Economists insist that individuals do not make choices willy-nilly. Rather, economists assume that individuals make choices in a purposeful way, one that seeks the maximum value for some objective. We assume that consumers seek to maximize utility and that firms seek to maximize profits.

Whatever is being maximized, choices are based on the marginal decision rule. Following this rule results in an allocation that achieves the greatest degree of utility or profit possible.

If utility- and profit-maximizing choices are made in the context of a price system that confronts decision makers with all of the costs and all of the benefits of their choices, the allocation of resources will be efficient. An efficient allocation is one that maximizes the net benefit of every activity. The concepts of consumer and producer surplus show us how this net benefit is shared. Equity is a separate issue, one that calls for a normative evaluation of the fairness of the distribution of income.

The allocation of resources will be inefficient in the absence of competitive markets. It will also be inefficient if property rights are not exclusive and transferable. These two conditions break down when there are public goods, common property resources, or external benefits or costs. In each of these cases, public sector intervention may improve the efficiency of resource allocation. When a market fails to achieve the efficient solution, net benefit falls short of the maximum possible. Deadweight loss is the amount by which net benefit falls below the net benefit possible at the efficient solution.

This chapter argues that consumers maximize utility and firms maximize profits. What do you suppose each of the following might be presumed to maximize?

For each of the following goods, indicate whether exclusive, transferable property rights exist and whether the good poses a problem for public policy. If it does, does the problem relate to a problem of property rights?

Which of the following goods or services are public? Why or why not?

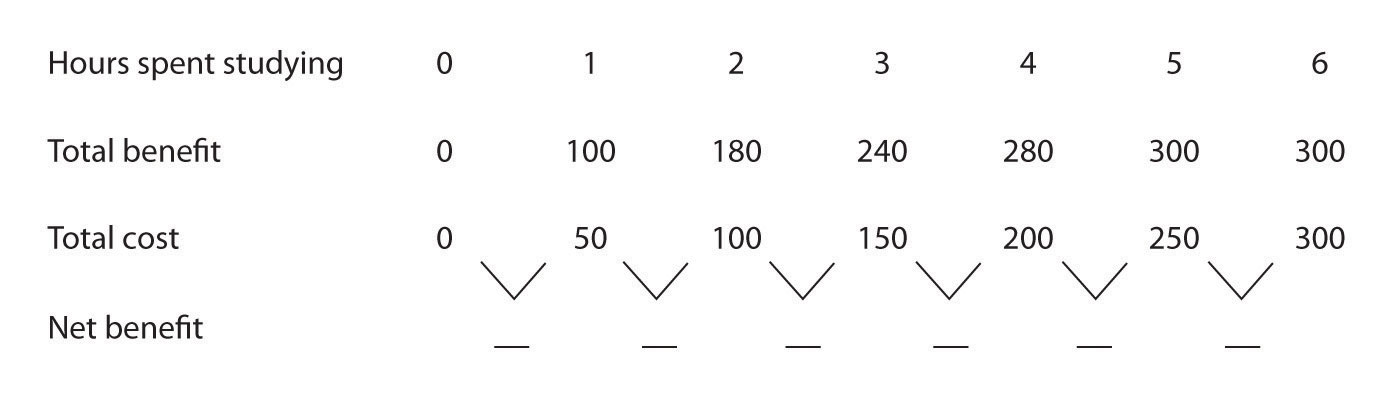

Joe Higgins is thinking about how much time to spend studying for a biology exam tomorrow. Using “utility units” he measures the benefits and costs of study; his calculations are shown in the following table.

Now suppose some friends of Joe’s call to say they are having a party tonight. Joe calculates that the party is now his best alternative to study, and he increases his estimate of the cost of each hour of study. One hour of study now costs 70; two hours cost 140; three hours 210, four hours 280; five hours 350; and six hours 470.

The local gasoline market in a particular city has demand and supply curves given by the following data. (All quantities are in millions of gallons per month.)

| Price per gallon | $1.00 | $1.50 | $2.00 | $2.50 | $3.00 | $3.50 | $4.00 |

| Quantity demanded | 6 | 5 | 4 | 3 | 2 | 1 | 0 |

| Quantity supplied | 0 | 1 | 2 | 3 | 4 | 5 | 6 |

The flu vaccination market has the demand and supply curves given by the following data. (All quantities are in thousands.)

| Price per vaccination | $10 | $15 | $20 | $25 | $30 |

| Quantity demanded | 90 | 80 | 70 | 60 | 50 |

| Quantity supplied | 50 | 60 | 70 | 80 | 90 |

Given the following information about the supply of and demand for apples:

| Price per pound | Quantity demanded (pounds per month) | Quantity Supplied (pounds per month |

|---|---|---|

| $0.50 | 12,000 | 0 |

| 0.75 | 10,000 | 2,000 |

| 1.00 | 8,000 | 4,000 |

| 1.25 | 6,000 | 6,000 |

| 1.50 | 4,000 | 8,000 |

| 1.75 | 2,000 | 10,000 |

| 2.00 | 0 | 12,000 |