After you have read this section, you should be able to answer the following questions:

Monetary policy has international implications as well. Changes in interest rates lead to changes in supply and demand in the foreign exchange market.Chapter 9 "Money: A User’s Guide" explains this connection. In turn, changes in exchange rates affect exports and imports and influence the overall demand for goods and services. Among other things, this means that the monetary policy of other countries will have an effect on your own country. So if you live in Europe, you are not immune to Federal Open Market Committee (FOMC) actions. And if you live in the United States, you are not immune to the actions of the European Central Bank (ECB).

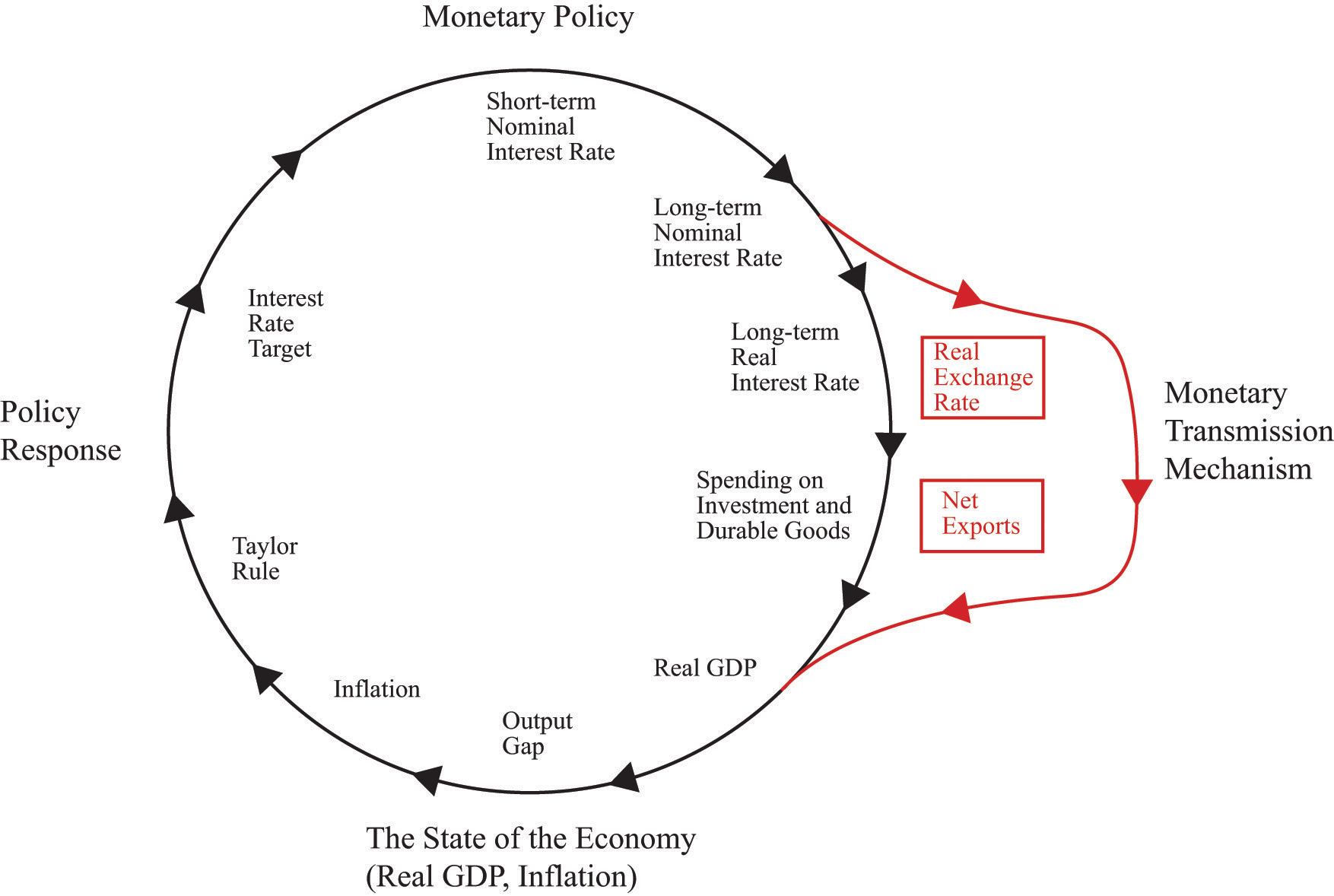

The key element in the monetary transmission mechanism is the ability of the central bank to influence the real interest rate. Changes in real interest rates lead to changes in spending on durable goods, which are a component of aggregate expenditures. But there is also another channel of influence. If the Fed cuts interest rates, for example, then the demand for dollars to invest in US asset markets will be reduced. This will reduce the foreign currency price of dollars. The weaker dollar means that goods produced in the United States are cheaper, so US exports will increase, and US imports will decrease. Thus changes in interest rates lead to changes in exchange rates, which in turn lead to changes in net exportsExports minus imports.. Net exports are also a component of aggregate expenditures. This is illustrated in Figure 10.17.

Figure 10.17

There is an additional channel of the monetary transmission mechanism that operates through the exchange rate. Changes in interest rates lead to changes in exchange rates, which in turn lead to changes in net exports. This channel reinforces the effect operating through interest rates.

Even when we include this channel, it is just as easy to understand the monetary transmission mechanism as it was before. When interest rates are cut, there is an increase both in spending on durables and net exports. Both channels lead to higher aggregate spending and thus higher output.

Toolkit: Section 16.10 "Foreign Exchange Market"

You can review the workings of the foreign exchange market and the definition of the exchange rate in the toolkit.

The United States does not exist alone in the world economy. US financial markets are influenced by events in other countries, such as the actions of the ECB. Likewise, citizens in Europe are influenced by monetary policy in the United States.

Suppose the ECB cuts interest rates in Europe. As in the United States, the typical mechanism for this would be a purchase of debt issued by European governments. An increase in the price of this debt is equivalent to a decrease in interest rates. If nothing else happens, this decrease in European interest rates gives rise to an arbitrage opportunity. Investors want to move funds to the United States to take advantage of the higher interest rates. There is an increased demand for US assets and hence an increased demand for dollars. Interest rates in the United States decrease, which tends to increase durable goods spending and stimulate the US economy. Against that, the higher value of the dollar leads to fewer exports from the United States and more imports into the United States, so US net exports will decrease.

Completely analogously, monetary policy in the United States influences interest rates in other countries. If the Fed undertakes an open market sale of US government debt, for example, interest rates will increase in other countries as well as in the United States.

The US Federal Reserve and the ECB are big players in world financial markets. Their actions move world interest rates and world currency markets. There are other countries that are relatively small in the world economy. For example, suppose the Central Bank of Iceland increases interest rates in that country. The mechanisms that we have explained still apply: investors will find Icelandic assets more attractive, and there will be an increased demand for the Icelandic krona. However, the flows of capital into Iceland will be negligible in terms of the world economy. They will not have any noticeable effect on interest rates in Europe or the United States.