Question: The primary focus of activity-based costing thus far has been on allocating manufacturing overhead costs to products. Although this is important for external reporting purposes, we can expand ABC to include costs beyond manufacturing overhead. Also, we can organize costs in different ways to help managers evaluate performance. What different approaches can be used to organize cost data in a way that helps managers make better decisions?

Answer: Cost data can be organized in a number of ways to help managers make decisions. Four common approaches are addressed in this section:

Question: U.S. Generally Accepted Accounting Principles require the allocation of all manufacturing costs to products for inventory costing purposes. The choice of an allocation method is not critical to this process. Companies that use direct labor hours, machine hours, activity-based costing, or some other method to allocate overhead costs to products are likely to be in compliance with U.S. GAAP. Throughout this chapter, we have illustrated how ABC is used to allocate manufacturing overhead costs. However, organizations often use ABC for purposes that go beyond allocating costs solely for external reporting. How might ABC be used to help companies in areas other than external reporting?

Answer: Commissions paid to sales people for the sale of specific products (often called selling, general, and administrative) are included as an operating expense in financial reports prepared for external users as required by U.S. GAAP. However, many organizations may assign commission costs to specific products for internal decision-making purposes. This treatment is not in compliance with U.S. GAAP, but it is perfectly acceptable for internal reporting purposes and may be done using activity-based costing. It is important to understand that managers have ultimate control over which costs should be allocated to products for internal reporting purposes, and this allocation often involves going beyond overhead costs.

Table 3.1 "Examples of Costs Allocated to Products" provides examples of costs that could be allocated to products. It also includes cost categories—product, selling, and general and administrative (G&A)—and indicates whether the cost allocation complies with U.S. GAAP for external reporting. As you can see in the far right column, all costs can be allocated to products for internal reporting purposes.

Table 3.1 Examples of Costs Allocated to Products

| Cost | Cost Category* | OK to Allocate to Products for External Reporting (U.S. GAAP)? | OK to Allocate to Products for Internal Reporting? |

|---|---|---|---|

| Direct materials | Product | Yes | Yes |

| Direct labor | Product | Yes | Yes |

| Manufacturing overhead** | Product | Yes | Yes |

| Sales commissions | Selling | No | Yes |

| Shipping products to customers | Selling | No | Yes |

| Product advertising | Selling | No | Yes |

| Legal costs for product lawsuit | G&A | No | Yes |

| Processing payroll for production personnel | G&A | No | Yes |

| Company president’s salary | G&A | No | Yes |

| Costs of implementing ABC | G&A | No | Yes |

|

*See Chapter 2 "How Is Job Costing Used to Track Production Costs?" for information about category definitions. **Includes all manufacturing costs other than direct labor and direct materials, such as factory related costs for supervisors, building rent, machine maintenance, utilities, and indirect materials. See Chapter 2 "How Is Job Costing Used to Track Production Costs?" for more detail. |

|||

Question: Most companies have departments that are classified as either service departments or production departments. Service departmentsDepartments that provide services to other departments within a company. provide services to other departments within the company and include such functions as accounting, human resources, legal, maintenance, and computer support. Production departmentsDepartments directly involved with producing goods or providing services for customers. are directly involved with producing goods or providing services for customers and include such functions as ordering materials, assembling products, and performing quality inspections. Why do companies often allocate a share of service department costs to production departments for internal reporting purposes even though U.S. GAAP generally does not allow it for external reporting?

Answer: Companies allocate service department costs to production departments for several reasons:

Question: How do companies allocate service department costs to production departments and how might this be done at SailRite?

Answer: Several methods of allocating service department costs to production departments are available. We introduce the simplest approach—the direct method—here (complex approaches are presented in more advanced cost accounting texts). The direct methodA method of allocating costs that allocates service department costs directly to production departments but not to other service departments. allocates service department costs directly to production departments but not to other service departments.

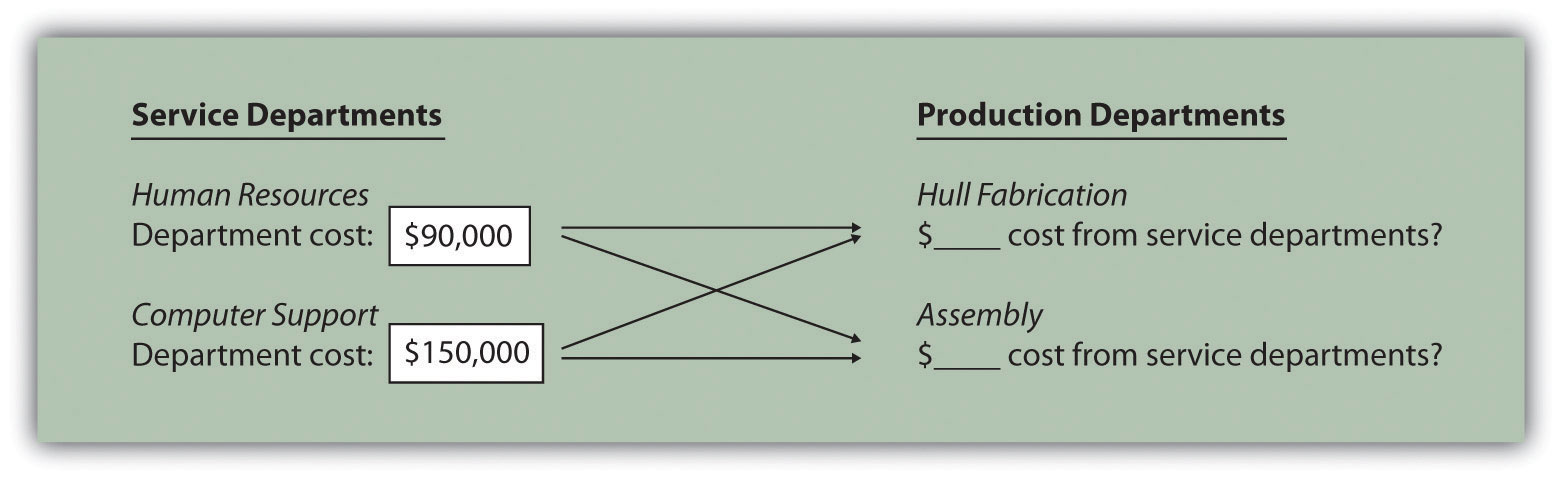

For example, assume that SailRite Company has two service departments—Human Resources and Computer Support. Costs associated with Human Resources and Computer Support total $90,000 and $150,000, respectively. Recall that SailRite has two production departments—Hull Fabrication and Assembly. The goal is to allocate service department costs to the two production departments, as shown in Figure 3.10 "Allocating Service Department Costs to Production Departments at SailRite Company: Direct Method (Before Allocations)".

Figure 3.10 Allocating Service Department Costs to Production Departments at SailRite Company: Direct Method (Before Allocations)

SailRite would like to allocate service department costs using an allocation base that drives these costs. Assume management decides to use the number of employees as the allocation base to allocate Human Resources costs, and the number of computers as the allocation base to allocate Computer Support costs. Allocation base activity for each production department is as follows:

| Hull Fabrication | Assembly | Total | |

| Number of employees | 35 | 85 | 120 |

| Number of computers | 42 | 33 | 75 |

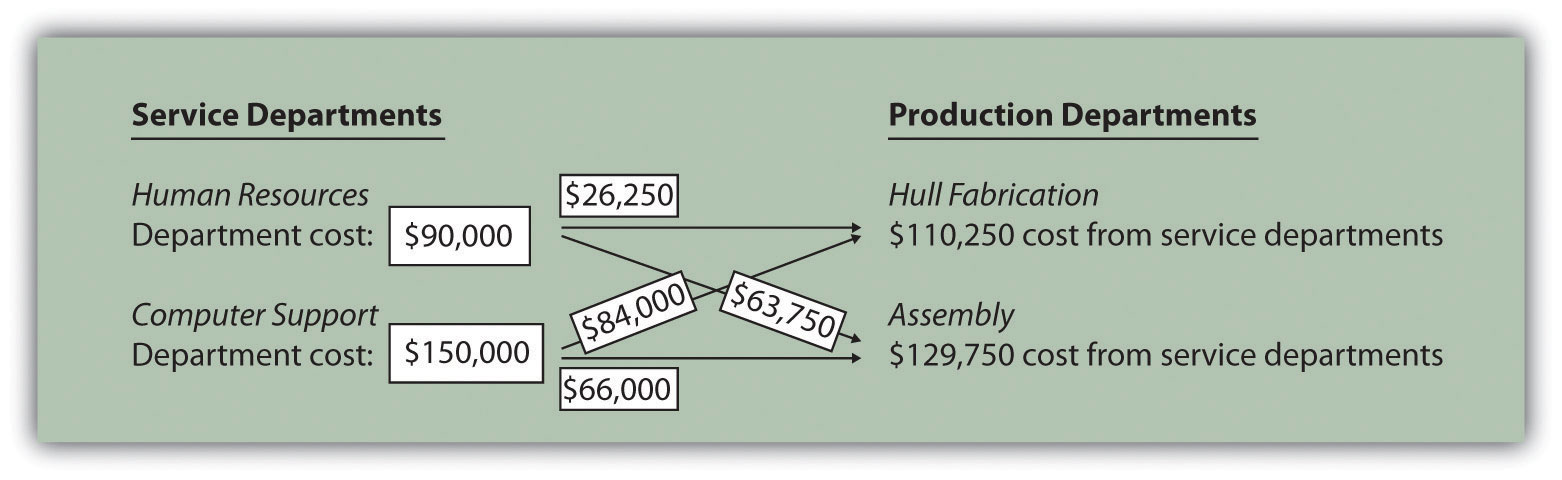

The allocation rate for human resource services is $750 per employee (= $90,000 department costs ÷ 120 employees). The allocation rate for computer support services is $2,000 per computer (= $150,000 ÷ 75 computers). Thus the Hull Fabrication department receives an allocation of $26,250 in human resource costs (= 35 employees × $750 rate) and $84,000 in computer support costs (= 42 computers × $2,000 rate). The Assembly department receives an allocation of $63,750 in human resource costs (= 85 employees × $750 rate) and $66,000 in computer support costs (= 33 computers × $2,000 rate).

The allocations to production departments are shown in Figure 3.11 "Allocating Service Department Costs to SailRite’s Production Departments: Direct Method (After Allocations)". If management chooses to allocate service department costs to production departments as described here, there must be some benefit to going through the process. Should these costs be assigned to activity cost pools for the purpose of costing products (activity-based costing)? Should production department managers be evaluated based on the use of these services? Should actual service department usage be compared to budgeted usage for each production department? The answers to these questions vary from one organization to the next. However, one point is certain—the benefits of implementing this allocation system must outweigh the costs!

Figure 3.11 Allocating Service Department Costs to SailRite’s Production Departments: Direct Method (After Allocations)

Question: Some organizations group activities into four cost categories, called the hierarchy of costs, to help managers form cost pools for activity-based costing purposes. The cost hierarchyA method of costing that groups costs based on whether the activity is at the facility level, product or customer level, batch level, or unit level.Credit for developing the cost hierarchy is generally given to R. Cooper and R. S. Kaplan, “Profit Priorities from Activity-Based Costing,” Harvard Business Review, May 1991, 130–35.groups costs based on whether the activity is at the facility level, product or customer level, batch level, or unit level. What is the difference between each of these categories, and how does this information help managers?

Answer: Each category within the cost hierarchy is described as follows:

The cost hierarchy serves as a framework for managers to establish cost pools and determine what drives the change in costs for each cost pool. It also provides a sense of how quickly (or slowly) costs change based on decisions made by management. Examples of activities often identified by companies using activity-based costing, and how these activities fit in the cost hierarchy, appear in Table 3.2 "Cost Hierarchy Examples".

Table 3.2 Cost Hierarchy Examples

| Cost Hierarchy Category | Activity/Cost |

|---|---|

| Facility-level | Plant depreciation |

| Building rent | |

| Management of facility | |

| Product/customer-level | New product development |

| Product engineering | |

| Product marketing and advertising | |

| Maintaining customer records | |

| Batch-level | Machine setups |

| Processing purchase orders | |

| Batch quality inspections | |

| Unit-level | Energy to run production machines |

| Direct labor | |

| Direct materials |

Question: The hierarchy of costs is not the only approach organizations use to group costs. Managers are also concerned about measuring the costs associated with quality. Quality-related costs can be organized into four categories. The first two categories—prevention and appraisal—are costs incurred to control and improve quality. The final two categories—internal failure and external failure—are costs incurred as a result of failing to control and improve quality. What is the difference between these cost categories, and how does this information help managers improve quality?

Companies that measure these costs of quality typically calculate the costs in each category as a percent of total revenue. The goal is to steadily shift costs toward the prevention and appraisal categories and away from the internal and external failure categories. As organizations concentrate more on preventing defects, total quality costs as a percent of revenue tends to decline and product quality improves. Table 3.3 "Summary of Quality Costs" provides a summary of the four classifications of quality-related costs.

Table 3.3 Summary of Quality Costs

| Quality Cost Category | Description |

|---|---|

| Prevention cost | Cost of activities that prevent defects in products, such as quality training and raw materials inspections |

| Appraisal cost | Cost of activities that detect defective products before they are delivered to customers, such as finished goods inspections and field inspections |

| Internal failure cost | Cost of activities that result from detecting defective products before they are delivered to customers, such as rework and scrap |

| External failure cost | Cost of activities that result from delivering defective products to customers, such as warranty repairs and warranty replacements |

Fill in the following table to identify if the cost item can be included in the cost of products for external reporting purposes and/or internal reporting purposes. The first item is completed for you.

| Cost | OK to Allocate to Products for External Reporting (U.S. GAAP)? | OK to Allocate to Products for Internal Reporting? |

| Direct materials | Yes | Yes |

| Salaries of sales people | ||

| Indirect materials used in production | ||

| Rent for headquarters building | ||

| Product promotions | ||

| Direct labor | ||

| Legal costs for patent applications | ||

| Processing payroll for human resource personnel | ||

| Depreciation of factory equipment | ||

| Marketing vice president’s salary | ||

| Depreciation of administrative department equipment |

Solution to Review Problem 3.6

| Cost | OK to Allocate to Products for External Reporting (U.S. GAAP)? | OK to Allocate to Products for Internal Reporting? |

| Direct materials | Yes | Yes |

| Salaries of sales people | No | Yes |

| Indirect materials used in production | Yes | Yes |

| Rent for headquarters building | No | Yes |

| Product promotions | No | Yes |

| Direct labor | Yes | Yes |

| Legal costs for patent applications | No | Yes |

| Processing payroll for human resource personnel | No | Yes |

| Depreciation of factory equipment | Yes | Yes |

| Marketing vice president’s salary | No | Yes |

| Depreciation of administrative department equipment | No | Yes |

Questions

What is the difference between a value-added activity and a non-value-added activity? Provide two examples of non-value-added activities for each of the following:

Brief Exercises

Product Costing at SailRite. Refer to the dialogue presented at the beginning of the chapter and the follow-up dialogue before Figure 3.7 "Activity-Based Costing Versus Plantwide Costing at SailRite Company".

Required:

Calculating Plantwide Predetermined Overhead Rate. Manufacturing overhead costs totaling $5,000,000 are expected for this coming year. The company also expects to use 50,000 direct labor hours and 20,000 machine hours.

Required:

Calculating Department Predetermined Overhead Rates. Manufacturing overhead costs totaling $1,000,000 are expected for this coming year—$400,000 in the Assembly department and $600,000 in the Finishing department. The Assembly department expects to use 4,000 machine hours, and the Finishing department expects to use 30,000 direct labor hours.

Required:

Identifying Cost Drivers. Ehrman Company identified the activities listed in the following as being most important (step 1 and step 2 of activity-based costing), and it formed cost pools for each activity.

Required:

Perform step 3 of the activity-based costing process by identifying a possible cost driver for each activity.

Identifying Cost Drivers: Service Company. McHale Architects, Inc., designs, engineers, and supervises the construction of custom homes. The following activities were identified as being most important (step 1 and step 2 of activity-based costing), and cost pools were formed for each activity.

Required:

Perform step 3 of the activity-based costing process by identifying a possible cost driver for each activity.

Value-Added and Non-Value-Added Activities. Novak Corporation manufactures custom-made kayaks and accessories. The company performs the following activities.

Required:

Label each activity as value-added or non-value-added.

Allocation Base for Service Departments. Valencia Company has 15 production departments and produces hundreds of products. Service department costs are allocated to production departments using the direct method. Five service departments provide the following services to the production departments.

Required:

Exercises: Set A

Plantwide Versus Department Allocations of Overhead. San Juan Company expects to incur $600,000 in overhead costs this coming year—$100,000 in the Cutting department, $300,000 in the Assembly department, and $200,000 in the Finishing department. Direct labor hours worked in all departments are expected to total 40,000 (used for the plantwide rate). The Cutting department expects to use 20,000 machine hours, the Assembly department expects to use 25,000 direct labor hours, and the Finishing department expects to incur $100,000 in direct labor costs (this information will be used for department rates).

Required:

Computing Product Costs Using Activity-Based Costing. Stillwater Company identified the following activities, estimated costs for each activity, and identified cost drivers for each activity for this coming year. (These are the first three steps of activity-based costing.)

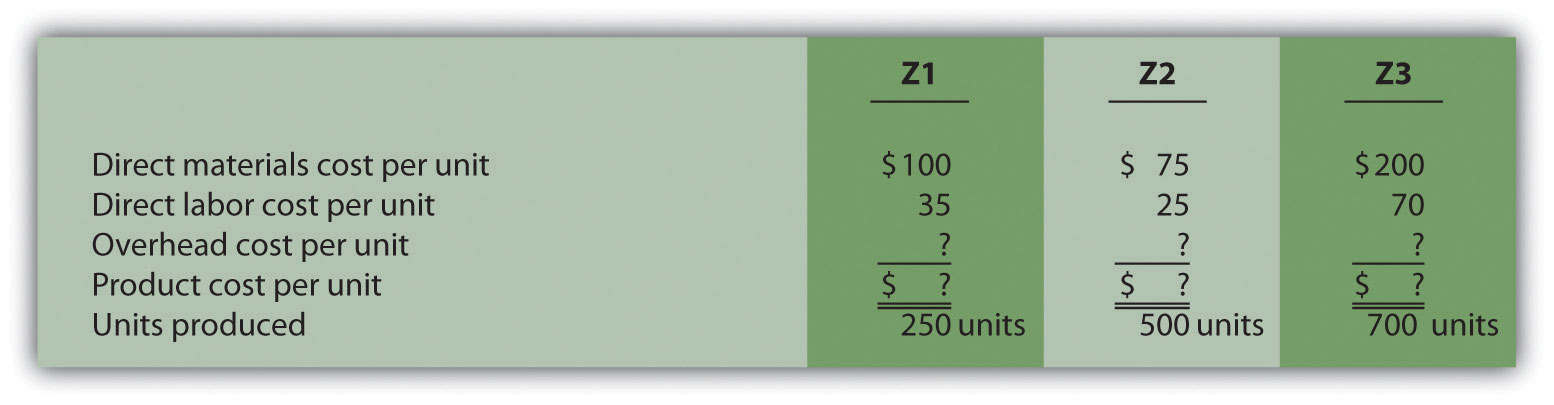

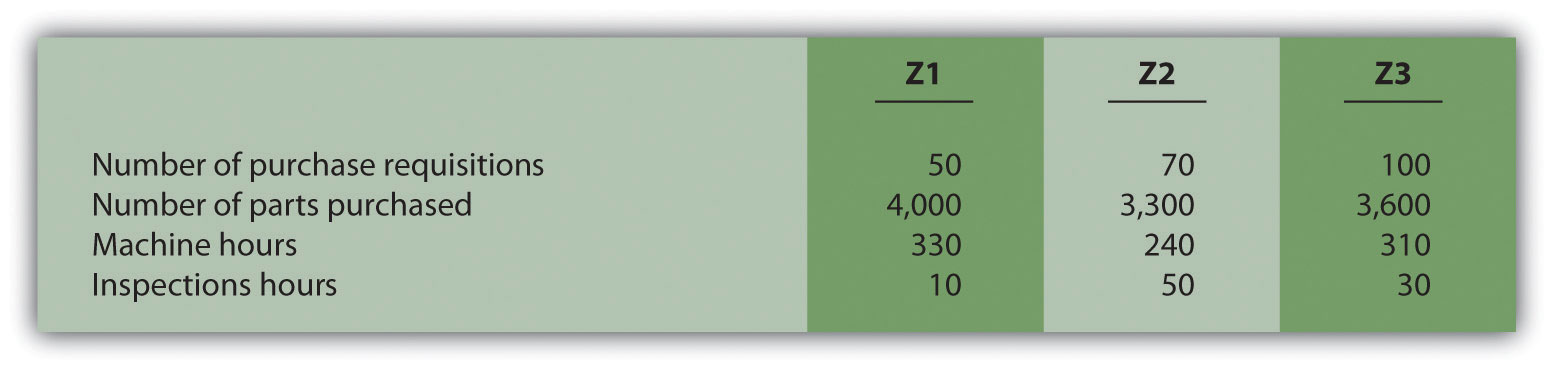

The company produces three products, Z1, Z2, and Z3. Information about these products for the month of January follows:

Actual cost driver activity levels for the month of January are as follows:

Required:

Journal Entry to Apply Overhead. Caspian Company is deciding which of three approaches it should use to apply overhead to products. Information for each approach is provided in the following.

Activity-based costing rates. Three activities were identified and rates were calculated for each activity.

| Purchase requisitions | $15 per requisition processed |

| Production setup | $50 per setup |

| Quality control | $70 per inspection |

Required:

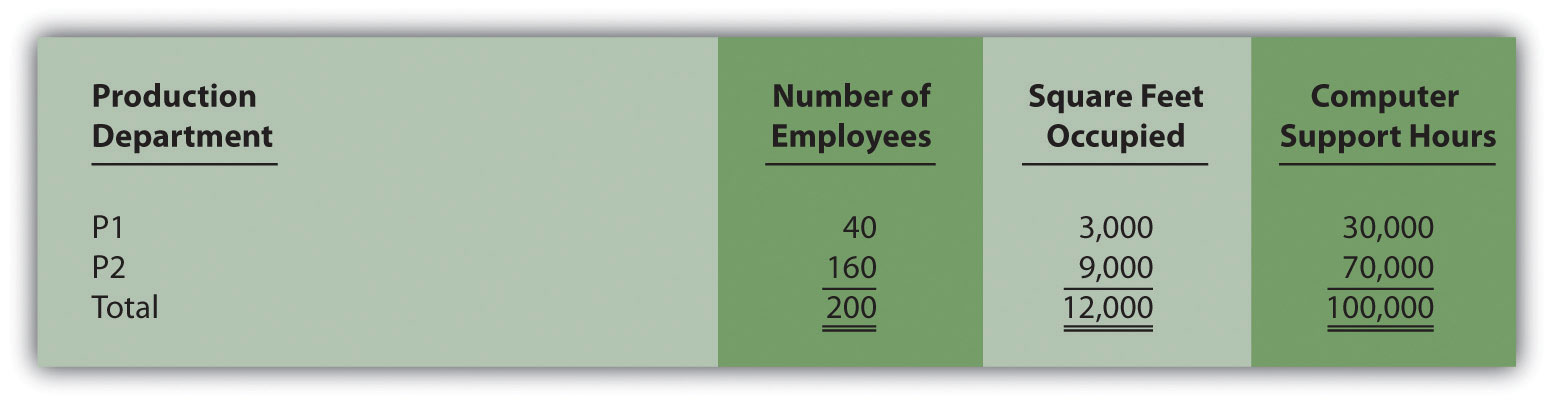

Allocating Service Department Costs. Crandall Company has two production departments (P1 and P2) and three service departments (S1, S2, and S3). Service department costs are allocated to production departments using the direct method. The $400,000 costs of department S1 are allocated based on the number of employees in each production department. The $600,000 costs of department S2 are allocated based on the square footage of space occupied by each production department. The $300,000 costs of department S3 are allocated based on hours of computer support used by each production department. Information for each production department follows.

Required:

Cost Hierarchy. The following activities and costs are for Tanaka Company.

Required:

Exercises: Set B

Plantwide Versus Department Allocations of Overhead: Service Company. Chan and Associates provides wetlands design and maintenance services for its customers, most of whom are developers. Billing is based on costs plus a 30 percent markup. Thus costs are allocated to customers rather than to products.

Total overhead costs this coming year are expected to be $2,000,000 ($600,000 in the Design department and $1,400,000 in the Wetlands Maintenance department). Direct labor costs are expected to total $800,000 (used for the plantwide rate). The Design department expects to incur direct labor costs of $500,000, and the Wetlands Maintenance department expects to work 30,000 direct labor hours (this information is used for the department rates).

Required:

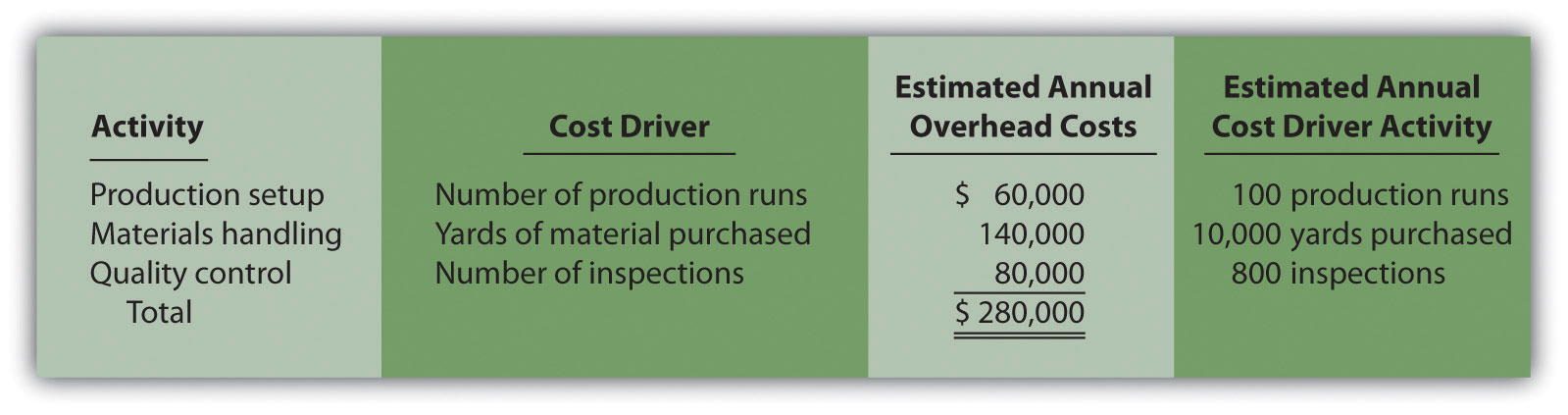

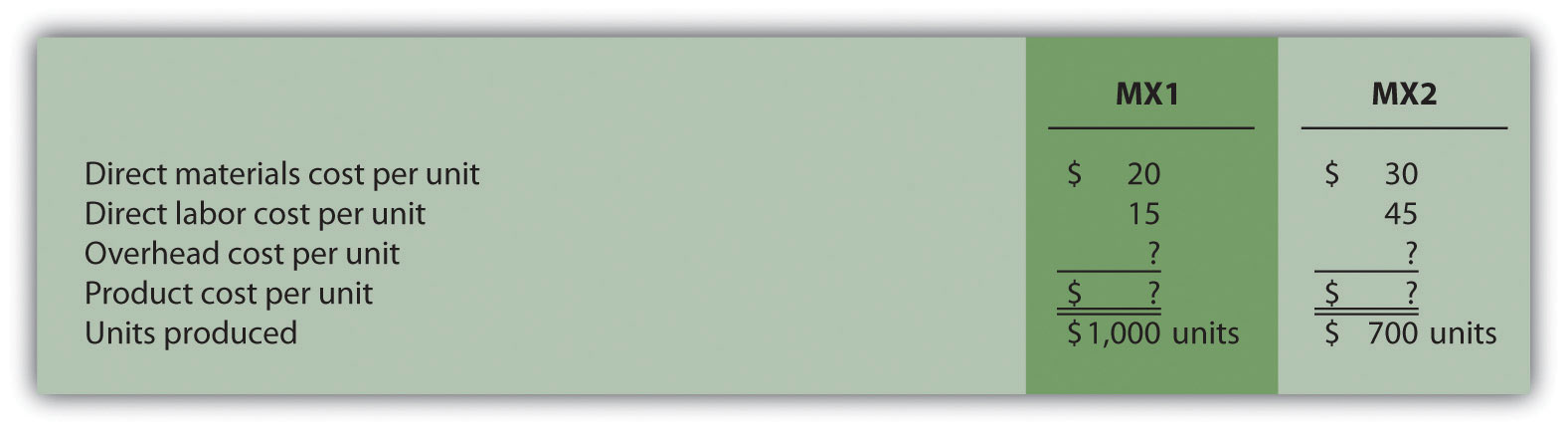

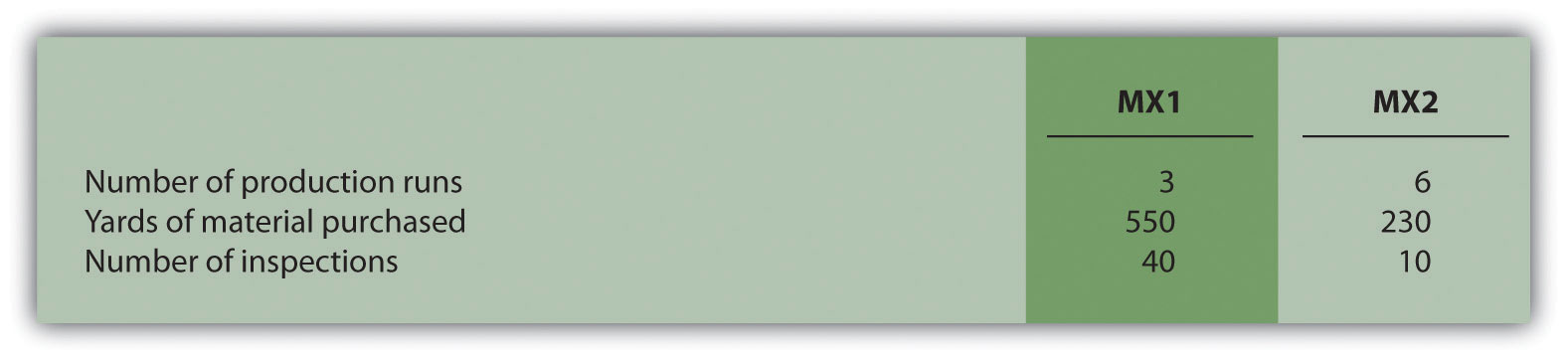

Computing Product Costs Using Activity-Based Costing. Petrov Company identified the following activities, estimated costs for each activity, and identified cost drivers for each activity for this coming year. (These are the first three steps of activity-based costing.)

The company produces two products, MX1 and MX2. Information about these products for the month of March follows:

Actual cost driver activity levels for the month of March are as follows:

Required:

Journal Entry to Apply Overhead, Closing Overhead Account. Premium Products, Inc., is deciding which of three approaches it should use to apply overhead to products. Information for each approach is provided as follows.

Activity-based costing rates. Three activities were identified, and rates were calculated for each activity.

| Materials handling | $8 per pound of material purchased |

| Production setup | $60 per setup |

| Quality control | $110 per batch inspected |

Required:

Premium Products, Inc., closes overapplied or underapplied overhead to the cost of goods sold account at the end of each year. Prepare the journal entry to close the manufacturing overhead account at the end of the year for each of the following independent scenarios assuming the company made the journal entry to apply overhead in requirement c.

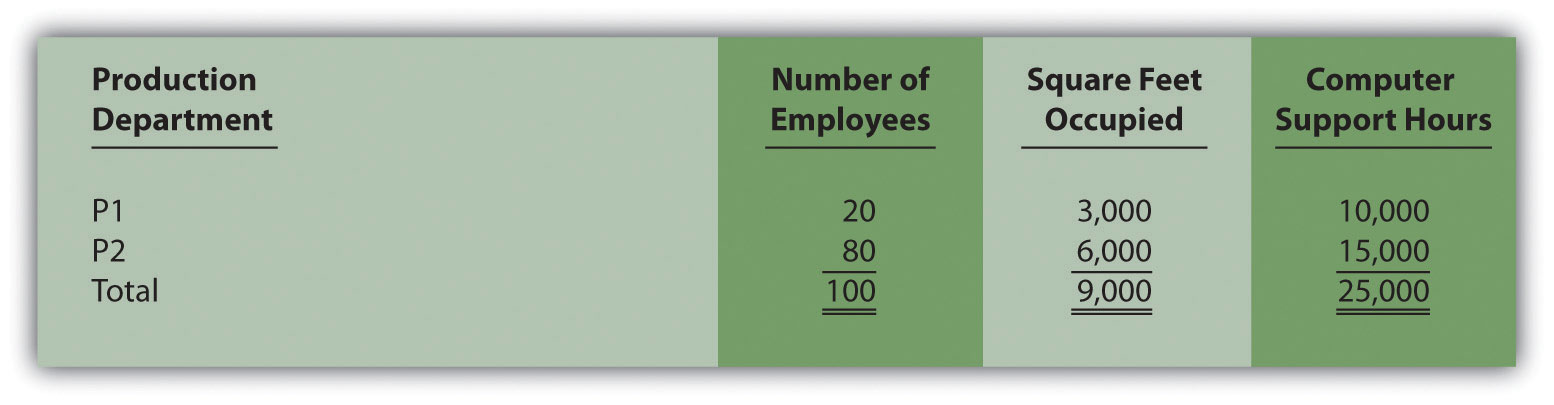

Allocating Service Department Costs. Southwest, Inc., has two production departments (P1 and P2) and three service departments (S1, S2, and S3). Service department costs are allocated to production departments using the direct method. The $800,000 costs of department S1 are allocated based on the number of employees in each production department. The $300,000 costs of department S2 are allocated based on the square footage of space occupied by each production department. The $600,000 costs of department S3 are allocated based on hours of computer support used by each production department. Information for each production department follows.

Required:

Cost Hierarchy. The following activities and costs are for Rios Corporation.

Required:

Problems

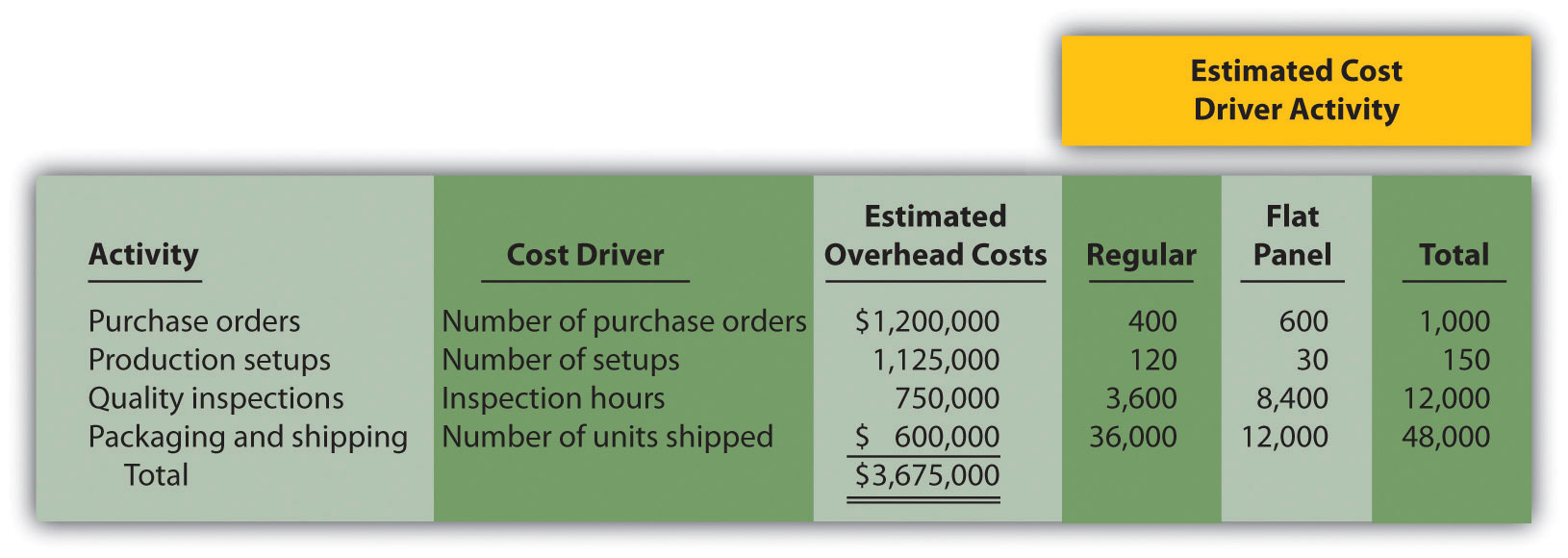

Activity-Based Costing Versus Traditional Approach. Techno Company produces a regular computer monitor that sells for $175 and a flat panel computer monitor that sells for $300. Last year, total overhead costs of $3,675,000 were allocated based on direct labor hours. A total of 63,000 direct labor hours were required last year to build 36,000 regular monitors (1.75 hours per unit), and 42,000 direct labor hours were required to build 12,000 flat panel monitors (3.50 hours per unit). Total direct labor and direct materials costs for last year were as follows:

| Regular Monitor | Flat Panel Monitor | |

| Direct materials | $1,908,000 | $ 900,000 |

| Direct labor | $1,728,000 | $1,200,000 |

The management of Techno Company would like to use activity-based costing to allocate overhead rather than one plantwide rate based on direct labor hours. The following estimates are for the activities and related cost drivers identified as having the greatest impact on overhead costs.

Required:

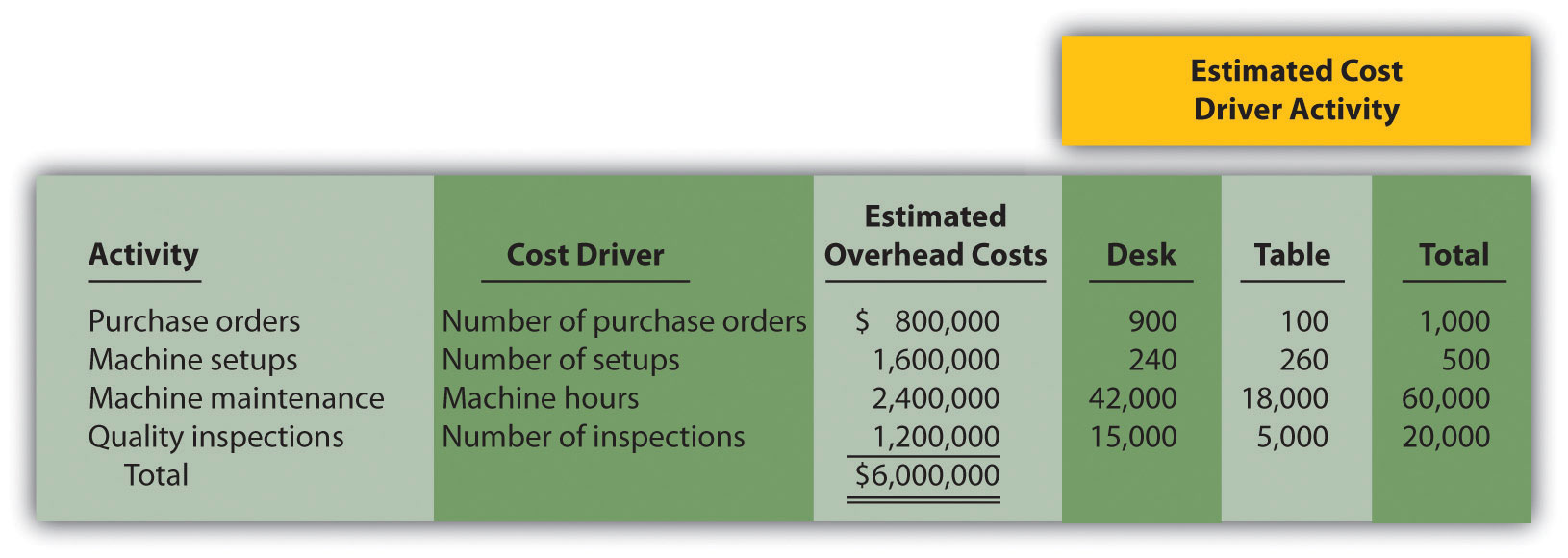

Activity-Based Costing Versus Traditional Approach, Activity-Based Management. Quality Furniture, Inc., produces a wood desk that sells for $500 and a wood table that sells for $900. Last year, total overhead costs of $6,000,000 were allocated based on direct labor costs. Direct labor costs totaled $2,000,000 last year, and Quality Furniture produced 15,000 desks and 5,000 tables. Total direct labor and direct materials costs by product for last year were as follows:

| Desk | Table | |

| Direct materials | $1,575,000 | $950,000 |

| Direct labor | $1,200,000 | $800,000 |

The management of Quality Furniture would like to use activity-based costing to allocate overhead rather than one plantwide rate based on direct labor costs. The following estimates are for the activities and related cost drivers identified as having the greatest impact on overhead costs.

Required:

Calculating and Recording Overhead Applied. Assume Quality Furniture, Inc., discussed in Problem 41, uses activity-based costing.

Required:

The following activity associated with the desk product was reported for the month of March.

| Number of purchase orders processed | 40 |

| Number of machine setups | 22 |

| Number of machine hours | 2,425 |

| Number of quality inspections | 890 |

Using the predetermined overhead rates calculated in requirement a, determine the amount of overhead applied to the desk product for the month of March.

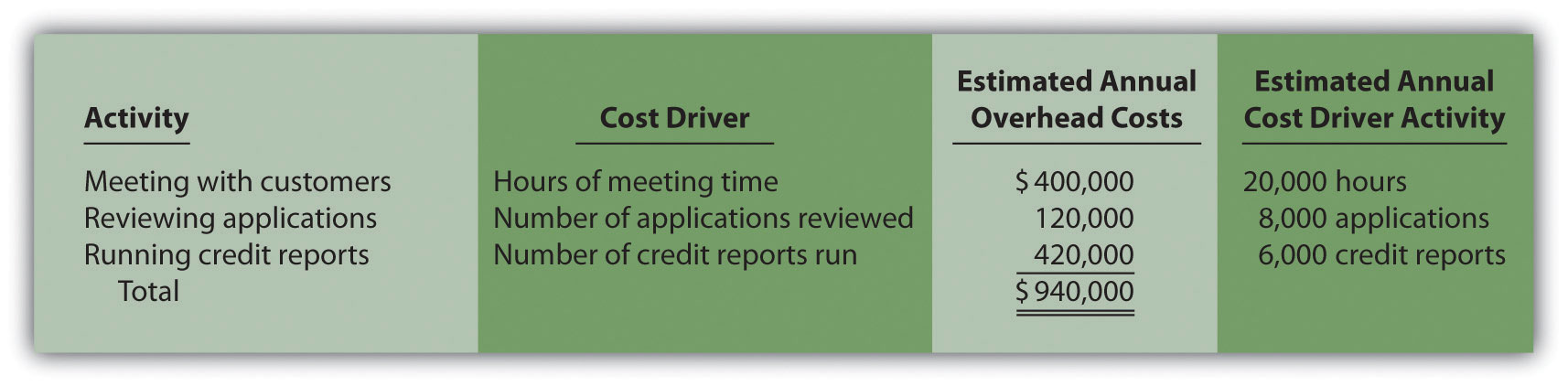

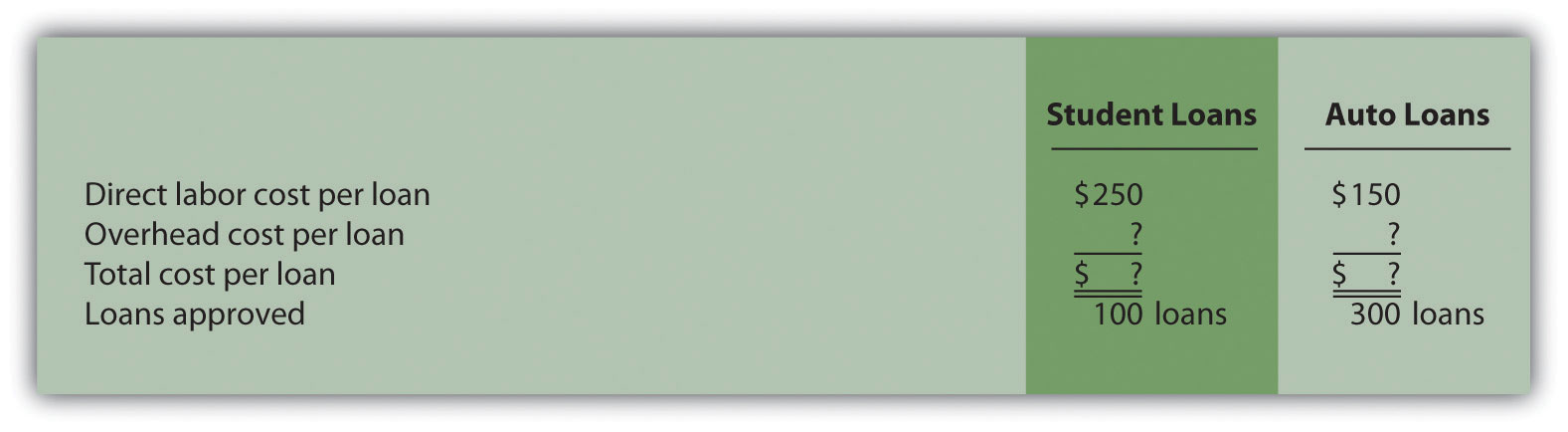

Computing Product Costs Using Activity-Based Costing, Service Company. Roseville Community Bank uses activity-based costing to assign overhead costs to two different loan products—student loans and auto loans. The bank identified the following activities, estimated costs for each activity, and identified cost drivers for each activity for this coming year. (These are the first three steps of activity-based costing.)

The following information for the two loan products offered by Roseville Community Bank is for the month of July:

Actual cost driver activity levels for the month of July are as follows:

Required:

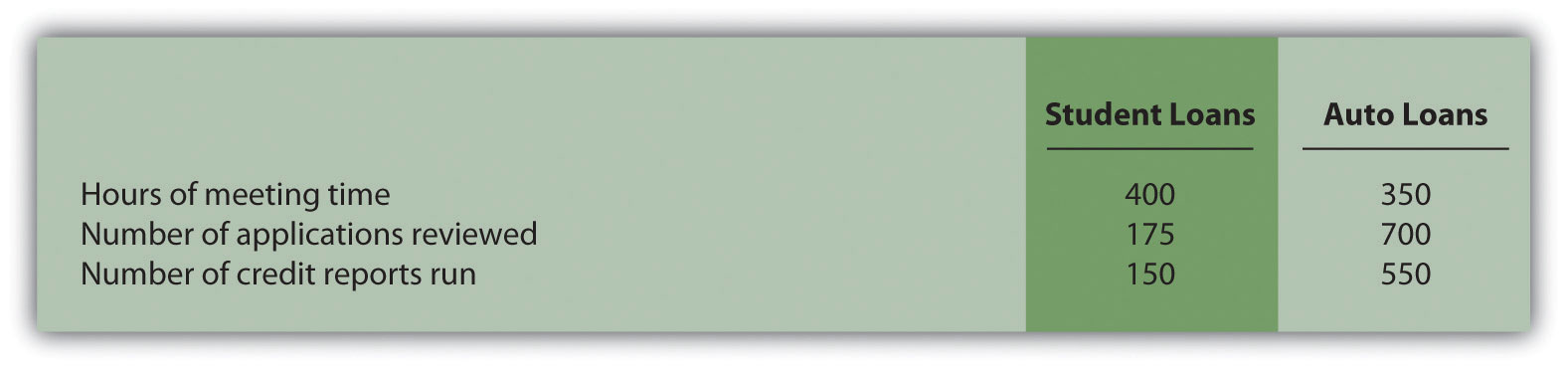

Activity-Based Costing Versus Traditional Approach: Service Company, Activity-Based Management. Hodges and Associates is a small firm that provides structural engineering services for its clients. The company performs structural engineering services for both residential and commercial buildings. Last year, total overhead costs of $330,000 were allocated based on direct labor costs. A total of $300,000 in direct labor costs were incurred in the following areas: $120,000 in the residential segment and $180,000 in the commercial segment. Direct materials used were negligible and are included in overhead costs. Sales revenue totaled $450,000 for residential services and $330,000 for commercial services.

The management of Hodges and Associates would like to use activity-based costing to allocate overhead rather than a plantwide rate based on direct labor costs. The following estimates are for the activities and related cost drivers identified as having the greatest impact on overhead costs.

Required:

Calculating and Recording Overhead Applied: Service Company. Assume Hodges and Associates, discussed in Problem 44, uses activity-based costing.

Required:

The following activity associated with the commercial product was reported for the month of September.

| Number of direct labor hours | 350 |

| Number of computer hours | 960 |

| Number of applications | 50 |

Using the predetermined overhead rates calculated in requirement a, determine the amount of overhead applied to the commercial product for the month of September.

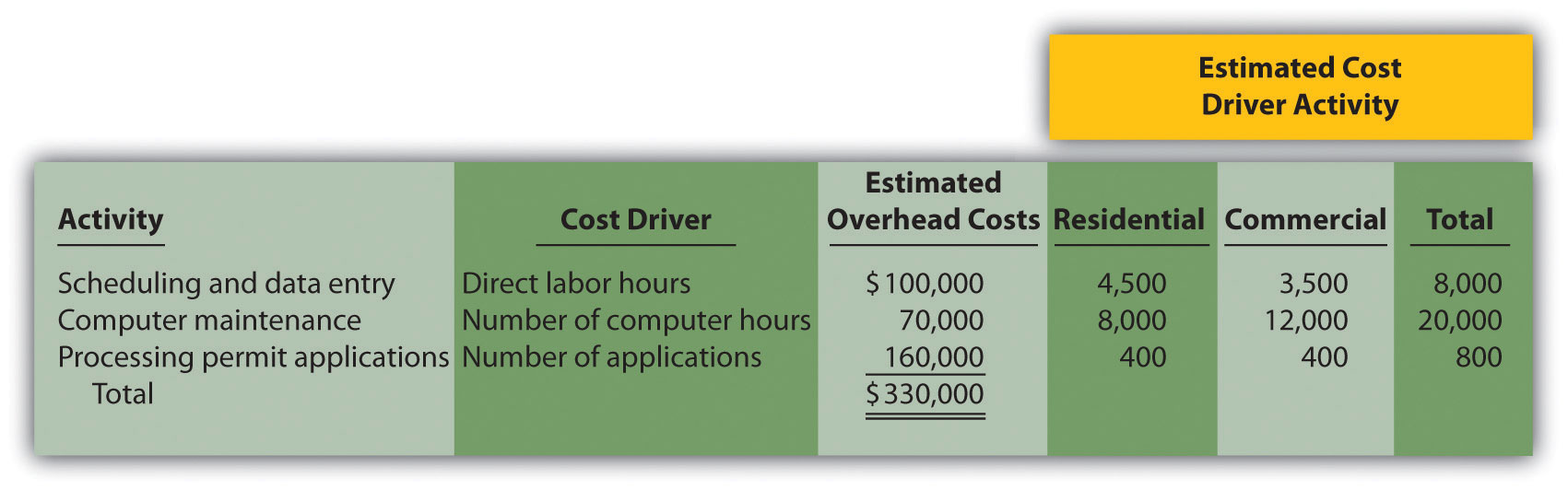

Allocating Service Department Costs. Szabo Industries has two production departments (Finishing and Painting) and three service departments (Maintenance, Computer Support, and Personnel). Service department costs are allocated to production departments using the direct method. Maintenance allocates costs totaling $3,000,000 based on the square footage of space occupied by each production department. Computer Support allocates costs totaling $4,000,000 based on hours of computer support used by each production department. Personnel allocates costs totaling $2,500,000 based on number of employees in each production department. Information for each production department follows.

Required:

Selecting an Allocation Base for Service Costs. Winstead, Inc., is looking for an appropriate allocation base to allocate personnel costs totaling $5,000,000. Service department costs are allocated to three production departments: Assembly, Sanding, and Finishing. Management is considering two allocation bases.

| Possible Allocation Base | Assembly | Sanding | Finishing |

| Number of employees | 30 | 20 | 50 |

| Square feet of space occupied | 25,000 | 15,000 | 10,000 |

Required:

One Step Further: Skill-Building Cases

Overhead Allocation. Do you agree with the following statement? Explain your answer.

Total estimated overhead costs will vary depending on whether we use the plantwide method, department method, or activity-based costing to allocate overhead.

Cost Allocation Issues. Assume you rent a house with two friends. The total monthly rent is $1,500. Your bedroom is the smallest of the three bedrooms, and each of the others has a bathroom attached. You and your friends are trying to decide how to divide up the rent. Two possibilities are being discussed.

Required:

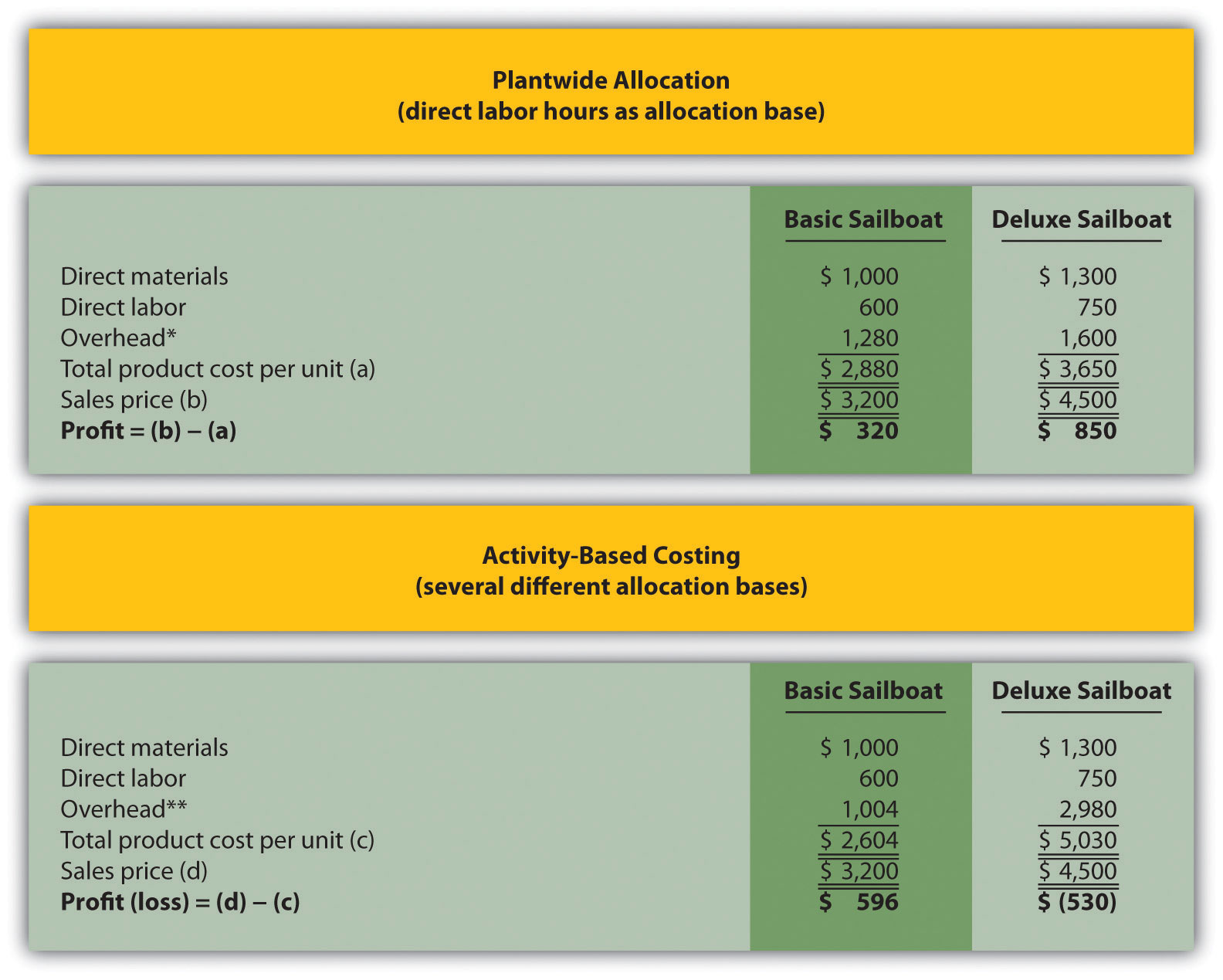

Changing Plantwide Allocation Rate at SailRite. Recall from the chapter discussion that SailRite uses one plantwide rate based on direct labor hours to allocate manufacturing overhead costs to the company’s two sailboat products—Basic and Deluxe. Management was concerned about the inaccuracy of overhead costs being assigned to each product and decided to calculate product costs using activity-based costing. Product cost and profit results are summarized in the following for the plantwide allocation approach (based on direct labor hours) and activity-based costing approach. This information was presented in the chapter in Figure 3.7 "Activity-Based Costing Versus Plantwide Costing at SailRite Company".

*Overhead taken from Figure 3.2 "SailRite Company Product Costs Using One Plantwide Rate Based on Direct Labor Hours".

**Overhead taken from Figure 3.5 "Allocation of Overhead Costs to Products at SailRite Company".

Although management of SailRite prefers the accuracy of activity-based costing, the cost of maintaining such an accounting system for the long term is prohibitive. John, the accountant, has proposed going back to using one plantwide rate, but he would like to allocate overhead costs using machine hours rather than direct labor hours.

Recall that overhead costs totaled $8,000,000. A total of 90,000 machine hours were used for the period: 50,000 for Basic sailboats and 40,000 for Deluxe sailboats. The company produced 5,000 units of the Basic model and 1,000 units of the Deluxe model. Thus the Basic model uses 10 machine hours per unit (= 50,000 machine hours ÷ 5,000 units) and the Deluxe model uses 40 machine hours per unit (= 40,000 machine hours ÷ 1,000 units).

Required:

Service Department Cost Allocation. Biotech, Inc., recently began providing cafeteria services to its employees. Because revenue from the sale of food at the cafeteria does not fully cover cafeteria expenses, Biotech must pay for the shortfall. These costs are allocated to production departments based on employee usage. That is, the company tracks which employees use the cafeteria and allocates costs to production departments accordingly.

Sarah Kolster, manager of the quality testing department, is not happy with receiving cafeteria cost allocations. She is evaluated based on meeting a cost budget established at the beginning of the fiscal year, which does not include the cafeteria allocation, and she clearly has an incentive to minimize costs.

When Sarah met with the company’s accountant, Dan, regarding this issue, she said, “Dan, I like the idea of providing cafeteria service to our employees, but the costs allocated to my department are killing my budget. Last month alone, I was allocated $3,000 in costs related to the new cafeteria. I have no choice but to require my employees to go elsewhere for food.”

Dan responded, “I understand your concern, Sarah. Management’s intent was to provide a service to our employees that would improve productivity and reward employees for their hard work. If you tell your employees to stop using the cafeteria, more costs will be allocated to other departments, and the other departments might also stop using the cafeteria. My belief is that the cafeteria will be self-sufficient within a year if more employees are encouraged to use it. This translates into no more cost allocations to departments within a year. I’ll discuss your concerns with top management later this week.”

Required:

Comprehensive Case

Activity-Based Costing, Journal Entries, T-Accounts, and Preparing an Income Statement. This problem is an adaptation of the example presented at the end of Chapter 2 "How Is Job Costing Used to Track Production Costs?" for Custom Furniture Company. The only difference is that this problem uses activity-based costing to allocate overhead costs rather than one plantwide rate. Recall that inventory beginning balances were $25,000 for raw materials inventory, $35,000 for work-in-process inventory, and $90,000 for finished goods inventory.

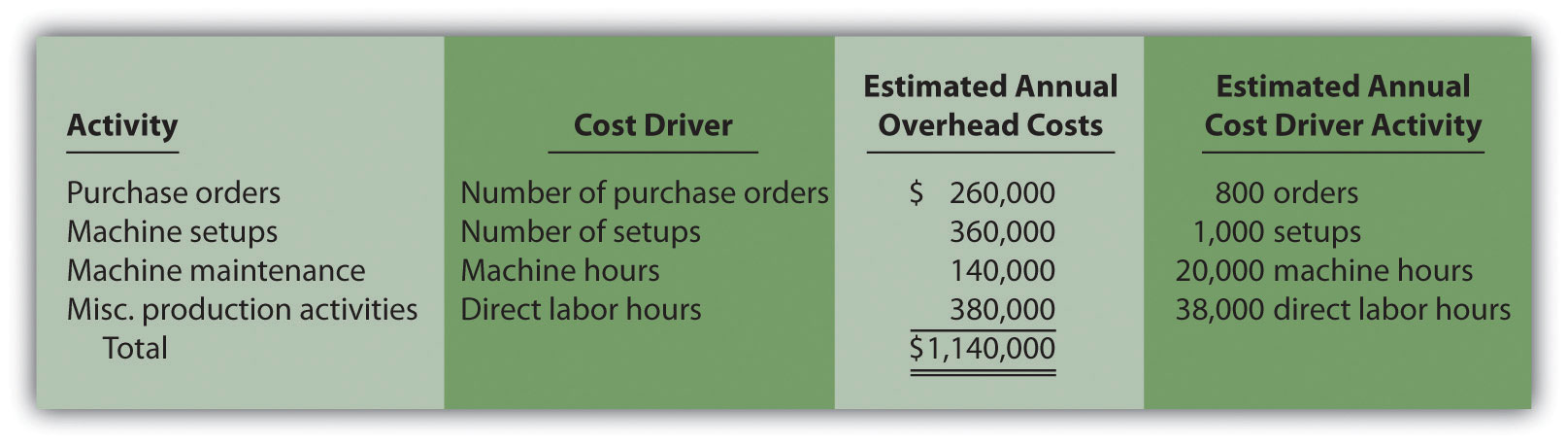

Management of Custom Furniture Company would like to use activity-based costing to allocate overhead costs totaling $1,140,000 rather than one plantwide rate based on direct labor hours. The following estimates are for the activities and related cost drivers identified as having the greatest impact on overhead costs.

Transactions for the month of May are shown as follows:

Manufacturing overhead is applied to products based on the following cost driver activity for the month:

| Number of purchase orders | 75 |

| Number of machine setups | 120 |

| Machine hours | 1,850 |

| Direct labor hours | 3,240 |

Required: