Imagine you are the accountant for Drive Write, a company that produces computer disk drives, and you are in charge of all accounting functions within the company. The president has informed you that if the company’s profits grow by 20 percent this year, you will receive a $20,000 bonus, and she will receive a $50,000 bonus. No bonuses will be awarded if profit growth is less than 20 percent. Because the company’s profits have grown 20 percent annually for the last 10 years, investors have come to expect significant growth from one year to the next. Near the end of this fiscal year, the president and you have the following conversation:

| President: | We are awfully close to hitting our numbers and getting to the 20 percent target. With two weeks remaining, projections show we will come in at 18 percent for the year. What can we do on the accounting side to increase current year profits? |

| Accountant: | Well, I’m not sure there is anything we can do. Our accounting is squeaky clean, as confirmed by our independent auditors. Perhaps our sales will improve next year. |

| President: | There has to be something we can do—I could sure use the bonus money, and our investors would appreciate an increase in their investment! I know we have a large customer order to be filled the first week of next year. Why not include that sale in this year’s numbers? |

| Accountant: | I’m not comfortable recording sales in the wrong fiscal year. |

| President: | We’re only talking about moving sales by a few days! I would like you to consider this carefully. If you can’t do this, I may have to find an accountant who can! Let’s talk about our options later this week. |

Question: The situation at Drive Write creates a serious ethical dilemma. (The Drive Write example is based on a real company called MiniScribe Corporation, subsequently purchased by a competitor.) Companies are constantly under pressure to meet sales and profit goals. Employees who succeed in meeting these goals often reap huge monetary rewards; those who fail may be penalized with lower pay or may even lose their jobs. What would you do if asked to record information in a way that distorts the company’s financial results?

Answer: As the accountant for Drive Write, your response to the president’s request would likely affect your reputation as a professional and your future as an accountant. The unethical behavior at corporations like Xerox, Enron, and WorldCom in recent years makes it imperative that we know both how to act ethically and how to resolve ethical conflicts.

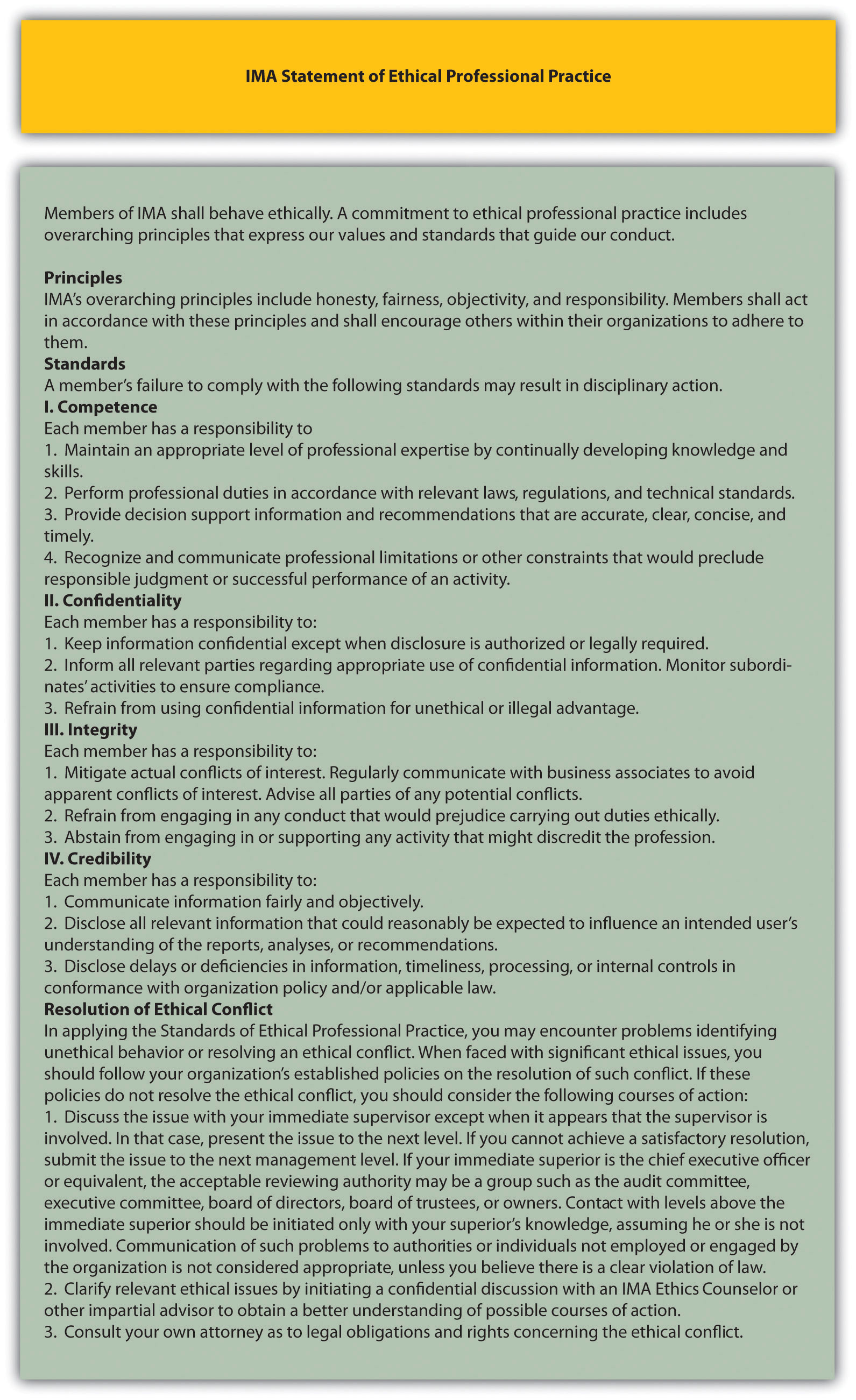

To help guide accounting professionals through ethical dilemmas like the one at Drive Write, the Institute of Management Accountants (IMA) has established a Statement of Ethical Professional Practice, which appears in Figure 1.2 "IMA Statement of Ethical Professional Practice". The standards outlined in this statement are guidelines that can help accountants choose an ethically acceptable course of action. As you review Figure 1.2 "IMA Statement of Ethical Professional Practice", notice that the IMA specifies four core responsibilities (competence, confidentiality, integrity, and credibility) as well as guidelines on how to resolve ethical conflicts. The “Resolution of Ethical Conflict” section provides specific guidance on how to resolve the conflict at Drive Write.

Figure 1.2 IMA Statement of Ethical Professional Practice

Source: Adapted from the Institute of Management Accountants, http://www.imanet.org.

Question: The IMA is just one of many professional accounting organizations. Do other professional accounting organizations also provide guidance regarding ethics in accounting?

Answer: Yes, other professional organizations do provide ethical guidance. Several are listed as follows:

Because of alleged wrongdoing, such as that reported in the Note 1.27 "Business in Action 1.3", improving ethics is a top priority for most businesses as shown in the Note 1.28 "Business in Action 1.4". As a result, professional organizations like those we have cited have become instrumental in providing ethical guidelines.

Production Firm Employees Charged with Fraud

The Securities and Exchange Commission (SEC) filed three actions against Diebold, Inc., a manufacturer and seller of automated teller machines, for improperly inflating earnings over a five-year period. Three former employees—the CFO, controller, and director of accounting—were accused of improperly inflating revenue on factory orders, improperly recognizing revenue on a lease transaction, manipulating reserves and accruals, improperly capitalizing expenses, and improperly increasing the value of inventory. These actions allegedly resulted in over 40 misstated annual, quarterly, and other reports filed with the SEC, along with numerous inaccurate press releases.

The company agreed to pay a $25,000,000 civil penalty, and the three former employees remain in litigation. Although the CEO was not accused of wrongdoing, he settled with the SEC and agreed to pay back cash bonuses, stock, and stock options received during the periods when the financial fraud was committed.

Source: Securities and Exchange Commission, “SEC Charges Diebold and Former Executives with Accounting Fraud,” news release, June 2, 2010.

The Code of Ethics at Home Depot and Hewlett-Packard

Ethics policies are becoming increasingly important to organizations. Home Depot, Inc., has an ethics code that “provides the basic principles for associates to make business decisions consistent with how Home Depot operates” and “forms the groundwork for our ethical behavior.”

Hewlett-Packard Company has established “business ethics guided by enduring values.” The company states it is committed to the following principles: honesty, excellence, responsibility, compassion, citizenship, fairness, and respect.

Sources: Home Depot, “Home Page,” http://www.homedepot.com; Hewlett-Packard, “Home Page,” http://www.hp.com.

Solution to Review Problem 1.4

The four key standards shown in Figure 1.2 "IMA Statement of Ethical Professional Practice" are outlined as follows:

Several options exist for resolving ethical conflicts. The IMA suggests the following courses of action: