One might find at first consideration a tenuous link between a business’s accounting system and the concept of customer value. However, if looked at from the customer’s perspective, a business that provides accurate and prompt billings is a business that can control its costs, which can result in lower prices. A business that improves its overall efficiency because it can accurately monitor and track its operations provides far greater value than a business with a haphazard approach to accounting controls.

The ability to tailor a business’s operations to better meet customer needs is the key to providing value. As a business acquires a better appreciation of its capabilities, it can then make improvements that will better meet customer needs and outperform competitors.“Customer Value Analysis,” Quality Solutions, Inc., accessed December 2, 2011, www.qualitysolutions.com/customer_value_analysis.htm.

As a business grows more confident in its ability to handle accounting issues, it may wish to look at more sophisticated techniques that can better serve the business and the customer. As Andrew Hereth puts it, “An accounting process needs to be established that accounts for the cost of each customer, for each market and for each channel.”Andrew Hereth, “Accounting for Superior Customer Service,” Andrew M. Hereth Blog, accessed December 2, 2011, andrewmhereth.com/blog/accounting-for -superior-customer-service.

Like good health, positive cash flow is something you’re most aware of when you haven’t got it. That’s one of the most profound truths in life.“The Importance of Cash Flow Management—Entrepreneur University,” Young Entrepreneur Blog, February 9, 2009, accessed February 14, 2012, www.youngentrepreneur.com/blog/entrepreneur-university/the-importance-of -cash-flow-management-entrepreneur-university.

Robert Heller

Creating a positive cash flow or at least reducing a negative cash flow should be of central interest to all small businesses. Unlike the example of Alex’s Soft Serve Services, not all small businesses can anticipate that they will be able to cover a negative cash flow simply by borrowing. That means that businesses must be much more proactive in attempting to eliminate or reduce negative cash flows. Therefore it is important to examine some ways in which a small business can increase its cash inflows.

One of the best ways to maintain a positive cash flow is to reduce the size of the negative cash flow, which can be done by conducting cash-flow analyses on a regular basis. Throughout this chapter, the time frame most commonly used has been the fiscal year or a fiscal month. In the case of rigorously monitoring cash flow, it is strongly suggested that one consider using even smaller time units, namely a weekly analysis or even a daily analysis.

Computer-based accounting systems have much to offer the owner of a small business. Most small businesses would find that a computerized accounting system has the following advantages over a manual system:

Computer-based accounting packages that have been designed for small to midsize businesses have been available for more than a quarter of a century. Many of the packages that existed twenty-five years ago are no longer available. Some have argued that a natural selection process exists for computerized accounting system so that today’s survivors represent the best qualities required of such systems.John Hedtke, “Natural Selection of Low-Cost Accounting,” Accounting Technology 22, no. 5 (2006): 34–38. In recent years, a whole new category of accounting software has been developed—cloud-based software. This software resides on the web and does not require a software package to be downloaded on small business owner’s computer. Such programs are accessible from any computer.

Selecting a new computer accounting system or changing from a manual system to a computer-based system is a major step for any small business. It should be conducted with careful consideration and treated as a major project. Prior to starting the project, it is highly advisable to sit down with one’s accountant and consider the options. Some of the first steps in starting this project involve specifying the budget and the required attributes of the software package. In developing the budget, one should consider the initial acquisition price of the software, training costs, and maintenance costs. If one is planning to move from one computerized accounting system to another, the cost of transferring operations should also be considered in the overall budgeting process. With regard to the initial purchase price, these packages can range from being free to costing thousands of dollars depending on the number of modules required. Some systems use a fee structure that is based on the number of users. This would allow a business owner to get some sense of the look and the feel of the software package.

The second initial phase of the acquisition process centers on identifying what is needed in the accounting package. This relates to the elements (support services) or modules that are absolutely required. One should also identify what modules might be of benefit at some point in the future. To assist an owner in identifying what modules are required or may be required in the future, the information that flows into the accounting system must be specified. In Section 9.1 "Understanding the Need for Accounting Systems", we refer to the idea of accounting transactions, which fall into several categories. A business needs to identify all the required categories, particularly if it is transitioning from a manual system to a computerized system. A business also needs to identify the accounting reports that are required throughout the business. It is important to consider if the software is compatible with e-business, e-commerce, and Internet capabilities.

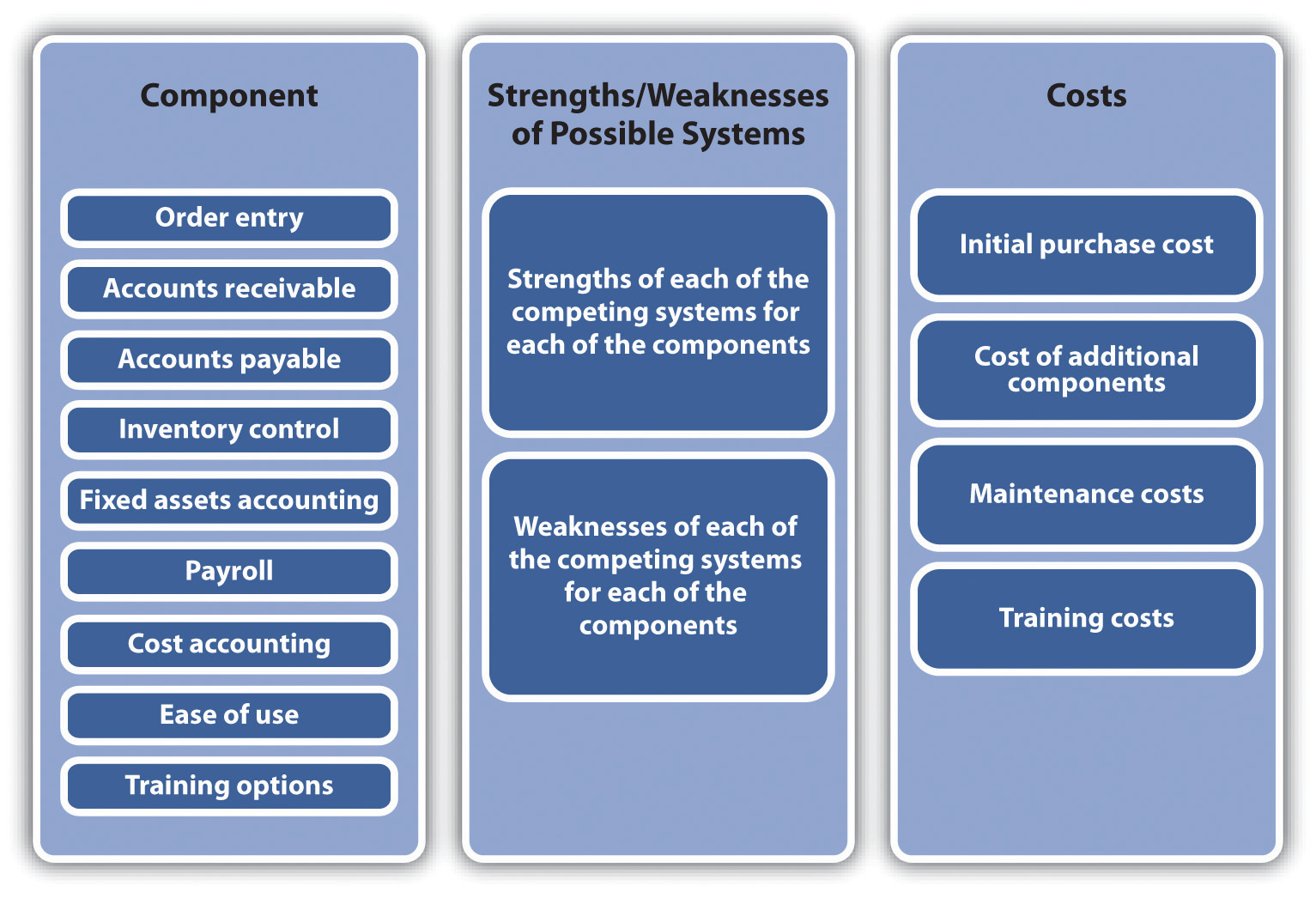

Another issue is to consider how many people will have to access the system throughout the entire business. This number will have a dramatic impact on the training requirements. Recognize that the business will have to provide manuals that must be accessible to all who will be using the accounting system. This also brings up the issue of the necessity of employee training programs. Consider the relative ease of use of any computerized accounting system—not only for yourself but also for the employees. This is where an understanding of the learning curve of using the system will be extremely important. Again, a business’s accountant can play a critical role not only in determining the selection of the system but also in developing training programs for the employees and showing them how to use the system. Having generated this list of the required components of the accounting system, one should identify competing software products (along with their costs) and prioritize them, as shown in Figure 9.6 "Evaluation of Computer Accounting Systems". In addition to consulting with an accountant, a business owner should review the various accounting software packages by talking to other business owners, reading evaluations in the business and computer press, and exploring software packages on a trial basis.“Top 15 Accounting Software Vendors Revealed,” Business-Software.com, accessed December 2, 2011, www.business-software.com/erp/about-erp-financial -accounting.php. Many accounting software packages allow users to try out the system with no initial charge. After a fixed period of time, usually thirty days, the program becomes inoperative. This allows you to become familiar with the look and the feel of the software.

Figure 9.6 Evaluation of Computer Accounting Systems

The third preliminary step is the creation of a timeline that would determine when you must successfully implement the accounting package into the actual operations of the business. This timeline should consider the time required to conduct test runs of the software. Tests should be conducted with only one or two modules. They should be operated for a sufficient period of time (at least a month) to examine if the system works as well as the manual system or the current computerized system. A timeline should also be created for training the personnel who will be using the software.

Moving to a computerized accounting system or a new system means that you should be ready for any disaster. To prepare for such disasters, there should be a formal policy of backing up all data on a regular basis. The backed up data should be at another locale other than the main storage site. Portable hard drives for off-site data storage site serve this purpose well. Some software packages perform their own backup procedures.

Several factors may need to be considered when examining accounting software for small businesses, including the followinging: will the software run on computers that a business currently uses, how often should the company provide updates of the software, and are there specific versions of the accounting software for the industry in which a business operates. Small businesses should also consider cloud computing options with regard to accounting software. Cloud computingThe situation in which vendor software does not reside on the computer system of a small business. refers to the fact that programs and data are stored off-site at another location. This means that accounting transactions can be entered from any computer, in some cases from smartphones, and are accessible anywhere in the world. Although for start-up businesses and the very smallest of businesses the adoption of a computerized accounting system appears to be a daunting task, in the long run, it is a key element for the long-term survival of the business.

Evaluating Accounting Software

Video that discusses ways to determine what software is best.

www.ehow.com/video_5103398_evaluating-accounting-software.html

Sales and cash-flow forecasting can often prove to be a significant challenge to small business owners. Assumptions have to be made, forecasting models must be selected, and calculations have to be made. In many cases, the forecasts will not be exact. This can be profoundly frustrating. Yet one of the great benefits of forecasting is that it may force a small business owner to think about what the future may hold. However, neither small businesses nor large businesses can predict or plan for all events. Certain events just happen. Given this element of unpredictable chance, businesses should think about how they might protect and conserve their cash flow should the “unthinkable” occur.

Yankee Gas had a project that involved installing a pipeline from Waterbury, Connecticut, to Wallingford, Connecticut.Josh Morgan, “Yankee Gas Work Upsets Local Businessowners,” The Cheshire Herald (Cheshire, Connecticut), October 21, 2010. The original intent according to Yankee Gas was that all work on the pipeline would occur during the night to minimize customer disruptions. Or at least, this was what the storeowners along the line of the work were told. During one phase of the project, the company altered the schedule and began working during daytime hours. Installation involved digging a trench into which the pipeline was laid. This produced a major disruption that required that traffic be diverted away from several businesses’ main entrances and their parking lots. Multiple businesses found their customers had to be “forceful” with the local police to enter areas near the businesses. One of the businesses was a deli that focused on preparing fresh food on a daily basis. Food that was not sold during the day had to be discarded that night. This occurred during the summer months, which were the best times for this deli. A local gas station saw sales drop so precipitously that the owner was unable to meet the rent.

One of the responses on the part of many of the business owners was to seek compensation. Unfortunately, they found that no one was willing to accept responsibility for the detour policy. As an owner of a travel agency put it, “The Town said it was the State, the State said it was the (local) police and the police said it was Yankee Gas.”Josh Morgan, “Yankee Gas Work Upsets Local Businessowners,” The Cheshire Herald (Cheshire, Connecticut), October 21, 2010. While the owners await the resolution of responsibility, they have to consider the possibility of more street work during the following summer.