Question: Now that you are familiar with the four key steps, let’s take a look at the statement of cash flows for Home Store, Inc. Where do we start in preparing Home Store, Inc.’s statement of cash flows?

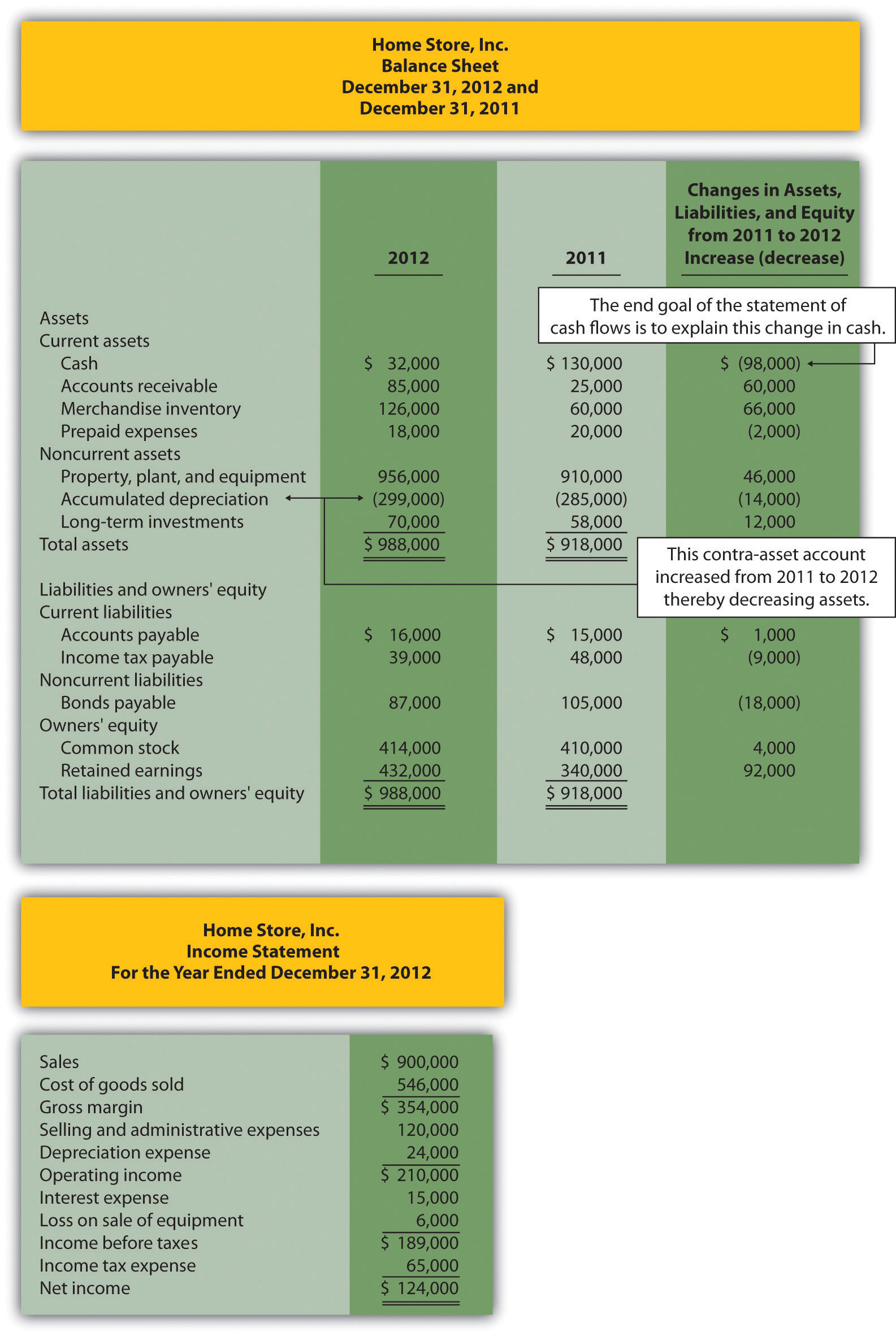

Answer: As stated earlier, the information needed to prepare the statement of cash flows includes the balance sheet, income statement, and other selected data. This information is presented in Figure 12.3 "Balance Sheet and Income Statement for Home Store, Inc.". Other pertinent data for 2012 are as follows:

With these data and the information provided in Figure 12.3 "Balance Sheet and Income Statement for Home Store, Inc.", we can start preparing the statement of cash flows. It is important to note that all positive amounts shown in the statement of cash flows denote an increase in cash, and all negative amounts denote a decrease in cash.

Figure 12.3 Balance Sheet and Income Statement for Home Store, Inc.

Question: We will be using the indirect method to prepare the operating activities section. (The direct method is covered in the appendix.) The starting point using the indirect method is net income. Home Store, Inc., had net income of $124,000 in 2012. This amount comes from the income statement, which was prepared using the accrual basis of accounting. How do we convert this amount to a cash basis?

Answer: Several adjustments are necessary to convert this amount to a cash basis and to provide an amount related only to daily operating activities of the business. If the resulting adjusted amount is a cash inflow, it is called cash provided by operating activities; if it is a cash outflow, it is called cash used by operating activities.

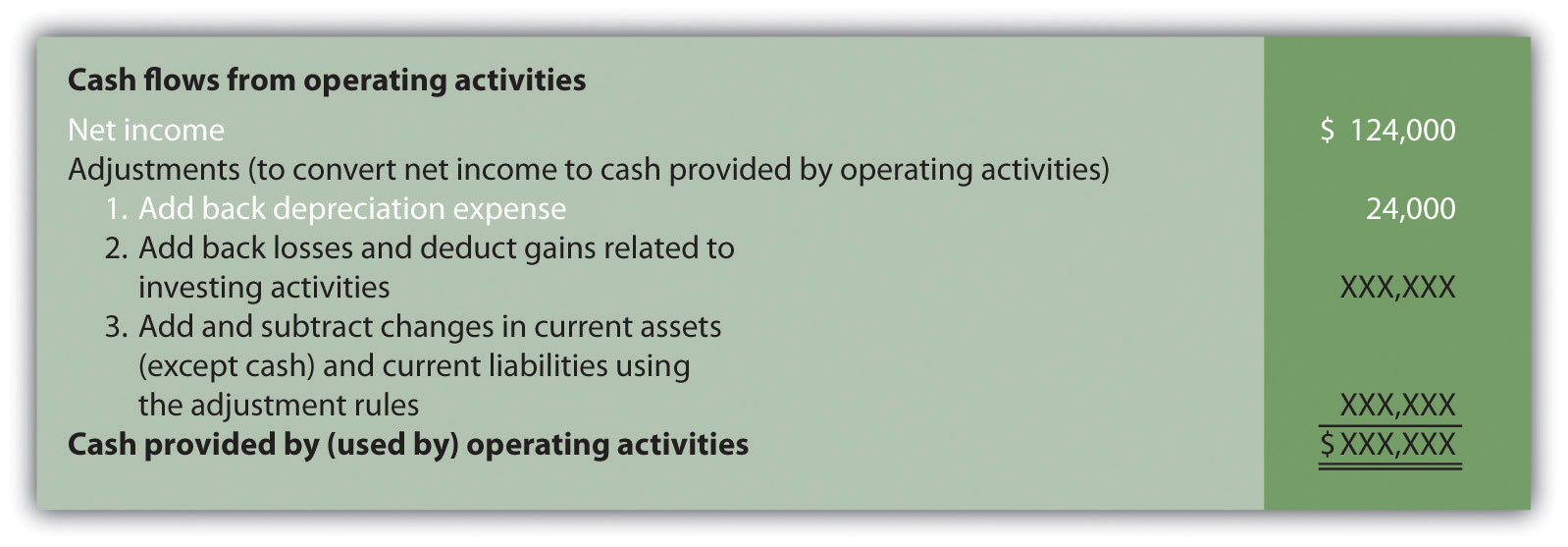

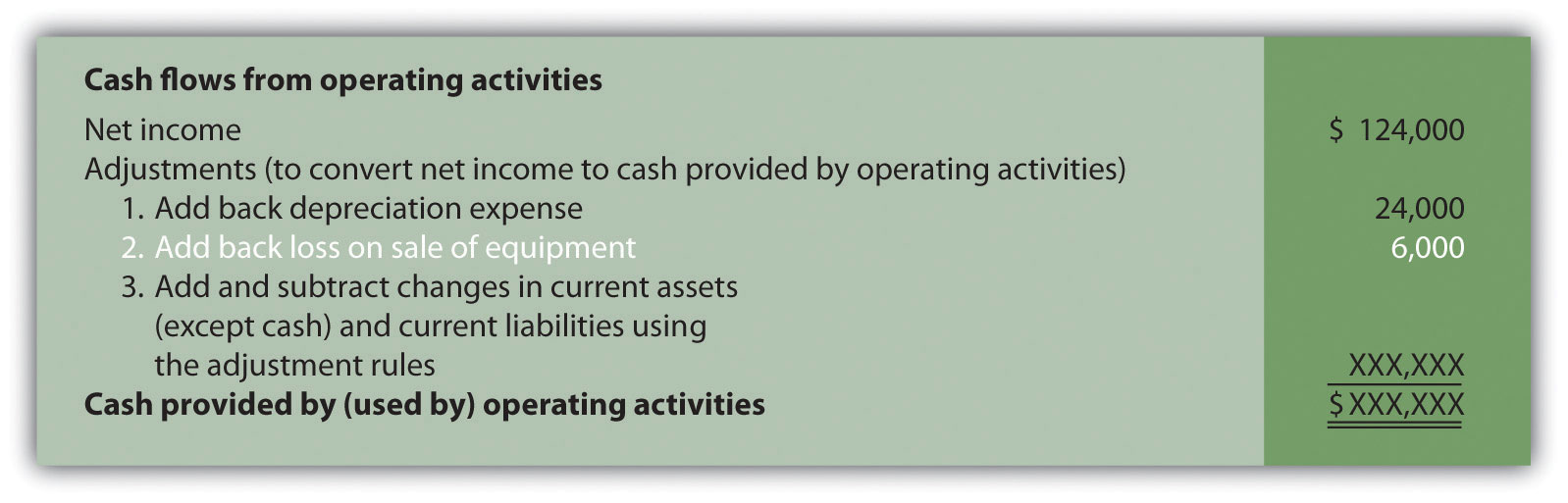

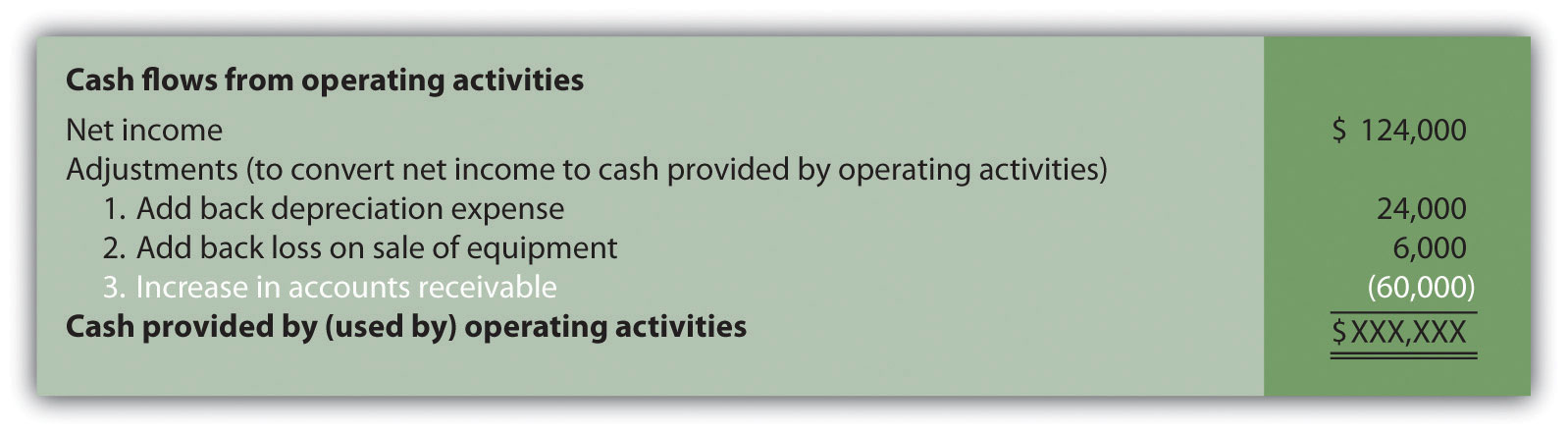

Three general types of adjustments are necessary to convert net income to cash provided by operating activities. These three types of adjustments are shown in Figure 12.4 "Operating Activities Format and Adjustments", which also displays the format used for the operating activities section of the statement of cash flows. Examine this figure carefully.

Figure 12.4 Operating Activities Format and Adjustments

Question: What is the first type of adjustment necessary to convert net income to a cash basis?

Answer: The first adjustment to net income involves adding back expenses that do not affect cash (often called noncash expenses). For example, the accrual basis of accounting deducts depreciation expense in calculating net income, even though depreciation expense does not involve cash. (Recall the financial accounting entry to record depreciation expense: debit depreciation expense and credit accumulated depreciation. Notice cash is not involved.) Thus to convert net income to a cash basis, depreciation expense is added back to net income. In effect, we are reversing depreciation expense because it is not an expense using the cash basis of accounting. The end result is as though depreciation expense was never deducted as an expense.

Next, we show how the first adjustment to net income appears in the operating activities section of the statement of cash flows for Home Store, Inc. (net income and depreciation expense come from the income statement shown in Figure 12.3 "Balance Sheet and Income Statement for Home Store, Inc."):

The income statement for Home Store, Inc., shows $24,000 in depreciation expense for the year. As shown previously, this amount is added back to the net income of $124,000.

Question: What is the second type of adjustment necessary to convert net income to a cash basis?

Answer: The second adjustment to net income involves adding back losses and deducting gains related to investing activities. For example, Home Store, Inc., realized a $6,000 loss on the sale of equipment. This loss is shown on the income statement as a deduction in calculating net income (see Figure 12.3 "Balance Sheet and Income Statement for Home Store, Inc."). However, this loss is not related to the daily operations of the business. That is, Home Store, Inc., is not in the business of buying and selling equipment daily. Remember, we are trying to find the cash provided by operating activities in this section of the statement of cash flows.

Since equipment is a noncurrent asset, cash activity related to the disposal of equipment should be included in the investment activities section of the statement of cash flows. Thus the $6,000 loss shown as a deduction on the income statement is added back to net income, and it will be included later in the investing activities section as part of the proceeds from the sale of equipment. In effect, we are reversing the $6,000 loss because it is not an operating expense.

Here’s how the second adjustment to net income appears in the operating activities section of the statement of cash flows for Home Store, Inc.:

Question: What is the third type of adjustment necessary to convert net income to a cash basis?

Answer: The third type of adjustment to net income involves analyzing the changes in all current assets (except cash) and current liabilities from the beginning of the period to the end of the period. These changes are already shown in the far right column of the balance sheet portion of Figure 12.3 "Balance Sheet and Income Statement for Home Store, Inc.". Two important rules must be followed to determine how the change is reflected as an adjustment to net income. Study these two rules carefully:

Now let’s work through each current asset and current liability line item shown in the balance sheet (Figure 12.3 "Balance Sheet and Income Statement for Home Store, Inc.") and use these rules to determine how each item fits into the operating activities section as an adjustment to net income.

The first current asset line item, cash, shows the change in cash from the beginning of the year to the end of year. Cash decreased by $98,000. The goal of the statement of cash flows is to show what caused this $98,000 decrease. This amount will appear in step 4 when we reconcile the beginning cash balance to the ending cash balance. The next line item is accounts receivable.

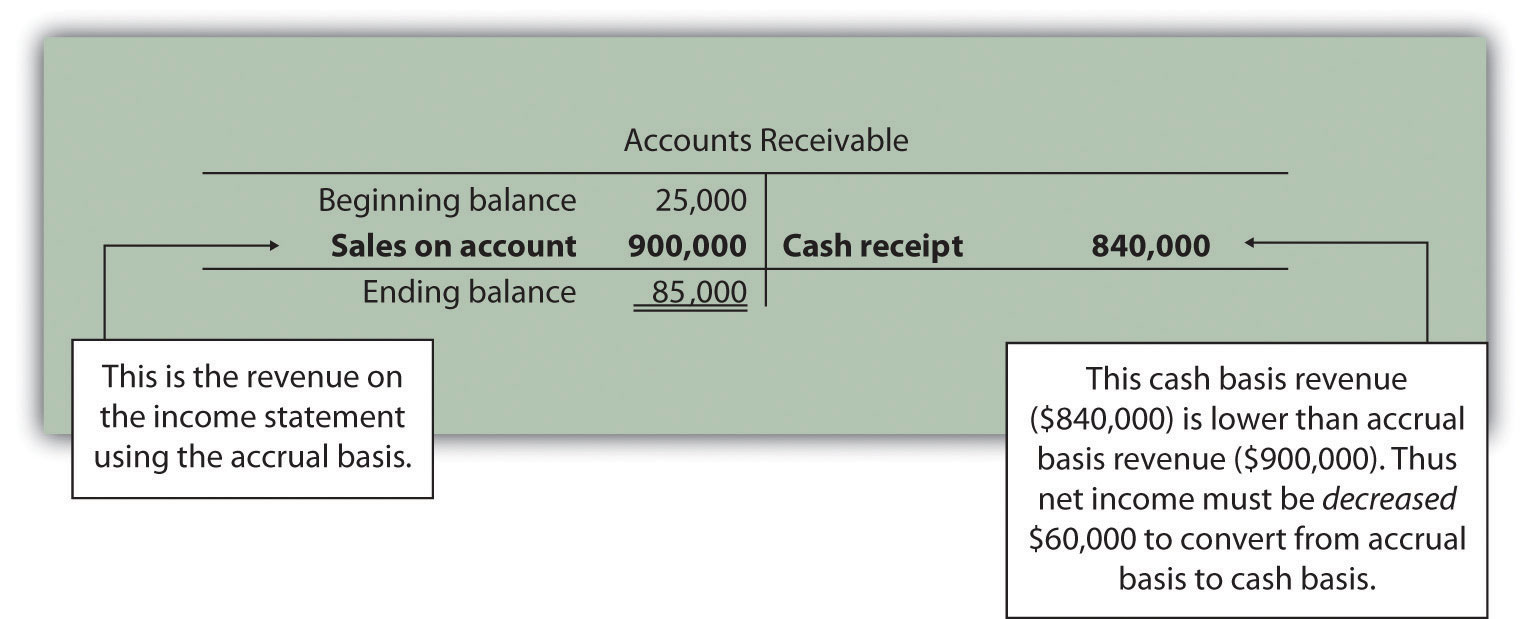

Accounts receivable (current asset) increased by $60,000. The current asset rule states that increases in current assets are deducted from net income. Thus $60,000 is deducted from net income in the operating activities section of the statement of cash flows. Here’s why.

Assume all Home Store’s sales shown on the income statement are credit sales (each sale required a debit to accounts receivable and a credit to sales). The beginning accounts receivable balance of $25,000 is increased by $900,000 for credit sales made during the year, resulting in $925,000 in total receivables to be collected. Since $85,000 in accounts receivable remains at the end of the year, $840,000 in cash was collected (= $925,000 − $85,000). On a cash basis, Home Store, Inc., should show $840,000 in revenue rather than $900,000. Thus net income must be reduced by $60,000 (= $900,000 revenue using accrual basis − $840,000 revenue using cash basis). The accounts receivable T-account shown in the following provides further clarification.

Here’s how the accounts receivable adjustment to net income appears in the operating activities section of the statement of cash flows for Home Store, Inc.:

We will continue analyzing each current asset and current liability item in the balance sheet shown in Figure 12.3 "Balance Sheet and Income Statement for Home Store, Inc." and present the resulting adjustments and completed operating activities section at the end of our analysis in Figure 12.5 "Operating Activities Section of Statement of Cash Flows (Home Store, Inc.)".

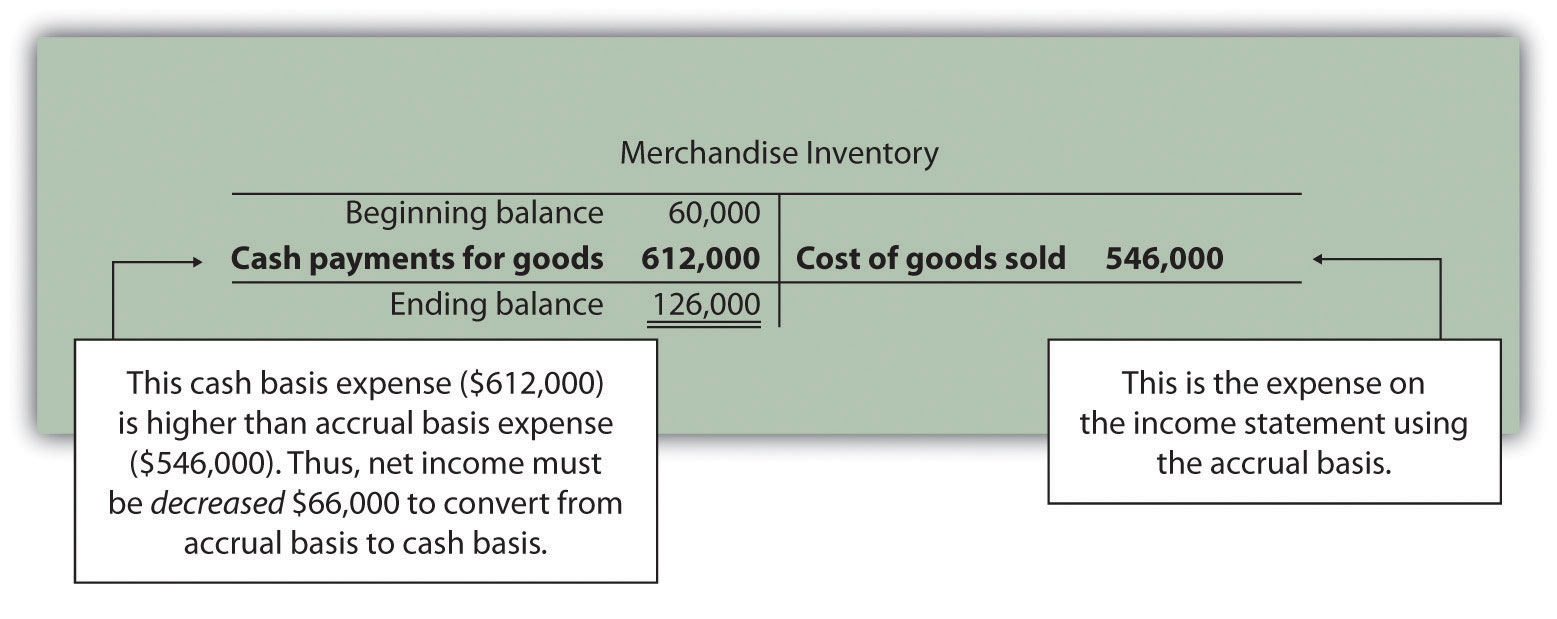

Merchandise inventory (current asset) increased by $66,000. Because the current asset rule states that increases in current assets are deducted from net income, $66,000 is deducted from net income in the operating activities section of the statement of cash flows. To explain why, let’s assume Home Store, Inc., pays cash for all purchases of merchandise inventory. If the merchandise inventory account increases over time, more goods are purchased than are sold. Because merchandise inventory at Home Store, Inc., increased $66,000 and cost of goods sold totaled $546,000 (as shown in Figure 12.3 "Balance Sheet and Income Statement for Home Store, Inc."), the company must have purchased inventory with a cost of $612,000 during the period (= $66,000 + $546,000). Thus more cash was paid for merchandise ($612,000) than was reflected on the income statement as cost of goods sold ($546,000). If expenses are higher using a cash basis, the adjustment must decrease net income. Therefore $66,000 is deducted from net income in the operating activities section of the statement of cash flows. This information is summarized in the merchandise inventory T-account in the following.

Prepaid expenses (current asset) decreased by $2,000. Because the current asset rule states that decreases in current assets are added to net income, $2,000 is added to net income in the operating activities section of the statement of cash flows. This is because cash paid for these expenses was lower than the expenses recognized on the income statement using the accrual basis. Since expenses are $2,000 lower using the cash basis, net income must be increased by $2,000.

Important Current Asset Rule

When preparing the operating activities section of the statement of cash flows, increases in current assets are deducted from net income; decreases in current assets are added to net income.

Question: Now that we know how to handle the change in current assets when preparing the operating activities section of the statement of cash flows, what do we do with current liabilities?

Answer: The current liability rule is a bit different than the current asset rule as described next.

Accounts payable (current liability) increased by $1,000. Because the current liability rule states that increases in current liabilities are added to net income, $1,000 is added to net income in the operating activities section of the statement of cash flows. An increase in accounts payable signifies that Home Store, Inc., recorded more as an expense on the income statement (accrual basis) than the company paid in cash (cash basis). Since expenses are lower using the cash basis, net income must be increased by $1,000.

Income tax payable (current liability) decreased by $9,000. Because the current liability rule states that decreases in current liabilities are deducted from net income, $9,000 is deducted from net income in the operating activities section of the statement of cash flows. A decrease in income tax payable signifies that Home Store, Inc., paid more for income taxes (cash basis) than the company recorded as an expense on the income statement (accrual basis). Since expenses are higher using the cash basis, net income must be decreased by $9,000.

Important Current Liability Rule

When preparing the operating activities section of the statement of cash flows, increases in current liabilities are added to net income; decreases in current liabilities are deducted from net income.

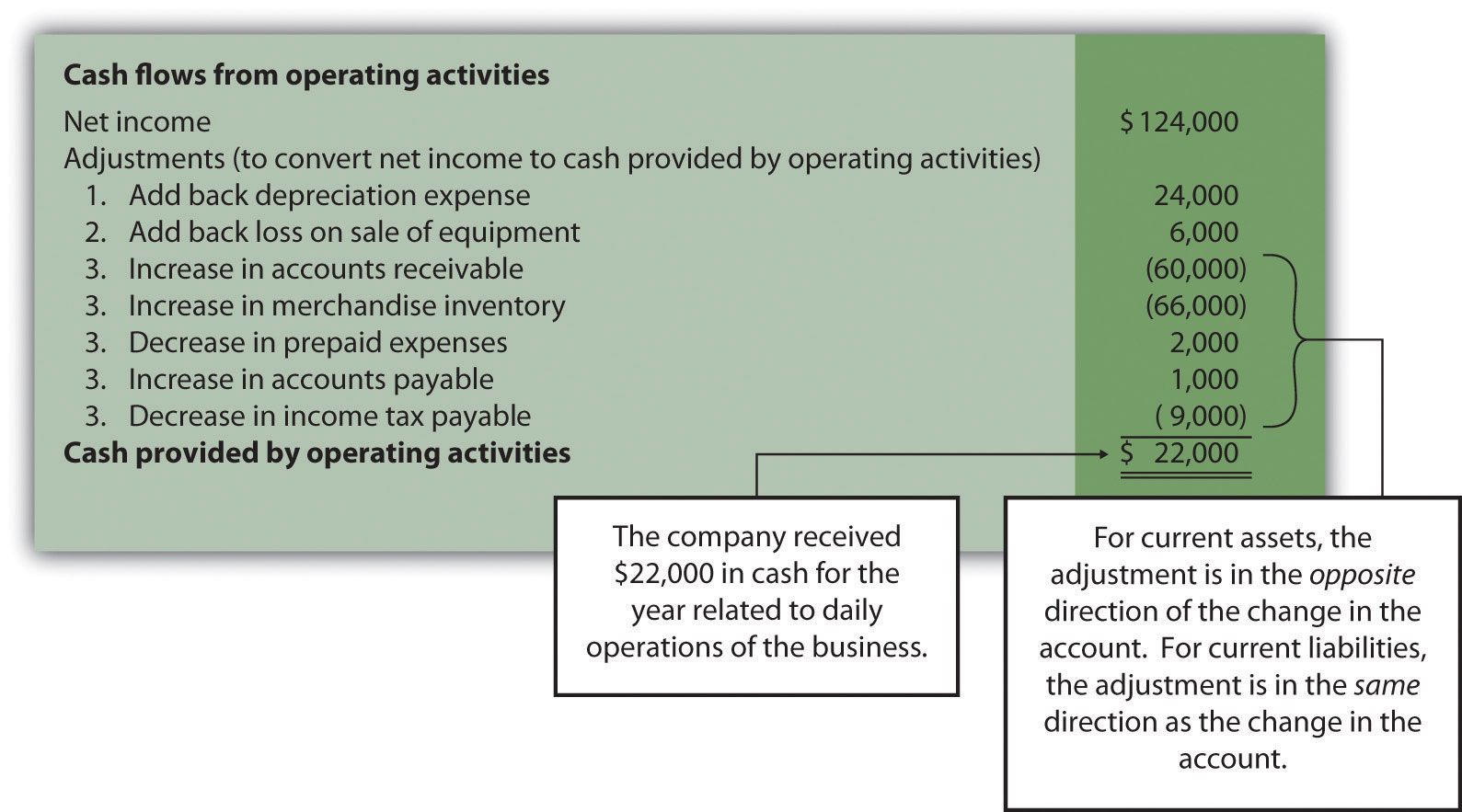

Question: What does the operating activities section of the statement of cash flows look like for Home Store, Inc.?

Answer: Figure 12.5 "Operating Activities Section of Statement of Cash Flows (Home Store, Inc.)" shows the completed operating activities section of the statement of cash flows for Home Store. Inc. The most important line is at the bottom, which shows cash of $22,000 was generated during the year from daily operations of the business. Notice this amount is significantly lower than the net income amount of $124,000 reported on the income statement. Study Figure 12.5 "Operating Activities Section of Statement of Cash Flows (Home Store, Inc.)" carefully noting the three types of adjustments made to net income.

Figure 12.5 Operating Activities Section of Statement of Cash Flows (Home Store, Inc.)

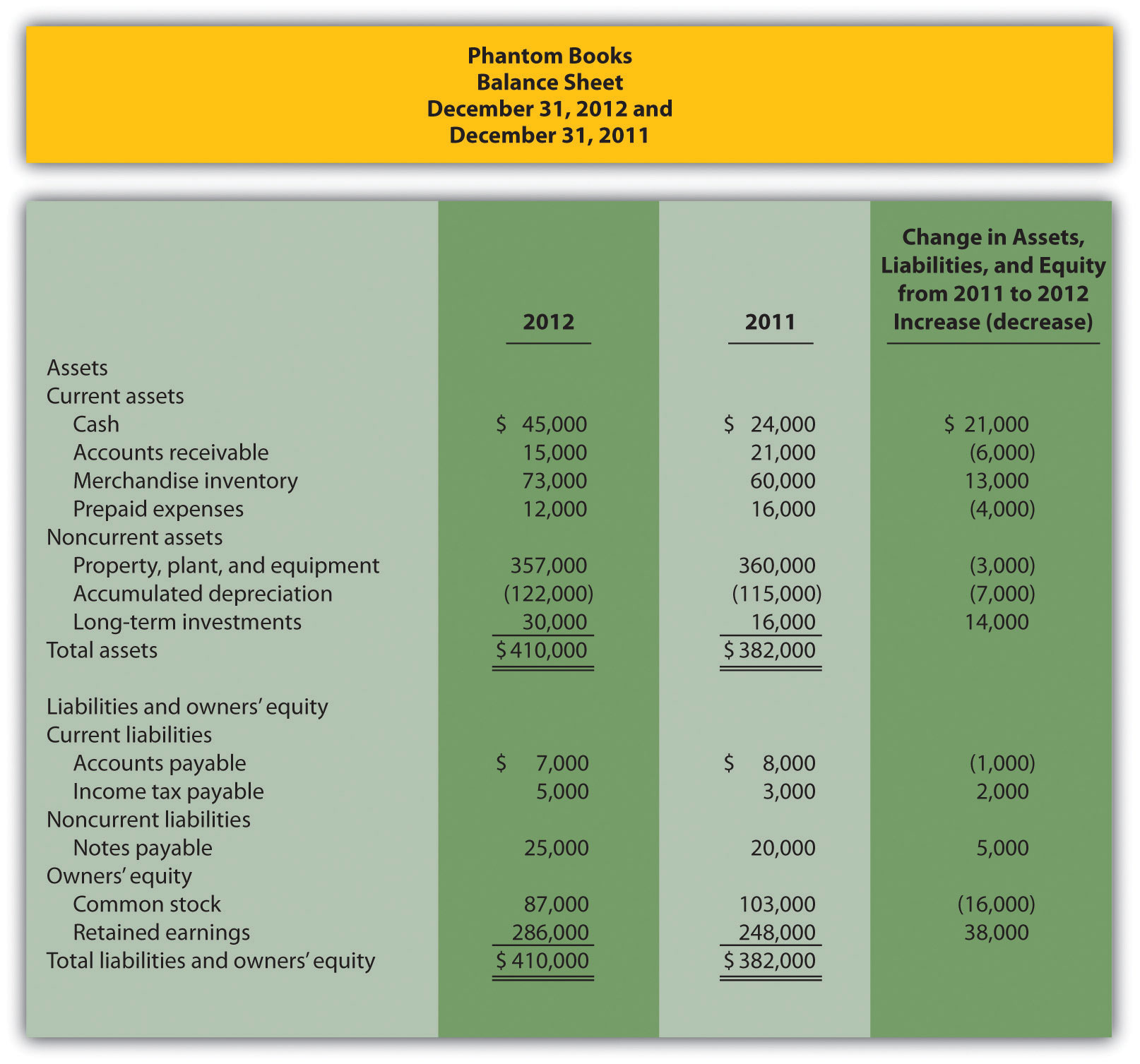

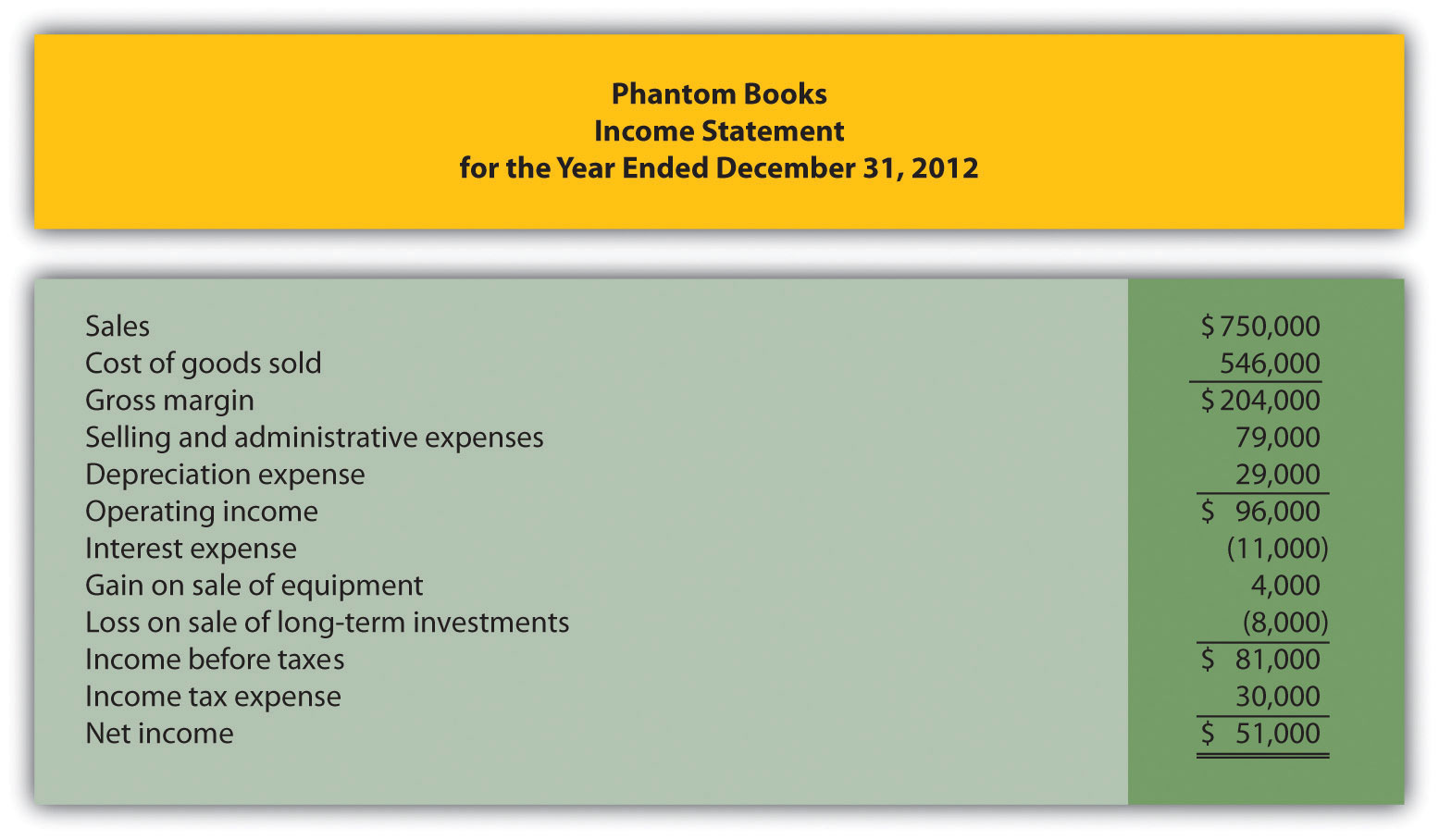

Note 12.21 "Review Problem 12.4" through Note 12.25 "Review Problem 12.7" will use the data presented as follows for Phantom Books. Each review problem corresponds to the four steps required to prepare a statement of cash flows.

Phantom Books is a retail store that sells new and used books. Phantom’s most recent balance sheet, income statement, and other important information for 2012 are presented in the following.

Additional data for 2012 include the following:

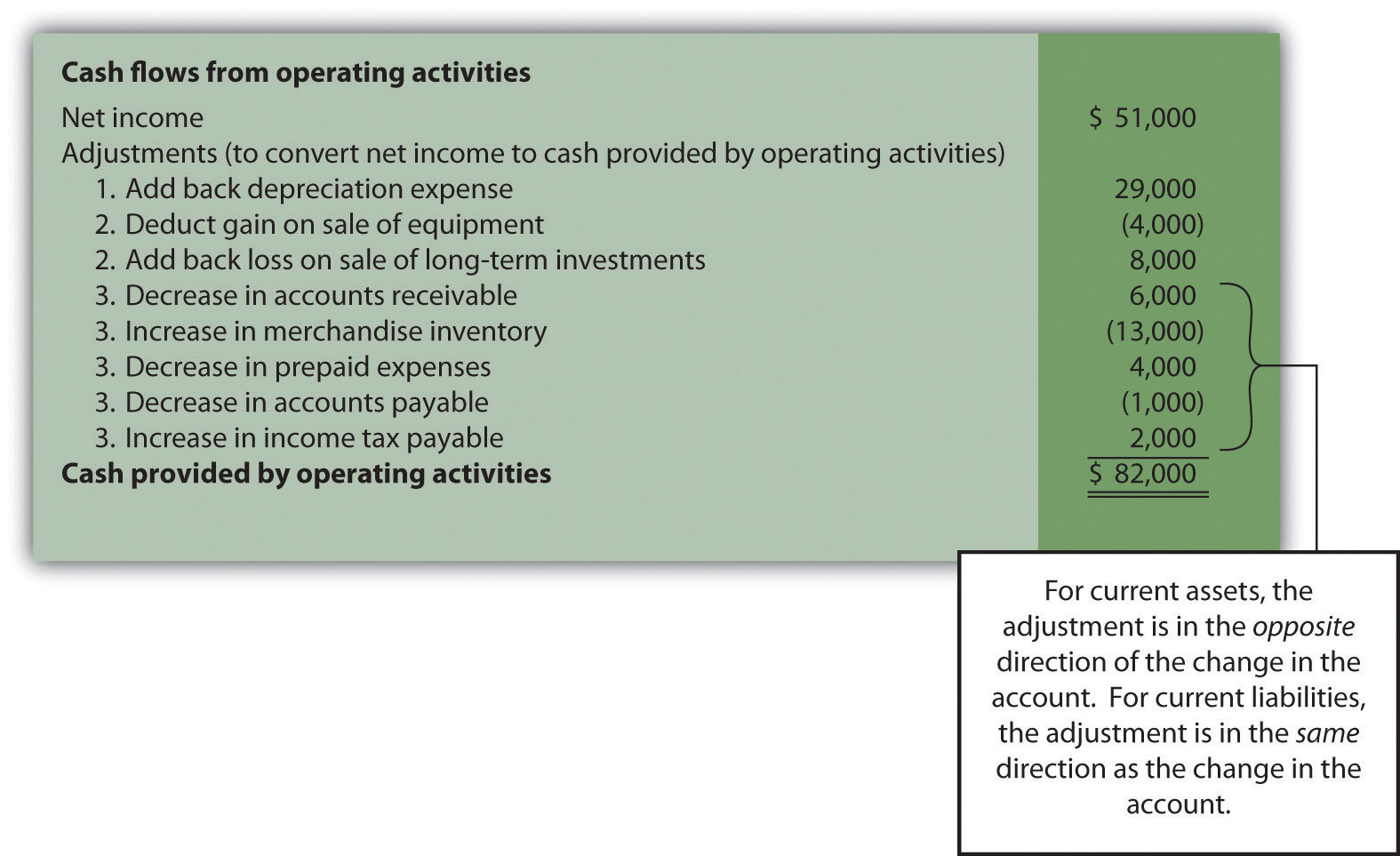

Solution to Review Problem 12.4

Start with net income from the income statement; make the appropriate adjustments for (1) noncash expenses, such as depreciation and amortization; (2) gains and losses related to investing activities; and (3) changes in current assets other than cash and current liabilities. The operating activities section of the statement of cash flows for Phantom Books appears as follows.

Before moving on to step 2, note that investing and financing activities sections always use the same format whether the operating activities section is presented using the direct method or indirect method.

Question: Now that we have completed the operating activities section for Home Store, Inc., the next step is to prepare the investing activities section. What information is used for this section, and how is it prepared?

Answer: The investing activities section of the statement of cash flows focuses on cash activities related to noncurrent assets. Review the noncurrent asset section of Home Store, Inc.’s balance sheet presented in Figure 12.3 "Balance Sheet and Income Statement for Home Store, Inc.". Three noncurrent asset line items must be analyzed to determine how to present cash flow information in the investing activities section.

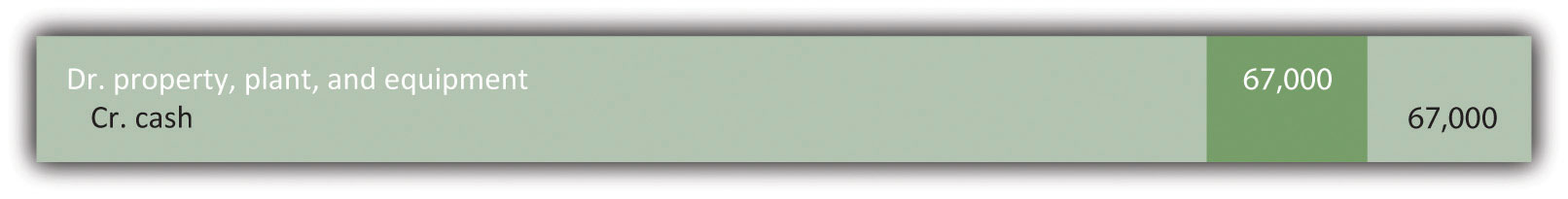

Property, plant, and equipment increased by $46,000. The additional information provided for 2012 indicates two types of transactions caused this increase. First, the company purchased equipment for $67,000 cash. Home Store, Inc., made the following journal entry for this transaction:

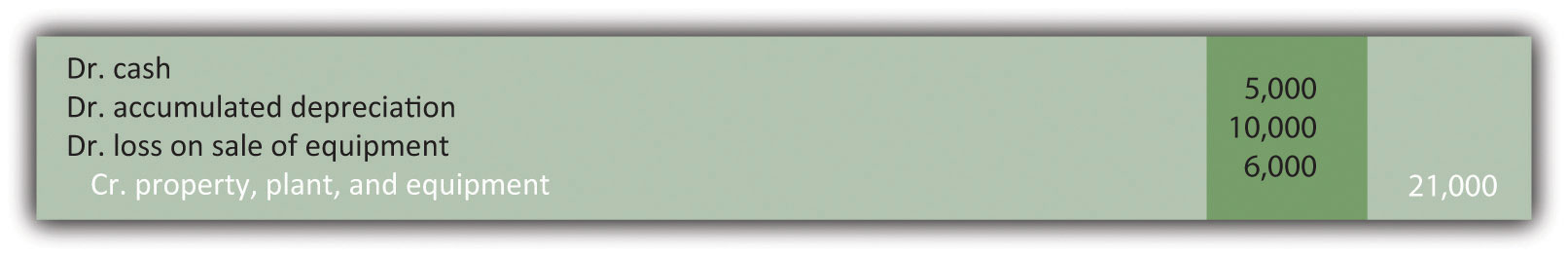

Second, the company sold equipment for $5,000 cash (often called a disposal of equipment). This equipment was on the books at an original cost of $21,000 with accumulated depreciation of $10,000. Home Store, Inc., made the following journal entry for this transaction:

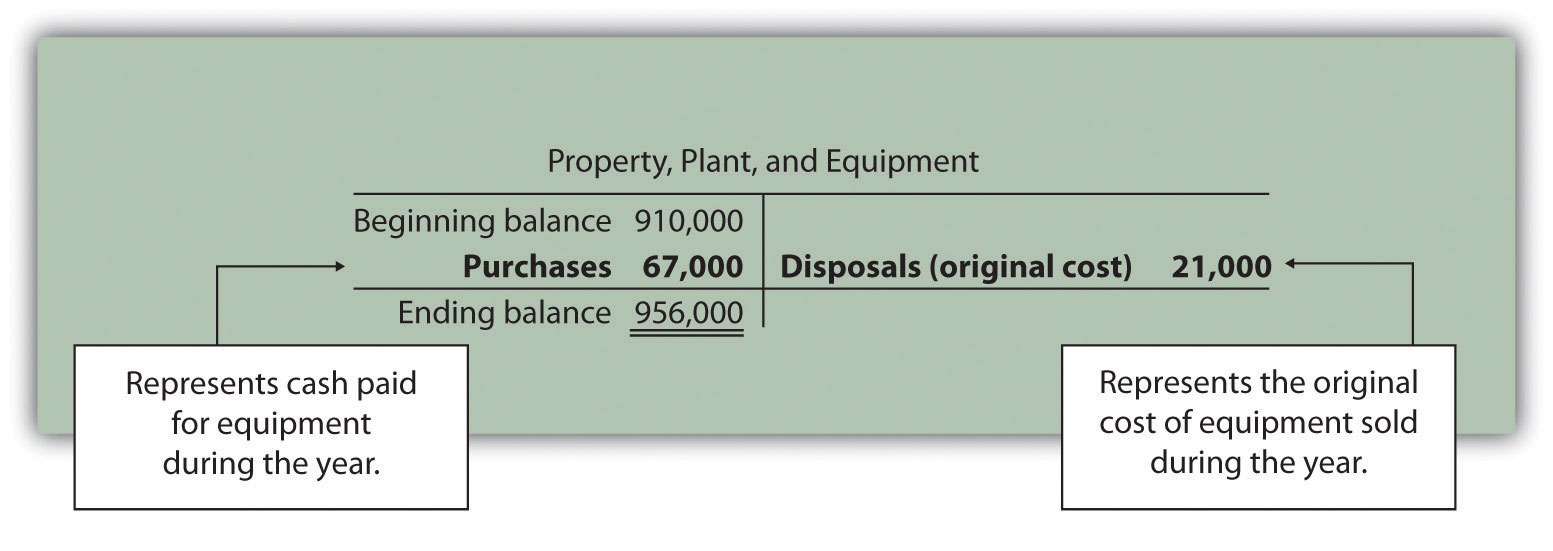

Notice the two entries to property, plant, and equipment shown previously. The net effect of these 2 entries is an increase of $46,000 (= $67,000 − $21,000). This is summarized in the following T-account:

Question: How is this property, plant, and equipment information used in the investing activities section of the statement of cash flows for Home Store, Inc.?

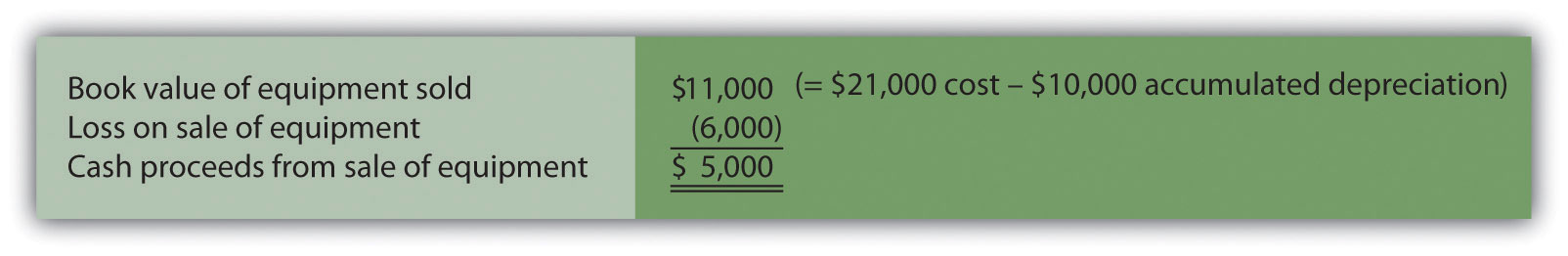

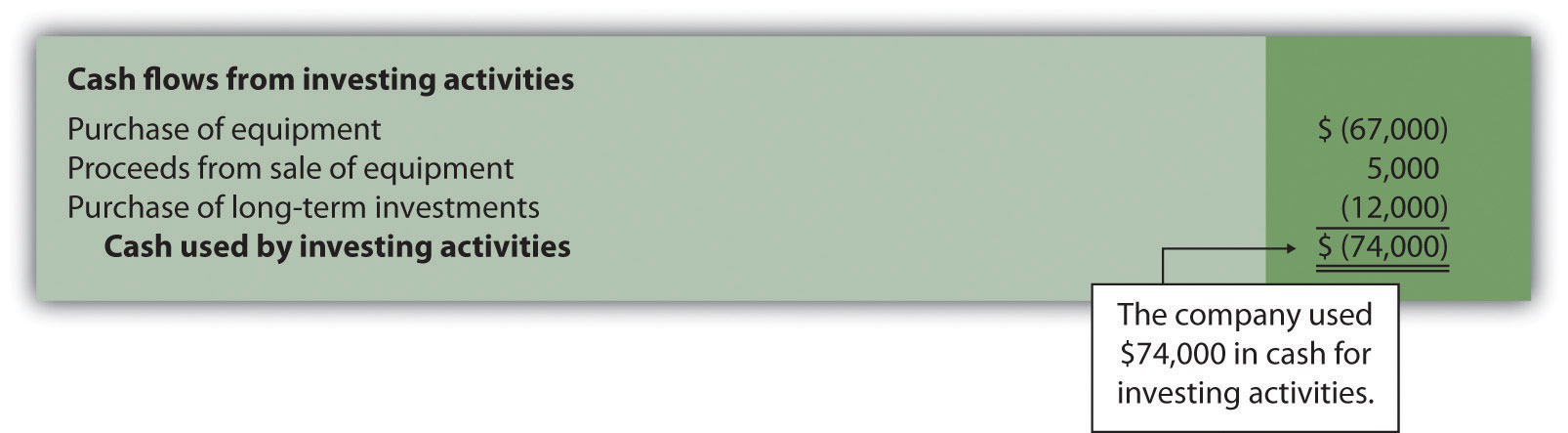

Answer: First, the purchase of equipment for $67,000 cash is shown as a decrease in cash. Second, the sale of equipment for $5,000 is shown as an increase in cash. It is not enough to simply show a cash outflow of $62,000 in the investing activities section of the statement of cash flows (= $67,000 − $5,000). Instead, Home Store, Inc., must show the components of this cash outflow as separate line items in the statement of cash flows as required by U.S. GAAP. The formal presentation of this information in the investing activities section is shown later in Figure 12.6 "Investing Activities Section of Statement of Cash Flows (Home Store, Inc.)".

Accumulated depreciation decreased noncurrent assets by $14,000. This contra asset account is not typical of the other asset accounts shown on Home Store, Inc.’s balance sheet since contra asset accounts have the effect of reducing assets. Thus as this accumulated depreciation account increases, it further reduces overall assets. Terminology can get confusing, so here is a simple way to look at it. The higher the account goes; the more it reduces assets. This is why the change column shows this account as decreasing assets.

Two items caused the change in the accumulated depreciation account. First, the sale of equipment during the year caused the company to take $10,000 in accumulated depreciation off the books. Second, $24,000 in depreciation expense was recorded during the year (with a corresponding entry to accumulated depreciation). This information is summarized in the following T-account:

Question: How is accumulated depreciation information used in the statement of cash flows for Home Store, Inc.?

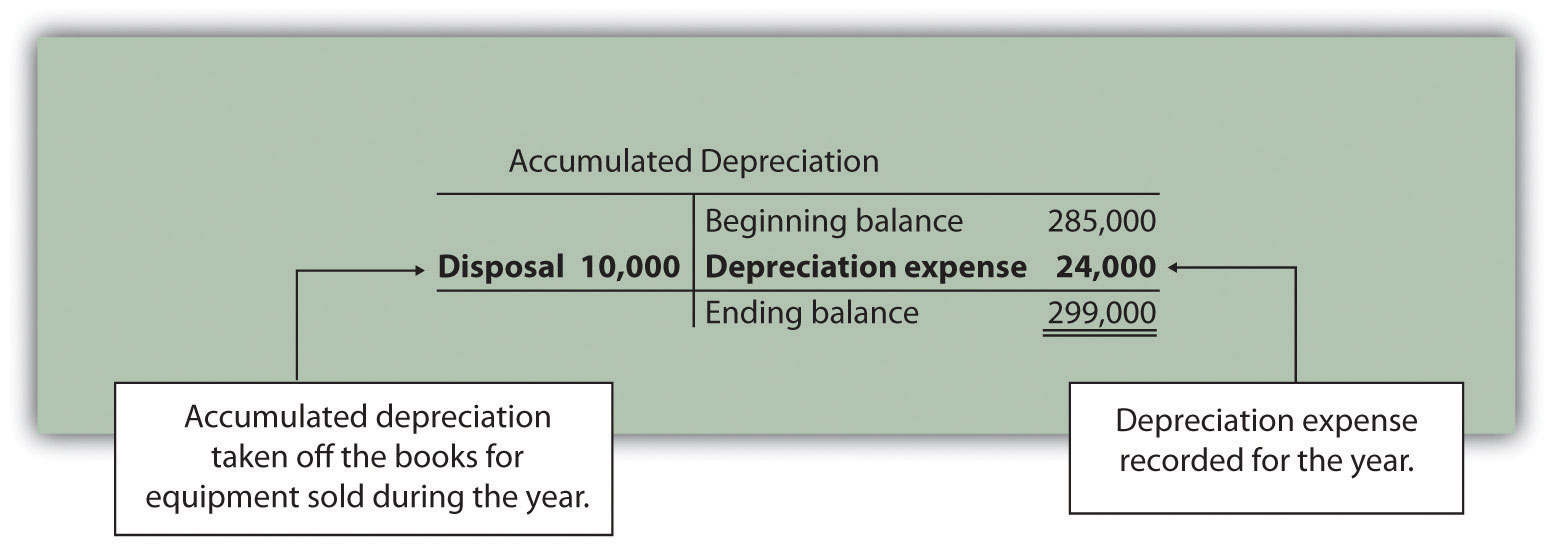

Answer: This information is already reflected in two places (the work has already been done!). First, depreciation expense is a noncash expense and is added back to net income in the operating activities section of the statement of cash flows (see Figure 12.5 "Operating Activities Section of Statement of Cash Flows (Home Store, Inc.)"). Second, $10,000 of accumulated depreciation related to disposals is included as part of the $5,000 proceeds from the sale of equipment in the investing activities section of the statement of cash flows (see Figure 12.6 "Investing Activities Section of Statement of Cash Flows (Home Store, Inc.)"). Here are the components of the equipment sale that support the $5,000 in cash proceeds shown in the investing activities section:

Long-term investments increased by $12,000. The additional information provided for 2012 indicates there were no sales of long-term investments during the year. The increase of $12,000 is solely from purchasing long-term investments with cash. Thus the purchase of long-term investments for $12,000 is shown as a decrease in cash in the investing activities section.

Figure 12.6 "Investing Activities Section of Statement of Cash Flows (Home Store, Inc.)" shows the three investing activities described previously: (1) a $67,000 decrease in cash from the purchase of equipment, (2) a $5,000 increase in cash from the sale of equipment, and (3) a $12,000 decrease in cash from the purchase of long-term investments. Examine Figure 12.6 "Investing Activities Section of Statement of Cash Flows (Home Store, Inc.)" carefully noting the impact these three items have on cash and the resulting cash used by investing activities of $74,000.

Figure 12.6 Investing Activities Section of Statement of Cash Flows (Home Store, Inc.)

Using the information presented in Note 12.21 "Review Problem 12.4":

Solution to Review Problem 12.5

Start by analyzing changes in noncurrent assets on the balance sheet. Then prepare the investing activities section of the statement of cash flows. The cash flows related to each noncurrent asset account are underlined as follows.

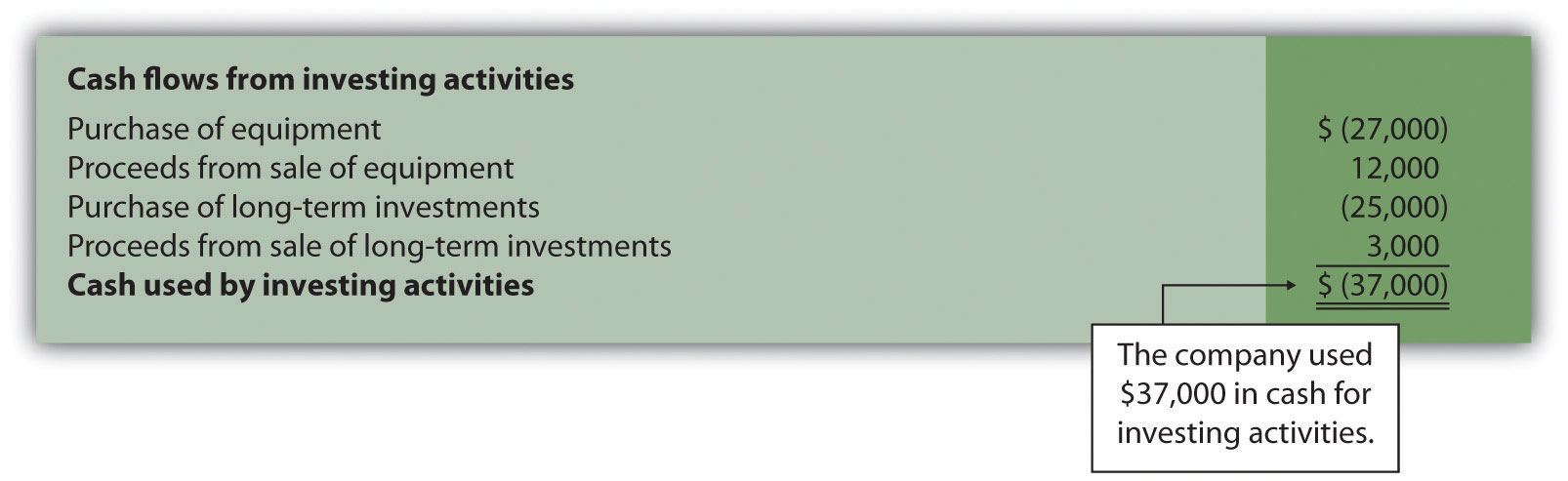

Property, plant, and equipment decreased by $3,000. Additional data provided indicate 2 items caused this change: (1) equipment was purchased for $27,000 cash, causing a $27,000 increase in the account; and (2) equipment with an original cost of $30,000 was sold for $12,000 cash, causing a $30,000 decrease in the account. The net effect of these 2 items on the property, plant, and equipment account is a decrease of $3,000 (= $27,000 purchase − $30,000 original cost of equipment sold). The impact these items have on cash is reflected in the investing activities section of the statement of cash flows by showing a $27,000 cash outflow for the purchase of equipment and a $12,000 cash inflow from the sale of equipment.

Accumulated depreciation decreased assets by $7,000. Two items caused this change: (1) the sale of equipment caused the company to take $22,000 in accumulated depreciation off the books—this was the accumulated depreciation on the books for the equipment sold, and (2) $29,000 in depreciation expense was recorded during the year, with a corresponding entry to accumulated depreciation. Neither of these entries to accumulated depreciation impacts the investing activities section. However, $29,000 in depreciation expense is a noncash expense and is added back to net income in the operating activities section (see solution to Note 12.21 "Review Problem 12.4").

Long-term investments increased by $14,000. Additional data provided indicate 2 items caused this change: (1) long-term investments with an original cost of $11,000 were sold for $3,000 cash, and (2) long-term investments were purchased for $25,000 cash. The net effect of these 2 items on the long-term investments account is an increase of $14,000 (= $25,000 purchase − $11,000 original cost of investments sold). The impact these items have on cash is reflected in the investing activities section of the statement of cash flows by showing a $25,000 cash outflow for the purchase of investments, and a $3,000 cash inflow from the sale of investments.

The investing activities section of the statement of cash flows for Phantom Books is shown as follows:

Question: Now that we have completed the operating and investing activities sections for Home Store, Inc., the next step is to prepare the financing activities section. What information is used for this section, and how is it prepared?

Answer: The financing activities section of the statement of cash flows focuses on cash activities related to noncurrent liabilities and owners’ equity (i.e., cash activities related to long-term company financing). Review the noncurrent liability and owners’ equity sections of Home Store, Inc.’s balance sheet presented in Figure 12.3 "Balance Sheet and Income Statement for Home Store, Inc.". One noncurrent liability item (bonds payable) and two owners’ equity items (common stock and retained earnings) must be analyzed to determine how to present cash flow information in the financing activities section. The formal presentation of this information in the financing activities section is shown later in Figure 12.7 "Financing Activities Section of Statement of Cash Flows (Home Store, Inc.)".

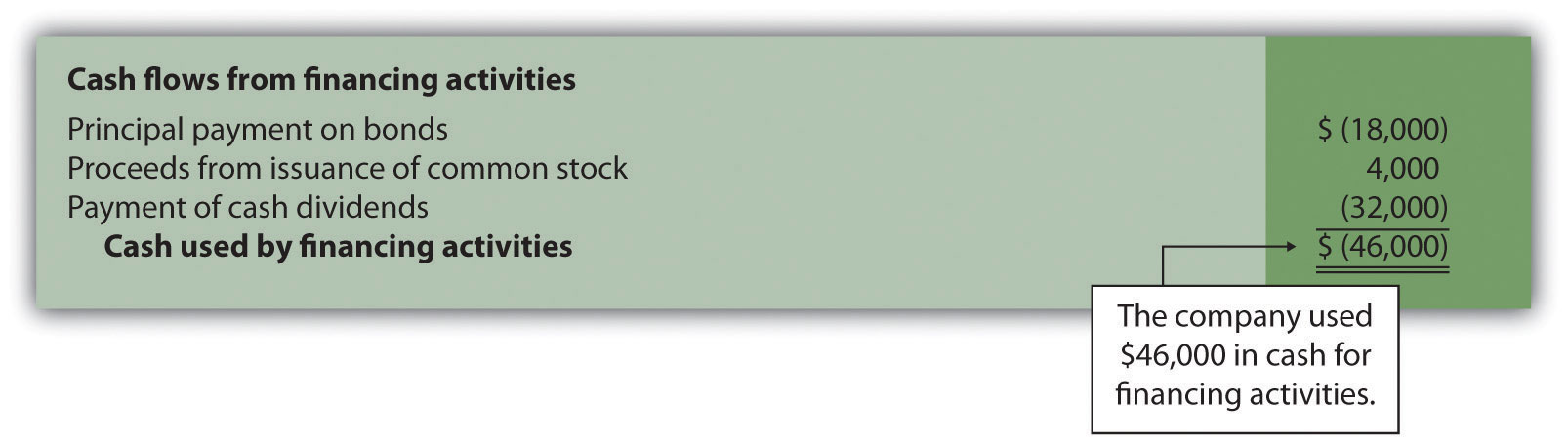

Bonds payable decreased by $18,000. The additional information provided for 2012 indicates Home Store, Inc., paid off bonds during the year with a principal amount of $18,000. This is reflected in the financing activities section of the statement of cash flows as an $18,000 decrease in cash.

Common stock increased by $4,000. The additional information provided for 2012 indicates the company issued common stock for $4,000 cash. This is reflected in the financing activities section of the statement of cash flows as $4,000 increase in cash.

Retained earnings increased by $92,000. Two items caused this increase: (1) net income of $124,000 increased retained earnings, and (2) cash dividends paid totaling $32,000 decreased retained earnings. The net effect of these two entries is an increase of $92,000 (= $124,000 net income − $32,000 cash dividends).

Question: How is this information used in the statement of cash flows?

Answer: Net income is already included at the top of the operating activities section as shown in Figure 12.5 "Operating Activities Section of Statement of Cash Flows (Home Store, Inc.)". Cash dividends are included in the financing activities section as a $32,000 decrease in cash.

Figure 12.7 "Financing Activities Section of Statement of Cash Flows (Home Store, Inc.)" shows the three financing activities described previously: (1) an $18,000 decrease in cash from paying off the principal amount of bonds, (2) a $4,000 increase in cash from the issuance of common stock, and (3) a $32,000 decrease in cash from the payment of cash dividends. Examine Figure 12.7 "Financing Activities Section of Statement of Cash Flows (Home Store, Inc.)" carefully noting the impact these three items have on cash and the resulting cash used by financing activities of $46,000.

Figure 12.7 Financing Activities Section of Statement of Cash Flows (Home Store, Inc.)

Source: Photo courtesy of Rob Enslin, http://www.flickr.com/photos/doos/6086236471/.

Dividend Payments at Microsoft Corporation

By fiscal year ended June 30, 2004, Microsoft was sitting on more than $60,000,000,000 in cash and short-term investments. After reviewing its options, the company chose to give much of this cash back to shareholders in the form of cash dividends. A one-time increase in cash dividends resulted in $33,500,000,000 paid to the owners of the company during the second quarter of fiscal year 2005 (three months ended December 31, 2004). This information is found in the financing activities section of Microsoft’s statement of cash flows.

Source: Microsoft Corporation, “2004 Annual Report,” http://www.microsoft.com; Microsoft Corporation, “2005 Second Quarter Statement of Cash Flows,” http://www.microsoft.com.

Question: Some organizations have noncash activities involving the exchange of one noncurrent or owners’ equity balance sheet item for another (e.g., the issuance of common stock for a building; or the issuance of common stock in exchange for bonds held by creditors). Do these types of transactions appear in the statement of cash flows?

Answer: These exchanges do not involve cash and thus do not appear directly on the statement of cash flows. However, if the amount is significant, this type of exchange must be disclosed as a separate note below the statement of cash flows or in the notes to the financial statements.

Using the information presented in Note 12.21 "Review Problem 12.4" do the following:

Solution to Review Problem 12.6

Start by analyzing changes in noncurrent liabilities and owners’ equity on the balance sheet. Then prepare the financing activities section of the statement of cash flows. The cash flows related to each noncurrent liability and owners’ equity account are underlined as follows.

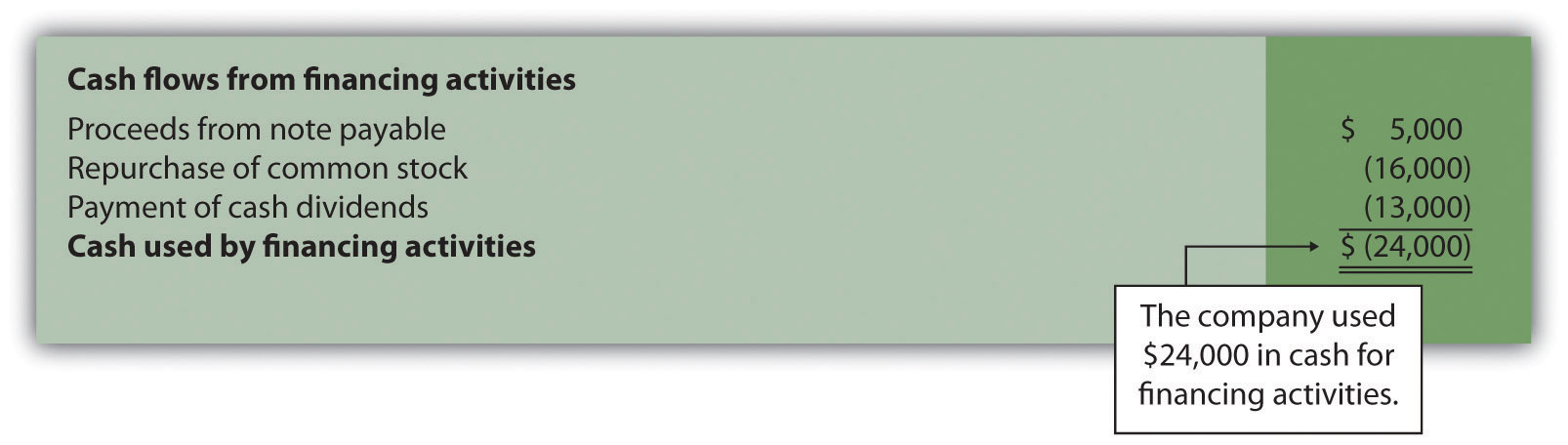

Note payable increased by $5,000. Additional data provided indicate the company signed a note with the bank and received $5,000 cash. This is reflected in the financing activities section as a $5,000 cash inflow.

Common stock decreased by $16,000. Additional data provided indicate the company repurchased common stock for $16,000 cash. This is reflected in the financing activities section as a $16,000 cash outflow.

Retained earnings increased by $38,000. Two items caused this increase: (1) net income of $51,000 increased retained earnings and (2) cash dividends paid totaling $13,000 (provided as additional data) decreased retained earnings. The net effect of these 2 items is an increase of $38,000 (= $51,000 net income − $13,000 cash dividends). Net income is already included at the top of the operating activities section as shown in the solution to Note 12.21 "Review Problem 12.4". Cash dividends are included in the financing activities section as a $13,000 cash outflow.

The financing activities section of the statement of cash flows for Phantom Books is shown as follows:

Question: We’re almost done with Home Store, Inc.’s statement of cash flows. What is the fourth and final step needed to complete the statement of cash flows?

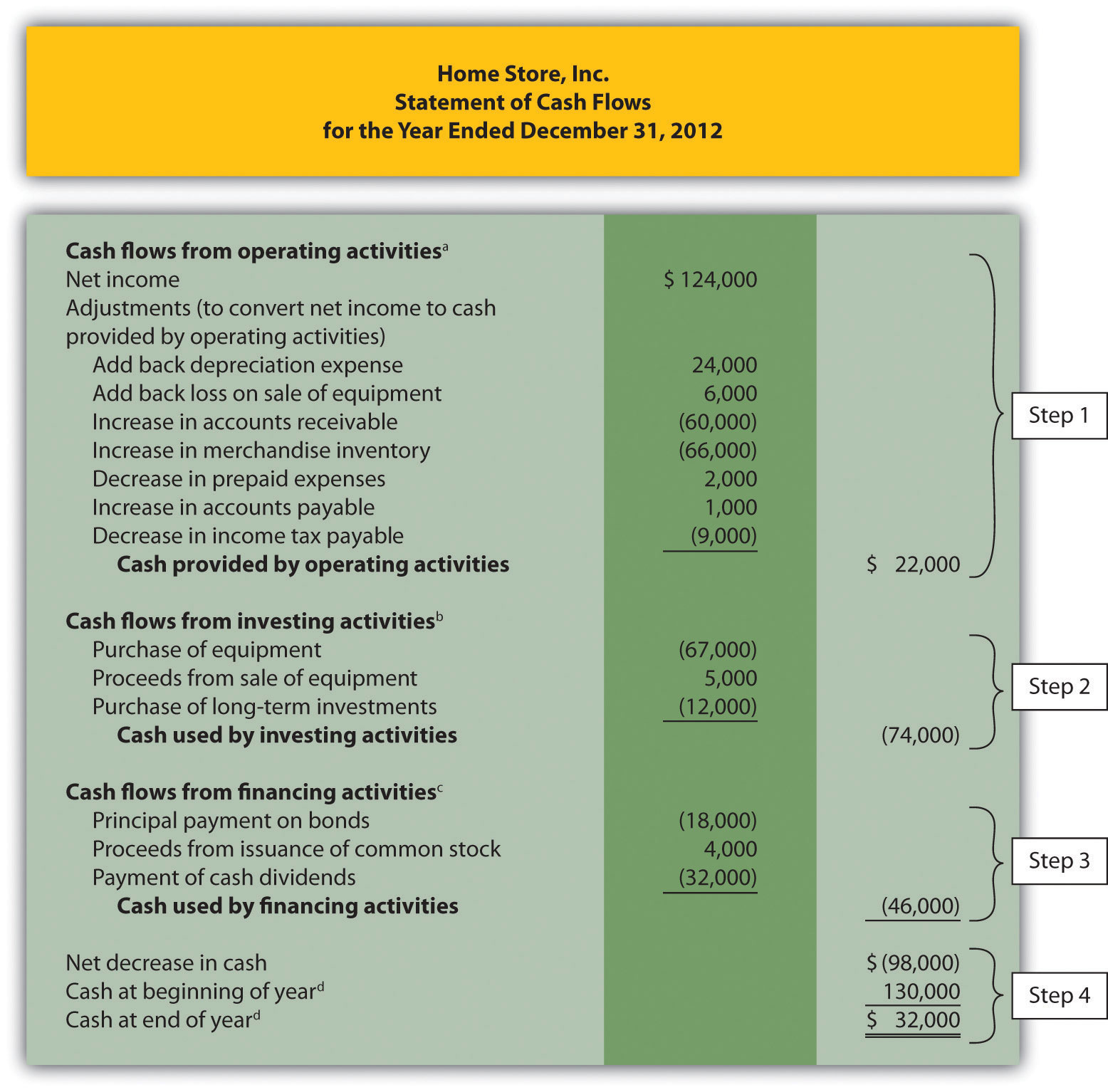

Answer: The final step is to show that the change in cash on the statement of cash flows agrees with the change in cash on the balance sheet. As shown at the bottom of the completed statement of cash flows for Home Store, Inc., in Figure 12.8 "Statement of Cash Flows (Home Store, Inc.)", the net decrease in cash of $98,000 shown on this statement (= $22,000 increase from operating activities − $74,000 decrease from investing activities − $46,000 decrease from financing activities) agrees with the change in cash shown on the balance sheet (= $32,000 ending cash balance − $130,000 beginning balance).

Figure 12.8 Statement of Cash Flows (Home Store, Inc.)

a From Figure 12.5 "Operating Activities Section of Statement of Cash Flows (Home Store, Inc.)".

b From Figure 12.6 "Investing Activities Section of Statement of Cash Flows (Home Store, Inc.)".

c From Figure 12.7 "Financing Activities Section of Statement of Cash Flows (Home Store, Inc.)".

d From Figure 12.3 "Balance Sheet and Income Statement for Home Store, Inc.".

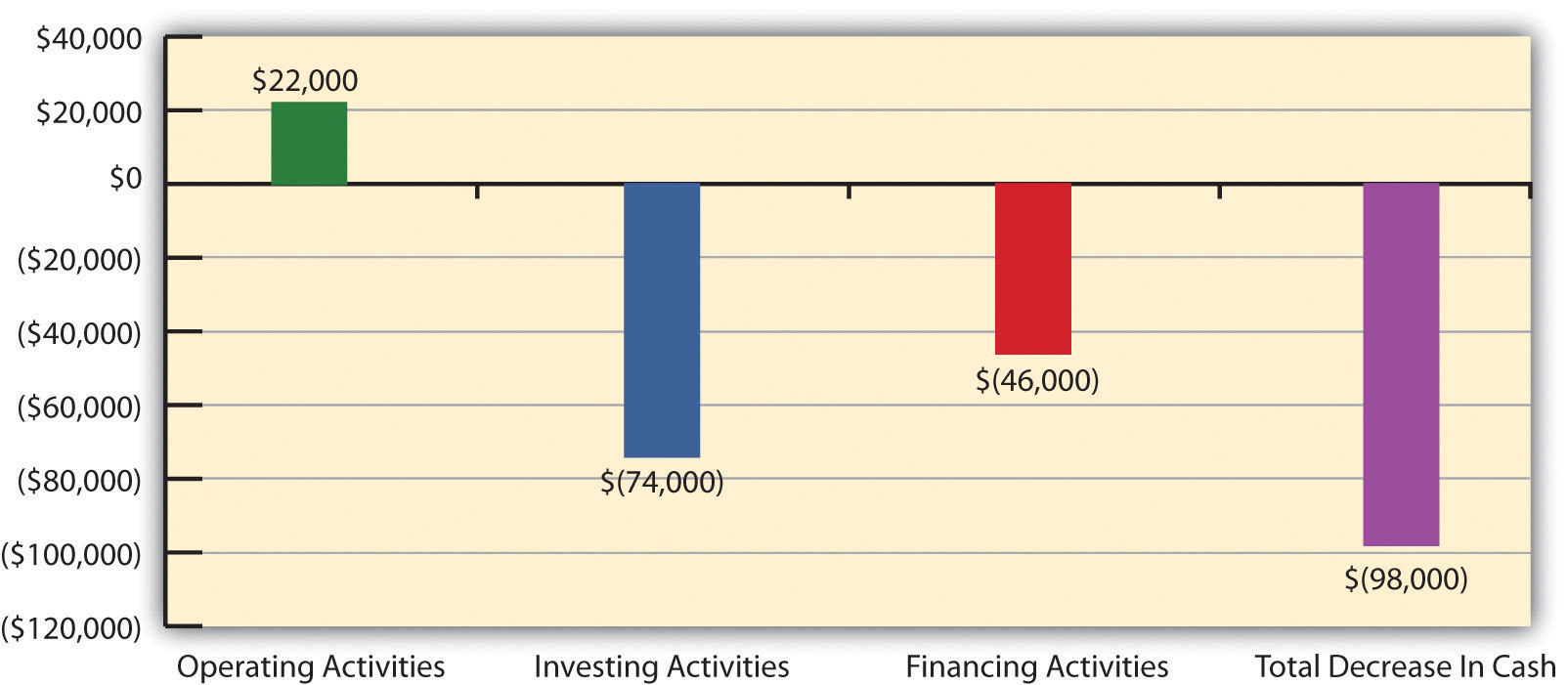

Figure 12.9 "Cash Flows at Home Store, Inc." provides a summary of cash flows for operating activities, investing activities, and financing activities for Home Store, Inc., along with the resulting total decrease in cash of $98,000.

Figure 12.9 Cash Flows at Home Store, Inc.

Using the information presented in Note 12.21 "Review Problem 12.4" and the solutions to Note 12.21 "Review Problem 12.4", Note 12.22 "Review Problem 12.5", and Note 12.24 "Review Problem 12.6", prepare a complete statement of cash flows for Phantom Books. Follow the format presented in Figure 12.8 "Statement of Cash Flows (Home Store, Inc.)".

Solution to Review Problem 12.7

a From Note 12.21 "Review Problem 12.4".

b From Note 12.22 "Review Problem 12.5".

c From Note 12.24 "Review Problem 12.6".

Recall the dialogue at Home Store, Inc., between John (CEO), Steve (treasurer), and Linda (CFO). John was concerned about the company’s drop in cash from $130,000 at the beginning of the year to $32,000 at the end of the year. He asked Linda to investigate and wanted to know how much cash was generated from daily operations during the year. The group reconvened the following week. As you read the dialogue that follows, refer to Figure 12.8 "Statement of Cash Flows (Home Store, Inc.)"; it is the statement of cash flows that Linda prepared for the meeting.

| John (CEO): | Welcome, everyone. Linda, what information do you have for us regarding the company’s cash flow? |

| Linda (CFO): | I’ve completed a statement of cash flows for the year—here are copies for your review (see Figure 12.8 "Statement of Cash Flows (Home Store, Inc.)"). This statement tells us about the company’s cash activities during the year and ultimately explains why cash decreased by $98,000. |

| John: | How much cash did we generate from ongoing operations for the year? |

| Linda: | That can be found in the top portion of the statement under “cash flows from operating activities.” We generated $22,000 from operating activities. |

| Steve (Treasurer): | You’re kidding! We had net income totaling $124,000 but only generated $22,000 in cash? |

| John: | That does seem like a huge disparity. Linda, are you sure this is correct? |

| Linda: | Yes! The reason cash from operating activities is so much lower than net income is that accounts receivable and merchandise inventory increased significantly from the beginning of the year to the end of the year. In fact, both accounts more than doubled. |

| Steve: | The cash tied up in these two areas is definitely hurting our cash flow. We really struggled to meet our cash budgets for accounts receivable collections and inventory purchases. |

| John: | Clearly, we’ve got to get a handle on receivables and inventory. But even with this huge difference between net income and cash flows from operating activities, we generated $22,000 in cash. This does not explain why cash decreased by $98,000. |

| Linda: | You’re right, John. Operating activities produced positive cash flow in spite of these receivables and inventory issues. Let’s look further down the statement. Notice we spent $67,000 on equipment and purchased $12,000 in long-term investments. |

| Steve: | Yes, I recall purchasing a new forklift—the old one was a safety hazard—and purchasing long-term investments at the beginning of the year when our cash balance was on the high side. |

| Linda: | Once we factor in the cash proceeds from the old equipment, you can see we spent $74,000 in cash for equipment and investments. |

| John: | Looking back, we probably should have financed the equipment rather than having paid for it all at once. What else can you tell us, Linda? |

| Linda: | Bonds totaling $18,000 came due during the year, as shown toward the bottom of the statement, and we paid $32,000 in dividends. |

| Steve: | I realize the board felt cash levels were high enough during 2011 to warrant a large dividend payment in 2012, but we need to cut way back on these dividends in the future. |

| Linda: | I agree. To answer your question, John, the $98,000 decrease in cash came primarily from the purchase of equipment and long-term investments and payments for bonds and cash dividends. |

| John: | Thank you, Linda. This provides the information we need to improve cash flow going forward. |

As you can see from this dialogue, the statement of cash flows is not only a reporting requirement for most companies, it is also a useful tool for analytical and planning purposes. Next, we will discuss how to use cash flow information to assess performance and help in planning for the future.