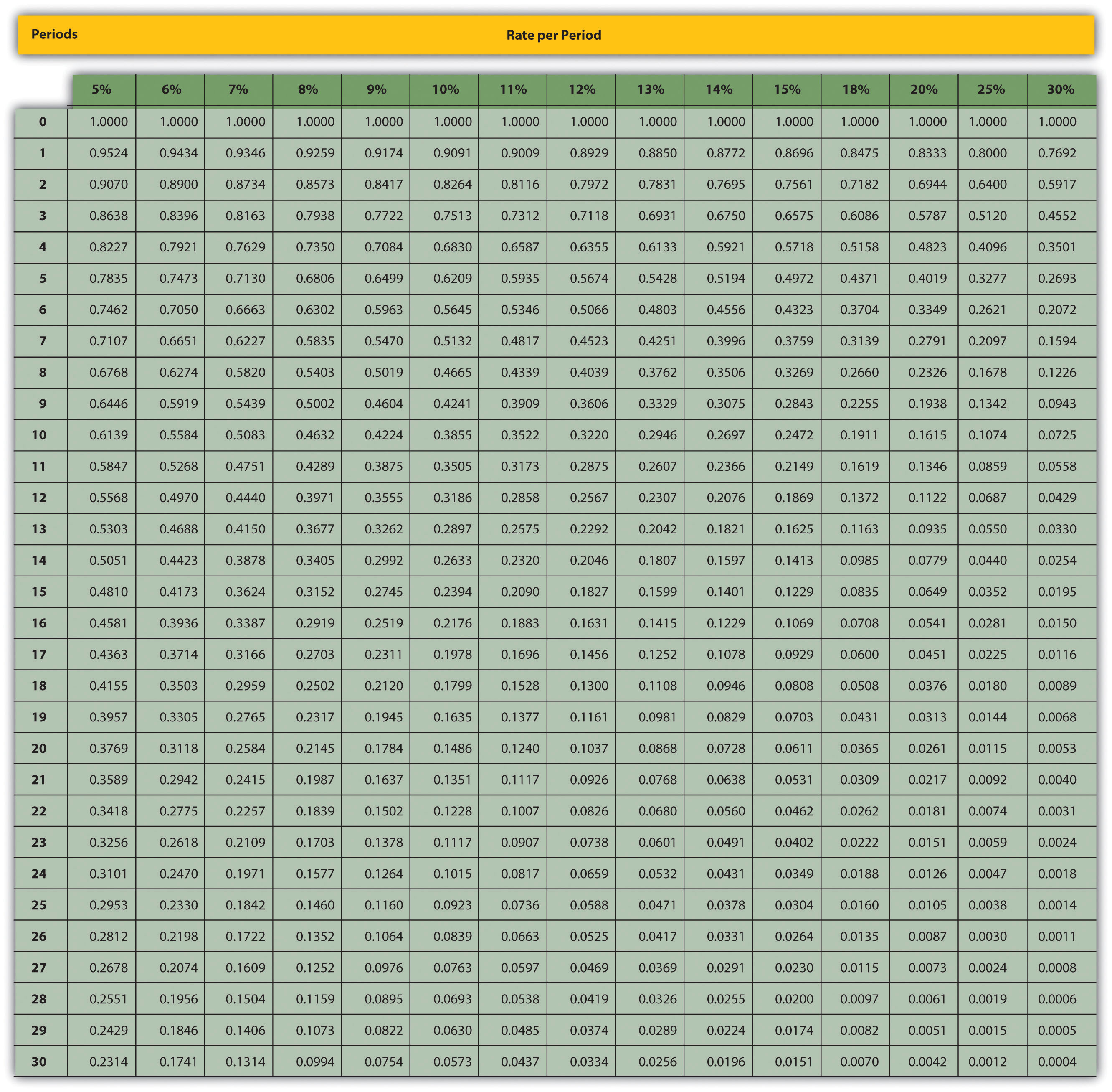

Figure 8.9 Present Value of $1 Received at the End of n Periods

Note:

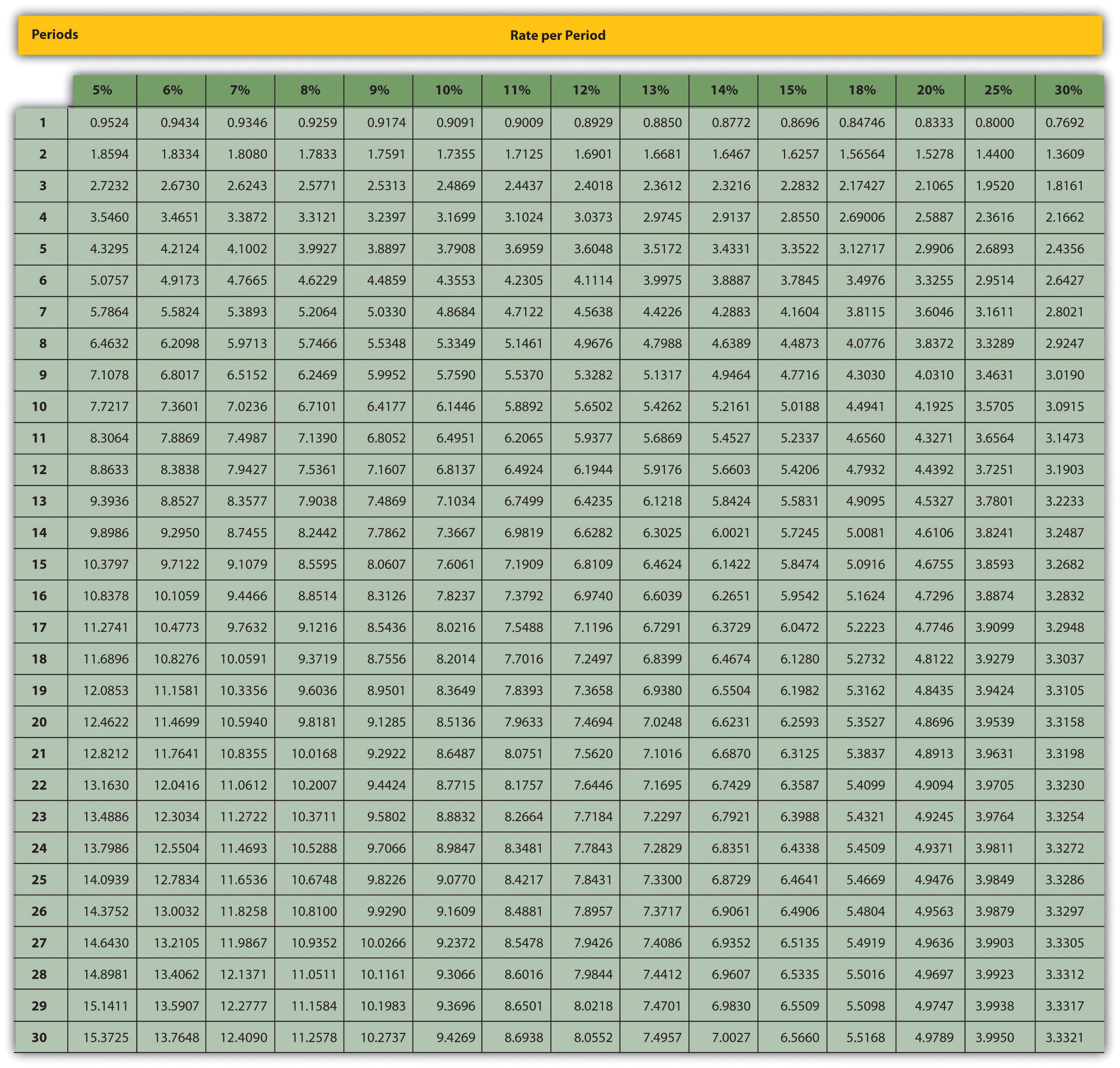

Figure 8.10 Present Value of a $1 Annuity Received at the End of Each Period for n Periods

Note:

Questions

Brief Exercises

Present Value Calculations. For each of the following independent scenarios, use Figure 8.9 "Present Value of $1 Received at the End of " in the appendix to calculate the present value of the cash flow described.

Present Value Calculations (Annuities). For each of the following independent scenarios, use Figure 8.10 "Present Value of a $1 Annuity Received at the End of Each Period for " in the appendix to calculate the present value of the cash flow described. Round to the nearest dollar.

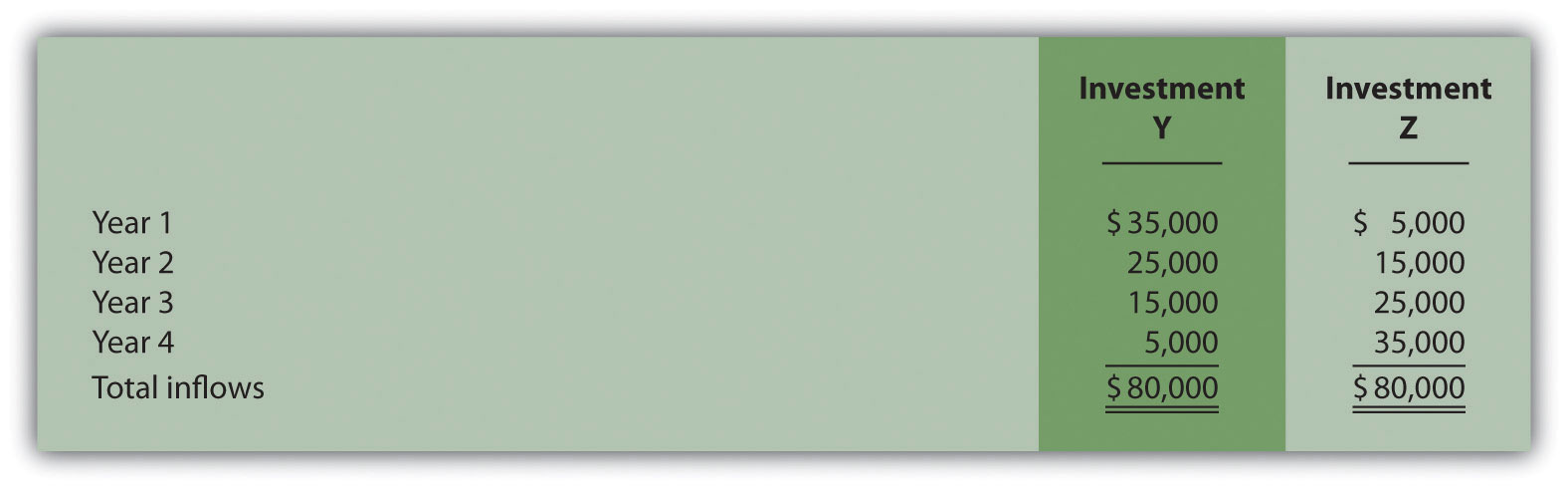

Net Present Value Calculations. Freefall, Inc., has two independent investment opportunities, each requiring an initial investment of $65,000. The company’s required rate of return is 8 percent. The cash inflows for each investment are provided as follows.

Required:

Ethical Issues in Making a Capital Budgeting Decision. Assume the manager of a store earns an annual bonus based on meeting a certain level of net income, which has been achieved consistently over the past five years. The company is currently considering the addition of a second store, which is expected to become profitable after two years. The manager is responsible for making the final decision whether the second store should be opened and would receive an annual bonus only if a certain level of net income were achieved for both stores combined.

Why might the manager refuse to invest in the new store even though the investment is projected to achieve a return greater than the company’s required rate of return?

Exercises: Set A

Net Present Value Analysis. Architect Services, Inc., would like to purchase a blueprint machine for $50,000. The machine is expected to have a life of 4 years, and a salvage value of $10,000. Annual maintenance costs will total $14,000. Annual savings are predicted to be $30,000. The company’s required rate of return is 11 percent.

Required:

Internal Rate of Return Analysis. Architect Services, Inc., would like to purchase a blueprint machine for $50,000. The machine is expected to have a life of 4 years, and a salvage value of $10,000. Annual maintenance costs will total $14,000. Annual savings are predicted to be $30,000. The company’s required rate of return is 11 percent (this is the same data as the previous exercise).

Required:

Net Present Value Analysis with Multiple Investments, Alternative Format. Conway Construction Corporation would like to purchase a fleet of trucks at a cost of $260,000. Additional equipment needed to maintain the fleet of trucks will be purchased at the end of year 2 for $40,000. The trucks are expected to have a life of 8 years, and a salvage value of $20,000. Annual costs for maintenance, insurance, and other cash expenses will total $42,000. Annual net cash receipts resulting from this purchase are predicted to be $135,000. The company’s required rate of return is 14 percent.

Required:

Calculating NPV and IRR Using Excel. Wood Products Company would like to purchase a computerized wood lathe for $100,000. The machine is expected to have a life of 5 years, and a salvage value of $5,000. Annual maintenance costs will total $20,000. Annual net cash receipts resulting from this machine are predicted to be $45,000. The company’s required rate of return is 15 percent.

Required:

Net Present Value Analysis with Taxes. Timberline Company would like to purchase a new machine for $100,000. The machine will have a life of 5 years with no salvage value, and is expected to generate annual cash revenue of $50,000. Annual cash expenses, excluding depreciation, will total $24,000. The company uses the straight-line depreciation method, has a tax rate of 40 percent, and requires a 12 percent rate of return.

Required:

Exercises: Set B

Net Present Value Analysis. Wood Products Company would like to purchase a computerized wood lathe for $100,000. The machine is expected to have a life of 5 years, and a salvage value of $5,000. Annual maintenance costs will total $20,000. Annual net cash receipts resulting from this machine are predicted to be $45,000. The company’s required rate of return is 15 percent.

Required:

Internal Rate of Return Analysis. Wood Products Company would like to purchase a computerized wood lathe for $100,000. The machine is expected to have a life of 5 years, and a salvage value of $5,000. Annual maintenance costs will total $20,000. Annual net cash receipts resulting from this machine are predicted to be $45,000. The company’s required rate of return is 15 percent (this is the same data as the previous exercise).

Required:

Net Present Value Analysis and Qualitative Factors, Alternative Format. Pete’s Plumbing Supplies would like to expand into a new warehouse at a cost of $500,000. The warehouse is expected to have a life of 20 years, and a salvage value of $100,000. Annual costs for maintenance, insurance, and other cash expenses will total $60,000. Annual net cash receipts resulting from this expansion are predicted to be $115,000. The company’s required rate of return is 12 percent.

Required:

Calculating NPV and IRR Using Excel. Pete’s Plumbing Supplies would like to expand into a new warehouse at a cost of $500,000. The warehouse is expected to have a life of 20 years, and a salvage value of $100,000. Annual costs for maintenance, insurance, and other cash expenses will total $60,000. Annual net cash receipts resulting from this expansion are predicted to be $115,000. The company’s required rate of return is 12 percent.

Required:

Net Present Value Analysis with Taxes. Quality Chocolate, Inc., would like to purchase a new machine for $200,000. The machine will have a life of 4 years with no salvage value, and is expected to generate annual cash revenue of $90,000. Annual cash expenses, excluding depreciation, will total $10,000. The company uses the straight-line depreciation method, has a tax rate of 30 percent, and requires a 14 percent rate of return.

Required:

Problems

Evaluating Alternative Investments. Washington Brewery has two independent investment opportunities to purchase brewing equipment so the company can meet growing customer demand. The first option (equipment A) requires an initial investment of $230,000 for equipment with an expected life of 5 years and a salvage value of $20,000. The second option (equipment B) requires an initial investment of $120,000 for equipment with an expected life of 4 years and a salvage value of $15,000. The company’s required rate of return is 10 percent. Additional cash flow information for each investment is provided as follows.

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

|---|---|---|---|---|---|

| Equipment A | |||||

| Utility savings | $ 12,000 | $ 14,000 | $ 15,000 | $ 16,000 | $ 17,000 |

| Additional revenue | 45,000 | 48,000 | 50,000 | 55,000 | 60,000 |

| Maintenance costs | (5,000) | (8,000) | (10,000) | (13,000) | (16,000) |

| Equipment B | |||||

| Utility savings | $ 8,000 | $ 9,000 | $ 10,000 | $ 10,000 | - |

| Additional revenue | 35,000 | 36,000 | 38,000 | 42,000 | - |

| Maintenance costs | (6,000) | (8,000) | (9,000) | (11,000) | - |

Required:

Net Present Value, Internal Rate of Return, and Payback Period Analyses. Sherwin Moore Paint Company would like to further automate its production process by purchasing production equipment for $660,000. The equipment is expected to have a useful life of 8 years, and will be sold at the end of 8 years for $40,000. The equipment requires significant maintenance work at an annual cost of $75,000. Labor and material cost savings, shown in the table, are also expected to be significant.

| Year 1 | $160,000 |

| Year 2 | $190,000 |

| Year 3 | $200,000 |

| Year 4 | $240,000 |

| Year 5 | $280,000 |

| Year 6 | $220,000 |

| Year 7 | $180,000 |

| Year 8 | $155,000 |

The company’s required rate of return is 11 percent. Assume the company requires all investments to be recovered within five years.

Required:

Calculating NPV and IRR Using Excel. Sherwin Moore Paint Company would like to further automate its production process by purchasing production equipment for $660,000. The equipment is expected to have a useful life of 8 years, and will be sold at the end of 8 years for $40,000. The equipment requires significant maintenance work at an annual cost of $75,000. Labor and material cost savings, shown in the table, are also expected to be significant.

| Year 1 | $160,000 |

| Year 2 | $190,000 |

| Year 3 | $200,000 |

| Year 4 | $240,000 |

| Year 5 | $280,000 |

| Year 6 | $220,000 |

| Year 7 | $180,000 |

| Year 8 | $155,000 |

The company’s required rate of return is 11 percent.

Required:

Net Present Value Analysis, Multiple Investments, and Qualitative Factors. Oil Production, Inc., would like to drill oil from land the company already owns. The equipment is expected to cost $4,000,000, has a useful life of 5 years, and will be sold at the end of 5 years for $400,000. Annual costs for maintenance and other cash expenses will total $550,000. Annual net cash receipts resulting from the sale of oil are predicted to be $1,900,000. Working capital of $270,000 is required at the beginning of the project and will be returned at the end of 5 years. The equipment will require refurbishing at the end of year 3 at a cost of $300,000. Although the company’s cost of capital is 15 percent, management established a required rate of return of 20 percent due to the high risk associated with this project.

Required:

Calculating NPV and IRR Using Excel. Oil Production, Inc., would like to drill oil from land the company already owns. The equipment is expected to cost $4,000,000, has a useful life of 5 years, and will be sold at the end of 5 years for $400,000. Annual costs for maintenance and other cash expenses will total $550,000. Annual net cash receipts resulting from the sale of oil are predicted to be $1,900,000. Working capital of $270,000 is required at the beginning of the project and will be returned at the end of 5 years. The equipment will require refurbishing at the end of year 3 at a cost of $300,000. Although the company’s cost of capital is 15 percent, management established a required rate of return of 20 percent due to the high risk associated with this project.

Required:

Net Present Value, Internal Rate of Return, and Payback Period Analyses; Ethical Issues. Tower CD Stores would like to open a retail store in Houston. The initial investment to purchase the building is $420,000, and an additional $50,000 in working capital is required. Since this store will be operating for many years, the working capital will not be returned in the near future. Tower expects to remodel the store at the end of 3 years at a cost of $100,000. Annual net cash receipts from daily operations (cash receipts minus cash payments) are expected to be as follows.

| Year 1 | $ 80,000 |

| Year 2 | $115,000 |

| Year 3 | $118,000 |

| Year 4 | $140,000 |

| Year 5 | $155,000 |

| Year 6 | $167,000 |

| Year 7 | $175,000 |

The company’s required rate of return is 13 percent. Assume management decided to limit the analysis to 7 years.

Required:

Net Present Value with Taxes. Refer to the Tower CD Stores information presented in the previous problem. Assume the costs associated with the purchase of the building are depreciated over 20 years using the straight-line method, with no salvage value. Costs associated with the building remodel are depreciated over 10 years with no salvage value, starting with year 4. The company’s tax rate is 40 percent. Again, management will limit the analysis to seven years.

Required:

One Step Further: Skill-Building Cases

Internet Project: Capital Expenditures at Intel. Go to Intel’s Web site (http://www.intel.com) and enter “annual report” or “10K report” in the search feature. Find the most recent annual report or 10K report and review the Consolidated Statements of Cash Flows portion of the company’s financial statements. Find the Additions to property, plant and equipment line item in the Investing Activities section of the statement, and answer the following questions. Be sure to submit a printed copy of the consolidated statements of cash flows with your answers.

Group Activity: Qualitative Factors. Each of the following scenarios is being considered at three separate companies.

A maker of computer chips with a reputation of staying on the cutting edge of technology would like to invest in a new production facility. However, the net present value analysis indicates this proposal should be rejected.

Required:

Your instructor will divide the class into groups of two to four students, and assign one of the three independent scenarios listed previously to each group. Each group must perform the requirements listed here:

Comprehensive Cases

Ethical Issues in Capital Budgeting. Loomis Nursery grows a variety of plants for wholesale distribution. The company would like to expand its operations and is considering a move to one of two locations. The first location, Wyatville, is one hour from the ocean and therefore attractive for employees who like to travel on weekends. The second location, Kenton, is not as close to the ocean, and much further from desirable vacation destinations.

The company’s controller, Lisa Lennox, created a net present value analysis for each location. The Kenton location had a positive net present value, and the Wyatville location had a negative net present value. Upon providing this information to the chief financial officer of the company, Max Madden, Lisa was asked to “review the numbers carefully and make sure all the benefits of moving to Wyatville were included in the analysis.” Lisa knew that Max preferred vacationing near the ocean and had a strong desire to move operations to Wyatville. However, she was unable to find any errors in her analysis and could not identify any additional benefits.

Lisa approached Max with this information. Max responded, “There is no way Kenton should have a higher net present value than Wyatville. Redo your analysis to show that Wyatville has the highest net present value, and have it on my desk by the end of the week.”

Required:

Ethical Issues in Capital Budgeting. Toyonda Motor Company produces a variety of products including motorcycles, all-terrain vehicles, marine engines, automobiles, light trucks, and heavy-duty trucks. Each division manager at Toyonda Motor Company is paid a base salary and is given an annual cash bonus if the division achieves profits of at least 10 percent of the value of assets invested in the division (this is called return on investment).

Peggy Parkins, manager of the Light Truck Division, is considering investing in new production equipment. The net present value of the proposal is positive, and Peggy is convinced the new equipment will provide a competitive edge in future years. However, because of the significant up-front cost and related depreciation, short-term profits will be negatively affected by this investment. In fact, the new equipment will reduce return on investment below the 10 percent threshold for at least 3 years, which will prevent Peggy from receiving her annual bonuses for at least 3 years. However, profits are expected to increase significantly after the three-year period. Peggy is planning to retire in two years and therefore would prefer to reject the proposal to invest in new production equipment.

Required: