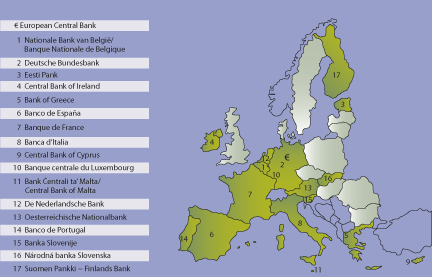

The Fed is the world’s most important central bank because the United States has been the world’s most important economy since at least World War II. But the Maastricht Treaty created a contender:www.eurotreaties.com/maastrichtext.html the European Central Bank (ECB),www.ecb.int/home/html/index.en.html the central bank of the euro area, the seventeen major countries that have adopted the euro as their unit of account: Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia and Spain (see Figure 14.1 "The Eurozone").

Figure 14.1 The Eurozone

The ECB is part of a larger system, the European System of Central Banks (ESCB), some of the countries of which (Bulgaria, Czech Republic, Denmark, Estonia, Cyprus, Latvia, Lithuania, Hungary, Malta, Poland, Romania, Slovakia, Sweden, and the United Kingdom) are part of the European Union but have opted out of the currency union. Other countries in the ESCB, including Bulgaria, Denmark, Latvia, and Lithuania, currently link their national currencies to the euro.

The ECB or Eurosystem was consciously modeled on the Fed, so it is not surprising that their structures are similar. Each nation is like a Federal Reserve district headed by its national central bank (NCB). At its headquarters in Frankfurt sits the ECB’s Executive Board, the structural equivalent of the Fed’s Board of Governors, and the Governing Council, which like the Fed’s FOMC makes monetary policy decisions. The ECB is more decentralized than the Fed, however, because the NCBs control their own budgets and conduct their own open market operations. Also unlike the Fed, the ECB does not regulate financial institutions, a task left to each individual country’s government. The two central banks, of course, also differ in many matters of detail. The ECB was led by Frenchman Jean-Claude Trichet from 2003 until November 2011, when he was replaced by Italian economist and central banker Mario Draghi.en.wikipedia.org/wiki/President_of_the_European_Central_Bank#Trichet Unless he resigns, like the ECB’s first president, Dutchman Wim Duisenberg did (1998–2003), Draghi will serve a single 8-year term. Like the other presidents, he was appointed by the European Council, which is comprised of the heads of state of the EU member states, the president of the European Commission, and the president of the European Council.

Three other important central banks, the Bank of England, the Bank of Japan, and the Bank of Canada, look nothing like the Fed or the ECB because they are unitary institutions with no districts. Although they are more independent from their respective governments than in the past, most are not as independent as the Fed or the ECB. Despite their structural differences and relative dearth of independence, unit central banks like the Bank of Japan implement monetary policy in ways very similar to the Fed and ECB.Dieter Gerdesmeier, Francesco Mongelli, and Barbara Roffia, “The Eurosystem, the US Federal Reserve and the Bank of Japan: Similarities and Differences,” ECB Working Paper Series No. 742 (March 2007).