Question: Companies rarely investigate all variances because there is a cost associated with identifying the causes of variances. This cost involves employees who spend time talking with personnel from areas including purchasing and production to determine why variances occurred and how to control costs in the future. What can managers do to reduce the cost of investigating variances?

Answer: Managers typically establish criteria to determine which variances to focus on rather than simply investigating all variances. This is called management by exception. Management by exceptionA term used to describe managers who focus solely on variances showing actual results that are significantly different than expected results. describes managers who focus solely on variances that are significant.

Question: Figure 10.14 "Comparison of Variable and Fixed Manufacturing Overhead Variance Analysis for Jerry’s Ice Cream" summarizes the cost variances calculated for Jerry’s Ice Cream. If you were in charge of investigating variances at Jerry’s Ice Cream, how would you determine which variances to focus on and which to ignore?

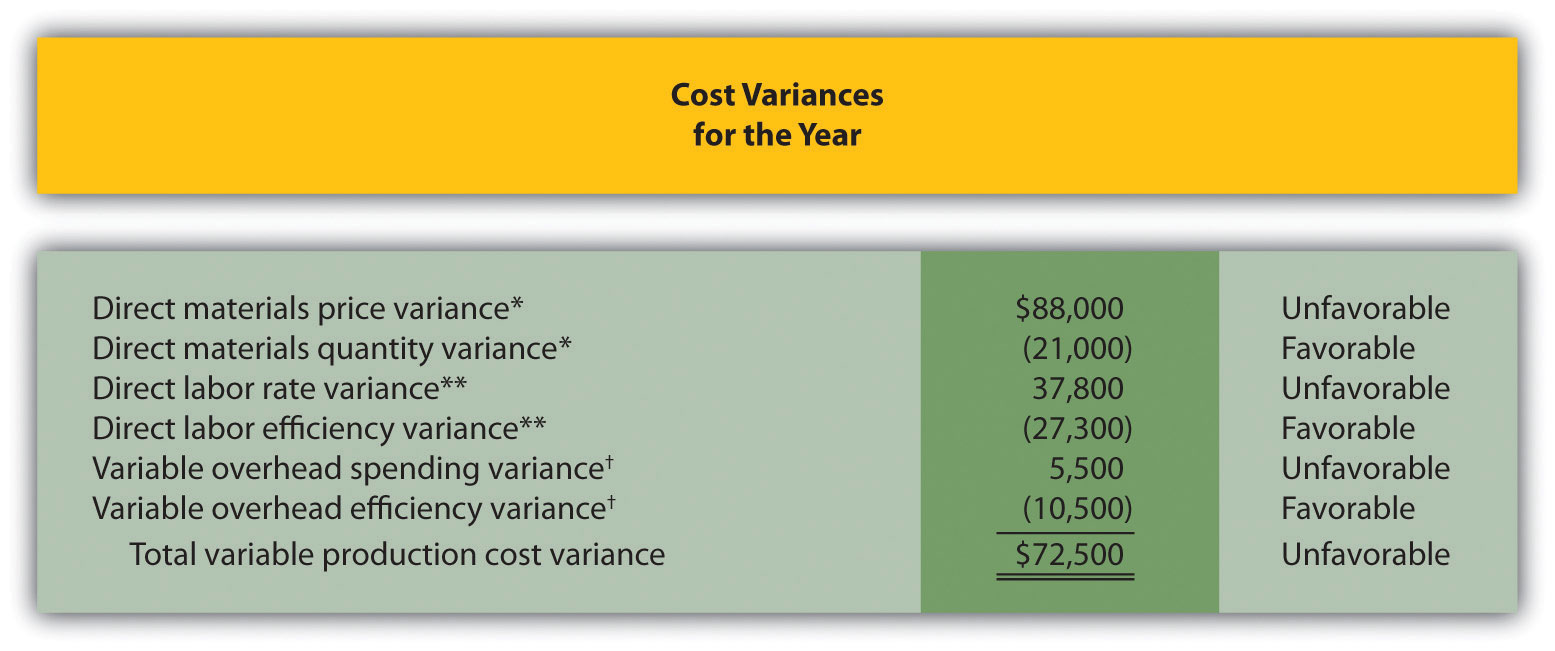

Figure 10.10 Summary of Cost Variances at Jerry’s Ice Cream

*From Figure 10.4 "Direct Materials Variance Analysis for Jerry’s Ice Cream".

**From Figure 10.6 "Direct Labor Variance Analysis for Jerry’s Ice Cream".

† From Figure 10.8 "Variable Manufacturing Overhead Variance Analysis for Jerry’s Ice Cream".

Answer: Some managers might review all unfavorable variances. However, the variable overhead spending variance of $5,500 is not very significant relative to the other variances and may not be worth investigating. Also, by focusing solely on unfavorable variances, managers might overlook problems that may result from favorable variances.

Another approach might be to investigate all favorable and unfavorable variances above a certain minimum level, calculated as a percent of the flexible budget amount. For example, management could establish a policy to investigate all variances at or above 10 percent of the flexible budget amount for each cost. At Jerry’s Ice Cream, this would mean investigating all variances at or above $42,000 for direct materials (= 10 percent × $420,000), $27,300 for direct labor (= 10 percent × $273,000), and $10,500 for variable overhead (= 10 percent × $105,000). Based on this policy, the following variances would be investigated:

Many companies calculate and investigate variances weekly, monthly, or quarterly and focus on trends. In this case, they may only investigate variances that are unfavorable and increasing over time.

Whatever the approach, managers understand that investigating variances requires resources. Thus managers must establish an efficient and cost-effective approach to analyzing variances by weighing the benefits derived from investigating variances against the costs incurred to perform the analysis.

Using Cost Variances to Detect Fraud

Variance analysis is not only an effective way to control costs; some companies, including The Dow Chemical Company, have found that investigating variances can also help them detect fraudulent activities. Dow, which provides chemical, plastic, and agricultural products to customers in 180 countries, has annual sales of $33,000,000,000 and approximately 46,000 employees. In 1998, the company created a department called Fraud Investigative Services (FIS) whose mission is to “deter and prevent incidents of fraud and financial abuse through detection, investigation, and education.”

The most common types of fraud allegations reviewed by Dow’s FIS include expense report fraud, kickback schemes, and embezzlement. Paul Zikmund, the director of FIS, states that “unexplainable cost variances between budget and actual amounts” are among the warning signs he looks for in identifying fraud.

For example, suppose the actual cost for direct materials is significantly higher than the budgeted cost. The cost accountant at Dow would begin investigating the cause of the variance by talking with the company’s purchasing agent. The purchasing agent might be unable (or unwilling) to explain why actual costs are so high. Further investigation might indicate that the purchasing agent was intentionally overbilling the vendor and receiving a kickback from the vendor.

Zikmund states that for every $1 that Dow spends on investigating fraud, the company recovers nearly $4. He also notes that Dow’s loss per employee is far below the industry average of $9 per employee per day. For a company with 46,000 employees, every dollar in savings per employee adds up to a significant amount.

Sources: Paul Zikmund, “Ferreting out Fraud,” Strategic Finance, April 2003, 1–4; Dow Chemical Company, “Home Page,” http://www.dow.com.

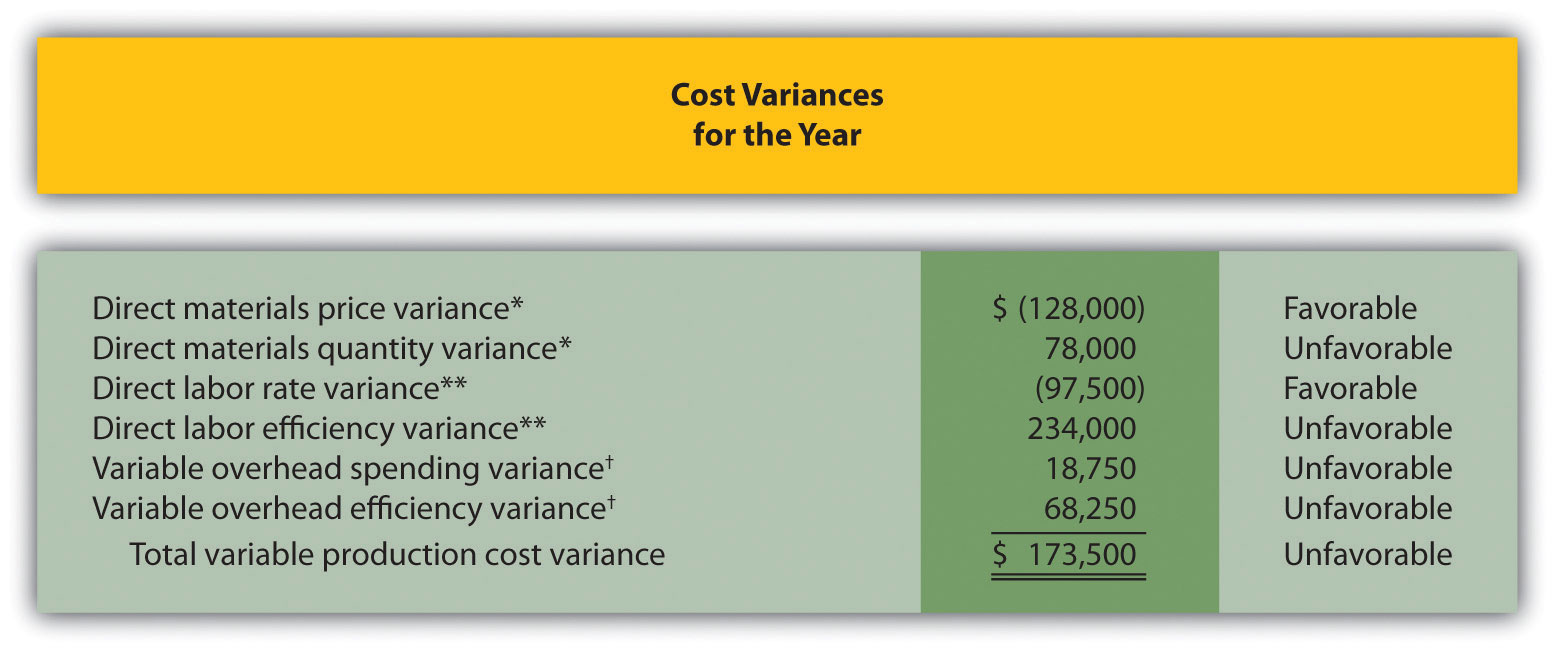

Use the solutions to Note 10.30 "Review Problem 10.3", Note 10.40 "Review Problem 10.4", and Note 10.49 "Review Problem 10.5" to complete the following:

Solution to Review Problem 10.6

See the following figure.

*From Note 10.30 "Review Problem 10.3".

**From Note 10.40 "Review Problem 10.4".

† From Note 10.49 "Review Problem 10.5".

Based on this policy, the following variances would be investigated: