As a general rule, one who signs a note as maker or a draft as drawer is personally liable unless he or she signs in a representative capacity and either the instrument or the signature shows that the signing has been made in a representative capacity. Various rules govern the permutations of signatures when an agent and a principal are involved.

The maker of a note and the acceptor of a draft have primary contract liability on the instruments. Secondarily liable are drawers and indorsers. Conditions precedent to secondary liability are presentment, dishonor, and notice of dishonor. Under the proper circumstances, any of these conditions may be waived or excused.

Presentment is a demand for payment made on the maker, acceptor, or drawee, or a demand for acceptance on the drawee. Presentment must be made (1) at the time specified in the instrument unless no time is specified, in which case it must be at the time specified for payment, or (2) within a reasonable time if a sight instrument.

Dishonor occurs when acceptance or payment is refused after presentment, at which time a holder has the right of recourse against secondary parties if he has given proper notice of dishonor.

A seller-transferor of any commercial paper gives five implied warranties, which become valuable to a holder seeking to collect in the event that there has been no indorsement or the indorsement has been qualified. These warranties are (1) good title, (2) genuine signatures, (3) no material alteration, (4) no defenses by other parties to the obligation to pay the transferor, and (5) no knowledge of insolvency of maker, acceptor, or drawer.

A holder on presentment makes certain warranties also: (1) entitled to enforce the instrument, (2) no knowledge that the maker’s or drawer’s signature is unauthorized, and (3) no material alteration.

Among the ways in which the parties may be discharged from their contract to honor the instrument are the following: (1) payment or satisfaction, (2) tender of payment, (3) cancellation and renunciation, (4) impairment of recourse or of collateral, (5) reacquisition, (6) fraudulent and material alteration, (7) certification, (8) acceptance varying a draft, and (9) unexcused delay in presentment or notice of dishonor.

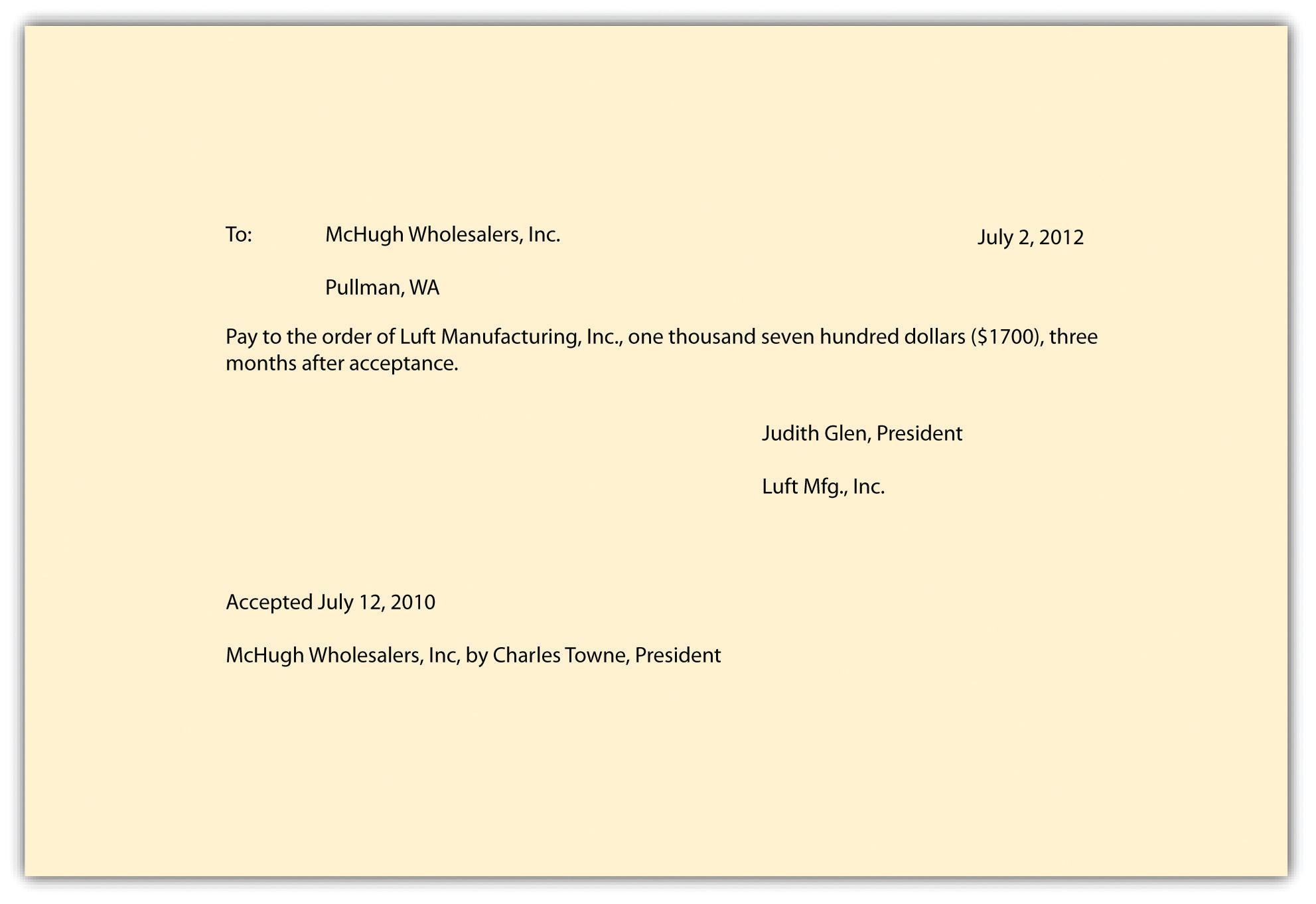

Howard Corporation has the following instrument, which it purchased in good faith and for value from Luft Manufacturing, Inc.

Figure 22.2

Judith Glen indorsed the instrument on the back in her capacity as president of Luft when it was transferred to Howard on July 15, 2012.

An otherwise valid negotiable bearer note is signed with the forged signature of Darby. Archer, who believed he knew Darby’s signature, bought the note in good faith from Harding, the forger. Archer transferred the note without indorsement to Barker, in partial payment of a debt. Barker then sold the note to Chase for 80 percent of its face amount and delivered it without indorsement. When Chase presented the note for payment at maturity, Darby refused to honor it, pleading forgery. Chase gave proper notice of dishonor to Barker and to Archer.

Drawers and indorsers have

Conditions(s) needed to establish secondary liability include

A demand for payment made on a maker, acceptor, or drawee is called

An example of an implied warranty given by a seller of commercial paper includes a warranty

Under UCC Article 3, discharge may result from