Which of the following is not true about double-entry bookkeeping?

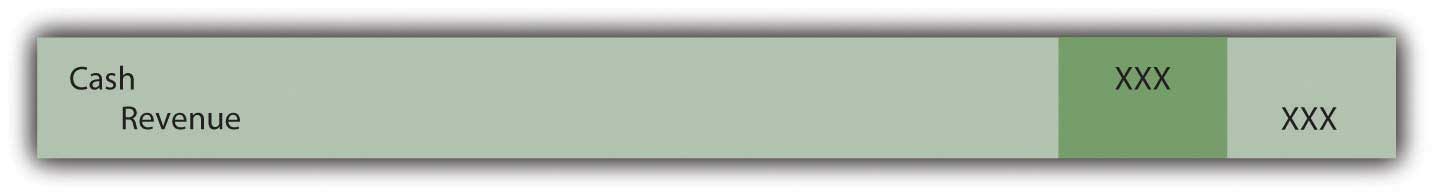

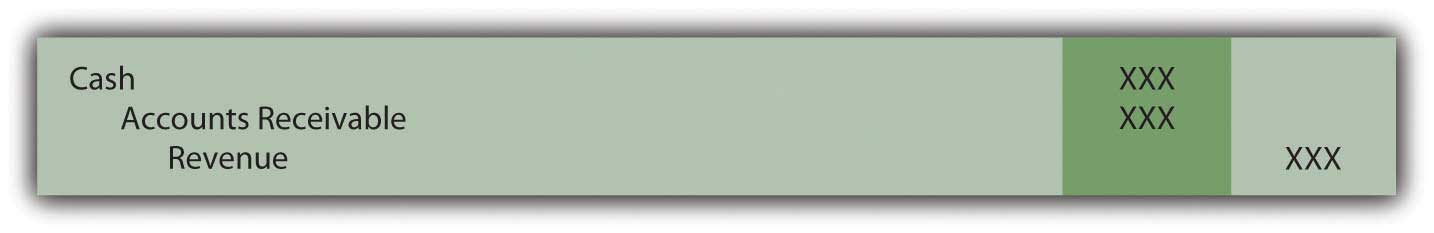

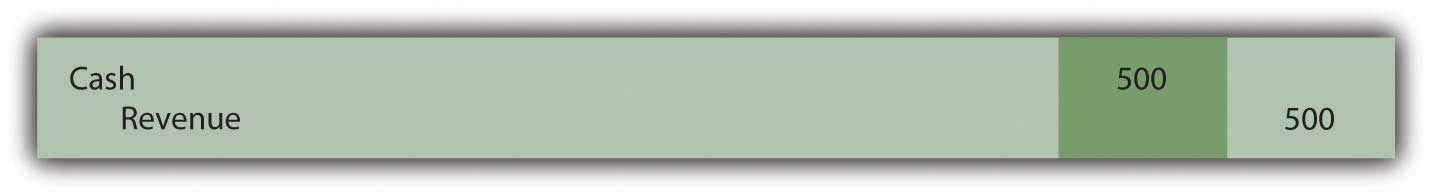

Which of the following entries could Yeats Company not make when they perform a service for a client?

Figure 4.20

Figure 4.21

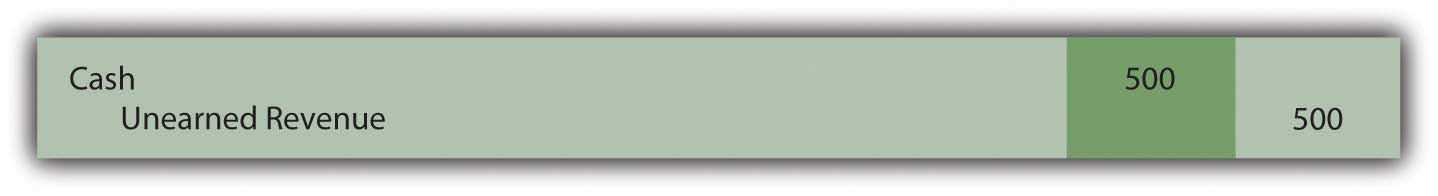

Figure 4.22

Figure 4.23

Which of the following is a transaction for Tyler Corporation?

Elenor Company sells 400 units of inventory for $40 each. The inventory originally cost Elenor $26 each. What is Elenor’s gross profit on this transaction?

Which of the following increases with a debit?

In January, Rollins Company is paid $500 by a client for work that Rollins will not begin until February. Which of the following is the correct journal entry for Rollins to make when the $500 is received?

Figure 4.24

Figure 4.25

Figure 4.26

Figure 4.27

Record the following journal entries for Taylor Company for the month of March:

For each of the following transactions, determine if Raymond Corporation has earned revenue during the month of May and, if so, how much it has earned.

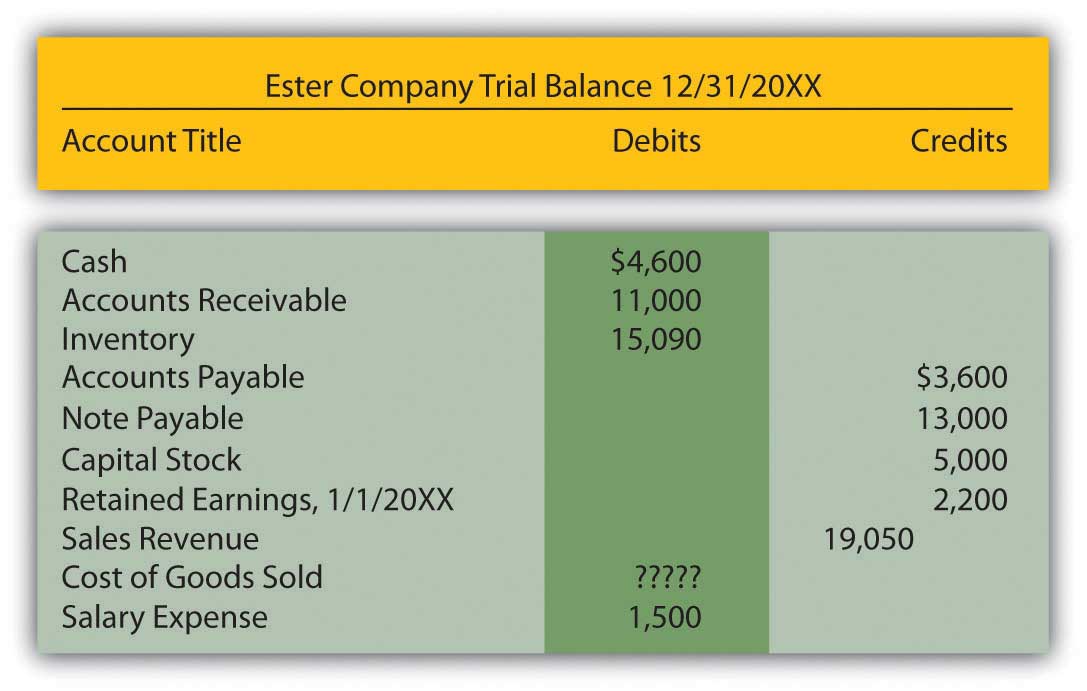

Determine the missing account balance in the following trial balance:

Figure 4.28 Trial Balance—Ester Company

State which balance, debit, or credit is normally held by the following accounts:

Near the end of her freshman year at college, Heather Miller is faced with the decision of whether to get a summer job, go to summer school, or start a summer dress making business. Heather has had some experience designing and sewing and believes it might be the most lucrative of her summer alternatives. She starts “Sew Cool.”

During June, the first month of business, the following occur:

Sew Cool’s taxes, paid in cash, amount to $87.

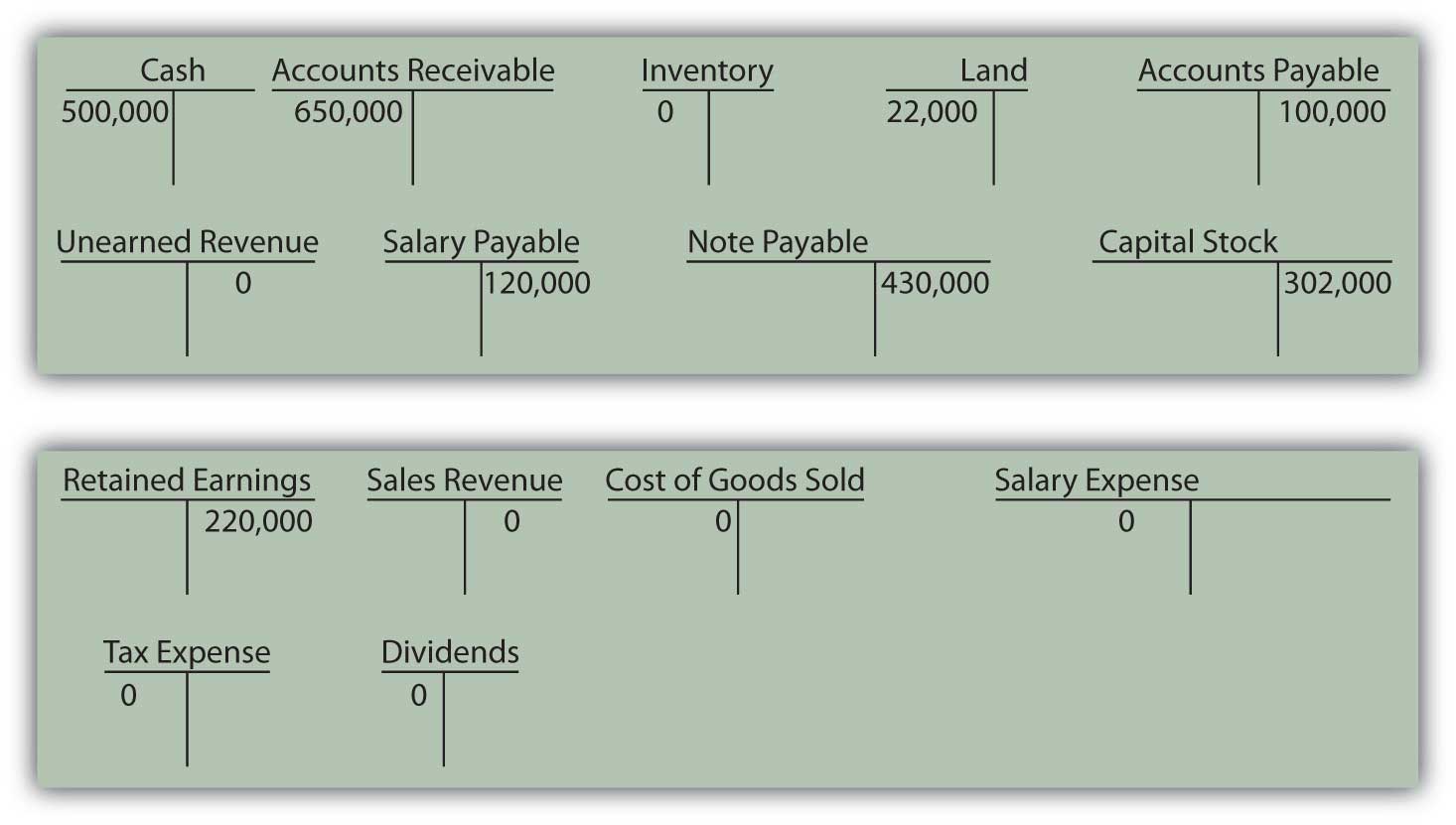

Bowling Corporation had the following transactions occur during February:

Bowling paid taxes in cash of $45,000.

Required:

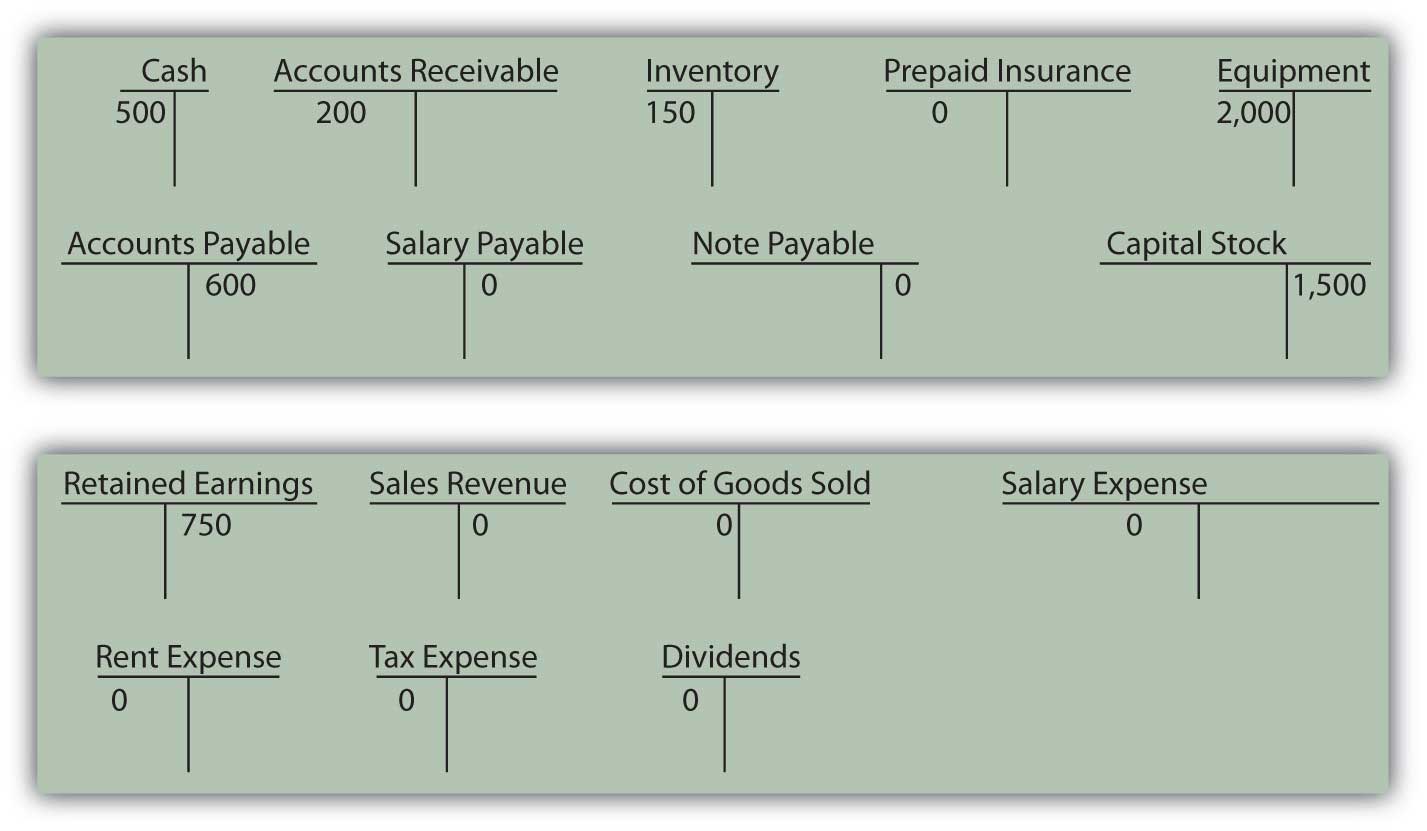

Complete the T-accounts below. Numbers already under the accounts represent the prior balance in that account.

Figure 4.29 Opening T-Account Balances

The following events occurred during the month of May for McLain Company.

Required:

Complete the T-accounts below. Numbers already under the accounts represent the prior balance in that account.

Figure 4.30 Opening T-Account Balances