Question: We have discussed how to assign direct material and direct labor costs to jobs using a materials requisition form, timesheet, and job cost sheet. The third manufacturing cost—manufacturing overhead—requires a little more work. How do companies assign manufacturing overhead costs, such as factory rent and factory utilities, to individual jobs?

Answer: Recall from Chapter 1 "What Is Managerial Accounting?" that manufacturing overhead consists of all costs related to the production process other than direct materials and direct labor. Because manufacturing overhead costs are difficult to trace to specific jobs, the amount allocated to each job is based on an estimate. The process of creating this estimate requires the calculation of a predetermined rate.

The goal is to allocate manufacturing overhead costs to jobs based on some common activity, such as direct labor hours, machine hours, or direct labor costs. The activity used to allocate manufacturing overhead costs to jobs is called an allocation baseThe activity used to allocate manufacturing overhead costs to jobs.. Once the allocation base is selected, a predetermined overhead rate can be established. The predetermined overhead rateA rate established prior to the year in which it is used in allocating manufacturing overhead costs to jobs. is calculated prior to the year in which it is used in allocating manufacturing overhead costs to jobs.

Question: How is the predetermined overhead rate calculated?

Answer: We calculate the predetermined overhead rate as follows, using estimates for the coming year:

*The numerator requires an estimate of all overhead costs for the year, such as indirect materials, indirect labor, and other indirect costs associated with the factory. Custom Furniture Company estimates annual overhead costs to be $1,140,000 based on actual overhead costs last year.

**The denominator requires an estimate of activity in the allocation base for the year. Custom Furniture uses direct labor hours as the allocation base and expects its direct labor workforce to record 38,000 direct labor hours for the year.

The predetermined overhead rate calculation for Custom Furniture is as follows:

Thus each job will be assigned $30 in overhead costs for every direct labor hour charged to the job. The assignment of overhead costs to jobs based on a predetermined overhead rate is called overhead appliedThe assignment of overhead costs to jobs based on a predetermined overhead rate.. Remember that overhead applied does not represent actual overhead costs incurred by the job—nor does it represent direct labor or direct material costs. Instead, overhead applied represents a portion of estimated overhead costs that is assigned to a particular job.

Question: Now that we know how to calculate the predetermined overhead rate, the next step is to use this rate to apply overhead to jobs. How do companies use the predetermined overhead rate to apply overhead to jobs, and how is this information recorded in the general journal?

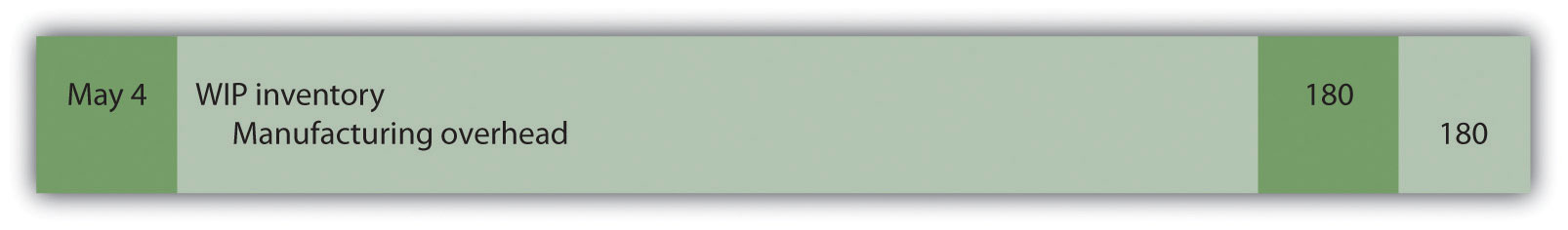

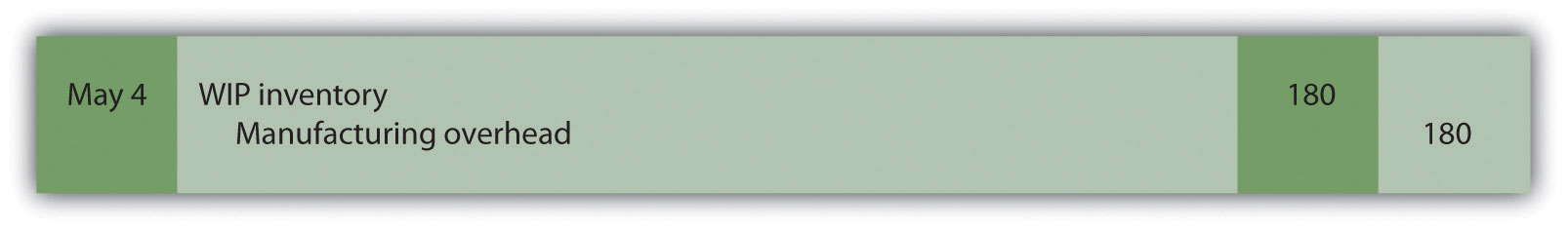

Answer: As shown on the timesheet in Figure 2.4 "Timesheet for Custom Furniture Company", Tim Wallace charged six hours to job 50. Because manufacturing overhead is applied at a rate of $30 per direct labor hour, $180 (= $30 × 6 hours) in overhead is applied to job 50. The journal entry to reflect this is as follows:

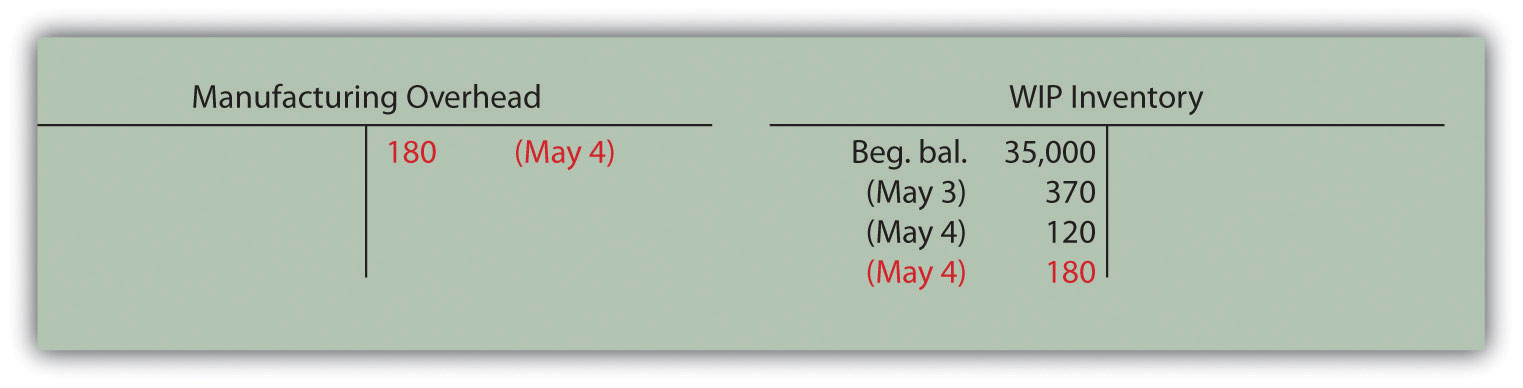

Recording the application of overhead costs to a job is further illustrated in the T-accounts that follow.

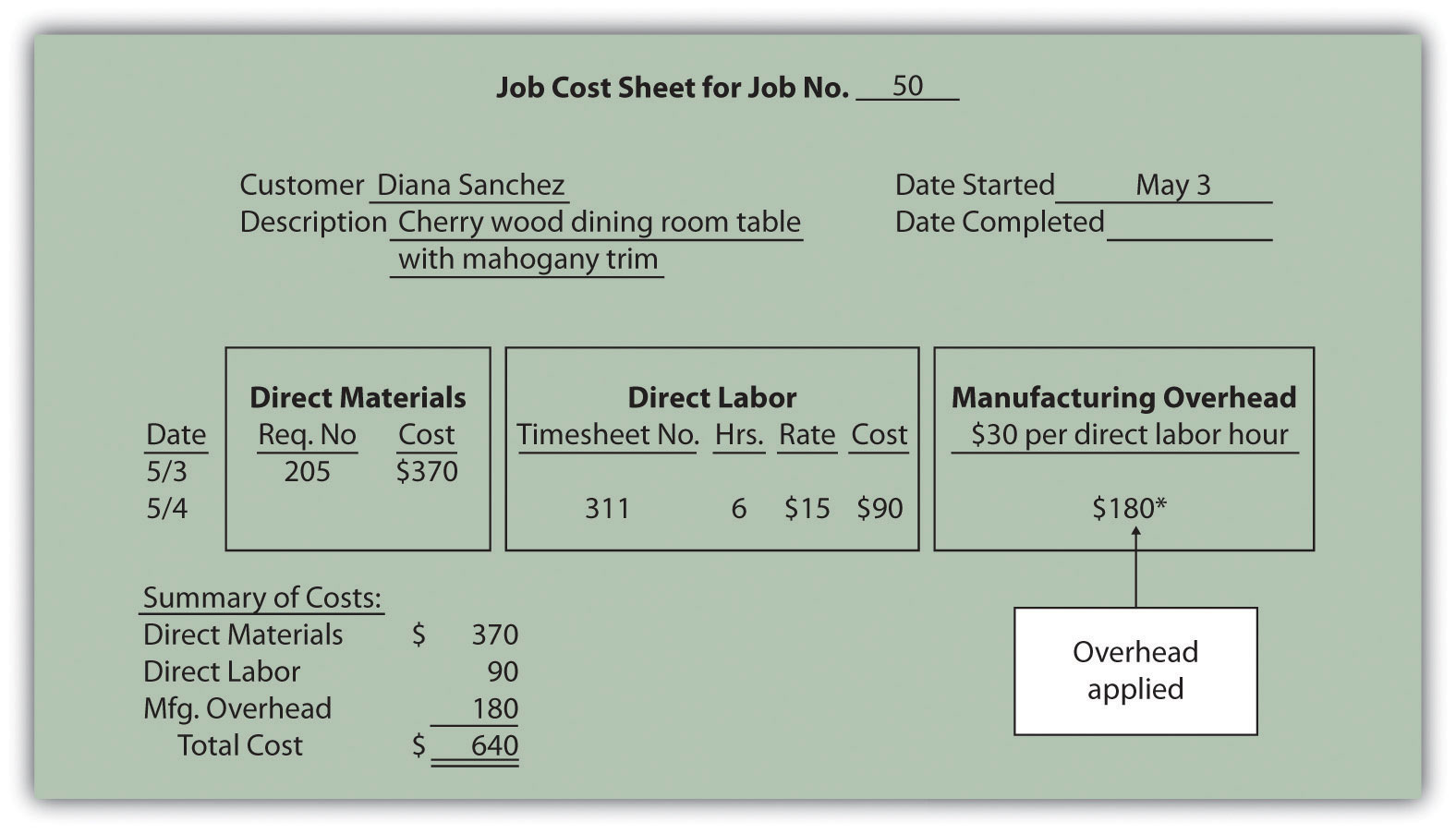

When this journal entry is recorded, we also record overhead applied on the appropriate job cost sheet, just as we did with direct materials and direct labor. Figure 2.6 "Overhead Applied for Custom Furniture Company’s Job 50" shows the manufacturing overhead applied based on the six hours worked by Tim Wallace. Notice that total manufacturing costs as of May 4 for job 50 are summarized at the bottom of the job cost sheet.

Figure 2.6 Overhead Applied for Custom Furniture Company’s Job 50

*$180 = $30 per direct labor hour × 6 direct labor hours.

Question: Although we used direct labor hours as the allocation base for Custom Furniture Company’s predetermined overhead rate, organizations use various other types of allocation bases. The most common allocation bases are direct labor hours, direct labor costs, and machine hours. What factors do companies consider when deciding on an allocation base?

Answer: Companies typically look at the following two items when determining which allocation base to use:

Link to overhead costs. The goal is to find an allocation base that drives overhead costs, often called a cost driverThe allocation base that drives overhead costs.. For example, if a company’s production process is labor intensive (i.e., it requires a large labor force), overhead costs are likely driven by direct labor hours or direct labor costs. The more direct labor hours worked, the higher the overhead costs incurred. Thus direct labor hours or direct labor costs would be used as the allocation base.

If a company’s production process is highly mechanized (i.e., it relies on machinery more than on labor), overhead costs are likely driven by machine hours. The more machine hours used, the higher the overhead costs incurred. Thus machine hours would be used as the allocation base.

It may make more sense to use several allocation bases and several overhead rates to allocate overhead to jobs. This approach, called activity-based costing, is discussed in depth in Chapter 3 "How Does an Organization Use Activity-Based Costing to Allocate Overhead Costs?".

Question: The use of a predetermined overhead rate rather than actual data to apply overhead to jobs is called normal costingA method of costing that uses a predetermined overhead rate to apply overhead to jobs.. Most companies prefer normal costing over assigning actual overhead costs to jobs. Why do most companies prefer to use normal costing?

Answer: Companies use normal costing for several reasons:

Question: Using a predetermined overhead rate to apply overhead costs to jobs requires the use of a manufacturing overhead account. How is the manufacturing overhead account used to record transactions?

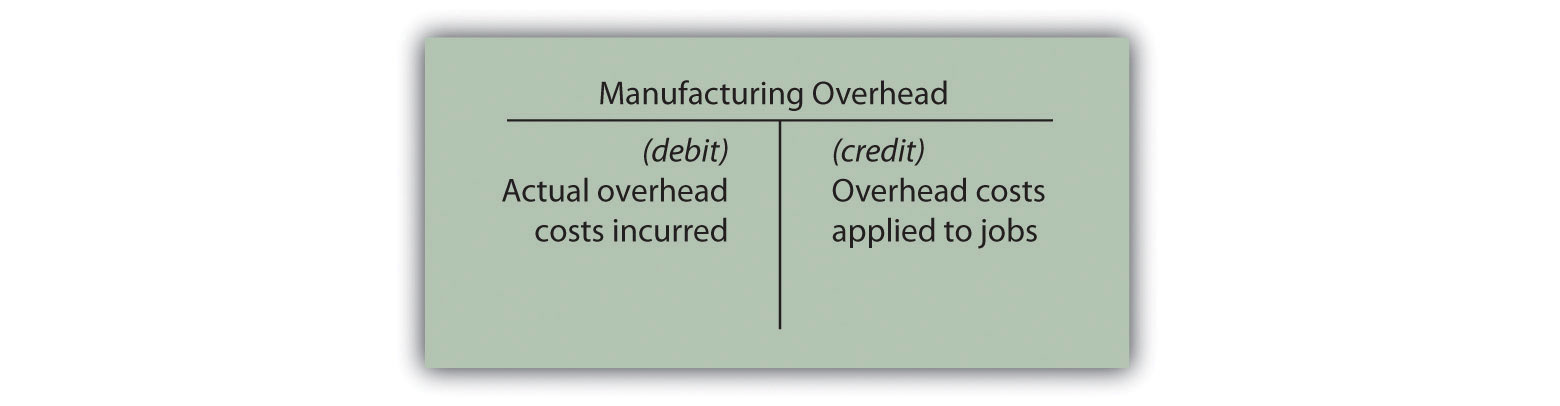

Answer: The manufacturing overhead account tracks the following two pieces of information:

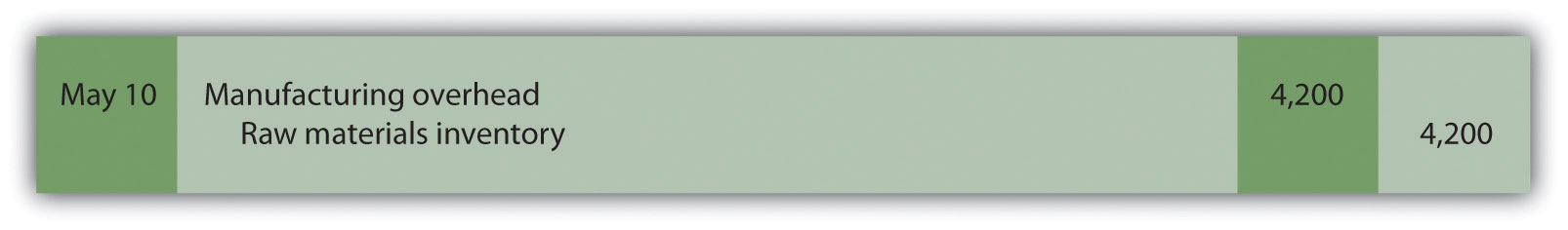

First, the manufacturing overhead account tracks actual overhead costs incurred. Recall that manufacturing overhead costs include all production costs other than direct labor and direct materials. The actual manufacturing overhead costs incurred in a period are recorded as debits in the manufacturing overhead account. For example, assume Custom Furniture Company places $4,200 in indirect materials into production on May 10. The journal entry to reflect this is as follows:

Other examples of actual manufacturing overhead costs include factory utilities, machine maintenance, and factory supervisor salaries. All these costs are recorded as debits in the manufacturing overhead account when incurred.

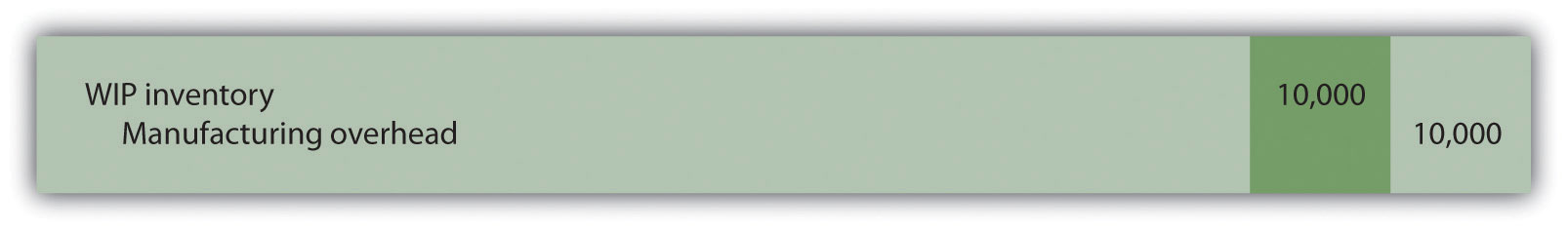

Second, the manufacturing overhead account tracks overhead costs applied to jobs. The overhead costs applied to jobs using a predetermined overhead rate are recorded as credits in the manufacturing overhead account. You saw an example of this earlier when $180 in overhead was applied to job 50 for Custom Furniture Company. We repeat the entry here.

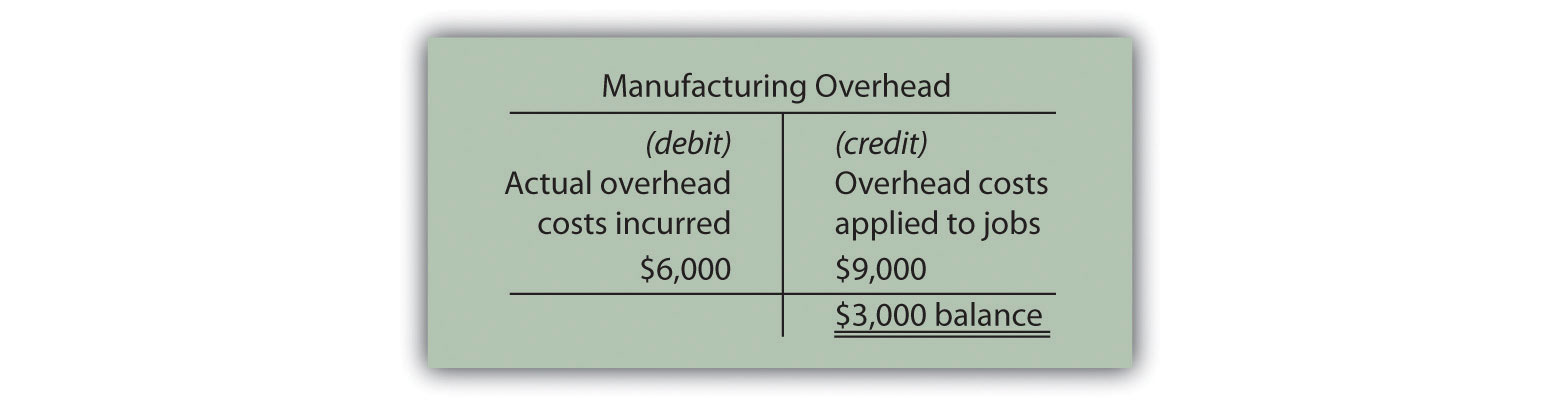

The following T-account summarizes how overhead costs flow through the manufacturing overhead account:

The manufacturing overhead account is classified as a clearing accountAn account used to hold financial data temporarily until it is closed out at the end of the period.. A clearing account is used to hold financial data temporarily and is closed out at the end of the period before preparing financial statements.

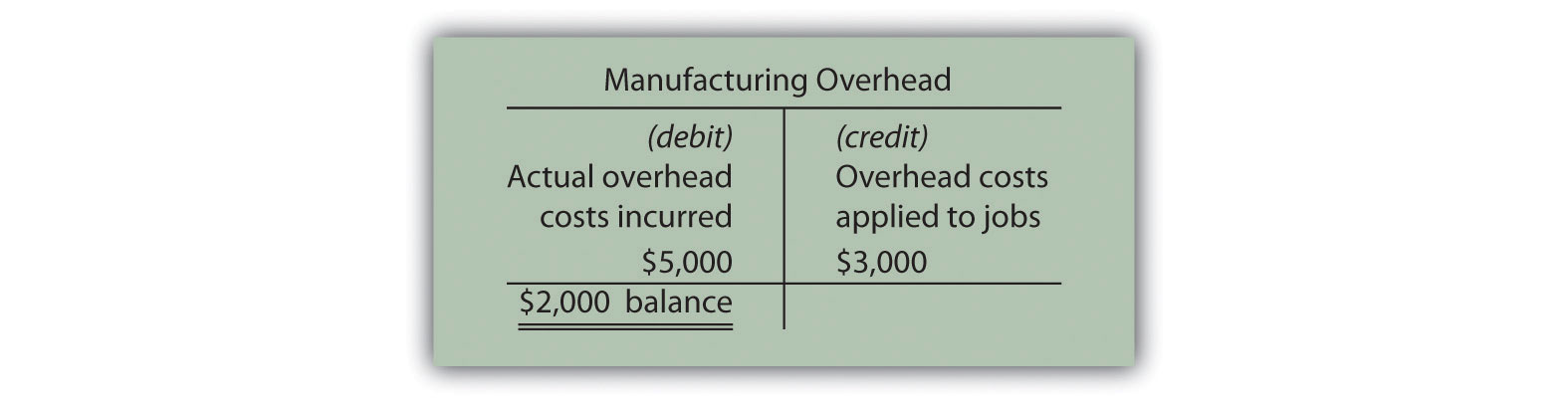

Question: Because manufacturing overhead costs are applied to jobs based on an estimated predetermined overhead rate, overhead applied (credit side of manufacturing overhead) rarely equals actual overhead costs incurred (debit side of manufacturing overhead). What terms are used to describe the difference between actual overhead costs incurred during a period and overhead applied during a period?

Answer: Two terms are used to describe this difference—underapplied overhead and overapplied overhead.

Underapplied overheadOverhead costs applied to jobs that are less than actual overhead costs. occurs when actual overhead costs (debits) are higher than overhead applied to jobs (credits). The T-account that follows provides an example of underapplied overhead. Note that the manufacturing overhead account has a debit balance when overhead is underapplied because fewer costs were applied to jobs than were actually incurred.

Overapplied overheadOverhead costs applied to jobs that exceed actual overhead costs. occurs when actual overhead costs (debits) are lower than overhead applied to jobs (credits). The T-account that follows provides an example of overapplied overhead. Note that the manufacturing overhead account has a credit balance when overhead is overapplied because more costs were applied to jobs than were actually incurred.

Source: Photo courtesy of prayitno, http://www.flickr.com/photos/34128007@N04/5293183651/.

Job Costing at Boeing

Boeing Company is the world’s leading aerospace company and the largest manufacturer of commercial jetliners and military aircraft combined. Boeing provides products and services to customers in 150 countries and employs 165,000 people throughout the world.

Since most of Boeing’s products are unique and costly, the company likely uses job costing to track costs associated with each product it manufactures. For example, the costly direct materials that go into each jetliner produced are tracked using a job cost sheet. Direct labor and manufacturing overhead costs (think huge production facilities!) are also assigned to each jetliner. This careful tracking of production costs for each jetliner provides management with important cost information that is used to assess production efficiency and profitability. Management can answer questions, such as “How much did direct materials cost?,” “How much overhead was allocated to each jetliner?,” or “What was the total production cost for each jetliner?” This is important information when it comes time to negotiate the sales price of a jetliner with a potential buyer like United Airlines or Southwest Airlines.

Source: Boeing, “Home Page,” http://www.boeing.com.

Question: Since the manufacturing overhead account is a clearing account, it must be closed at the end of the period. How do we close the manufacturing overhead account?

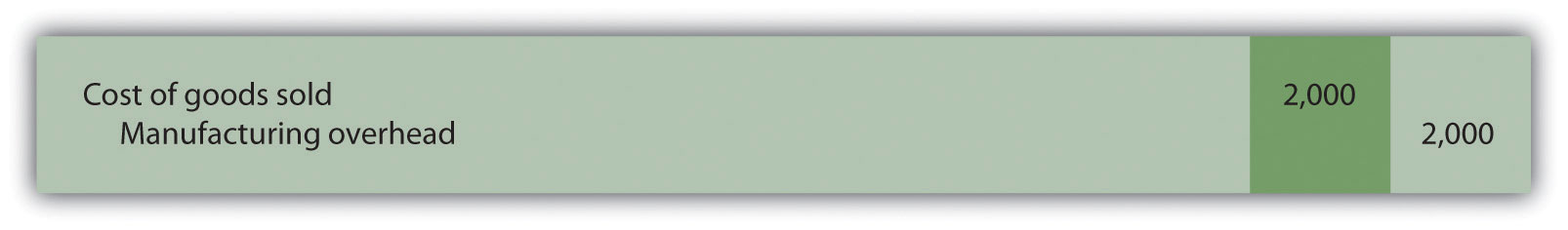

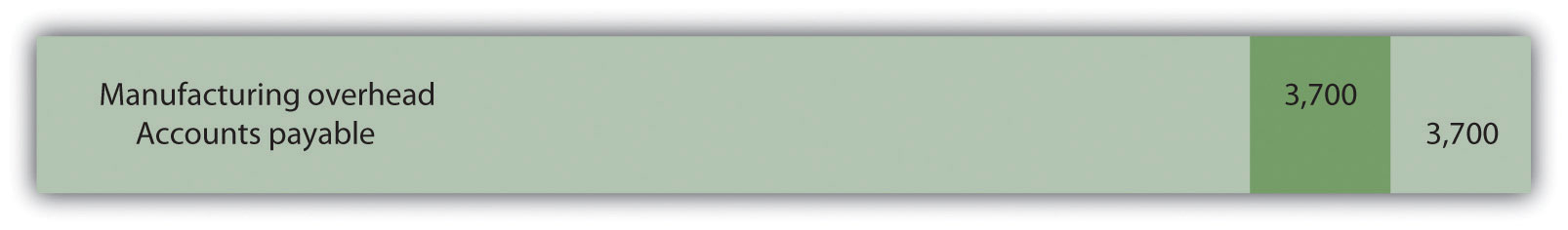

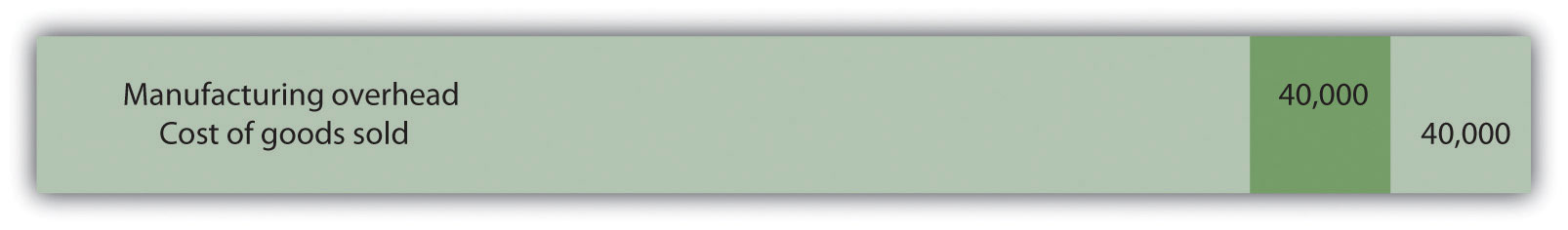

Answer: Most companies simply close the manufacturing overhead account balance to the cost of goods sold account. For example, if there is a $2,000 debit balance in manufacturing overhead at the end of the period, the journal entry to close the underapplied overhead is as follows:

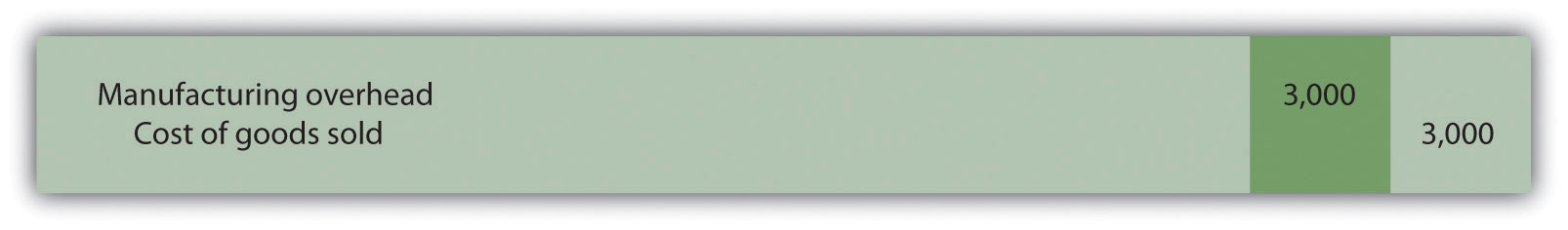

If manufacturing overhead has a $3,000 credit balance at the end of the period, the journal entry to close the overapplied overhead is as follows:

Question: Although most companies close the manufacturing overhead account to cost of goods sold, this is typically only done when the amount is immaterial (immaterial is a common accounting term used to describe an amount that is small relative to a company’s size). The term material describes a relatively large amount. How do we close the manufacturing overhead account when the amount is material?

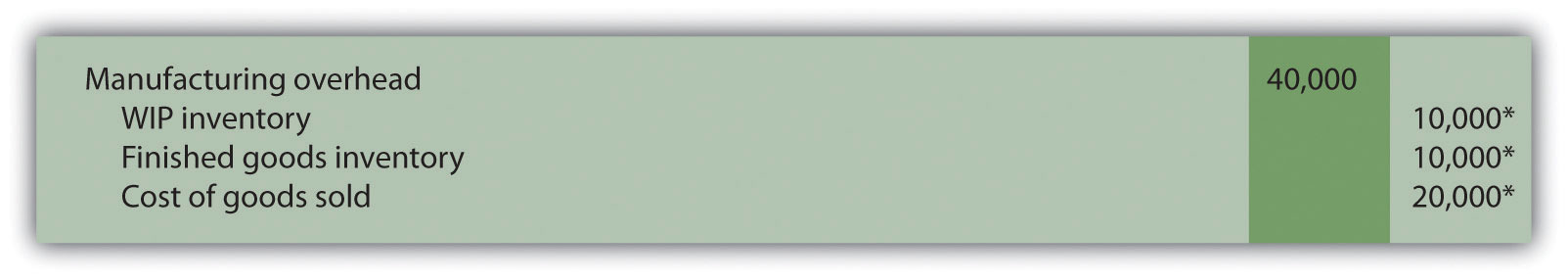

Answer: If the amount is material, it should be closed to three different accounts—work-in-process (WIP) inventory, finished goods inventory, and cost of goods sold—in proportion to the account balances in these accounts.

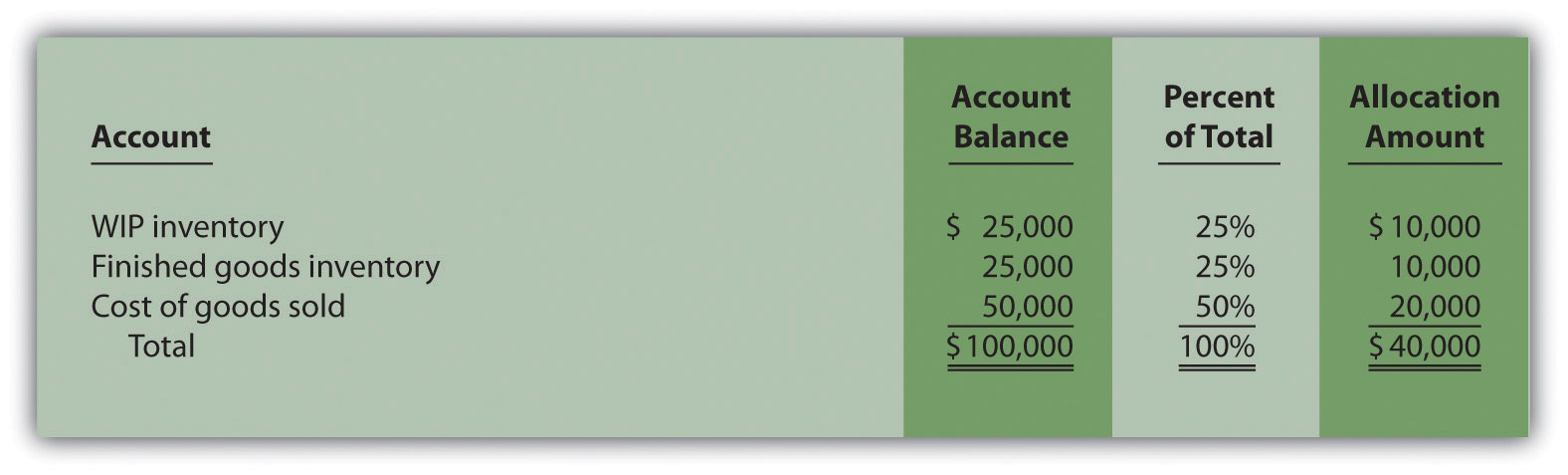

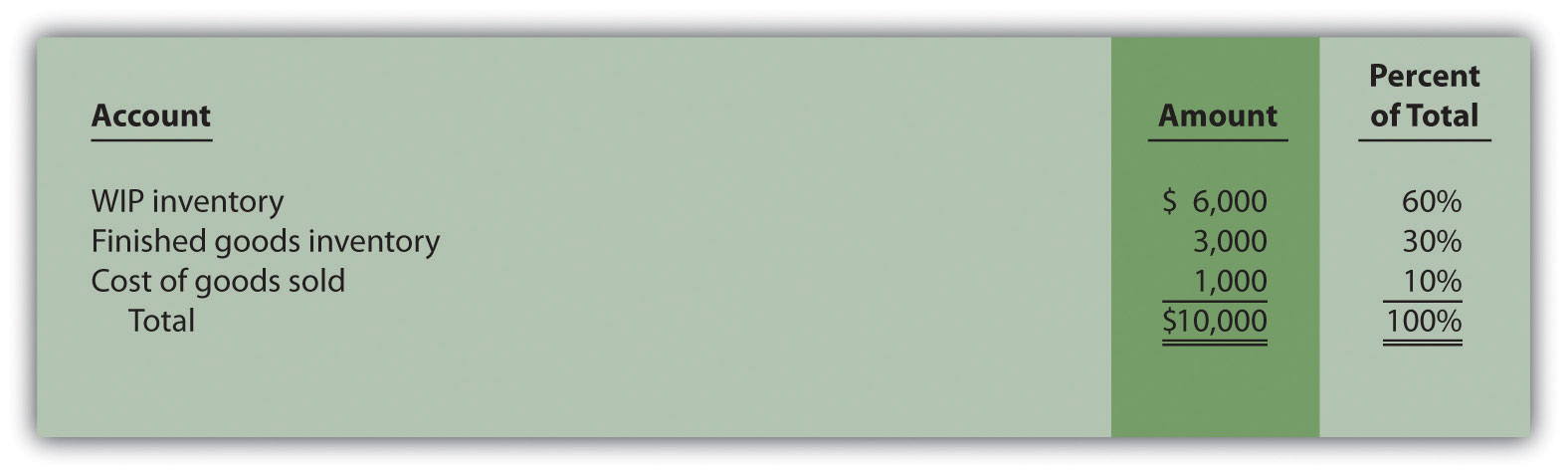

For example, suppose a company has $2,000 in underapplied overhead (debit balance in manufacturing overhead) and that the three account balances are as follows:

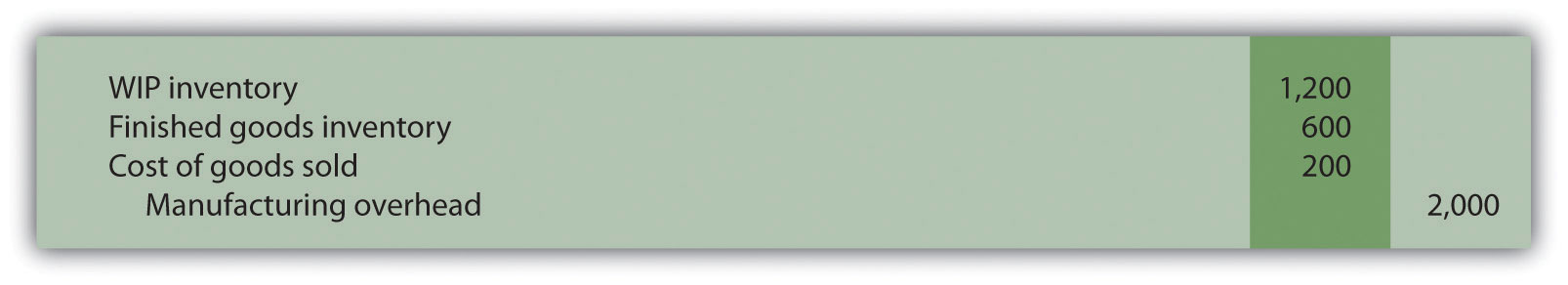

The $2,000 is closed to each of the three accounts based on their respective percentages. Thus $1,200 is apportioned to WIP inventory (= $2,000 × 60 percent), $600 goes to finished goods inventory (= $2,000 × 30 percent), and $200 goes to cost of goods sold (= $2,000 × 10 percent). The journal entry to close the $2,000 underapplied overhead debit balance in manufacturing overhead is as follows:

Although this approach is not as common as simply closing the manufacturing overhead account balance to cost of goods sold, companies do this when the amount is relatively significant.

Most companies use a normal costing system to track product costs. Normal costing tracks actual direct material costs and actual direct labor costs for each job and charges manufacturing overhead to jobs using a predetermined overhead rate. The predetermined overhead rate is calculated as follows:

Assume Chan Company incurs actual manufacturing overhead costs of $470,000 and applies overhead of $510,000 for the year. Account balances are as follows: WIP inventory, $25,000; finished goods inventory, $25,000; and cost of goods sold, $50,000.

Solutions to Review Problem 2.3

The predetermined overhead rate is calculated as follows:

If Chan’s production process is highly mechanized, overhead costs are likely driven by machine use. The more machine hours used, the higher the overhead costs incurred. Thus there is a link between machine hours and overhead costs, and using machine hours as an allocation base is preferable.

Machine hours are also easily tracked, making implementation relatively simple.

A total of $10,000 (= $5 per machine hour rate × 2,000 machine hours) will be applied to job 153 and recorded in the journal as follows:

This amount will also be recorded on the job cost sheet for Job 153.

*Amounts are calculated as follows. Allocation amount = percent of total × the overapplied balance of $40,000.