[…]

I thought about my new friend Mariya, her life and daily routine. She was married before I had my driver’s license. She pounded millet all day, sweating yet smiling. She hauled water from the well. She cooked. She birthed child after child. There was no end to the manual labor her life required. I liked to watch her. It was fascinating. But if hers was my life, I’d probably jump into that well.

I’ve always thought what life each soul is assigned to is a game of chance. I couldn’t help but to wonder what would have become of me had the powers that be had shaken those dice one more time on March 16, 1982, before moving the game piece that sent me to DePaul Hospital in St. Louis, Missouri.

If I had been born into Mariya’s life, would I have been able to hack it? If she had been born into my life, would she have been happier? […]Alexis Wolff, “Village Life—Niger,” February 27, 2005, accessed June 28, 2011, http://www.bootsnall.com/articles/05-02/village-life-niger.html.

In Niger, where Mariya lives, about 1 in 9 children die before their first birthday. Life expectancy at birth is 53 years, and less than 30 percent of the population can read and write. About one-fifth of the population is nomadic. An Oxfam study in 2005 found that nomads had recently lost about 70 percent of their animals, and that “almost one in ten families is surviving on a diet of mainly wild plants, leaves, and grass.”See “The World Factbook,” Central Intelligence Agency, accessed June 28, 2011, https://www.cia.gov/library/publications/the-world-factbook/index.html; and “Nomadic Way of Life in Niger Threatened by Food Crisis,” Oxfam America, August 16, 2005, accessed June 29, 2011, http://www.oxfamamerica.org/press/pressreleases/nomadic-way-of-life-in-niger-threatened-by-food-crisis. Real gross domestic product (real GDP)A measure of production that has been corrected for any changes in overall prices. per person in Niger is the equivalent of about $700 per year.

Call centers are a phenomenon that has taken over the young crowd of metros in India by a storm. Its implications are social, cultural and economic. It is a new society of the young, rich and free, selling the new dream of an independent life to the regular desi.

[…]

[C]heap labor in India owes its origin to the high rate of unemployment here. Hundreds of thousands of graduates are jobless and desperate for work in India.

[…]

Most call center jobs require a basic understanding of computers and a good grasp over English. And the urban youth of India are computer literate graduates with a command over English language. This is the ideal unskilled labor that the call center industry is looking for.

[…]

With its operations mainly during the night, the call centers offer an opportunity for the young to live a perpetual nocturnal life, a saleable idea to the youth. The fascination of the dark and the forbidden, is tremendous for the Indian youth, recently unleashed from the chains of tradition and culture. Because of this fascination, the industry has developed an air of revolution about itself. Not only is it cool to work for call centers, it is radical and revolutionary.

Just like the bikers subculture of the 60s and the flower children of the 70s, these call centerites also have their own lingo and a unique style of existence. Most of them are happy in a well paying monotonous job, reaping the benefits of technology, enjoying a life away from rush hour traffic and local trains. The moolah is good, the work is easy and life is comfortable.“The Indo-American Dream—Coming of Age with Call Center Jobs,” Mumbai Travel & Living Guide, accessed June 28, 2011, http://www.mumbaisuburbs.com/articles/call-centers-mumbai.html.

Life expectancy in India is 67 years, and the infant mortality rate is about 1 in 20. Real GDP per person is about $3,500.

More Americans own pets than ever before, and they're spending more money to keep them healthy, according to a survey released today by the American Veterinary Medical Association.

The number of U.S. households with pets climbed 7.6 million, to 59.5% of all homes, up from 58.3% in 2001. By comparison, about 35% of U.S. households have children, the Census Bureau says.

[…]

Pet owners are spending more on medical care. Veterinary expenditures for all pets were estimated at $24.5 billion in 2006. In inflation-adjusted dollars, Americans spent $22.4 billion in 2001.

This represents “the high-tech care that pet owners are demanding and willing to pay for,” DeHaven says. “Diseases that once would have been difficult to treat—diabetes, heart disease, cancer—today are very treatable. We’re even putting pacemakers in dogs.”Elizabeth Weiss, “We Really Love—and Spend on—Our Pets,” USA Today, December 11, 2007, accessed July 29, 2011, http://www.usatoday.com/life/lifestyle/2007-12-10-pet-survey_N.htm#.

In the United States, where spending on veterinary care for pets is considerably more than twice the entire GDP of Niger, the infant mortality rate is about 1 in 170, and life expectancy is about 78. Real GDP per person is more than 10 times greater than in India and almost 70 times greater than in Niger.

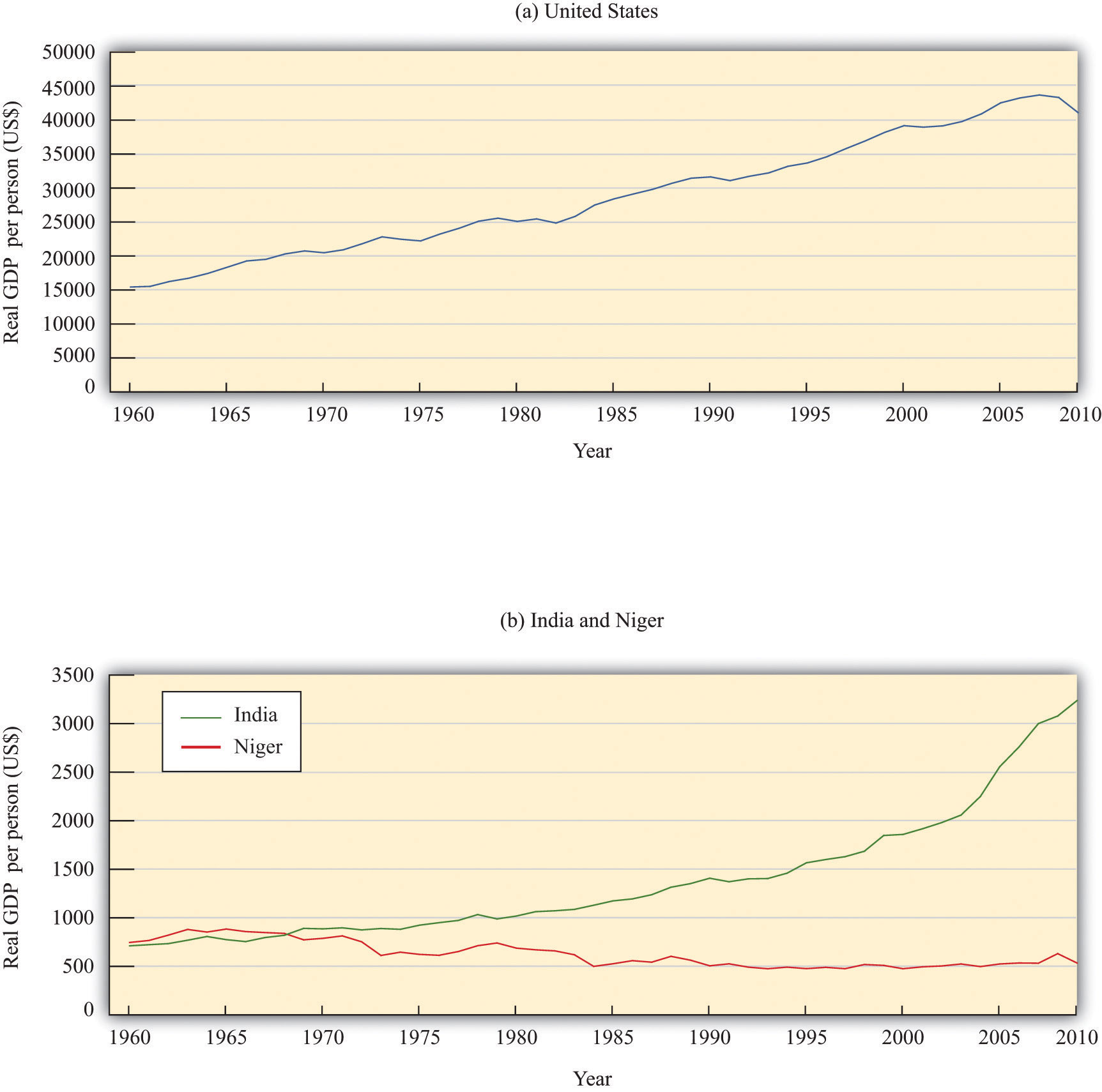

These stories are more than anecdotes. They are, in a real sense, representative of these three countries, as we can see by looking at economic data. Figure 6.1 "Real GDP per Person in the United States, India, and Niger" shows real GDP per person in India, the United States, and Niger over the 1960–2009 period.Alan Heston, Robert Summers, and Bettina Aten, “Penn World Table Version 6.2,” Center for International Comparisons of Production, Income and Prices at the University of Pennsylvania, September 2006, accessed June 29, 2011, http://pwt.econ.upenn.edu/php_site/pwt_index.php. The data in the Penn World Tables are constructed so that dollar figures for different countries can be legitimately compared. Specifically, the data are constructed on a purchasing power parity basis, meaning that they take into account the different prices of goods and services in different countries and are based on how much can actually be purchased. From part (a) of Figure 6.1 "Real GDP per Person in the United States, India, and Niger", we can see that GDP per person in the United States has grown substantially. On average, real GDP per person grew at 2 percent per year. Perhaps this doesn’t sound like a lot. Economic growth cumulates over time, however. An annual growth rate of 2 percent means that real GDP per person is about 2.6 times higher than half a century ago. To put it another way, each generation is roughly twice as rich as the previous generation. Although there are periods of high and low (sometimes even negative) growth in GDP per person, these fluctuations are overwhelmed by the overall positive growth in our economy. With this growth come many benefits: higher consumption, more varieties of goods, higher quality goods, better medical care, more enjoyable leisure time, and so on.

Figure 6.1 Real GDP per Person in the United States, India, and Niger

Real GDP per person in the United States (a) is substantially larger than (b) real GDP in India and Niger. The growth experiences of the three countries are also very different

Source: Alan Heston, Robert Summers and Bettina Aten, Penn World Table Version 7.0, Center for International Comparisons of Production, Income and Prices at the University of Pennsylvania, May 2011.

Part (b) of Figure 6.1 "Real GDP per Person in the United States, India, and Niger" shows real GDP per person for India and Niger. Notice first that the scale on this graph is very different. In 1960, real GDP per person in the United States was about $15,000 (measured in year 2005 dollars). In Niger and India, it was about 5 percent of the US figure—about $700 per person. The second striking feature of this graph is the very different performance of India and Niger. India, like the United States, has grown: GDP per person is much higher at the end of the sample than at the beginning. Indeed, India has grown faster than the United States: the average growth rate over the period was 3.1 percent. Over the last two decades, the difference is even starker: India has grown at about 4.4 percent per year on average. Nevertheless, the United States is still a lot richer than India.

By world standards, India is a long way from being the poorest country. In 1960, Niger was richer than India on a per person basis. But in the following half century, Niger became poorer, not richer. GDP per person decreased by almost 30 percent. India in 2009 was six times richer than Niger. Statistics on GDP are just that—statistics—and it is easy to look at graphs like these and forget that they are telling us about the welfare of human beings. But imagine for a moment that Niger had managed to grow like India, instead of collapsing as it did. People would not be surviving by eating grass, infants would be more likely to grow up to be adults instead of dying of preventable diseases, and children would be learning to read and write.

This is why the study of economic growth matters. And this is why, in this chapter, we take on arguably the most important question in the entire book.

Why are some countries rich and other countries poor?

Along the way, we tackle two other closely related questions. We want to know if the differences in income that we see in the world are likely to persist over time. The experiences of the United States, India, and Niger suggest that this question may not have a simple answer: India has been tending to catch up with the United States, but Niger has been falling further behind. As we seek to answer that question, we will also investigate the ultimate sources of economic growth:

Will poorer countries catch up to richer countries?

Why do countries grow?

The big mystery we investigate in this chapter is the vast variation in economic performance from country to country. We want to know why the experiences of the United States, India, and Niger are so different from one another.

We begin this chapter with an extended story. We think about how growth would work in a country with just a single inhabitant. Then we turn to a back-of-the-envelope calculation to understand why countries differ so much in terms of economic performance. To understand these differences, we focus attention on different inputs to the production function, first considering physical capital and then looking at human capital and technology. After that, we develop a complete framework for understanding how and why economies grow in the very long run. Finally, we look at policy and international institutions.

After you have read this section, you should be able to answer the following questions:

The macroeconomy is very complicated. Overall economic performance depends on billions of decisions made daily by millions of people. Economists have developed techniques to keep us from being overwhelmed by the sheer scale of the economy and the masses of data that are available to us. One of our favorite devices is to imagine what an economy would look like if it contained only one person. This fiction has two nice features: we do not have to worry about differences among individuals, and we can easily isolate the most important economic decisions. Thinking about the economy as if it were a single person is only a starting point, but it is an extremely useful trick for cutting through all the complexities of, say, a $12 trillion economy populated by 300 million individuals.

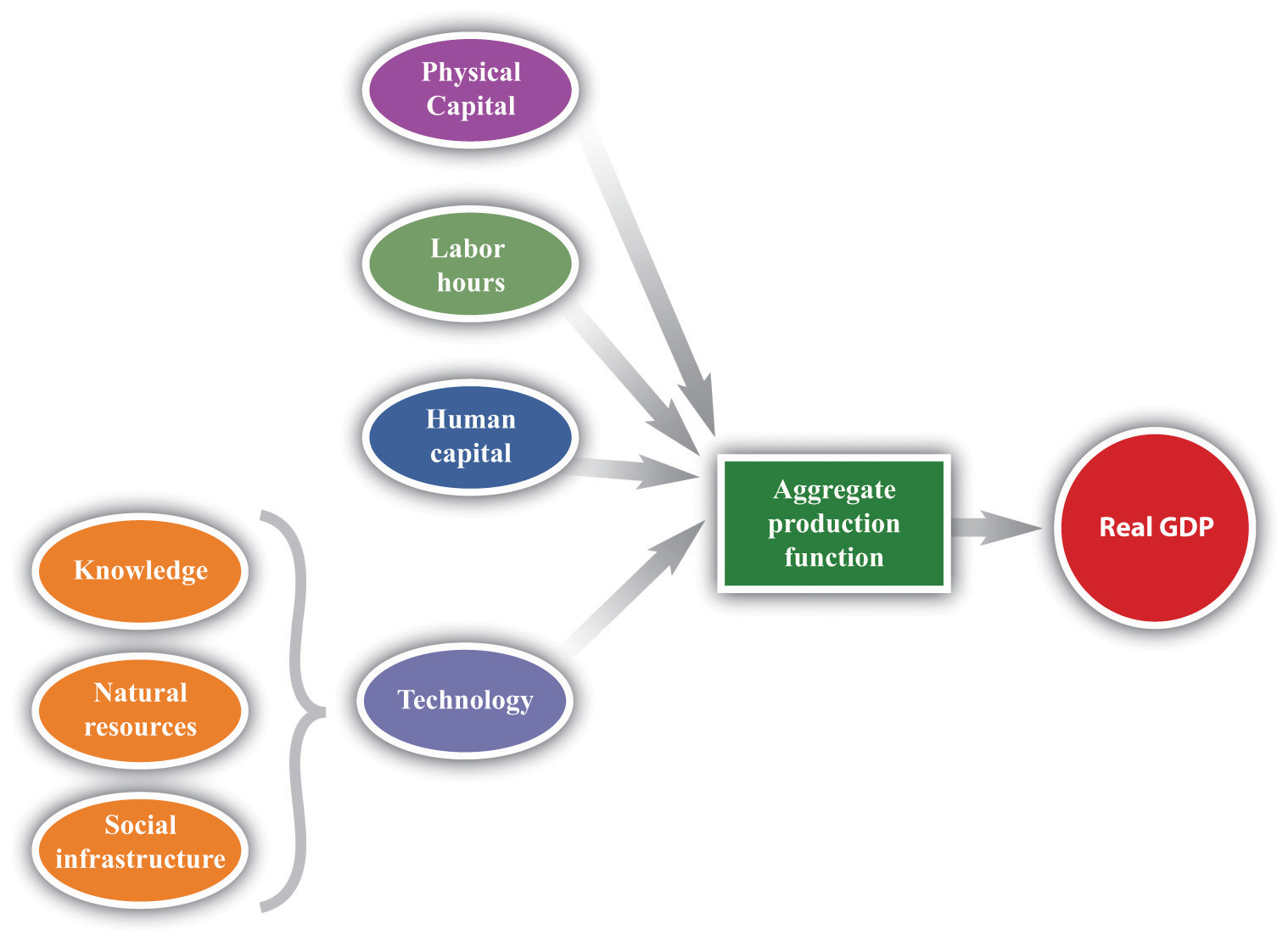

Figure 6.2 The Aggregate Production Function

The aggregate production function combines an economy’s physical capital stock, labor hours, human capital, and technology to produce output (real gross domestic product [real GDP]).

Imagine, then, an economy called Solovenia. Solovenia is populated by one individual—we will call him Juan. Juan has access to an aggregate production function. The amount of output (real GDP) that he can produce depends on how large a physical capital stock he owns, how many hours he chooses to work, his human capital, and his technology (Figure 6.2 "The Aggregate Production Function"). Physical capital is the stock of factories and machinery in the economy, while human capital refers to the skills and education of the workforce. Technology is a catchall term for everything else (other than capital, labor, or human capital) that affects output.Physical capital, human capital, and technology are discussed in more detail in Chapter 5 "Globalization and Competitiveness". It includes the following:

Toolkit: Section 16.15 "The Aggregate Production Function"

You can review the aggregate production function, including its inputs, in the toolkit.

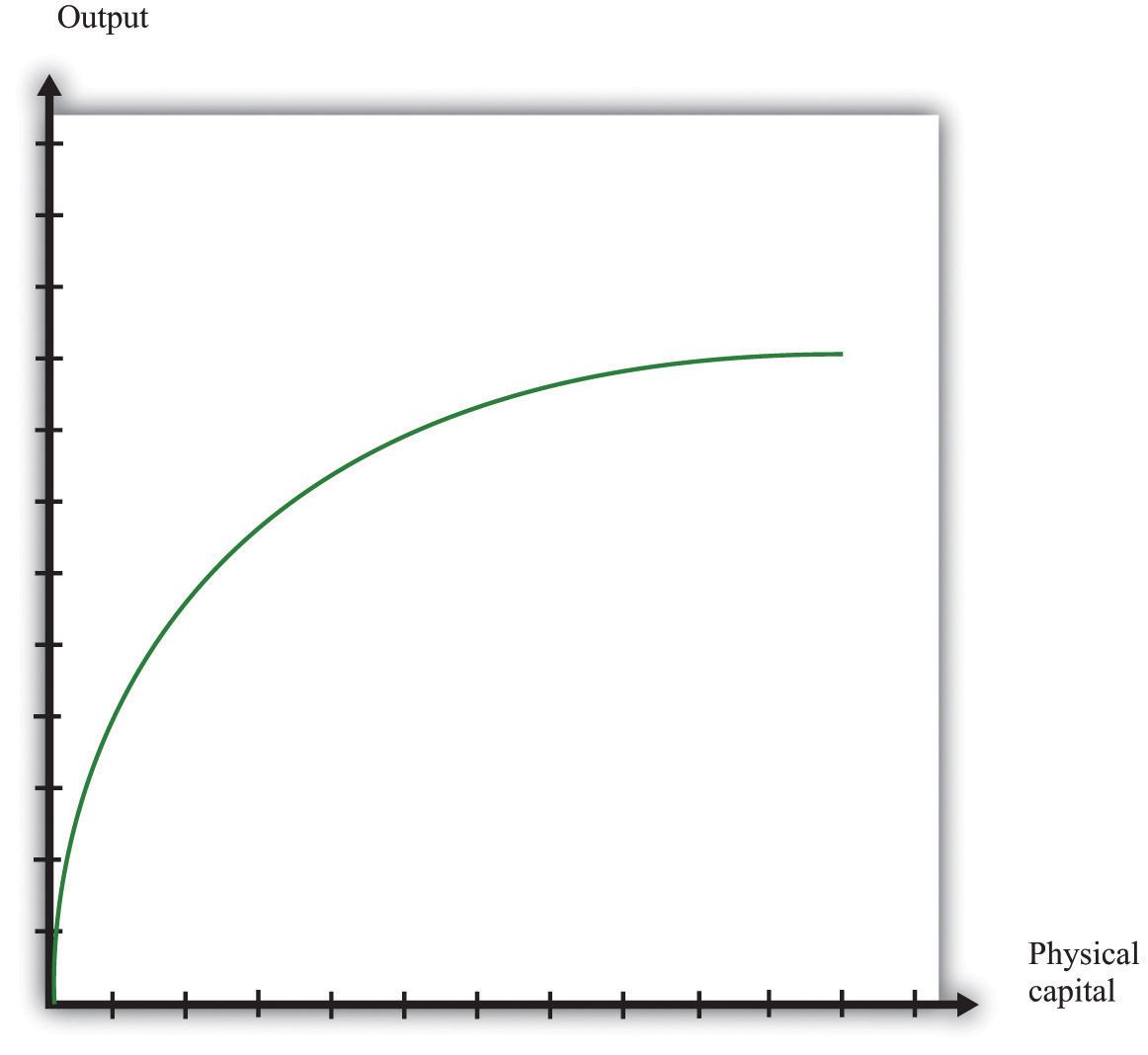

Much of our focus in this chapter is on how economies build up their stock of physical capital. Figure 6.3 "The Aggregate Production Function: Output as a Function of the Physical Capital Stock" shows how output in the aggregate production function depends on the capital stock. Increases in the capital stock lead to more output. If Juan has more tools to work with, then he can produce more goods. However, we usually think that the production function will exhibit diminishing marginal product of capital, which means that a given increase in the capital stock contributes more to output when the capital stock is low than when the capital stock is high. In Figure 6.3 "The Aggregate Production Function: Output as a Function of the Physical Capital Stock", we can see this from the fact that the production function gets flatter as the amount of physical capital increases.

Figure 6.3 The Aggregate Production Function: Output as a Function of the Physical Capital Stock

As the amount of physical capital increases, output increases, but at a decreasing rate because of the diminishing marginal product of capital.

Each day Juan chooses how much time to work and how much time to spend in leisure. Other things being equal, we expect that Juan likes to have leisure time. This is not to say that Juan never gets any satisfaction from working. But like most people—even those who enjoy their jobs—he would prefer to work a little bit less and play a little bit more. He cannot spend all his time in leisure, however. He works because he likes to consume. The harder he works, the more real GDP he can produce and consume. Juan’s decision about how many hours to work each day is determined in large part by how productive he can be—that is, how much real GDP he can produce for each hour of leisure time that he gives up.

Juan does not have to consume all the output that he produces; he might save some of it for the future. As well as deciding how much to work, he decides how much to consume and how much to save each day. You have probably made decisions like Juan’s. At some time in your life, you may have worked at a job—perhaps in a fast-food restaurant, a grocery store, or a coffee shop. Perhaps you were paid weekly. Then each week you might have spent all the money you earned on movies, meals out, or clothes. Or—like Juan—you might have decided to spend only some of that money and save some for the future. When you save money instead of spending it, you are choosing to consume goods and services at some future date instead of right now. You may choose to forgo movies and clothes today to save for the purchase of a car or a vacation.

The choice we have just described—consuming versus saving—is one of the most fundamental decisions in macroeconomics. It comes up again and again when we study the macroeconomy. Just as you and Juan make this choice, so does the overall economy. Of course, the economy doesn’t literally make its own decision about how much to save. Instead, the saving decisions of each individual household in the economy determine the overall amount of savings in the economy. And the economy as a whole doesn’t save the way you do—by putting money in a bank. An economy saves by devoting some of its production to capital goods rather than consumer goods. If Juan chooses to produce capital goods, he will have a larger capital stock in the future, which will allow him to be more productive and enjoy higher consumption in the future.

At any given moment, Juan’s ability to produce output is largely determined by his stock of physical capital, his human capital, and the state of technology in Solovenia. But, as time passes, the level of output in Solovenia can change through a variety of mechanisms.

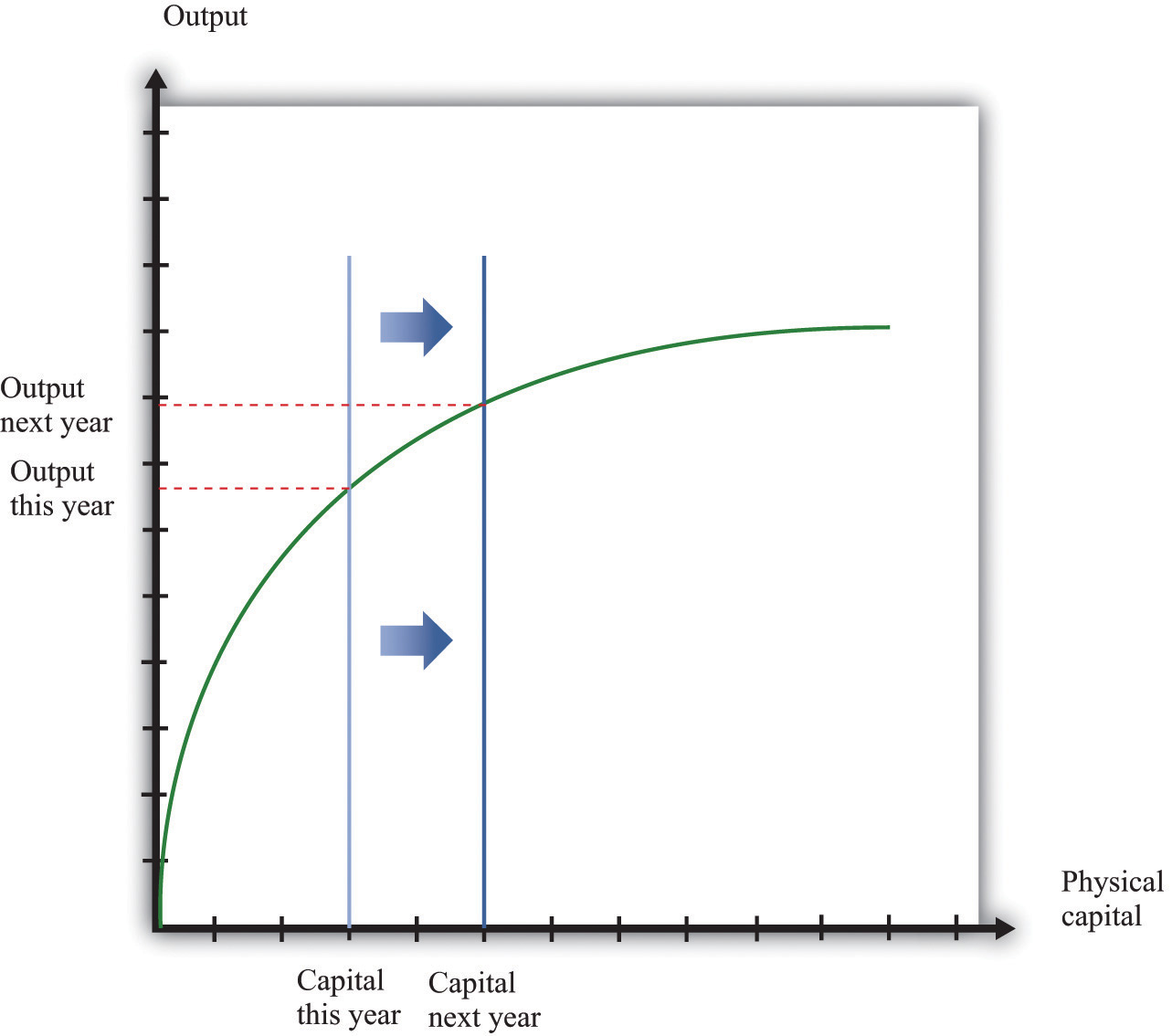

First, the capital stock in Solovenia can grow over time, as shown in Figure 6.4. Juan builds up his capital stock by saving. Since Juan is the only inhabitant, the amount he saves is equal to the national savingsThe sum of private and government saving. of Solovenia. It is the difference between his output (real GDP of Solovenia) and the amount he consumes.In a real economy, national savings also include the savings of government: we must add in the government surplus or subtract the government deficit, as appropriate.

Figure 6.4

Increases in the capital stock lead to increases in output. If the capital stock in Solovenia increases between this year and next year, output also increases. Increases in the capital stock are one source of growth.

The more that Juan saves today, the more he can build up his capital stock, and the higher his future standard of living will be. If Juan chooses to consume less today, he will have a higher living standard in the future. If Juan chooses to consume more today, he must accept that this means less consumption in the future. Economies, like individuals, can choose between eating their cake now or saving it for the future.

In making this decision, Juan weighs the cost of giving up a little bit of consumption today against the benefit of having a little bit more consumption in the future. The higher the marginal product of capital, the more future benefit he gets from sacrificing consumption today. Other things being equal, a higher marginal product of capital induces Juan to save more. Juan’s choice also depends on how patient or impatient he is. The more patient he is, the more he is willing to give up consumption today to enjoy more consumption in the future.

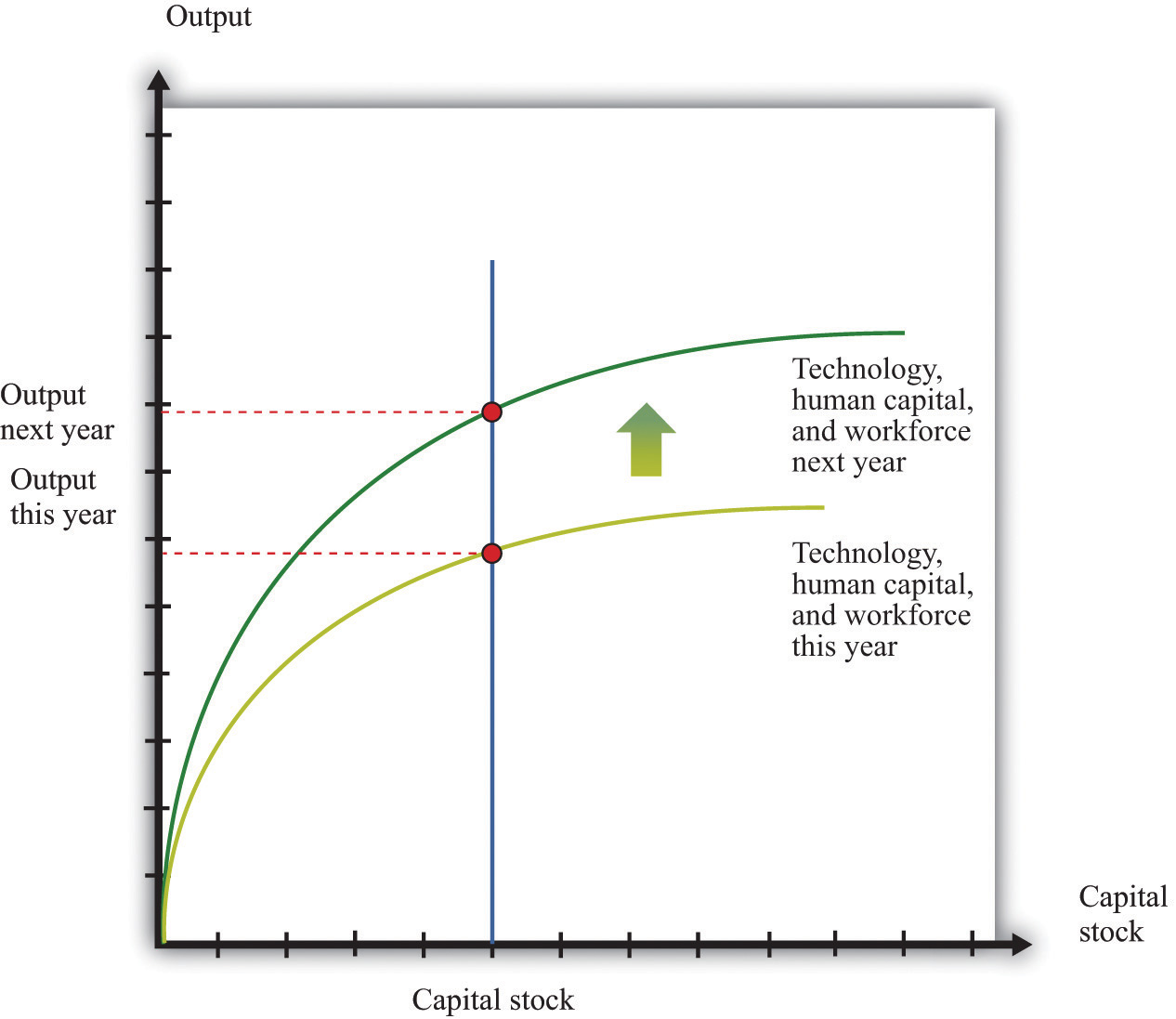

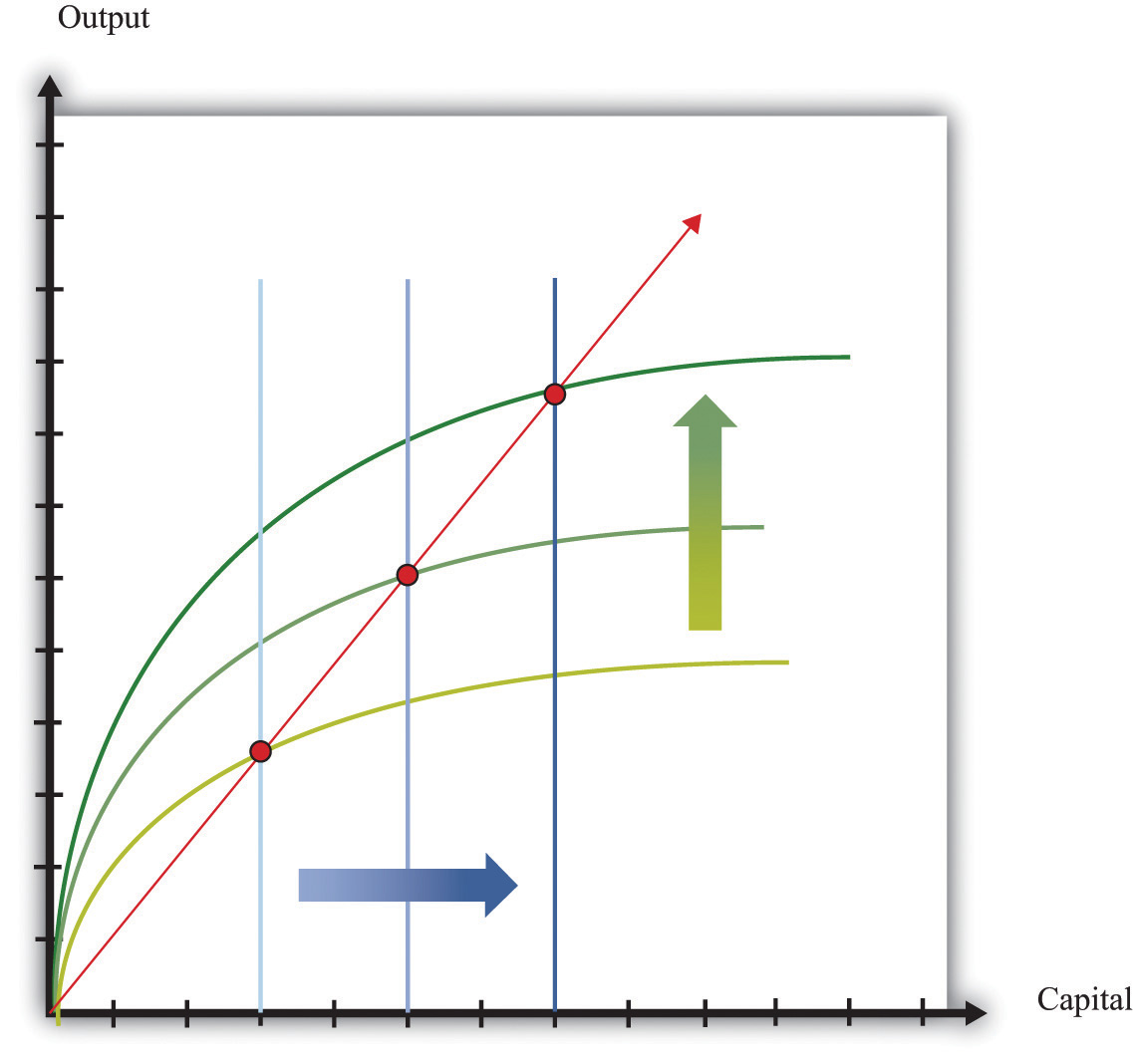

Increases in the amount of physical capital are one way in which an economy can grow. Another is through increases in human capital and technology. These shift the production function upward, as shown in Figure 6.5. Perhaps Juan sometimes has better ideas about how to do things. Perhaps he gets better with practice. Perhaps Juan spends some time trying to come up with better ways of producing things.

Figure 6.5

Increases in human capital or technology lead to increases in output. Increases in technology, human capital, and the workforce, like increases in the capital stock, are a source of output growth.

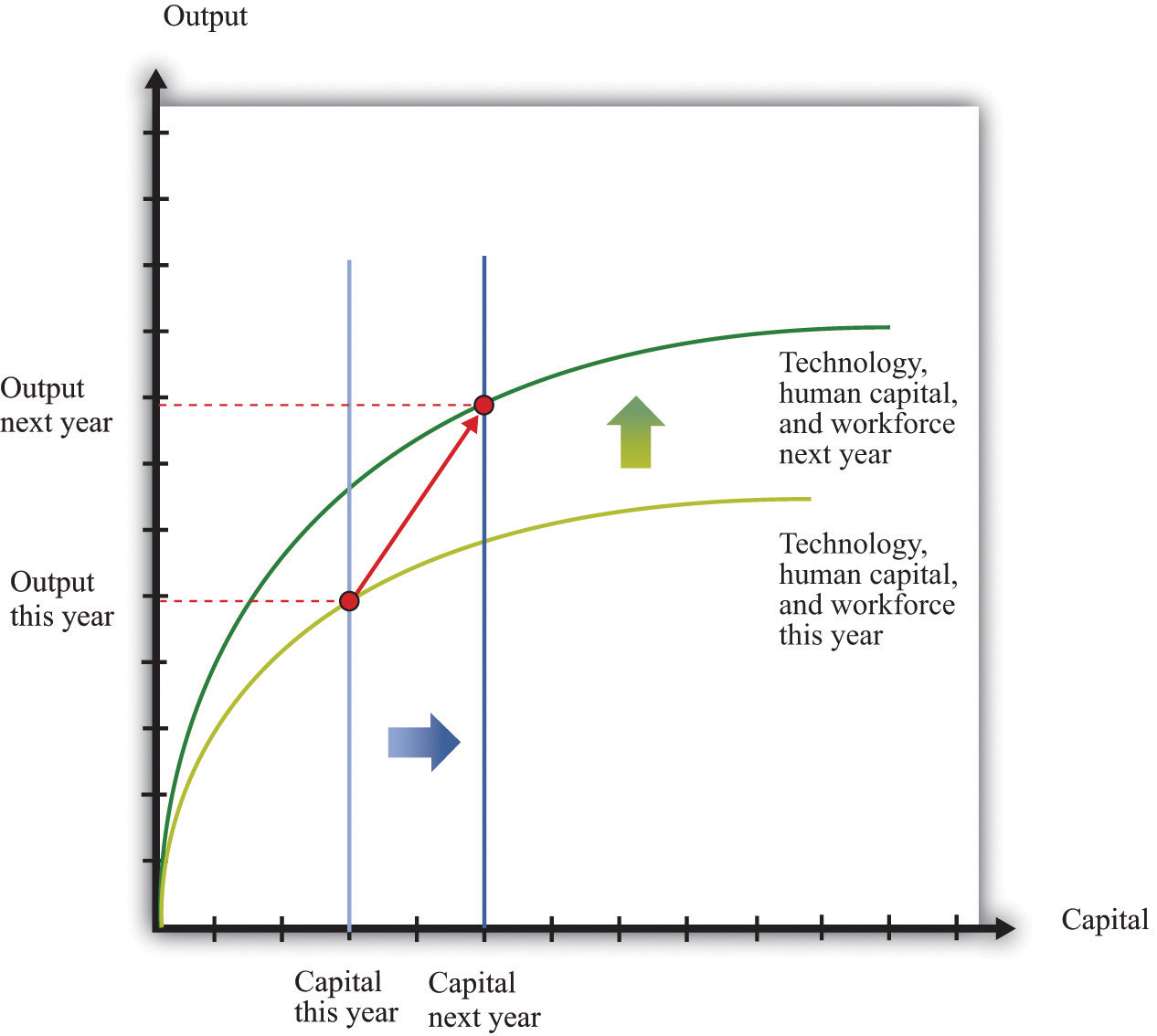

Through the accumulation of physical and human capital, and by improving the components of technology such as knowledge and social infrastructure, the output in Solovenia will grow over time. The combined effect of physical capital growth and improvements in technology is shown in Figure 6.6.

Figure 6.6

Increases in capital, human capital, and technology all lead to increases in output. In general, economies grow because of increases in capital, technology, human capital, and the workforce.

If Juan does not trade with the rest of the world, his only way to save for the future is by building up his capital stock. In this case, national savings equal investmentThe purchase of new goods that increase capital stock, allowing an economy to produce more output in the future.. An economy that does not trade with other countries is called a closed economyAn economy that does not trade with the rest of the world.. An economy that trades with other countries is called an open economyAn economy that trades with other countries.. In the modern world, no economy is completely closed, although some economies (such as Belgium) are much more open than others (such as North Korea). The world as a whole is a closed economy, of course.

If Solovenia is an open economy, Juan has other options. He might decide that he can get a better return on his savings by investing in foreign assets (such as Italian real estate, shares of Australian firms, or Korean government bonds). Domestic investment would then be less than national savings. Juan is lending to the rest of the world.

Alternatively, Juan might think that the benefits of investment in his home economy are sufficiently high that he borrows from the rest of the world to finance investment above and beyond the amount of his savings. Domestic investment is then greater than national savings. Of course, if Juan lends to the rest of the world, then he will have extra resources in the future when those loans are repaid. If he borrows from the rest of the world, he will need to pay off that loan at some point in the future.

There may be very good opportunities in an economy that justify a lot of investment. In this case, it is worthwhile for an economy to borrow from other countries to supplement its own savings and build up the capital stock faster. Even though the economy will have to pay off those loans in the future, the benefits from the higher capital stock are worth it.

The circular flow of income shows us how these flows show up in the national accounts. If we are borrowing on net from other countries, there is another source of funds in additional to national savings that can be used for domestic investment. If we are lending on net to other countries, domestic investment is reduced.

Toolkit: Section 16.16 "The Circular Flow of Income"

You can review the circular flow of income in the toolkit.

Savings and investment in a country are linked, but they are not the same thing. The savings rate tells us how much an economy is setting aside for the future. But when studying the accumulation of capital in an economy, we look at the investment rateThe total investment as a fraction of GDP. rather than the savings rate. Total investment as a fraction of GDP is called the investment rate:

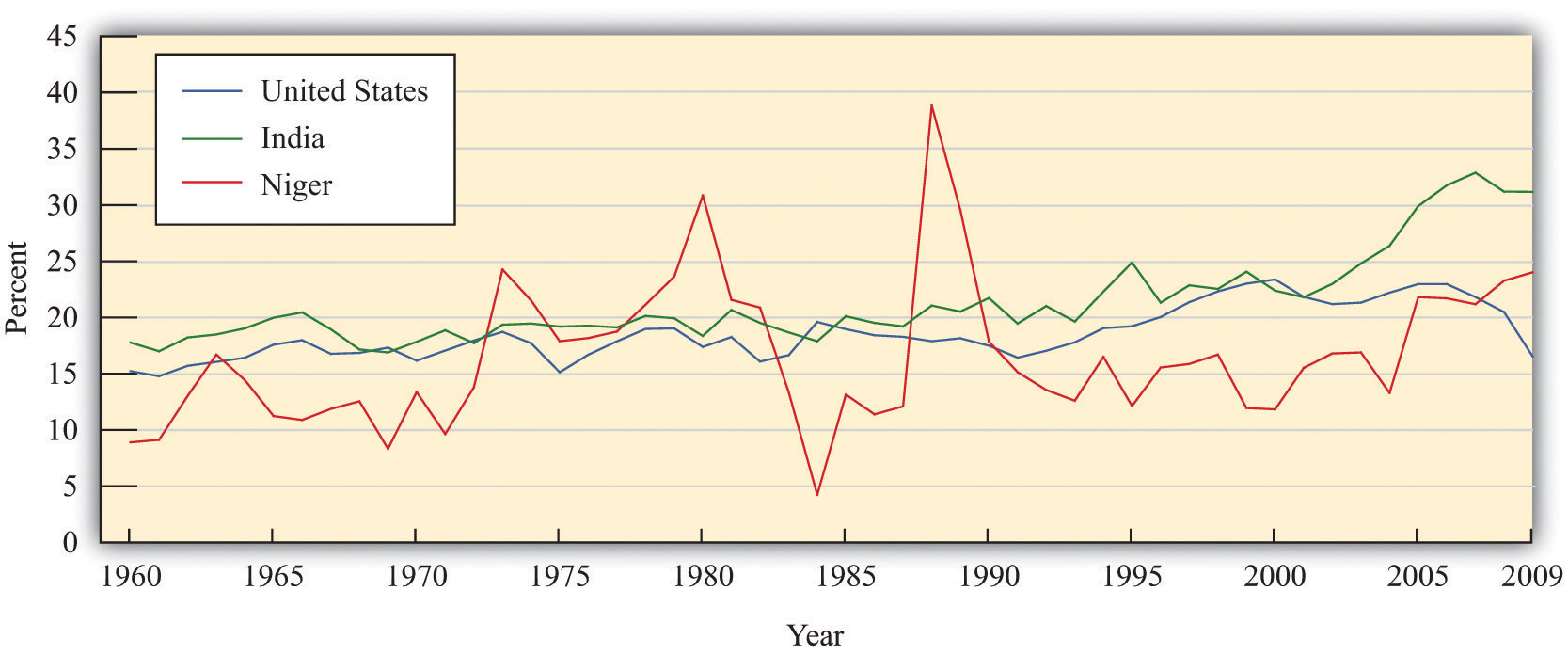

Figure 6.7 Investment Rates in the United States, India, and Niger

There are marked differences in investment rates in the United States, India, and Niger.

Source: Alan Heston, Robert Summers and Bettina Aten, Penn World Table Version 7.0, Center for International Comparisons of Production, Income and Prices at the University of Pennsylvania, May 2011.

Figure 6.7 "Investment Rates in the United States, India, and Niger" shows investment rates in the United States, India, and Niger from 1960 to 2009. A number of features of this picture are striking:International Monetary Fund, World Economic Outlook Database, April 2011, accessed July 29, 2011, http://www.imf.org/external/pubs/ft/weo/2011/01/weodata/index.aspx.

Low investment rates may be due to low savings rates. They may also reflect relatively low returns to increases in the capital stock in a country. The low investment rate that prevailed for many years in Niger not only reflected a low saving rate but also indicates that something is limiting investment from external sources. For the United States, in contrast, a significant part of the high investment rate is due not to domestic savings but to inflows from other countries.

We know that output per person is a useful indicator of living standards. Increases in output per person generally translate into increases in material standards of living. But to the extent that an economy trades with other countries, the two are not equivalent. If an economy borrows to finance its investment, output per person will exaggerate living standards in the country because it does not take into account outstanding obligations to other countries. If an economy places some of its savings elsewhere, then measures of output per person will understate living standards.The national accounts deal with this issue by distinguishing between GDP, which measures the production that takes place within a country’s borders, and gross national product (GNP), which corrects for income received from or paid to other countries.

Now add another country, Solovakia (with a single inhabitant named Una), and compare it to Solovenia. We can compare Solovenia and Solovakia by investigating which is producing more output per person and why. Imagine, for example, that Solovenia is a relatively poor country, and Solovakia is richer. Using our knowledge of the aggregate production function, we can understand how this difference might arise. It might be because Una has more human capital or knowledge than Juan, or because Una has a larger stock of physical capital.

Another basis for comparison is the rate at which the two economies are growing. If Solovakia is richer, and if it is also growing faster than Solovenia, then the gap between the two countries will become wider over time. We call such a process divergenceA growth process where poor countries grow slower than rich countries.. Conversely, if Solovenia is growing faster than Solovakia, then the gap between Juan’s and Una’s living standards will become smaller over time. Such a situation, where poorer countries catch up to richer ones, is called convergenceA growth process where poor countries grow faster than rich countries..

Why might we see either convergence or divergence? Part of the answer has to do with the marginal product of capitalThe extra output obtained from one more unit of capital. in the two countries. Suppose that Solovakia is richer because it has a larger stock of physical capital than Solovenia. In that case, we expect the marginal product of capital to be larger in Solovenia. Solovenia is a more competitive economy than Solovakia. Juan will want to invest at home, while Una will take some of the output that she produces in Solovakia and invest it in Solovenia. Therefore we expect capital to migrate from Solovakia to Solovenia. As a consequence, it is likely that Solovenia will grow faster than Solovakia, leading to convergence.

After you have read this section, you should be able to answer the following questions:

We started this chapter with the following question: “Why are some countries rich and other countries poor?” The aggregate production function and the story of Juan help us to understand what determines the amount of output that an economy can produce, taking us the first step toward explaining why some countries are richer than others.

The production function tells us that if we know four things—the size of the workforce, the amount of physical capital, the amount of human capital, and the level of technology—then we know how much output we are producing. When comparing two countries, if we find that one country has more physical capital, more labor, a better educated and trained workforce (that is, more human capital), and superior technology, then we know that country will have more output.

Differences in these inputs are often easy to observe. Large countries obviously have bigger workforces than small countries. Rich countries have more and better capital goods. In the farmlands of France, you see tractors and expensive farm machinery, while you see plows pulled by oxen in Vietnam; in Hong Kong, you see skyscrapers and fancy office buildings, while the tallest building in Burkina Faso is about 12 stories high; in the suburbs of the United States, you see large houses, while you see shacks made of cardboard and corrugated iron in the Philippines. Similarly, rich countries often have well-equipped schools, sophisticated training facilities, and fine universities, whereas poorer countries provide only basic education. We want to be able to say more, however. We would like to know how much these different inputs contribute to overall economic performance.

To get some sense of this, we look at some rough numbers for the United States, India, and Niger. We carried out this exercise using data from 2003, but the fundamental message does not depend on the year that we have chosen; we would get very similar conclusions with data from any recent year. To start, let us look at the different levels of output in these countries. Table 6.1 "Real GDP in the United States, India, and Niger" gives real gross domestic product (real GDP) in these countries. Note that we are now looking at the overall level of GDP, rather than GDP per person as we did at the beginning of this chapter. Real GDP in the United States was about $10.2 trillion. In India, real GDP was about one-third of US GDP: $3.1 trillion. In Niger, real GDP was under $10 billion. In other words, the United States produces about 1,000 times as much output as Niger.

Table 6.1 Real GDP in the United States, India, and Niger

| Country | Real GDP in 2003 (Billions of Year 2000 US Dollars) |

|---|---|

| United States | 10,205 |

| India | 3,138 |

| Niger | 9 |

Source: Alan Heston, Robert Summers and Bettina Aten, Penn World Table Version 7.0, Center for International Comparisons of Production, Income and Prices at the University of Pennsylvania, May 2011.

In the following subsections, we look at how the different inputs contribute to bring about these large differences in output. We go through a series of thought experiments in which we imagine putting the amount of each input available in the United States into the production functions for the Indian and Niger economies.

The United States, India, and Niger differ in many ways. One is simply the number of people in each country. The workforce in the United States is about 150 million people. The workforce in India is more than three times greater—about 478 million in 2010—while the workforce in Niger is only about 5 million people. Thus India has much more labor to put into its production function than does Niger.

In Table 6.2 "Real GDP in 2003 in the United States, India, and Niger if All Three Countries Had the Same Workforce" we look at what would happen to output in India and Niger if—counterfactually—each had a workforce the size of that in the United States while their other inputs were unchanged. Output in the United States is, of course, unchanged in this experiment. India’s output would decrease to about $1.4 trillion because they would have a smaller workforce. Niger’s output would increase about tenfold to $88 trillion. Differences in the workforce obviously matter but do not explain all or even most of the variation across the three countries. Niger’s output would still be less than 1 percent of output in the United States.

Table 6.2 Real GDP in 2003 in the United States, India, and Niger if All Three Countries Had the Same Workforce

| Country | Real GDP in 2003 (Billions of Year 2000 US Dollars) |

|---|---|

| United States | 10,205 |

| India | 1,475 |

| Niger | 88 |

Not surprisingly, the United States also has a much larger capital stock than does Niger. The capital stock in the United States is worth about $30 trillion. India’s capital stock is about $3 trillion, and Niger’s capital stock is much, much smaller—about $9 billion. So what would happen if we also gave India and Niger the same amount of physical capital as the United States? Table 6.3 "Real GDP in the United States, India, and Niger if All Three Countries Had the Same Workforce and Physical Capital Stock" shows the answer.

India’s GDP, in this thought experiment, goes back to something close to its actual value of around $3 trillion. In other words, the extra capital compensates for the smaller workforce. Real GDP in the United States is still more than three times larger than that in India. The extra capital makes a big difference in Niger, increasing its output about ten-fold. Even if Niger had the same size workforce and the same amount of capital as the United States, however, it would still have only a tenth of the amount of output. The other two inputs—human capital and technology—evidently matter as well.

Table 6.3 Real GDP in the United States, India, and Niger if All Three Countries Had the Same Workforce and Physical Capital Stock

| Country | Real GDP in 2003 (Billions of Year 2000 US Dollars) |

|---|---|

| United States | 10,205 |

| India | 3,054 |

| Niger | 1,304 |

Differences in education and skills certainly help to explain some of the differences among countries. Researchers have found evidence that measures of educational performance are correlated with GDP per person. The causality almost certainly runs in both directions: education levels are low in Niger because the country is so poor, and the country is poor because education is low.

We can include measures of education and training in an attempt to measure the skills of the workforce. In fact, economists Robert Hall and Chad Jones have constructed a measure that allows us to compare the amount of human capital in different countries.To estimate relative human capital levels in different countries, we use the figures in Robert Hall and Chad Jones, “Why Do Some Countries Produce So Much More Output per Worker Than Others?” Quarterly Journal of Economics 114, no. 1 (1999): 83–116. In Table 6.4 "Real GDP in 2003 in the United States, India, and Niger if All Three Countries Had the Same Workforce, Physical Capital Stock, and Human Capital Stock", we bring the human capital level in India and Niger up to the level in the United States and, as before, suppose that all three countries have the same amount of labor and physical capital. Real GDP in India would climb to about $5.2 trillion, or a little over half the level in United States. Niger’s real GDP would equal about $2.8 trillion, meaning the increased human capital would more than double Niger’s GDP. However, real GDP in the United States would still be more than three times greater than that of Niger.

Table 6.4 Real GDP in 2003 in the United States, India, and Niger if All Three Countries Had the Same Workforce, Physical Capital Stock, and Human Capital Stock

| Country | Real GDP in 2003 (Billions of Year 2000 US Dollars) |

|---|---|

| United States | 10,205 |

| India | 5,170 |

| Niger | 2,758 |

To summarize, even after we eliminate differences in labor, physical capital, and human capital, much is still left to be explained. According to our production function, the remaining variation is accounted for by differences in technology—our catchall term for everything apart from labor, physical capital, and human capital.

Just as firms accumulate physical capital, they also accumulate knowledge in various ways. Large firms in developed countries develop new knowledge through the activities of their research and development (R&D) divisions.Gains in productivity of this form sometimes end up embodied in capital stock—think of a computer operating system, such as Windows or Linux. Such knowledge increases the value of capital stock and is already captured by looking at the ratio of capital stock to GDP. In poorer countries, firms may access existing knowledge by importing technology from more developed countries.

Differences in knowledge help to explain differences in output per worker. The rich countries of the world tend to have access to state-of-the-art production techniques. We say that they are on the technology frontierWhere the most advanced production technologies are available.; they use the most advanced production technologies available. Factories in poor countries often do not use these production techniques and lack modern machinery. They are inside the technology frontier.

As economists have researched the differences in economic performance in rich and poor countries, they have found that success depends on more than physical capital, human capital, and knowledge. Appropriate institutions—the social infrastructure—also need to be in place. These are institutions that allow people to hold property and write and enforce contracts that ensure they can enjoy the fruits of their investment. Key ingredients are a basic rule of law and a relative lack of corruption. An ability to contract and trade in relatively free markets is also important.

Particularly in more advanced countries, we need the right institutions to encourage technological progress. This is complicated because there is a trade-off between policies to encourage the creation of knowledge and policies to encourage the dissemination of knowledge. Knowledge is typically a nonexcludable goodA good (or resource) for which it is impossible to selectively deny access., so individuals and firms are not guaranteed the rights to new knowledge that they create. This reduces the incentive to produce knowledge. To counter this problem, governments establish certain property rights over new knowledge, in the form of patent and copyright laws. Knowledge is also typically a nonrival goodA good where one person’s consumption of that good does not prevent others from also consuming it., so everyone can, in principle, benefit from a given piece of knowledge. Once new knowledge exists, the best thing to do is to give it away for free. Patent and copyright laws are good for encouraging the development of knowledge but bad for encouraging the dissemination of knowledge. Current debates over intellectual property rights (file sharing, open source, downloading of music, etc.) reflect this trade-off.

Differences in natural resourcesOil, coal, and other mineral deposits; agricultural and forest lands; and other resources used in the production process. can also play a role in explaining economic performance. Some countries are lucky enough to possess large amounts of valuable resources. Obvious examples are oil-producing states such as Saudi Arabia, Kuwait, Venezuela, the United States, and the United Kingdom. Yet there are many countries with considerable natural resources that have not enjoyed great prosperity. Niger’s uranium deposits, for example, have not helped that country very much. At the same time, some places with very little in the way of natural resources have been very successful economically: examples include Luxembourg and Hong Kong. Natural resources help, but they are not necessary for economic success, nor do they guarantee it.

After you have read this section, you should be able to answer the following questions:

Our first task in this chapter was to explain the vast differences in living standards that we observe in the world. We now know that this variation is due to differences in physical capital, human capital, and technology. The rough calculations in Section 6.2 "Four Reasons Why GDP Varies across Countries" tell us that variations in physical capital, human capital, and technology all play a role in explaining differences in economic performance.

Now we consider these inputs separately. In this section, we look at the accumulation of physical capital. In Section 6.4 "Balanced Growth", we look at the role of human capital and technology. Our main aim is to consider one of our two remaining questions:

Will poorer countries catch up to richer countries?

Capital goods are goods such as factories, machines, and trucks. They are used for the production of other goods and are not completely used up in the production process. Economies build up their capital stocks by devoting some of their gross domestic product (GDP) to new capital goods—that is, investment. As we saw in our discussion of Solovenia in Section 6.2 "Four Reasons Why GDP Varies across Countries", if a country does not interact much with other countries (that is, it is a closed economy) the amount of investment reflects savings within a country. In open economies, the amount of investment reflects the perceived benefits to investment in that country compared to other countries.

Capital goods wear out over time and have to be scrapped and replaced. A simple way to think about this depreciation is to imagine that a fraction of the capital stock wears out every year. A reasonable average depreciation rateThe fraction of the capital stock that wears out each year. for the US economy is 4 or 5 percent. To understand what this means, think about an economy where the capital stock consists of a large number of identical machines. A depreciation rate of 5 percent means that for every 100 machines in the economy, 5 machines must be replaced every year.The depreciation rate can be understood in terms of the average lifetime of a typical machine. For example, a depreciation rate of 5 percent is the same as saying that, on average, machines last for 20 years. To see this, imagine that capital stock is kept constant at 100 machines, and each machine lasts for 20 years. Imagine also that 5 machines are 1 year old, 5 machines are 2 years old, and so forth, with the oldest 5 machines being 20 years old. Each year, these 5 oldest machines would wear out (5 percent depreciation) and have to be replaced by 5 new machines. After a year has passed, the situation will be exactly the same as the previous year: there will be 5 machines that are 1 year old, 5 machines that are 2 years, and so forth. Mathematically, we are saying that the lifetime of a machine = 1/depreciation rate: 20 = 1/0.05.

The depreciation of capital goods reduces the capital stock. The total amount of capital lost to depreciation each year is calculated by multiplying the depreciation rate and the capital stock together. If the capital stock is $30 trillion, for example, and the depreciation rate is 5 percent, then $1.5 trillion (= $30 trillion × 0.05) worth of capital is lost each year.

The capital stock increases as long as there is enough new investment to replace the worn out capital and still contribute some extra. The overall change in the capital stock is equal to new investment minus depreciation:

change in capital stock = new investment − depreciation rate × capital stock.For example, suppose that the current capital stock (measured in trillions of dollars) is 40, and the depreciation rate is 10 percent per year. Then the capital stock after depreciation is 40 − (.1 × 40) = 40 − 4 = 36. Suppose that new investment is $4.8 trillion. Then the new capital stock is 36 + 4.8 = 40.8. In this case, capital stock has increased by $0.8 trillion, or 2 percent.

The equation for the change in the capital stock is one of the fundamental ingredients of economic growth. It tells us that economies build up their capital stock—and therefore their real GDP—by devoting enough output to new investment to both replace worn out capital and then add some more. If we divide both sides of the previous equation by the capital stock, we can obtain the growth rateThe change in a variable over time divided by its value in the beginning period. of the capital stock. (Remember that the growth rate of a variable is the change in the variable divided by its initial level.)

The growth rate of the capital stock depends on three things:

It is intuitive that a higher investment rate increases the growth rate of the capital stock, and a higher depreciation rate decreases the growth rate of the capital stock. It is less obvious why the growth rate of the capital stock is lower when the capital stock is higher. The growth rate measures the change in the capital stock as a percentage of the existing capital stock. A given change in the capital stock results in a smaller growth rate if the existing capital stock is larger. For example, suppose that the current capital stock is 100, and the change in the capital stock is 10. Then the growth rate is 10 percent. But if the current capital stock is 1,000, then the same change of 10 in the capital stock represents only a 1 percent growth rate.

Toolkit: Section 16.11 "Growth Rates"

The toolkit contains more information on how growth rates are calculated.

Why are we so interested in the accumulation of capital? One reason is that poverty of the kind we observe in Niger and elsewhere is a massive problem for the world. About 40 percent of the world’s population—close to 2.5 billion people—live in conditions of poverty. (The World Bank defines poverty as living on less than US$2 per day.) We are not going to solve the problem of mass poverty overnight, so we would like to know whether this gap between the rich and the poor is a permanent feature of the world. It might be that economies will diverge, meaning that the disparities in living standards will get worse and worse, or it might be that they will converge, with poorer countries catching up to richer countries.

When comparing two countries, if we find that the poorer economy is growing faster than the richer one, then the two are converging. If we find that the richer country is growing faster than the poorer one, they are diverging. Moreover, if a country has a small capital stock, we know that—other things being equal—it will tend to be a poorer country. If a country has a large capital stock, then—again, other things being equal—it is likely to be a richer country. The question of convergence then becomes: other things being equal, do we expect a country with a small capital stock to grow faster than an economy with a large capital stock?

The answer is yes, and the reason is the marginal product of capital. From the production function, the marginal product of capital is large when the capital stock is small. Think again about Juan in Solovenia. A large marginal product of capital means that he can obtain a lot of extra output if he acquires some extra capital. This gives him an incentive to save rather than consume. A large marginal product of capital also means that Juan can attract investment from other countries.

A country where the marginal product of capital is high is a competitive economy—one where both domestic savers and foreign savers want to build up the capital stock. The capital stock will grow quickly in such an economy. This is precisely what we saw in the equation for the growth rate of the capital stock: higher investment and a lower capital stock both lead to a larger capital stock growth rate. Both of these imply that a country with a large marginal product of capital will tend to grow fast.

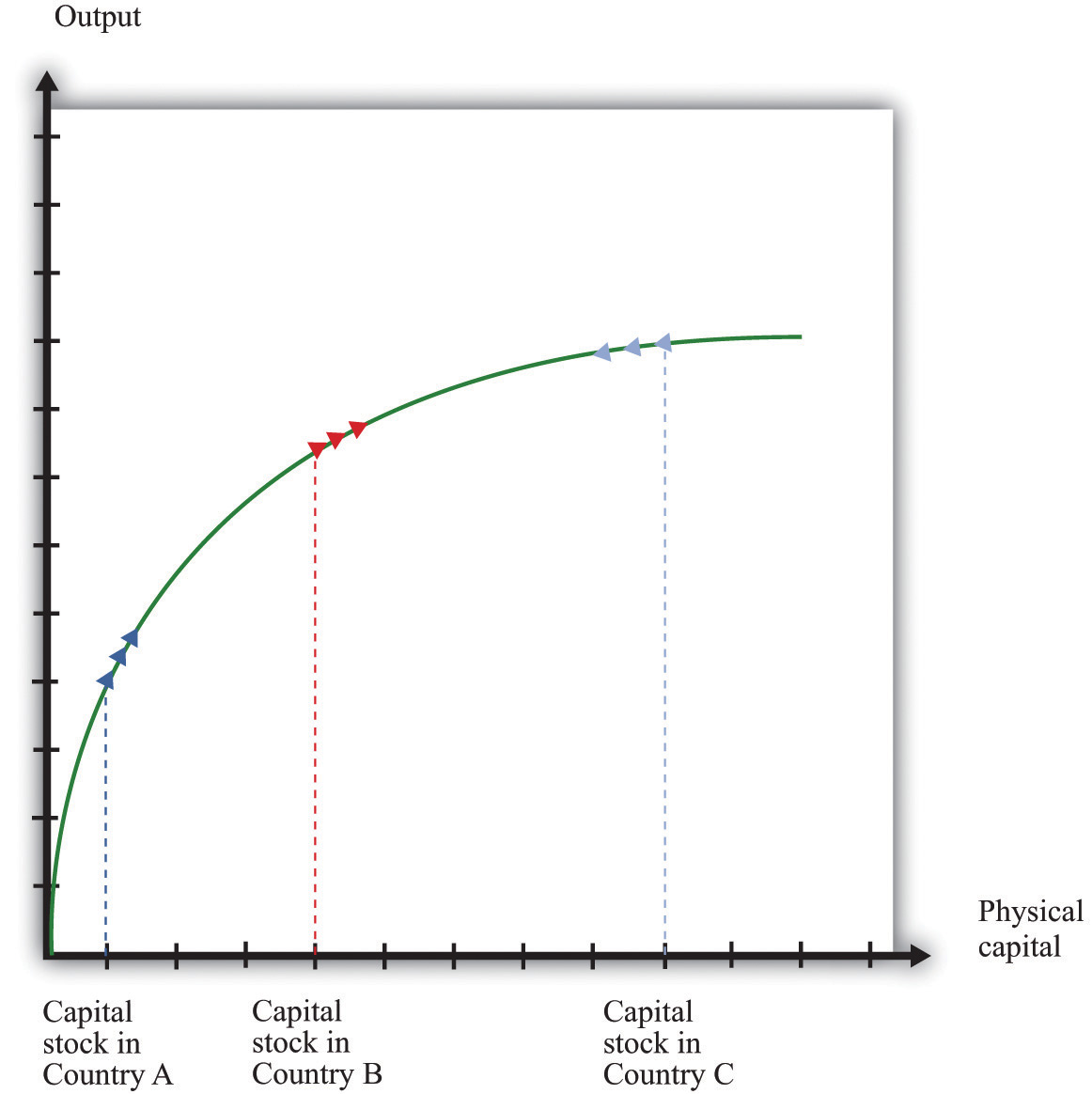

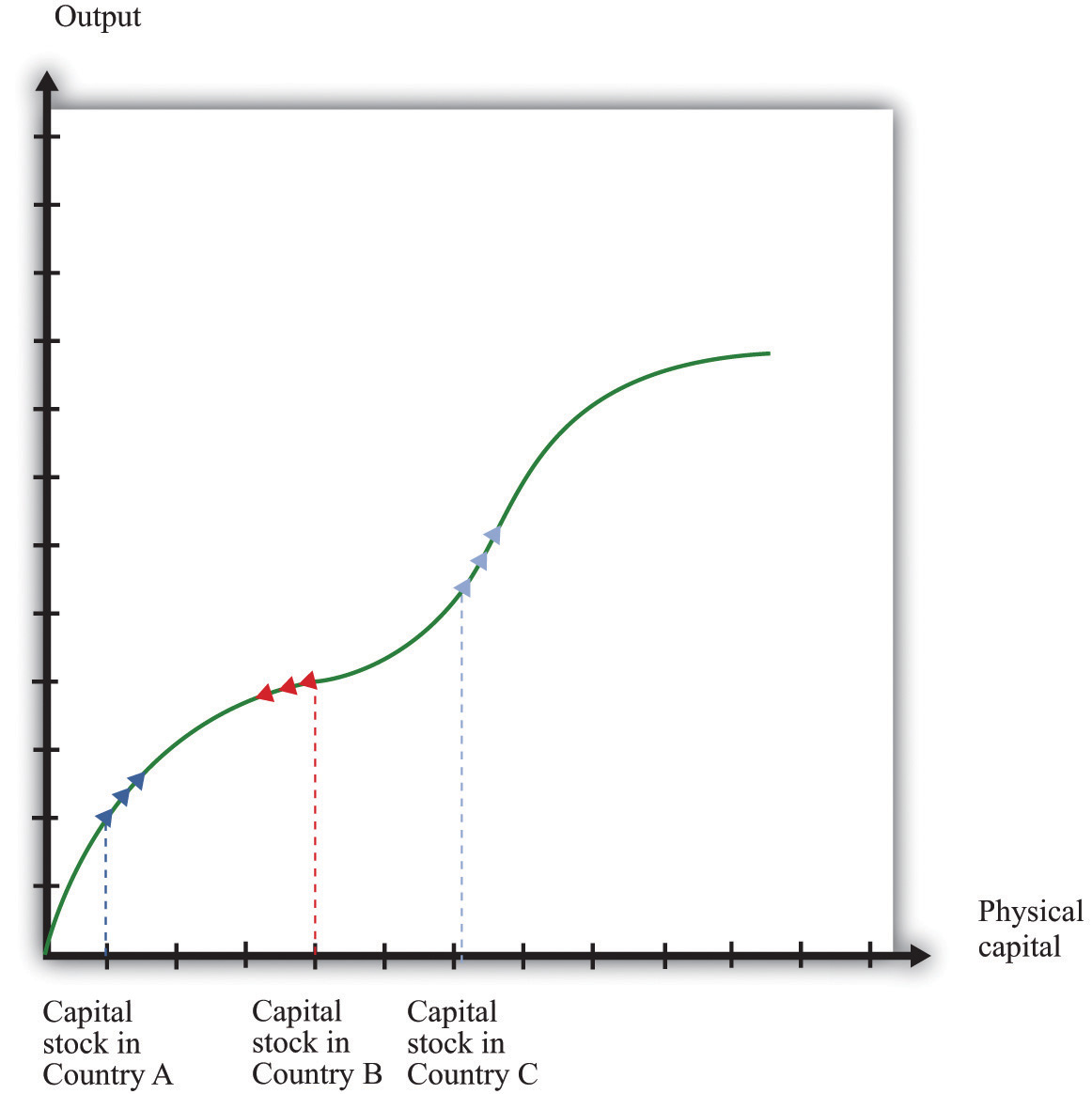

We illustrate this idea in Figure 6.8 "Convergence through the Accumulation of Capital". Country A has a small capital stock. The aggregate production function tells us that this translates into a large marginal product of capital—the production function is steep. In turn, a large marginal product of capital means that country A will grow quickly. Country B has an identical production function but a larger capital stock, so the marginal product of capital is lower in country B than in country A. There is less incentive to invest, implying that country B, while richer than country A, grows more slowly.

Figure 6.8 "Convergence through the Accumulation of Capital" also shows that it is possible for a country to have such a large capital stock that it shrinks rather than grows. Country C has so much capital that its marginal product is very low. There is little incentive to build up the capital stock, so the capital stock depreciates faster than it is replaced by new investment. In such an economy, the capital stock and output would decrease over time.

Figure 6.8 Convergence through the Accumulation of Capital

The growth rate of the capital stock depends on the marginal product of capital. Country A has little capital, so the marginal product of capital is large, and the capital stock will grow rapidly. Country B has more capital, so the capital stock grows more slowly. Country C has so much capital that the capital stock decreases.

Figure 6.8 "Convergence through the Accumulation of Capital" suggests an even stronger conclusion: all three economies will ultimately end up at the same capital stock and the same level of output—complete convergence. This conclusion is half right. If the three economies were identical except for their capital stocks and if there were no growth in human capital and technology, they would indeed converge to exactly the same level of capital stock and output. In Section 6.4 "Balanced Growth", we look at this argument more carefully. First, though, we examine the evidence on convergence.

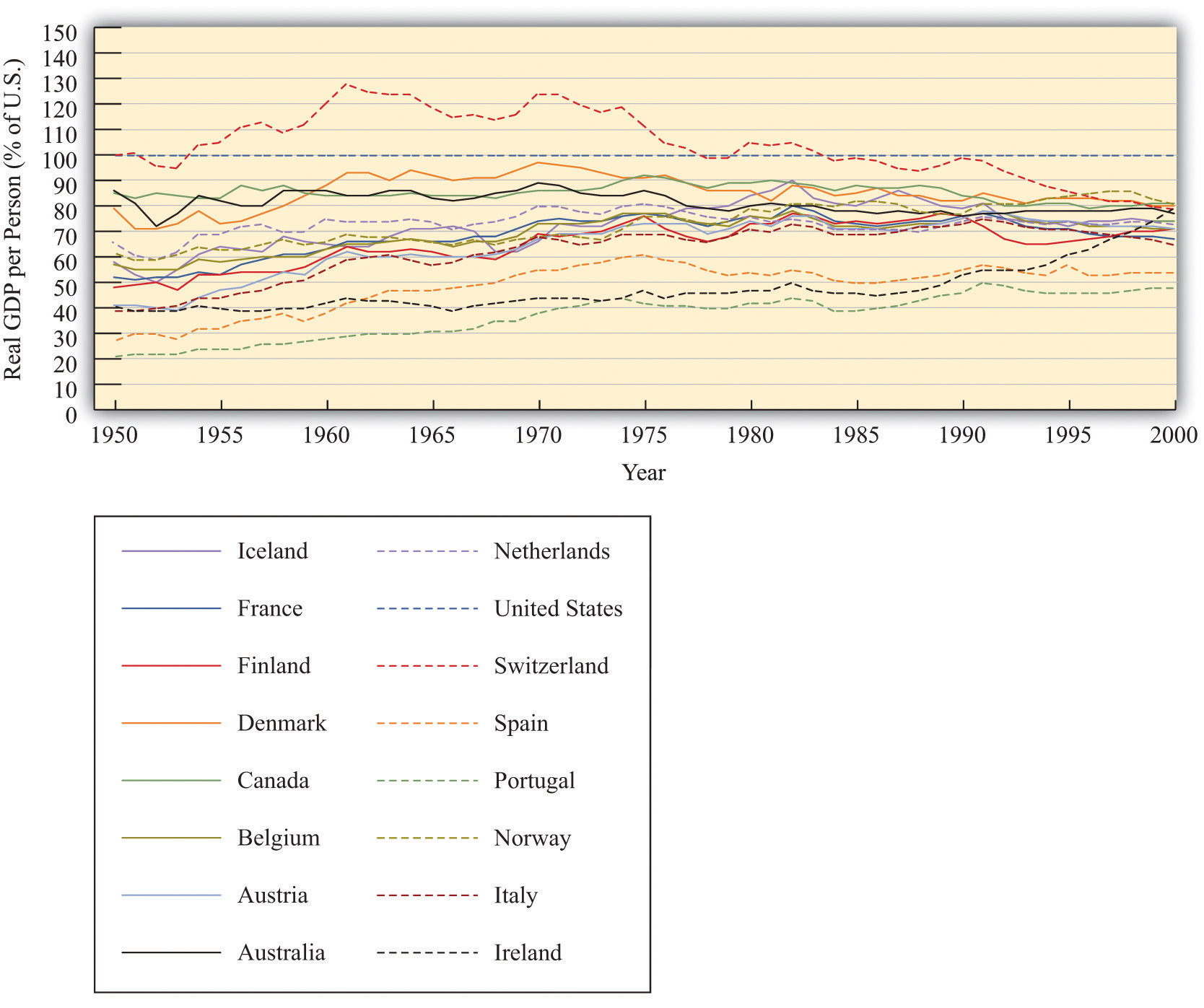

Convergence is a very pretty theory but is it borne out by the evidence? Figure 6.9 "Some Evidence of Convergence" shows the growth experience of several countries in the second half of the 20th century. These countries are all members of the Organisation for Economic Co-operation and Development (OECD) and are, relatively speaking, rich.The countries are Australia, Austria, Belgium, Canada, Denmark, Finland, France, Iceland, Ireland, Italy, the Netherlands, Norway, Portugal, Spain, Switzerland, and the United States. The median real GDP per capita in 1950 for these countries was about $6,000, in year 1996 dollars. Data for Figure 6.9 "Some Evidence of Convergence" and Figure 6.10 "Some Evidence of Divergence" come from Alan Heston, Robert Summers, and Bettina Aten, “Penn World Table Version 6.2,” Center for International Comparisons of Production, Income and Prices at the University of Pennsylvania, September 2006, accessed June 29, 2011, http://pwt.econ.upenn.edu/php_site/pwt_index.php. Figure 6.9 "Some Evidence of Convergence" shows real GDP per person in these countries relative to the United States (the United States itself is the horizontal line near the top of the figure.) Figure 6.9 "Some Evidence of Convergence" does show some evidence of convergence. Countries with higher levels of real GDP person in 1950 tended to grow more slowly than countries with lower levels of real GDP per person. Poorer countries in this group tended to catch up with richer countries.

Figure 6.9 Some Evidence of Convergence

The growth experience of 16 relatively developed countries, measured as real GDP per person relative to the level in the United States, shows considerable evidence of convergence.

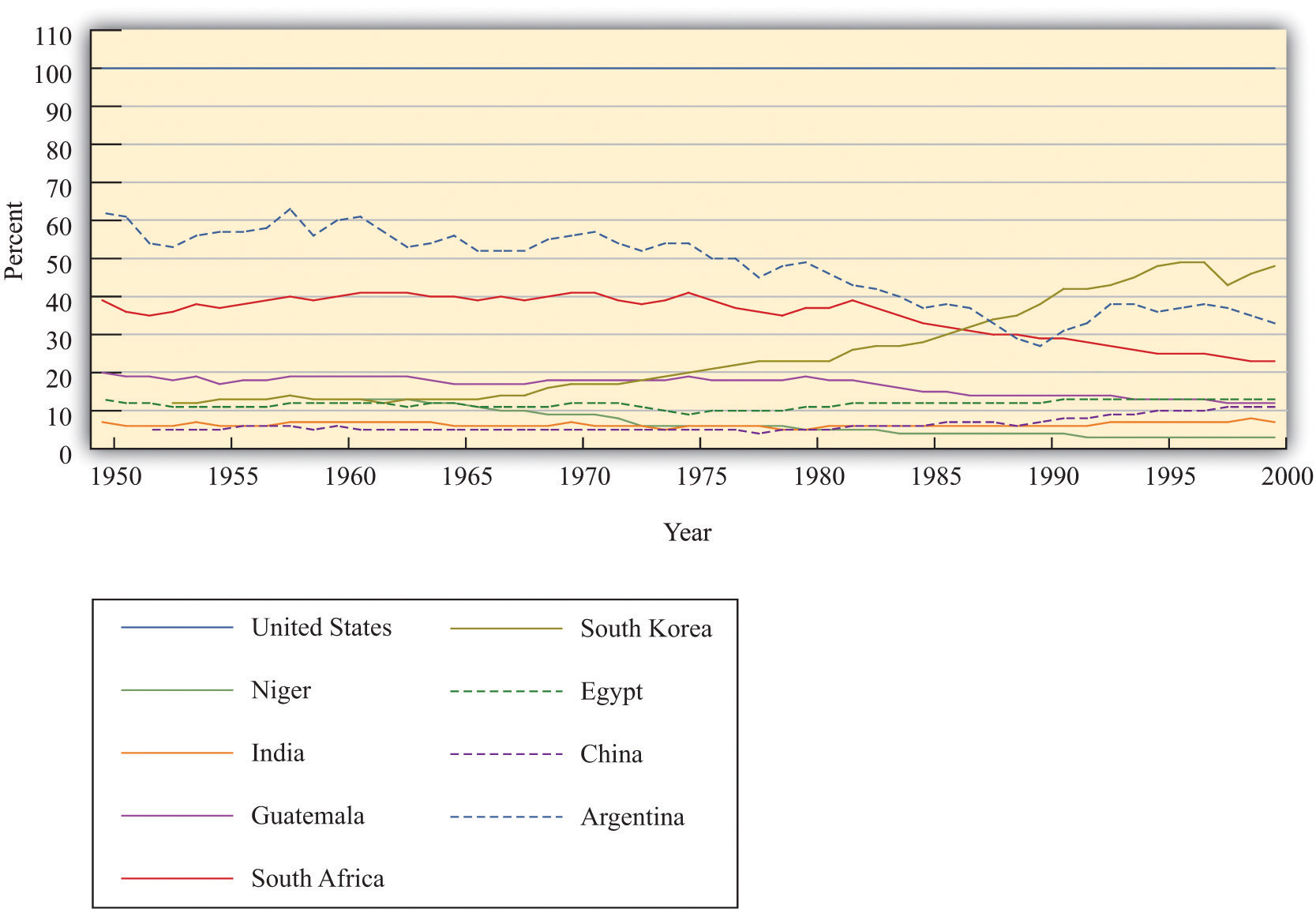

So far so good. But Figure 6.10 "Some Evidence of Divergence" shows the growth experience over the same period for a more diverse group of countries. This group is largely composed of poorer countries. The picture here is very different: we do not see convergence. There is no evidence that the poorer countries are growing faster than the richer countries. In some cases, there even appears to be divergence: poor countries growing more slowly than rich countries so that output levels in rich and poor countries move further apart.

Figure 6.10 Some Evidence of Divergence

In contrast to Figure 6.9 "Some Evidence of Convergence", the countries in this sample do not appear to be converging. Many countries that were poor in 1950 were just as poor, relatively speaking, in 2000.

Table 6.5 "Evidence from Select Countries" shows more data for some of these countries. It lists the level of initial GDP per person and the average growth rate in GDP per person between the early 1950s and the end of the century. For example, Argentina had real GDP per person of $6,430 in 1950 (in year 1996 dollars) and grew at an average rate of 1.25 percent over the 50-year period. Egypt and South Korea had very close levels of GDP per person in the early 1950s, but growth in South Korea was much higher than that in Egypt: by the year 2000, GDP per person was $15,876 in South Korea but only $4,184 in Egypt. These two countries very clearly diverged rather than converged. Looking at China, the level of GDP per person in the early 1950s was less than 10 percent that of Argentina. By 2000, GDP per person in China was about 33 percent of that in Argentina.

Table 6.5 Evidence from Select Countries

| Country (Starting Year) | Real GDP per Capita (Year 1996 US Dollars) | Percentage Average Growth Rate to 2000 |

|---|---|---|

| Argentina (1950) | 6,430 | 1.25 |

| Egypt (1950) | 1,371 | 2.33 |

| China (1952) | 584 | 4.0 |

| South Korea (1953) | 1,328 | 5.5 |

Source: Penn World Tables

Overall, this evidence suggests that our theory can explain the behavior over time of some but not all countries. If we look at relatively rich countries, then we do see evidence of convergence. Across broader groups of countries, we do not see convergence, and we see some evidence of divergence.

Why is it that, contrary to what Figure 6.8 "Convergence through the Accumulation of Capital" seems to suggest, not all countries converge? The logic of that picture rests on the diminishing marginal product of capital. If rich countries have lower marginal product of capital than poor countries, then we expect poor countries to catch up. If, for some reason, richer countries sometimes also have a higher marginal product of capital than poorer countries, then the argument for convergence disappears.

Figure 6.11 "Divergence Arising from Increasing Marginal Product of Capital" shows an example where the aggregate production function looks a bit different. This production function has a range where increases in capital stock lead to a higher rather than a lower marginal product of capital. That is, for some amounts of capital, we see increasing marginal product of capital rather than diminishing marginal product of capital. In the figure, country A and country B converge, just as in our previous diagram. But country C is rich enough to lie on the other side of the range where there is an increasing marginal product of capital. Country C therefore has a higher marginal product of capital than country B, even though country C is richer. Countries B and C will diverge, rather than converge.

Figure 6.11 Divergence Arising from Increasing Marginal Product of Capital

In this diagram, three countries have an aggregate production function that does not always exhibit diminishing marginal product of capital. As a result, the economies need not converge.

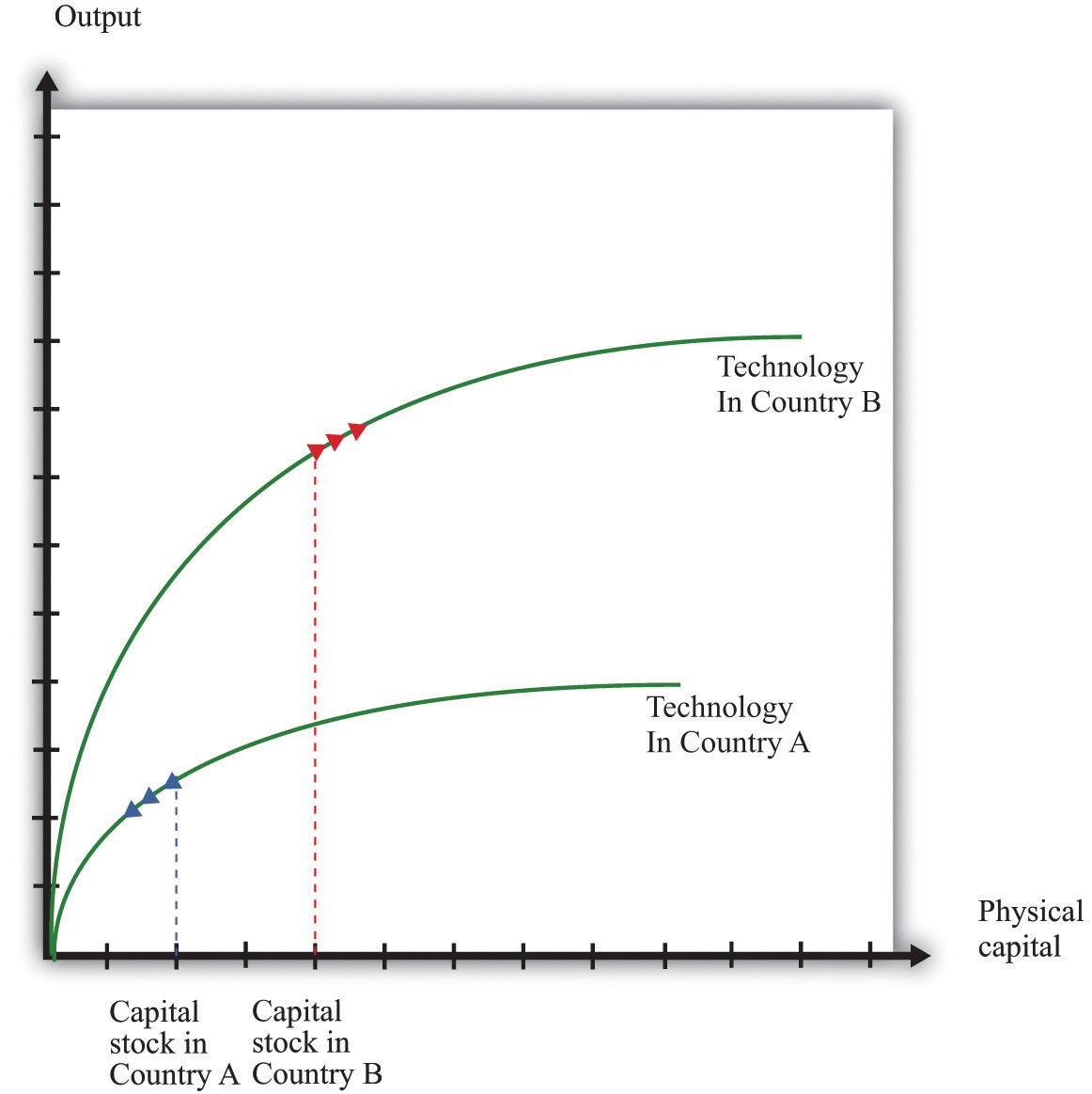

Figure 6.12 "Divergence Arising from Differences in Technology" shows another reason why a richer country might have a higher marginal product of capital than a smaller country. In Figure 6.8 "Convergence through the Accumulation of Capital" we supposed that the three countries had the same production function and differed only in terms of their capital stock. In Figure 6.12 "Divergence Arising from Differences in Technology", country B is richer than country A for two reasons: it has more capital and has a superior technology (or more labor or human capital). The higher capital stock, other things being equal, means a lower marginal product of capital in country B. But the superior technology, other things being equal, means a higher marginal product of capital in country B. In the picture we have drawn, the technology effect dominates. Country B has the higher marginal product of capital, so it is the more attractive location for capital—it is more competitive. Because of this, the capital stock increases in country B. Indeed, if the only factor driving investment is the marginal product of capital, then we would expect capital to flow among countries until the marginal product of capital is equal everywhere.We discuss capital migration across countries in more detail in Chapter 5 "Globalization and Competitiveness".

One reason why a richer economy might have better technology is because it has better social infrastructure. In particular, developed economies often have the legal and cultural institutions that preserve property rightsAn individual’s (or institution’s) legal right to make all decisions regarding the use of a particular resource.. The return on investment is higher, other things being equal, when property rights are protected. In economies with less well-developed institutions, investors need a higher rate of return to compensate them for the additional risk of placing their capital in those countries.

Measuring these aspects of social infrastructure is a challenge. The World Bank has attempted to do so in its 2005 World Development Report.World Bank, World Development Report 2005: A Better Investment Climate for Everyone (New York: World Bank and Oxford University Press, 2004), 8, accessed August 22, 2011, http://siteresources.worldbank.org/INTWDR2005/Resources/complete_report.pdf. The study looks at various aspects of doing business in 48 countries. The top constraints on investment reported by firms were policy uncertainty, macroeconomic instability, and taxes. Many of the risks of doing business are directly associated with government action in the present and in the future. This is nicely stated in the World Bank report: “Because investment decisions are forward looking, firms’ judgments about the future are critical. Many risks for firms, including uncertain responses by customers and competitors, are a normal part of investment, and firms should bear them. But governments have an important role to play in maintaining a stable and secure environment, including by protecting property rights. Policy uncertainty, macroeconomic instability, and arbitrary regulation can also cloud opportunities and chill incentives to invest. Indeed, policy-related risks are the main concern of firms in developing countries.”World Bank, World Development Report 2005: A Better Investment Climate for Everyone (New York: World Bank and Oxford University Press, 2004), 5, accessed August 22, 2011, http://siteresources.worldbank.org/INTWDR2005/Resources/complete_report.pdf.

Figure 6.12 Divergence Arising from Differences in Technology

In this diagram, country B has a better technology or more human capital than country A. Even though country B has a larger capital stock, it also has a larger marginal product of capital.

Suppose we have 100 units of capital stock at the beginning of 2012 and the following table gives the investment for the next 5 years. Suppose the depreciation rate is 5 percent. Fill in the blanks in the table for the years 2012–2017.

| Year | Capital Stock (Start of Year) | Investment | Depreciation |

|---|---|---|---|

| 2012 | 100 | 80 | |

| 2013 | 20 | ||

| 2014 | 50 | ||

| 2015 | 120 | ||

| 2016 | 10 |

After you have read this section, you should be able to answer the following questions:

We have seen that the accumulation of capital—other things being equal—leads economies to converge over time. However, we saw that the evidence for such convergence in the data is highly mixed. To understand more about when economies will and will not converge, we need a more complete theory of the sources of economic growth. In this section, we develop such a theory and then use it to look again at the question of convergence. We initially take as given—that is, as exogenousSomething that comes from outside a model and is not explained in our analysis.—the growth rates of human capital, the workforce, and the technology.

We begin with the tool of growth accounting. The growth accounting equation for our aggregate production function is as follows:Growth accounting is discussed in more detail in Chapter 5 "Globalization and Competitiveness".

output growth rate = [a × (capital growth rate)] + [(1 − a) × (workforce growth rate + human capital growth rate)] + technology growth rate.Toolkit: Section 16.17 "Growth Accounting"

You can review growth accounting in the toolkit.

In this equation, a is just a number. For the US economy, a is approximately equal to 1/3. Remember that output is just another term for real gross domestic product (real GDP).

It turns out that, in the very long run, we expect the capital stock and the level of output to grow at exactly the same rate. We see why later in this section. Such a situation is called balanced growthWhen the growth rate of the capital stock and the output growth rate are equal.. When this is true, the growth accounting equation then becomesYou don’t need to worry about the mathematical details, but if you are interested, we obtain this equation by setting the capital growth rate equal to the output growth rate:output growth rateBG = [a × (output growth rateBG)] + [(1 − a) × (workforce growth rate + human capital growth rate)] + technology growth rate, which implies (1 − a) × output growth rateBG = [(1 − a) × (workforce growth rate + human capital growth rate)] + technology growth rate.Dividing this equation by (1 − a) gives us the equation in the text.

For example, suppose that a = 1/3, the human capital growth rate = 0.01, the technology growth rate = 0.02, and the workforce growth rate = 0.03. Then

When we are comparing living standards across countries, it is better to adjust for differences in the size of the workforce to obtain output per worker. This is a measure of the overall productivityThe effectiveness of an economy for producing output. of an economy—that is, the effectiveness of an economy for producing output. (Of course, output per worker and output per person are very closely related. For the US economy, the workforce is roughly half the total population, so output per person is therefore approximately half as much as output per worker.) The growth rate of output per worker equals the growth rate of output minus the growth rate of the workforce:

This equation tells us that, in the end, the secret to economic growth is the development of knowledge and skills. Invention, innovation, education, training, and improvements in social infrastructure are the drivers of economic growth in the very long run.

Perhaps surprisingly, the growth rate of the capital stock is not a fundamental determinant of the growth rate. When we have balanced growth, the capital stock grows, which contributes to the overall growth of output. But if we ask what determines the overall growth rate in an economy, it is the growth of technology and human capital. The capital stock then adjusts to keep the economy on its balanced-growth path. By the definition of balanced growth, the growth rate of the capital stock is equal to the output growth rate.

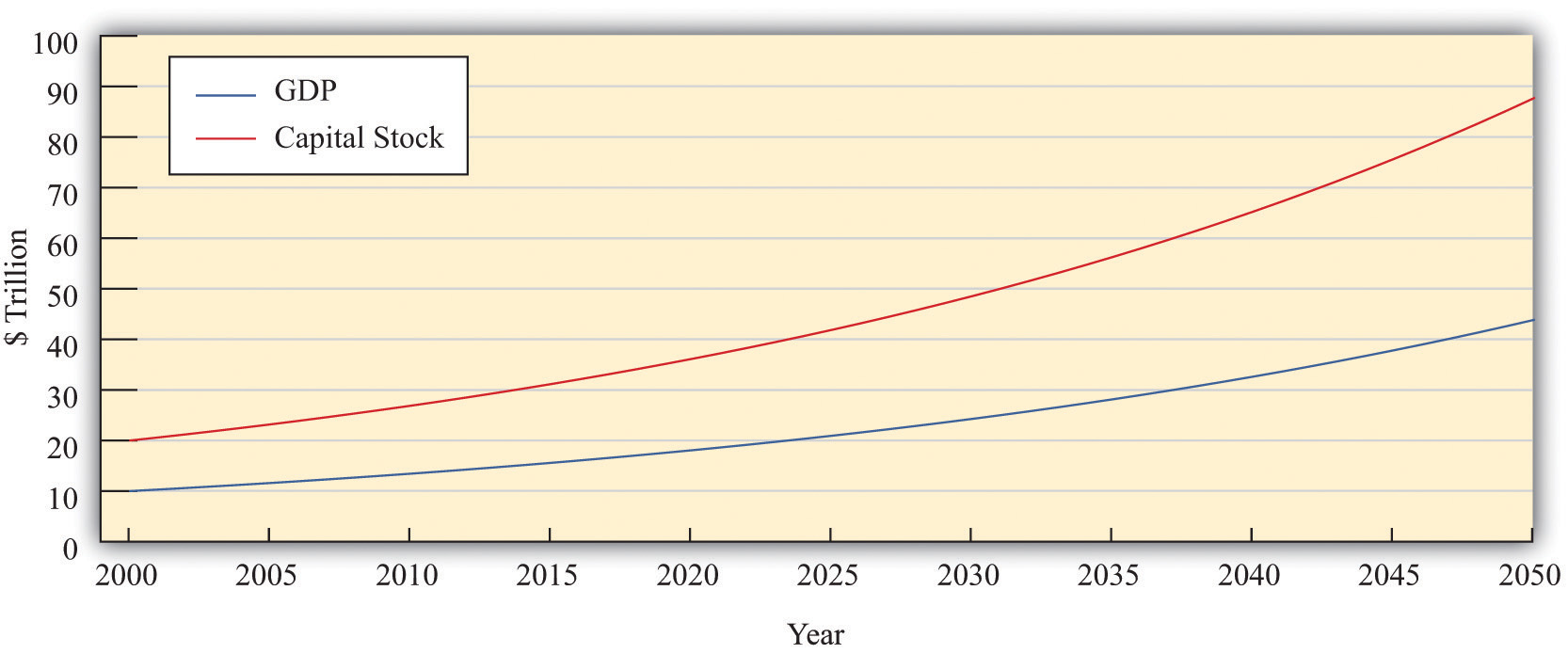

Figure 6.13 Output and Capital Stock in a Balanced-Growth Economy

This picture shows an example of an economy on a balanced-growth path. Both variables grow at 3 percent per year and the capital stock is always equal to exactly twice the level of GDP.

Figure 6.13 "Output and Capital Stock in a Balanced-Growth Economy" illustrates balanced growth. Look first at output. Notice that even though the growth rate of output is constant, the graph is not a straight line. Instead, it curves upward: the change in the level of output increases over time. This is because a growth rate is a percentage change. In our example, output in 2000 is $10 trillion, and the growth rate is 3 percent. From 2000 to 2001, output increases by $300 billion (= $10 trillion × 0.03). By 2050, output is equal to $44 trillion. Between that year and the next, output increases by $1.3 trillion (= $44 trillion × 0.03). Even though the growth rate is the same, the change in the level of output is more than four times as large.

When output and the capital stock grow at the same rate, the ratio of the capital stock to GDP does not change. In Figure 6.13 "Output and Capital Stock in a Balanced-Growth Economy", the value of the capital stock is always twice the value of output. The capital stock and real GDP both grow at the same rate (3 percent per year), so the ratio of the capital stock to GDP does not change over time.

Figure 6.14

Balanced growth means that the ratio of the capital stock to output does not change. On a balanced-growth path, output and the capital stock grow at the same rate, so the ratio of the capital stock to output is always the same: the growth path of the economy is a straight line from the origin.

Figure 6.14 shows what a constant ratio of the capital stock to GDP looks like in our production function diagrams. Along any straight line from the origin, the ratio of the capital stock to output does not change. As a simple example, suppose that (as in Figure 6.13 "Output and Capital Stock in a Balanced-Growth Economy") the capital stock is always twice the level of output. This means that output is always half of the capital stock:

output = 0.5 × capital stock.This is just the equation of a straight line that passes through the origin. In Figure 6.14, increases in human capital or technology shift the production function upward. On the balanced-growth path, capital stock grows at exactly the right rate so that the economy grows along a straight line from the origin.

If an economy is not yet on its balanced-growth path, it will tend to go toward that path. If a country has a small capital stock relative to GDP, then its capital stock will grow faster than real GDP. Countries that are still developing may well be in this position. Countries that are further along in the development process are likely to be (approximately) on their balanced-growth paths. For such countries, the ratio of capital stock to output is unchanging.

Economies that have not yet accumulated enough capital to be on their balanced-growth paths will have a growth rate that equals the balanced-growth rate plus an additional factor due to the growth rate of capital relative to GDP.If you are interested in the mathematical derivation of this equation, you can find it in the toolkit.

The first term is the growth rate along the balanced-growth path. The second term is the additional component to growth that comes about whenever the capital stock is growing faster than output.

Table 6.6 "Approaching the Balanced-Growth Path" gives an example of an economy that is approaching a balanced-growth path. Like the economy in Figure 6.13 "Output and Capital Stock in a Balanced-Growth Economy", the balanced-growth output growth rate is 3 percent. The workforce grows at 1 percent, so output per worker grows at 2 percent along the balanced-growth path. However, this economy starts off (in the year 2000) with a smaller capital stock than is needed for balanced growth. Looking at the first row of the table, you can see that the capital stock grows at 14.4 percent, while output grows at 6.8 percent. Because capital grows faster than output, there is an additional component to growth, as we have just explained. This contributes an extra 3.8 percentage points to the growth rate, so output per worker grows at 5.8 percent.

As time goes on, the capital stock grows relative to output, and the economy gets closer to the balanced-growth path. As this happens, the additional component of growth becomes smaller. For example, in 2010, the capital stock grows at 6.8 percent, and output grows at 4.3 percent. The growth rate of output per worker is 3.3 percent—2 percentage points being the balanced-growth contribution and 1.3 percent due to the faster growth rate of capital stock compared to output. By 2050, the economy is close to balanced growth: output per worker grows at 2.3 percent, with capital stock growing only a little bit faster than output.

Table 6.6 Approaching the Balanced-Growth Path

| Year | Balanced-Growth Output Growth Rate (%) | Balanced-Growth Output per Worker Growth Rate (%) | Capital Growth Rate (%) | Output Growth Rate (%) | Output per Worker Growth Rate (%) |

|---|---|---|---|---|---|

| 2000 | 3.0 | 2.0 | 14.4 | 6.8 | 5.8 |

| 2005 | 3.0 | 2.0 | 9.3 | 5.1 | 4.1 |

| 2010 | 3.0 | 2.0 | 6.8 | 4.3 | 3.3 |

| 2015 | 3.0 | 2.0 | 5.5 | 3.8 | 2.8 |

| 2020 | 3.0 | 2.0 | 4.7 | 3.6 | 2.6 |

| 2025 | 3.0 | 2.0 | 4.1 | 3.4 | 2.4 |

| … | … | … | … | … | … |

| 2050 | 3.0 | 2.0 | 3.8 | 3.3 | 2.3 |

Countries that are well below their growth path will see their capital stock grow rapidly relative to GDP. They will experience relatively rapid GDP growth. Countries that are close to their balanced-growth path will see their capital stock grow more slowly relative to GDP and have a GDP growth rate that is only slightly bigger than the balanced-growth rate. Although the economy will eventually reach its balanced-growth value, this adjustment may take decades. For this reason, we say that the economy will achieve balanced growth only in the very long run.To be mathematically precise, the economy gets closer and closer to its balanced-growth path but never quite gets there. Over a period of decades, it gets close enough that it makes no practical difference.

We can now use our theory of balanced growth to make our earlier argument for convergence more precise. Then we consider whether we might also see convergence from changes in human capital and technology.

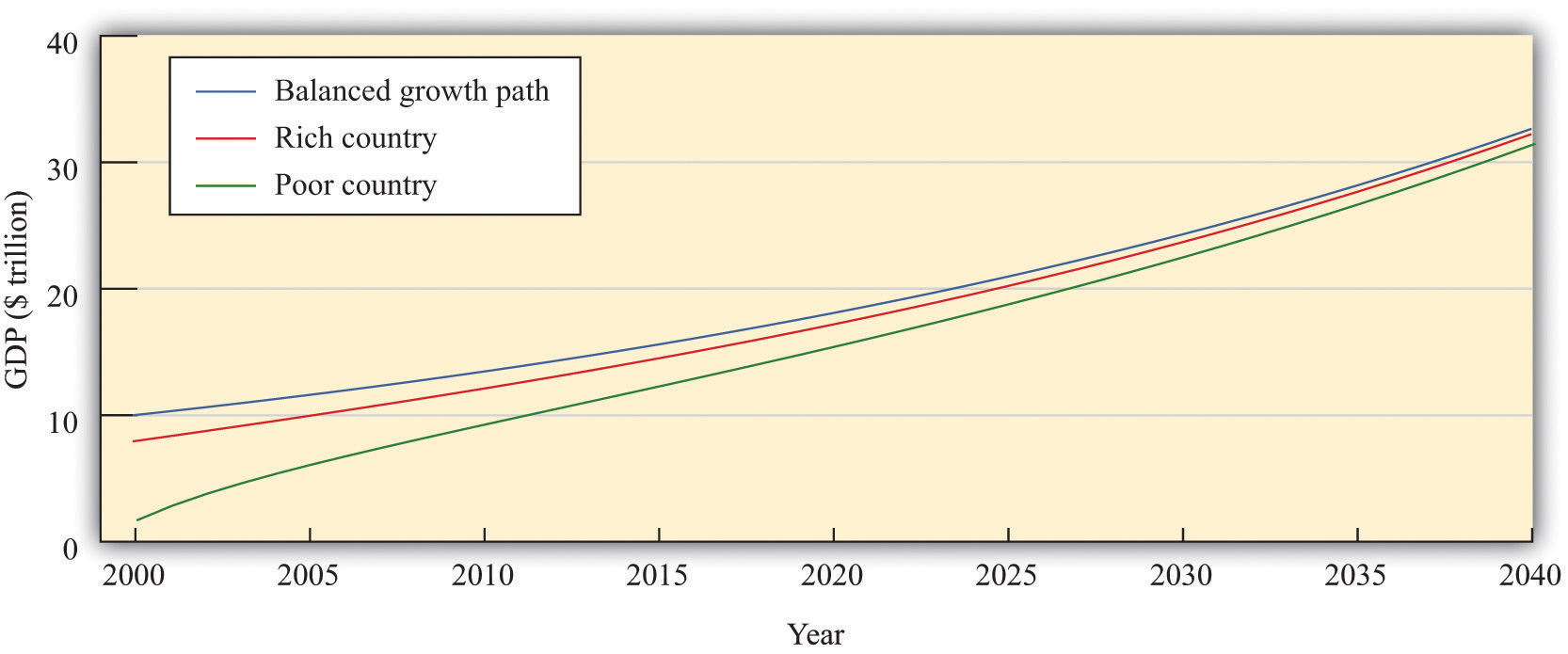

Imagine that we are comparing two countries that are identical in almost every respect. They both have the same levels of technology and human capital and the same balanced-growth ratio of capital stock to GDP. However, they have different amounts of physical capital. Suppose that one of the countries has a large capital stock (call it the rich country) and the other country has a much smaller capital stock (call it the poor country).

These two economies will initially have different levels of output and living standards. Our model predicts, however, that these differences will be temporary. Both economies will approach the balanced-growth path. The poor country will grow more rapidly because its ratio of capital stock to GDP will be increasing more quickly as it moves toward the balanced-growth path. Over time, we expect to see the poor country catch up to the rich one. We illustrate this in Figure 6.15 "Convergence of a Rich Country and a Poor Country".

Figure 6.15 Convergence of a Rich Country and a Poor Country

Consider two economies, identical in all respects except that one has a smaller capital stock than the other. The poorer country accumulates capital faster than the richer country and grows faster.

This is exactly the same mechanism for convergence that we saw before. The country with a smaller capital stock will have a higher marginal product of capital and will grow faster because the country is a more attractive place for investment. Because the poor country accumulates capital more rapidly than the richer country, it will grow faster. The two countries will converge to the same balanced-growth path and to the same level of output per person.

So far we have not considered why human capital might change over time. If there are reasons to think that this variable might grow more quickly in poor countries than in rich countries, we have another force that might drive convergence.

In some ways, human capital resembles physical capital. As with the physical capital stock, some accumulation is the result of decisions by governments, and some comes from decisions by private agents. From the government side, it is likely that economies with low levels of human capital might also be economies in which there is a high return to basic education. If literacy rates are low and most children do not receive much education, even straightforward investments in schooling might yield big gains in terms of the ultimate capabilities of the workforce. Governments in poor countries might see big potential gains from investment in education. Private individuals and firms may also perceive that the returns on education are larger in poorer economies. If very few people in the economy have college degrees, an individual might find that a college education yields a very large payoff. By contrast, if the population as a whole is highly educated, it might take a much larger investment to stand out from others.

This discussion is somewhat speculative. Human capital is difficult to measure, and the marginal product of human capital is even harder to quantify. Nevertheless, there are some good reasons to believe that the incentives to invest in human capital are greater in poorer economies. If so, we have another reason to expect convergence.

What about technology? Will it grow faster in poorer economies? The answer depends on which aspect of technology we are talking about.

Differences in knowledge between rich and poor countries are likely to diminish over time. Rich economies are typically close to the technology frontier, meaning that they are using state-of-the-art production techniques. For countries on the technology frontier, growth in knowledge can only come the hard way, through investment in research and development (R&D). Countries inside the technology frontier are typically poorer developing countries. These economies can grow their stock of knowledge simply by importing knowledge from countries at the frontier. Technological advance is much cheaper and easier if you can use others’ inventions and innovations rather than coming up with your own. We therefore expect such countries to have faster growth rates of knowledge. As they become more developed, the growth of knowledge in these economies will slow down to the rate experienced by other countries near the technology frontier. But in the meantime, they will grow faster than rich countries. Technology transfer to developing economies is surely a force leading to convergence of economies.

There is less to say about social infrastructure and natural resources. The amount of natural resources available in an economy is largely due to accidents of history and geography: there is no obvious reason to expect the growth rate of natural resources to be linked to the level of development. Social infrastructure, meanwhile, is a complicated mix of institutions, customs, and other factors. Again, there is no obvious reason to expect social infrastructure to grow more quickly in poorer economies.

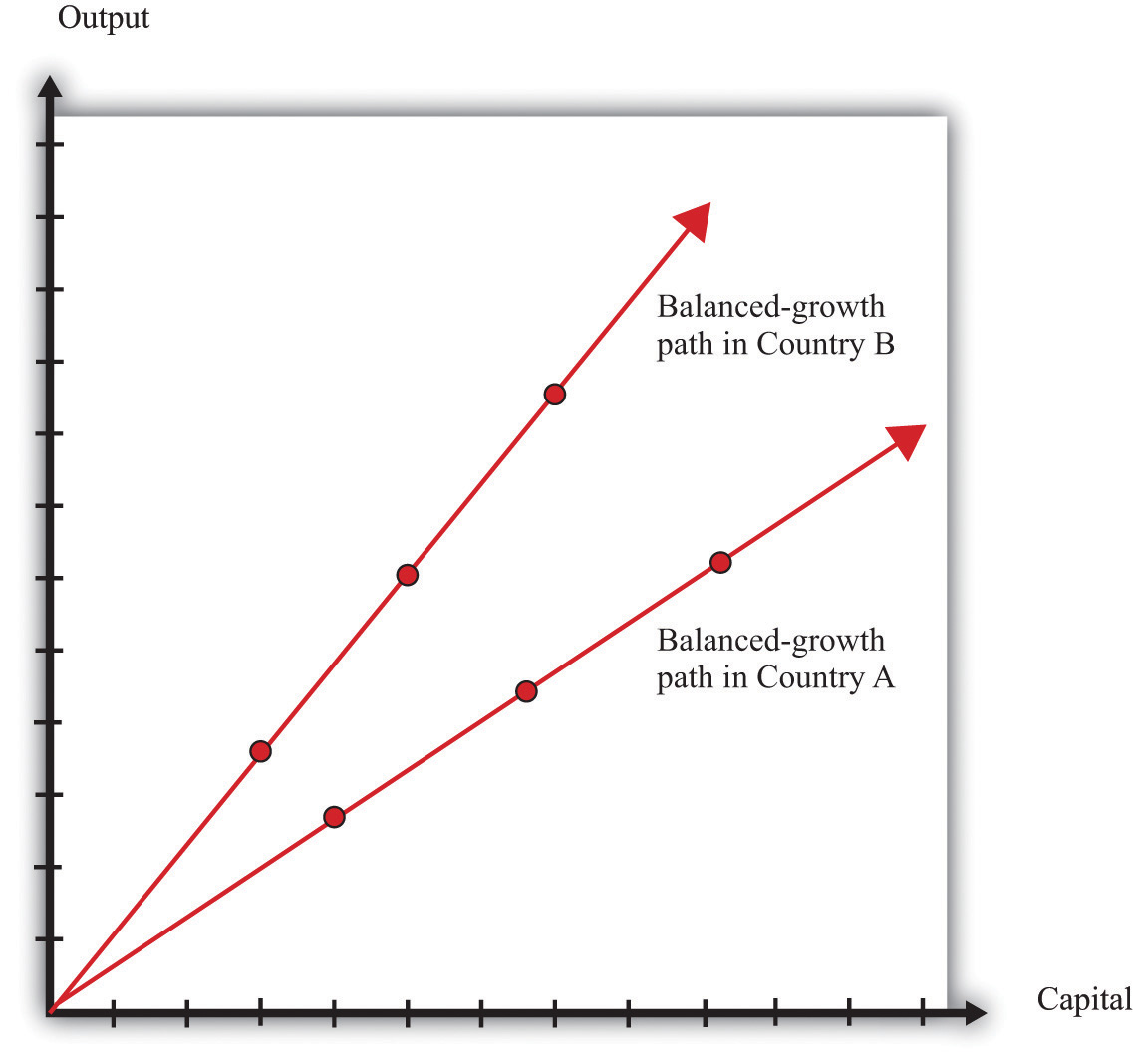

Now that we have incorporated human capital and technology into our framework, we can identify some further possible explanations of divergence. Our theory says that economies will converge if they differ only in terms of their initial capital stock. But it is possible that different economies will also have different balanced-growth paths. Figure 6.16 "Balanced Growth in Two Countries with Different Ratios of Capital to Output" shows what this looks like. The ratio of capital stock to output in the very long run depends on a number of different factors, including the growth rate of technology and the growth rate of the workforce. If these differ across countries, then their balanced-growth paths will differ as well, and we will not observe convergence.The toolkit presents a complete model of balanced growth, including a formula for the balanced-growth ratio of capital stock to output.

Figure 6.16 Balanced Growth in Two Countries with Different Ratios of Capital to Output

Economies may have different balanced-growth paths. In this example, the ratio of capital stock to output is higher in country A than in country B.

This explanation—and our previous stories of divergence—tells us why different economies will not necessarily end up at exactly the same level of output per worker. But the problem of divergence is in some ways worse than that. Some countries are not only failing to converge but also moving further and further apart. In other words, in some cases, richer economies are growing faster than poorer economies. Indeed, as we saw with Niger, some of the poorest economies in the world have been shrinking rather than growing.

Remember that the growth rate of output per worker on a balanced-growth path is as follows:

We can explain divergence in our framework if human capital or technology is growing more slowly in poor countries than in rich ones. Are there reasons to expect this to be the case? Earlier, we said that countries with low levels of human capital might also be countries where the return to human capital investment was large, which is a force for convergence. We also pointed out, however, that the marginal product of physical capital might be larger in an economy with a superior technology, even if that economy had more capital. The same is true of human capital. Countries can build up their human capital through schooling and training. They can also build up their human capital by attracting skilled workers from other countries. If richer countries are able to attract skilled workers, then we will see divergence rather than convergence.In Chapter 5 "Globalization and Competitiveness", we discuss how economies actively seek to attract human capital.

Turning to technology, divergence in social infrastructure is certainly a possibility. Social infrastructure includes the rule of law, the general business climate, social attitudes toward corruption, the protection of property rights, and many other intangible factors. These influences on economic growth are difficult to define and almost impossible to measure accurately. Yet economists are convinced that successful economies must have a good set of such social institutions. It is likely that it is easier to build and improve such institutions in countries that are relatively prosperous, which would again lead richer countries to grow more rapidly than poorer countries.

Economists have built some of these ideas into the theoretical framework of economic growth. Unfortunately, the models are too complicated for an introductory economics textbook, so we will not go into them in any detail here. We can, however, provide a simple example that conveys the flavor of these more complex ideas. The story goes as follows. We know that workers acquire human capital through education and on-the-job training. Suppose that, when there is more physical capital in the economy (relative to the number of workers), it is easier to acquire human capital. You can study in modern facilities with up-to-date computers. You work with state-of-the-art machinery and become more skilled. In this story, human capital is endogenousSomething that is explained within our analysis.: it depends on the amount of physical capital.

To be concrete, imagine that technology is constant, and the amount of human capital is proportional to the amount of physical capital per worker. When we incorporate this assumption into the production function, we end up with a very straightforward relationship:

output = B × physical capital,where B is just a number.The derivation of this equation is not very difficult; it is explained in the toolkit.

In this economy, the ratio of capital stock to GDP is constant at all times (capital/output = 1/B). This economy is always on a balanced-growth path. Because of this, the growth rate of output equals the growth rate of capital stock:

output growth rate = physical capital growth rate.The more important point, though, is that this technology does not exhibit diminishing marginal product of capital. The marginal product of capital is constant: it equals B. If this number were different in different economies, then we would expect to see capital stock flowing from economies where B is small toward economies where B is large. We would see divergence rather than convergence.