Question: The goal of this section is to pull it all together for Custom Furniture Company. We begin by looking at revenue and cost information for May, including manufacturing and nonmanufacturing costs. Why is it important for companies like Custom Furniture Company to correctly classify and record costs such as direct materials (e.g., wood used for each table), salaries of administrative personnel, and rent on the factory?

Answer: Companies must be able to evaluate the profitability of each job and on a broader scale, evaluate the overall profitability of the company. This requires that all manufacturing and nonmanufacturing costs be classified and recorded correctly in the general journal. The following information shows how to accomplish this with transactions for the month of May at Custom Furniture Company.

Question: How are the typical transactions for a manufacturing company recorded in the general journal?

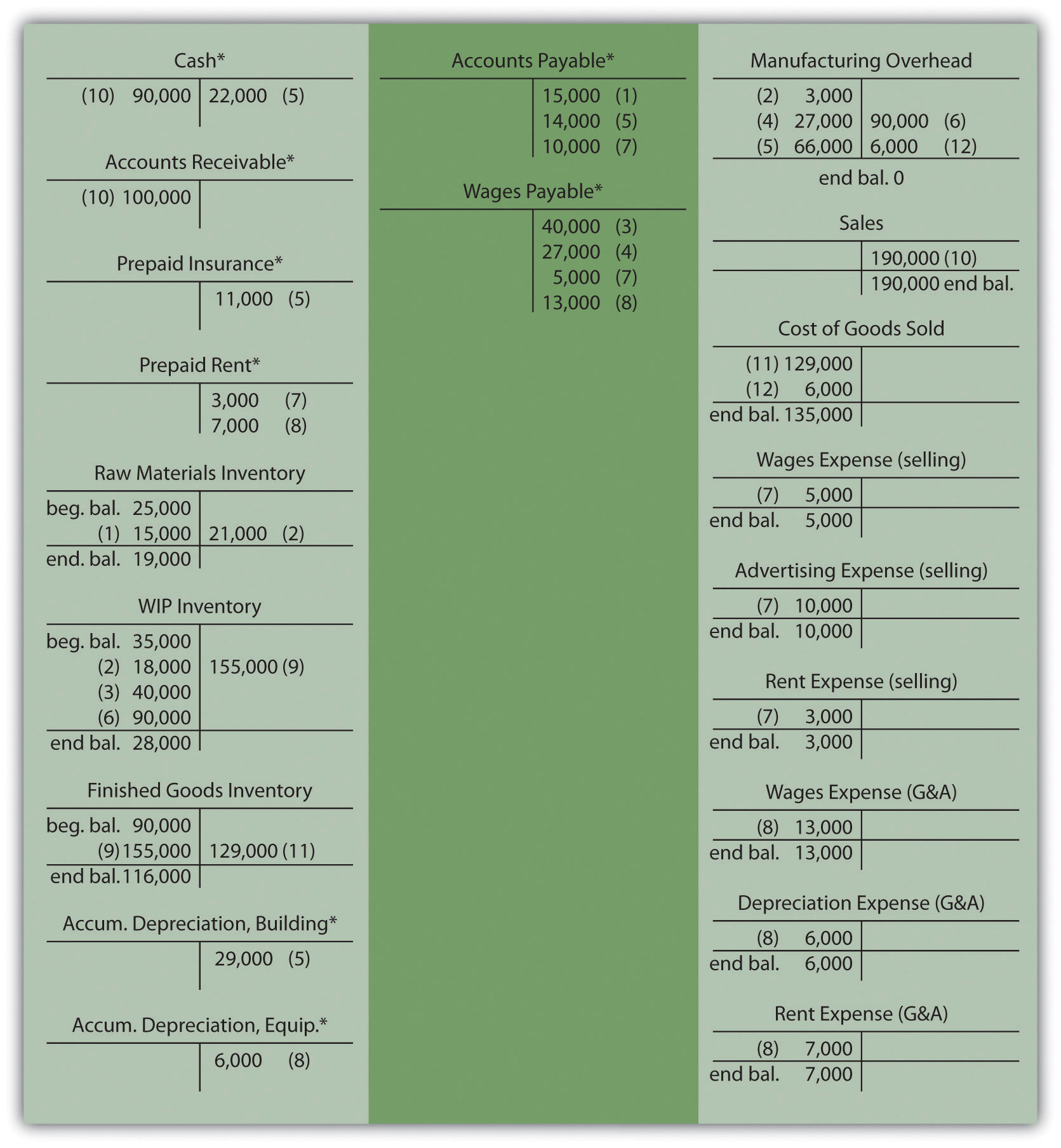

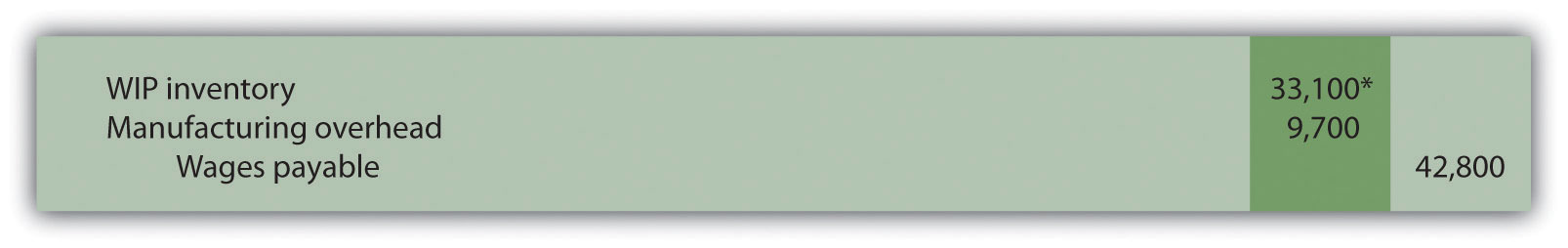

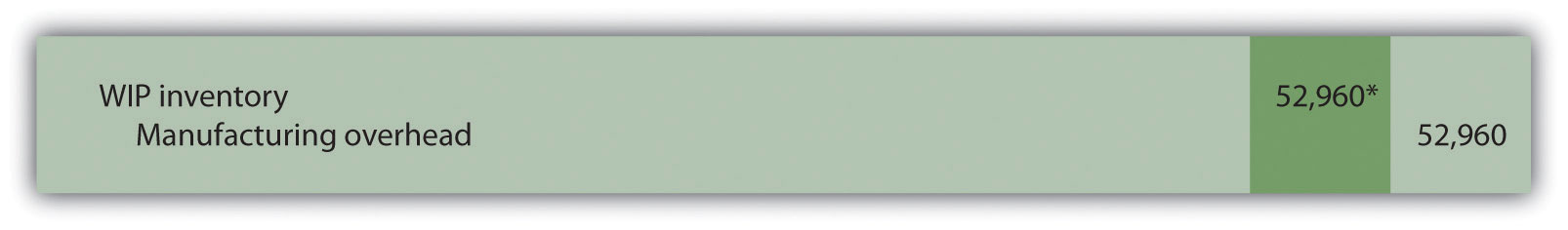

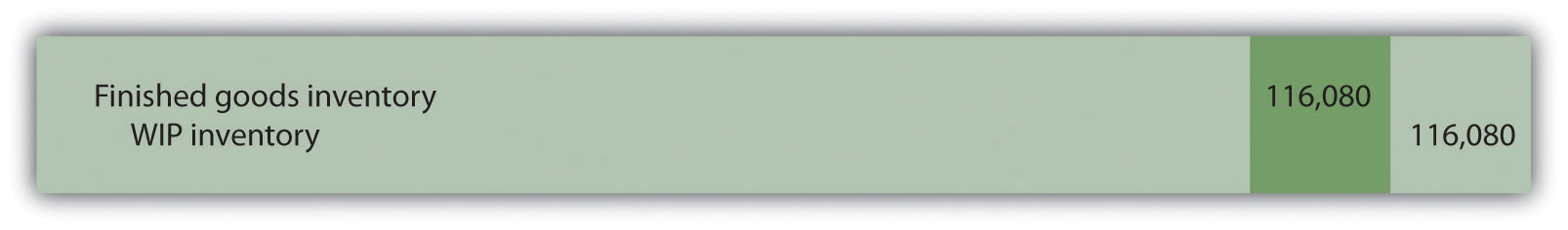

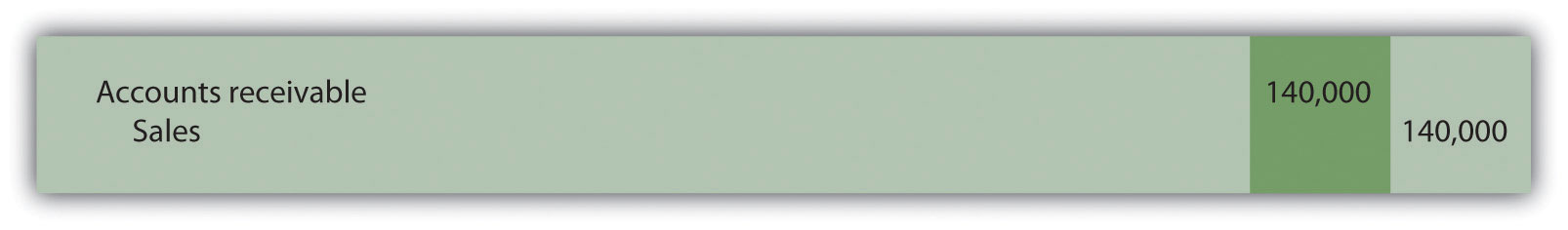

Answer: Figure 2.7 "Custom Furniture Company’s Journal Entries for May" shows Custom Furniture Company’s journal entries for May. Figure 2.8 "Custom Furniture Company’s T-Accounts" presents the same information in T-account format. (Note that each entry shows the total dollar amount for the month rather than individual transaction amounts.) If you understand how to make an entry summarized in total, you know how to make each individual (perhaps daily) entry. Beginning balances for raw materials inventory ($25,000), work-in-process inventory ($35,000), and finished goods inventory ($90,000) are shown in the T-accounts in Figure 2.8 "Custom Furniture Company’s T-Accounts". Although it is not necessary to refer back to Chapter 1 "What Is Managerial Accounting?" at this point, we should note that the beginning balance and transaction amounts used here for these three inventory accounts tie back to the three schedules presented in Chapter 1 "What Is Managerial Accounting?" (schedule of raw materials placed in production, schedule of cost of goods manufactured, and schedule of cost of goods sold).

Figure 2.7 Custom Furniture Company’s Journal Entries for May

*All debit amounts to work-in-process inventory are also recorded on the appropriate job cost sheets.

Figure 2.8 Custom Furniture Company’s T-Accounts

*Beginning and ending balances are only provided for inventory accounts since the focus of this chapter is on manufacturing costs that flow through the inventory accounts.

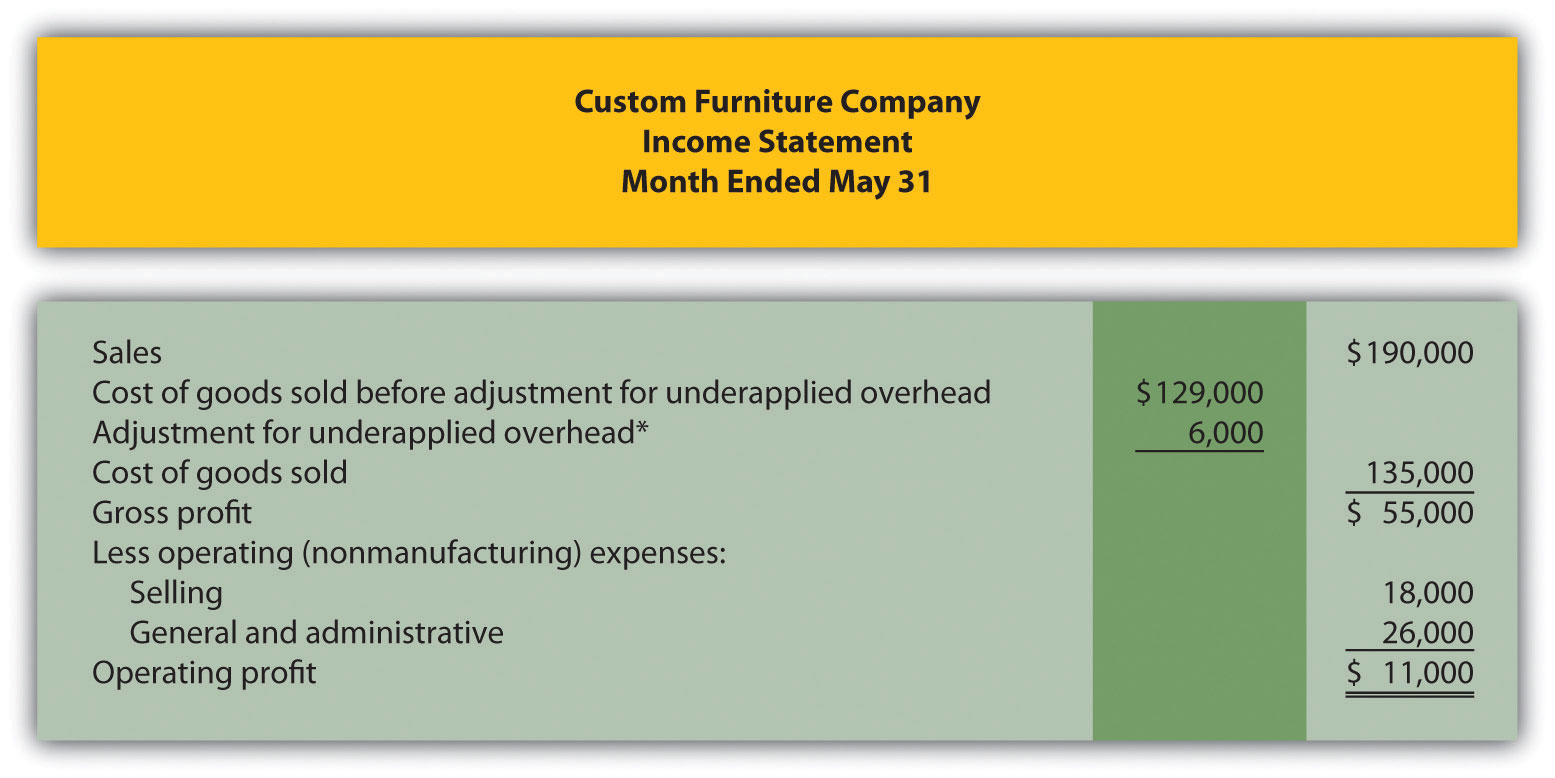

Question: Now that the information for the month of May has been recorded for Custom Furniture Company, we need to summarize this information to evaluate the profitability of the company and the profitability of jobs. How profitable was Custom Furniture for the month of May?

Answer: Custom Furniture Company’s income statement for the month of May, shown in Figure 2.9 "Custom Furniture Company’s Income Statement", indicates the company had operating profit of $11,000. This information comes directly from the T-accounts shown in Figure 2.8 "Custom Furniture Company’s T-Accounts".

Figure 2.9 Custom Furniture Company’s Income Statement

*See entry 12 in Figure 2.7 "Custom Furniture Company’s Journal Entries for May" and Figure 2.8 "Custom Furniture Company’s T-Accounts" for this adjustment. This represents the amount of overhead underapplied to jobs and closed out to cost of goods sold at the end of May. An alternative presentation is to simply show the cost of goods sold amount of $135,000 directly under sales.

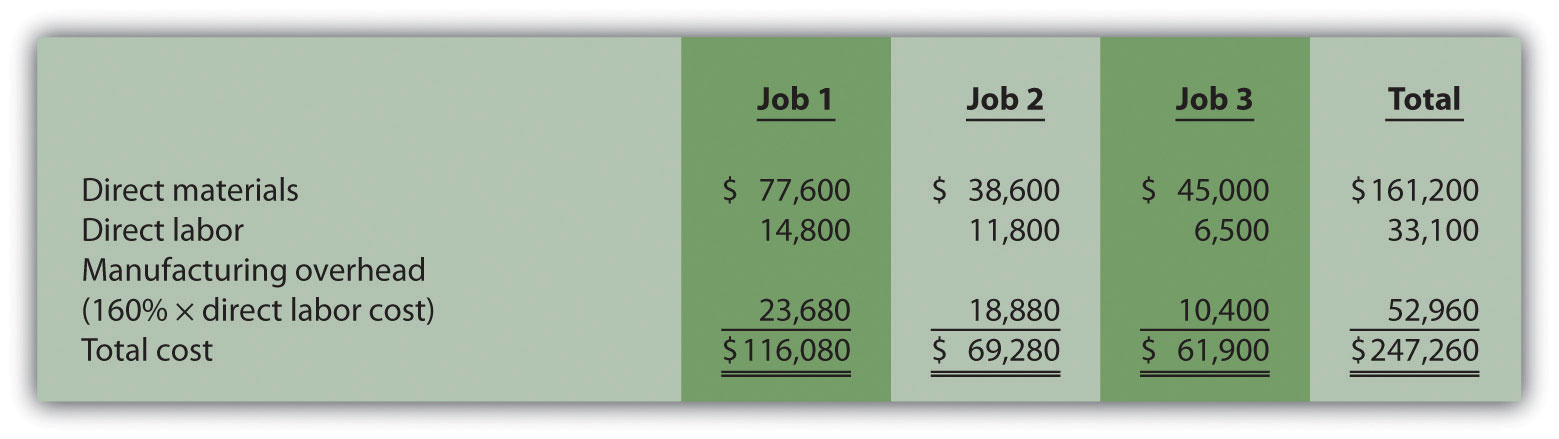

Recall from the beginning of the chapter that Dan Stevens, the owner of Custom Furniture Company, is concerned about the company’s profitability. Although Dan prices his furniture at 70 percent above estimated production costs, the company had only $11,000 in profits for the month of May, as shown in Figure 2.9 "Custom Furniture Company’s Income Statement". Dan asked Leslie (the accountant) to look into the accuracy of his estimates by reviewing actual production costs for the three costliest tables produced in May. As you read Leslie’s comments, be sure to look at the income statement in Figure 2.9 "Custom Furniture Company’s Income Statement" and the job cost estimates and actual results in Figure 2.10 "Job Cost Estimates Versus Actual Results for Custom Furniture Company".

Figure 2.10 Job Cost Estimates Versus Actual Results for Custom Furniture Company

a Product costs are from the job cost sheet, and the sales price is based on the original bid.

b Based on 70 percent markup of estimated total production costs. For example, job 40’s sales price of $18,360 = $10,800 × 170 percent.

c Equals gross profit divided by total production costs. Company target is 70 percent.

d Rounded.

| Leslie: | Dan, I have the production cost information you requested. |

| Dan: | Great! What did you find out? |

| Leslie: | Well, first I looked at the income statement for May. If you establish prices based on a 70 percent markup of production costs, then sales revenue should be 170 percent of cost of goods sold, and the resulting gross profit should be 70 percent of cost of goods sold. |

| Dan: | Sounds reasonable. Are we anywhere near these numbers? |

| Leslie: | Not really. Cost of goods sold for May total $135,000, so sales should be closer to $229,500 (that would be $135,000 times 170 percent), and gross profit should be closer to $94,500, which is $135,000 times 70 percent. As you can see on the income statement, we didn’t get very close to these numbers. |

| Dan: | Do you have any idea why? |

| Leslie: | I pulled together production cost information from our job costing system for the three highest-cost tables produced in May as you requested. |

| Dan: | And? |

| Leslie: | I compared the job cost sheet information for each item with your original estimates, and here’s what I found. It looks as if the problem is with direct materials. All three jobs show that direct material costs were significantly higher than you estimated. Direct labor and manufacturing overhead costs were pretty close. |

| Dan: | Wow, I’m surprised that direct material costs were so high. I’ll have to check into this further. I do recall wood costs increasing over the last couple of months, but not to this extent. |

| Leslie: | There are lots of potential causes for the increase in direct materials. Perhaps materials were wasted as a result of machine problems or because of inexperienced employees. |

| Dan: | Let’s try to nail down why my estimates are so far off so I can do a better job of estimating costs in the future. |

| Leslie: | Good idea—I’ll look into the direct materials costs and get back to you later this week. |

Question: Figure 2.10 "Job Cost Estimates Versus Actual Results for Custom Furniture Company" provides an in depth view of the costs associated with each job and the resulting profitability. How does this information help Custom Furniture Company plan for the future?

Answer: This information helps managers assess the profitability of individual jobs. Custom Furniture Company was able to identify areas of concern by comparing information from job cost sheets with Dan’s estimates. Dan and Leslie will have to do more research to find the cause of the high material costs. If changes cannot be made to the production process to reduce these costs, Dan may have to consider revising his estimates and raising prices on future jobs. The goal is to provide enough information for the company to make informed decisions about areas of concern, such as direct materials costs, and how much to charge for future jobs.

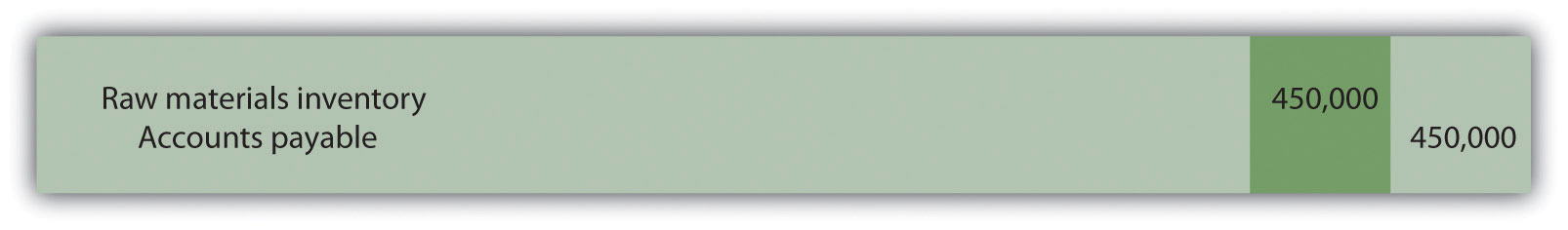

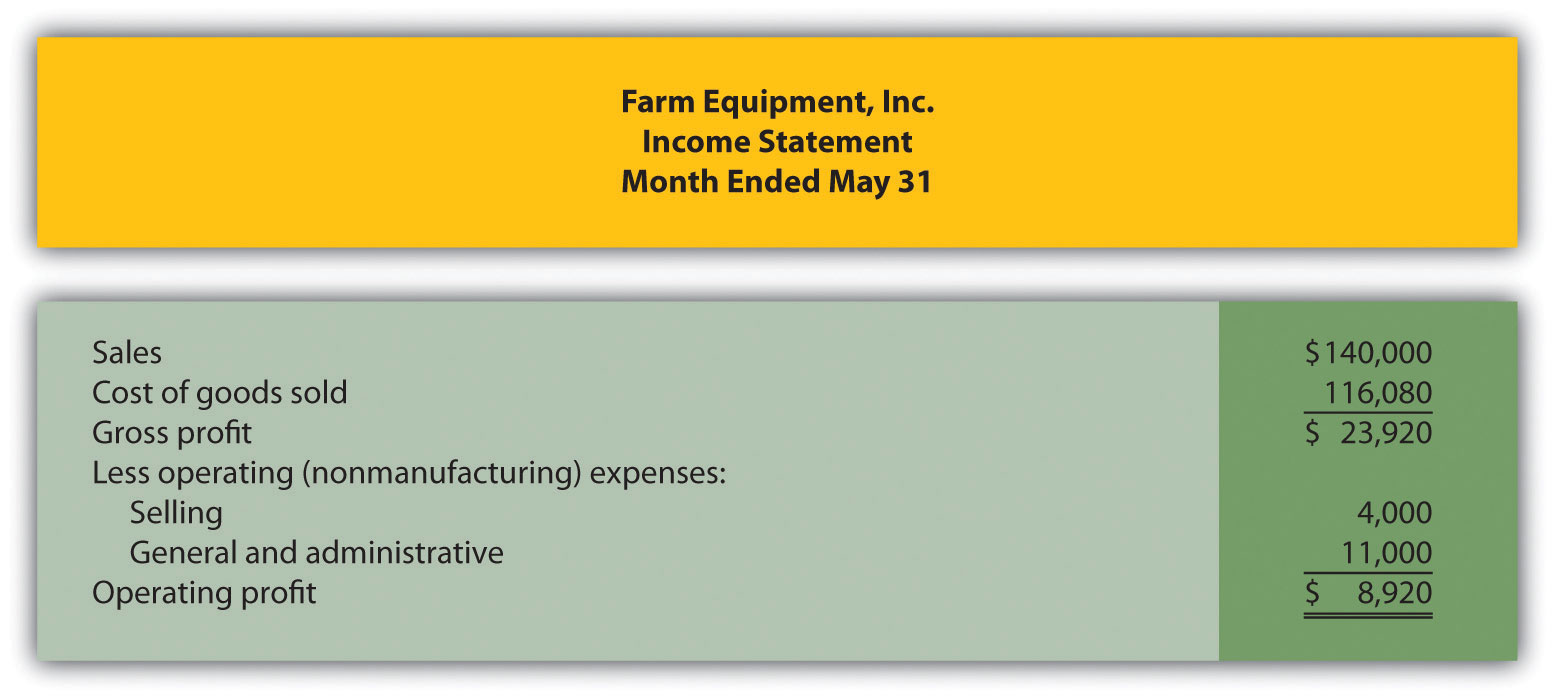

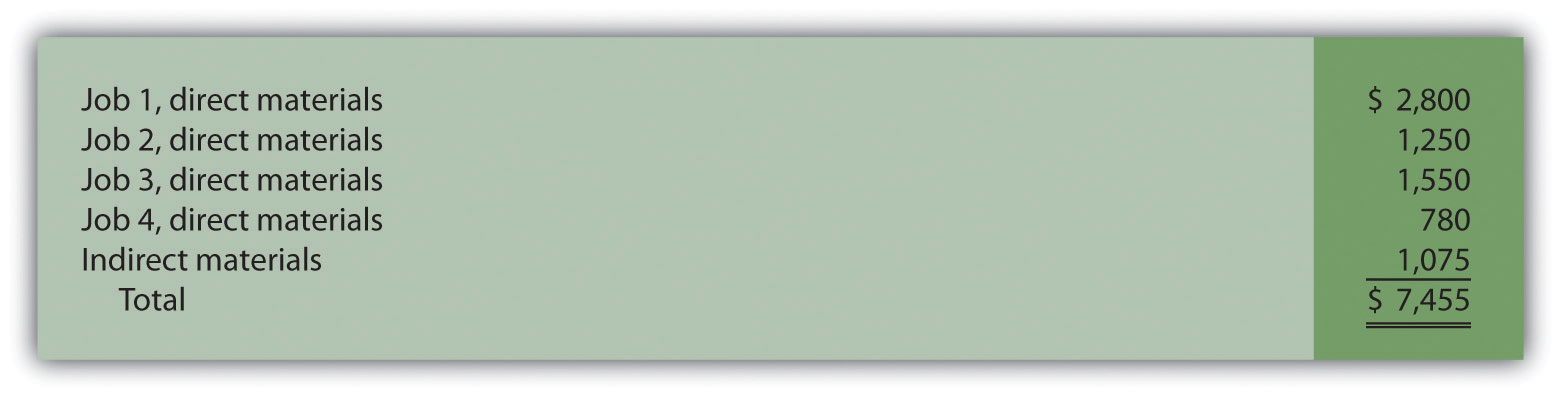

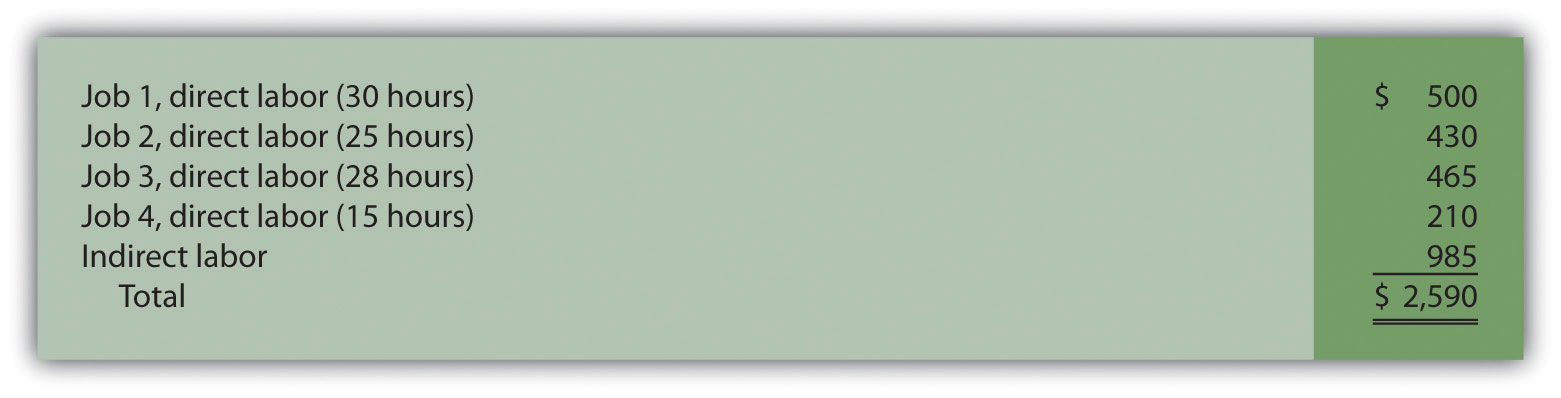

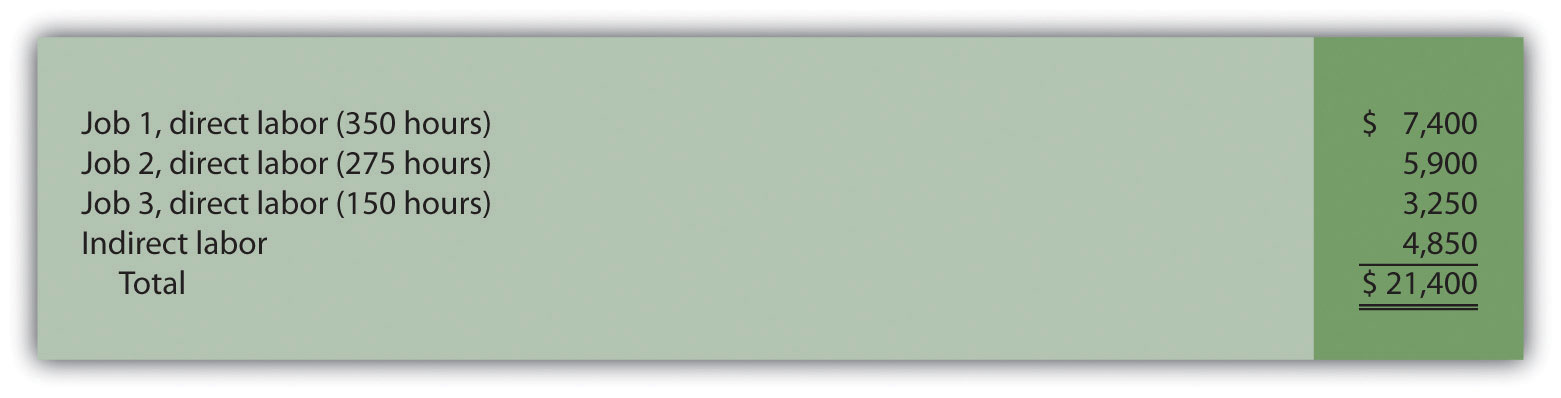

Farm Equipment, Inc., produces tractors and other farm machinery. Each piece of equipment is built to customer specifications. During May, its first month of operations, Farm Equipment, Inc., began working on three customer orders: jobs 1, 2, and 3. The following transactions occurred during May:

Processed material requisitions for the following items:

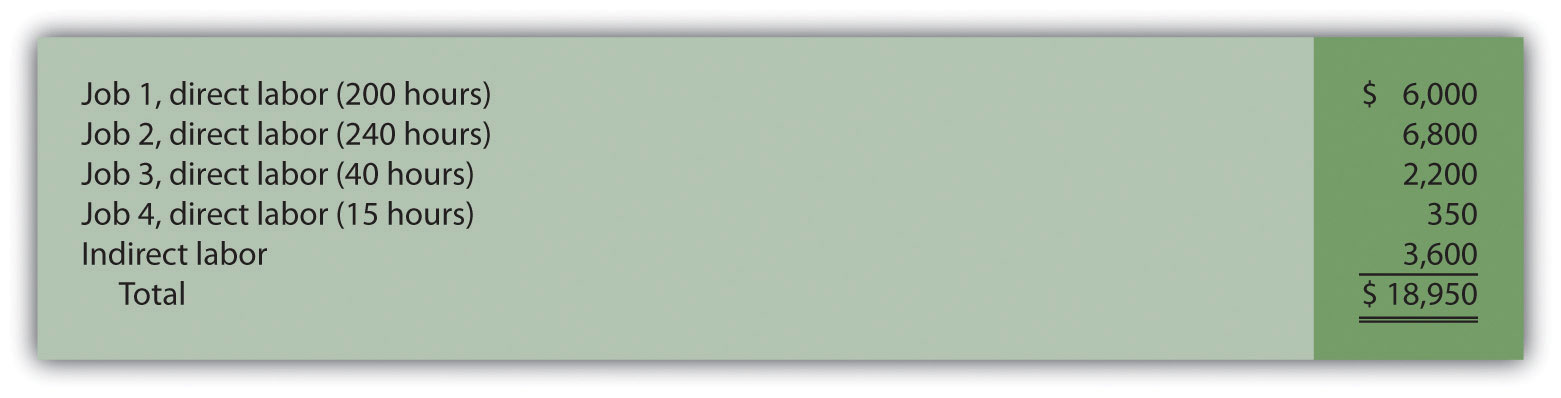

Processed timesheets showing the following:

Required:

Solutions to Review Problem 2.5

*$161,200 comes from the total for direct materials in part a.

*$33,100 comes from the total for direct labor in part a.

*$52,960 comes from the total for manufacturing overhead in part a.

Questions

Brief Exercises

Job Costing Versus Process Costing. Indicate whether each of the firms listed in the following would use job costing or process costing.

Job Costing Versus Process Costing. Indicate whether each of the firms listed in the following would use job costing or process costing.

Recording Purchase and Transfer of Raw Materials in T-Accounts. The following transactions occurred during the month of October:

| October 5 | Raw materials totaling $15,000 were purchased on account. |

| October 8 | Direct materials totaling $6,000 were placed in production. |

| October 10 | Indirect materials totaling $1,000 were placed in production. |

Required:

Service Organization Accounts. Provide the account name commonly used by service companies for each of the following accounts used in a manufacturing environment.

Exercises: Set A

Raw Materials Inventory Journal Entries. The balance in Sedona Company’s raw materials inventory account was $110,000 at the beginning of September. Raw materials purchased during the month totaled $50,000. Sedona used $17,000 in direct materials and $8,000 in indirect materials for the month.

Required:

Prepare separate journal entries to record the following items:

Work-in-Process Inventory Journal Entries. The balance in Reid Company’s work-in-process inventory account was $300,000 at the beginning of March. Manufacturing costs for the month are as follows:

| Direct materials | $ 40,000 |

| Direct labor | $ 70,000 |

| Manufacturing overhead applied | $200,000 |

| Cost of goods manufactured | $290,000 |

Required:

Prepare separate journal entries to record the following items. (Hint: Use Figure 2.7 "Custom Furniture Company’s Journal Entries for May" as a guide.)

Cost of Goods Sold Journal Entries. The balance in Blue Oak Company’s finished goods inventory account was $25,000 at the beginning of September. Cost of goods manufactured for the month totaled $17,000, and cost of goods sold totaled $14,000.

Required:

Prepare separate journal entries to record the following items. (Hint: Use Figure 2.7 "Custom Furniture Company’s Journal Entries for May" as a guide.)

Income Statement (with cost of goods sold adjustment). Rambler Company had the following activity for the year ended December 31.

| Sales revenue | $2,050,000 |

| Selling expenses | $ 575,000 |

| General and administrative expenses | $ 330,000 |

| Cost of goods sold (before adjustment) | $ 700,000 |

| Underapplied overhead | $ 23,000 |

Required:

Prepare an income statement for year ended December 31.

Manufacturing Overhead Allocation Base and Calculating the Cost of Jobs. Pyramid Company expects to incur $3,000,000 in manufacturing overhead costs this year. During the year, it expects to use 40,000 direct labor hours at a cost of $600,000 and 80,000 machine hours.

Required:

| Direct materials | $6,000 |

| Direct labor | $4,000 (200 hours at $15 per hour) + (100 hours at $10 per hour) |

| Machine time | 700 hours |

Exercises: Set B

Raw Materials Inventory Journal Entries. The balance in Clay Company’s raw materials inventory account was $45,000 at the beginning of April. Raw materials purchased during the month totaled $55,000. Clay used $48,000 in direct materials and $14,000 in indirect materials for the month.

Required:

Prepare separate journal entries to record the following items:

Work-in-Process Inventory Journal Entries. The balance in the work-in-process inventory account of Verdi Production, Inc., was $900,000 at the beginning of May. Manufacturing costs for the month are as follows:

| Direct materials | $ 340,000 |

| Direct labor | $ 810,000 |

| Manufacturing overhead applied | $ 660,000 |

| Cost of goods manufactured | $1,960,000 |

Required:

Prepare separate journal entries to record the following items. (Hint: Use Figure 2.7 "Custom Furniture Company’s Journal Entries for May" as a guide.)

Cost of Goods Sold Journal Entries. The balance in Posada Company’s finished goods inventory account was $650,000 at the beginning of March. Cost of goods manufactured for the month totaled $445,000, and cost of goods sold totaled $470,000.

Required:

Prepare separate journal entries to record the following items. (Hint: Use Figure 2.7 "Custom Furniture Company’s Journal Entries for May" as a guide.)

Income Statement (with cost of goods sold adjustment). Statton Company had the following activity for the year ended December 31.

| Sales revenue | $4,000,000 |

| Selling expenses | $ 825,000 |

| General and administrative expenses | $ 470,000 |

| Cost of goods sold (before adjustment) | $1,900,000 |

| Overapplied overhead | $ 109,000 |

Required:

Prepare an income statement for year ended December 31.

Manufacturing Overhead Allocation Base and Calculating the Cost of Jobs. Elko Company expects to incur $800,000 in manufacturing overhead costs this year. During the year, it expects to use 10,000 direct labor hours at a cost of $200,000 and 4,000 machine hours.

Required:

| Direct materials | $1,750 |

| Direct labor | $860 (30 hours at $12 per hour) + (50 hours at $10 per hour) |

| Machine time | 20 hours |

Problems

Actual and Applied Manufacturing Overhead. Marine Products, Inc., incurred the following actual overhead costs for the month of June.

| Indirect materials | $20,000 |

| Indirect labor | $18,000 |

| Rent | $ 3,000 |

| Equipment depreciation | $ 6,500 |

Overhead is applied based on a predetermined rate of $12 per machine hour, and 5,100 machine hours were used during June.

Required:

Actual and Applied Manufacturing Overhead. Quincy Company incurred the following actual overhead costs for the month of February.

| Indirect materials | $335,000 |

| Indirect labor | $275,000 |

| Factory depreciation | $ 18,000 |

| Factory utilities | $ 9,500 |

Overhead is applied based on a predetermined rate of $2 per direct labor dollar (200 percent of direct labor cost), and direct labor costs were $300,000 for the month.

Required:

Calculating the Cost of Jobs, Making Journal Entries, and Preparing an Income Statement. Racing Bikes, Inc., produces custom bicycles for professional racers. Each bike is built to customer specifications. During July, its first month of operations, Racing Bikes began production of four customer orders—jobs 1 through 4. The following transactions occurred during July.

Processed material requisitions for the following items:

Processed timesheets showing the following:

Required:

Calculating the Cost of Jobs, Making Journal Entries, and Preparing an Income Statement. Classic Boats, Inc., produces custom wood boats. Each boat is built to customer specifications. During April, its first month of operations, Classic Boats began production of three customer orders—jobs 1 through 3. The following transactions occurred during April.

Processed material requisitions for the following items:

Processed timesheets showing the following:

Required:

Calculating the Cost of Jobs and Making Journal Entries for a Service Company. Sampson & Associates provides accounting services. It began jobs 1 through 3 in the first week of January. The following transactions occurred that week.

Processed timesheets showing the following:

Required:

Calculating the Cost of Jobs and Making Journal Entries for a Service Company. Management Consulting, Inc., provides consulting services and began operations on September 1. It began jobs 1 through 4 during the first half of September. The following transactions occurred during that time.

Processed timesheets showing the following:

Required:

Closing Manufacturing Overhead: Two Approaches. Olympia Company incurred actual manufacturing overhead costs of $630,000 during the year ended December 31, 2012. A total of $570,000 in overhead was applied to jobs. At December 31, 2012, work-in-process inventory totals $200,000, and finished goods inventory totals $400,000. Cost of goods sold before adjustments totals $1,400,000 for the year.

Required:

Closing Manufacturing Overhead: Two Approaches. Placer Company incurred actual manufacturing overhead costs of $260,000 during the year ended December 31, 2012. A total of $350,000 in overhead was applied to jobs. At December 31, 2012, work-in-process inventory totals $100,000, and finished goods inventory totals $300,000. Cost of goods sold before adjustments totals $600,000 for the year.

Required:

One Step Further: Skill-Building Cases

Ethics: Shifting Hours Using Job Costing. Shawney Accountancy Corporation provides accounting services. It uses a job costing system to track each client’s revenues and costs. The firm is currently working on two jobs. The first job, preparing tax returns for Bantem Corporation, was bid at $25,000 and had budgeted costs of $18,000. The second job, performing a review of internal controls for Maxum Company, was bid at 50 percent above actual costs. The following conversation took place between Kelly (a manager) and Ron (senior staff working for Kelly).

| Kelly: | Ron, I just reviewed timesheets for the two jobs we’re working on, and it appears we are quickly approaching the budget of $18,000 for the Bantem job. |

| Ron: | Yes, we’re having trouble completing the Bantem job in the hours budgeted. |

| Kelly: | This is the first year on the Bantem job, and budgeting for first-year clients is always difficult. |

| Ron: | I’m sure we can retain this job next year with a little bump in the bid—perhaps to $29,000. |

| Kelly: | That’s fine for next year, but I have to answer to my boss for this year’s results. Why don’t we take some of the pressure off by charging some time from the Bantem job to the internal control project we have with Maxum Company? We’re under budget with the Maxum job, and they are paying us based on actual costs plus a 50 percent markup. |

| Ron: | Can we do that? |

| Kelly: | We don’t do it often, but in cases like this, we have to get creative. |

Required:

Internet Project: Automation and Overhead Allocation. Over the past several decades, manufacturing companies have tended to move away from direct labor and more toward automation (i.e., using machinery rather than people to produce products).

Required:

Group Project: Labor Costs at General Motors and Toyota. Both General Motors (GM) and Toyota have production facilities in Texas. GM’s plant was built in 1956 on a 249-acre site and has since undergone billions of dollars in renovations. Toyota’s plant was built in 2006 on 2,000 acres. Each plant has a production capacity of 200,000 vehicles per year. GM averages close to 22 assembly labor hours per vehicle (no data on labor hours per vehicle are available for Toyota). The labor cost per vehicle is $1,800 for GM, which uses a unionized labor force, and $800 for Toyota, which uses nonunion labor. (Based on Lee Hawkins Jr. and Norihiko Shirouzu, “A Tale of Two Auto Plants,” Wall Street Journal, May 24, 2006.)

Required:

Form groups of two to four students and respond to the following items:

Comprehensive Cases

Journal Entries, Closing Manufacturing Overhead, and Preparing an Income Statement. Benning, Inc., is a defense contractor that uses job costing. Because the firm uses a perpetual inventory system, the three supporting schedules to the income statement (the schedule of raw materials placed in production, the schedule of cost of goods manufactured, and the schedule of cost of goods sold) are not necessary. Inventory account beginning balances at January 1, 2012, are listed as follows.

| Raw materials inventory | $ 500,000 |

| Work-in-process inventory | $ 700,000 |

| Finished goods inventory | $1,800,000 |

You will be recording the following transactions, which summarize the activities that occurred during the year ended December 31, 2012:

The costs listed in the following related to the factory were incurred during the period. (Hint: Record these items in one entry with one debit to manufacturing overhead and four separate credits):

| Building depreciation | $580,000 |

| Insurance (prepaid during 2012, now expired) | $220,000 |

| Utilities (on account) | $ 80,000 |

| Maintenance (paid cash) | $440,000 |

Required:

Journal Entries, Closing Manufacturing Overhead, and Preparing an Income Statement. Sierra Nursery Company grows a variety of plants and sells them to local nurseries. Raw materials consist of such items as seeds and the fertilizer required to grow plants from the seedling stage to a viable, saleable plant. Sierra Nursery uses a job costing system to track revenues and costs associated with customer orders. Because the firm uses a perpetual inventory system, the three supporting schedules to the income statement (the schedule of raw materials placed in production, the schedule of cost of goods manufactured, and the schedule of cost of goods sold) are not necessary. Inventory account beginning balances at January 1, 2012, are as follows:

| Raw materials inventory | $50,000 |

| Work-in-process inventory | $60,000 |

| Finished goods inventory | $90,000 |

You will be recording the following transactions, which summarize the activities that occurred during the year ended December 31, 2012:

The costs listed in the following related to the nursery were incurred during the period. (Hint: Record these items in one entry with one debit to manufacturing overhead and four separate credits):

| Equipment depreciation | $22,000 |

| Rent (prepaid during 2012) | $36,000 |

| Utilities (on account) | $33,000 |

| Maintenance (paid cash) | $19,000 |

Required: