If your college or university is like most, you spend a lot of time, and money, dealing with firms that face very little competition. Your campus bookstore is likely to be the only local firm selling the texts that professors require you to read. Your school may have granted an exclusive franchise to a single firm for food service and to another firm for vending machines. A single firm may provide your utilities—electricity, natural gas, and water.

Unlike the individual firms we have previously studied that operate in a competitive market, taking the price, which is determined by demand and supply, as given, in this chapter we investigate the behavior of firms that have their markets all to themselves. As the only suppliers of particular goods or services, they face the downward-sloping market demand curve alone.

We will find that firms that have their markets all to themselves behave in a manner that is in many respects quite different from the behavior of firms in perfect competition. Such firms continue to use the marginal decision rule in maximizing profits, but their freedom to select from the price and quantity combinations given by the market demand curve affects the way in which they apply this rule.

We will show that a monopoly firm is likely to produce less and charge more for what it produces than firms in a competitive industry. As a result, a monopoly solution is likely to be inefficient from society’s perspective. We will explore the policy alternatives available to government agencies in dealing with monopoly firms. First, though, we will look at characteristics of monopoly and at conditions that give rise to monopolies in the first place.

Monopoly is at the opposite end of the spectrum of market models from perfect competition. A monopolyA firm that that is the only producer of a good or service for which there are no close substitutes and for which entry by potential rivals is prohibitively difficult. firm has no rivals. It is the only firm in its industry. There are no close substitutes for the good or service a monopoly produces. Not only does a monopoly firm have the market to itself, but it also need not worry about other firms entering. In the case of monopoly, entry by potential rivals is prohibitively difficult.

A monopoly does not take the market price as given; it determines its own price. It selects from its demand curve the price that corresponds to the quantity the firm has chosen to produce in order to earn the maximum profit possible. The entry of new firms, which eliminates profit in the long run in a competitive market, cannot occur in the monopoly model.

A firm that sets or picks price based on its output decision is called a price setterA firm that sets or picks price based on its output decision.. A firm that acts as a price setter possesses monopoly powerThe ability to act as a price setter.. We shall see in the next chapter that monopolies are not the only firms that have this power; however, the absence of rivals in monopoly gives it much more price-setting power.

As was the case when we discussed perfect competition in the previous chapter, the assumptions of the monopoly model are rather strong. In assuming there is one firm in a market, we assume there are no other firms producing goods or services that could be considered part of the same market as that of the monopoly firm. In assuming blocked entry, we assume, for reasons we will discuss below, that no other firm can enter that market. Such conditions are rare in the real world. As always with models, we make the assumptions that define monopoly in order to simplify our analysis, not to describe the real world. The result is a model that gives us important insights into the nature of the choices of firms and their impact on the economy.

Why are some markets dominated by single firms? What are the sources of monopoly power? Economists have identified a number of conditions that, individually or in combination, can lead to domination of a market by a single firm and create barriers that prevent the entry of new firms.

Barriers to entryCharacteristic of a particular market that block the entry of new firms in a monopoly market. are characteristics of a particular market that block new firms from entering it. They include economies of scale, special advantages of location, high sunk costs, a dominant position in the ownership of some of the inputs required to produce the good, and government restrictions. These barriers may be interrelated, making entry that much more formidable. Although these barriers might allow one firm to gain and hold monopoly control over a market, there are often forces at work that can erode this control.

Scale economies and diseconomies define the shape of a firm’s long-run average cost (LRAC) curve as it increases its output. If long-run average cost declines as the level of production increases, a firm is said to experience economies of scale.

A firm that confronts economies of scale over the entire range of outputs demanded in its industry is a natural monopolyA firm that confronts economies of scale over the entire range of outputs demanded in its industry.. Utilities that distribute electricity, water, and natural gas to some markets are examples. In a natural monopoly, the LRAC of any one firm intersects the market demand curve where long-run average costs are falling or are at a minimum. If this is the case, one firm in the industry will expand to exploit the economies of scale available to it. Because this firm will have lower unit costs than its rivals, it can drive them out of the market and gain monopoly control over the industry.

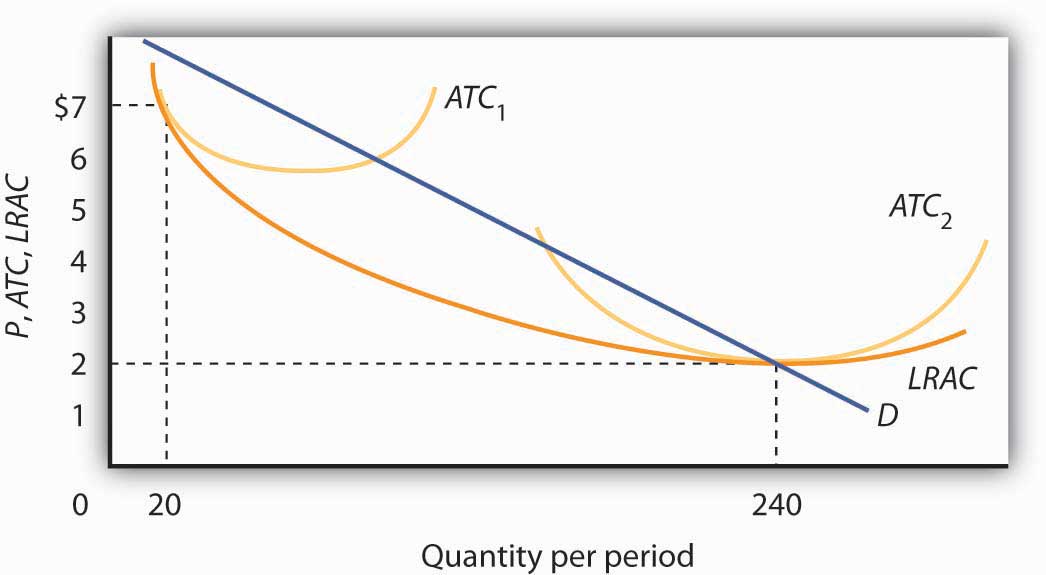

Suppose there are 12 firms, each operating at the scale shown by ATC1 (average total cost) in Figure 10.1 "Economies of Scale Lead to Natural Monopoly". A firm that expanded its scale of operation to achieve an average total cost curve such as ATC2 could produce 240 units of output at a lower cost than could the smaller firms producing 20 units each. By cutting its price below the minimum average total cost of the smaller plants, the larger firm could drive the smaller ones out of business. In this situation, the industry demand is not large enough to support more than one firm. If another firm attempted to enter the industry, the natural monopolist would always be able to undersell it.

Figure 10.1 Economies of Scale Lead to Natural Monopoly

A firm with falling LRAC throughout the range of outputs relevant to existing demand (D) will monopolize the industry. Here, one firm operating with a large plant (ATC2) produces 240 units of output at a lower cost than the $7 cost per unit of the 12 firms operating at a smaller scale (ATC1), and producing 20 units of output each.

Sometimes monopoly power is the result of location. For example, sellers in markets isolated by distance from their nearest rivals have a degree of monopoly power. The local movie theater in a small town has a monopoly in showing first-run movies. Doctors, dentists, and mechanics in isolated towns may also be monopolists.

The greater the cost of establishing a new business in an industry, the more difficult it is to enter that industry. That cost will, in turn, be greater if the outlays required to start a business are unlikely to be recovered if the business should fail.

Suppose, for example, that entry into a particular industry requires extensive advertising to make consumers aware of the new brand. Should the effort fail, there is no way to recover the expenditures for such advertising. An expenditure that has already been made and that cannot be recovered is called a sunk costAn expenditure that has already been made and that cannot be recovered..

If a substantial fraction of a firm’s initial outlays will be lost upon exit from the industry, exit will be costly. Difficulty of exit can make for difficulty of entry. The more firms have to lose from an unsuccessful effort to penetrate a particular market, the less likely they are to try. The potential for high sunk costs could thus contribute to the monopoly power of an established firm by making entry by other firms more difficult.

In very few cases the source of monopoly power is the ownership of strategic inputs. If a particular firm owns all of an input required for the production of a particular good or service, then it could emerge as the only producer of that good or service.

The Aluminum Company of America (ALCOA) gained monopoly power through its ownership of virtually all the bauxite mines in the world (bauxite is the source of aluminum). The International Nickel Company of Canada at one time owned virtually all the world’s nickel. De Beers acquired rights to nearly all the world’s diamond production, giving it enormous power in the market for diamonds. With new diamond supplies in Canada, Australia, and Russia being developed and sold independently of DeBeers, however, this power has declined, and today DeBeers controls a substantially smaller percentage of the world’s supply.

Another important basis for monopoly power consists of special privileges granted to some business firms by government agencies. State and local governments have commonly assigned exclusive franchises—rights to conduct business in a specific market—to taxi and bus companies, to cable television companies, and to providers of telephone services, electricity, natural gas, and water, although the trend in recent years has been to encourage competition for many of these services. Governments might also regulate entry into an industry or a profession through licensing and certification requirements. Governments also provide patent protection to inventors of new products or production methods in order to encourage innovation; these patents may afford their holders a degree of monopoly power during the 17-year life of the patent.

Patents can take on extra importance when network effects are present. Network effectsSituations where products become more useful the larger the number of users of the product. arise in situations where products become more useful the larger the number of users of the product. For example, one advantage of using the Windows computer operating system is that so many other people use it. That has advantages in terms of sharing files and other information.

What is the source of monopoly power—if any—in each of the following situations?

Matty Moroun was quietly enjoying his monopoly power. He is the owner of the 80-year-old Ambassador Bridge, a suspension bridge that is the only connection between Detroit, Michigan, and Windsor, Ontario. He purchased the bridge from Warren Buffet in 1974 for $30 million. Forbes estimates that it is now worth more than $500 million. Mr. Moroun oversees the artery over which $100 billion of goods—one-quarter of U.S. trade with Canada and 40% of all truck shipments from the United States—make their way between the two countries.

Despite complaints of high and rising tolls—he has more than doubled fares for cars and tripled fares for trucks—Mr. Moroun has so far held on. Kenneth Davies, a lawyer who often battles Mr. Moroun in court, is a grudging admirer. “He’s very intelligent and very aggressive. His avarice and greed are just American capitalism at work,” he told Forbes.

What are the sources of his monopoly power? With the closest alternative bridge across the Detroit River two hours away, location is a big plus. In addition, the cost of creating a new transportation link is high. A group that is considering converting an old train tunnel to truck use and boring a new train tunnel some distance away is facing a $600 million price tag for the project. In addition to having entry by potential competitors blocked, he has a status not shared by most other monopolists. The Michigan Supreme Court ruled in 2008 that the city of Detroit cannot regulate his business because of the bridge’s international nature. Canadian courts have barred any effort by Canadian authorities to regulate him. He will not even allow inspectors from the government of the United States to set foot on his bridge.

Increased security since 9/11 has caused delays, but Mr. Moroun has eased these by increasing his own spending on security to $50,000 a week and by building additional inspection stations and gifting them to the U.S. inspection agency, the General Services Administration. Even a monopolist understands the importance of keeping his customers content! Mr. Maroun has even proposed building a new bridge just next to the existing bridge.

Because of the terrorist attacks on 9/11 and the concern about vulnerability and security, calls to deal with this monopoly have increased. Some people argue that the government should buy what is the most important single international arterial in North America, while others have called for more regulatory oversight. The Canadian and Michigan governments have been discussing the possibility of building a publicly funded bridge nearby. Time will tell whether Mr. Moroun can hold onto what Forbes writers Stephane Fitch and Joann Muller dubbed “the best monopoly you never heard of.”

Sources: Stephane Fitch and Joann Muller, “The Troll Under the Bridge,” Forbes 174:10 (November 15, 2004): 134–139; John Gallagher, “Plan Uses Parkway to Ease Ambassador Bridge Traffic,” Detroit Free Press, May 1, 2008; “State Supreme Court Sides With Ambassador Bridge in Dispute,” Detroit News, May 7, 2008; and “A Floating Detroit River Bridge?” The Toronto Star, July 30, 2010.

Analyzing choices is a more complex challenge for a monopoly firm than for a perfectly competitive firm. After all, a competitive firm takes the market price as given and determines its profit-maximizing output. Because a monopoly has its market all to itself, it can determine not only its output but its price as well. What kinds of price and output choices will such a firm make?

We will answer that question in the context of the marginal decision rule: a firm will produce additional units of a good until marginal revenue equals marginal cost. To apply that rule to a monopoly firm, we must first investigate the special relationship between demand and marginal revenue for a monopoly.

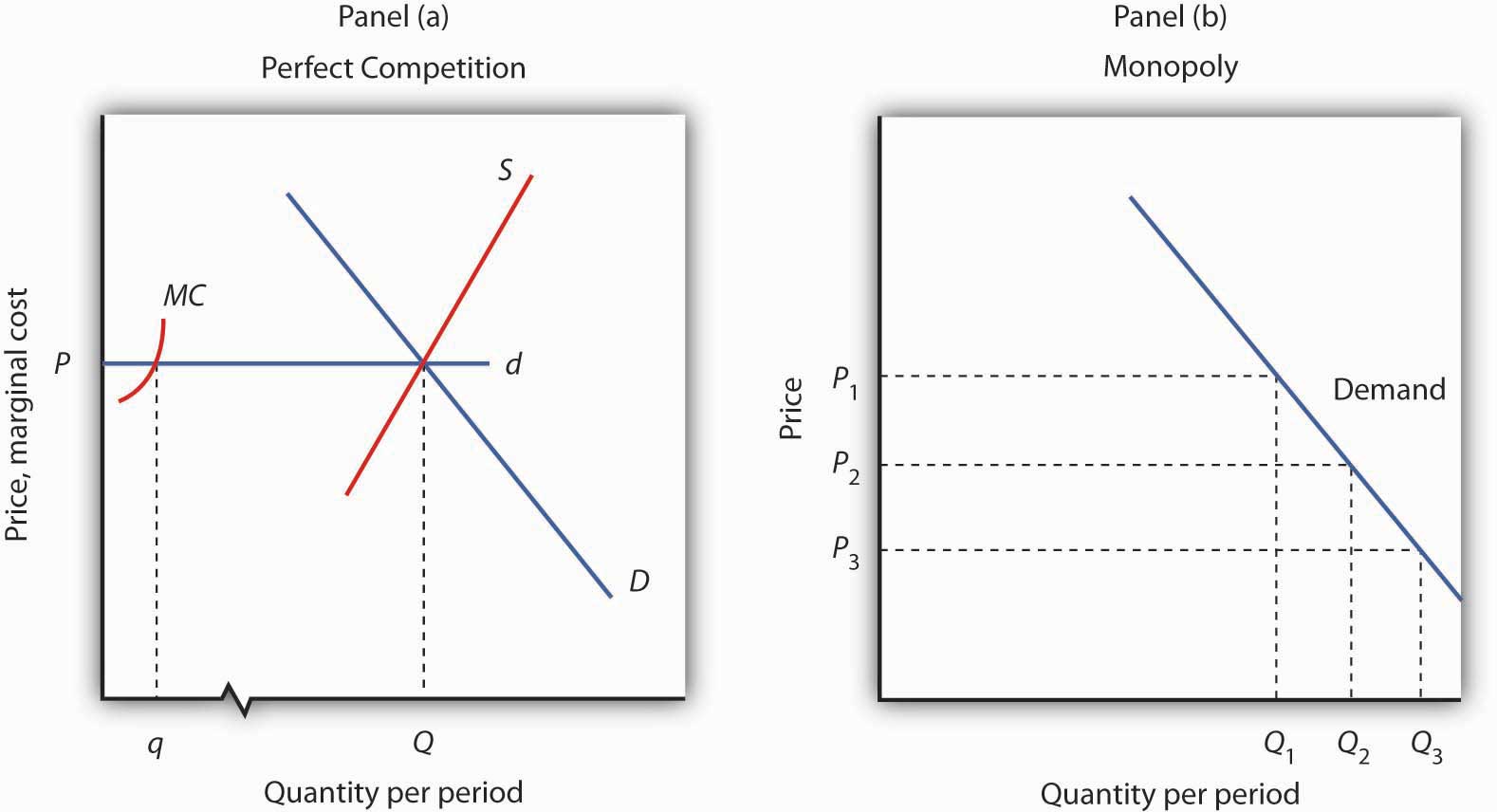

Because a monopoly firm has its market all to itself, it faces the market demand curve. Figure 10.2 "Perfect Competition Versus Monopoly" compares the demand situations faced by a monopoly and a perfectly competitive firm. In Panel (a), the equilibrium price for a perfectly competitive firm is determined by the intersection of the demand and supply curves. The market supply curve is found simply by summing the supply curves of individual firms. Those, in turn, consist of the portions of marginal cost curves that lie above the average variable cost curves. The marginal cost curve, MC, for a single firm is illustrated. Notice the break in the horizontal axis indicating that the quantity produced by a single firm is a trivially small fraction of the whole. In the perfectly competitive model, one firm has nothing to do with the determination of the market price. Each firm in a perfectly competitive industry faces a horizontal demand curve defined by the market price.

Figure 10.2 Perfect Competition Versus Monopoly

Panel (a) shows the determination of equilibrium price and output in a perfectly competitive market. A typical firm with marginal cost curve MC is a price taker, choosing to produce quantity q at the equilibrium price P. In Panel (b) a monopoly faces a downward-sloping market demand curve. As a profit maximizer, it determines its profit-maximizing output. Once it determines that quantity, however, the price at which it can sell that output is found from the demand curve. The monopoly firm can sell additional units only by lowering price. The perfectly competitive firm, by contrast, can sell any quantity it wants at the market price.

Contrast the situation shown in Panel (a) with the one faced by the monopoly firm in Panel (b). Because it is the only supplier in the industry, the monopolist faces the downward-sloping market demand curve alone. It may choose to produce any quantity. But, unlike the perfectly competitive firm, which can sell all it wants at the going market price, a monopolist can sell a greater quantity only by cutting its price.

Suppose, for example, that a monopoly firm can sell quantity Q1 units at a price P1 in Panel (b). If it wants to increase its output to Q2 units—and sell that quantity—it must reduce its price to P2. To sell quantity Q3 it would have to reduce the price to P3. The monopoly firm may choose its price and output, but it is restricted to a combination of price and output that lies on the demand curve. It could not, for example, charge price P1 and sell quantity Q3. To be a price setter, a firm must face a downward-sloping demand curve.

A firm’s elasticity of demand with respect to price has important implications for assessing the impact of a price change on total revenue. Also, the price elasticity of demand can be different at different points on a firm’s demand curve. In this section, we shall see why a monopoly firm will always select a price in the elastic region of its demand curve.

Suppose the demand curve facing a monopoly firm is given by Equation 10.1, where Q is the quantity demanded per unit of time and P is the price per unit:

Equation 10.1

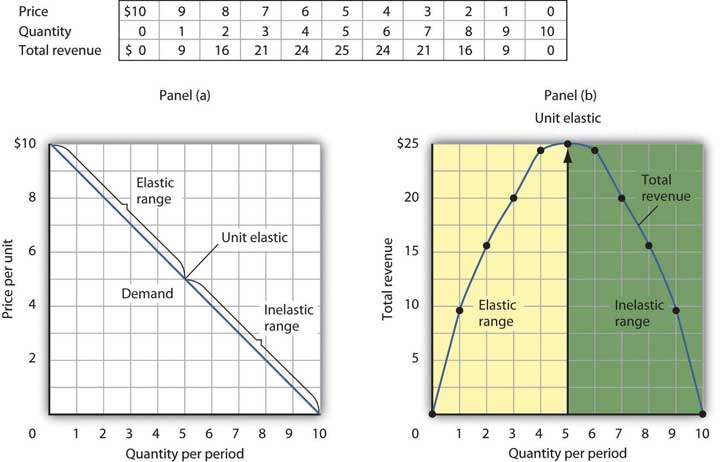

This demand equation implies the demand schedule shown in Figure 10.3 "Demand, Elasticity, and Total Revenue". Total revenue for each quantity equals the quantity times the price at which that quantity is demanded. The monopoly firm’s total revenue curve is given in Panel (b). Because a monopolist must cut the price of every unit in order to increase sales, total revenue does not always increase as output rises. In this case, total revenue reaches a maximum of $25 when 5 units are sold. Beyond 5 units, total revenue begins to decline.

Figure 10.3 Demand, Elasticity, and Total Revenue

Suppose a monopolist faces the downward-sloping demand curve shown in Panel (a). In order to increase the quantity sold, it must cut the price. Total revenue is found by multiplying the price and quantity sold at each price. Total revenue, plotted in Panel (b), is maximized at $25, when the quantity sold is 5 units and the price is $5. At that point on the demand curve, the price elasticity of demand equals −1.

The demand curve in Panel (a) of Figure 10.3 "Demand, Elasticity, and Total Revenue" shows ranges of values of the price elasticity of demand. We have learned that price elasticity varies along a linear demand curve in a special way: Demand is price elastic at points in the upper half of the demand curve and price inelastic in the lower half of the demand curve. If demand is price elastic, a price reduction increases total revenue. To sell an additional unit, a monopoly firm must lower its price. The sale of one more unit will increase revenue because the percentage increase in the quantity demanded exceeds the percentage decrease in the price. The elastic range of the demand curve corresponds to the range over which the total revenue curve is rising in Panel (b) of Figure 10.3 "Demand, Elasticity, and Total Revenue".

If demand is price inelastic, a price reduction reduces total revenue because the percentage increase in the quantity demanded is less than the percentage decrease in the price. Total revenue falls as the firm sells additional units over the inelastic range of the demand curve. The downward-sloping portion of the total revenue curve in Panel (b) corresponds to the inelastic range of the demand curve.

Finally, recall that the midpoint of a linear demand curve is the point at which demand becomes unit price elastic. That point on the total revenue curve in Panel (b) corresponds to the point at which total revenue reaches a maximum.

The relationship among price elasticity, demand, and total revenue has an important implication for the selection of the profit-maximizing price and output: A monopoly firm will never choose a price and output in the inelastic range of the demand curve. Suppose, for example, that the monopoly firm represented in Figure 10.3 "Demand, Elasticity, and Total Revenue" is charging $3 and selling 7 units. Its total revenue is thus $21. Because this combination is in the inelastic portion of the demand curve, the firm could increase its total revenue by raising its price. It could, at the same time, reduce its total cost. Raising price means reducing output; a reduction in output would reduce total cost. If the firm is operating in the inelastic range of its demand curve, then it is not maximizing profits. The firm could earn a higher profit by raising price and reducing output. It will continue to raise its price until it is in the elastic portion of its demand curve. A profit-maximizing monopoly firm will therefore select a price and output combination in the elastic range of its demand curve.

Of course, the firm could choose a point at which demand is unit price elastic. At that point, total revenue is maximized. But the firm seeks to maximize profit, not total revenue. A solution that maximizes total revenue will not maximize profit unless marginal cost is zero.

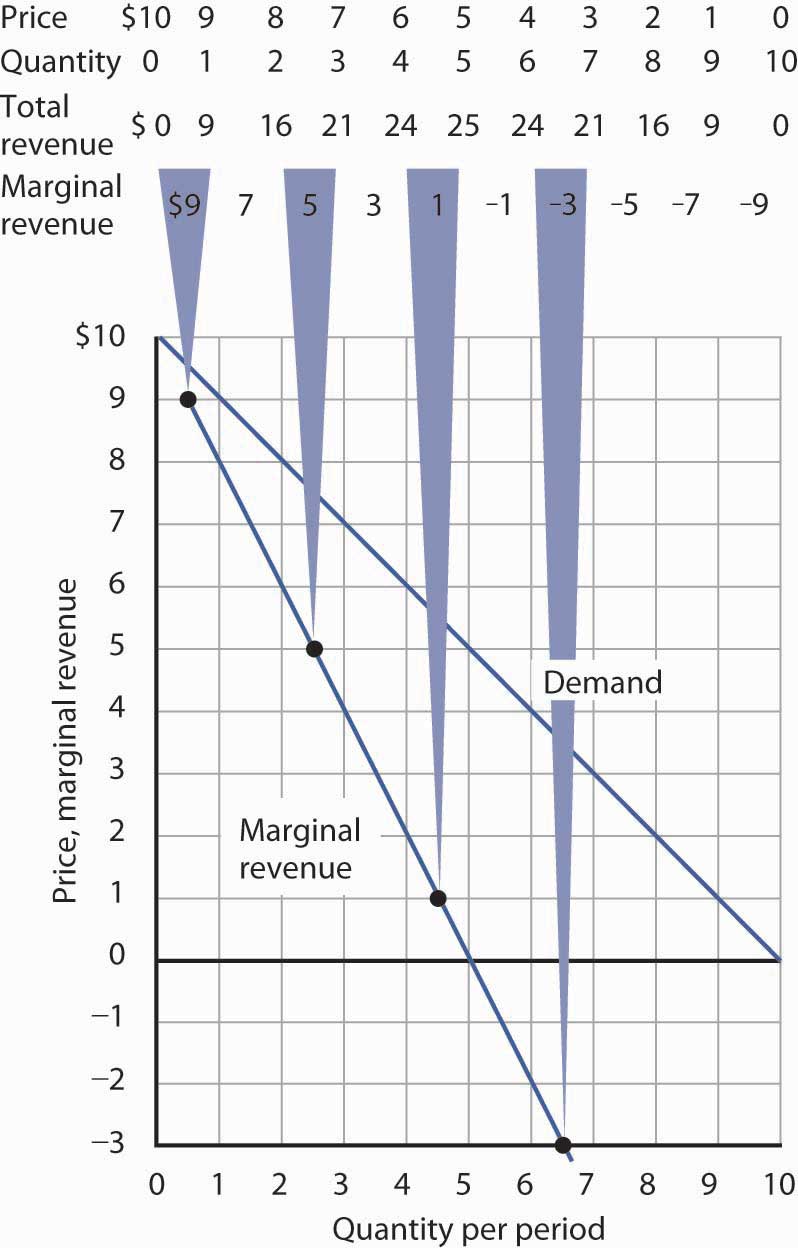

In the perfectly competitive case, the additional revenue a firm gains from selling an additional unit—its marginal revenue—is equal to the market price. The firm’s demand curve, which is a horizontal line at the market price, is also its marginal revenue curve. But a monopoly firm can sell an additional unit only by lowering the price. That fact complicates the relationship between the monopoly’s demand curve and its marginal revenue.

Suppose the firm in Figure 10.3 "Demand, Elasticity, and Total Revenue" sells 2 units at a price of $8 per unit. Its total revenue is $16. Now it wants to sell a third unit and wants to know the marginal revenue of that unit. To sell 3 units rather than 2, the firm must lower its price to $7 per unit. Total revenue rises to $21. The marginal revenue of the third unit is thus $5. But the price at which the firm sells 3 units is $7. Marginal revenue is less than price.

To see why the marginal revenue of the third unit is less than its price, we need to examine more carefully how the sale of that unit affects the firm’s revenues. The firm brings in $7 from the sale of the third unit. But selling the third unit required the firm to charge a price of $7 instead of the $8 the firm was charging for 2 units. Now the firm receives less for the first 2 units. The marginal revenue of the third unit is the $7 the firm receives for that unit minus the $1 reduction in revenue for each of the first two units. The marginal revenue of the third unit is thus $5. (In this chapter we assume that the monopoly firm sells all units of output at the same price. In the next chapter, we will look at cases in which firms charge different prices to different customers.)

Marginal revenue is less than price for the monopoly firm. Figure 10.4 "Demand and Marginal Revenue" shows the relationship between demand and marginal revenue, based on the demand curve introduced in Figure 10.3 "Demand, Elasticity, and Total Revenue". As always, we follow the convention of plotting marginal values at the midpoints of the intervals.

Figure 10.4 Demand and Marginal Revenue

The marginal revenue curve for the monopoly firm lies below its demand curve. It shows the additional revenue gained from selling an additional unit. Notice that, as always, marginal values are plotted at the midpoints of the respective intervals.

When the demand curve is linear, as in Figure 10.4 "Demand and Marginal Revenue", the marginal revenue curve can be placed according to the following rules: the marginal revenue curve is always below the demand curve and the marginal revenue curve will bisect any horizontal line drawn between the vertical axis and the demand curve. To put it another way, the marginal revenue curve will be twice as steep as the demand curve. The demand curve in Figure 10.4 "Demand and Marginal Revenue" is given by the equation , which can be written . The marginal revenue curve is given by , which is twice as steep as the demand curve.

The marginal revenue and demand curves in Figure 10.4 "Demand and Marginal Revenue" follow these rules. The marginal revenue curve lies below the demand curve, and it bisects any horizontal line drawn from the vertical axis to the demand curve. At a price of $6, for example, the quantity demanded is 4. The marginal revenue curve passes through 2 units at this price. At a price of 0, the quantity demanded is 10; the marginal revenue curve passes through 5 units at this point.

Just as there is a relationship between the firm’s demand curve and the price elasticity of demand, there is a relationship between its marginal revenue curve and elasticity. Where marginal revenue is positive, demand is price elastic. Where marginal revenue is negative, demand is price inelastic. Where marginal revenue is zero, demand is unit price elastic.

| When marginal revenue is … | then demand is … |

|---|---|

| positive, | price elastic. |

| negative, | price inelastic. |

| zero, | unit price elastic. |

A firm would not produce an additional unit of output with negative marginal revenue. And, assuming that the production of an additional unit has some cost, a firm would not produce the extra unit if it has zero marginal revenue. Because a monopoly firm will generally operate where marginal revenue is positive, we see once again that it will operate in the elastic range of its demand curve.

Profit-maximizing behavior is always based on the marginal decision rule: Additional units of a good should be produced as long as the marginal revenue of an additional unit exceeds the marginal cost. The maximizing solution occurs where marginal revenue equals marginal cost. As always, firms seek to maximize economic profit, and costs are measured in the economic sense of opportunity cost.

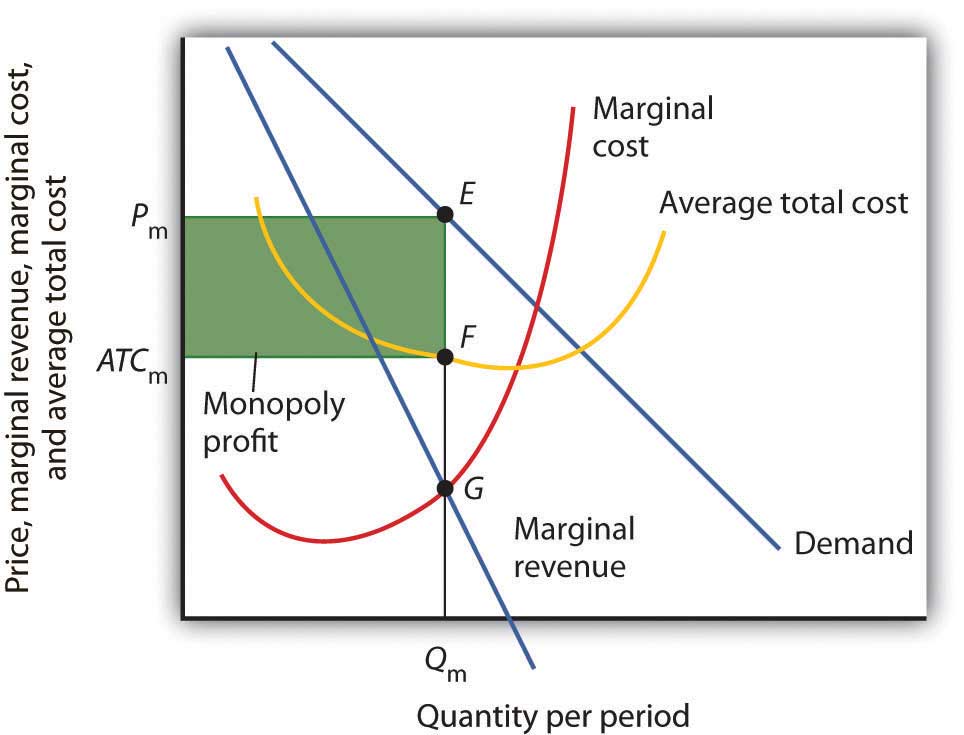

Figure 10.5 "The Monopoly Solution" shows a demand curve and an associated marginal revenue curve facing a monopoly firm. The marginal cost curve is like those we derived earlier; it falls over the range of output in which the firm experiences increasing marginal returns, then rises as the firm experiences diminishing marginal returns.

Figure 10.5 The Monopoly Solution

The monopoly firm maximizes profit by producing an output Qm at point G, where the marginal revenue and marginal cost curves intersect. It sells this output at price Pm.

To determine the profit-maximizing output, we note the quantity at which the firm’s marginal revenue and marginal cost curves intersect (Qm in Figure 10.5 "The Monopoly Solution"). We read up from Qm to the demand curve to find the price Pm at which the firm can sell Qm units per period. The profit-maximizing price and output are given by point E on the demand curve.

Thus we can determine a monopoly firm’s profit-maximizing price and output by following three steps:

Figure 10.6 Computing Monopoly Profit

A monopoly firm’s profit per unit is the difference between price and average total cost. Total profit equals profit per unit times the quantity produced. Total profit is given by the area of the shaded rectangle ATCmPmEF.

Once we have determined the monopoly firm’s price and output, we can determine its economic profit by adding the firm’s average total cost curve to the graph showing demand, marginal revenue, and marginal cost, as shown in Figure 10.6 "Computing Monopoly Profit". The average total cost (ATC) at an output of Qm units is ATCm. The firm’s profit per unit is thus Pm - ATCm. Total profit is found by multiplying the firm’s output, Qm, by profit per unit, so total profit equals Qm(Pm - ATCm)—the area of the shaded rectangle in Figure 10.6 "Computing Monopoly Profit".

Dispelling Myths About Monopoly

Three common misconceptions about monopoly are:

As Figure 10.5 "The Monopoly Solution" shows, once the monopoly firm decides on the number of units of output that will maximize profit, the price at which it can sell that many units is found by “reading off” the demand curve the price associated with that many units. If it tries to sell Qm units of output for more than Pm, some of its output will go unsold. The monopoly firm can set its price, but is restricted to price and output combinations that lie on its demand curve. It cannot just “charge whatever it wants.” And if it charges “all the market will bear,” it will sell either 0 or, at most, 1 unit of output.

Neither is the monopoly firm guaranteed a profit. Consider Figure 10.6 "Computing Monopoly Profit". Suppose the average total cost curve, instead of lying below the demand curve for some output levels as shown, were instead everywhere above the demand curve. In that case, the monopoly will incur losses no matter what price it chooses, since average total cost will always be greater than any price it might charge. As is the case for perfect competition, the monopoly firm can keep producing in the short run so long as price exceeds average variable cost. In the long run, it will stay in business only if it can cover all of its costs.

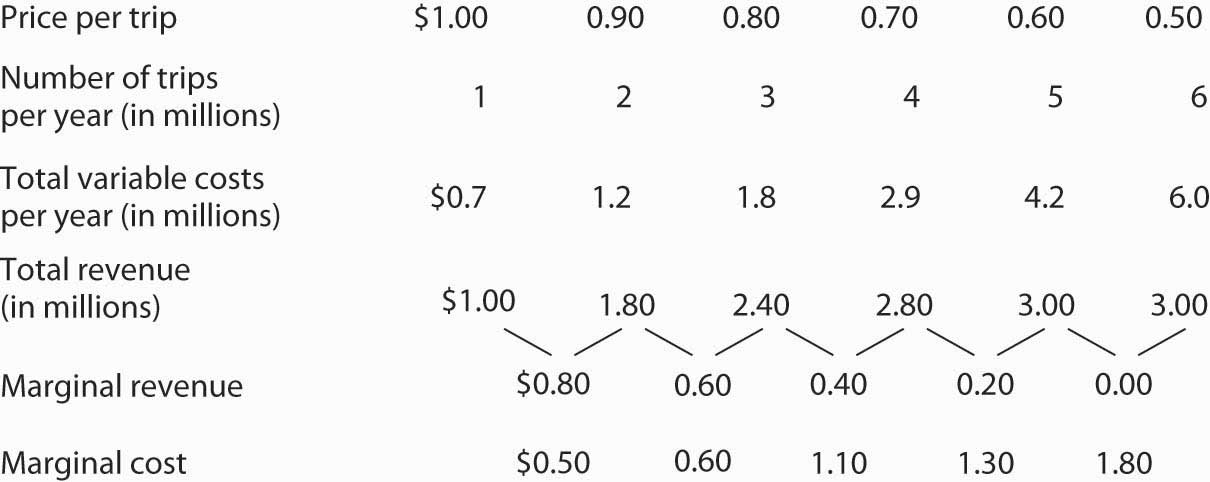

The Troll Road Company is considering building a toll road. It estimates that its linear demand curve is as shown below. Assume that the fixed cost of the road is $0.5 million per year. Maintenance costs, which are the only other costs of the road, are also given in the table.

| Tolls per trip | $1.00 | 0.90 | 0.80 | 0.70 | 0.60 | 0.50 |

| Number of trips per year (in millions) | 1 | 2 | 3 | 4 | 5 | 6 |

| Maintenance cost per year (in millions) | $0.7 | 1.2 | 1.8 | 2.9 | 4.2 | 6.0 |

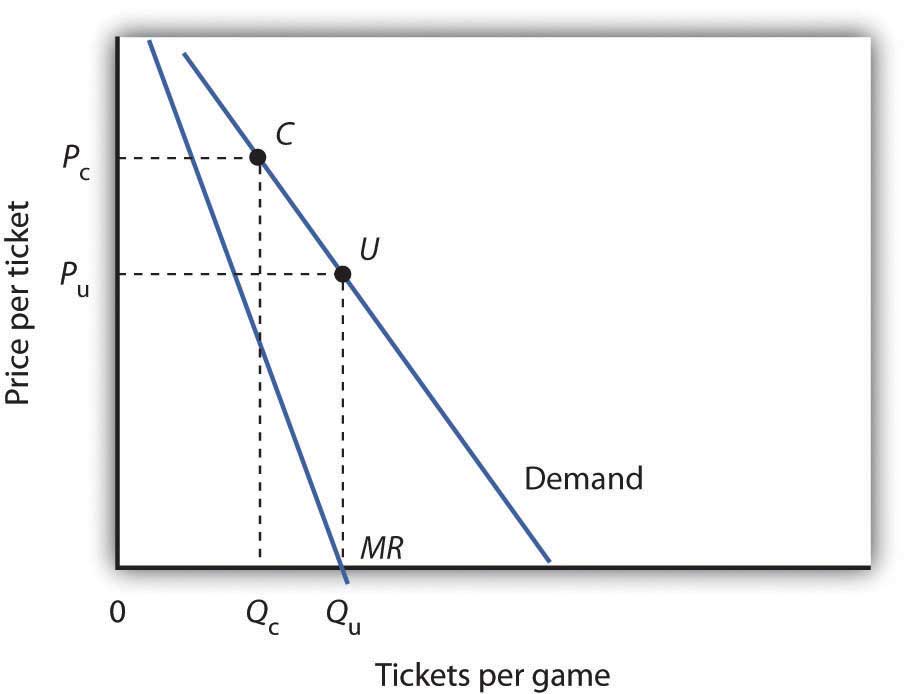

Love of the game? Love of the city? Are those the factors that influence owners of professional sports teams in setting admissions prices? Four economists at the University of Vancouver have what they think is the answer for one group of teams: professional hockey teams set admission prices at levels that maximize their profits. They regard hockey teams as monopoly firms and use the monopoly model to examine the team’s behavior.

The economists, Donald G. Ferguson, Kenneth G. Stewart, John Colin H. Jones, and Andre Le Dressay, used data from three seasons to estimate demand and marginal revenue curves facing each team in the National Hockey League. They found that demand for a team’s tickets is affected by population and income in the team’s home city, the team’s standing in the National Hockey League, and the number of superstars on the team.

Because a sports team’s costs do not vary significantly with the number of fans who attend a given game, the economists assumed that marginal cost is zero. The profit-maximizing number of seats sold per game is thus the quantity at which marginal revenue is zero, provided a team’s stadium is large enough to hold that quantity of fans. This unconstrained quantity is labeled Qu, with a corresponding price Pu in the graph.

Stadium size and the demand curve facing a team might prevent the team from selling the profit-maximizing quantity of tickets. If its stadium holds only Qc fans, for example, the team will sell that many tickets at price Pc; its marginal revenue is positive at that quantity. Economic theory thus predicts that the marginal revenue for teams that consistently sell out their games will be positive, and the marginal revenue for other teams will be zero.

The economists’ statistical results were consistent with the theory. They found that teams that do not typically sell out their games operate at a quantity at which marginal revenue is about zero and that teams with sellouts have positive marginal revenue. “It’s clear that these teams are very sophisticated in their use of pricing to maximize profits,” Mr. Ferguson said.

Not all studies of sporting event pricing have confirmed this conclusion. While a study of major league baseball ticket pricing by Leo Kahane and Stephen Shmanske and one of baseball spring training game tickets by Michael Donihue, David Findlay, and Peter Newberry suggested that tickets are priced where demand is unit elastic, some other studies of ticket pricing of sporting events have found that tickets are priced in the inelastic region of the demand curve. On its face, this would mean that team owners were not maximizing profits. Why would team owners do this? Are they really charging too little? To fans, it certainly may not seem so!

While some have argued that owners want to please fans by selling tickets for less than the profit-maximizing price, others argue they do so for possible political considerations, for example, keeping prices below the profit-maximizing level could help when they are asking for subsidies for building new stadiums. In line with the notion that team owners do behave like other profit-maximizing firms, another line of research, for example, that proposed by Anthony Krautmann and David Berri, has been to recognize that owners also get revenue from selling concessions so that getting more fans at the game may boost revenue from other sources.

Sources: Michael R. Donihue, David W. Findlay, and Peter W. Newberry, “An Analysis of Attendance at Major League Baseball Spring Games,” Journal of Sports Economics 8:1 (February 2007): 39–61; Donald G. Ferguson et al., “The Pricing of Sports Events: Do Teams Maximize Profit?” Journal of Industrial Economics 39:3 (March 1991): 297–310 and personal interview; Leo Kahane and Stephen Shmanske, “Team Roster Turnover and Attendance in Major League Baseball,” Applied Economics 29 (1997): 425–431; and Anthony C. Krautmann and David J. Berri, “Can We Find It at the Concessions?” Journal of Sports Economics 8:2 (April 2007): 183–191.

Maintenance costs constitute the variable costs associated with building the road. In order to answer the first four parts of the question, you will need to compute total revenue, marginal revenue, and marginal cost, as shown at right:

We have seen that for monopolies pursuing profit maximization, the outcome differs from the case of perfect competition. Does this matter to society? In this section, we will focus on the differences that stem from market structure and assess their implications.

A monopoly firm determines its output by setting marginal cost equal to marginal revenue. It then charges the price at which it can sell that output, a price determined by the demand curve. That price exceeds marginal revenue; it therefore exceeds marginal cost as well. That contrasts with the case in perfect competition, in which price and marginal cost are equal. The higher price charged by a monopoly firm may allow it a profit—in large part at the expense of consumers, whose reduced options may give them little say in the matter. The monopoly solution thus raises problems of efficiency, equity, and the concentration of power.

The fact that price in monopoly exceeds marginal cost suggests that the monopoly solution violates the basic condition for economic efficiency, that the price system must confront decision makers with all of the costs and all of the benefits of their choices. Efficiency requires that consumers confront prices that equal marginal costs. Because a monopoly firm charges a price greater than marginal cost, consumers will consume less of the monopoly’s good or service than is economically efficient.

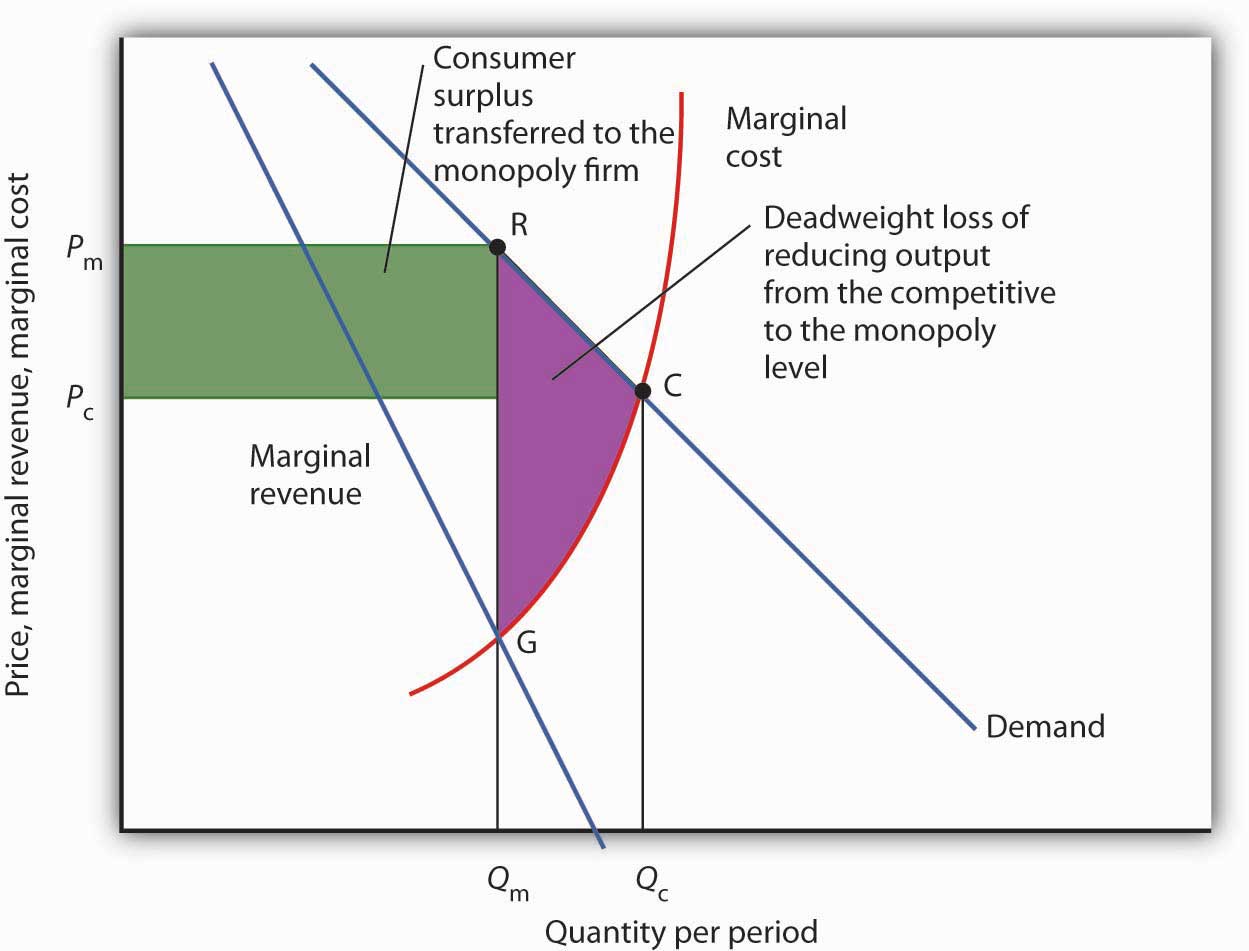

To contrast the efficiency of the perfectly competitive outcome with the inefficiency of the monopoly outcome, imagine a perfectly competitive industry whose solution is depicted in Figure 10.7 "Perfect Competition, Monopoly, and Efficiency". The short-run industry supply curve is the summation of individual marginal cost curves; it may be regarded as the marginal cost curve for the industry. A perfectly competitive industry achieves equilibrium at point C, at price Pc and quantity Qc.

Figure 10.7 Perfect Competition, Monopoly, and Efficiency

Given market demand and marginal revenue, we can compare the behavior of a monopoly to that of a perfectly competitive industry. The marginal cost curve may be thought of as the supply curve of a perfectly competitive industry. The perfectly competitive industry produces quantity Qc and sells the output at price Pc. The monopolist restricts output to Qm and raises the price to Pm.

Reorganizing a perfectly competitive industry as a monopoly results in a deadweight loss to society given by the shaded area GRC. It also transfers a portion of the consumer surplus earned in the competitive case to the monopoly firm.

Now, suppose that all the firms in the industry merge and a government restriction prohibits entry by any new firms. Our perfectly competitive industry is now a monopoly. Assume the monopoly continues to have the same marginal cost and demand curves that the competitive industry did. The monopoly firm faces the same market demand curve, from which it derives its marginal revenue curve. It maximizes profit at output Qm and charges price Pm. Output is lower and price higher than in the competitive solution.

Society would gain by moving from the monopoly solution at Qm to the competitive solution at Qc. The benefit to consumers would be given by the area under the demand curve between Qm and Qc; it is the area QmRCQc. An increase in output, of course, has a cost. Because the marginal cost curve measures the cost of each additional unit, we can think of the area under the marginal cost curve over some range of output as measuring the total cost of that output. Thus, the total cost of increasing output from Qm to Qc is the area under the marginal cost curve over that range—the area QmGCQc. Subtracting this cost from the benefit gives us the net gain of moving from the monopoly to the competitive solution; it is the shaded area GRC. That is the potential gain from moving to the efficient solution. The area GRC is a deadweight loss.

The monopoly solution raises issues not just of efficiency but also of equity. Figure 10.7 "Perfect Competition, Monopoly, and Efficiency" shows that the monopolist charges price Pm rather than the competitive price Pc; the higher price charged by the monopoly firm reduces consumer surplus. Consumer surplus is the difference between what consumers are willing to pay for a good and what they actually pay. It is measured by the area under the demand curve and above the price of the good over the range of output produced.

If the industry were competitive, consumer surplus would be the area below the demand curve and above PcC. With monopoly, consumer surplus would be the area below the demand curve and above PmR. Part of the reduction in consumer surplus is the area under the demand curve between Qc and Qm; it is contained in the deadweight loss area GRC. But consumers also lose the area of the rectangle bounded by the competitive and monopoly prices and by the monopoly output; this lost consumer surplus is transferred to the monopolist.

The fact that society suffers a deadweight loss due to monopoly is an efficiency problem. But the transfer of a portion of consumer surplus to the monopolist is an equity issue. Is such a transfer legitimate? After all, the monopoly firm enjoys a privileged position, protected by barriers to entry from competition. Should it be allowed to extract these gains from consumers? We will see that public policy suggests that the answer is no. Regulatory efforts imposed in monopoly cases often seek to reduce the degree to which monopoly firms extract consumer surplus from consumers by reducing the prices these firms charge.

The objections to monopoly run much deeper than worries over economic efficiency and high prices. Because it enjoys barriers that block potential rivals, a monopoly firm wields considerable market power. For many people, that concentration of power is objectionable. A decentralized, competitive market constantly tests the ability of firms to satisfy consumers, pushes them to find new products and new and better production methods, and whittles away economic profits. Firms that operate in the shelter of monopoly may be largely immune to such pressures. Consumers are likely to be left with fewer choices, higher costs, and lower quality.

Perhaps more important in the view of many economists is the fact that the existence of economic profits provides both an incentive and the means for monopolists to aggressively protect their position and extend it if possible. These economists point out that monopolists may be willing to spend their economic profits in attempts to influence political leaders and public authorities (including regulatory authorities) who can help them maintain or enhance their monopoly position. Graft and corruption may be the result, claim these critics. Indeed, Microsoft has been accused by its rivals of bullying computer manufacturers into installing its web browser, Internet Explorer, exclusively on their computers.

Attitudes about Microsoft reflect these concerns. Even among people who feel that its products are good and fairly priced, there is uneasiness about our seeming dependence on them. And once it has secured its dominant position, will it charge more for its products? Will it continue to innovate?

Pulling together what we have learned in this chapter on monopoly and previously on perfect competition, Table 10.1 "Characteristics of Perfect Competition and Monopoly" summarizes the differences between the models of perfect competition and monopoly. Most importantly we note that whereas the perfectly competitive firm is a price taker, the monopoly firm is a price setter. Because of this difference, we can object to monopoly on grounds of economic efficiency; monopolies produce too little and charge too much. Also, the high price and persistent profits strike many as inequitable. Others may simply see monopoly as an unacceptable concentration of power.

Table 10.1 Characteristics of Perfect Competition and Monopoly

| Characteristic or Event | Perfect Competition | Monopoly |

|---|---|---|

| Market | Large number of sellers and buyers producing a homogeneous good or service, easy entry. | Large number of buyers, one seller. Entry is blocked. |

| Demand and marginal revenue curves | The firm’s demand and marginal revenue curve is a horizontal line at the market price. | The firm faces the market demand curve; marginal revenue is below market demand. |

| Price | Determined by demand and supply; each firm is a price taker. Price equals marginal cost. | The monopoly firm determines price; it is a price setter. Price is greater than marginal cost. |

| Profit maximization | Firms produce where marginal cost equals marginal revenue | Firms produce where marginal cost equals marginal revenue and charge the corresponding price on the demand curve. |

| Profit | Entry forces economic profit to zero in the long run. | Because entry is blocked, a monopoly firm can sustain an economic profit in the long run. |

| Efficiency | The equilibrium solution is efficient because price equals marginal cost. | The equilibrium solution is inefficient because price is greater than marginal cost. |

Public policy toward monopoly generally recognizes two important dimensions of the monopoly problem. On the one hand, the combining of competing firms into a monopoly creates an inefficient and, to many, inequitable solution. On the other hand, some industries are characterized as natural monopolies; production by a single firm allows economies of scale that result in lower costs.

The combining of competing firms into a monopoly firm or unfairly driving competitors out of business is generally forbidden in the United States. Regulatory efforts to prevent monopoly fall under the purview of the nation’s antitrust laws, discussed in more detail in a later chapter.

At the same time, we must be careful to avoid the mistake of simply assuming that competition is the alternative to monopoly, that every monopoly can and should be replaced by a competitive market. One key source of monopoly power, after all, is economies of scale. In the case of natural monopoly, the alternative to a single firm is many small, high-cost producers. We may not like having only one local provider of water, but we might like even less having dozens of providers whose costs—and prices—are higher. Where monopolies exist because economies of scale prevail over the entire range of market demand, they may serve a useful economic role. We might want to regulate their production and pricing choices, but we may not want to give up their cost advantages.

Where a natural monopoly exists, the price charged by the firm and other aspects of its behavior may be subject to regulation. Water or natural gas, for example, are often distributed by a public utility—a monopoly firm—at prices regulated by a state or local government agency. Typically, such agencies seek to force the firm to charge lower prices, and to make less profit, than it would otherwise seek.

Although economists are hesitant to levy blanket condemnations of monopoly, they are generally sharply critical of monopoly power where no rationale for it exists. When firms have substantial monopoly power only as the result of government policies that block entry, there may be little defense for their monopoly positions.

Public policy toward monopoly aims generally to strike the balance implied by economic analysis. Where rationales exist, as in the case of natural monopoly, monopolies are permitted—and their prices are regulated. In other cases, monopoly is prohibited outright. Societies are likely to at least consider taking action of some kind against monopolies unless they appear to offer cost or other technological advantages.

An important factor in thinking about public policy toward monopoly is to recognize that monopoly power can be a fleeting thing. Firms constantly seek out the market power that monopoly offers. When conditions are right to achieve this power, firms that succeed in carving out monopoly positions enjoy substantial profits. But the potential for high profits invites continuing attempts to break down the barriers to entry that insulate monopolies from competition.

Technological change and the pursuit of profits chip away constantly at the entrenched power of monopolies. Breathtaking technological change has occurred in the telecommunications industry. Catalog companies are challenging the monopoly positions of some retailers; internet booksellers and online textbook companies such as gone.2012books.lardbucket.org are challenging the monopoly power of your university’s bookstore; and Federal Express, UPS, and other companies are taking on the U.S. Postal Service. The assaults on monopoly power are continuous. Thus, even the monopoly firm must be on the lookout for potential competitors.

Potential rivals are always beating at the door and thereby making the monopoly’s fragile market contestable—that is, open to entry, at least in the sense of rival firms producing “close enough,” if not perfect, substitutes—close enough that they might eliminate the firm’s monopoly power.

Does the statement below better describe a firm operating in a perfectly competitive market or a firm that is a monopoly?

Back in the olden days—before 1984—to use a telephone in the United States almost certainly meant being a customer of AT&T. Ma Bell, as the company was known, provided local and long-distance service to virtually every U.S. household. AT&T was clearly a monopoly.

The Justice Department began its battle with AT&T in the 1970s, charging it with monopolizing the industry. The case culminated in a landmark 1984 ruling that broke the company up into seven so-called “Baby Bells” that would provide local telephone service. AT&T would continue to provide long-distance service.

In effect, the ruling replaced a single national monopoly with seven regional monopolies in local telephone service. AT&T maintained its monopoly position in long-distance service—for a while. The turmoil that has followed illustrates the fragility of monopoly power.

Technological developments in the industry have brought dramatic changes. Companies found ways to challenge AT&T’s monopoly position in long-distance telephone service. Cable operators sprang up, typically developing monopoly power over the provision of cable television in their regional markets, but also offering phone service. Mobile phone service, provided by AT&T, and others such as Verizon and Sprint, has led many consumers to do without land-line phone service entirely. Companies that had traditionally been telephone companies have begun providing cable services as well as Internet access. The ready availability of video services on the Internet threatens to make cable providers outmoded middlemen.

What is the status of AT&T today? While no longer a monopoly, it is a major player in all of the areas related to telecommunications and larger than all of its competitors in the United States. In 2011, it began the process of buying T-Mobile USA, a mobile service provider focused on the youth market. By the end of that year, however, in the face of strong opposition from the Department of Justice and the Federal Communications Commission on the grounds that the merger would stifle competition in the industry, AT&T announced that it was dropping the deal. Does AT&T have market power today? Undoubtedly. Is it a monopoly? Not anymore.

Source: Company Monitor, USA Telecommunication Report, Q2 2011: 69–79.

This chapter has examined the profit-maximizing behavior of monopoly firms. Monopoly occurs if an industry consists of a single firm and entry into that industry is blocked.

Potential sources of monopoly power include the existence of economies of scale over the range of market demand, locational advantages, high sunk costs associated with entry, restricted ownership of raw materials and inputs, and government restrictions such as licenses or patents. Network effects for certain products further increase the market power that patents afford.

Because the demand curve faced by the monopolist is downward-sloping, the firm is a price setter. It will maximize profits by producing the quantity of output at which marginal cost equals marginal revenue. The profit-maximizing price is then found on the demand curve for that quantity.

Because a typical monopolist holds market price above marginal cost, the major impact of monopoly is a reduction in efficiency. Compared to a competitive market, the monopoly is characterized by more centralized power, potential higher profits, and less pressure to be responsive to consumer preferences. Public policy toward monopoly includes antitrust laws and, in the case of natural monopolies, regulation of price and other aspects of the firm’s behavior.

Consider the following firms. Would you regard any of them as a monopoly? Why or why not? Could you use the monopoly model in analyzing the choices of any of them? Explain.

How do the following events affect a monopoly firm’s price and output? How will it affect the firm’s profits? Illustrate your answers graphically.

A university football team estimates that it faces the demand schedule shown for tickets for each home game it plays. The team plays in a stadium that holds 60,000 fans. It estimates that its marginal cost of attendance, and thus for tickets sold, is zero.

| Price per ticket | Tickets per game |

|---|---|

| $100 | 0 |

| 80 | 20,000 |

| 60 | 40,000 |

| 40 | 60,000 |

| 20 | 80,000 |

| 0 | 100,000 |

A monopoly firm faces a demand curve given by the following equation: P = $500 − 10Q, where Q equals quantity sold per day. Its marginal cost curve is MC = $100 per day. Assume that the firm faces no fixed cost.