After reading this chapter, you should be able to understand and articulate answers to the following questions:

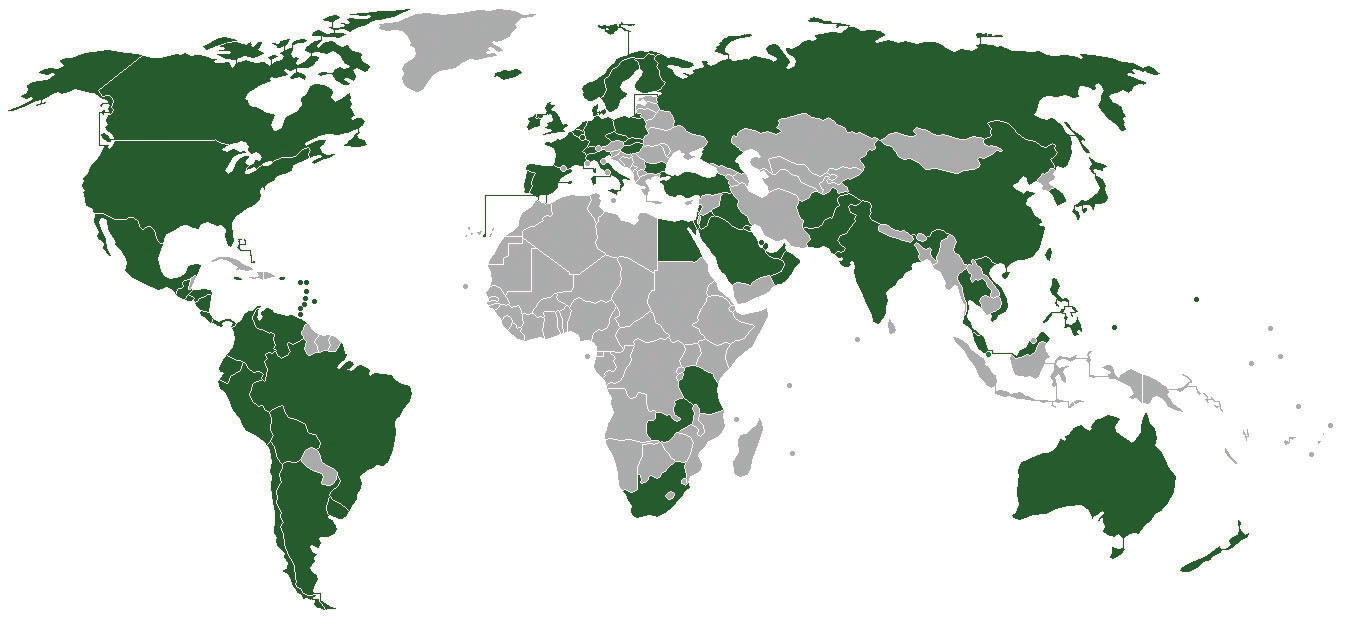

As shown in the highlighted countries, Subway is well on its way to building a worldwide sandwich empire.

Image courtesy of Nomi887, http://en.wikipedia.org/wiki/File:Subway_world_map1edit.png.

Many observers were stunned in March 2011 when news broke that Subway had surpassed McDonald’s as the biggest restaurant chain in the world. At the time of the announcement, Subway had 33,749 units under its banner while McDonald’s had 32,737.Kingsley, P. 2011, March 9. How a sandwich franchise ousted McDonald’s. The Guardian. Retrieved from http://www.guardian.co.uk/lifeandstyle/2011/mar/09/subway-biggest -fast-food-chain Despite its meteoric growth, many opportunities remained. In China, for example, Subway had fewer than two hundred stores. In contrast, China hosts more than 3,200 Kentucky Fried Chicken stores. Overall, Subway was on a roll, and this success seemed likely to continue.

How had Subway surpassed a global icon like McDonald’s? One key factor was Subway’s efforts to provide and promote healthy eating options. This emphasis took hold in the late 1990s when the American public became captivated by college student Jared Fogle. As a freshman at Indiana University in 1998, the 425 pound Fogle decided to try to lose weight by walking regularly and eating a diet consisting of Subway subs. Amazingly, Fogle dropped 245 pounds by February of 1999.

Subway executives knew that a great story had fallen into their laps. They decided to feature Fogle in Subway’s advertising and soon he was a well-known celebrity. In 2007, Fogle met with President Bush about nutrition and testified before the US Congress about the need for healthier snack options in schools. Today, Fogle is the face of Subway and one of the few celebrities that are instantly recognizable based on his first name alone. Much like Beyoncé and Oprah, you can mention “Jared” to almost anyone in America and that person will know exactly of whom you are speaking. Subway’s line of Fresh Fit sandwiches is targeted at prospective Jareds who want to improve their diets.

Because American diets contain too much salt, which can cause high blood pressure, salt levels in restaurant food are attracting increased scrutiny. Subway responded to this issue in April 2011 when its outlets in the United States reduced the amount of salt in all its sandwiches by at least 15 percent without any alteration in taste. The Fresh Fit line of sandwiches received a more dramatic 28 percent reduction in salt. These changes were enacted after customers of Subway’s outlets in New Zealand and Australia embraced similar adjustments. Although the new sandwich recipes cost slightly more than the old ones, Subway plans to absorb these costs rather than raising their prices.Riley, C. 2011, April. Subway lowers salt in its sandwiches. CNNMoney. Retrieved from http://money.cnn.com/2011/04/18/news/companies/subway_salt/index.htm This may be a wise strategy for retaining customers, who have become very price sensitive because of the ongoing uncertainty surrounding the American economy and the high unemployment.

For any organization, the environmentThe set of external conditions and forces that have the potential to influence the organization. consists of the set of external conditions and forces that have the potential to influence the organization. In the case of Subway, for example, the environment contains its customers, its rivals such as McDonald’s and Kentucky Fried Chicken, social trends such as the shift in society toward healthier eating, political entities such as the US Congress, and many additional conditions and forces.

It is useful to break the concept of the environment down into two components. The general environment (or macroenvironment)Overall trends and events in society such as social trends, technological trends, demographics, and economic conditions. includes overall trends and events in society such as social trends, technological trends, demographics, and economic conditions. The industry (or competitive environment)Multiple organizations that collectively compete with one another by providing similar goods, services, or both. consists of multiple organizations that collectively compete with one another by providing similar goods, services, or both.

Every action that an organization takes, such as raising its prices or launching an advertising campaign, creates some degree of changes in the world around it. Most organizations are limited to influencing their industry. Subway’s move to cut salt in its sandwiches, for example, may lead other fast-food firms to revisit the amount of salt contained in their products. A few organizations wield such power and influence that they can shape some elements of the general environment. While most organizations simply react to major technological trends, for example, the actions of firms such as Intel, Microsoft, and Apple help create these trends. Some aspects of the general environment, such as demographics, simply must be taken as a given by all organizations. Overall, the environment has a far greater influence on most organizations than most organizations have on the environment.

Understanding the environment that surrounds an organization is important to the executives in charge of the organizations. There are several reasons for this. First, the environment provides resources that an organization needs in order to create goods and services. In the seventeenth century, British poet John Donne famously noted that “no man is an island.” Similarly, it is accurate to say that no organization is self-sufficient. As the human body must consume oxygen, food, and water, an organization needs to take in resources such as labor, money, and raw materials from outside its boundaries. Subway, for example, simply would cease to exist without the contributions of the franchisees that operate its stores, the suppliers that provide food and other necessary inputs, and the customers who provide Subway with money through purchasing its products. An organization cannot survive without the support of its environment.

Second, the environment is a source of opportunities and threats for an organization. OpportunitiesEvents and trends that create chances to improve an organization’s performance level. are events and trends that create chances to improve an organization’s performance level. In the late 1990s, for example, Jared Fogle’s growing fame created an opportunity for Subway to position itself as a healthy alternative to traditional fast-food restaurants. ThreatsEvents and trends that may undermine an organization’s performance. are events and trends that may undermine an organization’s performance. Subway faces a threat from some upstart restaurant chains. Saladworks, for example, offers a variety of salads that contain fewer than five hundred calories. Noodles and Company offers a variety of sandwiches, pasta dishes, and salads that contain fewer than four hundred calories. These two firms are much smaller than Subway, but they could grow to become substantial threats to Subway’s positioning as a healthy eatery.

Executives must also realize that virtually any environmental trend or event is likely to create opportunities for some organizations and threats for others. This is true even in extreme cases. In addition to horrible human death and suffering, the March 2011 earthquake and tsunami in Japan devastated many organizations, ranging from small businesses that were simply wiped out to corporate giants such as Toyota whose manufacturing capabilities were undermined. As odd as it may seem, however, these tragic events also opened up significant opportunities for other organizations. The rebuilding of infrastructure and dwellings requires concrete, steel, and other materials. Japanese concrete manufacturers, steelmakers, and construction companies are likely to be very busy in the years ahead.

Third, the environment shapes the various strategic decisions that executives make as they attempt to lead their organizations to success. The environment often places important constraints on an organization’s goals, for example. A firm that sets a goal of increasing annual sales by 50 percent might struggle to achieve this goal during an economic recession or if several new competitors enter its business. Environmental conditions also need to be taken into account when examining whether to start doing business in a new country, whether to acquire another company, and whether to launch an innovative product, to name just a few.

An organization’s environment includes factors that it can readily affect as well as factors that largely lay beyond its influence. The latter set of factors are said to exist within the general environment. Because the general environment often has a substantial influence on an organization’s level of success, executives must track trends and events as they evolve and try to anticipate the implications of these trends and events.

PESTEL analysisThe examination of political, economic, social, technological, environmental, and legal factors and their implications for an organization. is one important tool that executives can rely on to organize factors within the general environment and to identify how these factors influence industries and the firms within them. PESTEL is an anagram, meaning it is a word that created by using parts of other words. In particular, PESTEL reflects the names of the six segments of the general environment: (1) political, (2) economic, (3) social, (4) technological, (5) environmental, and (6) legal. Wise executives carefully examine each of these six segments to identify major opportunities and threats and then adjust their firms’ strategies accordingly (Figure 3.1 "PESTEL").

The political segmentThe portion of the general environment that involves governments. centers on the role of governments in shaping business. This segment includes elements such as tax policies, changes in trade restrictions and tariffs, and the stability of governments (Figure 3.2 "Political Factors"). Immigration policy is an aspect of the political segment of the general environment that offers important implications for many different organizations. What approach to take to illegal immigration into the United States from Mexico has been a hotly debated dilemma. Some hospital executives have noted that illegal immigrants put a strain on the health care system because immigrants seldom can pay for medical services and hospitals cannot by law turn them away from emergency rooms.

Proposals to provide support to businesses are often featured within political campaigns.

Reproduced with permission from [citation redacted per publisher request].

Meanwhile, farmers argue that a tightening of immigration policy would be harmful because farmers rely heavily on cheap labor provided by illegal immigrants. In particular, if farmers were forced to employ only legal workers, this would substantially increase the cost of vegetables. Restaurant chains such as Subway would then pay higher prices for lettuce, tomatoes, and other perishables. Subway would then have to decide whether to absorb these costs or pass them along to customers by charging more for subs. Overall, any changes in immigration policy will have implications for hospitals, farmers, restaurants, and many other organizations.

The economic segmentThe portion of the general environment that involves economic and financial conditions. centers on the economic conditions within which organizations operate. It includes elements such as interest rates, inflation rates, gross domestic product, unemployment rates, levels of disposable income, and the general growth or decline of the economy (Figure 3.3 "Economic Factors"). The economic crisis of the late 2000s has had a tremendous negative effect on a vast array of organizations. Rising unemployment discouraged consumers from purchasing expensive, nonessential goods such as automobiles and television sets. Bank failures during the economic crisis led to a dramatic tightening of credit markets. This dealt a huge blow to home builders, for example, who saw demand for new houses plummet because mortgages were extremely difficult to obtain.

Some businesses, however, actually prospered during the crisis. Retailers that offer deep discounts, such as Dollar General and Walmart, enjoyed an increase in their customer base as consumers sought to find ways to economize. Similarly, restaurants such as Subway that charge relatively low prices gained customers, while high-end restaurants such as Ruth’s Chris Steak House worked hard to retain their clientele.

Decisions about interest rates made by the Federal Reserve create opportunities for some organizations and threats for others.

Reproduced with permission from [citation redacted per publisher request].

A generation ago, ketchup was an essential element of every American pantry and salsa was a relatively unknown product. Today, however, food manufacturers sell more salsa than ketchup in the United States. This change reflects the social segmentThe portion of the general environment that involves demographics and cultural trends. of the general environment. Social factors include trends in demographics such as population size, age, and ethnic mix, as well as cultural trends such as attitudes toward obesity and consumer activism (Figure 3.4 "Social Factors"). The exploding popularity of salsa reflects the increasing number of Latinos in the United States over time, as well as the growing acceptance of Latino food by other ethnic groups.

Sometimes changes in the social segment arise from unexpected sources. Before World War II, the American workforce was overwhelmingly male. When millions of men were sent to Europe and Asia to fight in the war, however, organizations had no choice but to rely heavily on female employees. At the time, the attitudes of many executives toward women were appalling. Consider, for example, some of the advice provided to male supervisors of female workers in the July 1943 issue of Transportation Magazine:1943 guide to hiring women. 2007, September–October. Savvy & Sage, p. 16.

The tremendous contributions of female workers during the war contradicted these awful stereotypes. The main role of women who assembled airplanes, ships, and other war materials was to support the military, of course, but their efforts also changed a lot of male executives’ minds about what females could accomplish within organizations if provided with opportunities. Inequities in the workplace still exist today, but modern attitudes among men toward women in the workplace are much more enlightened than they were in 1943.

Women’s immense contributions to the war effort during World War II helped create positive social changes in the ensuing decades.

Image courtesy of J. Howard Miller, http://en.wikipedia.org/wiki/File:We_Can_Do_It!.jpg.

Beyond being a positive social change, the widespread acceptance of women into the workforce has created important opportunities for certain organizations. Retailers such as Talbot’s and Dillard’s sell business attire to women. Subway and other restaurants benefit when the scarceness of time lead dual income families to purchase take-out meals rather than cook at home.

A surprising demographic trend is that both China and India have more than twice as many English-speaking college graduates each year than does the United States.

Reproduced with permission from [citation redacted per publisher request].

The technological segmentThe portion of the general environment that involves scientific advances. centers on improvements in products and services that are provided by science. Relevant factors include, for example, changes in the rate of new product development, increases in automation, and advancements in service industry delivery (Figure 3.5 "Technological Factors"). One key feature of the modern era is the ever-increasing pace of technological innovation. In 1965, Intel cofounder Gordon E. Moore offered an idea that has come to be known as Moore’s law. Moore’s law suggests that the performance of microcircuit technology roughly doubles every two years. This law has been very accurate in the decades since it was offered.

One implication of Moore’s law is that over time electronic devices can become smaller but also more powerful. This creates important opportunities and threats in a variety of settings. Consider, for example, photography. Just a decade ago, digital cameras were relatively large and they produced mediocre images. With each passing year, however, digital cameras have become smaller, lighter, and better. Today, digital cameras are, in essence, minicomputers, and electronics firms such as Panasonic have been able to establish strong positions in the market. Meanwhile, film photography icon Kodak has been forced to abandon products that had been successful for decades. In 2005, the firm announced that it would stop producing black-and-white photographic paper. Four years later, Kodachrome color film was phased out.

Successful technologies are also being embraced at a much faster rate than in earlier generations. The Internet reached fifty million users in only four years. In contrast, television reached the same number of users in thirteen years while it took radio thirty-eight years. This trend creates great opportunities for organizations that depend on emerging technologies. Writers of applications for Apple’s iPad and other tablet devices, for example, are able to target a fast-growing population of users. At the same time, organizations that depend on technologies that are being displaced must be aware that consumers could abandon them at a very rapid pace. As more and more Internet users rely on Wi-Fi service, for example, demand for cable modems may plummet.

Moore’s law explains how today’s iPhone can be one hundred times faster, one hundred times lighter, and ten times less expensive than a “portable” computer built in the 1980s.

Image courtesy of Evolution, http://en.wikipedia.org/wiki/File:Osborne_Executive_with_iPhone_in_2009.jpg.

Although the influence of the technological segment on technology-based companies such as Panasonic and Apple is readily apparent, technological trends and events help to shape low-tech businesses too. In 2009, Subway started a service called Subway Now. This service allows customers to place their orders in advance using text messages and avoid standing in line at the store. By offering customers this service, Subway is also responding to a trend in the general environment’s social segment: the need to save time in today’s fast-paced society.

The environmental segmentThe portion of the general environment that involves the natural environment. involves the physical conditions within which organizations operate. It includes factors such as natural disasters, pollution levels, and weather patterns (Figure 3.6 "Environmental Factors"). The threat of pollution, for example, has forced municipalities to treat water supplies with chemicals. These chemicals increase the safety of the water but detract from its taste. This has created opportunities for businesses that provide better-tasting water. Rather than consume cheap but bad-tasting tap water, many consumers purchase bottled water. Indeed, according to the Beverage Marketing Corporation, the amount of bottled water consumed by the average American increased from 1.6 gallons in 1976 to 28.3 gallons in 2006.Plastic recycling facts. earth911.com. Retrieved from http://earth911.com/recycling/plastic/plastic-bottle-recycling-facts At present, roughly one-third of Americans drink bottled water regularly.

As is the case for many companies, bottled water producers not only have benefited from the general environment but also have been threatened by it. Some estimates are that 80 percent of plastic bottles end up in landfills. This has led some socially conscious consumers to become hostile to bottled water. Meanwhile, water filtration systems offered by Brita and other companies are a cheaper way to obtain clean and tasty water. Such systems also hold considerable appeal for individuals who feel the need to cut personal expenses due to economic conditions. In sum, bottled water producers have been provided opportunities by the environmental segment of the general environment (specifically, the spread of poor-tasting water to combat pollution) but are faced with threats from the social segment (the social conscience of some consumers) and the economic segment (the financial concerns of other consumers).

A key trend within the environmental segment is an increasing emphasis on conserving fossil fuels.

Reproduced with permission from [citation redacted per publisher request].

The legal segmentThe portion of the general environment that involves the law and courts. centers on how the courts influence business activity. Examples of important legal factors include employment laws, health and safety regulations, discrimination laws, and antitrust laws (Figure 3.7 "Legal Factors").

Intellectual property rightsThe ability of an organization to protect intangible goods such as movies, software, and video games from piracy. are a particularly daunting aspect of the legal segment for many organizations. When a studio such as Pixar produces a movie, a software firm such as Adobe revises a program, or a video game company such as Activision devises a new game, these firms are creating intellectual property. Such firms attempt to make profits by selling copies of their movies, programs, and games to individuals. Piracy of intellectual property—a process wherein illegal copies are made and sold by others—poses a serious threat to such profits. Law enforcement agencies and courts in many countries, including the United States, provide organizations with the necessary legal mechanisms to protect their intellectual property from piracy.

In other countries, such as China, piracy of intellectual property is quite common. Three other general environment segments play a role in making piracy a major concern. First, in terms of the social segment, China is the most populous country in the world. Second, in terms of the economic segment, China’s affluence is growing rapidly. Third, in terms of the technological segment, rapid advances in computers and communication have made piracy easier over time. Taken together, these various general environment trends lead piracy to be a major source of angst for firms that rely on intellectual property to deliver profits.

A key legal trend in recent years is forcing executives to have greater accountability for corporate misdeeds via laws such as the 2002 Sarbanes-Oxley Act.

Reproduced with permission from [citation redacted per publisher request].

Visit the executive suite of any company and the chances are very high that the chief executive officer and her vice presidents are relying on five forces analysisA technique for understanding an industry by examining the interactions among competitors in an industry, potential new entrants to the industry, substitutes for the industry’s offerings, suppliers to the industry, and the industry’s buyers. to understand their industry. Introduced more than thirty years ago by Professor Michael Porter of the Harvard Business School, five forces analysis has long been and remains perhaps the most popular analytical tool in the business world (Figure 3.8 "Industry Analysis").

The purpose of five forces analysis is to identify how much profit potential exists in an industry. To do so, five forces analysis considers the interactions among the competitors in an industry, potential new entrants to the industry, substitutes for the industry’s offerings, suppliers to the industry, and the industry’s buyers.Porter, M. E. 1979, March–April. How competitive forces shape strategy. Harvard Business Review, 137–156. If none of these five forces works to undermine profits in the industry, then the profit potential is very strong. If all the forces work to undermine profits, then the profit potential is very weak. Most industries lie somewhere in between these extremes. This could involve, for example, all five forces providing firms with modest help or two forces encouraging profits while the other three undermine profits. Once executives determine how much profit potential exists in an industry, they can then decide what strategic moves to make to be successful. If the situation looks bleak, for example, one possible move is to exit the industry.

The competitorsThe set of firms that produce goods or services within an industry. in an industry are firms that produce similar products or services. Competitors use a variety of moves such as advertising, new offerings, and price cuts to try to outmaneuver one another to retain existing buyers and to attract new ones. Because competitors seek to serve the same general set of buyers, rivalry can become intense (Figure 3.9 "Rivalry"). Subway faces fierce competition within the restaurant business, for example. This is illustrated by a quote from the man who built McDonald’s into a worldwide icon. Former CEO Ray Kroc allegedly once claimed that “if any of my competitors were drowning, I’d stick a hose in their mouth.” While this sentiment was (hopefully) just a figure of speech, the announcement in March 2011 that Subway had surpassed McDonald’s in terms of numbers of stores might lead the hostility of McDonald’s toward its rival to rise.

Understanding the intensity of rivalry among an industry’s competitors is important because the degree of intensity helps shape the industry’s profit potential. Of particular concern is whether firms in an industry compete based on price. When competition is bitter and cutthroat, the prices competitors charge—and their profit margins—tend to go down. If, on the other hand, competitors avoid bitter rivalry, then price wars can be avoided and profit potential increases.

Every industry is unique to some degree, but there are some general characteristics that help to predict the likelihood that fierce rivalry will erupt. Rivalry tends to be fierce, for example, to the extent that the growth rate of demand for the industry’s offerings is low (because a lack of new customers forces firms to compete more for existing customers), fixed costs in the industry are high (because firms will fight to have enough customers to cover these costs), competitors are not differentiated from one another (because this forces firms to compete based on price rather than based on the uniqueness of their offerings), and exit barriersFactors that make it difficult for a firm to stop competing in an industry. in the industry are high (because firms do not have the option of leaving the industry gracefully). Exit barriers can include emotional barriers, such as the bad publicity associated with massive layoffs, or more objective reasons to stay in an industry, such as a desire to recoup considerable costs that might have been previously spent to enter and compete.

Industry concentration is an important aspect of competition in many industries. Industry concentration is the extent to which a small number of firms dominate an industry (Figure 3.10 "Industry Concentration"). Among circuses, for example, the four largest companies collectively own 89 percent of the market. Meanwhile, these companies tend to keep their competition rather polite. Their advertising does not lampoon one another, and they do not put on shows in the same city at the same time. This does not guarantee that the circus industry will be profitable; there are four other forces to consider as well as the quality of each firm’s strategy. But low levels of rivalry certainly help build the profit potential of the industry.

In contrast, the restaurant industry is fragmented, meaning that the largest rivals control just a small fraction of the business and that a large number of firms are important participants. Rivalry in fragmented industries tends to become bitter and fierce. Quiznos, a chain of sub shops that is roughly 15 percent the size of Subway, has directed some of its advertising campaigns directly at Subway, including one depicting a fictional sub shop called “Wrong Way” that bore a strong resemblance to Subway.

Within fragmented industries, it is almost inevitable that over time some firms will try to steal customers from other firms, such as by lowering prices, and that any competitive move by one firm will be matched by others. In the wake of Subway’s success in offering foot-long subs for $5, for example, Quiznos has matched Subway’s price. Such price jockeying is delightful to customers, of course, but it tends to reduce prices (and profit margins) within an industry. Indeed, Quiznos later escalated its attempt to attract budget-minded consumers by introducing a flatbread sandwich that cost only $2. Overall, when choosing strategic moves, Subway’s presence in a fragmented industry forces the firm to try to anticipate not only how fellow restaurant giants such as McDonald’s and Burger King will react but also how smaller sub shop chains like Quiznos and various regional and local players will respond.

Competing within a highly profitable industry is desirable, but it can also attract unwanted attention from outside the industry. Potential new entrantsFirms that do not currently compete in an industry but might join the industry in the future. to an industry are firms that do not currently compete in the industry but may in the future (Figure 3.11 "New Entrants"). New entrants tend to reduce the profit potential of an industry by increasing its competitiveness. If, for example, an industry consisting of five firms is entered by two new firms, this means that seven rather than five firms are now trying to attract the same general pool of customers. Thus executives need to analyze how likely it is that one or more new entrants will enter their industry as part of their effort to understand the profit potential that their industry offers.

New entrants can join the fray within an industry in several different ways. New entrants can be start-up companies created by entrepreneurs, foreign firms that decide to enter a new geographic area, supplier firms that choose to enter their customers’ business, or buyer firms that choose to enter their suppliers’ business. The likelihood of these four paths being taken varies across industries. Restaurant firms such as Subway, for example, do not need to worry about their buyers entering the industry because they sell directly to individuals, not to firms. It is also unlikely that Subway’s suppliers, such as farmers, will make a big splash in the restaurant industry.

On the other hand, entrepreneurs launch new restaurant concepts every year, and one or more of these concepts may evolve into a fearsome competitor. Also, competitors based overseas sometimes enter Subway’s core US market. In February 2011, Australia-based Oporto opened its first US store in California.Odell, K. 2011, February 22. Portuguese-influenced Australian chicken burger chain, Oporto, comes to SoCal. Eater LA. Retrieved from http://la.eater.com/archives/2011/02/22/portugueseinfluenced_australian_chicken_burger_chain_oporto_comes_to_socal.php Oporto operates more than 130 chicken burger restaurants in its home country. Time will tell whether this new entrant has a significant effect on Subway and other restaurant firms. Because a chicken burger closely resembles a hamburger, McDonald’s and Burger King may have more to fear from Oporto than does Subway.

Every industry is unique to some degree, but some general characteristics help to predict the likelihood that new entrants will join an industry. New entry is less likely, for example, to the extent that existing competitors enjoy economies of scale (because new entrants struggle to match incumbents’ prices), capital requirements to enter the industry are high (because new entrants struggle to gather enough cash to get started), access to distribution channels is limited (because new entrants struggle to get their offerings to customers), governmental policy discourages new entry, differentiation among existing competitors is high (because each incumbent has a group of loyal customers that enjoy its unique features), switching costs are high (because this discourages customers from buying a new entrant’s offerings), expected retaliation from existing competitors is high, and cost advantages independent of size exist.

Executives need to take stock not only of their direct competition but also of players in other industries that can steal their customers. SubstitutesOfferings from other industries that fulfill the same need or a very similar need as an industry’s products or services. are offerings that differ from the goods and services provided by the competitors in an industry but that fill similar needs to what the industry offers (Figure 3.12 "Substitutes"). How strong of a threat substitutes are depends on how effective substitutes are in serving an industry’s customers.

At first glance, it could appear that the satellite television business is a tranquil one because there are only two significant competitors—DIRECTV and DISH Network. These two industry giants, however, face a daunting challenge from substitutes. The closest substitute for satellite television is provided by cable television firms, such as Comcast and Charter Communications. DIRECTV and DISH Network also need to be wary of streaming video services, such as Netflix, and video rental services, such as Redbox. The availability of viable substitutes places stringent limits on what DIRECTV and DISH Network can charge for their services. If the satellite television firms raise their prices, customers will be tempted to obtain video programs from alternative sources. This limits the profit potential of the satellite television business.

In other settings, viable substitutes are not available, and this helps an industry’s competitors enjoy profits. Like lightbulbs, candles can provide lighting within a home. Few consumers, however, would be willing to use candles instead of lightbulbs. Candles simply do not provide as much light as lightbulbs. Also, the risk of starting a fire when using candles is far greater than the fire risk of using lightbulbs. Because candles are a poor substitute, lightbulb makers such as General Electric and Siemens do not need to fear candle makers stealing their customers and undermining their profits.

The dividing line between which firms are competitors and which firms offer substitutes is a challenging issue for executives. Most observers would agree that, from Subway’s perspective, sandwich maker Quiznos should be considered a competitor and that grocery stores such as Kroger offer a substitute for Subway’s offerings. But what about full-service restaurants, such as Ruth’s Chris Steak House, and “fast causal” outlets, such as Panera Bread? Whether firms such as these are considered competitors or substitutes depends on how the industry is defined. Under a broad definition—Subway competes in the restaurant business—Ruth’s Chris and Panera should be considered competitors. Under a narrower definition—Subway competes in the sandwich business—Panera is a competitor and Ruth’s Chris is a substitute. Under a very narrow definition—Subway competes in the sub sandwich business—both Ruth’s Chris and Panera provide substitute offerings. Thus clearly defining a firm’s industry is an important step for executives who are performing a five forces analysis.

SuppliersProviders of inputs that the competitors in an industry need to create goods or services. provide inputs that the firms in an industry need to create the goods and services that they in turn sell to their buyers. A variety of supplies are important to companies, including raw materials, financial resources, and labor (Figure 3.13 "Suppliers"). For restaurant firms such as Subway, key suppliers include such firms as Sysco that bring various foods to their doors, restaurant supply stores that sell kitchen equipment, and employees that provide labor.

The relative bargaining power between an industry’s competitors and its suppliers helps shape the profit potential of the industry. If suppliers have greater leverage over the competitors than the competitors have over the suppliers, then suppliers can increase their prices over time. This cuts into competitors’ profit margins and makes them less likely to be prosperous. On the other hand, if suppliers have less leverage over the competitors than the competitors have over the suppliers, then suppliers may be forced to lower their prices over time. This strengthens competitors’ profit margins and makes them more likely to be prosperous. Thus when analyzing the profit potential of their industry, executives must carefully consider whether suppliers have the ability to demand higher prices.

Every industry is unique to some degree, but some general characteristics help to predict the likelihood that suppliers will be powerful relative to the firms to which they sell their goods and services. Suppliers tend to be powerful, for example, to the extent that the suppliers’ industry is dominated by a few companies, if it is more concentrated than the industry that it supplies and/or if there is no effective substitute for what the supplier group provides. These circumstances restrict industry competitors’ ability to shop around for better prices and put suppliers in a position of strength.

Supplier power is also stronger to the extent that industry members rely heavily on suppliers to be profitable, industry members face high costs when changing suppliers, and suppliers’ products are differentiated. Finally, suppliers possess power to the extent that they have the ability to become a new entrant to the industry if they wish. This is a strategy called forward vertical integrationA strategy that involves a supplier entering the industry that it supplies inputs to.. Ford, for example, used a forward vertical integration strategy when it purchased rental car company (and Ford customer) Hertz. A difficult financial situation forced Ford to sell Hertz for $5.6 billion in 2005. But before rental car companies such as Avis and Thrifty drive too hard of a bargain when buying cars from an automaker, their executives should remember that automakers are much bigger firms than are rental car companies. The executives running the automaker might simply decide that they want to enjoy the rental car company’s profits themselves and acquire the firm.

Flash of Genius

When dealing with a large company, a small supplier can get squashed like a bug on a windshield. That is what college professor and inventor Dr. Robert Kearns found out when he invented intermittent windshield wipers in the 1960s and attempted to supply them to Ford Motor Company. As depicted in the 2008 movie Flash of Genius, Kearns dreamed of manufacturing the wipers and selling them to Detroit automakers. Rather than buy the wipers from Kearns, Ford replicated the design. An angry Kearns then spent many years trying to hold the firm accountable for infringing on his patent. Kearns eventually won in court, but he paid a terrible personal price along the way, including a nervous breakdown and estrangement from his family. Kearns’s lengthy battle with Ford illustrates the concept of bargaining power that is central to Porter’s five forces model. Even though Kearns created an exceptional new product, he had little leverage when dealing with a massive, well-financed automobile manufacturer.

BuyersPurchasers of the goods or services that the competitors in an industry create. purchase the goods and services that the firms in an industry produce (Figure 3.14 "Buyers"). For Subway and other restaurants, buyers are individual people. In contrast, the buyers for some firms are other firms rather than end users. For Procter & Gamble, for example, buyers are retailers such as Walmart and Target who stock Procter & Gamble’s pharmaceuticals, hair care products, pet supplies, cleaning products, and other household goods on their shelves.

The relative bargaining power between an industry’s competitors and its buyers helps shape the profit potential of the industry. If buyers have greater leverage over the competitors than the competitors have over the buyers, then the competitors may be forced to lower their prices over time. This weakens competitors’ profit margins and makes them less likely to be prosperous. Walmart furnishes a good example. The mammoth retailer is notorious among manufacturers of goods for demanding lower and lower prices over time.Bianco, B., & Zellner, W. 2003, October 6. Is Wal-Mart too powerful? Bloomberg Businessweek. Retrieved from http://www.businessweek.com/magazine/content/03_40/b3852001_mz001.htm In 2008, for example, the firm threatened to stop selling compact discs if record companies did not lower their prices. Walmart has the power to insist on price concessions because its sales volume is huge. Compact discs make up a small portion of Walmart’s overall sales, so exiting the market would not hurt Walmart. From the perspective of record companies, however, Walmart is their biggest buyer. If the record companies were to refuse to do business with Walmart, they would miss out on access to a large portion of consumers.

On the other hand, if buyers have less leverage over the competitors than the competitors have over the buyers, then competitors can raise their prices and enjoy greater profits. This description fits the textbook industry quite well. College students are often dismayed to learn that an assigned textbook costs $150 or more. Historically, textbook publishers have been able to charge high prices because buyers had no leverage. A student enrolled in a class must purchase the specific book that the professor has selected. Used copies are sometimes a lower-cost option, but textbook publishers have cleverly worked to undermine the used textbook market by releasing new editions after very short periods of time.

Of course, the presence of a very high profit industry is attractive to potential new entrants. Firms such as Unnamed Publisher, the publisher of this book, have entered the textbook market with lower-priced offerings. Time will tell whether such offerings bring down textbook prices. Like any new entrant, upstarts in the textbook business must prove that they can execute their strategies before they can gain widespread acceptance. Overall, when analyzing the profit potential of their industry, executives must carefully consider whether buyers have the ability to demand lower prices. In the textbook market, buyers do not.

Every industry is unique to some degree, but some general characteristics help to predict the likelihood that buyers will be powerful relative to the firms from which they purchases goods and services. Buyers tend to be powerful, for example, to the extent that there are relatively few buyers compared with the number of firms that supply the industry, the industry’s goods or services are standardized or undifferentiated, buyers face little or no switching costs in changing vendors, the good or service purchased by the buyers represents a high percentage of the buyer’s costs, and the good or service is of limited importance to the quality or price of the buyer’s offerings.

Finally, buyers possess power to the extent that they have the ability to become a new entrant to the industry if they wish. This strategy is called backward vertical integrationA strategy that involves a buyer entering the industry that it purchases goods or services from.. DIRECTV used to be an important customer of TiVo, the pioneer of digital video recorders. This situation changed, however, when executives at DIRECTV grew weary of their relationship with TiVo. DIRECTV then used a backward vertical integration strategy and started offering DIRECTV-branded digital video recorders. Profits that used to be enjoyed by TiVo were transferred at that point to DIRECTV.

Five forces analysis is useful, but it has some limitations too. The description of five forces analysis provided by its creator, Michael Porter, seems to assume that competition is a zero-sum game, meaning that the amount of profit potential in an industry is fixed. One implication is that, if a firm is to make more profit, it must take that profit from a rival, a supplier, or a buyer. In some settings, however, collaboration can create a larger pool of profit that benefits everyone involved in the collaboration. In general, collaboration is a possibility that five forces analysis tends to downplay. The relationships among the rivals in an industry, for example, are depicted as adversarial. In reality, these relationships are sometimes adversarial and sometimes collaborative. General Motors and Toyota compete fiercely all around the world, for example, but they also have worked together in joint ventures. Similarly, five forces analysis tends to portray a firm’s relationships with its suppliers and buyers as adversarial, but many firms find ways to collaborate with these parties for mutual benefit. Indeed, concepts such as just-in-time inventory systems depend heavily on a firm working as a partner with its suppliers and buyers.

The analysis of the strategic groupsSets of firms that follow similar strategies. in an industry can offer important insights to executives. Strategic groups are sets of firms that follow similar strategies to one another.Hunt, M. S. 1972. Competition in the major home appliance industry 1960–1970. (Unpublished doctoral dissertation). Harvard University, Cambridge, MA; Short, J. C., Ketchen, D. J., Palmer, T., & Hult, G. T. 2007. Firm, strategic group, and industry influences on performance. Strategic Management Journal, 28, 147–167. More specifically, a strategic group consists of a set of industry competitors that have similar characteristics to one another but differ in important ways from the members of other groups (Figure 3.15 "Strategic Groups").

Understanding the nature of strategic groups within an industry is important for at least three reasons. First, emphasizing the members of a firm’s group is helpful because these firms are usually its closest rivals. When assessing their firm’s performance and considering strategic moves, the other members of a group are often the best referents for executives to consider. In some cases, one or more strategic groups in the industry are irrelevant. Subway, for example, does not need to worry about competing for customers with the likes of Ruth’s Chris Steak House and P. F. Chang’s. This is partly because firms confront mobility barriersFactors that make it unlikely or illogical for a firm to change strategic groups over time. that make it difficult or illogical for a particular firm to change groups over time. Because Subway is unlikely to offer a gourmet steak as well as the experience offered by fine-dining outlets, they can largely ignore the actions taken by firms in that restaurant industry strategic group.

Second, the strategies pursued by firms within other strategic groups highlight alternative paths to success. A firm may be able to borrow an idea from another strategic group and use this idea to improve its situation. During the recession of the late 2000s, midquality restaurant chains such as Applebee’s and Chili’s used a variety of promotions such as coupons and meal combinations to try to attract budget-conscious consumers. Firms such as Subway and Quiznos that already offered low-priced meals still had an inherent price advantage over Applebee’s and Chili’s, however: There is no tipping expected at the former restaurants, but there is at the latter. It must have been tempting to executives at Applebee’s and Chili’s to try to expand their appeal to budget-conscious consumers by experimenting with operating formats that do not involve tipping.

Third, the analysis of strategic groups can reveal gaps in the industry that represent untapped opportunities. Within the restaurant business, for example, it appears that no national chain offers both very high-quality meals and a very diverse menu. Perhaps the firm that comes the closest to filling this niche is the Cheesecake Factory, a chain of approximately 150 outlets whose menu includes more than 200 lunch, dinner, and dessert items. Ruth’s Chris Steak House already offers very high quality food; its executives could consider moving the firm toward offering a very diverse menu as well. This would involve considerable risk, however. Perhaps no national chain offers both very high quality meals and a very diverse menu because doing so is extremely difficult. Nevertheless, examining the strategic groups in an industry with an eye toward untapped opportunities offers executives a chance to consider novel ideas.

This chapter explains several considerations for examining the external environment that executives must monitor to lead their organizations strategically. Executives must be aware of trends and changes in the general environment, as well as the condition of their specific industry, as elements of both have the potential to change considerably over time. While PESTEL analysis provides a useful framework to understand the general environment, Porter’s five forces is helpful to make sense of an industry’s profit potential. Strategic groups are valuable for understanding close competitors that affect a firm more than other industry members. When executives carefully monitor their organization’s environment using these tools, they greatly increase the chances of their organization being successful.