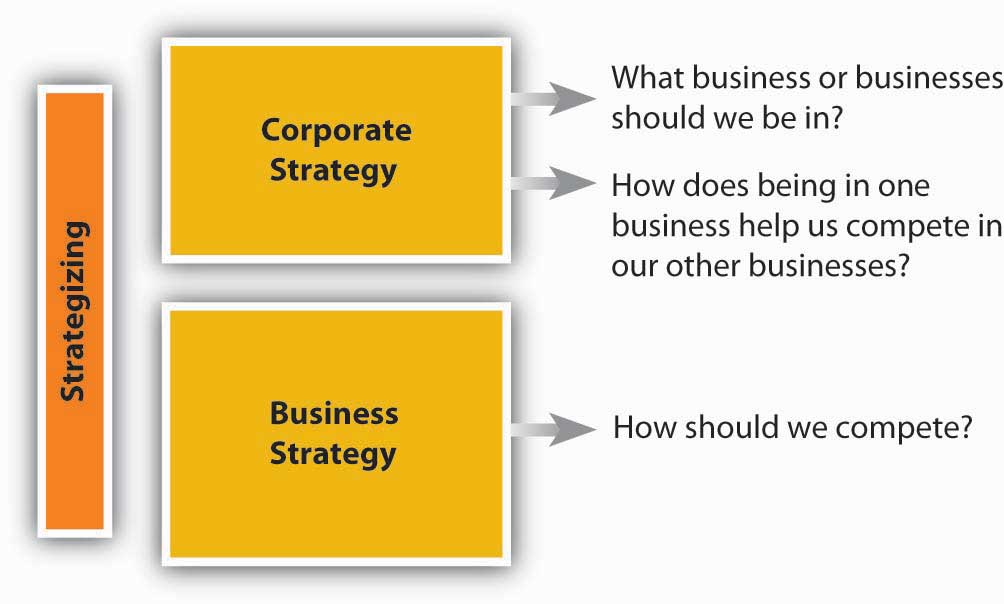

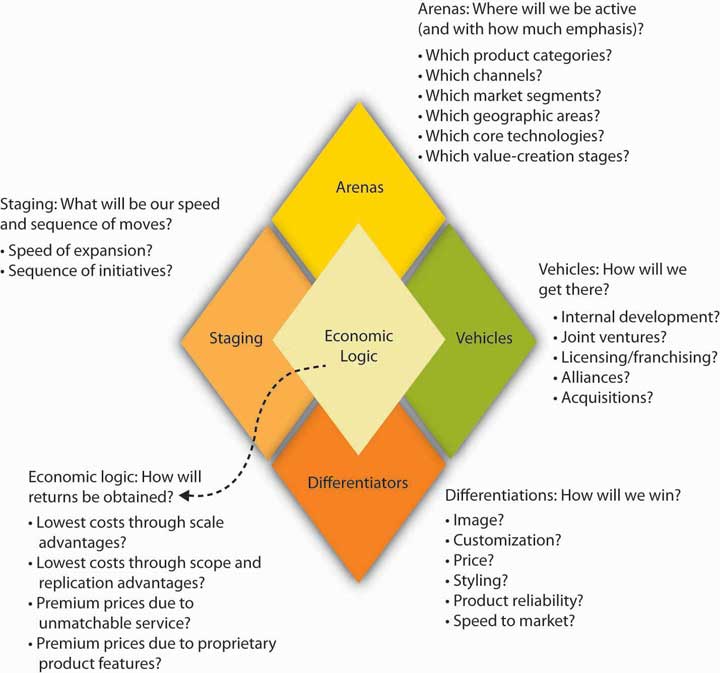

At this point, even in terms of strategy formulation, there are two aspects of strategizing that you should recognize. The first, corporate strategyThe set of strategic alternatives that an organization chooses from as it manages its operations simultaneously across several industries and several markets. answers strategy questions related to “What business or businesses should we be in?” and “How does our business X help us compete in business Y, and vice versa?” In many ways, corporate strategy considers an organization to be a portfolio of businesses, resources, capabilities, or activities. You are probably familiar with McDonald’s, for instance, and their ubiquitous golden arches fast-food outlets. However, you may be less likely to know that McDonald’s owned the slightly upscale burrito vendor Chipotle for several years as well.Carpenter, M. A., & Sanders, W. G. (2008). Fast food chic? The Chipotle burrito. University of Wisconsin Business Case. The McDonald’s corporate strategy helped its managers evaluate and answer questions about whether it made sense for McDonald’s set of businesses to include different restaurants such as McDonald’s and Chipotle. While other food-service companies have multiple outlets—YUM! Brands, for example, owns A&W, Taco Bell, Pizza Hut, Long John Silver’s, and Kentucky Fried Chicken—McDonald’s determined that one brand (McDonald’s) was a better strategy for it in the future, and sold off Chipotle in 2006. The following figure provides a graphic guide to this kind of planning.

Figure 5.8 Corporate and Business Strategy

The logic behind corporate strategy is one of synergy and diversification. That is, synergies arise when each of YUM! Brands food outlets does better because they have common ownership and can share valuable inputs into their businesses. Specifically, synergyThe interaction of two or more activities, creating a combined effect greater than the sum of their individual efforts. exists when the interaction of two or more activities (such as those in a business) create a combined effect greater than the sum of their individual effects. The idea is that the combination of certain businesses is stronger than they would be individually because they either do things more cheaply or of higher quality as a result of their coordination under a common owner.

DiversificationThe number of different businesses that an organization is engaged in and the extent to which these businesses are related to one another. in contrast, is where an organization participates in multiple businesses that are in some way distinct from each other, as Taco Bell is from Pizza Hut, for instance. Just as with a portfolio of stock, the purpose of diversification is to spread out risk and opportunities over a larger set of businesses. Some may be high growth, some slow growth or declining; some may perform worse during recessions, while others perform better. Sometimes the businesses can be very different, such as when fashion sunglass maker Maui Jim diversified into property and casualty insurance through its merger with RLI Corporation.Retrieved October 30, 2008, http://www.secinfo.com/dRqWm.89X3.htm#34f. Perhaps more than a coincidence, RLI was founded some 60 years earlier as Replacement Lens International (later changed to its abbreviation, RLI, in line with its broader insurance products offerings), with the primary business of providing insurance for replacement contact lenses. There are three major diversification strategies: (1) concentric diversification, where the new business produces products that are technically similar to the company’s current product but that appeal to a new consumer group; (2) horizontal diversification, where the new business produces products that are totally unrelated to the company’s current product but that appeal to the same consumer group; and (3) conglomerate diversification, where the new business produces products that are totally unrelated to the company’s current product and that appeal to an entirely new consumer group.

Whereas corporate strategy looks at an organization as a portfolio of things, business strategyThe set of strategic alternatives that an organization chooses from as it conducts business in a particular industry or market. focuses on how a given business needs to compete to be effective. Again, all organizations need strategies to survive and thrive. A neighborhood church, for instance, probably wants to serve existing members, build new membership, and, at the same time, raise surplus monies to help it with outreach activities. Its strategy would answer questions surrounding the accomplishment of these key objectives. In a for-profit company such as McDonald’s, its business strategy would help it keep existing customers, grow its business by moving into new markets and taking customers from competitors like Taco Bell and Burger King, and do all this at a profit level demanded by the stock market.

So what are the inputs into strategizing? At the most basic level, you will need to gather information and conduct analysis about the internal characteristics of the organization and the external market conditions. This means an internal appraisal and an external appraisal. On the internal side, you will want to gain a sense of the organization’s strengths and weaknesses; on the external side, you will want to develop some sense of the organization’s opportunities and threats. Together, these four inputs into strategizing are often called SWOT analysisAn assessment of strengths, weaknesses, opportunities, and threats. which stands for strengths, weaknesses, opportunities, and threats (see the SWOT analysis figure). It does not matter if you start this appraisal process internally or externally, but you will quickly see that the two need to mesh eventually. At the very least, the strategy should leverage strengths to take advantage of opportunities and mitigate threats, while the downside consequences of weaknesses are minimized or managed.

Figure 5.9 SWOT Analysis

SWOT was developed by Ken Andrews in the early 1970s.Andrews, K. (1971). The concept of corporate strategy. Homewood, IL: R. D. Irwin. An assessment of strengths and weaknesses occurs as a part of organizational analysis; that is, it is an audit of the company’s internal workings, which are relatively easier to control than outside factors. Conversely, examining opportunities and threats is a part of environmental analysis—the company must look outside of the organization to determine opportunities and threats, over which it has lesser control.

Andrews’s original conception of the strategy model that preceded the SWOT asked four basic questions about a company and its environment: (1) What can we do? (2) What do we want to do? (3) What might we do? and (4) What do others expect us to do?

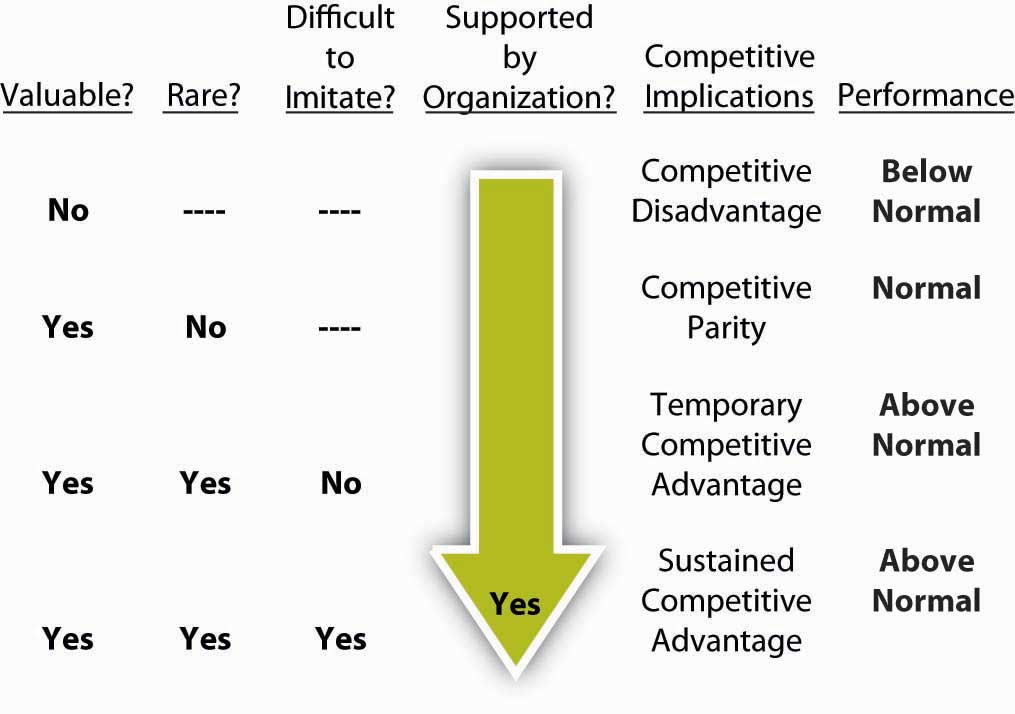

A good starting point for strategizing is an assessment of what an organization does well and what it does less well. In general good strategies take advantage of strengths and minimize the disadvantages posed by any weaknesses. Michael Jordan, for instance, is an excellent all-around athlete; he excels in baseball and golf, but his athletic skills show best in basketball. As with Jordan, when you can identify certain strengths that set an organization well apart from actual and potential competitors, that strength is considered a source of competitive advantage. The hardest thing for an organization to do is to develop its competitive advantage into a sustainable competitive advantageA competitive advantage that will exist after all attempts at strategic imitation have ceased. where the organization’s strengths cannot be easily duplicated or imitated by other firms, nor made redundant or less valuable by changes in the external environment.

On the basis of what you just learned about competitive advantage and sustainable competitive advantage, you can see why some understanding of the external environment is a critical input into strategy. Opportunities assess the external attractive factors that represent the reason for a business to exist and prosper. These are external to the business. What opportunities exist in its market, or in the environment, from which managers might hope the organization will benefit? Threats include factors beyond your control that could place the strategy, or the business, at risk. These are also external—managers typically have no control over them, but may benefit by having contingency plans to address them if they should occur.

Unnamed Publisher is a new college textbook company (and the publisher of this POM text!) that operates with the tagline vision of “Free textbooks. Online. Anytime. Anywhere. Anyone.”Retrieved October 28, 2008, from http://www.gone.2012books.lardbucket.org.

Strengths

Weaknesses

Opportunities

Threats

In a nutshell, SWOT analysis helps you identify strategic alternatives that address the following questions:

Before wrapping up this section, let’s look at a few of the external and internal analysis tools that might help you conduct a SWOT analysis. These tools are covered in greater detail toward the end of the chapter.

Internal analysis tools help you identify an organization’s strengths and weaknesses. The two tools that we identify here, and develop later in the chapter, are the value chain and VRIO tools. The value chain asks you, in effect, to take the organization apart and identify the important constituent parts. Sometimes these parts take the form of functions, like marketing or manufacturing. For instance, Disney is really good at developing and making money from its branded products, such as Cinderella or Pirates of the Caribbean. This is a marketing function (it is also a design function, which is another Disney strength).

Value chain functions are also called capabilities. This is where VRIO comes in. VRIO stands for valuable, rare, inimitable, and organization—basically, the VRIO framework suggests that a capability, or a resource, such as a patent or great location, is likely to yield a competitive advantage to an organization when it can be shown that it is valuable, rare, difficult to imitate, and supported by the organization (and, yes, this is the same organization that you find in P-O-L-C). Essentially, where the value chain might suggest internal areas of strength, VRIO helps you understand whether those strengths will give it a competitive advantage. Going back to our Disney example, for instance, strong marketing and design capabilities are valuable, rare, and very difficult to imitate, and Disney is organized to take full advantage of them.

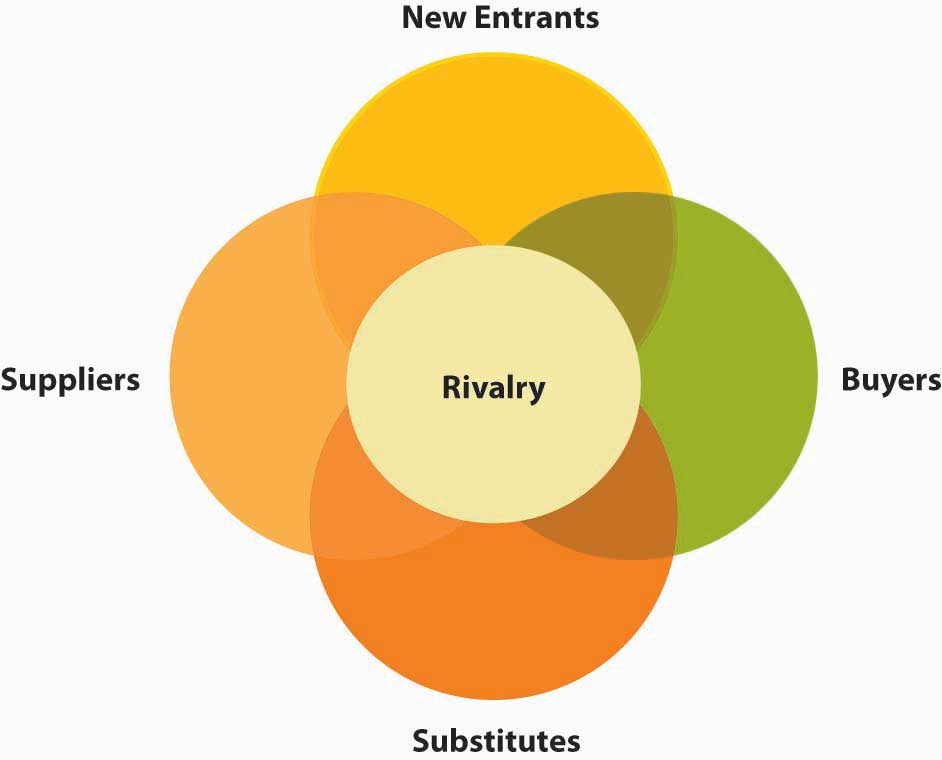

While there are probably hundreds of different ways for you to study an organizations’ external environment, the two primary tools are PESTEL and industry analysis. PESTEL, as you probably guessed, is simply an acronym. It stands for political, economic, sociocultural, technological, environmental, and legal environments. Simply, the PESTEL framework directs you to collect information about, and analyze, each environmental dimension to identify the broad range of threats and opportunities facing the organization. Industry analysis, in contrast, asks you to map out the different relationships that the organization might have with suppliers, customers, and competitors. Whereas PESTEL provides you with a good sense of the broader macro-environment, industry analysis should tell you about the organization’s competitive environment and the key industry-level factors that seem to influence performance.

Strategy formulation is an essential component of planning; it forms the bridge that enables the organization to progress from vision and mission to goals and objectives. In terms of the P-O-L-C framework, strategy formulation is the P (planning) and strategy implementation is realized by O-L-C. Corporate strategy helps to answer questions about which businesses to compete in, while business strategy helps to answer questions about how to compete. The best strategies are based on a thorough SWOT analysis—that is, a strategy that capitalizes on an organization’s strengths, weaknesses, opportunities, and threats.

How do the strategies we see in organizations come into being? In this section, you will learn about intended and realized strategies. The section concludes with discussion of how strategies are made.

The best-laid plans of mice and men often go awry.

Robert Burns, “To a Mouse,” 1785

This quote from English poet Robert Burns is especially applicable to strategy. While we have been discussing strategy and strategizing as if they were the outcome of a rational, predictable, analytical process, your own experience should tell you that a fine plan does not guarantee a fine outcome. Many things can happen between the development of the plan and its realization, including (but not limited to): (1) the plan is poorly constructed, (2) competitors undermine the advantages envisioned by the plan, or (3) the plan was good but poorly executed. You can probably imagine a number of other factors that might undermine a strategic plan and the results that follow.

How organizations make strategy has emerged as an area of intense debate within the strategy field. Henry Mintzberg and his colleagues at McGill University distinguish intended, deliberate, realized, and emergent strategies.Mintzberg, H. (1987, July–August). Crafting strategy. Harvard Business Review, pp. 66–75; Mintzberg, H. (1996). The entrepreneurial organization. In H. Mintzberg & J. B. Quinn (Eds.), The strategy process (3rd ed.). Englewood Cliffs, NJ: Prentice-Hall; Mintzberg, H., & Waters, J. A. (1985). Of strategies, deliberate and emergent. Strategic Management Journal, 6, 257–272.These four different aspects of strategy are summarized in the following figure. Intended strategyThe strategy conceived of by managers and the impetus for initial attempts at strategy implementation. is strategy as conceived by the top management team. Even here, rationality is limited and the intended strategy is the result of a process of negotiation, bargaining, and compromise, involving many individuals and groups within the organization. However, realized strategyThe actual strategy that is implemented and comes to fruition as a consequence of implementation and other internal and external factors.—the actual strategy that is implemented—is only partly related to that which was intended (Mintzberg suggests only 10%–30% of intended strategy is realized).

Figure 5.11 Intended, Deliberate, Realized, and Emergent Strategies

The primary determinant of realized strategy is what Mintzberg terms emergent strategyA pattern of action that develops over time in an organization in the absence of vision, mission, and goals, or despite missions and goals, or in addition to what was conceived of in the intended and deliberate strategies.—the decisions that emerge from the complex processes in which individual managers interpret the intended strategy and adapt to changing external circumstances.See Mintzberg, H. Patterns in strategy formulation. (1978). Management Science, 24, 934–948; Mintzberg, H., & Waters, J. A. (1985). Of strategies, deliberate and emergent. Strategic Management Journal, 6, 257–272. (1985); and Mintzberg, H. (1988). Mintzberg on management: Inside our strange world of organizations. New York: Free Press. Thus, the realized strategy is a consequence of deliberateA plan of action, flowing from the intended strategy, that an organization chooses and implements to support its vision, mission, and goals. and emerging factors. Analysis of Honda’s successful entry into the U.S. motorcycle market has provided a battleground for the debate between those who view strategy making as primarily a rational, analytical process of deliberate planning (the design school) and those that envisage strategy as emerging from a complex process of organizational decision making (the emergence or learning school).The two views of Honda are captured in two Harvard cases: Honda [A]. (1989). Boston: Harvard Business School, Case 384049, and Honda [B]. (1989). Boston: Harvard Business School, Case 384050.

Although the debate between the two schools continues,For further debate of the Honda case, see Mintzberg, H., Pascale, R. T., Goold, M., & Rumelt, Richard P. (1996, Summer). The Honda effect revisited. California Management Review, 38, 78–117. we hope that it is apparent to you that the central issue is not “Which school is right?” but “How can the two views complement one another to give us a richer understanding of strategy making?” Let us explore these complementarities in relation to the factual question of how strategies are made and the normative question of how strategies should be made.

Robert Grant, author of Contemporary Strategy Analysis, shares his view of how strategy is made as follows.Grant, R. M. (2002). Contemporary strategy analysis (4th ed., pp. 25–26). New York: Blackwell. For most organizations, strategy making combines design and emergence. The deliberate design of strategy (through formal processes such as board meetings and strategic planning) has been characterized as a primarily top-down process. Emergence has been viewed as the result of multiple decisions at many levels, particularly within middle management, and has been viewed as a bottom-up process. These processes may interact in interesting ways. At Intel, the key historic decision to abandon memory chips and concentrate on microprocessors was the result of a host of decentralized decisions taken at divisional and plant level that were subsequently acknowledged by top management and promulgated as strategy.Burgelman, R. A., & Grove, A. (1996, Winter). Strategic dissonance. California Management Review, 38, 8–28.

In practice, both design and emergence occur at all levels of the organization. The strategic planning systems of large companies involve top management passing directives and guidelines down the organization and the businesses passing their draft plans up to corporate. Similarly, emergence occurs throughout the organization—opportunism by CEOs is probably the single most important reason why realized strategies deviate from intended strategies. What we can say for sure is that the role of emergence relative to design increases as the business environment becomes increasingly volatile and unpredictable.

Organizations that inhabit relatively stable environments—the Roman Catholic Church and national postal services—can plan their strategies in some detail. Organizations whose environments cannot be forecast with any degree of certainty—a gang of car thieves or a construction company located in the Gaza Strip—can establish only a few strategic principles and guidelines; the rest must emerge as circumstances unfold.

Mintzberg’s advocacy of strategy making as an iterative process involving experimentation and feedback is not necessarily an argument against the rational, systematic design of strategy. The critical issues are, first, determining the balance of design and emergence and, second, how to guide the process of emergence. The strategic planning systems of most companies involve a combination of design and emergence. Thus, headquarters sets guidelines in the form of vision and mission statements, business principles, performance targets, and capital expenditure budgets. However, within the strategic plans that are decided, divisional and business unit managers have considerable freedom to adjust, adapt, and experiment.

You learned about the processes surrounding strategy development. Specifically, you saw the difference between intended and realized strategy, where intended strategy is essentially the desired strategy, and realized strategy is what is actually put in place. You also learned how strategy is ultimately made. Ultimately, the best strategies come about when managers are able to balance the needs for design (planning) with being flexible enough to capitalize on the benefits of emergence.

This section helps you understand that a strategy provides a company with focus. Strategy is ultimately about choice—what the organization does and does not do. As we’ve seen, vision and mission provide a good sense of direction for the organization, but they are not meant to serve as, or take the place of, the actual strategy. Strategy is about choices, and that eventually means making trade-offs such that the strategy and the firm are distinctive in the eyes of stakeholders. In this section, you will learn about strategic focus—that is, how trade-offs are reconciled—as well as two frameworks for thinking about what such focus might entail.

While there are different schools of thought about how strategy comes about, researchers generally agree that strategic focusWhen an organization is clear about its mission and vision and has a coherent, well-articulated strategy for achieving those. is a common characteristic across successful organizations. Strategic focus is seen when an organization is very clear about its mission and vision and has a coherent, well-articulated strategy for achieving those. When a once high-flying firm encounters performance problems, it is not uncommon to hear business analysts say that the firm’s managers have lost focus on the customers or markets where they were once highly successful. For instance, Dell Computer’s strategy is highly focused around the efficient sale and manufacture of computers and computer peripheral devices. However, during the mid-2000s, Dell started branching out into other products such as digital cameras, DVD players, and flat-screen televisions. As a result, it lost focus on its core sales and manufacturing business, and its performance flagged. As recently as mid-2008, however, Dell has realized a tremendous turnaround: “We are executing on all points of our strategy to drive growth in every product category and in every part of the world,” said a press release from Michael Dell, chairman and CEO. “These results are early signs of our progress against our five strategic priorities. Through a continued focus, we expect to continue growing faster than the industry and increase our revenue, profitability and cash flow for greater shareholder value.”Dell increases revenue and earnings, lowers operating expenses. (2008, May 28). Dell press release. Retrieved November 3, 2008, from http://www.dell.com/content/topics/global.aspx/corp/pressoffice/en/2008/2008_05_29_rr_000?c=us&l=en’s=corp.

Dell provides an excellent example of what is meant by strategic focus. This spirit of focus is echoed in the following two parts of this section where we introduce you to the complementary notions of strategy as trade-offs and strategy as discipline.

Three of the most widely read books on competitive analysis in the 1980s were Michael Porter’s Competitive Strategy, Competitive Advantage, and Competitive Advantage of Nations.Porter, M. (1985). Competitive advantage: Creating and sustaining superior performance. New York: Free Press; Porter, M. (1989). Competitive advantage of nations. New York: Free Press. Porter, M. (1980). Competitive strategy: Techniques for analyzing industries and companies. New York: Free Press, 1980; Porter, M. (2001, March). Strategy and the Internet. Harvard Business Review, pp. 63–78; Retrospective on Michael Porter’s Competitive strategy. (2002). Academy of Management Executive 16(2), 40–65. In his various books, Porter developed three generic strategies that, he argues, can be used singly or in combination to create a defendable position and to outperform competitors, whether they are within an industry or across nations. The strategies are (1) overall cost leadership, (2) differentiation, and (3) focus on a particular market niche.

These strategies are termed generic because they can be applied to any size or form of business. We refer to them as trade-off strategies because Porter argues that a firm must choose to embrace one strategy or risk not having a strategy at all. Overall lower cost or cost leadershipA strategy in which an organization attempts to gain a competitive advantage by reducing its costs below the costs of competing firms. refers to the strategy where a firm’s competitive advantage is based on the bet that it can develop, manufacture, and distribute products more efficiently than competitors. DifferentiationThe strategy where competitive advantage is based on superior products or service. refers to the strategy where competitive advantage is based on superior products or service. Superiority arises from factors other than low cost, such as customer service, product quality, or unique style. To put these strategies into context, you might think about Wal-Mart as pursuing a cost-leadership strategy and Harley Davidson as pursuing a differentiation strategyA strategy in which an organization seeks to distinguish itself from competitors through the perceived quality of its products or services..

Porter suggests that another factor affecting a company’s competitive position is its competitive scope. Competitive scope defines the breadth of a company’s target market. A company can have a broad (mass market) competitive scope or a narrow (niche market) competitive scope. A firm following the focus strategyA strategy in which an organization concentrates on a specific regional market, product line, or group of buyers in combination with its pursuit of either an overall cost leadership or differentiation strategy. concentrates on meeting the specialized needs of its customers. Products and services can be designed to meet the needs of buyers. One approach to focusing is to service either industrial buyers or consumers but not both. Martin-Brower, the third-largest food distributor in the United States, serves only the eight leading fast-food chains. It is the world’s largest distributor of products to the world’s largest restaurant company—McDonald’s. With its limited customer list, Martin-Brower need only stock a limited product line; its ordering procedures are adjusted to match those of its customers; and its warehouses are located so as to be convenient to customers.

Firms using a narrow focus strategy can also tailor advertising and promotional efforts to a particular market niche. Many automobile dealers advertise that they are the largest volume dealer for a specific geographic area. Other car dealers advertise that they have the highest customer satisfaction scores within their defined market or the most awards for their service department.

Another differentiation strategy is to design products specifically for a customer. Such customization may range from individually designing a product for a single customer to offering a menu from which customers can select options for the finished product. Tailor-made clothing and custom-built houses include the customer in all aspects of production, from product design to final acceptance, and involve customer input in all key decisions. However, providing such individualized attention to customers may not be feasible for firms with an industry-wide orientation. At the other end of the customization scale, customers buying a new car, even in the budget price category, can often choose not only the exterior and interior colors but also accessories such as CD players, rooftop racks, and upgraded tires.

By positioning itself in either broad scope or narrow scope and a low-cost strategy or differentiation strategy, an organization will fall into one of the following generic competitive strategies: cost leadership, cost focus, differentiation, and focused differentiation.

Figure 5.13 Porter’s Generic Strategies

Source: Porter, M. E. (1980). Competitive Strategy. New York: Free Press.

Cost leadership is a low-cost, broad-based market strategy. Firms pursuing this type of strategy must be particularly efficient in engineering tasks, production operations, and physical distribution. Because these firms focus on a large market, they must also be able to minimize costs in marketing and research and development (R&D). A low-cost leader can gain significant market share enabling it to procure a more powerful position relative to both suppliers and competitors. This strategy is particularly effective for organizations in industries where there is limited possibility of product differentiation and where buyers are very price sensitive.

Overall cost leadership is not without potential problems. Two or more firms competing for cost leadership may engage in price wars that drive profits to very low levels. Ideally, a firm using a cost-leader strategy will develop an advantage that others cannot easily copy. Cost leaders also must maintain their investment in state-of-the-art equipment or face the possible entry of more cost-effective competitors. Major changes in technology may drastically change production processes so that previous investments in production technology are no longer advantageous. Finally, firms may become so concerned with maintaining low costs that they overlook needed changes in production or marketing.

The cost-leadership strategy may be more difficult in a dynamic environment because some of the expenses that firms may seek to minimize are research and development costs or marketing research costs—expenses the firm may need to incur to remain competitive.

A cost-focus strategy is a low-cost, narrowly focused market strategy. Firms employing this strategy may focus on a particular buyer segment or a particular geographic segment and must locate a niche market that wants or needs an efficient product and is willing to forgo extras to pay a lower price for the product. A company’s costs can be reduced by providing little or no service, providing a low-cost method of distribution, or producing a no-frills product.

A differentiation strategy involves marketing a unique product to a broad-based market. Because this type of strategy involves a unique product, price is not the significant factor. In fact, consumers may be willing to pay a high price for a product that they perceive as different. The product difference may be based on product design, method of distribution, or any aspect of the product (other than price) that is significant to a broad group of consumers. A company choosing this strategy must develop and maintain a product perceived as different enough from the competitors’ products to warrant the asking price.

Several studies have shown that a differentiation strategy is more likely to generate higher profits than a cost-leadership strategy, because differentiation creates stronger entry barriers. However, a cost-leadership strategy is more likely to generate increases in market share.

A differentiation-focus strategy is the marketing of a differentiated product to a narrow market, often involving a unique product and a unique market. This strategy is viable for a company that can convince consumers that its narrow focus allows it to provide better goods and services than its competitors.

Differentiation does not allow a firm to ignore costs; it makes a firm’s products less susceptible to cost pressures from competitors because customers see the product as unique and are willing to pay extra to have the product with the desirable features. Differentiation can be achieved through real product features or through advertising that causes the customer to perceive that the product is unique.

Differentiation may lead to customer brand loyalty and result in reduced price elasticity. Differentiation may also lead to higher profit margins and reduce the need to be a low-cost producer. Since customers see the product as different from competing products and they like the product features, customers are willing to pay a premium for these features. As long as the firm can increase the selling price by more than the marginal cost of adding the features, the profit margin is increased. Firms must be able to charge more for their differentiated product than it costs them to make it distinct, or else they may be better off making generic, undifferentiated products. Firms must remain sensitive to cost differences. They must carefully monitor the incremental costs of differentiating their product and make certain the difference is reflected in the price.

Firms pursuing a differentiation strategy are vulnerable to different competitive threats than firms pursuing a cost-leader strategy. Customers may sacrifice features, service, or image for cost savings. Price-sensitive customers may be willing to forgo desirable features in favor of a less costly alternative. This can be seen in the growth in popularity of store brands and private labels. Often, the same firms that produce name-brand products produce the private-label products. The two products may be physically identical, but stores are able to sell the private-label products for a lower price because very little money was put into advertising to differentiate the private-label product.

Imitation may also reduce the perceived differences between products when competitors copy product features. Thus, for firms to be able to recover the cost of marketing research or R&D, they may need to add a product feature that is not easily copied by a competitor.

A final risk for firms pursuing a differentiation strategy is changing consumer tastes. The feature that customers like and find attractive about a product this year may not make the product popular next year. Changes in customer tastes are especially obvious in the fashion industry. For example, although Ralph Lauren’s Polo has been a very successful brand of apparel, some younger consumers have shifted to Tommy Hilfiger and other youth-oriented brands.

For a variety of reasons, including the differences between intended versus realized strategies discussed in an earlier section, none of these competitive strategies is guaranteed to achieve success. Some companies that have successfully implemented one of Porter’s generic strategies have found that they could not sustain the strategy. Several risks associated with these strategies are based on evolved market conditions (buyer perceptions, competitors, etc.).

Can forms of competitive advantage be combined? That is, can a firm straddle strategies so that it is simultaneously the low-cost leader and a differentiator? Porter asserts that a successful strategy requires a firm to stake out a market position aggressively and that different strategies involve distinctly different approaches to competing and operating the business. Some research suggests that straddling strategies is a recipe for below-average profitability compared to the industry. Porter also argues that straddling strategies is an indication that the firm’s managers have not made necessary choices about the business and its strategy. A straddling strategy may be especially dangerous for narrow scope firms that have been successful in the past, but then start neglecting their focus.

An organization pursuing a differentiation strategy seeks competitive advantage by offering products or services that are unique from those offered by rivals, either through design, brand image, technology, features, or customer service. Alternatively, an organization pursuing a cost-leadership strategy attempts to gain competitive advantage based on being the overall low-cost provider of a product or service. To be “all things to all people” can mean becoming “stuck in the middle” with no distinct competitive advantage. The difference between being “stuck in the middle” and successfully pursuing combination strategies merits discussion. Although Porter describes the dangers of not being successful in either cost control or differentiation, some firms have been able to succeed using combination strategies.

Research suggests that, in some cases, it is possible to be a cost leader while maintaining a differentiated product. Southwest Airlines has combined cost-cutting measures with differentiation. The company has been able to reduce costs by not assigning seating and by eliminating meals on its planes. It has also been able to promote in its advertising that its fares are so low that checked bags fly free, in contrast to the fees that competitors such as American and United charge for checked luggage. Southwest’s consistent low-fare strategy has attracted a significant number of passengers, allowing the airline to succeed.

Another firm that has pursued an effective combination strategy is Nike. You may think that Nike has always been highly successful, but it has actually weathered some pretty aggressive competitive assaults. For instance, when customer preferences moved to wide-legged jeans and cargo pants, Nike’s market share slipped. Competitors such as Adidas offered less expensive shoes and undercut Nike’s price. Nike’s stock price dropped in 1998 to half its 1997 high. However, Nike achieved a turnaround by cutting costs and developing new, distinctive products. Nike reduced costs by cutting some of its endorsements. Company research suggested the endorsement by the Italian soccer team, for example, was not achieving the desired results. Michael Jordan and a few other “big name” endorsers were retained while others, such as the Italian soccer team, were eliminated, resulting in savings estimated at over $100 million. Laying off 7% of its 22,000 employees allowed the company to lower costs by another $200 million, and inventory was reduced to save additional money. As a result of these moves, Nike reported a 70% increase in earnings for the first quarter of 1999 and saw a significant rebound in its stock price. While cutting costs, the firm also introduced new products designed to differentiate Nike’s products from the competition.

Some industry environments may actually call for combination strategies. Trends suggest that executives operating in highly complex environments, such as health care, do not have the luxury of choosing exclusively one strategy over another. The hospital industry may represent such an environment, as hospitals must compete on a variety of fronts. Combination (i.e., more complicated) strategies are both feasible and necessary to compete successfully. For instance, reimbursement to diagnosis-related groups, and the continual lowering of reimbursement ceilings have forced hospitals to compete on the basis of cost. At the same time, many of them jockey for position with differentiation based on such features as technology and birthing rooms. Thus, many hospitals may need to adopt some form of hybrid strategy to compete successfully.Walters, B. A., & Bhuian, S. (2004). Complexity absorption and performance: A structural analysis of acute-care hospitals. Journal of Management, 30, 97–121.

While Michael Porter’s generic strategies were introduced in the 1980s and still dominate much of the dialogue about strategy and strategizing, a complementary approach was offered more recently by CSC Index consultants Michael Treacy and Fred Wiersema. Their value disciplines model is quite similar to the three generic strategies from Porter (cost leadership, differentiation, focus). However, there is at least one major difference. According to the value disciplines model, no discipline may be neglected: threshold levels on the two disciplines that are not selected must be maintained. According to Porter, companies that act like this run a risk of getting “stuck in the middle.”

In their book, The Discipline of Market Leaders, they offered four rules that competing companies must obey with regard to strategy formulation:Treacy, M., & Wiersema, F. (1997). The discipline of market leaders: Choose your customers, narrow your focus, dominate your market. Reading, M Addison-Wesley.

Treacy and Wiersema describe three generic value disciplines: operational excellence, product leadership, and customer intimacy. As with Porter’s perspective about the importance of making trade-offs, any company must choose one of these value disciplines and consistently and vigorously act on it, as indicated by the four rules mentioned earlier.

The case study that their book uses to illustrate the “operational excellence” value discipline is AT&T’s experience in introducing the Universal Card, a combined long-distance calling card and general purpose credit card, featuring low annual fees and customer-friendly service.

Key characteristics of the strategy are superb operations and execution, often by providing a reasonable quality at a very low price, and task-oriented vision toward personnel. The focus is on efficiency, streamlined operations, supply chain management, no frills, and volume. Most large international corporations are operating according to this discipline. Measuring systems are important, as is extremely limited variation in product assortment.

Firms that do this strategy well are very strong in innovation and brand marketing. Organization leaders demonstrate a recognition that the company’s current success and future prospects lie in its talented product design people and those who support them. The company operates in dynamic markets. The focus is on development, innovation, design, time to market, and high margins in a short time frame. Company cultures are flexible to encourage innovation. Structure also encourages innovation through small ad hoc working groups, an “experimentation is good” mind-set, and compensation systems that reward success. Intel, the leading computer chip company, is a great example of a firm pursuing a successful product leadership strategy.

Companies pursuing this strategy excel in customer attention and customer service. They tailor their products and services to individual or almost individual customers. There is large variation in product assortment. The focus is on: customer relationship management (CRM), deliver products and services on time and above customer expectations, lifetime value concepts, reliability, being close to the customer. Decision authority is given to employees who are close to the customer. The operating principles of this value discipline include having a full range of services available to serve customers upon demand—this may involve running what the authors call a “hollow company,” where a variety of goods or services are available quickly through contract arrangements, rather than the supplier business having everything in stock all the time.

The recent partnership between Airborne Express, IBM, and Xerox is a great example of an effective customer intimacy strategy. Airborne also provides centralized control to IBM and Xerox part-distribution networks. Airborne provides Xerox and IBM with a central source of shipment data and performance metrics. The air-express carrier also manages a single, same-day delivery contract for both companies. In addition, Airborne now examines same-day or special-delivery requirements and recommends a lower-priced alternative where appropriate.Retrieved November 3, 2008, from http://www.logisticsmgmt.com/article/CA145552.html.

Treacy and Wiersema maintain that, because of the focus of management time and resources that is required, a firm can realistically choose only one of these three value disciplines in which to specialize. This logic is similar to Porter’s in that firms that mix different strategies run the risk of being “stuck in the middle.” Most companies, in fact, do not specialize in any of the three, and thus they realize only mediocre or average levels of achievement in each area.

The companies that do not make the hard choices associated with focus are in no sense market leaders. In today’s business environment of increased competition and the need more than ever before for competitive differentiation, their complacency will not lead to increased market share, sales, or profits.

“When we look at these managers’ businesses [complacent firms], we invariably find companies that don’t excel, but are merely mediocre on the three disciplines…What they haven’t done is create a breakthrough on any one dimension to reach new heights of performance. They have not traveled past operational competence to reach operational excellence, past customer responsiveness to achieve customer intimacy, or beyond product differentiation to establish product leadership. To these managers we say that if you decide to play an average game, to dabble in all areas, don’t expect to become a market leader.”Treacy, M., & Wiersema, F. (1997). The discipline of market leaders: Choose your customers, narrow your focus, dominate your market (p. 40). Reading, M Addison-Wesley.

Within the context of redesigning the operating model of a company to focus on a particular value discipline, Treacy and Wiersema discuss creating what they call “the cult of the customer.” This is a mind-set that is oriented toward putting the customer’s needs as a key priority throughout the company, at all levels. They also review some of the challenges involved in sustaining market leadership once it is attained (i.e., avoiding the natural complacency that tends to creep into an operation once dominance of the market is achieved).

Strategic focus seems to be a common element in the strategies across successful firms. Two prevalent views of strategy where focus is a key component are strategy as trade-offs and strategy as discipline. Michael Porter identifies three flavors of strategy: (1) cost leadership, (2) differentiation, or (3) focus of cost leadership or differentiation on a particular market niche. Firms can straddle these strategies, but such straddling is likely to dilute strategic focus. Strategy also provides discipline. Treacy and Wiersema’s three strategic disciplines are (1) operational excellence, (2) product leadership, and (3) customer intimacy.

In this section, you will learn about some of the basic internal inputs for strategy formulation—starting with the organization’s strengths and weaknesses. We will focus on three aspects of internal analysis here, though you recognize that these should be complemented by external analysis as well. There is no correct order in which to do internal and external analyses, and the process is likely to be iterative. That is, you might do some internal analysis that suggests the need for other external analysis, or vice versa. For the internal environment, it is best to start with an assessment of resources and capabilities and then work your way into the identification of core competences using VRIO analysis.

By exploiting internal resources and capabilities and meeting the demanding standards of global competition, firms create value for customers.McEvily, S. K., & Chakravarthy, B. (2002). The persistence of knowledge-based advantage: An empirical test for product performance and technological knowledge. Strategic Management Journal, 23, 285–305; Buckley, P. J., & Carter, M. J. (2000). Knowledge management in global technology markets: Applying theory to practice. Long Range Planning, 33(1), 55–71. Value is measured by a product’s performance characteristics and by its attributes for which customers are willing to pay.Pocket Strategy. (1998). Value (p. 165). London: The Economist Books. Those particular bundles of resources and capabilities that provide unique advantages to the firm are considered core competenciesA particular bundle of resources and capabilities that provides unique competitive advantages to the firm..Prahalad, C. K., and Hamel, G. (1990). The core competence of the organization. Harvard Business Review, 90, 79–93. Core competencies are resources and capabilities that serve as a source of a firm’s competitive advantage over rivals. Core competencies distinguish a company competitively and reflect its personality. Core competencies emerge over time through an organizational process of accumulating and learning how to deploy different resources and capabilities. As the capacity to take action, core competencies are “crown jewels of a company,” the activities the company performs especially well compared with competitors and through which the firm adds unique value to its goods or services over a long period of time.Hafeez, K., Zhang, Y. B., & Malak, N. (2002). Core competence for sustainable competitive advantage: A structured methodology for identifying core competence. IEEE Transactions on Engineering Management, 49(1), 28–35; Prahalad, C. K., & Hamel, G. (1990). The core competence of the corporation. Harvard Business Review, 68(3), 79–93.

Sometimes consistency and predictability provide value to customers, such as the type of value Walgreens drugstores provides. As a Fortune magazine writer noted, “Do you realize that from 1975 to today, Walgreens beat Intel? It beat Intel nearly two to one, GE almost five to one. It beat 3M, Coke, Boeing, Motorola.”Useem, J. (2001, February 19). Most admired: Conquering vertical limits. Fortune, pp. 84–96. Walgreens was able to do this by using its core competencies to offer value desired by its target customer group. Instead of responding to the trends of the day, “During the Internet scare of 1998 and 1999, when slogans of ‘Change or Die!’ were all but graffitied on the subway, Walgreens obstinately stuck to its corporate credo of ‘Crawl, walk, run.’ Its refusal to act until it thoroughly understood the implications of e-commerce was deeply unfashionable, but…Walgreens is the epitome of the inner-directed company.”Useem, J. (2001, February 19). Most admired: Conquering vertical limits. Fortune, pp. 84–96. Thus, Walgreens creates value by focusing on the unique capabilities it has built, nurtured, and continues to improve across time.

During the past several decades, the strategic management process was concerned largely with understanding the characteristics of the industry in which the firm competed and, in light of those characteristics, determining how the firm should position itself relative to competitors. This emphasis on industry characteristics and competitive strategy may have understated the role of the firm’s resources and capabilities in developing competitive advantage. In the current competitive landscape, core competencies, in combination with product-market positions, are the firm’s most important sources of competitive advantage.Hitt, M. A., Nixon, R. D., Clifford, P. G., & Coyne, K. P. (1999). The development and use of strategic resources. In M. A. Hitt, P. G. Clifford, R. D. Nixon, & K. P. Coyne (Eds.), Dynamic Strategic Resources (pp. 1–14). Chichester: Wiley. The core competencies of a firm, in addition to its analysis of its general, industry, and competitor environments, should drive its selection of strategies. As Clayton Christensen noted, “Successful strategists need to cultivate a deep understanding of the processes of competition and progress and of the factors that undergird each advantage. Only thus will they be able to see when old advantages are poised to disappear and how new advantages can be built in their stead.”Christensen, C. M. (2001). The past and future of competitive advantage. Sloan Management Review, 42(2), 105–109. By drawing on internal analysis and emphasizing core competencies when formulating strategies, companies learn to compete primarily on the basis of firm-specific differences, but they must be aware of how things are changing as well.

Broad in scope, resources cover a spectrum of individual, social, and organizational phenomena.Eisenhardt, K., & Martin, J. (2000). Dynamic capabilities: What are they? Strategic Management Journal, 21, 1105–1121; Michalisin, M. D., Kline, D. M., & Smith. R. D. (2000). Intangible strategic assets and firm performance: A multi-industry study of the resource-based view, Journal of Business Strategies, 17(2), 91–117. Typically, resources alone do not yield a competitive advantage.West, G. P., & DeCastro, J. (2001). The Achilles heel of firm strategy: Resource weaknesses and distinctive inadequacies. Journal of Management Studies, 38(3), 26–45.; Deeds, D. L., DeCarolis, D., & J. Coombs. (2000). Dynamic capabilities and new product development in high technology ventures: An empirical analysis of new biotechnology firms. Journal of Business Venturing, 15, 211–229; Chi, T. (1994). Trading in strategic resources: Necessary conditions, transaction cost problems, and choice of exchange structure. Strategic Management Journal, 15, 271–290. In fact, the core competencies that yield a competitive advantage are created through the unique bundling of several resources.Berman, S., Down, J., & Hill, C. (2002). Tacit knowledge as a source of competitive advantage in the National Basketball Association. Academy of Management Journal, 45, 13–31. For example, Amazon.com has combined service and distribution resources to develop its competitive advantages. The firm started as an online bookseller, directly shipping orders to customers. It quickly grew large and established a distribution network through which it could ship “millions of different items to millions of different customers.” Compared with Amazon’s use of combined resources, traditional bricks-and-mortar companies, such as Toys “R” Us and Borders, found it hard to establish an effective online presence. These difficulties led them to develop partnerships with Amazon. Through these arrangements, Amazon now handles online presence and the shipping of goods for several firms, including Toys “R” Us and Borders, which now can focus on sales in their stores. Arrangements such as these are useful to the bricks-and-mortar companies because they are not accustomed to shipping so much diverse merchandise directly to individuals.Shepard, S. (2001, April 30). Interview: “The company is not in the stock.” Business Week, pp. 94–96.

Some of a firm’s resources are tangible while others are intangible. Tangible resources are assets that can be seen and quantified. Production equipment, manufacturing plants, and formal reporting structures are examples of tangible resources. Intangible resources typically include assets that are rooted deeply in the firm’s history and have accumulated over time. Because they are embedded in unique patterns of routines, intangible resources are relatively difficult for competitors to analyze and imitate. Knowledge, trust between managers and employees, ideas, the capacity for innovation, managerial capabilities, organizational routines (the unique ways people work together), scientific capabilities, and the firm’s reputation for its goods or services and how it interacts with people (such as employees, customers, and suppliers) are all examples of intangible resources.Feldman, M. S. (2000). Organizational routines as a source of continuous change, Organization Science, 11, 611–629; Knott, A. M., & McKelvey, B. (1999). Nirvana efficiency: A comparative test of residual claims and routines. Journal of Economic Behavior & Organization, 38, 365–383. The four types of tangible resources are financial, organizational, physical, and technological. The three types of intangible resources are human, innovation, and reputational.

As a manager or entrepreneur, you will be challenged to understand fully the strategic value of your firm’s tangible and intangible resources. The strategic value of resources is indicated by the degree to which they can contribute to the development of core competencies, and, ultimately, competitive advantage. For example, as a tangible resource, a distribution facility is assigned a monetary value on the firm’s balance sheet. The real value of the facility, however, is grounded in a variety of factors, such as its proximity to raw materials and customers, but also in intangible factors such as the manner in which workers integrate their actions internally and with other stakeholders, such as suppliers and customers.Gavetti, G., & Levinthal, D. (2000). Looking forward and looking backward: Cognitive and experimental search. Administrative Science Quarterly, 45, 113–137; Coff, R. W. (1999). How buyers cope with uncertainty when acquiring firms in knowledge-intensive industries: Caveat emptor. Organization Science, 10, 144–161; Marsh, S. J., & Ranft, A. L. (1999). Why resources matter: An empirical study of knowledge-based resources on new market entry. In M. A. Hitt, P. G. Clifford, R. D. Nixon, & K. P. Coyne (Eds.), Dynamic strategic resources (pp. 43–66). Chichester: Wiley.

Capabilities are the firm’s capacity to deploy resources that have been purposely integrated to achieve a desired end state.Helfat, C. E., & Raubitschek, R. S. (2000). Product sequencing: Co-evolution of knowledge, capabilities, and products. Strategic Management Journal, 21, 961–979. The glue that holds an organization together, capabilities emerge over time through complex interactions among tangible and intangible resources. Capabilities can be tangible, like a business process that is automated, but most of them tend to be tacit and intangible. Critical to forming competitive advantages, capabilities are often based on developing, carrying, and exchanging information and knowledge through the firm’s human capital.Hitt, M. A., Bierman, L., Shimizu, K., & Kochhar, R. (2001) Direct and moderating effects of human capital on strategy and performance in professional service firms: A resource-based perspective. Academy of Management Journal, 44(1), 13–28; Hitt, M. A., Ireland, R. D., & Lee, H. (2000). Technological learning, knowledge management, firm growth and performance: An introductory essay. Journal of Engineering and Technology Management, 17, 231–246; Hoopes, D. G., & Postrel, S. (1999). Shared knowledge: “Glitches,” and product development performance. Strategic Management Journal, 20, 837–865; Quinn, J. B. (1994). The Intelligent Enterprise. New York: Free Press. Because a knowledge base is grounded in organizational actions that may not be explicitly understood by all employees, repetition and practice increase the value of a firm’s capabilities.

The foundation of many capabilities lies in the skills and knowledge of a firm’s employees and, often, their functional expertise. Hence, the value of human capital in developing and using capabilities and, ultimately, core competencies cannot be overstated. Firms committed to continuously developing their people’s capabilities seem to accept the adage that “the person who knows how will always have a job. The person who knows why will always be his boss.”Thoughts on the business of life. (1999, May 17). Forbes, p. 352.

Global business leaders increasingly support the view that the knowledge possessed by human capital is among the most significant of an organization’s capabilities and may ultimately be at the root of all competitive advantages. But firms must also be able to use the knowledge that they have and transfer it among their operating businesses.Argote, L., & Ingram, P. (2000). Knowledge transfer: A basis for competitive advantage in firms. Organizational Behavior and Human Decision Processes, 82, 150–169. For example, researchers have suggested that “in the information age, things are ancillary, knowledge is central. A company’s value derives not from things, but from knowledge, know-how, intellectual assets, competencies—all of it embedded in people.”Dess, G. G., & Picken, J. C. (1999). Beyond productivity. New York: AMACOM. Given this reality, the firm’s challenge is to create an environment that allows people to fit their individual pieces of knowledge together so that, collectively, employees possess as much organizational knowledge as possible.Coy, P. (2002, Spring). High turnover, high risk [Special Issue]. Business Week, p. 24.

To help them develop an environment in which knowledge is widely spread across all employees, some organizations have created the new upper-level managerial position of chief learning officer (CLO). Establishing a CLO position highlights a firm’s belief that “future success will depend on competencies that traditionally have not been actively managed or measured—including creativity and the speed with which new ideas are learned and shared.”Baldwin, T. T., & Danielson, C. C. (2000). Building a learning strategy at the top: Interviews with ten of America’s CLOs. Business Horizons, 43(6), 5–14. In general, the firm should manage knowledge in ways that will support its efforts to create value for customers.Kuratko, D. F., Ireland, R. D., & Hornsby, J. S. (2001). Improving firm performance through entrepreneurial actions: Acordia’s corporate entrepreneurship strategy. Academy of Management Executive, 15(4), 60–71; Hansen, M. T., Nhoria, N., & Tierney, T. (1999). What’s your strategy for managing knowledge? Harvard Business Review, 77(2), 106–116.

Figure 5.15 The Value Chain

Adapted from Porter, M. (1985). Competitive Advantage. New York: Free Press. Exhibit is creative commons licensed at http://en.wikipedia.org/wiki/Image:ValueChain.PNG.

Capabilities are often developed in specific functional areas (such as manufacturing, R&D, and marketing) or in a part of a functional area (for example, advertising). The value chainThe primary and support activities that an organization uses to create value in the form of products or services., popularized by Michael Porter’s book Competitive Advantage, is a useful tool for taking stock of organizational capabilities. A value chain is a chain of activities. In the value chain, some of the activities are deemed to be primary, in the sense that these activities add direct value. In the preceding figure, primary activities are logistics (inbound and outbound), marketing, and service. Support activities include how the firm is organized (infrastructure), human resources, technology, and procurement. Products pass through all activities of the chain in order, and at each activity, the product gains some value. A firm is effective to the extent that the chain of activities gives the products more added value than the sum of added values of all activities.

It is important not to mix the concept of the value chain with the costs occurring throughout the activities. A diamond cutter can be used as an example of the difference. The cutting activity may have a low cost, but the activity adds to much of the value of the end product, since a rough diamond is significantly less valuable than a cut, polished diamond. Research suggests a relationship between capabilities developed in particular functional areas and the firm’s financial performance at both the corporate and business-unit levels,Hitt, M. A., & Ireland, R. D. (1986). Relationships among corporate level distinctive competencies, diversification strategy, corporate structure, and performance. Journal of Management Studies, 23, 401–416; Hitt, M. A., & Ireland, R. D. (1985). Corporate distinctive competence, strategy, industry, and performance. Strategic Management Journal, 6, 273–293; Hitt, M. A., Ireland, R. D., & Palia, K. A. (1982). Industrial firms’ grand strategy and functional importance. Academy of Management Journal, 25, 265–298; Hitt, M. A., Ireland, R. D., & Stadter, G. (1982). Functional importance and company performance: Moderating effects of grand strategy and industry type. Strategic Management Journal, 3, 315–330; Snow, C. C., & Hrebiniak, E. G. (1980). Strategy, distinctive competence, and organizational performance. Administrative Science Quarterly, 25, 317–336. suggesting the need to develop capabilities at both levels.

Given that almost anything a firm possesses can be considered a resource or capability, how should you attempt to narrow down the ones that are core competencies, and explain why firm performance differs? To lead to a sustainable competitive advantage, a resource or capability should be valuable, rare, inimitable (including nonsubstitutable), and organized. This VRIO framework is the foundation for internal analysis.VRIO analysis is at the core of the resource-based view of the firm. Wernerfelt, B. (1984). A resource-based view of the firm. Strategic Management Journal, 5, 171–180. Barney, J. B. (1991). Firm resources and sustained competitive advantage. Journal of Management, 19, 99–120. VRIOStands for valuable, rare, inimitable, and organization. is an acronym for valuable, rare, inimitable, and organization.

If you ask managers why their firms do well while others do poorly, a common answer is likely to be “our people.” But this is really not an answer. It may be the start of an answer, but you need to probe more deeply—what is it about “our people” that is especially valuable? Why don’t competitors have similar people? Can’t competitors hire our people away? Or is it that there something special about the organization that brings out the best in people? These kinds of questions form the basis of VRIO and get to the heart of why some resources help firms more than others.

Figure 5.16 VRIO and Relative Firm Performance

Moreover, your ability to identify whether an organization has VRIO resources will also likely explain their competitive position. In the figure, you can see that a firm’s performance relative to industry peers is likely to vary according to the level to which resources, capabilities, and ultimately core competences satisfy VRIO criteria. The four criteria are explored next.

A resource or capability is said to be valuable if it allows the firm to exploit opportunities or negate threats in the environment. Union Pacific’s extensive network of rail-line property and equipment in the Gulf Coast of the United States is valuable because it allows the company to provide a cost-effective way to transport chemicals. Because the Gulf Coast is the gateway for the majority of chemical production in the United States, the rail network allows the firm to exploit a market opportunity. Delta’s control of the majority of gates at the Cincinnati / Northern Kentucky International Airport (CVG) gives it a significant advantage in many markets. Travelers worldwide have rated CVG one of the best airports for service and convenience 10 years running. The possession of this resource allows Delta to minimize the threat of competition in this city. Delta controls air travel in this desirable hub city, which means that this asset (resource) has significant value. If a resource does not allow a firm to minimize threats or exploit opportunities, it does not enhance the competitive position of the firm. In fact, some scholars suggest that owning resources that do not meet the VRIO test of value actually puts the firm at a competitive disadvantage.Barney, J. B. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17, 99–120.

A resource is rare simply if it is not widely possessed by other competitors. Of the criteria this is probably the easiest to judge. For example, Coke’s brand name is valuable but most of Coke’s competitors (Pepsi, 7Up, RC) also have widely recognized brand names, making it not that rare. Of course, Coke’s brand may be the most recognized, but that makes it more valuable, not more rare, in this case.

A firm that possesses valuable resources that are not rare is not in a position of advantage relative to competitors. Rather, valuable resources that are commonly held by many competitors simply allow firms to be at par with competitors. However, when a firm maintains possession of valuable resources that are rare in the industry they are in a position of competitive advantage over firms that do not possess the resource. They may be able to exploit opportunities or negate threats in ways that those lacking the resource will not be able to do. Delta’s virtual control of air traffic through Cincinnati gives it a valuable and rare resource in that market.

How rare do the resources need to be for a firm to have a competitive advantage? In practice, this is a difficult question to answer unequivocally. At the two extremes (i.e., one firm possesses the resource or all firms possess it), the concept is intuitive. If only one firm possesses the resource, it has significant advantage over all other competitors. For instance, Monsanto had such an advantage for many years because they owned the patent to aspartame, the chemical compound in NutraSweet, they had a valuable and extremely rare resource. Because during the lifetime of the patent they were the only firm that could sell aspartame, they had an advantage in the artificial sweetener market. However, meeting the condition of rarity does not always require exclusive ownership. When only a few firms possess the resource, they will have an advantage over the remaining competitors. For instance, Toyota and Honda both have the capabilities to build cars of high quality at relatively low cost.Dyer, J. H., Kale, P., & Singh, H. (2004, July–August). When to ally and when to acquire. Harvard Business Review, 109–115. Their products regularly beat rival firms’ products in both short-term and long-term quality ratings.Dyer, J. H., & Hatch, N. (2004). Using Supplier Networks to Learn Faster. Sloan Management Review, 45(3), 57–63. Thus, the criterion of rarity requires that the resource not be widely possessed in the industry. It also suggests that the more exclusive a firm’s access to a particularly valuable resource, the greater the benefit for having it.