Question: What are the three types of cash flows presented on the statement of cash flows?

Answer: Cash flows are classified as operating, investing, or financing activities on the statement of cash flows, depending on the nature of the transaction. Each of these three classifications is defined as follows.

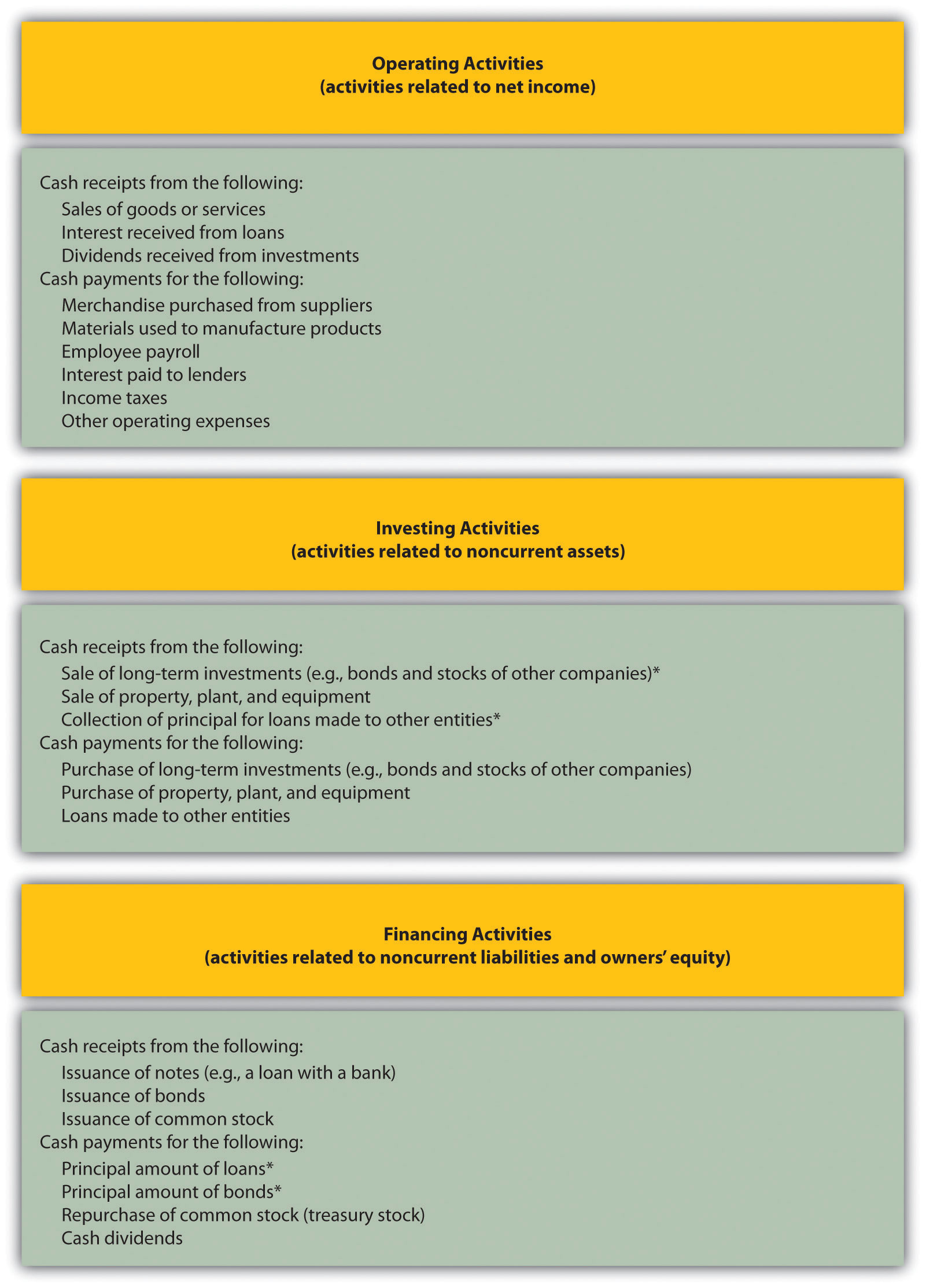

Figure 12.1 "Examples of Cash Flows from Operating, Investing, and Financing Activities" shows examples of cash flow activities that generate cash or require cash outflows within a period. Figure 12.2 "Examples of Cash Flow Activity by Category" presents a more comprehensive list of examples of items typically included in operating, investing, and financing sections of the statement of cash flows.

Figure 12.2 Examples of Cash Flow Activity by Category

*Receipts of cash for dividends from investments and for interest on loans made to other entities are included in operating activities since both items relate to net income. Likewise, payments of cash for interest on loans with a bank or on bonds issued are also included in operating activities because these items also relate to net income.

Question: Which section of the statement of cash flows is regarded by most financial experts to be most important?

Answer: The operating activities section of the statement of cash flows is generally regarded as the most important section since it provides cash flow information related to the daily operations of the business. This section answers the question, “how much cash did we generate from the daily activities of our core business?” Owners, creditors, and managers are most interested in cash flow generated from daily activities rather than from a one-time issuance of stock or a one-time sale of land. The operating activities section allows stakeholders to assess the ongoing viability of the company. We discuss how to use cash flow information to evaluate organizations later in the chapter.

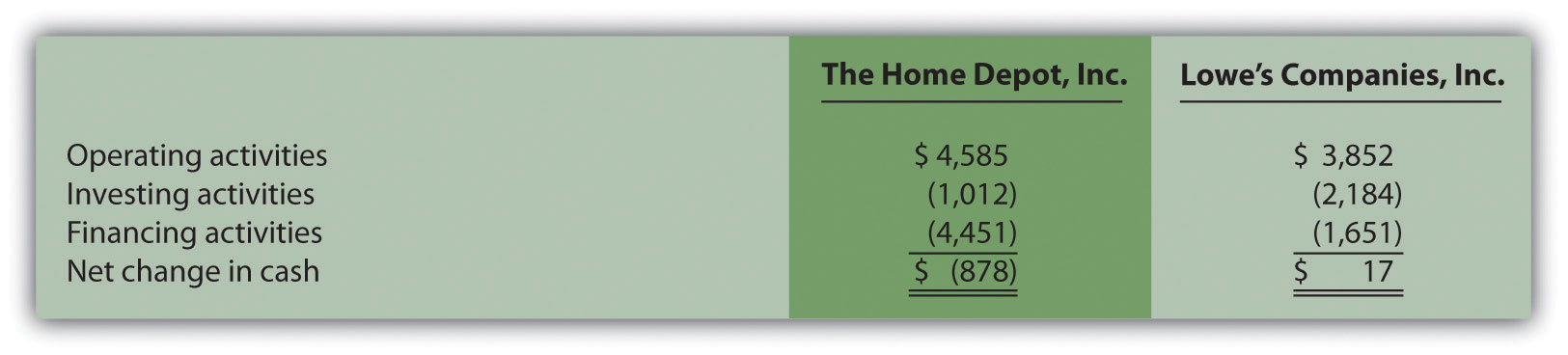

Cash Activity at Home Depot and Lowe’s

The Home Depot. Inc., and Lowe’s Companies, Inc., are large home improvement retail companies with stores throughout North America. A review of the statements of cash flows for both companies reveals the following cash activity. Positive amounts are cash inflows, and negative amounts are cash outflows.

Amounts are in millions.

This information shows both companies generated significant amounts of cash from daily operating activities; $4,600,000,000 for The Home Depot and $3,900,000,000 for Lowe’s. It is interesting to note both companies spent significant amounts of cash to acquire property and equipment and long-term investments as reflected in the negative investing activities amounts. For both companies, a significant amount of cash outflows from financing activities were for the repurchase of common stock. Apparently, both companies chose to return cash to owners by repurchasing stock.

Source: The Home Depot Inc., “2010 Annual Report,” http://www.homedepot.com; Lowe’s Companies Inc., “2010 Annual Report,” http://www.lowes.com.

Identify whether each of the following items would appear in the operating, investing, or financing activities section of the statement of cash flows. Explain your answer for each item.

Solution to Review Problem 12.2