Question: Many companies have independent divisions that transfer goods or services from one division to another. If division managers are evaluated based only on division results using measures, such as segmented net income, profit margin ratio, or return on investment (ROI), conflicts can arise causing managers to take a course of action that benefits the division but hurts the company as a whole. For example, a division manager may decide to purchase raw materials from an outside supplier even though the same materials can be produced at a lower cost by another division within the company (the other division’s manager refuses to sell the materials at a reduced price because she is evaluated based on her division’s profits!). How should a company establish transfer pricing to avoid this kind of conflict?

Answer: The price used to value the transfer of goods or services between divisions within the same company is called a transfer priceThe value assigned to the transfer of goods or services between divisions within the same company.. Several different approaches can be used to establish transfer prices between divisions. The goal is to establish a transfer pricing policy that encourages managers to do what is in the best interest of the company while also doing what is in the best interest of the division manager (this is called goal congruence). Several common approaches are presented next.

Question: How does the general economic transfer pricing rule help organizations to establish an appropriate transfer price?

Answer: The general economic transfer pricing rule attempts to establish guidelines for divisions to maximize overall company profit. This rule states the transfer price should be set at differential cost to the selling division (normally variable cost), plus the opportunity cost of making the sale internally (none if the seller has idle capacity or selling price minus differential cost if the seller is at capacity). This rule is summarized in “Key Equation: Economic Transfer Pricing Rule.”

Economic Transfer Pricing Rule

Let’s look at an example illustrating how to establish a reasonable transfer price using the economic transfer pricing rule. Umbrellas, Inc., has two divisions—Assembly and Marketing. In the past, all transfers of umbrellas from Assembly to Marketing were valued at the variable cost of $6 each. However, the Assembly division manager would like to raise the price to $9 per unit.

Which transfer price should be used to maximize company profit, $6 or $9? The answer depends on whether the selling division (Assembly) is below capacity or at capacity.

Question: Assume Assembly is below capacity. This means there is no opportunity cost of selling internally since no outside sales are forgone as a result of the transaction. What is the appropriate transfer price in this scenario?

Answer: Given this set of circumstances, the Assembly division should set the transfer price at its variable cost of $6 per unit as shown in “Key Equation: Transfer Pricing When below Capacity (Umbrellas, Inc.).” This ensures Marketing does not purchase the umbrellas from another supplier at an amount greater than Umbrella, Inc.’s variable cost.

Transfer Pricing When below Capacity (Umbrellas, Inc.)

*This is the variable cost for Assembly to produce each umbrella.

**Opportunity cost is zero since no outside sales are forgone as a result of making this internal sale.

If Assembly sets the transfer price higher than $6 per unit ($9 for example), thereby violating the economic transfer pricing rule, the risk is that Marketing might find another company willing to provide the umbrellas for an amount less than $9 and higher than $6. If Marketing chooses to buy umbrellas from an outside supplier for $7, for example, profit declines at Umbrella, Inc., because the company paid $1 more than necessary for each umbrella ($1 = $7 outside supplier price − $6 Umbrella, Inc.’s variable cost). Although Marketing looks better as an investment center buying from the outside for $7 because the cost is $2 less than the internal transfer price, the overall company is worse off because the $7 cost is $1 higher than if the umbrellas were produced internally.

Question: Now assume Assembly is at capacity. This creates an opportunity cost of selling internally, since outside sales must be forgone as a result of the transaction. What is the appropriate transfer price in this scenario?

Answer: Given this new set of circumstances for Umbrellas, Inc., the Assembly division should set the transfer price at its variable cost of $6 per unit plus the opportunity cost of selling internally. Assume the Assembly division sells the umbrellas to outside customers for $10 each. The opportunity cost of selling internally is $4 (= $10 market price − $6 variable cost). Thus the transfer price that maximizes company profit is $10 as shown in “Key Equation: Transfer Pricing When at Capacity (Umbrellas, Inc.).” Assembly is indifferent whether it sells internally for $10 or to outside customers for $10.

Transfer Pricing When at Capacity (Umbrellas, Inc.)

*This is the variable cost for Assembly to produce each umbrella.

**Opportunity cost is the revenue forgone of $4 by selling internally. Revenue forgone of $4 = $10 market price – $6 variable cost.

The economic transfer pricing rule works well when outside market prices are available (see Note 11.50 "Business in Action 11.5"). However, not all goods or services transferred from one division to another have a readily available outside market price. Thus other methods of establishing transfer pricing must be considered.

Transfer Pricing at General Electric

A review of the notes to General Electric’s annual report reveals the amount of “intersegment revenues” recorded for each of the company’s six segments. This is referring to revenue derived from transferring goods and services between divisions. The note also states that “sales from one component (segment) to another generally are priced at equivalent commercial selling prices.” It appears from this note that General Electric uses market price to establish transfer prices.

Source: General Electric, “2006 Annual Report,” http://www.ge.com.

Question: Another approach to establishing a transfer price is to use the cost of the goods or services being transferred. How are these costs determined?

Answer: Transfer prices can be based on variable cost, full absorption cost, or cost-plus. Each approach is described next.

Some companies simply use the selling division’s variable cost as the transfer price. However, the weakness in this approach is the selling division will not be able to mark up its products or services, and as a result, will not be able to generate a profit. This is not a problem for selling divisions treated as cost centers, but profit center and investment center managers will not be satisfied with such an approach.

Companies sometimes set the transfer price at the selling division’s full absorption cost. The selling division manager prefers to cover all costs rather than only variable costs, and using full-absorption cost accomplishes this goal. However, the company’s concern is the buying division might choose to purchase from an outside provider at a higher price than the differential cost plus opportunity cost but lower than the selling division’s full absorption cost. The result is a decision that does not maximize company profit.

Companies often add a markup to the selling division’s variable cost or full absorption cost to set the transfer price. This enables the selling division to earn a profit on internal transfers. Again, the risk is that the buying division might buy from an outside supplier at a higher price than differential cost plus opportunity cost, resulting in lower company profit.

Question: If the general economic transfer pricing rule is not used, and the cost approach is not used, another alternative is to simply negotiate the transfer price. What are the potential weaknesses in negotiating a transfer price?

Answer: Investment center division managers are often expected to act independent of each other. In fact, many companies treat investment centers as separate businesses. To promote the autonomy of each division manager, companies often require the buying and selling divisions to negotiate a transfer price. This sounds reasonable in concept, but the same weakness exists here as with using costs to set a transfer price. The buying division may choose to purchase the goods or services from an outside supplier if negotiations break down, which may lead to a suboptimal decision for the company as a whole.

An additional weakness is the time required to negotiate a transfer price. Managers can spend significant amounts of time in negotiations when the time might be better spent more productively elsewhere in the division.

Question: Which transfer pricing approach is best?

Answer: There is no one “best” approach to establishing transfer prices. No two companies are identical, and the choice of a transfer pricing policy depends largely on the nature of the company. The most common approaches used in industry are presented in this appendix. The goal is to establish a transfer pricing policy that encourages managers to do what is in the best interest of the company while also serving the best interest of the division manager.

Maine Products, LLP, has two divisions—Chocolate and Mint. The Chocolate division typically sells its chocolate to the Mint division for $3 per pound, which covers variable costs. The Chocolate division sells to outside customers for $5 per pound. Use the general economic transfer pricing rule to address the following requirements:

Solution to Review Problem 11.8

Because the Chocolate division is below capacity, no outside customer sales are forgone as a result of selling internally. Thus the opportunity cost of selling internally is zero. The optimal transfer price is $3, calculated as follows:

*This is the variable cost per pound.

**Opportunity cost is zero since no outside sales are forgone as a result of selling internally.

Since the Chocolate division is at capacity, outside customer sales are forgone as a result of selling internally. Thus there is an opportunity cost of selling internally. The optimal transfer price is $5, calculated as follows:

*This is the variable cost per pound.

**Opportunity cost is the revenue forgone of $2 by selling internally (= $5 market price − $3 variable cost).

Questions

Brief Exercises

Decentralizing Operations. Burton Electronics produces radios, computers, and navigation systems. Although all high level decisions are made at company headquarters by top management, rapid expansion and increasingly specialized products have caused the company to consider decentralizing into three divisions. Each division manager would be responsible for costs, revenues, and investments in assets.

Required:

Responsibility Centers. Aviation Products, Inc., operates primarily in the United States and has several segments:

Required:

For each of the preceding segments, identify whether it is a cost center, profit center, or investment center. Explain your answer.

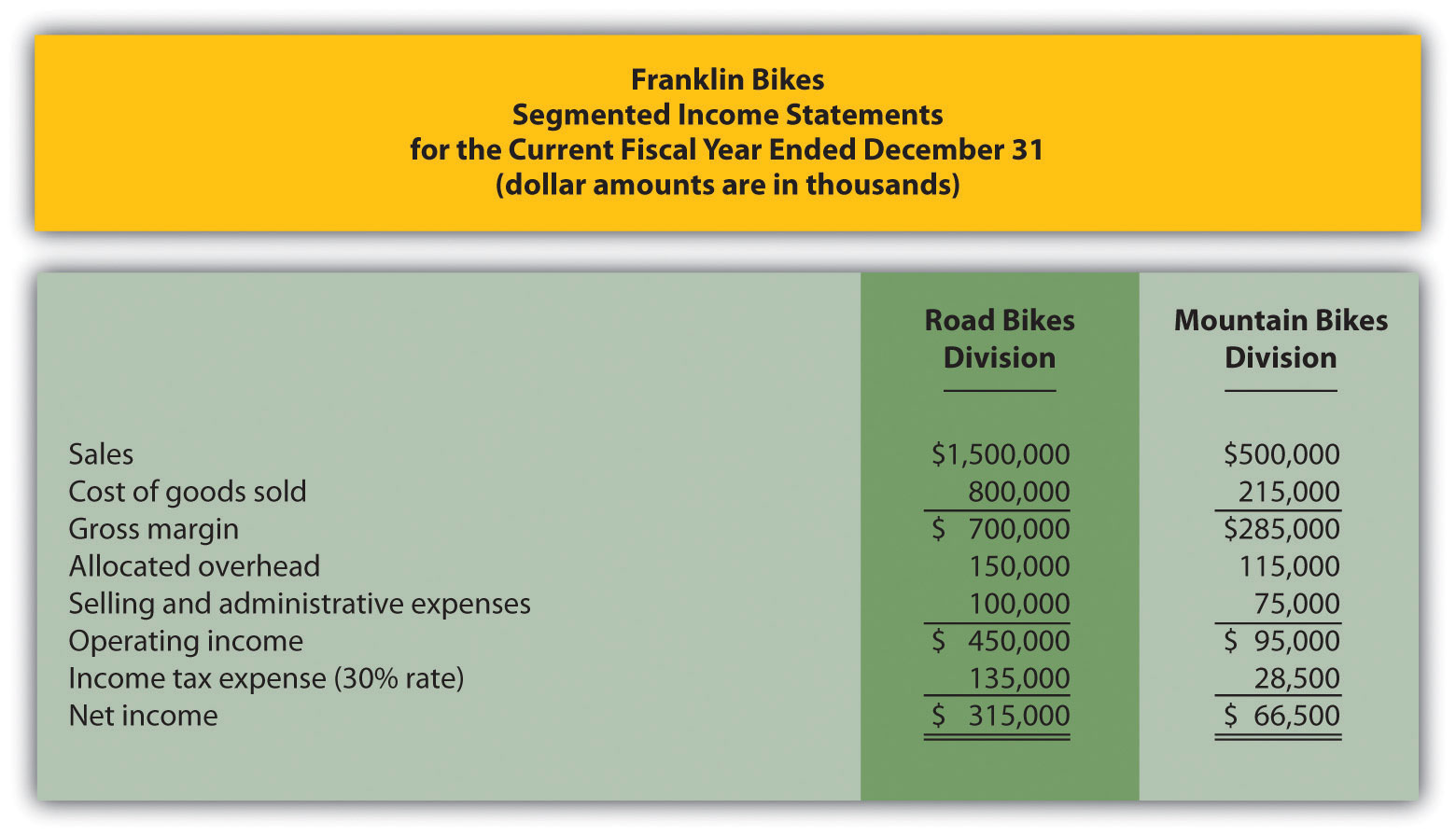

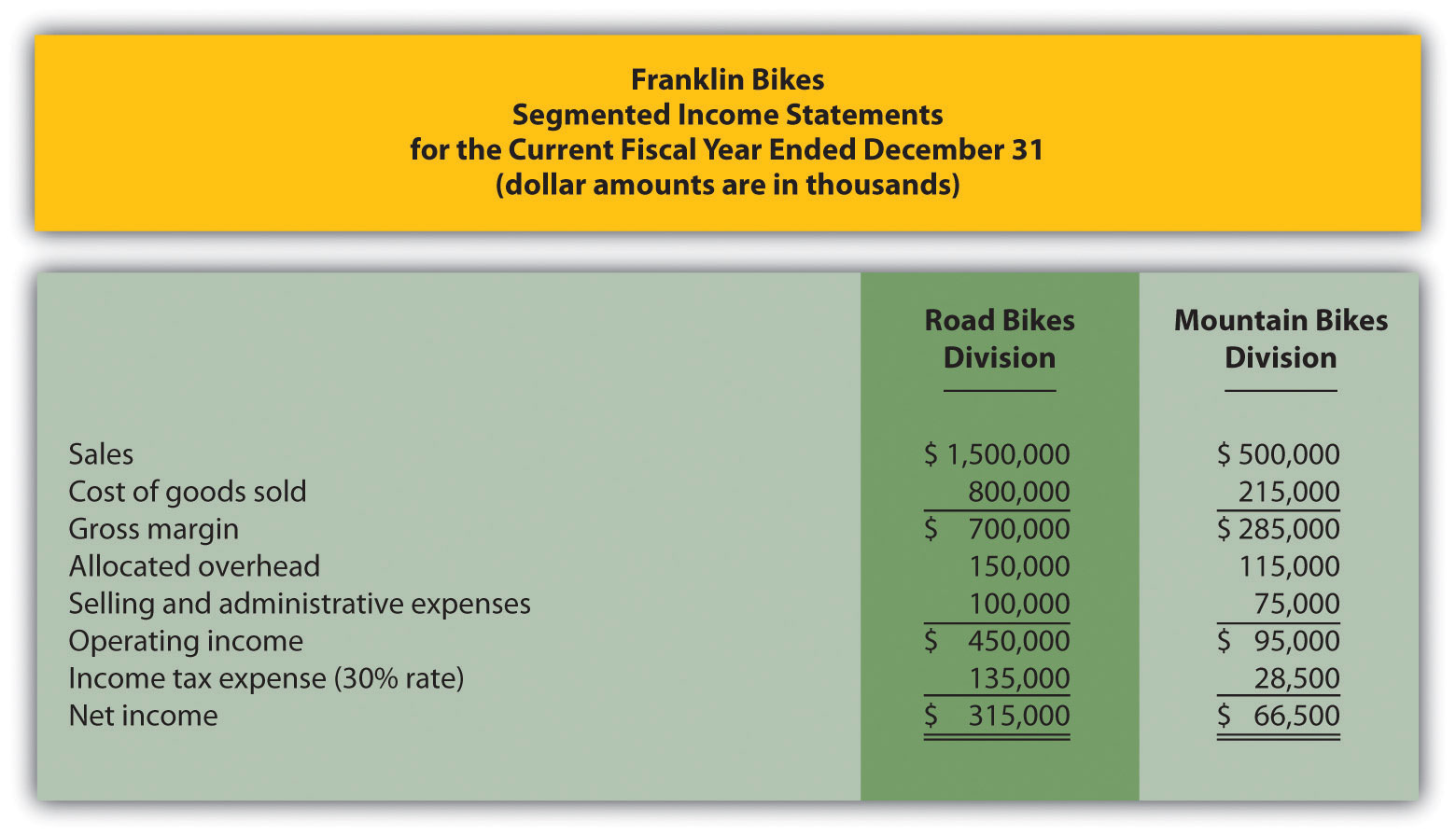

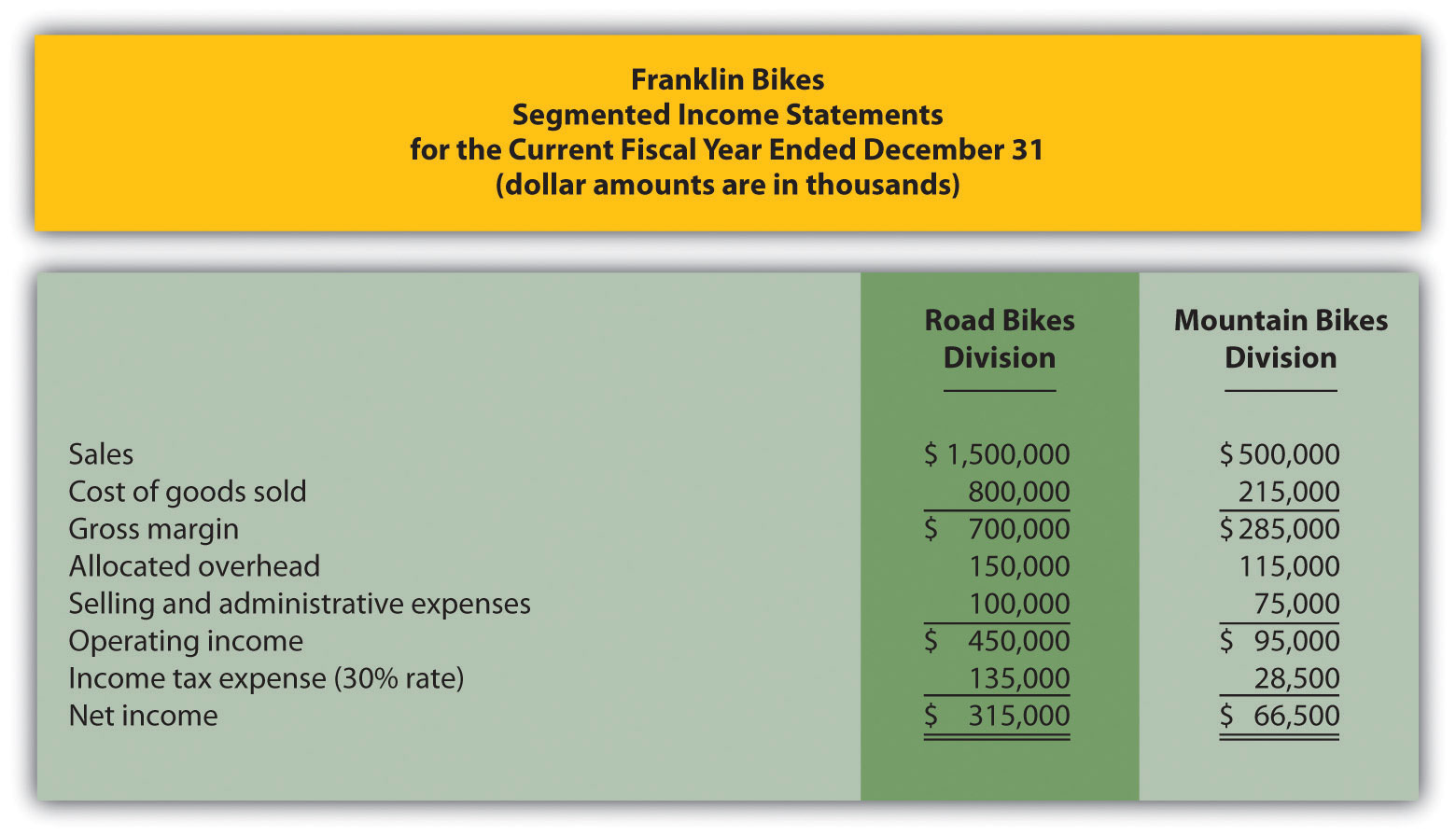

Segmented Net Income. Franklin Bikes has two divisions—Road Bikes and Mountain Bikes. Using the segmented income statements presented in the following, determine the profit margin ratio for each division.

Return on Investment (ROI). The segmented income statements presented as follows are for the two divisions of Franklin Bikes. (This is the same company as the previous exercise. This exercise can be assigned independently.) Assume the Road Bikes division had average operating assets totaling $4,500,000 for the year, and the Mountain Bikes division had average operating assets of $800,000. Calculate ROI for each division.

Residual Income (RI). The segmented income statements presented as follows are for the two divisions of Franklin Bikes. (This is the same company as the previous exercises. This exercise can be assigned independently.) Assume the Road Bikes division had average operating assets totaling $4,500,000 for the year, and the Mountain Bikes division had average operating assets of $800,000. The company’s cost of capital rate is 8 percent. Calculate RI for each division.

Economic Value Added (EVA). Computer Tech Company has two divisions—Hardware and Software. Adjustments have already been made to net operating profit after taxes (NOPAT) and average operating assets for the purposes of calculating EVA for each division. This adjusted information is shown as follows. Assume the company’s cost of capital is 12 percent. Calculate EVA for each division.

| Hardware Division | Software Division | |

| NOPAT—adjusted | $ 810,000 | $ 980,000 |

| Average operating assets—adjusted | 3,500,000 | 3,200,000 |

Exercises: Set A

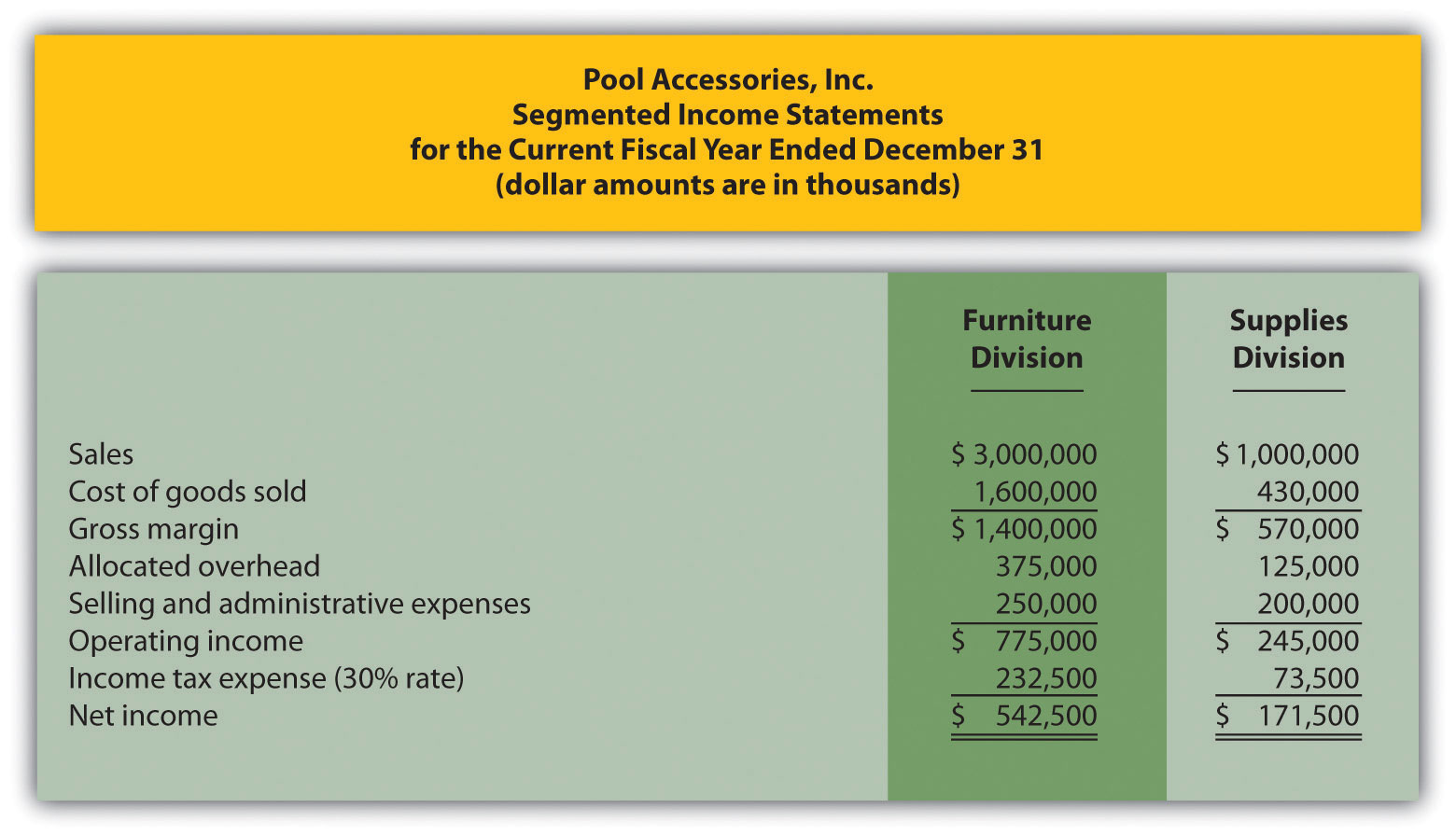

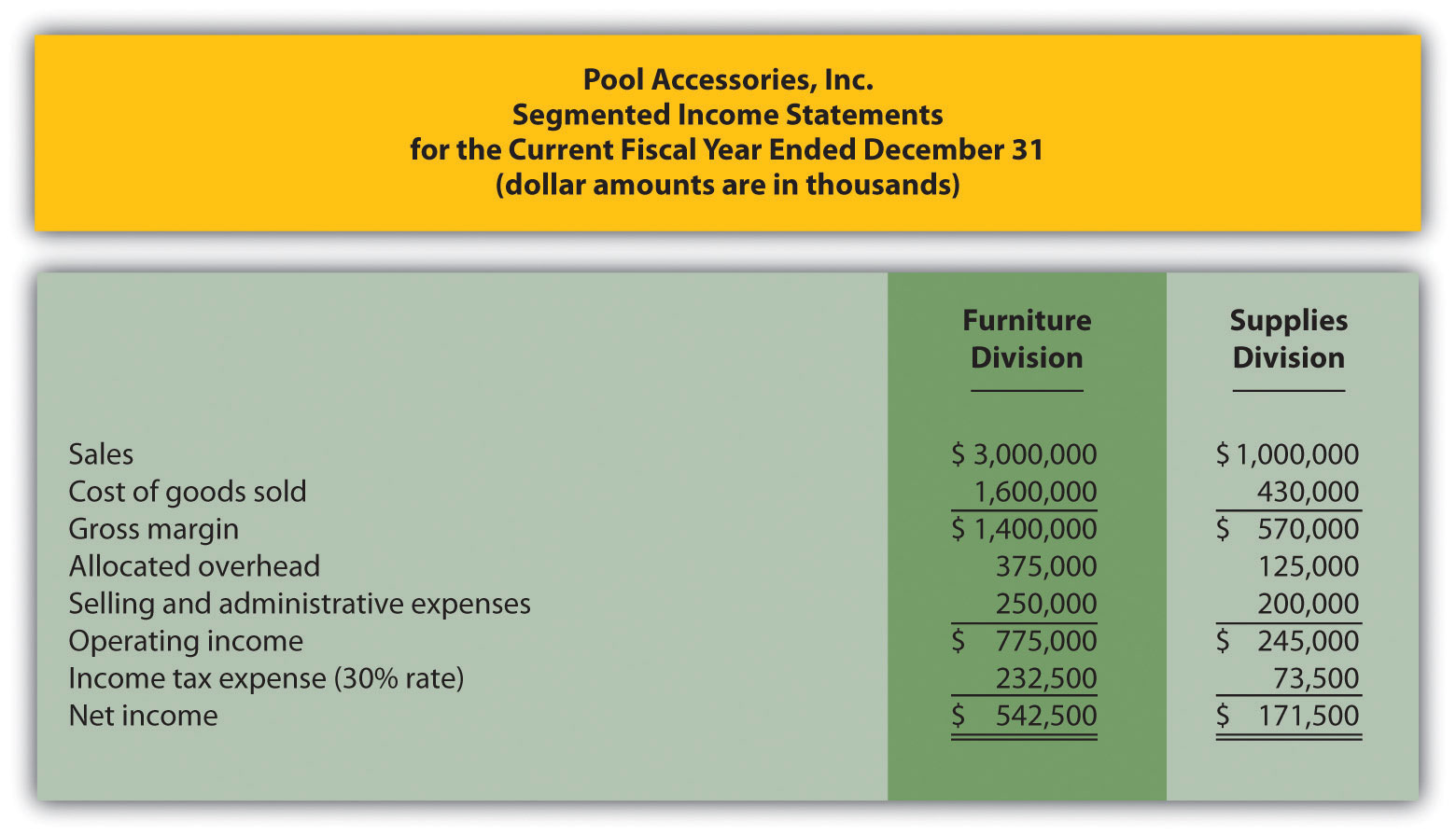

Segmented Net Income. Pool Accessories, Inc., has two divisions—Furniture and Supplies. The following segmented financial information is for the most recent fiscal year ended December 31.

| Furniture Division | Supplies Division | |

| Sales | $3,000,000 | $1,000,000 |

| Cost of goods sold | 1,600,000 | 430,000 |

| Allocated overhead | 375,000 | 125,000 |

| Selling and administrative expenses | 250,000 | 200,000 |

Assume the tax rate is 30 percent.

Required:

ROI. Pool Accessories, Inc., has two divisions—Furniture and Supplies. (This is the same company as the previous exercise. This exercise can be assigned independently.) Segmented income statement information for the most recent fiscal year ended December 31 is shown as follows. Assume the Furniture division had average operating assets totaling $6,500,000 for the year, and the Supplies division had average operating assets of $1,750,000.

Required:

ROI Using Operating Profit Margin and Asset Turnover. Pool Accessories, Inc., has two divisions—Furniture and Supplies. (This is the same company as the previous exercises. This exercise can be assigned independently.) Segmented income statement information for the most recent fiscal year ended December 31 is shown as follows. Assume the Furniture division had average operating assets totaling $6,500,000 for the year, and the Supplies division had average operating assets of $1,750,000.

Required:

RI. Pool Accessories, Inc., has two divisions—Furniture and Supplies. (This is the same company as the previous exercises. This exercise can be assigned independently.) Segmented income statement information for the most recent fiscal year ended December 31 is shown as follows. Assume the Furniture division had average operating assets totaling $6,500,000 for the year, and the Supplies division had average operating assets of $1,750,000. Assume the cost of capital rate is 10 percent.

Required:

Solving Unknowns for ROI. The following information is for two divisions at Kayak Company.

| Lake Division | Ocean Division | |

| Sales | ? | $900,000 |

| Operating income | ? | $108,000 |

| Operating profit margin | 8.0 percent | ? |

| Average operating assets | $150,000 | $600,000 |

| Asset turnover | 1.7 | ? |

| ROI | ? | ? |

Required:

Find the missing information for each division.

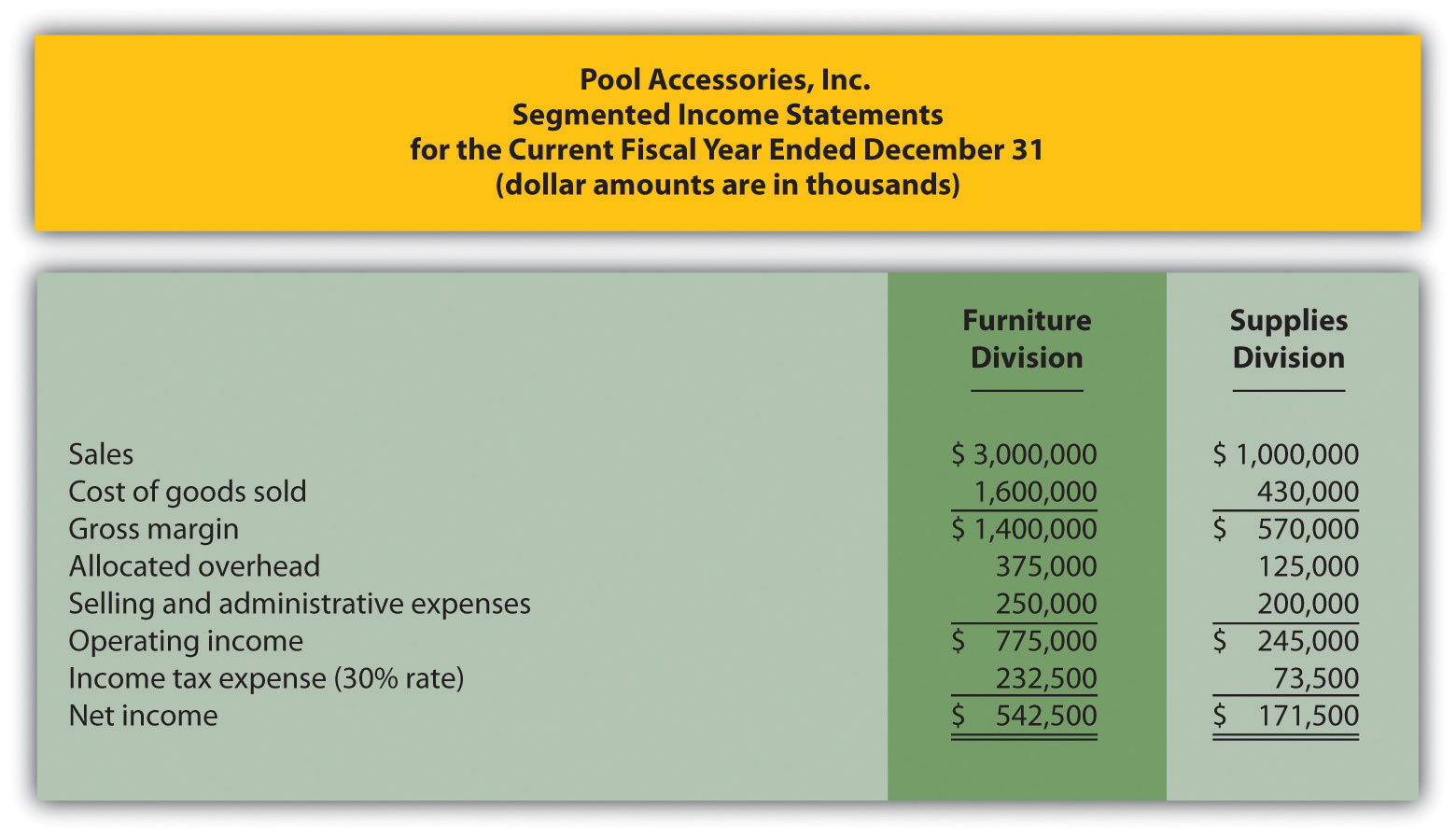

EVA. Links Company produces golf clubs and other sporting goods accessories. The following information is for each division at Links for the most recent fiscal year.

To calculate EVA, the management requires adjustments for R&D and noninterest bearing current liabilities as outlined in the following.

Research and development will be capitalized and amortized over several years resulting in an increase to average operating assets of $400,000 for the Golf division and $650,000 for the Sporting Goods division. On the income statement, R&D expense for the year will be added back to operating income; then R&D amortization expense for one year will be deducted. The current year amortization expense will total $100,000 for the Golf division and $150,000 for the Sporting Goods division.

Noninterest bearing liabilities will be deducted from average operating assets.

Required:

Calculate EVA for each division and comment on your results.

(Appendix) Transfer Pricing. Creative Colors, Inc., a producer of paint, has two divisions—Paint division and Can division. Each division manager is evaluated based on profit produced by each division.

The Can division sells its cans to the Paint division for $2 per case to cover variable costs. The Can division also sells to outside customers for $3 per case.

Required:

Exercises: Set B

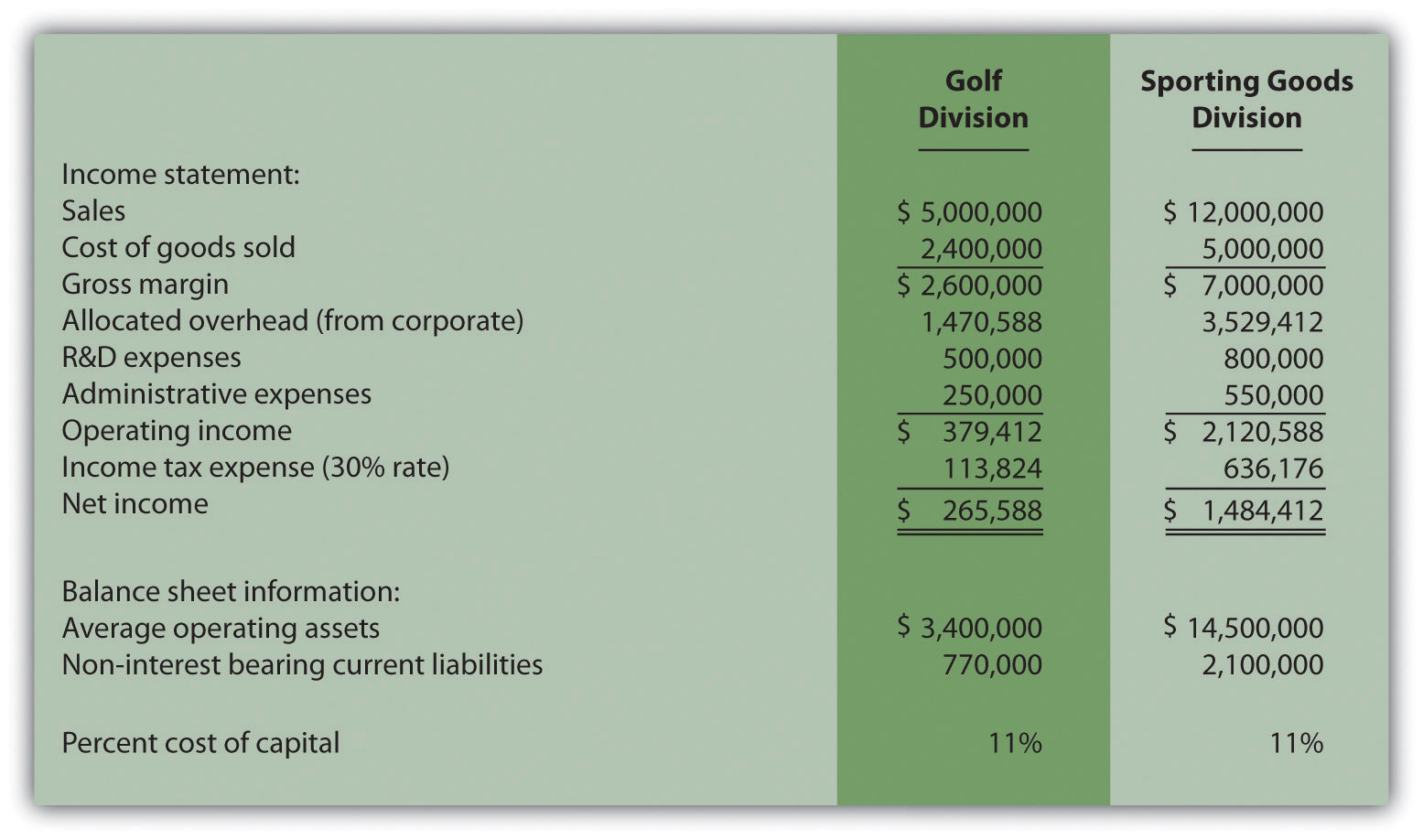

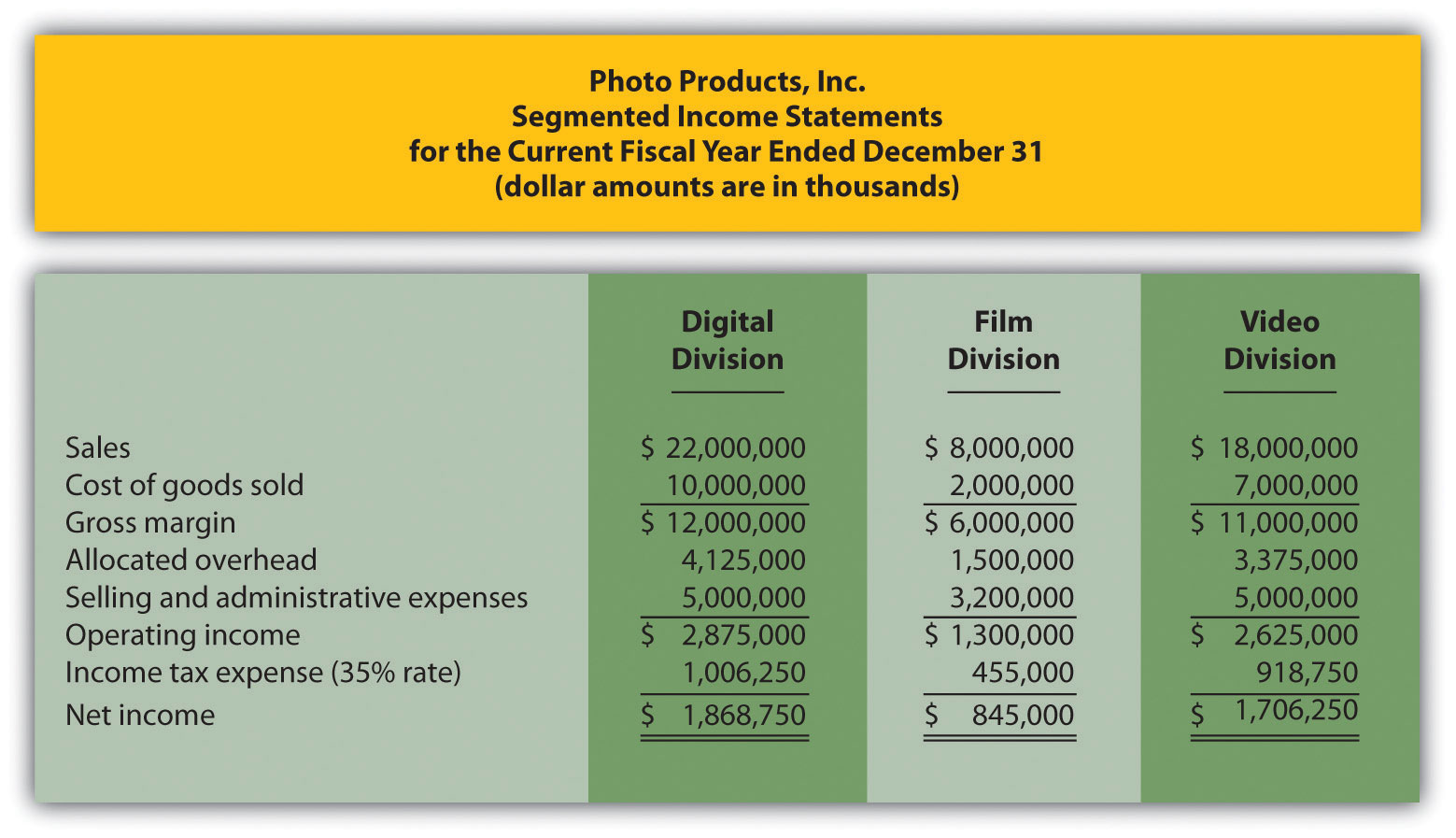

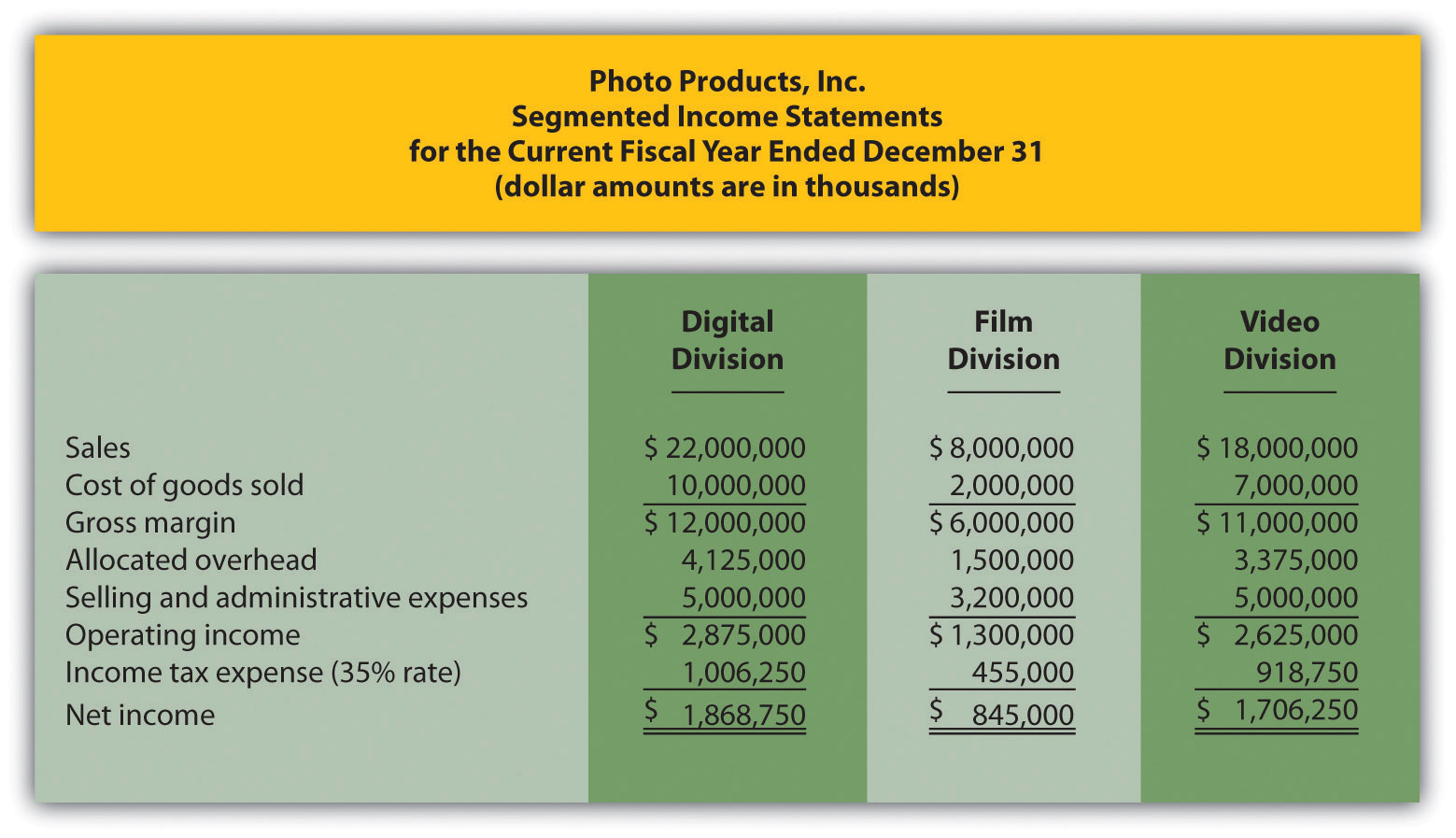

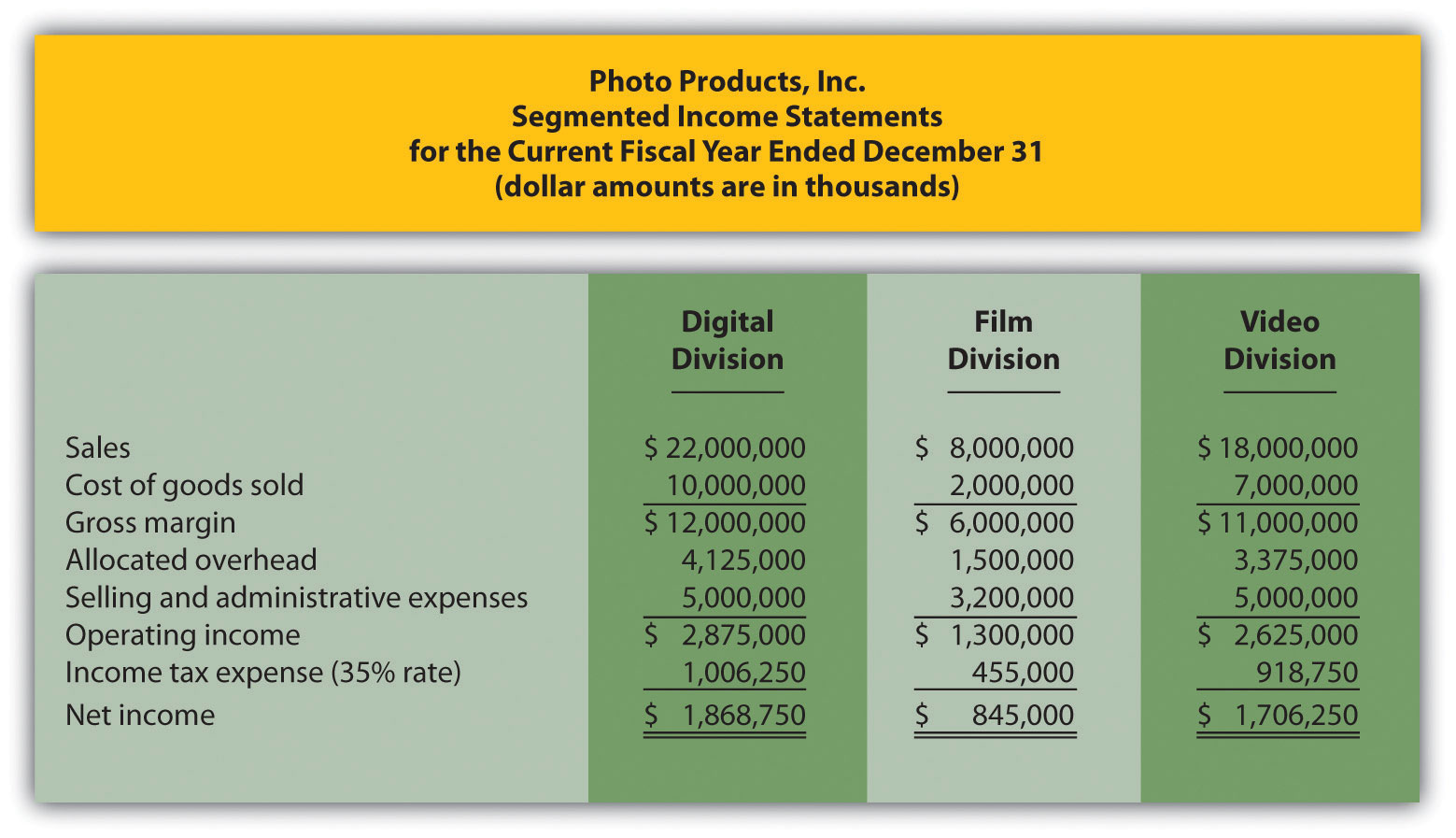

Segmented Net Income. Photo Products, Inc., has three divisions—Digital, Film, and Video. The following segmented financial information is for the most recent fiscal year ended December 31.

| Digital Division | Film Division | Video Division | |

| Sales | $22,000,000 | $8,000,000 | $18,000,000 |

| Cost of goods sold | 10,000,000 | 2,000,000 | 7,000,000 |

| Allocated overhead | 4,125,000 | 1,500,000 | 3,375,000 |

| Selling and administrative expenses | 5,000,000 | 3,200,000 | 5,000,000 |

Assume the tax rate is 35 percent.

Required:

ROI. Photo Products, Inc., has three divisions—Digital, Film, and Video. (This is the same company as the previous exercise. This exercise can be assigned independently.) Segmented income statement information for the most recent fiscal year ended December 31 is shown as follows. Assume average operating assets totaled $15,000,000 for the Digital division, $6,500,000 for the Film division, and $17,500,000 for the Video division.

Required:

ROI Using Operating Profit Margin and Asset Turnover. Photo Products, Inc., has three divisions—Digital, Film, and Video. (This is the same company as the previous exercises. This exercise can be assigned independently.) Segmented income statement information for the most recent fiscal year ended December 31 is shown as follows. Assume average operating assets totaled $15,000,000 for the Digital division, $6,500,000 for the Film division, and $17,500,000 for the Video division.

Required:

RI. Photo Products, Inc., has three divisions—Digital, Film, and Video. (This is the same company as the previous exercises. This exercise can be assigned independently.) Segmented income statement information for the most recent fiscal year ended December 31 is shown as follows. Assume average operating assets totaled $15,000,000 for the Digital division, $6,500,000 for the Film division, and $17,500,000 for the Video division. Assume the cost of capital rate is 16 percent.

Required:

Solving Unknowns for ROI. The following information is for two divisions at Arrowhead, Inc.

| North Division | South Division | |

| Sales | $1,200,000 | $400,000 |

| Operating income | $ 132,000 | $ 40,000 |

| Operating profit margin | ? | ? |

| Average operating assets | $1,000,000 | ? |

| Asset turnover | ? | ? |

| ROI | ? | 8.0 percent |

Required:

Find the missing information for each division.

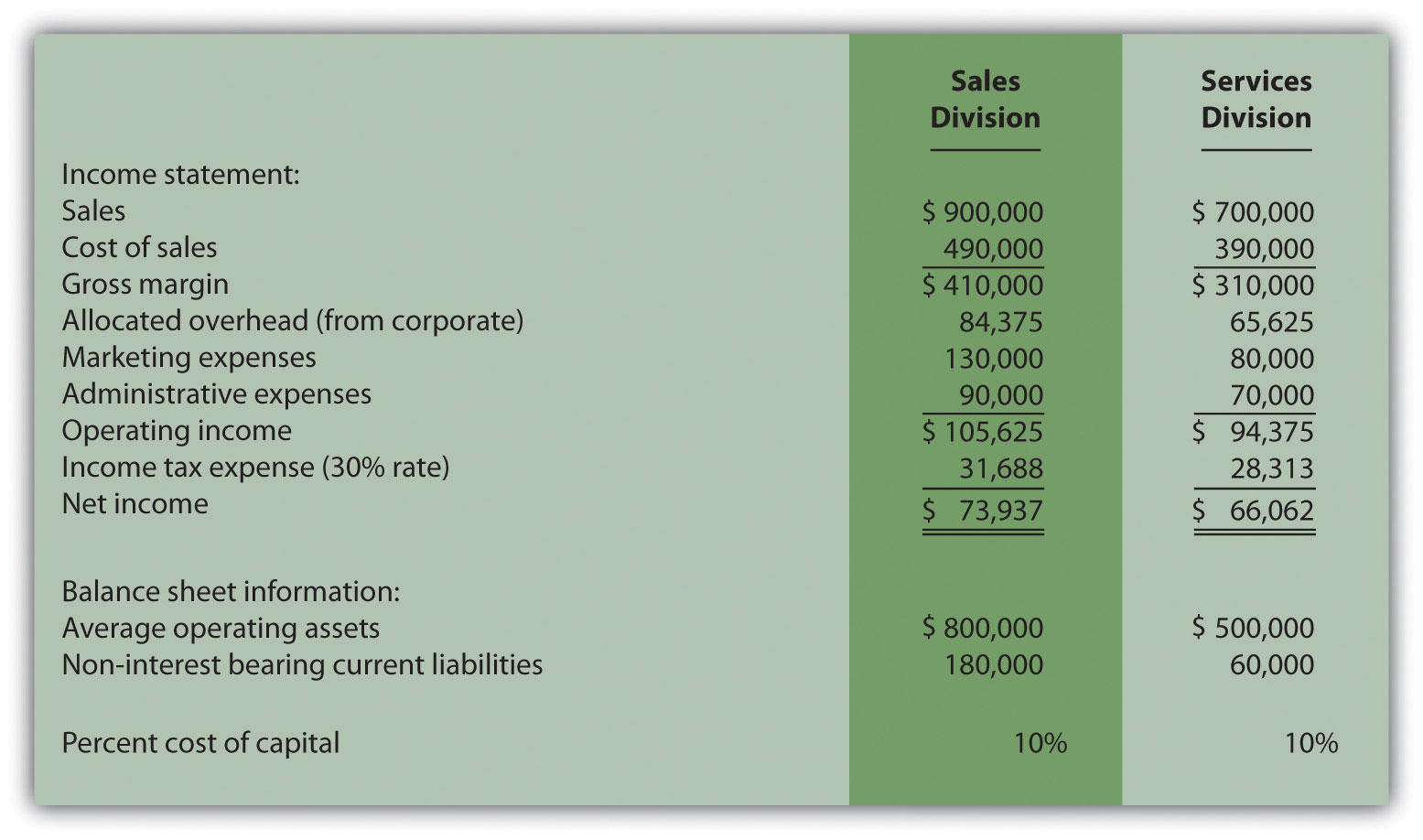

EVA. Sailboats, Inc., sells sailboat parts and accessories and provides rigging services. The following information is for each division at Sailboats, Inc., for the most recent fiscal year.

To calculate EVA, management requires adjustments for marketing and noninterest bearing current liabilities as outlined in the following.

Marketing will be capitalized and amortized over several years resulting in an increase to average operating assets of $100,000 for the Sales division and $65,000 for the Services division. On the income statement, marketing expense for the year will be added back to operating income; marketing amortization expense for one year will be deducted. The current year amortization expense will total $30,000 for the Sales division and $15,000 for the Services division.

Noninterest bearing liabilities will be deducted from average operating assets.

Required:

Calculate EVA for each division and comment on your results.

(Appendix) Transfer Pricing. Gail’s Gardening has two divisions—Retail and Nursery. The Retail division sells plants and supplies. The Nursery division takes tree seedlings and grows them to healthy young plants before selling the trees internally to the Retail division and to outside customers. Each division manager is evaluated based on profit produced by each division.

The Nursery division sells its trees to the Retail division for $4 per tree to cover its variable costs. The Nursery division also sells to outside customers for $6 per tree.

Required:

Problems

Segmented Net Income, ROI, and RI. Custom Auto Company has two divisions—East and West. The following segmented financial information is for the most recent fiscal year:

| East Division | West Division | |

| Sales | $2,000,000 | $4,000,000 |

| Cost of goods sold | 800,000 | 2,040,000 |

| Allocated overhead | 600,000 | 1,200,000 |

| Selling and administrative expenses | 360,000 | 380,000 |

The East division had average operating assets totaling $1,800,000 for the year, and the West division had average operating assets of $2,600,000. Assume the cost of capital rate is 8 percent, and the company’s tax rate is 30 percent. Division managers are responsible for sales, costs, and investments in assets.

Required:

Investment Decisions Using ROI and RI. (Note: the previous problem must be completed before working this problem.) Assume each division of Custom Auto Company is considering separate investment opportunities expected to yield a return of 10 percent, well above the company’s minimum required rate of return of 8 percent. Each investment opportunity will require $1,000,000 in average operating assets and yield operating income of $100,000.

Required:

Segmented Net Income, ROI, and RI; Making Investment Decisions. Quality Cycles, Inc., has two divisions—Cruisers and Racers. The following segmented financial information is for the most recent fiscal year:

| Cruisers Division | Racers Division | |

| Sales | $6,000,000 | $10,000,000 |

| Cost of goods sold | 2,500,000 | 4,000,000 |

| Allocated overhead | 375,000 | 625,000 |

| Selling and administrative expenses | 2,100,000 | 3,950,000 |

The Cruisers division had average operating assets totaling $5,700,000 for the year, and the Racers division had average operating assets of $9,600,000. Assume the cost of capital rate is 10 percent, and the company’s tax rate is 30 percent.

Required:

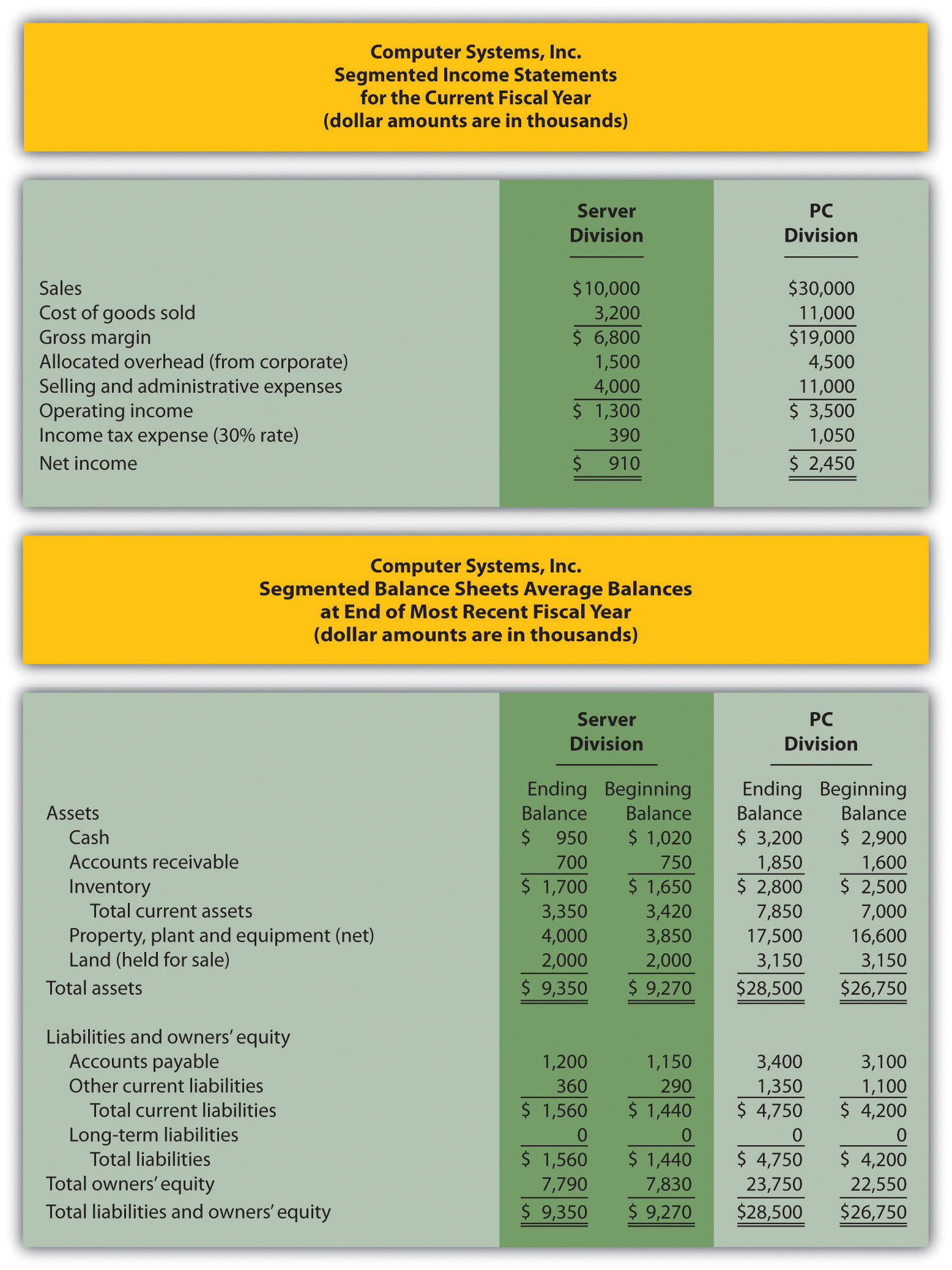

Operating Profit Margin, Asset Turnover, and ROI. Financial information for Computer Systems, Inc., for the most recent fiscal year appears as follows. All dollar amounts are in thousands.

Required:

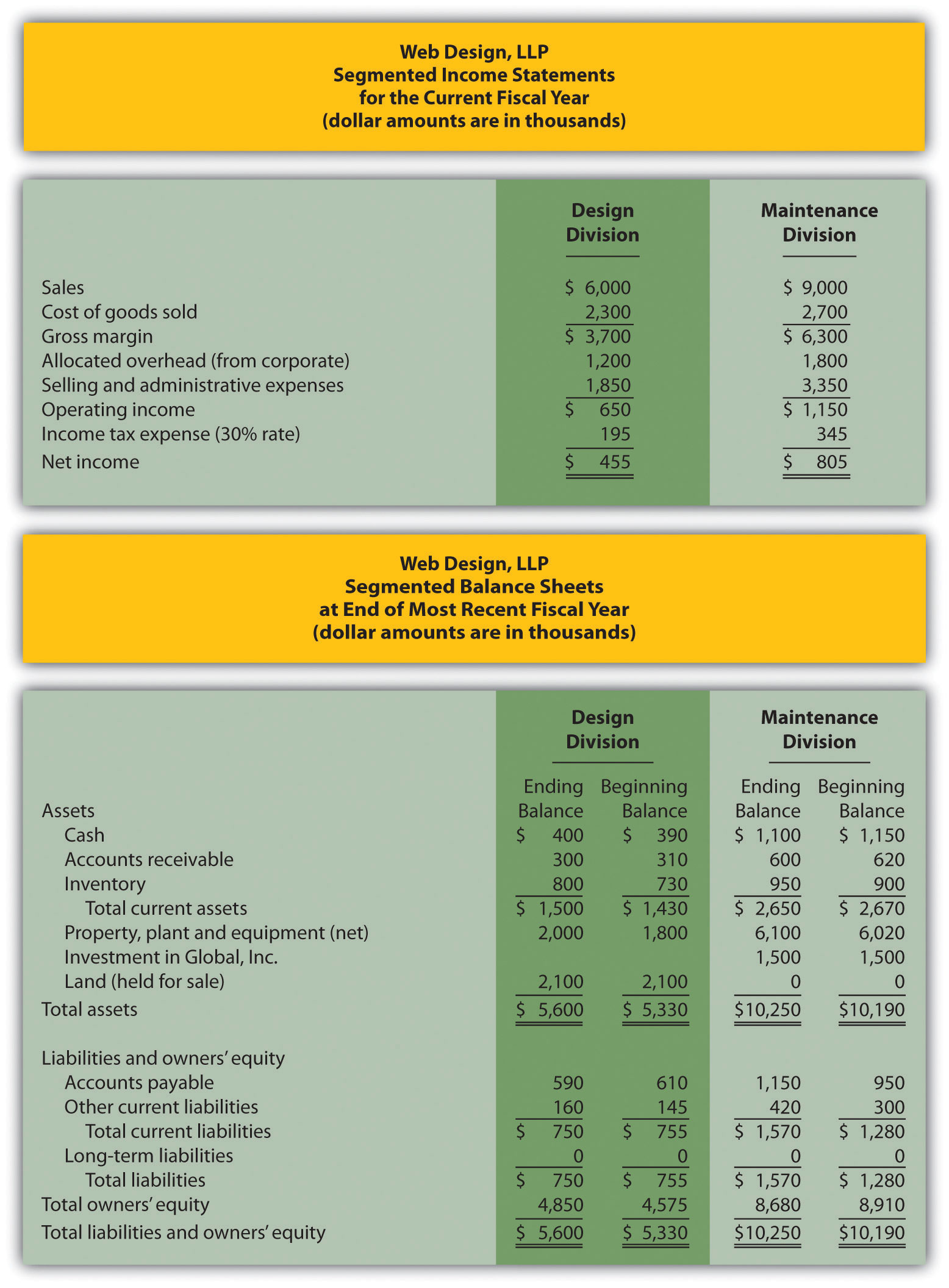

Operating Profit Margin, Asset Turnover, ROI, and RI. Financial information for Web Design, LLP, for the most recent fiscal year appears as follows. All dollar amounts are in thousands.

Required:

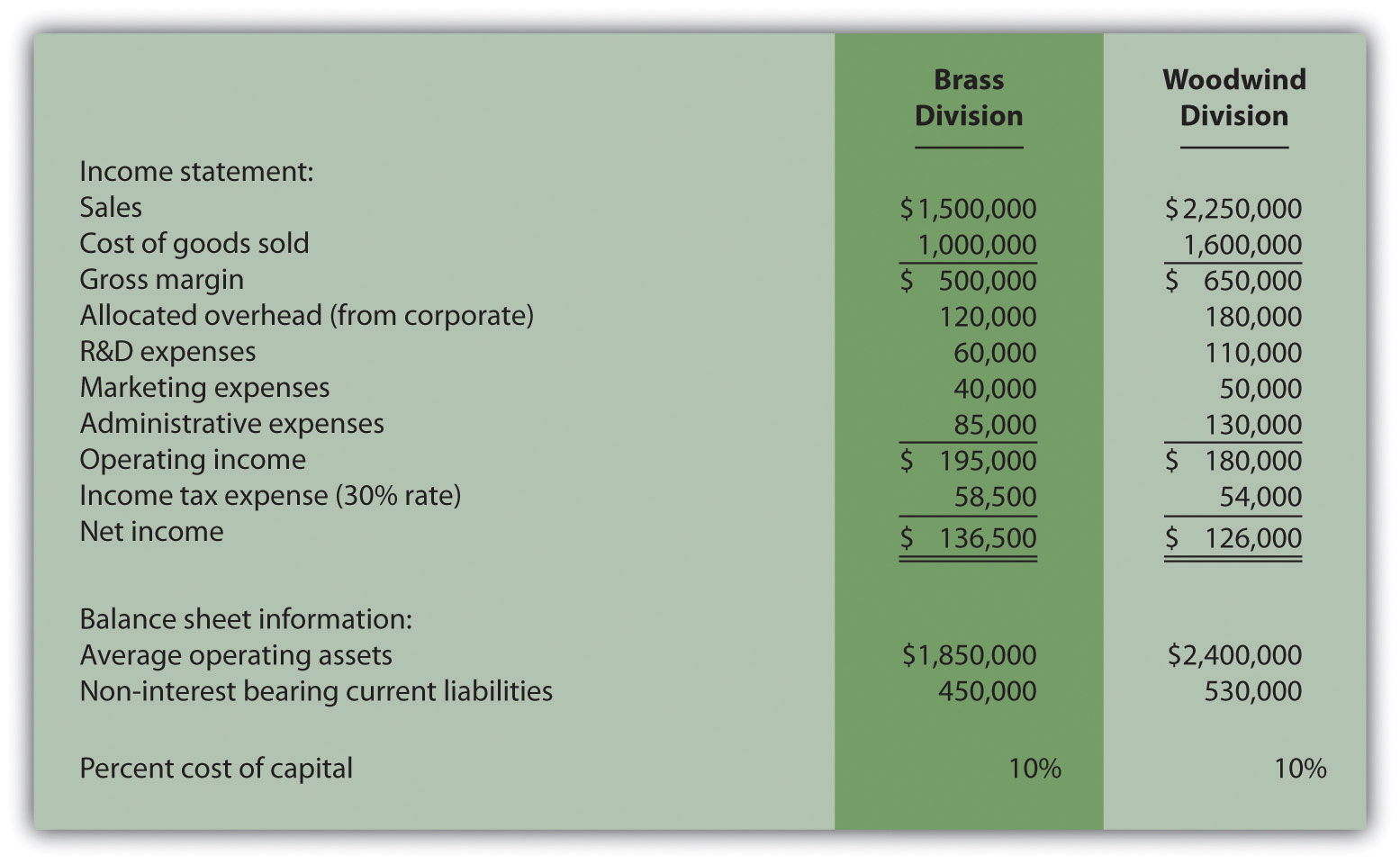

EVA. Conner, Inc., produces brass and woodwind music instruments. The following information is for each division at Conner for the most recent fiscal year.

To calculate EVA, management requires adjustments for R&D expenses, marketing expenses, and noninterest bearing current liabilities as outlined in the following.

Research and development will be capitalized and amortized over several years resulting in an increase to average operating assets of $40,000 for the Brass division and $80,000 for the Woodwind division. On the income statement, R&D expenses for the year will be added back to operating income; R&D amortization expense for one year will be deducted. The current year amortization expense will total $20,000 for the Brass division and $30,000 for the Woodwind division.

Marketing will be capitalized and amortized over several years resulting in an increase to average operating assets of $30,000 for the Brass division and $38,000 for the Woodwind division. On the income statement, marketing expenses for the year will be added back to operating income; marketing amortization expense for one year will be deducted. The current year amortization expense will total $10,000 for the Brass division and $12,000 for the Woodwind division.

Noninterest bearing current liabilities will be deducted from average operating assets.

Required:

(Appendix) Transfer Pricing, Service Company. Kathy Kraven is the CEO and president of Legal Solutions, Inc. She oversees the company’s two divisions—Human Resources and Litigation. The Human Resources division provides legal services to personnel departments at various clients who need help creating personnel policies and manuals. The Litigation division provides legal services to support clients in litigation. Litigation often asks for help from Human Resources when faced with issues surrounding personnel policies but also has the option of seeking help outside the firm. Currently, Human Resources is below capacity and uses variable cost as its price for providing services to Litigation.

Since each division is evaluated by how much profit it generates, Human Resources would like to increase the price charged to Litigation. Litigation is steadfast against any such change. Kathy Kraven has stepped in and established the following policy: effective immediately, Human Resources will charge Litigation variable costs plus 20 percent for any services rendered internally.

Required:

(Appendix) Transfer Pricing, Retail Company. Fred’s Fishing Supplies has two divisions, Lake and Deep Sea. Each division manager is evaluated based on profit produced by each division. The Lake division often sells a certain graphite fishing rod internally to the Deep Sea division for $50 per rod to cover variable costs. The Lake division also sells the same graphite rod to outside customers for $60 per rod. The Deep Sea division manager has the option of purchasing a similar rod from an outside supplier for $56.

Required:

One Step Further: Skill-Building Cases

Group Activity—Decentralizing Operations. Each of the following scenarios is being considered at two separate companies.

Required:

Form groups of two to four students. Each group is to perform the following requirements for the scenario assigned:

Creating a Segmented Income Statement Using Excel. Pool Accessories, Inc., has two divisions—Furniture and Supplies. The following segmented financial information is for the most recent fiscal year ended December 31.

| Furniture Division | Supplies Division | |

| Sales | $3,000,000 | $1,000,000 |

| Cost of goods sold | 1,600,000 | 430,000 |

| Allocated overhead | 375,000 | 125,000 |

| Selling and administrative expenses | 250,000 | 200,000 |

Assume the tax rate is 30 percent.

Required:

Comprehensive Case

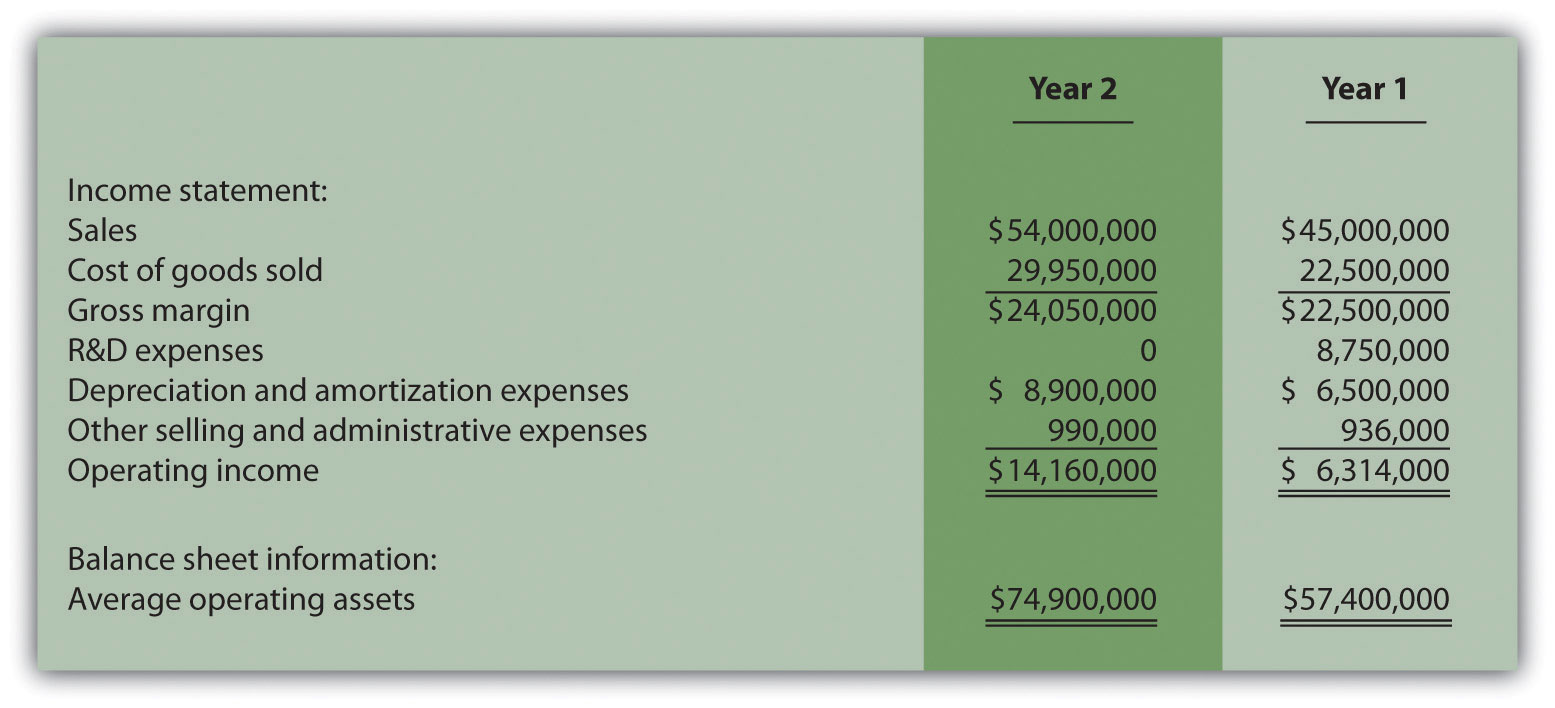

Ethics and ROI. Computer chip makers incur significant costs for research and development. Some research and development projects result in technologies used in new computer chips. Other research and development projects do not result in a useable technology. Because of the unpredictable nature of R&D activities, U.S. GAAP require that R&D costs be expensed in the period incurred.

Integrated Circuits, Inc. (ICI), produces computer chips and invests heavily in R&D. The firm has been struggling in recent years, and as a result, the board of directors hired a new top management group with the clear purpose of improving profitability. The board proposed a compensation package providing top managers with an annual bonus if the company’s operating income this coming year (year 2) increases 10 percent compared to year 1 and ROI remains above the 11 percent level achieved in year 1.

The new top management group is willing to accept this proposal, but only if costs related to successful R&D activities are capitalized and amortized over five years for internal reporting purposes. Their argument is most R&D activities benefit future years, and U.S. GAAP unfairly requires all R&D costs to be expensed in the period incurred, regardless of whether the activities are successful. This treatment by U.S. GAAP provides a disincentive for managers to invest in R&D projects that are vital to the company’s future survival. The board of directors agrees with this assertion and grants the new management group their request to capitalize costs for successful R&D activities over five years.

One year has passed with the new management group in place, and their financial results are presented as follows (for year two), along with last year’s information (year one). The entire $10,000,000 spent on R&D in year 2 was for unsuccessful projects since management decided to go a different direction with the company’s technology at the end of year 2. Nevertheless, top management capitalized the entire $10,000,000 and amortized these costs over 5 years as reflected in the year 2 financial results. (Note: of this amount, $2,000,000 is included in depreciation and amortization expense for year 2, and $8,000,000 is included in average operating assets for year 2.)

Required:

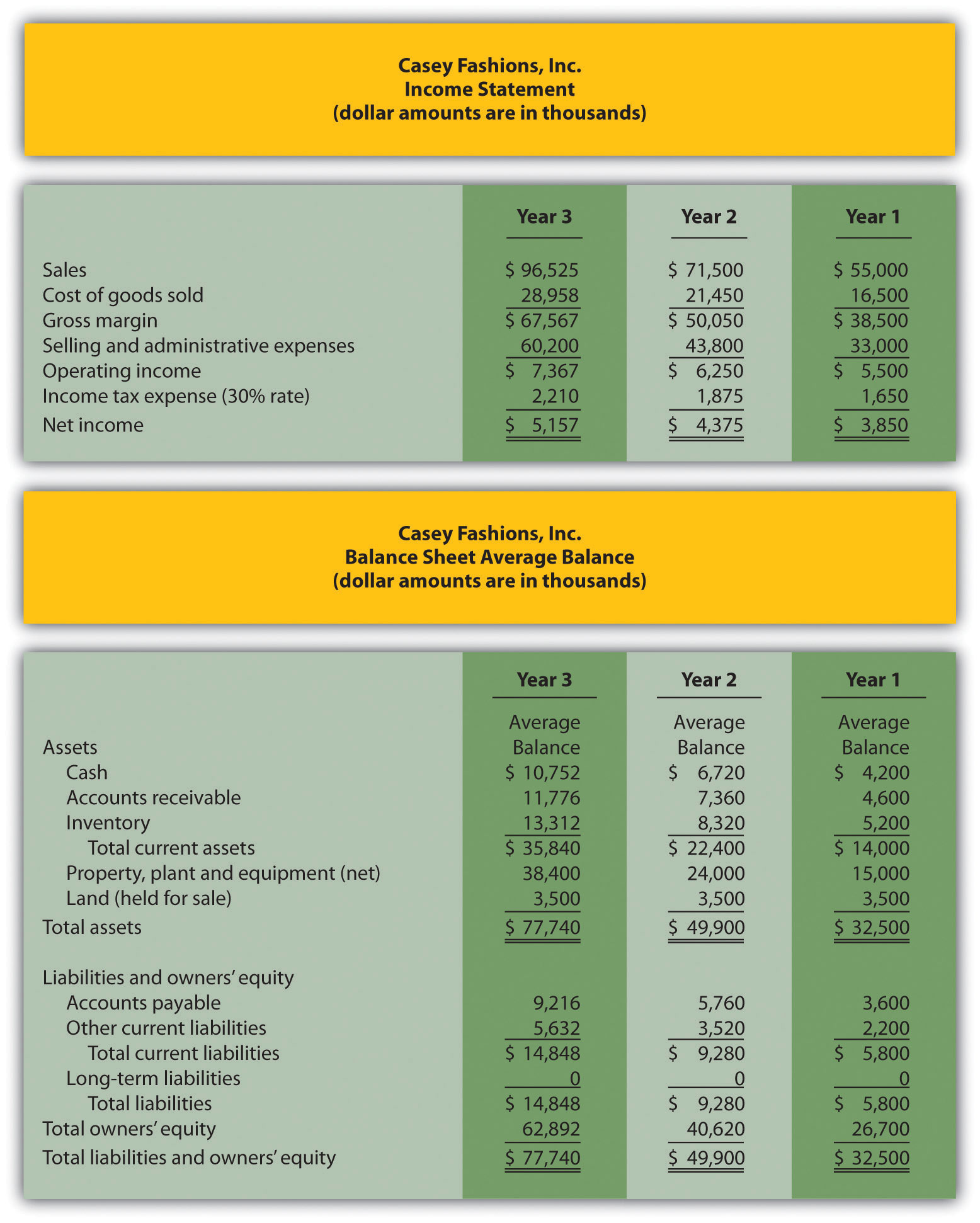

Performance Evaluation Methods. Casey Fashions, Inc., sells clothing throughout North America. The company’s compensation committee, made up of five members from the board of directors, is meeting to discuss the CEO’s contract, which expires next month. The committee is currently reviewing financial information for the three most recent fiscal years: year 3 (most recent), year 2, and year 1 (shown as follows).

The income statement indicates sales increased 30 percent from year 1 to year 2 and 35 percent from year 2 to year 3. Net income increased 14 percent from year 1 to year 2, and 18 percent from year 2 to year 3. One member on the committee, Chris Carson, would like to offer the CEO a multiyear extension with a significant bump in salary and thousands of shares of stock options. When questioned why, Chris pointed to the positive results reflected on the income statement.

Another committee member, Mary Nichols, agrees with Chris that income statement trends look great, but she would like to review other measures of performance as well. Mary has asked you to come up with two measures of performance that go beyond simply looking at the income statement.

Required: