Question: Custom Furniture Company’s direct materials include items such as wood and hardware. Direct labor involves the employees who build the custom tables. Manufacturing overhead includes items such as indirect materials (glue, screws, nails, sandpaper, and stain), indirect labor (production supervisor), and other manufacturing costs, such as factory equipment maintenance and factory utilities. What accounts are used to record the costs associated with these items, and where do these accounts appear in the financial statements?

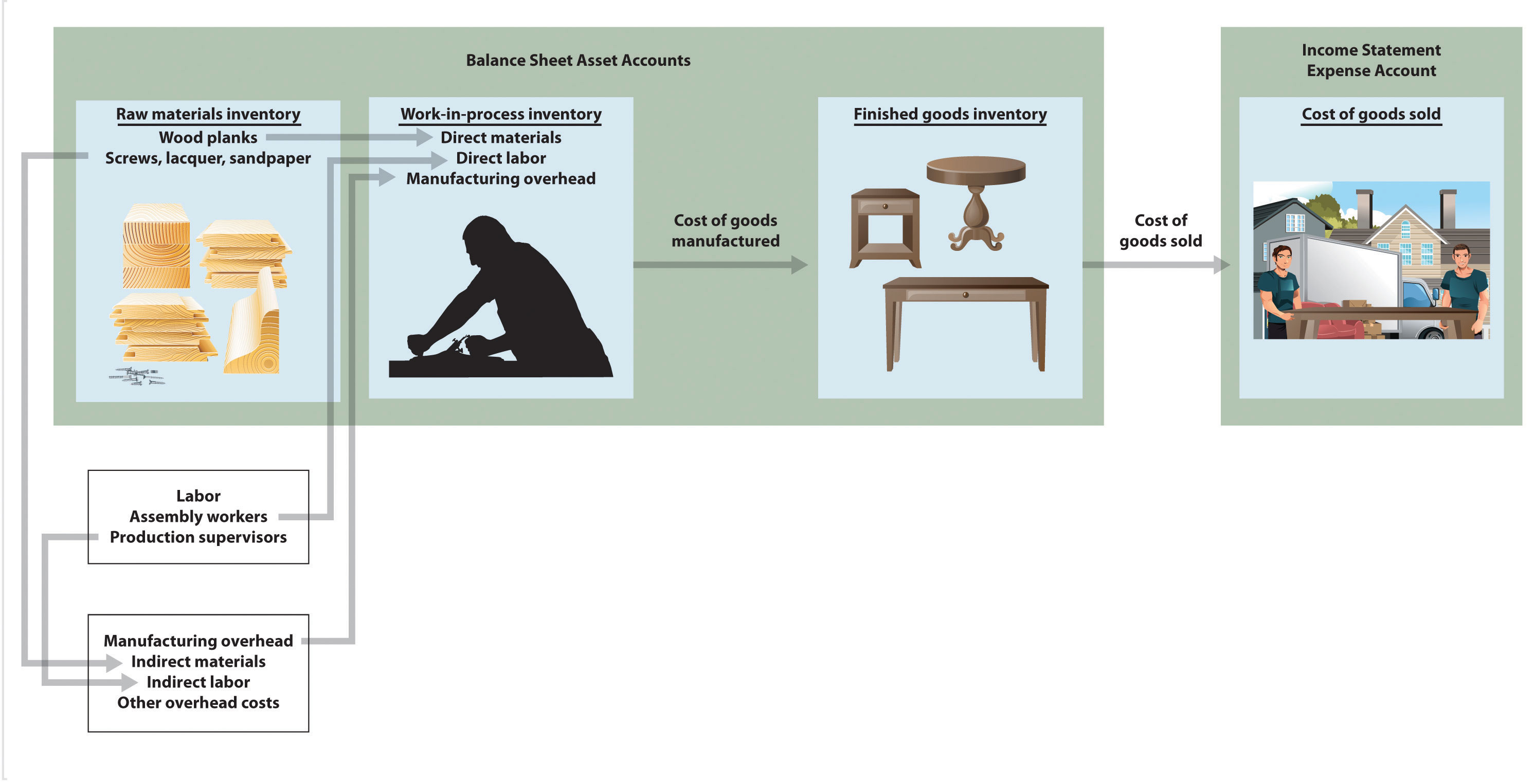

Answer: All the costs mentioned previously for Custom Furniture are product costs (also called manufacturing costs). Product costs are recorded as an asset on the balance sheet until the products are sold, at which point the costs are recorded as an expense on the income statement. To record product costs as an asset, accountants use one of three inventory accounts: raw materials inventory, work-in-process inventory, or finished goods inventory. The account they use depends on the product’s level of completion. They use one expense account—cost of goods sold—to record the product costs when the goods are sold.

Table 1.4 "Accounts Used to Record Product Costs" summarizes the accounts used to track product costs. Figure 1.6 "Flow of Product Costs through Balance Sheet and Income Statement Accounts" shows how product costs flow through the balance sheet and income statement. Lastly, Note 1.57 "Business in Action 1.7" provides an example of how the accounts shown in Table 1.4 "Accounts Used to Record Product Costs" and Figure 1.6 "Flow of Product Costs through Balance Sheet and Income Statement Accounts" appear in financial statements. Take time to review these items carefully. Your understanding of them will help clarify how product costs flow through the accounts and where product costs appear in the financial statements. The following discussion provides further clarification.

Question: What is the difference between raw materials inventory, work-in-process inventory, and finished goods inventory?

Answer: Each of these accounts is used to record product costs depending on where the product is in the production process, and each account is an asset account on the balance sheet.

The raw materials inventoryAn account used to record the cost of materials not yet put into production. account records the cost of materials not yet put into production. For Custom Furniture Company, this account includes items such as wood, brackets, screws, nails, glue, lacquer, and sandpaper.

The work-in-process (WIP) inventoryAn account used to record costs associated with products in the production process that are not yet complete. account records the costs of products that have not yet been completed. Suppose Custom Furniture Company has eight tables that are still in production at the end of the year. All manufacturing costs associated with these incomplete eight tables—direct materials, direct labor, and manufacturing overhead—are included in the WIP inventory account.

Once goods in WIP inventory are completed, they are transferred into finished goods inventory. The cost of completed goods that are transferred out of WIP inventory into finished goods inventory is called the cost of goods manufacturedThe cost of completed goods transferred from work-in-process inventory into finished goods inventory..

The finished goods inventoryAn account used to record the manufacturing costs associated with products that are completed and ready to sell. account records the manufacturing costs of products that are completed and ready to sell. Suppose Custom Furniture Company has five completed tables at the end of the year (in addition to the eight partially completed tables in work-in-process inventory). The manufacturing costs of these five tables—direct materials, direct labor, and manufacturing overhead—are included in the finished goods inventory account until the tables are sold. (For the purposes of this example, assume the tables are “sold” when delivered to the customer.)

Question: The costs of materials not yet put into production are included in raw materials inventory. The costs associated with products that are not yet complete are included in WIP inventory. And the costs associated with products that are completed and ready to sell are included in finished goods inventory. What happens to the product costs in finished goods inventory when the products are sold?

Answer: When completed goods are sold, their costs are transferred out of finished goods inventory into the cost of goods soldAn expense account on the income statement that represents the product costs for all goods sold during the period. account. Cost of goods sold is an expense account on the income statement that represents the product costs of all goods sold during the period.

For example, suppose Custom Furniture Company sells one table that cost $3,000 to produce (i.e., direct materials, direct labor, and manufacturing overhead costs incurred to produce the table total $3,000). The $3,000 cost is in finished goods inventory until the entry is made to record the sale, at which time finished goods inventory is reduced by $3,000 (the table is no longer in inventory) and cost of goods sold is increased by $3,000.

Table 1.4 Accounts Used to Record Product Costs

| Account Name | Description | Financial Statement |

|---|---|---|

| Raw materials inventory | Cost of unused production materials | Balance sheet (asset) |

| Work-in-process inventory | Cost of incomplete products | Balance sheet (asset) |

| Finished goods inventory | Cost of completed products not yet sold | Balance sheet (asset) |

| Cost of goods sold | Cost of products sold | Income statement (expense) |

Figure 1.6 Flow of Product Costs through Balance Sheet and Income Statement Accounts

Source: Photo courtesy of Matthew Rutledge, http://www.flickr.com/photos/rutlo/4252743250//.

Presentation of Product Costs at Advanced Micro Devices

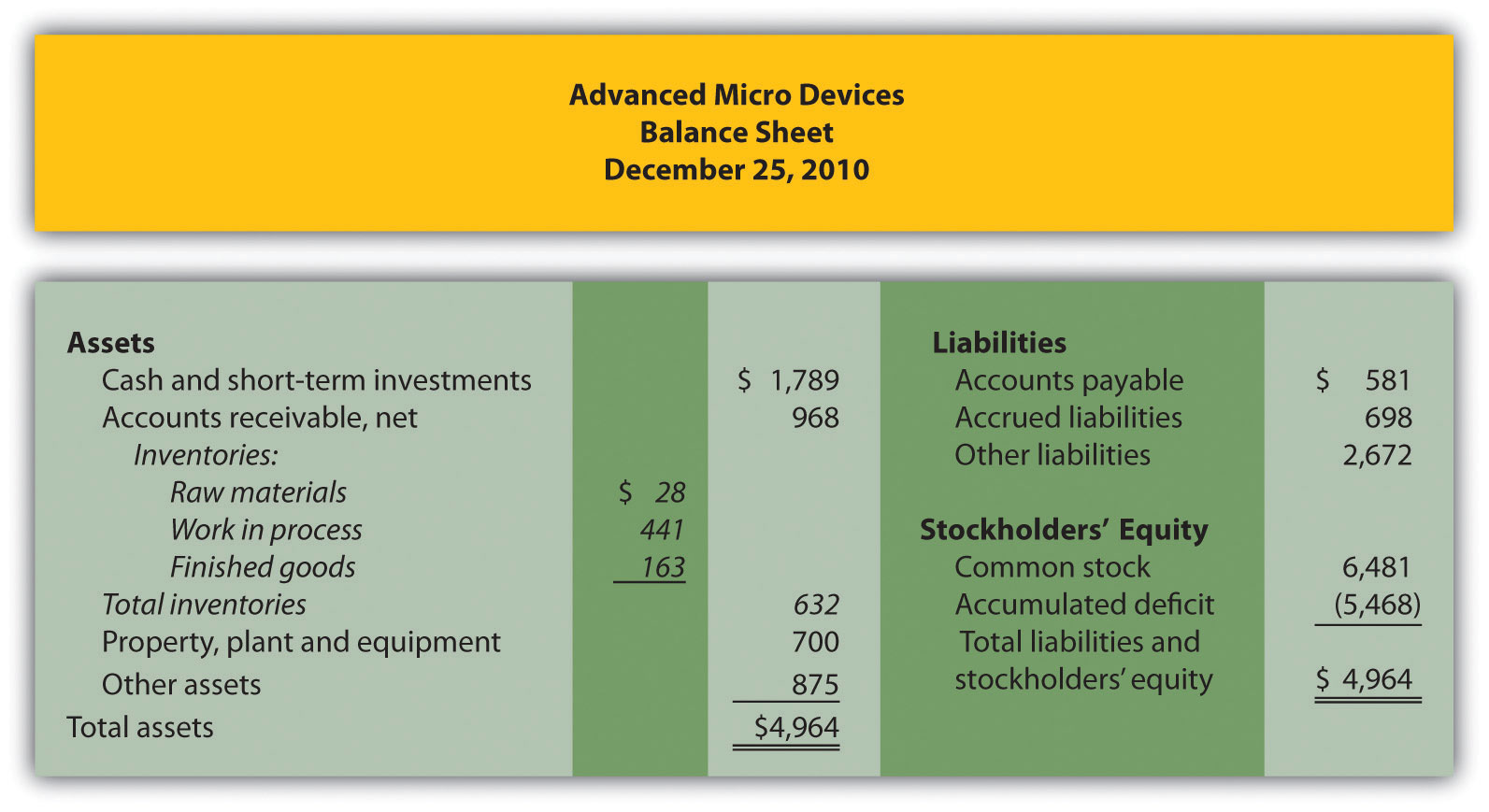

Advanced Micro Devices (AMD), a producer of microprocessors and flash memory devices for personal and networked computers, has annual revenues of $6,500,000,000. A summarized version of AMD’s balance sheet appears as follows (all amounts are in millions). Notice that three inventory accounts, totaling $632,000,000, support the total inventory amount that appears in the asset section of the balance sheet. The raw materials inventory account ($28,000,000) is used to record the cost of materials not yet put into production. The work-in-process inventory account ($441,000,000) is used to record costs associated with microprocessors and flash memory devices in the production process that are not yet complete. The finished goods inventory account ($163,000,000) is used to record the product costs associated with AMD’s products that are completed and ready to sell.

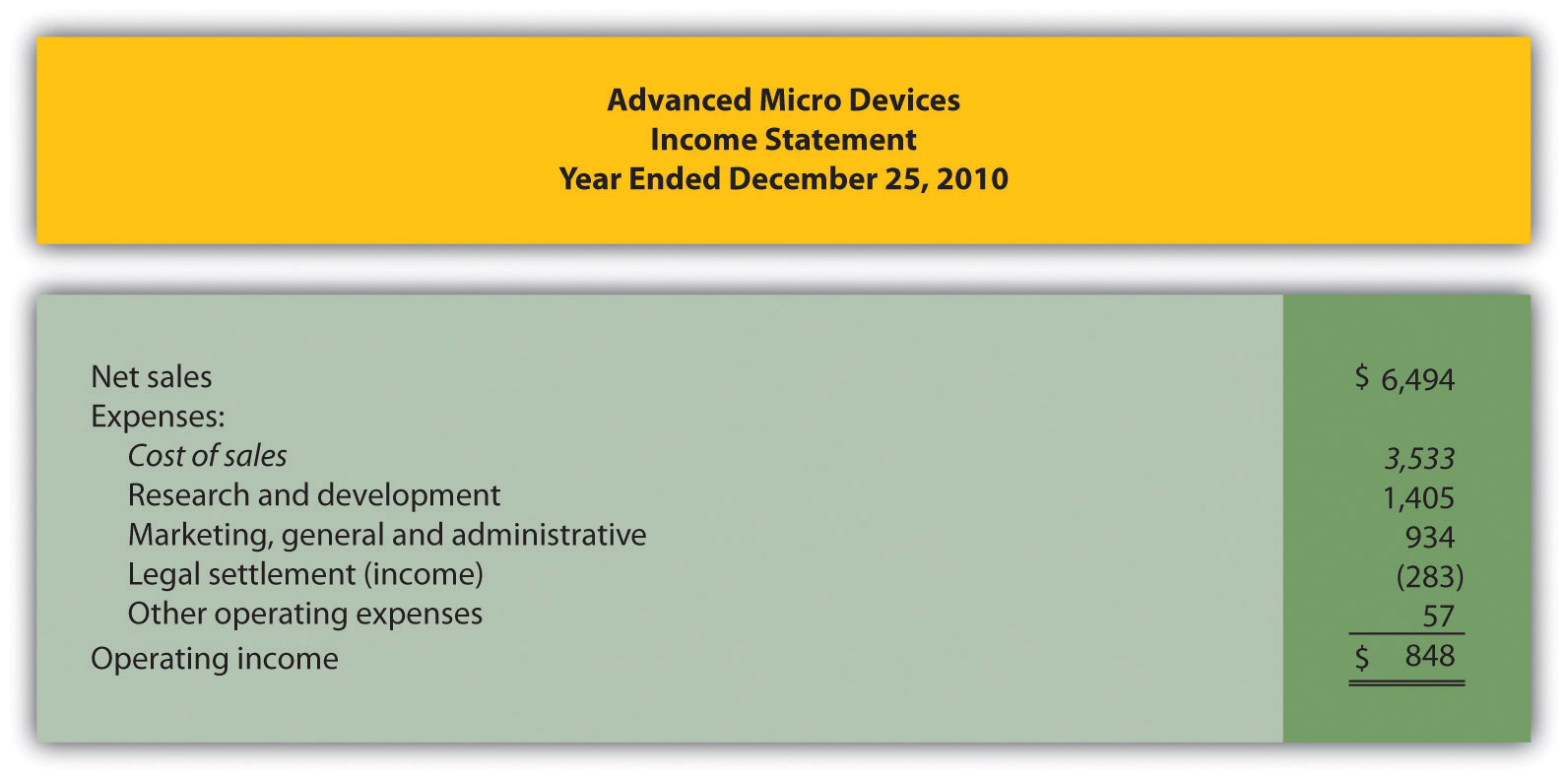

When AMD sells finished goods, the cost of these goods is transferred out of finished goods inventory into the cost of goods sold account, which this company calls cost of sales, as many companies do. The operating portion of AMD’s income statement follows—again, all amounts are in millions. Notice that cost of sales appears below net sales and above all other operating expenses.

Source: Advanced Micro Devices, “Advanced Micro Devices 2010 Annual Report,” http://www.amd.com.

Match each of the following accounts with the appropriate description that follows.

Solutions to Review Problem 1.7

| Raw materials inventory | 4. Used to record cost of materials not yet put into production. |

| Work-in-process inventory | 3. Used to record product costs associated with incomplete goods in the production process. |

| Finished goods inventory | 1. Used to record product costs associated with goods that are completed and ready to sell. |

| Cost of goods sold | 2. Used to record product costs associated with goods that are sold. |