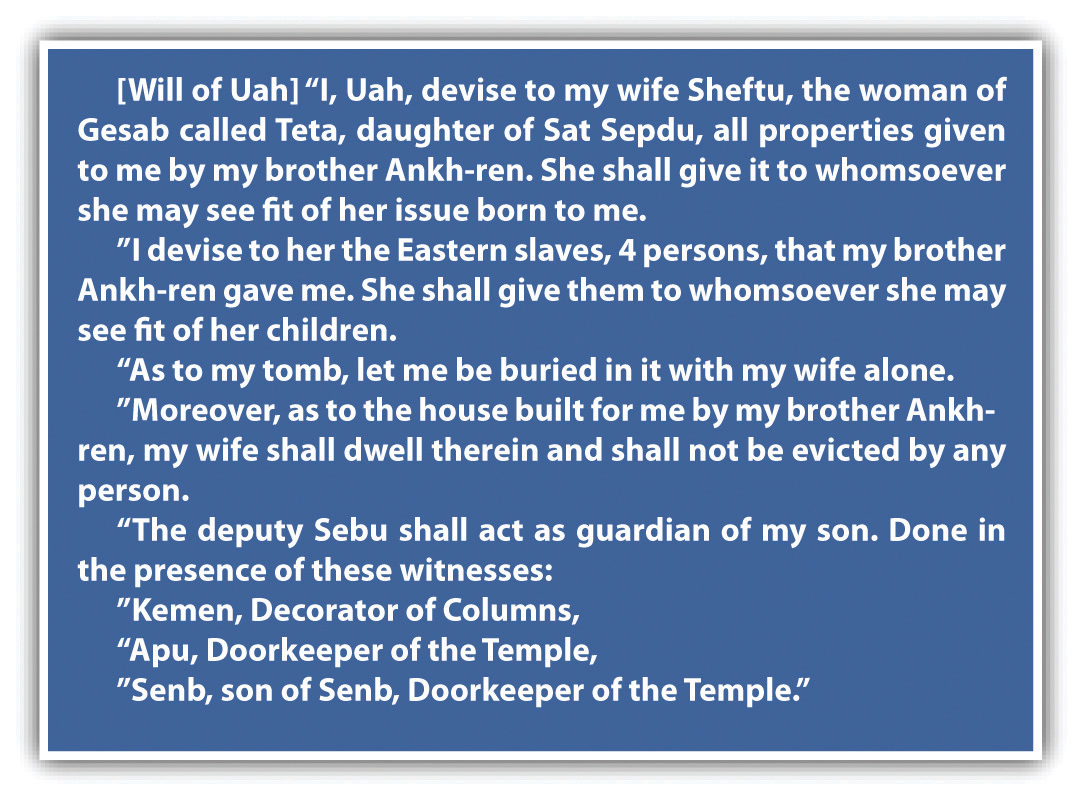

A willThe declaration of a person’s wishes (the testator) about the disposition of his assets on his death. is the declaration of a person’s wishes about the disposition of his assets on his death. Normally a written document, the will names the persons who are to receive specific items of real and personal property. Unlike a contract or a deed, a will is not binding as long as the person making the will lives. He may revoke it at any time. Wills have served their present function for virtually all of recorded history. The earliest known will is from 1800 BC (see Figure 36.2 "An Ancient Will"). Even if somewhat different in form, it served the same basic function as a modern will.

Figure 36.2 An Ancient Will

Source: John H. Wigmore, A Panorama of the World’s Legal Systems, vol. 1, p. 22.

Although most wills are written in a standardized form, some special types of wills are enforceable in many states.

ProbateThe process by which a deceased’s estate is managed under the supervision of a court. is the process by which a deceased’s estate is managed under the supervision of a court. In most states, the court supervising this process is a specialized one and is often called the probate court. Probate practices vary widely from state to state, although they follow a general pattern in which the assets of an estate are located, added up, and disbursed according to the terms of the will or, if there is no will, according to the law of intestate succession. To attempt to bring uniformity into the conflicting sets of state laws the National Conference of Commissioners on Uniform State Laws issued the Uniform Probate Code (UPC) in 1969, and by 2011 it had been adopted in its entirety in sixteen states. Several other states have adopted significant parts of the UPC, which was revised in 2006. Our discussion of wills and estate administration is drawn primarily from the UPC, but you should note that there are variations among the states in some of the procedures standardized in the UPC.

Any person who is over eighteen and of “sound mind” may make a will. One who is insane may not make an enforceable will, although the degree of mental capacity necessary to sustain a will is generally said to be a “modest level of competence” and is lower than the degree of capacity people must possess to manage their own affairs during their life. In other words, a court might order a guardian to manage the affairs of one who is mentally deficient but will uphold a will that the person has written. Insanity is not the only type of mental deficiency that will disqualify a will; medication of a person for serious physical pain might lead to the conclusion that the person’s mind was dulled and he did not understand what he was doing when writing his will. The case Estate of Seymour M. Rosen, (see Section 36.4.1 "Testamentary Capacity"), considers just such a situation.

Under the UPC, wills must be in writing. The will is not confined to the specific piece of paper called “will” and signed by the testator. It may incorporate by reference any other writing in existence when the will is made, as long as the will sufficiently identifies the other writing and manifests an intent to incorporate it. Although lawyers prepare neatly typed wills, the document can be written in pencil or pen and on any kind of paper or even on the back of an envelope. Typically, the written will has the following provisions: (1) a “publication clause,” listing the testator’s name and his or her intention to make a will; (2) a “revocation clause,” revoking all previously made wills; (3) burial instructions; (4) debt payments, listing specific assets to be used; (5) bequestsGift of personal property by will., which are gifts of personal property by will; (6) devisesGift of real property by will., which are gifts of real property by will; (7) a “residuary clause,” disposing of all property not covered by a specific bequest or devise; (8) a “penalty clause,” stating a penalty for anyone named in the will who contests the will; (9) the name of minor children’s guardian; and (10) the name of the executor. The executor’s job is to bring in all the assets of an estate, pay all just claims, and make distribution to beneficiaries in accord with the testator’s wishes. Beginning with California in 1983, several states have adopted statutory wills—simple fill-in-the-blank will forms that can be completed without consulting an attorney.

The testator must sign the will, and the proper place for the signature is at the end of the entire document. The testator need not sign his full name, although that is preferable; his initials or some other mark in his own hand, intended as an execution of the document, will suffice. The UPC permits someone else to sign for the testator as long as the signing is done in the testator’s presence and by his or her direction.

Most states require two or three witnesses to sign the will. The UPC requires two witnesses. The witnesses should observe the testator sign the will and then sign it themselves in the presence of each other. Since the witnesses might be asked to attest in court to the testator’s signature, it is sound practice to avoid witnesses who are unduly elderly and to use an extra witness or two. Most states forbid a person who has an interest in the will—that is, one who is a beneficiary under the will—from witnessing.

In some states, a beneficiary who serves as a witness will lose his or her right to a bequest or devise. The UPC differs from the usual rule: no will or any provision of a will is invalid because an interested party witnesses it, nor does the interested witness forfeit a bequest or devise.

Since wills are generally effective only at death, the testator may always revoke or amend a will during his lifetime. He may do so by tearing, burning, obliterating, or otherwise destroying it. A subsequent will has the effect of revoking an inconsistent prior will, and most wills expressly state that they are intended to revoke all prior wills. A written modification of or supplement to a prior will is called a codicilA written modification of or supplement to a prior will.. The codicil is often necessary, because circumstances are constantly changing. The testator may have moved to a new state where he must meet different formal requirements for executing the will; one of his beneficiaries may have died; his property may have changed. Or the law, especially the tax law, may have changed.

One exception to the rule that wills are effective only at death is the so-called living willA will that takes effect during life in cases of terminal illness, directing that physicians and others take no life-prolonging measures.. Beginning with California in 1976, most states have adopted legislation permitting people to declare that they refuse further treatment should they become terminally ill and unable to tell physicians not to prolong their lives if they can survive only by being hooked up to life-preserving machines. This living will takes effect during the patient’s life and must be honored by physicians unless the patient has revoked it. The patient may revoke at any time, even as he sees the doctor moving to disconnect the plug.

In most states, a later marriage revokes a prior will, but divorce does not. Under the UPC, however, a divorce or annulment revokes any disposition of property bequeathed or devised to the former spouse under a will executed prior to the divorce or annulment. A will is at least partially revoked if children are born after it is executed, unless it has either provided for subsequently born children or stated the testator’s intention to disinherit such children.

Specific bequests listed in a will might not be available in the estate when the testator or testatrix dies. AbatementA proportional reduction of the amount payable under a will when the funds are no longer available to pay in full. of a bequest happens when there are insufficient assets to pay the bequest. Suppose the testatrix leaves $10,000 each to “my four roommates,” but when she dies, her estate is worth only $20,000. The gift to each of the roommates is said to have abated, and each will take only $5,000.

Abatement can pose a serious problem in wills not carefully drafted. Since circumstances can always change, a general provision in a father’s will, providing “my dear daughter with all the rest, residue, and remainder of my estate,” will do her little good if business reverses mean that the $10,000 bequest to the local hospital exhausts the estate of its assets—even though at the time the will was made, the testator had assets of $1 million and supposed his daughter would be getting the bulk of it. Since specific gifts must be paid out ahead of general bequests or devises, abatement can cause the residual legatee (the person taking all assets not specifically distributed to named individuals) to suffer.

Suppose that a testator bequeathed her 1923 Rolls Royce to “my faithful secretary,” but that the car had been sold and she owned only a 1980 Volkswagen when she died. Since the Rolls was not part of the estate, it is said to have adeemed (to have been taken away). AdemptionRevocation or cancellation of a legatee’s rights under a will by the actions of the testator during his life, often by his having given away assets that the will says are to go to the legatee. of a gift in a will means that the intended legatee (the person named in the will) forfeits the object because it no longer exists. An object used as a substitute by the testator will not pass to the legatee unless it is clear that she intended the legatee to have it.

IntestacyDying without a will. means dying without a will. Intestacy happens all too frequently; even those who know the consequences for their heirs often put off making a will until it is too late—Abraham Lincoln, for one, who as an experienced lawyer knew very well the hazards to heirs of dying intestate. On his death, Lincoln’s property was divided, with one-third going to his widow, one-third to a grown son, and one-third to a twelve-year-old son. Statistics show that in New York, about one-third of the people who die with estates of $5,000 or more die without wills. In every state, statutes provide for the disposition of property of decedents dying without wills. If you die without a will, the state in effect has made one for you. Although the rules vary by statute from state to state, a common distribution pattern prevails.

At common law, parents of an intestate decedent could not inherit his property. Today, however, many states provide that parents will share in the property. If the parents have already died, then the estate will pass to collateral heirs (siblings, nieces, nephews, aunts, and uncles). If there are no collateral heirs, most state laws provide that the next surviving kin of equal degree will share the property equally (e.g., first cousins). If there are no surviving kin, the estate escheatsProperty of decedents that have no known heirs will “escheat” to the state. (es CHEETS) to the state, which is then the sole owner of the assets of the estate.

In some states, the surviving spouse without children will inherit the entire estate. In other states, the spouse must share the property with the decedent’s parents or, if they are deceased, with the collateral heirs.

In general, the surviving spouse will be entitled to one-third of the estate, and the remainder will pass in equal shares to living children of the decedent. The share of any child who died before the decedent will be divided equally among that child’s offspring. These grandchildren of the decedent are said to take per stirpesBy representation; in a distribution per stirpes, each class of individuals takes the share to which their deceased would have been entitled. (per STIR peas), meaning that they stand in the shoes of their parent. Suppose that the decedent left a wife, three children, and eight grandchildren (two children each of the three surviving children and two children of a fourth child who predeceased the decedent), and that the estate was worth $300,000. Under a typical intestate succession law, the widow would receive property worth $100,000. The balance of the property would be divided into four equal parts, one for each of the four children. The three surviving children would each receive $50,000. The two children of the fourth child would each receive $25,000. The other grandchildren would receive nothing.

A system of distribution in which all living descendants share equally, regardless of generation, is said to be a distribution per capitaAccording to the number of individuals, share and share alike; in a distribution per capita, each person named will receive an equal share.. In the preceding example, after the widow took her share, the remaining sum would be divided into eleven parts, three for the surviving children and eight for the surviving grandchildren.

If the decedent was a widow or widower with children, then the surviving children generally will take the entire estate.

To carry on the administration of an estate, a particular person must be responsible for locating the estate property and carrying out the decedent’s instructions. If named in the will, this person is called an executorThe administrator of an estate, named in the will by the testator.. When a woman serves, she is still known in many jurisdictions as an executrixThe female administrator of an estate, named in the will by the testator.. If the decedent died intestate, the court will appoint an administrator (or administratrix, if a woman), usually a close member of the family. The UPC refers to the person performing the function of executor or administrator as a personal representative. Unless excused by the will from doing so, the personal representative must post a bond, usually in an amount that exceeds the value of the decedent’s personal property.

The personal representative must immediately become familiar with the decedent’s business, preserve the assets, examine the books and records, check on insurance, and notify the appropriate banks.

When confirmed by the court (if necessary), the personal representative must offer the will in probate—that is, file the will with the court, prove its authenticity through witnesses, and defend it against any challenges. Once the court accepts the will, it will enter a formal decree admitting the will to probate.

Traditionally, a widow could make certain elections against the will; for example, she could choose dower and homestead rights. The right of dowerA right given to a widow to a life estate in one-third of the husband’s inheritable land. entitled the widow to a life estate in one-third of the husband’s inheritable land, while a homestead rightThe right to the family home (as measured by an amount of land or a specific dollar amount) to be free of all claims of creditors. is the right to the family home as measured by an amount of land (e.g., 160 acres of rural land or 1 acre of urban land in Kansas) or a specific dollar amount. In some states, this amount is quite low (e.g., $4,000 in Kansas) where the legislature has not upwardly adjusted the dollar amount for many years.

Today, most states have eliminated traditional dower rights. These states give the surviving spouse (widow or widower) the right to reject provisions made in a will and to take a share of the decedent’s estate instead.

Once the will is admitted to probate, the personal representative must assemble and inventory all assets. This task requires the personal representative to collect debts and rent due, supervise the decedent’s business, inspect the real estate, store personal and household effects, prove the death and collect proceeds of life insurance policies, take securities into custody, and ascertain whether the decedent held property in other states. Next, the assets must be appraised as of the date of death. When inventory and appraisal are completed, the personal representative must decide how and when to dispose of the assets by answering the following sorts of questions: Should a business be liquidated, sold, or allowed to continue to operate? Should securities be sold, and if so, when? Should the real estate be kept intact under the will or sold? To whom must the personal effects be given?

The personal representative must also handle claims against the estate. If the decedent had unpaid debts while alive, the estate will be responsible for paying them. In most states, the personal representative is required to advertise that the estate is in probate. When all claims have been gathered and authenticated, the personal representative must pay just claims in order of priority. In general (though by no means in every state), the order of priority is as follows: (1) funeral expenses, (2) administration expenses (cost of bond, advertising expenses, filing fees, lawsuit costs, etc.), (3) family allowance, (4) claims of the federal government, (5) hospital and other expenses associated with the decedent’s last illness, (6) claims of state and local governments, (7) wage claims, (8) lien claims, (9) all other debts. If the estate is too small to cover all these claims, every claim in the first category must be satisfied before the claims in the second category may be paid, and so on.

Before the estate can be distributed, the personal representative must take care of all taxes owed by the estate. She will have to file returns for both estate and income taxes and pay from assets of the estate the taxes due. (She may have to sell some assets to obtain sufficient cash to do so.) Estate taxesTaxes imposed by the federal government on large estates.—imposed by the federal government and based on the value of the estate—are nearly as old as the Republic; they date back to 1797. They were instituted originally to raise revenue, but in our time they serve also to break up large estates.

As of 2011, the first $1 million of an estate is exempt from taxation, lowering the threshold from an earlier standard. The Tax Policy Institute of the Brookings Institution estimates that 108,200 estates of people dying in 2011 will file estate tax returns, and 44,200 of those estates will pay taxes totaling $34.4 billion.

Although a unified tax is imposed on gifts during life and transfers at death, everyone is permitted to give away $13,000 per donee each year without paying any tax on the gift. A tax on sizable gifts is imposed to prevent people with large estates from giving away during their lives portions of their estate in order to escape estate taxes. Thus two grandparents with two married children and four grandchildren may give away $26,000 ($13,000 from each grandparent) to their eight descendants (children, spouses, grandchildren) each year, for a total of $208,000, without paying any tax.

State governments also impose taxes at death. In many states, these are known as inheritance taxesState taxes on an heir’s right to receive the property. and are taxes on the heir’s right to receive the property. The tax rate depends on the relationship to the decedent: the closer the relation, the smaller the tax. Thus a child will pay less than a nephew or niece, and either of them will pay less than an unrelated friend who is named in the will.

Once the taxes are paid, a final accountingDone by the executor to close out an estate in probate. After taxes and debts are paid, an accounting must be prepared, showing the remaining principal, income, and disbursements to beneficiaries. must be prepared, showing the remaining principal, income, and disbursements. Only at this point may the personal representative actually distribute the assets of the estate according to the will.

Any person with the requisite capacity may make a will and bequeath personal property to named heirs. A will can also devise real property. Throughout the United States, there are fairly common requirements to be met for a will to qualify for probate.

Intestacy statutes will govern where there is no will, and an administrator will be appointed by the probate court. Intestacy statutes will dictate which relatives will get what portion of the decedent’s estate, portions that are likely to differ from what the decedent would have done had he or she left a valid will. Where there are no heirs, the decedent’s property escheats to the state.

An executor (or executrix) is the person named in the will to administer the estate and render a final accounting. Estate and inheritance taxes may be owed if the estate is large enough.