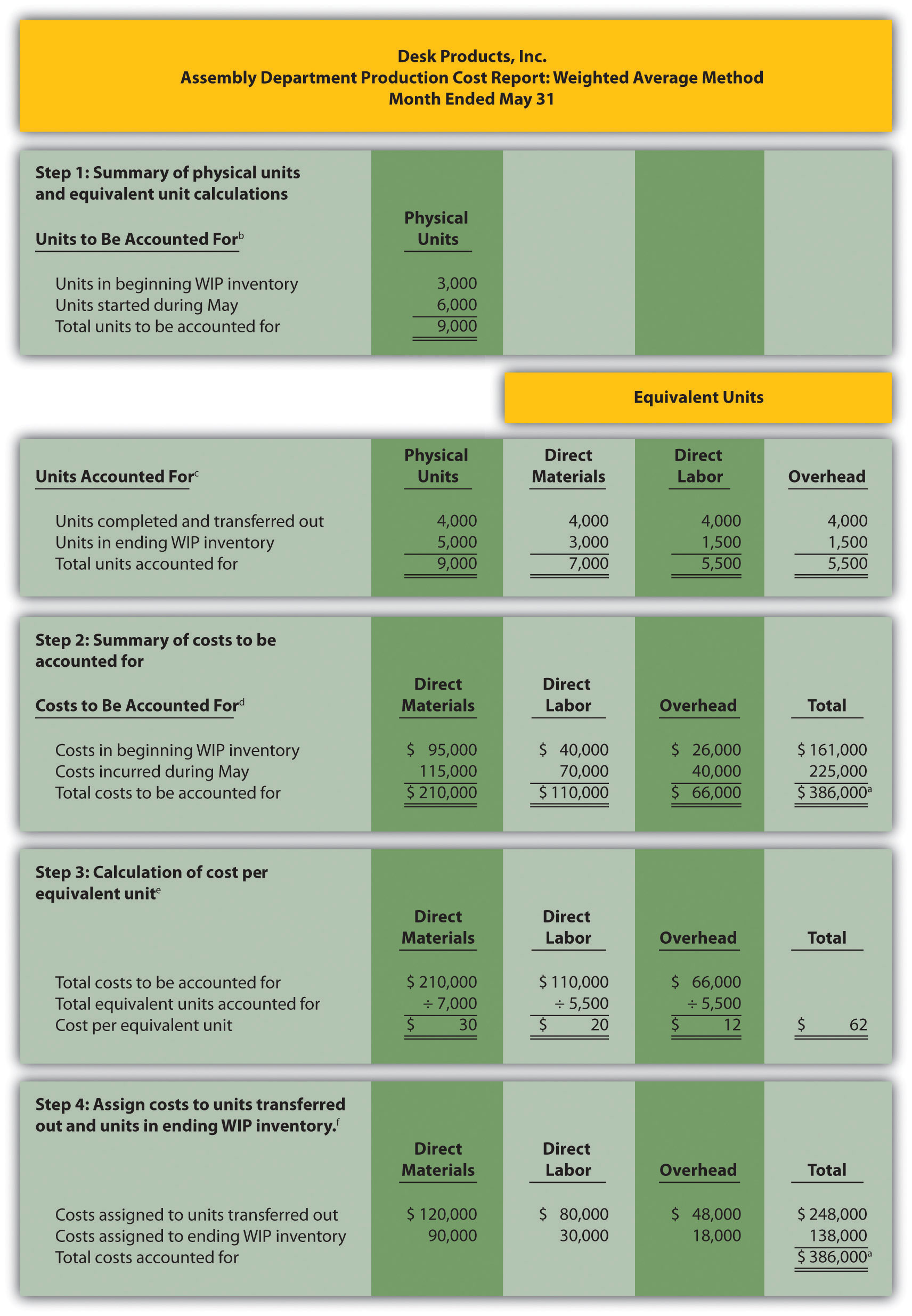

Question: The results of the four key steps are typically presented in a production cost report. The production cost reportA report that summarizes the production and cost activity within a department for a reporting period. summarizes the production and cost activity within a department for a reporting period. It is simply a formal summary of the four steps performed to assign costs to units transferred out and units in ending work-in-process (WIP) inventory. What does the production cost report look like for the Assembly department at Desk Products, Inc.?

Answer: The production cost report for the month of May for the Assembly department appears in Figure 4.9 "Production Cost Report for Desk Products’ Assembly Department". Notice that each section of this report corresponds with one of the four steps described earlier. We provide references to the following illustrations so you can review the detail supporting calculations.

Figure 4.9 Production Cost Report for Desk Products’ Assembly Department

a Total costs to be accounted for (step 2) must equal total costs accounted for (step 4).

b Data are given.

c This section comes from Figure 4.4 "Flow of Units and Equivalent Unit Calculations for Desk Products’ Assembly Department".

d This section comes from Figure 4.5 "Summary of Costs to Be Accounted for in Desk Products’ Assembly Department".

e This section comes from Figure 4.6 "Calculation of the Cost per Equivalent Unit for Desk Products’ Assembly Department".

f This section comes from Figure 4.7 "Assigning Costs to Products in Desk Products’ Assembly Department".

Question: Although the production cost report provides information needed to transfer costs from one account to another, managers also use this report for decision-making purposes. What important questions can be answered using the production cost report?

Answer: A production cost report helps managers answer several important questions:

Question: Why might the per unit cost data provided in the production cost report be misleading?

Answer: When using information from the production cost report, managers must be careful not to assume that all production costs are variable costs. The CEO of Desk Products, Inc., Ann Watkins, was told that the Assembly department cost for each desk totaled $62 for the month of May (from Figure 4.9 "Production Cost Report for Desk Products’ Assembly Department", step 3). However, if the company produces more or fewer units than were produced in May, the unit cost will change. This is because the $62 unit cost includes both variable and fixed costs (see Chapter 5 "How Do Organizations Identify Cost Behavior Patterns?" for a detailed discussion of fixed and variable costs).

Assume direct materials and direct labor are variable costs. In the Assembly department, the variable costs per unit associated with direct materials and direct labor of $50 (= $30 direct materials + $20 direct labor) will remain the same regardless of the level of production, within the relevant range. However, the remaining unit product cost of $12 associated with overhead must be analyzed further to determine the amount that is variable (e.g., indirect materials) and the amount that is fixed (e.g., factory rent). Managers must understand that fixed costs per unit will change depending on the level of production. More specifically, Ann Watkins must understand that the $62 unit cost in the Assembly department provided in the production cost report will change depending on the level of production. Chapter 5 "How Do Organizations Identify Cost Behavior Patterns?" provides a detailed presentation of how cost information can be separated into fixed and variable components for the purpose of providing managers with more useful information.

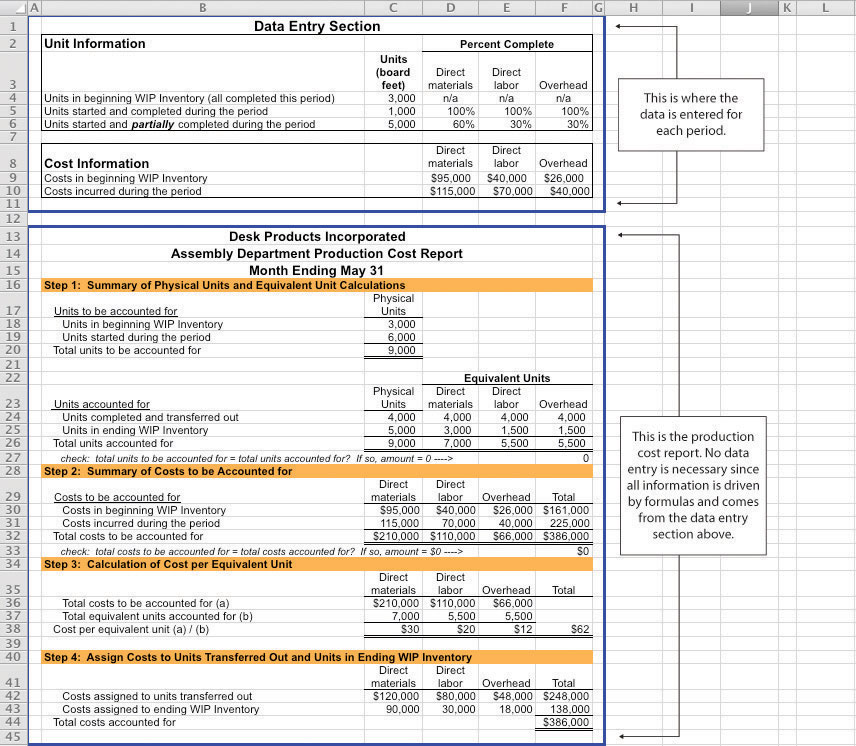

Using Excel to Prepare a Production Cost Report

Managers typically use computer software to prepare production cost reports. They do so for several reasons:

Review Figure 4.9 "Production Cost Report for Desk Products’ Assembly Department" and then ask yourself: “How can I use Excel to help prepare this report?” Answers will vary widely depending on your experience with Excel. However, Excel has a few basic features that can make the job of creating a production cost report easier. For example, you can use formulas to sum numbers in a column (note that each of the four steps presented in Figure 4.9 "Production Cost Report for Desk Products’ Assembly Department" has column totals) and to calculate the cost per equivalent unit. Also you can establish a separate line to double-check that

For those who want to add more complex features, the basic data (e.g., the data in Table 4.2 "Production Information for Desk Products’ Assembly Department") can be entered at the top of the spreadsheet and pulled down to the production cost report where necessary.

An example of how to use Excel to prepare a production cost report follows. Notice that the basic data are at the top of the spreadsheet, and the rest of the report is driven by formulas. Each month, the data at the top are changed to reflect the current month’s activity, and the production cost report takes care of itself.

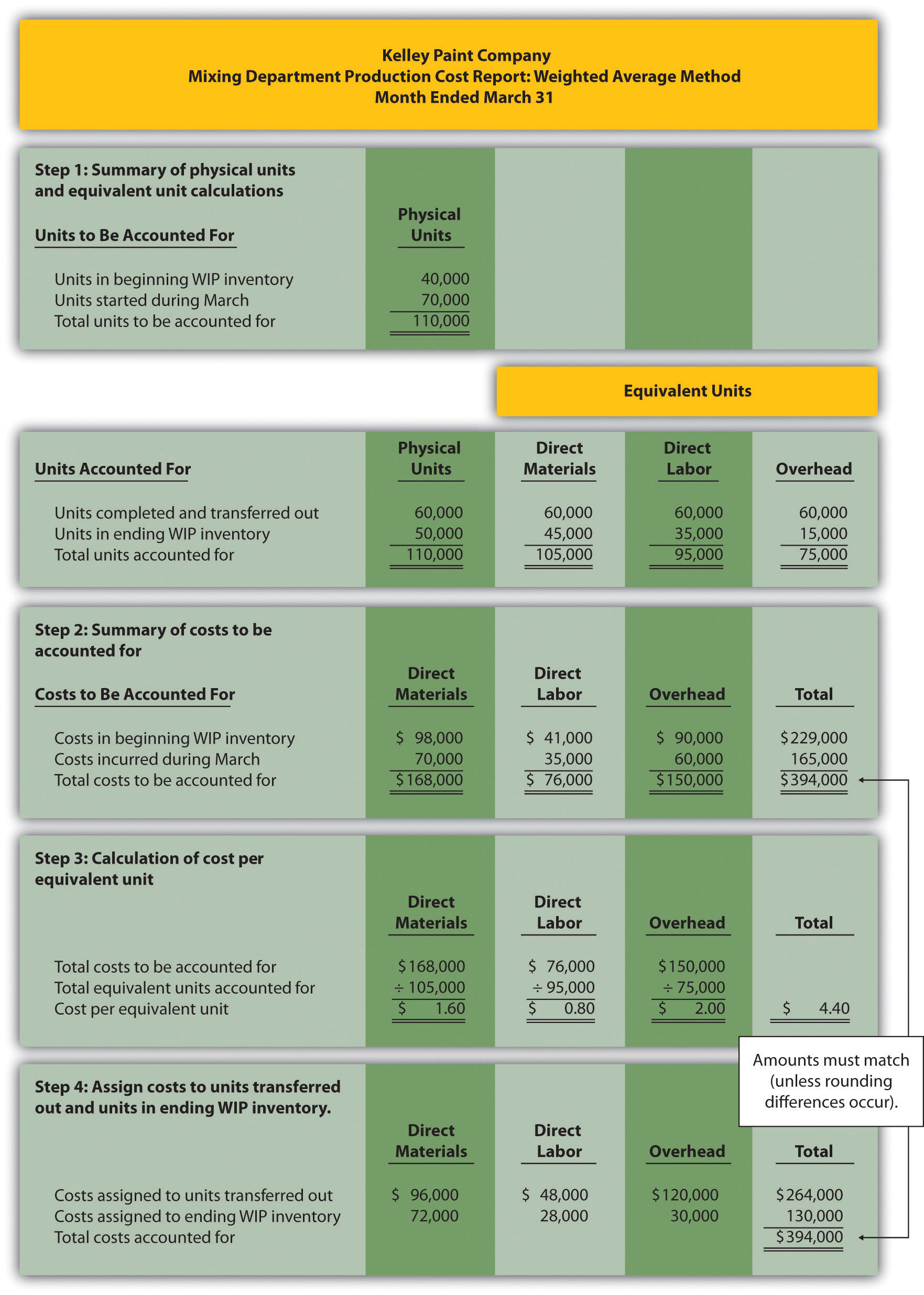

Using the information in Note 4.24 "Review Problem 4.4", prepare a production cost report for the Mixing department of Kelley Paint Company for the month ended March 31. (Hint: You have already completed the four key steps in Note 4.24 "Review Problem 4.4". Simply summarize the information in a production cost report as shown in Figure 4.9 "Production Cost Report for Desk Products’ Assembly Department".)

Solution to Review Problem 4.5

(See solutions to Note 4.24 "Review Problem 4.4" for detailed calculations.)

Questions

Brief Exercises

Product Costing at Desk Products, Inc. Refer to the dialogue presented at the beginning of the chapter.

Required:

Job Costing Versus Process Costing. For each firm listed in the following, identify whether it would use job costing or process costing.

Process Costing Journal Entries. Assume a company has two processing departments—Molding and Packaging. Transactions for the month are shown as follows.

Required:

Prepare journal entries to record transactions 1 through 5.

Calculating Equivalent Units. Complete the requirements for each item in the following.

Calculating Cost per Equivalent Unit. The following information pertains to the Finishing department for the month of June.

| Direct Materials | Direct Labor | Overhead | |

| Total costs to be accounted for | $100,000 | $200,000 | $300,000 |

| Total equivalent units accounted for | 10,000 units | 8,000 units | 8,000 units |

Required:

Calculate the cost per equivalent unit for direct materials, direct labor, overhead, and in total. Show your calculations.

Assigning Costs to Completed Units and to Units in Ending WIP Inventory. The following information is for the Painting department for the month of January.

| Direct Materials | Direct Labor | Overhead | |

| Cost per equivalent unit | $2.10 | $1.50 | $3.80 |

| Equivalent units completed and transferred out | 3,000 units | 3,000 units | 3,000 units |

| Equivalent units in ending WIP inventory | 1,000 units | 1,200 units | 1,200 units |

Required:

Exercises: Set A

Assigning Costs to Products: Weighted Average Method. Sydney, Inc., uses the weighted average method for its process costing system. The Assembly department at Sydney, Inc., began April with 6,000 units in work-in-process inventory, all of which were completed and transferred out during April. An additional 8,000 units were started during the month, 3,000 of which were completed and transferred out during April. A total of 5,000 units remained in work-in-process inventory at the end of April and were at varying levels of completion, as shown in the following.

| Direct materials | 40 percent complete |

| Direct labor | 30 percent complete |

| Overhead | 50 percent complete |

The following cost information is for the Assembly department at Sydney, Inc., for the month of April.

| Direct Materials | Direct Labor | Overhead | Total | |

| Beginning WIP inventory | $300,000 | $350,000 | $250,000 | $900,000 |

| Incurred during the month | $180,000 | $200,000 | $170,000 | $550,000 |

Required:

Process Costing Journal Entries. Silva Piping Company produces PVC piping in two processing departments—Fabrication and Packaging. Transactions for the month of July are shown as follows.

Direct labor costs (wages payable) are incurred by each department as follows:

| Fabrication | $4,500 |

| Packaging | $6,700 |

Manufacturing overhead costs are applied to each department as follows:

| Fabrication | $20,000 |

| Packaging | $14,000 |

Products with a cost of $31,000 are sold to customers.

Required:

Exercises: Set B

Assigning Costs to Products: Weighted Average Method. Varian Company uses the weighted average method for its process costing system. The Molding department at Varian began the month of January with 80,000 units in work-in-process inventory, all of which were completed and transferred out during January. An additional 90,000 units were started during the month, 30,000 of which were completed and transferred out during January. A total of 60,000 units remained in work-in-process inventory at the end of January and were at varying levels of completion, as shown in the following.

| Direct materials | 80 percent complete |

| Direct labor | 90 percent complete |

| Overhead | 90 percent complete |

The following cost information is for the Molding department at Varian Company for the month of January.

| Direct Materials | Direct Labor | Overhead | Total | |

| Beginning WIP inventory | $1,400,000 | $1,100,000 | $1,700,000 | $4,200,000 |

| Incurred during the month | $1,210,000 | $ 980,000 | $1,450,000 | $3,640,000 |

Required:

Process Costing Journal Entries. Westside Chemicals produces paint thinner in three processing departments—Mixing, Testing, and Packaging. Transactions for the month of September are shown as follows.

Direct labor costs (wages payable) incurred by each department are as follows:

| Mixing | $35,000 |

| Testing | $25,000 |

| Packaging | $18,000 |

Manufacturing overhead costs are applied to each department as follows:

| Mixing | $17,500 |

| Testing | $12,500 |

| Packaging | $ 6,000 |

Required:

Problems

Production Cost Report: Weighted Average Method. Calvin Chemical Company produces a chemical used in the production of silicon wafers. Calvin Chemical uses the weighted average method for its process costing system. The Mixing department at Calvin Chemical began the month of June with 5,000 units (gallons) in work-in-process inventory, all of which were completed and transferred out during June. An additional 15,000 units were started during the month, 11,000 of which were completed and transferred out during June. A total of 4,000 units remained in work-in-process inventory at the end of June and were at varying levels of completion, as shown in the following.

| Direct materials | 60 percent complete |

| Direct labor | 40 percent complete |

| Overhead | 40 percent complete |

The cost information is as follows:

Costs in beginning work-in-process inventory

| Direct materials | $8,000 |

| Direct labor | $3,000 |

| Overhead | $2,800 |

Costs incurred during the month

| Direct materials | $21,000 |

| Direct labor | $ 8,500 |

| Overhead | $ 7,200 |

Required:

Production Cost Report: Weighted Average Method. Quality Confections Company manufactures chocolate bars in two processing departments, Mixing and Packaging, and uses the weighted average method for its process costing system. The table that follows shows information for the Mixing department for the month of March.

| Unit Information (Measured in Pounds) | Mixing |

| Beginning work-in-process inventory | 8,000 |

| Started or transferred in during the month | 230,000 |

| Ending work-in-process inventory: 80 percent materials, 70 percent labor, and 60 percent overhead | 6,000 |

| Cost Information | |

| Beginning Work-in-Process Inventory | |

| Direct materials | $ 3,000 |

| Direct labor | $ 1,500 |

| Overhead | $ 2,200 |

| Costs Incurred during the Period | |

| Direct materials | $103,000 |

| Direct labor | $ 55,000 |

| Overhead | $ 81,000 |

Required:

Production Cost Report and Journal Entries: Weighted Average Method. Wood Products, Inc., manufactures plywood in two processing departments, Milling and Sanding, and uses the weighted average method for its process costing system. The table that follows shows information for the Milling department for the month of April.

| Unit Information (Measured in Feet) | Milling |

| Beginning work-in-process inventory | 24,000 |

| Started or transferred in during the month | 110,000 |

| Ending work-in-process inventory: 80 percent materials, 70 percent labor, and 60 percent overhead | 32,000 |

| Cost Information | |

| Beginning Work-in-Process Inventory | |

| Direct materials | $ 9,000 |

| Direct labor | $ 3,000 |

| Overhead | $ 3,200 |

| Costs Incurred during the Period | |

| Direct materials | $45,000 |

| Direct labor | $14,000 |

| Overhead | $16,000 |

Required:

For the Milling department at Wood Products, Inc., prepare journal entries to record:

One Step Further: Skill-Building Cases

Internet Project: Production Company Plant Tour. Using the Internet, find a company that provides a virtual tour of its production processes. Document your findings by completing the following requirements.

Required:

Process Costing at Coca-Cola. Refer to Note 4.4 "Business in Action 4.1".

Required:

Process Costing at Wrigley. Refer to Note 4.9 "Business in Action 4.2".

Required:

Group Activity: Job or Process Costing? Form groups of two to four students. Each group should determine whether a process costing or job costing system is most likely used to calculate product costs for each item listed in the following and should be prepared to explain its answers.

Comprehensive Cases

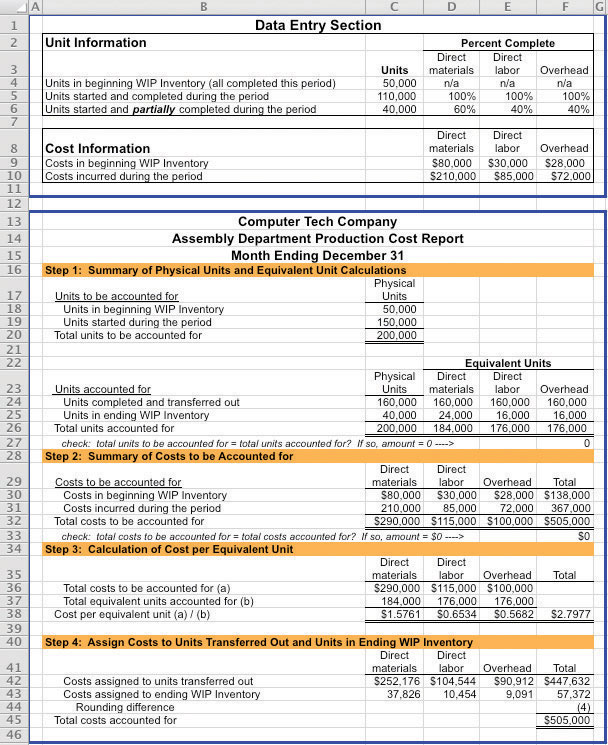

Ethics: Manipulating Percentage of Completion Estimates. Computer Tech Corporation produces computer keyboards, and its fiscal year ends on December 31. The weighted average method is used for the company’s process costing system. As the controller of Computer Tech, you present December’s production cost report for the Assembly department to the president of the company. The Assembly department is the last processing department before goods are transferred to finished goods inventory. All 160,000 units completed and transferred out during the month were sold by December 31.

The board of directors at Computer Tech established a compensation incentive plan that includes a substantial bonus for the president of the company if annual net income before taxes exceeds $2,000,000. Preliminary figures show current year net income before taxes totaling $1,970,000, which is short of the target by $30,000. The president approaches you and asks you to increase the percentage of completion for the 40,000 units in ending WIP inventory to 90 percent for direct materials and to 95 percent for direct labor and overhead. Even though you are confident in the percentages used to prepare the production cost report, which appears as follows, the president insists that his change is minor and will have little impact on how investors and creditors view the company.

Required:

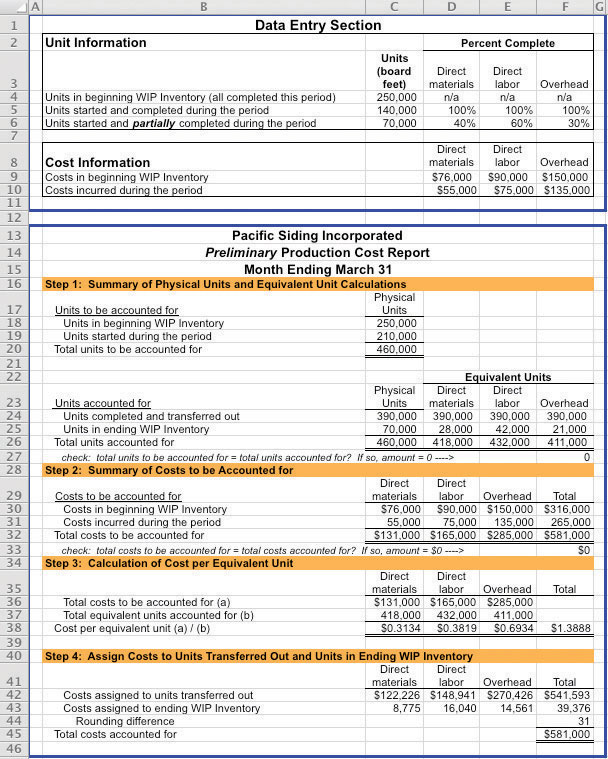

Ethics: Increasing Production to Boost Profits. Pacific Siding, Inc., produces synthetic wood siding used in the construction of residential and commercial buildings. Pacific Siding’s fiscal year ends on March 31, and the weighted average method is used for the company’s process costing system.

Financial results for the first 11 months of the current fiscal year (through February 28) are well below expectations of management, owners, and creditors. Halfway through the month of March, the chief executive officer and chief financial officer asked the controller to estimate the production results for the month of March in the form of a production cost report (the company only has one production department). This report is shown as follows.

Armed with the preliminary production cost report for March, and knowing that the company’s production is well below capacity, the CEO and CFO decide to produce as many units as possible for the last half of March even though sales are not expected to increase any time soon. The production manager is told to push his employees to get as far as possible with production, thereby increasing the percentage of completion for ending WIP inventory. However, since the production process takes three weeks to complete, all the units produced in the last half of March will be in WIP inventory at the end of March.

Required:

Using the following assumptions, prepare a revised estimate of production results in the form of a production cost report for the month of March.

Assumptions based on the CEO and CFO’s request to boost production