If you buy a good, then you obtain buyer surplus. If you did not expect to obtain any surplus, then you would not choose to buy the good.

If you sell a good, then you obtain seller surplus. If you did not expect to obtain any surplus, you would not sell the good.

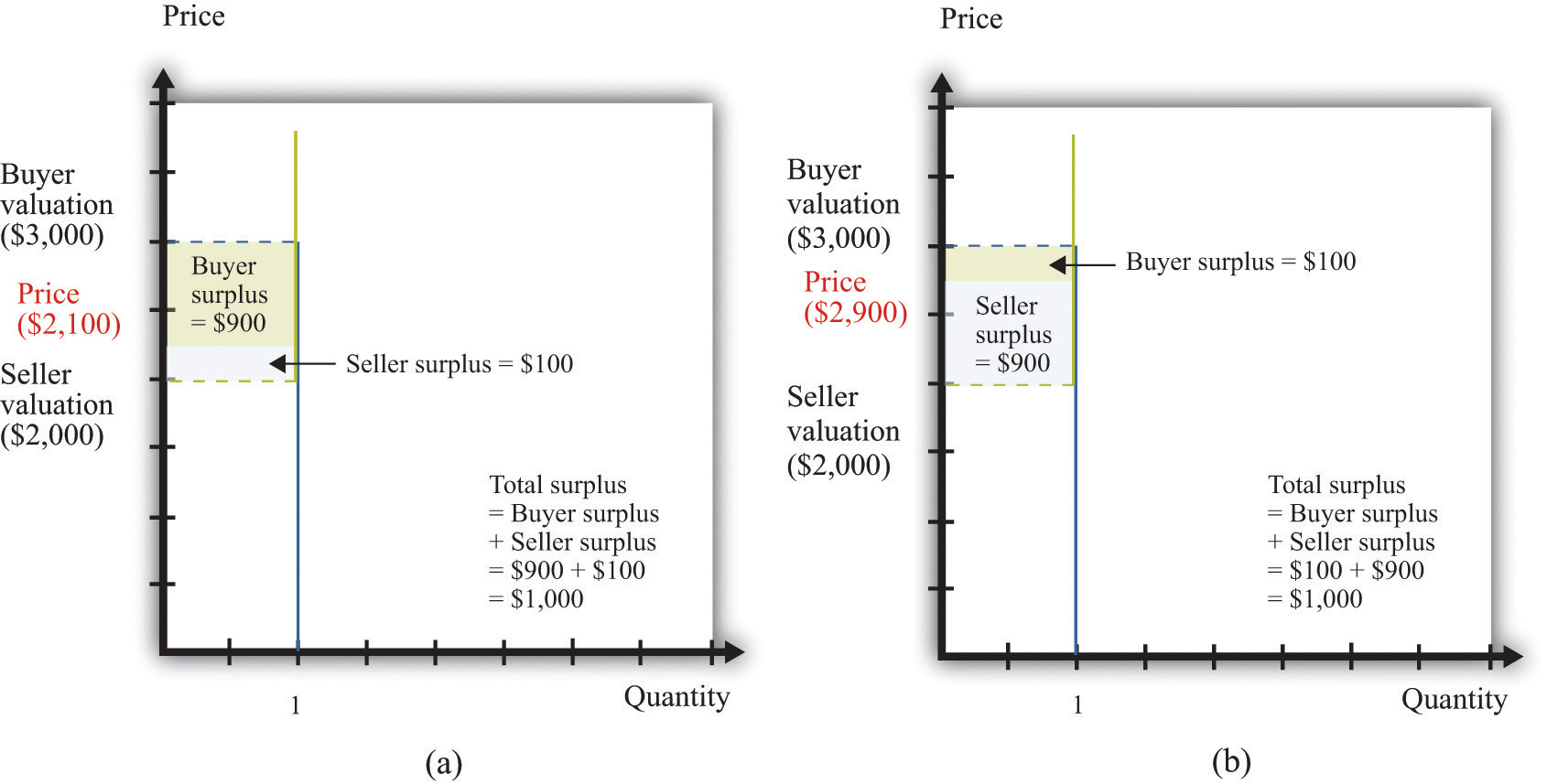

Buyer surplus and seller surplus are created by trade in a competitive market (Figure 31.6 "A Competitive Market"). The equilibrium price and the equilibrium quantity are determined by the intersection of the supply and demand curves. The area below the demand curve and above the price is the buyer surplus; the area above the supply curve and below the price is the seller surplus. The sum of the buyer surplus and the seller surplus is called total surplus or the gains from trade.

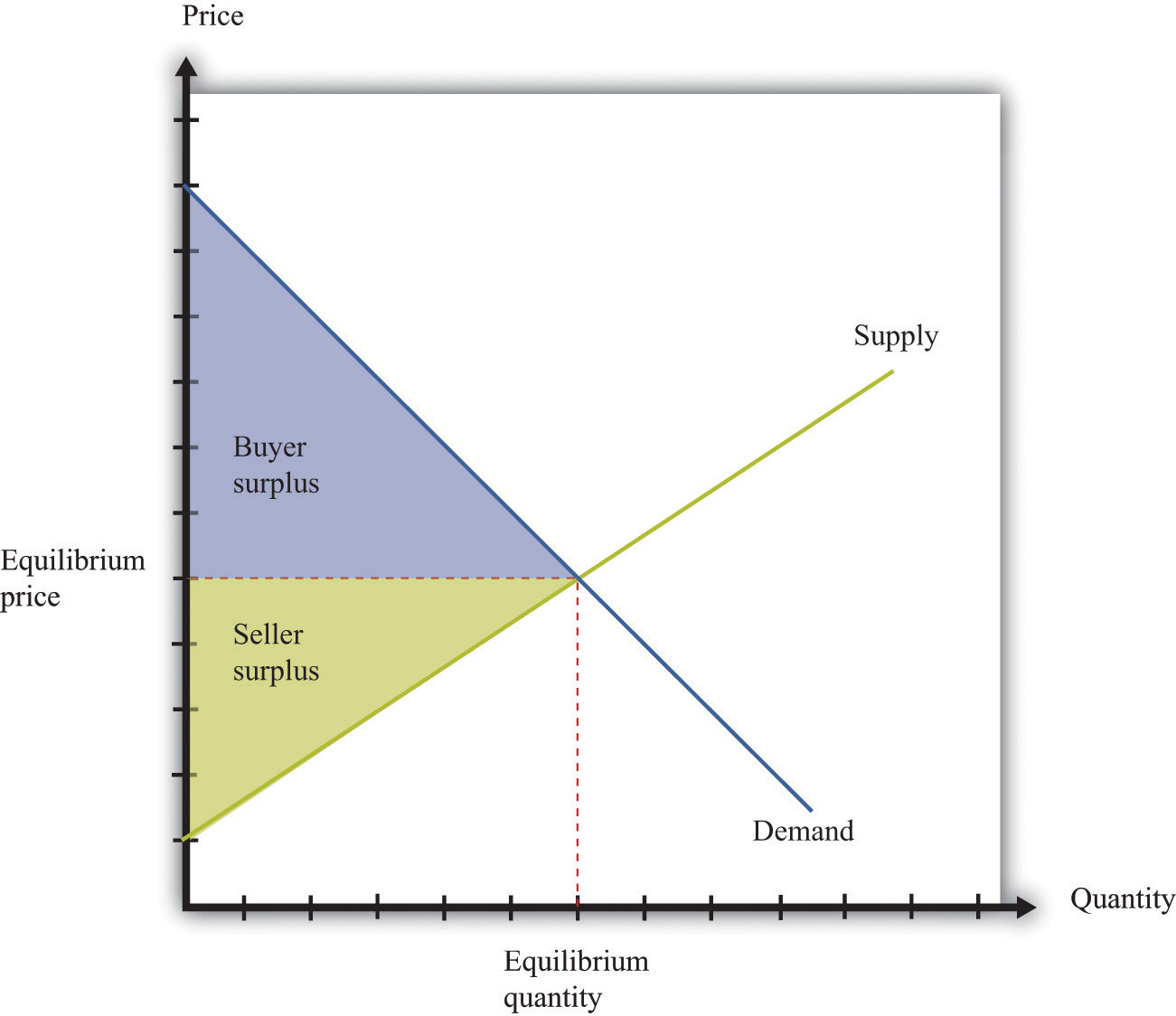

Buyer surplus and seller surplus can also arise from individual bargaining (Figure 31.7 "Individual Bargaining"). When a single unit is traded (the case of unit demand and unit supply), the total surplus is the difference between the buyer’s valuation and the seller’s valuation. Bargaining determines how they share the gains from trade. The quantity of trades, indicated on the horizontal axis, is either zero or one. The valuations of the buyer and the seller are shown on the vertical axis. In this case, the valuation of the buyer ($3,000) exceeds the valuation of the seller ($2,000), indicating that there are gains from trade equal to $1,000. How these gains are shared between the buyer and seller depends on the price they agree on. In part (a) of Figure 31.7 "Individual Bargaining", the buyer gets most of the surplus; in part (b) of Figure 31.7 "Individual Bargaining", the seller gets most of the surplus.

Figure 31.6 A Competitive Market

Figure 31.7 Individual Bargaining