As products physically move through the production process, the product costs associated with these products move through several important accounts as shown back in Figure 4.1 "A Comparison of Cost Flows for Job Costing and Process Costing". In this section, we present a detailed look at how product costs flow through accounts using a process costing system. Later in the chapter, we explain how dollar amounts are established for product costs that flow through the accounts. As you review each of the following cost flows for a process costing system, remember that product costs are now tracked by department rather than by job.

Question: In a process costing setting, direct materials are often used by several production departments. How do we record direct materials costs for each production department?

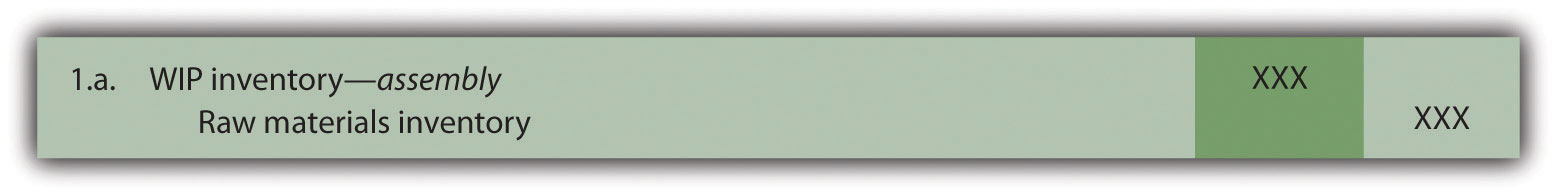

Answer: When direct materials are requisitioned from the raw materials storeroom, a journal entry is made to reduce the raw materials inventory account and increase the appropriate work-in-process inventory account. For example, assume the Assembly department of Desk Products, Inc., requisitions direct materials to be used in production. The journal entry to reflect this is as follows:

The use of direct materials is not limited to one production department. Suppose the Finishing department requisitions direct materials for production. The journal entry to reflect this is as follows:

Notice that two different work-in-process inventory accounts are used to track production costs—one for each department.

Question: Each production department typically has a direct labor work force. How do we record direct labor costs for each production department?

Answer: Direct labor costs are recorded directly in the production department’s work-in-process inventory account. Assume direct labor costs are incurred by the Assembly department. The journal entry to reflect this is as follows:

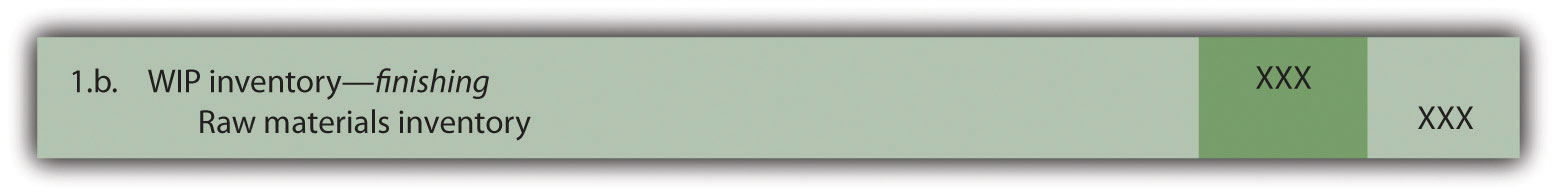

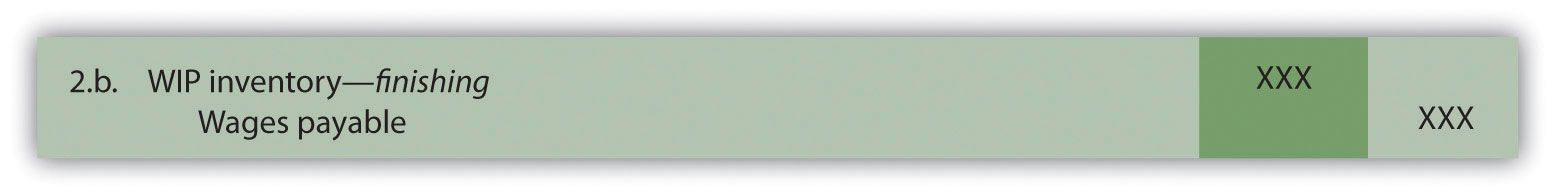

As with direct materials, the use of direct labor is not limited to one production department. Suppose direct labor costs are incurred by the Finishing department. The journal entry to reflect this is as follows:

Question: Manufacturing overhead costs are typically assigned to products using a predetermined overhead rate using a normal costing system as discussed in Chapter 2 "How Is Job Costing Used to Track Production Costs?" (job costing) and Chapter 3 "How Does an Organization Use Activity-Based Costing to Allocate Overhead Costs?" (activity-based costing). How do we record manufacturing overhead costs for each department?

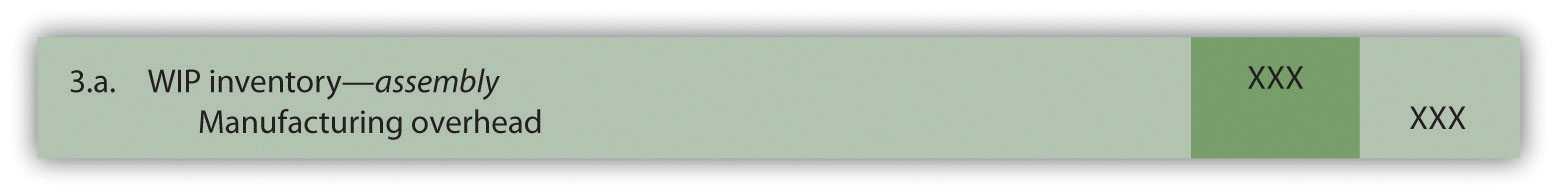

Answer: Assume manufacturing overhead costs (often simply called overhead costs) are being applied to products going through the Assembly department. The journal entry to reflect this is as follows:

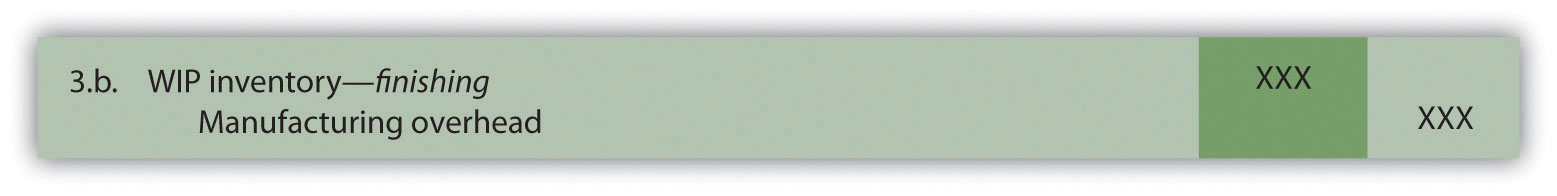

The journal entry to reflect manufacturing overhead costs being applied to products going through the Finishing department is as follows:

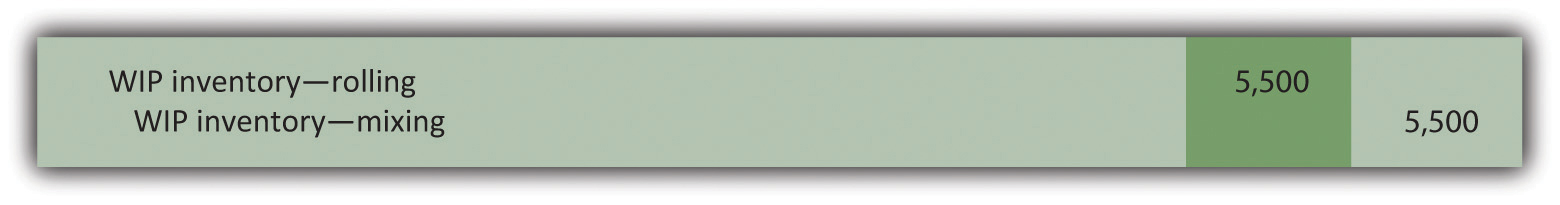

Question: At this point, we have discussed how to record product costs (direct materials, direct labor, and manufacturing overhead) related to each production department. As you review Figure 4.1 "A Comparison of Cost Flows for Job Costing and Process Costing", notice that products often flow from one production department to the next. Transferred-in costsCosts associated with products moving from one department to another. are the costs associated with products moving from one department to another. How do we record transferred-in costs for each department?

Answer: Assume the Assembly department at Desk Products, Inc., completes a batch of desks and moves the desks to the Finishing department. The costs associated with these desks must be transferred from the work-in-process inventory account for the Assembly department to the work-in-process inventory account for the Finishing department. Thus these costs are being transferred in to the Finishing department. The journal entry to reflect this is as follows:

Question: Goods are completed and ready to sell once they have gone through the final production department. The final production department at Desk Products, Inc., is the Finishing department. How do we record production costs for products moved from the final production department to the finished goods warehouse?

Answer: When goods go through the final production department and are completed, the related costs are moved to the finished goods inventory account. The journal entry to reflect this is as follows:

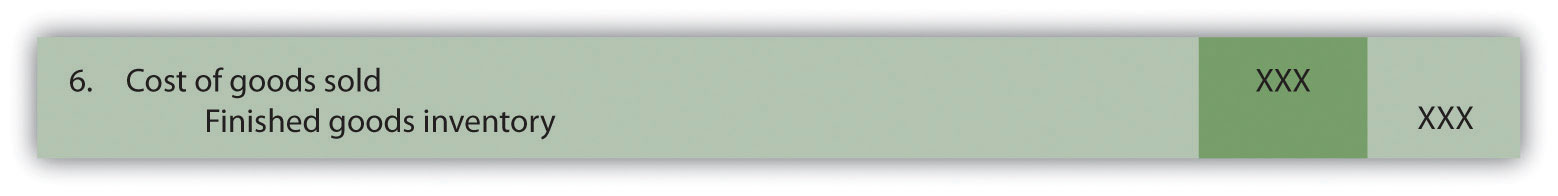

Question: How do we record production costs for goods that have been sold?

Answer: Once the completed goods are sold, the related costs are moved out of the finished goods inventory account and into the cost of goods sold account. The journal entry to reflect this is as follows:

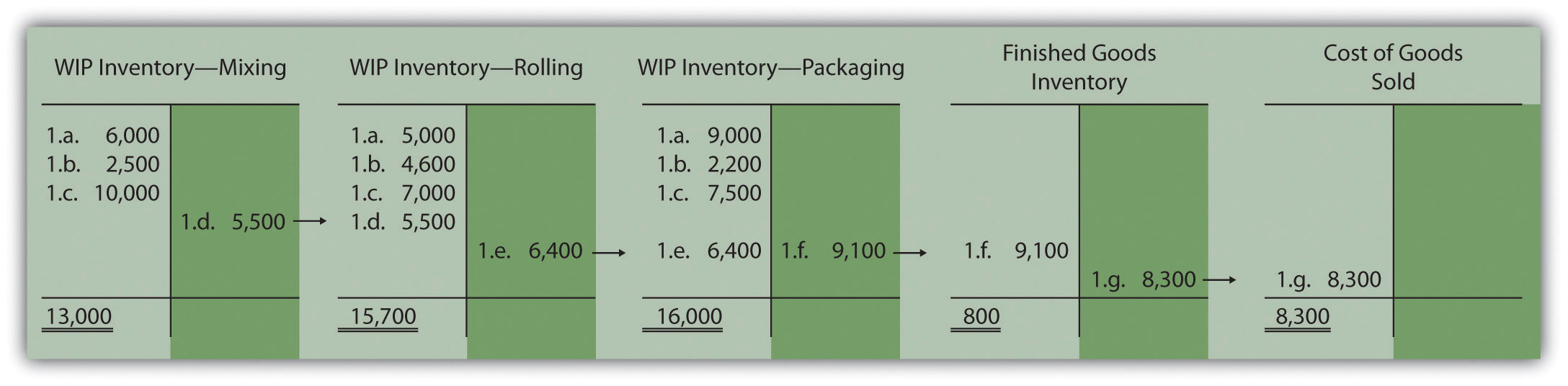

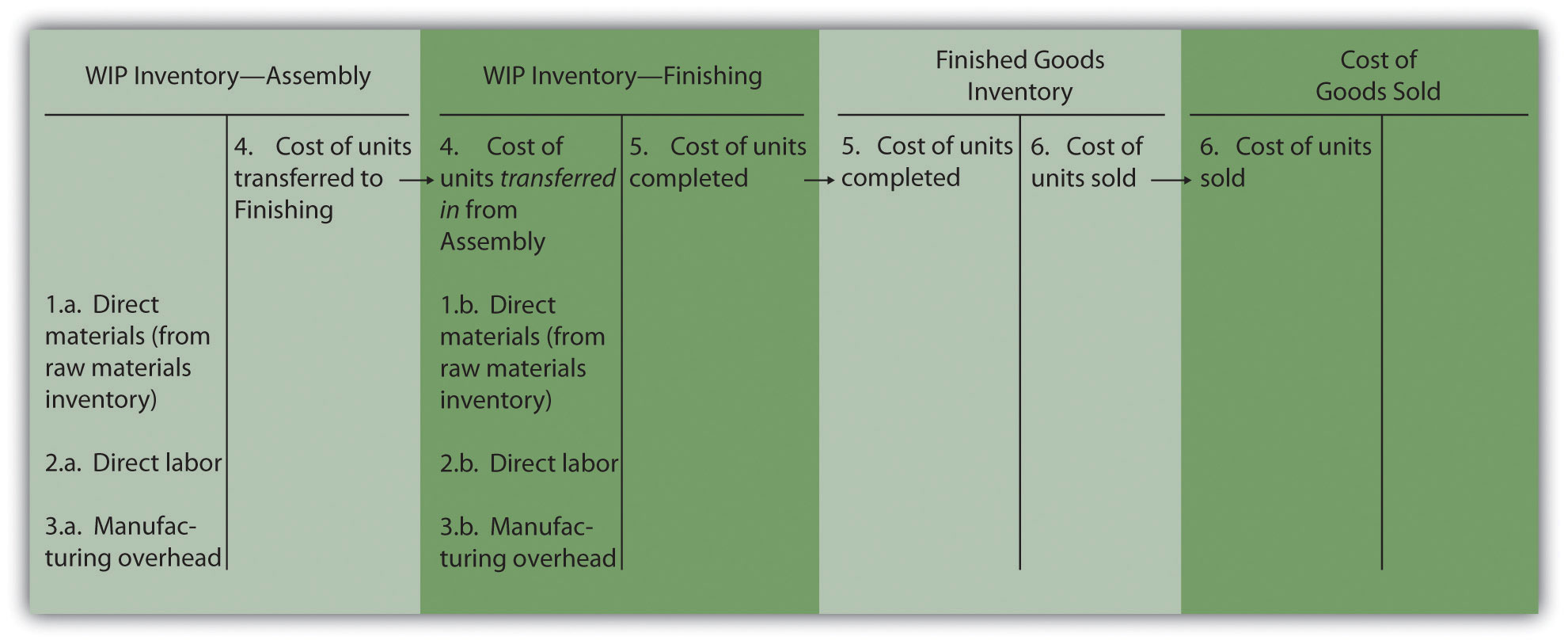

Figure 4.2 "Flow of Product Costs in a Process Costing System" summarizes the flow of product costs through T-accounts for each of the journal entries presented in this section. Note that when goods are sold and production costs are moved from finished goods inventory to cost of goods sold, an additional entry is made to record the revenue associated with this transaction. We do not show this entry because the focus of this section is on the flow of production costs rather than revenues.

Figure 4.2 Flow of Product Costs in a Process Costing System

Source: Photo courtesy of Mykl Roventine, http://www.flickr.com/photos/myklroventine/3471836813/.

The Production Process for Wrigley’s Gum

The Wrigley Company has 14 factories located in various parts of the world, including North America, Europe, Africa, India, and the Asia/Pacific region. The gum produced by these factories is sold in 150 countries. According to Wrigley Company, 50 percent of Americans chew gum, and on average, each person consumes 190 sticks per year. The number drops to 130 sticks per person in the United Kingdom and to 100 sticks per person in Taiwan.

The production process at Wrigley involves six sequential stages:

Because Wrigley produces identical units of product in batches employing a consistent process, it likely uses a process costing system. With such a system, Wrigley would need a separate work-in-process inventory account to track costs for each stage of the production process.

Source: Wrigley’s, “Home Page,” http://www.wrigley.com.

Chewy Gum Corporation produces bubble gum in large batches and uses a process costing system. Three departments—Mixing, Rolling, and Packaging—are involved in the production process. Chewy Gum has the following transactions:

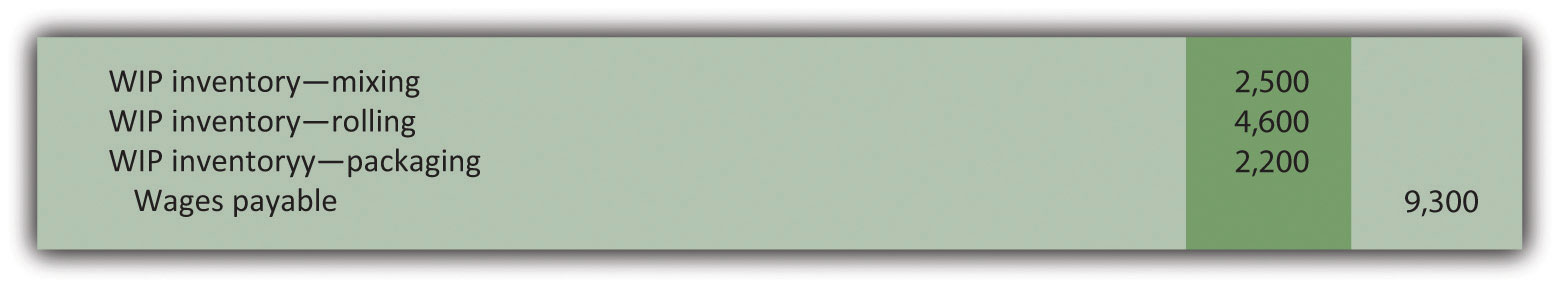

Each production department incurs the following direct labor costs (wages payable):

| Mixing | $2,500 |

| Rolling | $4,600 |

| Packaging | $2,200 |

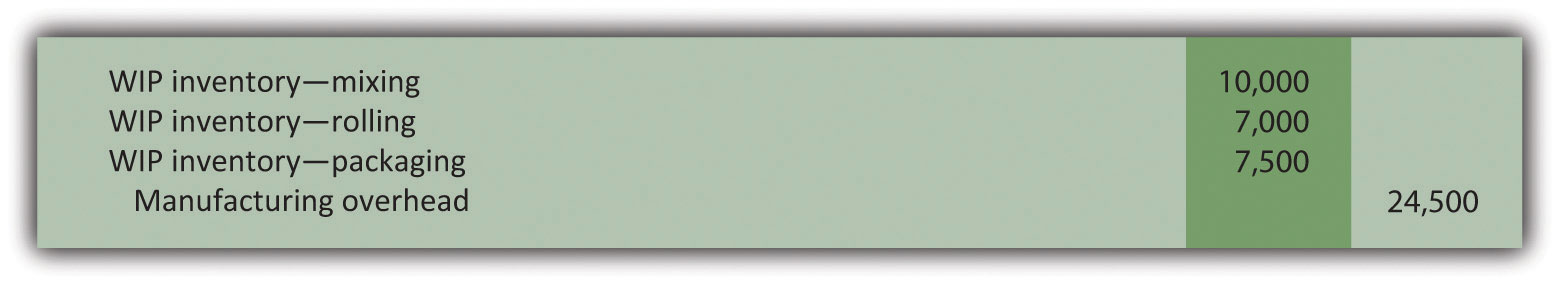

Manufacturing overhead costs are applied to each department as follows:

| Mixing | $10,000 |

| Rolling | $ 7,000 |

| Packaging | $ 7,500 |

Perform the following steps for each transaction:

Solution to Review Problem 4.2