Holly Hill Acres, Ltd. v. Charter Bank of Gainesville

314 So.2d 209 (Fla. App. 1975)

Scheb, J.

Appellant/defendant [Holly Hill] appeals from a summary judgment in favor of appellee/plaintiff Bank in a suit wherein the plaintiff Bank sought to foreclose a note and mortgage given by defendant.

The plaintiff Bank was the assignee from Rogers and Blythe of a promissory note and purchase money mortgage executed and delivered by the defendant. The note, executed April 28, 1972, contains the following stipulation:

This note with interest is secured by a mortgage on real estate, of even date herewith, made by the maker hereof in favor of the said payee, and shall be construed and enforced according to the laws of the State of Florida. The terms of said mortgage are by this reference made a part hereof. (emphasis added)

Rogers and Blythe assigned the promissory note and mortgage in question to the plaintiff Bank to secure their own note. Plaintiff Bank sued defendant [Holly Hill] and joined Rogers and Blythe as defendants alleging a default on their note as well as a default on defendant’s [Holly Hill’s] note.

Defendant answered incorporating an affirmative defense that fraud on the part of Rogers and Blythe induced the sale which gave rise to the purchase money mortgage. Rogers and Blythe denied the fraud. In opposition to plaintiff Bank’s motion for summary judgment, the defendant submitted an affidavit in support of its allegation of fraud on the part of agents of Rogers and Blythe. The trial court held the plaintiff Bank was a holder in due course of the note executed by defendant and entered a summary final judgment against the defendant.

The note having incorporated the terms of the purchase money mortgage was not negotiable. The plaintiff Bank was not a holder in due course, therefore, the defendant was entitled to raise against the plaintiff any defenses which could be raised between the appellant and Rogers and Blythe. Since defendant asserted an affirmative defense of fraud, it was incumbent on the plaintiff to establish the non-existence of any genuine issue of any material fact or the legal insufficiency of defendant’s affirmative defense. Having failed to do so, plaintiff was not entitled to a judgment as a matter of law; hence, we reverse.

The note, incorporating by reference the terms of the mortgage, did not contain the unconditional promise to pay required by [the UCC]. Rather, the note falls within the scope of [UCC 3-106(a)(ii)]: “A promise or order is unconditional unless it states that…it is subject to or governed by any other writing.”

Plaintiff Bank relies upon Scott v. Taylor [Florida] 1912 [Citation], as authority for the proposition that its note is negotiable. Scott, however, involved a note which stated: “this note secured by mortgage.” Mere reference to a note being secured by mortgage is a common commercial practice and such reference in itself does not impede the negotiability of the note. There is, however, a significant difference in a note stating that it is “secured by a mortgage” from one which provides, “the terms of said mortgage are by this reference made a part hereof.” In the former instance the note merely refers to a separate agreement which does not impede its negotiability, while in the latter instance the note is rendered non-negotiable.

As a general rule the assignee of a mortgage securing a non-negotiable note, even though a bona fide purchaser for value, takes subject to all defenses available as against the mortgagee. [Citation] Defendant raised the issue of fraud as between himself and other parties to the note, therefore, it was incumbent on the plaintiff Bank, as movant for a summary judgment, to prove the non-existence of any genuinely triable issue. [Citation]

Accordingly, the entry of a summary final judgment is reversed and the cause remanded for further proceedings.

Centerre Bank of Branson v. Campbell

744 S.W.2d 490 (Mo. App. 1988)

Crow, J.

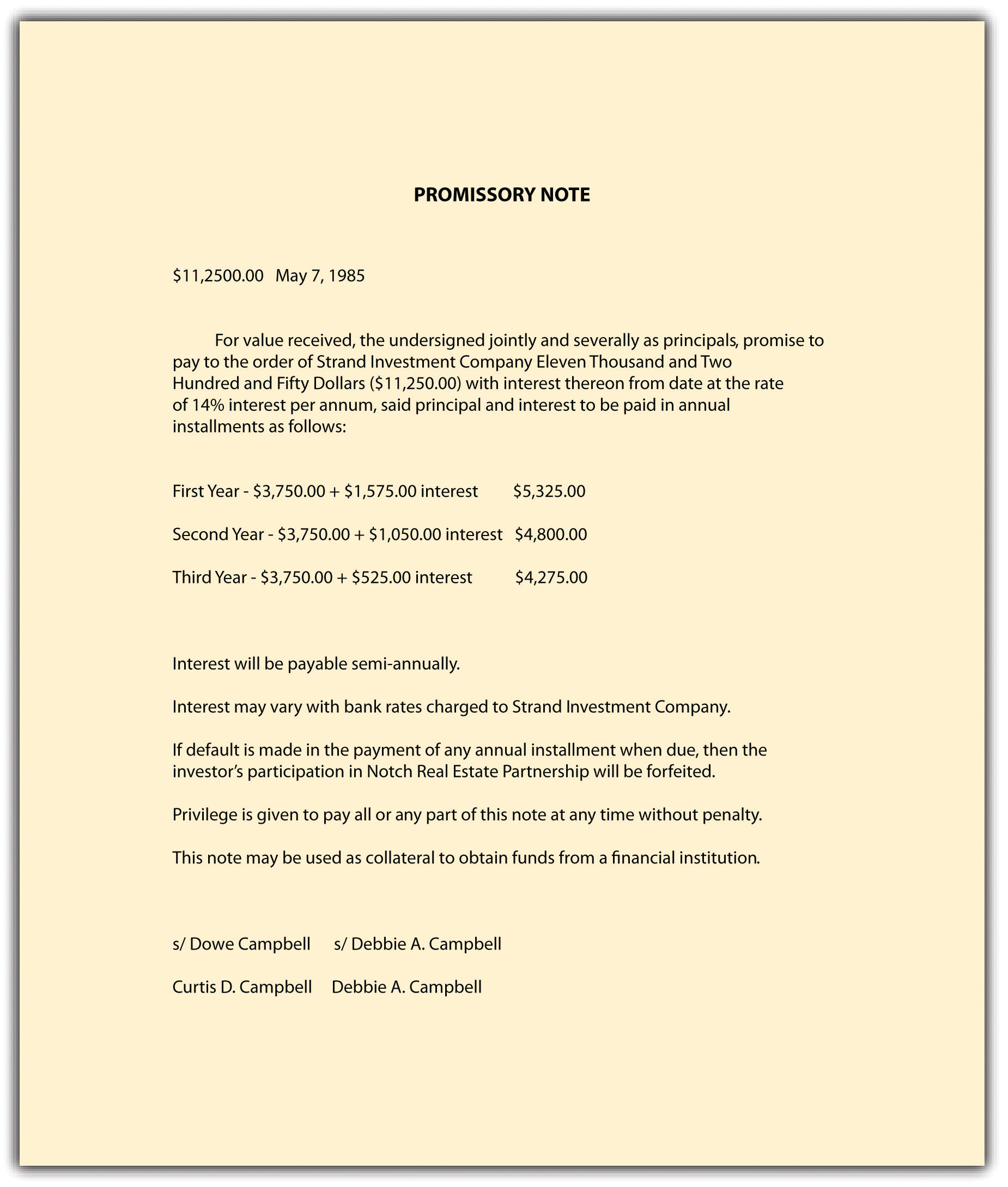

On or about May 7, 1985, appellants (“the Campbells”) signed the following document:

Figure 13.5

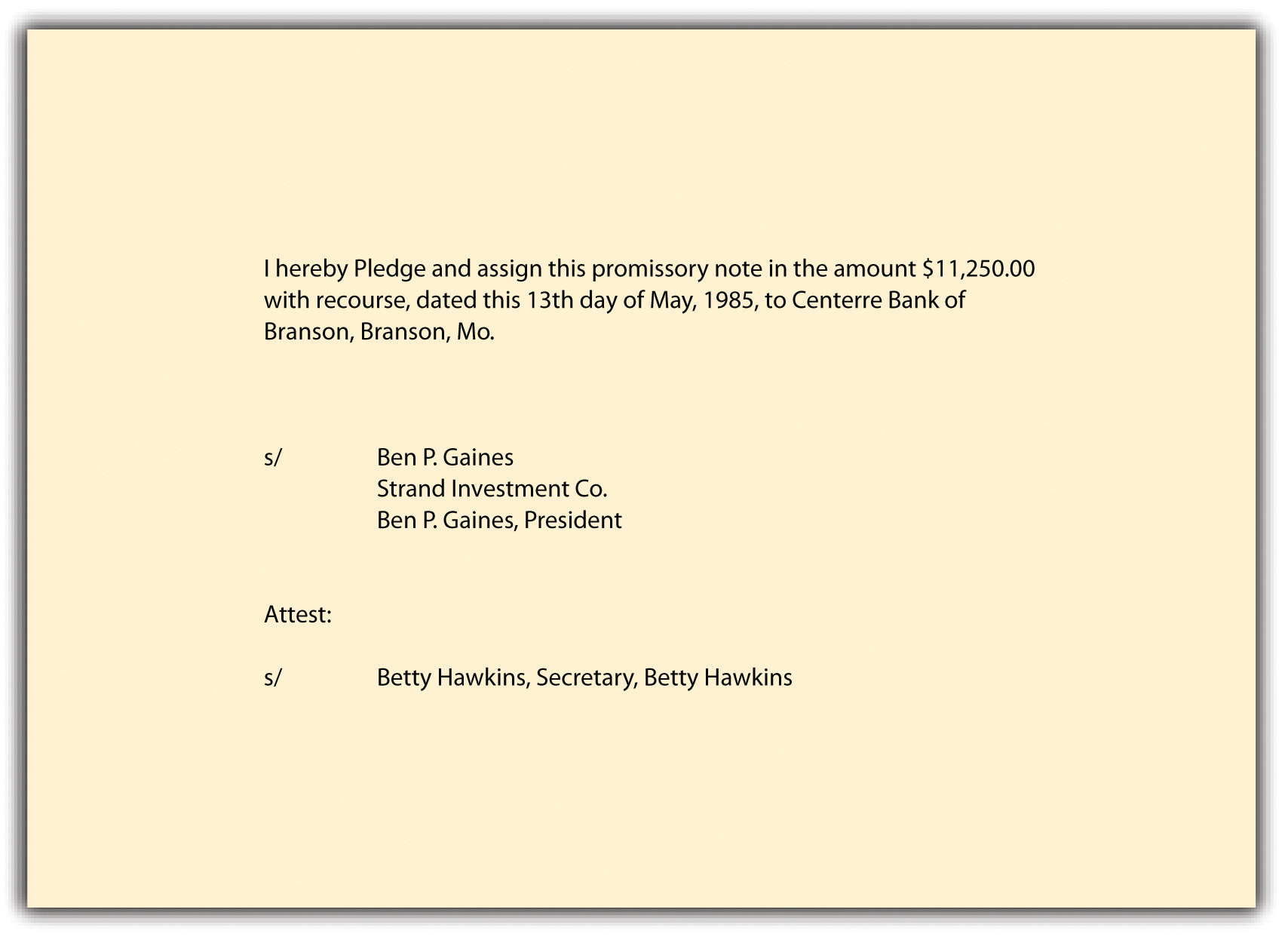

On May 13, 1985, the president and secretary of Strand Investment Company (“Strand”) signed the following provision [see Figure 22.6] on the reverse side of the above [Figure 13.5] document:

Figure 13.6

On June 30, 1986, Centerre Bank of Branson (“Centerre”) sued the Campbells. Pertinent to the issues on this appeal, Centerre’s petition averred:

“1. …on [May 7,] 1985, the [Campbells] made and delivered to Strand…their promissory note…and thereby promised to pay to Strand…or its order…($11,250.00) with interest thereon from date at the rate of fourteen percent (14%) per annum; that a copy of said promissory note is attached hereto…and incorporated herein by reference.

2. That thereafter and before maturity, said note was assigned and delivered by Strand…to [Centerre] for valuable consideration and [Centerre] is the owner and holder of said promissory note.”

Centerre’s petition went on to allege that default had been made in payment of the note and that there was an unpaid principal balance of $9,000, plus accrued interest, due thereon. Centerre’s petition prayed for judgment against the Campbells for the unpaid principal and interest.

[The Campbells] aver that the note was given for the purchase of an interest in a limited partnership to be created by Strand, that no limited partnership was thereafter created by Strand, and that by reason thereof there was “a complete and total failure of consideration for the said promissory note.” Consequently, pled the answers, Centerre “should be estopped from asserting a claim against [the Campbells] on said promissory note because of such total failure of consideration for same.”

The cause was tried to the court, all parties having waived trial by jury. At trial, the attorney for the Campbells asked Curtis D. Campbell what the consideration was for the note. Centerre’s attorney interrupted: “We object to any testimony as to the consideration for the note because it’s our position that is not a defense in this lawsuit since the bank is the holder in due course.”…

The trial court entered judgment in favor of Centerre and against the Campbells for $9,000, plus accrued interest and costs. The trial court filed no findings of fact or conclusions of law, none having been requested. The trial court did, however, include in its judgment a finding that Centerre “is a holder in due course of the promissory note sued upon.”

The Campbells appeal, briefing four points. Their first three, taken together, present a single hypothesis of error consisting of these components: (a) the Campbells showed “by clear and convincing evidence a valid and meritorious defense in that there existed a total lack and failure of consideration for the promissory note in question,” (b) Centerre acquired the note subject to such defense in that Centerre was not a holder in due course, as one can be a holder in due course of a note only if the note is a negotiable instrument, and (c) the note was not a negotiable instrument inasmuch as “it failed to state a sum certain due the payee.”…

We have already noted that if Centerre is not a holder in due course, the Campbells can assert the defense of failure of consideration against Centerre to the same degree they could have asserted it against Strand. We have also spelled out that Centerre cannot be a holder in due course if the note is not a negotiable instrument. The pivotal issue, therefore, is whether the provision that interest may vary with bank rates charged to Strand prevents the note from being a negotiable instrument.…

Neither side has cited a Missouri case applying [UCC 3-104(a)] to a note containing a provision similar to: “Interest may vary with bank rates charged to Strand.” Our independent research has likewise proven fruitless. There are, however, instructive decisions from other jurisdictions.

In Taylor v. Roeder, [Citation, Virginia] (1987), a note provided for interest at “[t]hree percent (3.00%) over Chase Manhattan prime to be adjusted monthly.” A second note provided for interest at “3% over Chase Manhattan prime adjusted monthly.” Applying sections of the Uniform Commercial Code adopted by Virginia identical to [the Missouri UCC], the court held the notes were not negotiable instruments in that the amounts required to satisfy them could not be ascertained without reference to an extrinsic source, the varying prime rate of interest charged by Chase Manhattan Bank.

In Branch Banking and Trust Co. v. Creasy, [Citation, North Carolina] (1980), a guaranty agreement provided that the aggregate amount of principal of all indebtedness and liabilities at any one time for which the guarantor would be liable shall not exceed $35,000. The court, emphasizing that to be a negotiable instrument a writing must contain, among other things, an unconditional promise to pay a sum certain in money, held the agreement was not a negotiable instrument. The opinion recited that for the requirement of a sum certain to be met, it is necessary that at the time of payment the holder be able to determine the amount which is then payable from the instrument itself, with any necessary computation, without reference to any outside source. It is essential, said the court, for a negotiable instrument “to bear a definite sum so that subsequent holders may take and transfer the instrument without having to plumb the intricacies of the instrument’s background.…

In A. Alport & Son, Inc. v. Hotel Evans, Inc., [Citation] (1970), a note contained the notation “with interest at bank rates.” Applying a section of the Uniform Commercial Code adopted by New York identical to [3-104(a)] the court held the note was not a negotiable instrument in that the amount of interest had to be established by facts outside the instrument.

In the instant case, the Campbells insist that it is impossible to determine from the face of the note the amount due and payable on any payment date, as the note provides that interest may vary with bank rates charged to Strand. Consequently, say the Campbells, the note is not a negotiable instrument, as it does not contain a promise to pay a “sum certain” [UCC 3-104(a)].

Centerre responds that the provision that interest may vary with bank rates charged to Strand is not “directory,” but instead is merely “discretionary.” The argument begs the question. Even if one assumes that Strand would elect not to vary the interest charged the Campbells if interest rates charged Strand by banks changed, a holder of the note would have to investigate such facts before determining the amount due on the note at any time of payment. We hold that under 3-104 and 3-106, supra, and the authorities discussed earlier, the provision that interest may vary with bank rates charged to Strand bars the note from being a negotiable instrument, thus no assignee thereof can be a holder in due course. The trial court therefore erred as a matter of law in ruling that Centerre was a holder in due course.…

An alert reader will have noticed two other extraordinary features about the note, not mentioned in this opinion. First, the note provides in one place that principal and interest are to be paid in annual installments; in another place it provides that interest will be payable semiannually. Second, there is no acceleration clause providing that if default be made in the payment of any installment when due, then all remaining installments shall become due and payable immediately. It would have thus been arguable that, at time of trial, only the first year’s installment of principal and interest was due. No issue is raised, however, regarding any of these matters, and we decline to consider them sua sponte [on our own].

The judgment is reversed and the cause is remanded for a new trial.

Newman v. Manufacturers Nat. Bank of Detroit

152 N.W.2d 564 (Mich. App. 1967)

Holbrook, J.

As evidence of [a debt owed to a business associate, Belle Epstein], plaintiff [Marvin Newman in 1955] drew two checks on the National Bank of Detroit, one for $1,000 [about $8,000 in 2010 dollars] and the other for $200 [about $1,600 in 2010 dollars]. The checks were left undated. Plaintiff testified that he paid all but $300 of this debt during the following next 4 years. Thereafter, Belle Epstein told plaintiff that she had destroyed the two checks.…

Plaintiff never notified defendant Bank to stop payment on the checks nor that he had issued the checks without filling in the dates. The date line of National Bank of Detroit check forms contained the first 3 numbers of the year but left the last numeral, month and day entries, blank, viz., “Detroit 1, Mich. _ _ 195_ _.” The checks were cashed in Phoenix, Arizona, April 17, 1964, and the date line of each check was completed…They were presented to and paid by Manufacturers National Bank of Detroit, April 22, 1964, under the endorsement of Belle Epstein. The plaintiff protested such payment when he was informed of it about a month later. Defendant Bank denied liability and plaintiff brought suit.…

The two checks were dated April 16, 1964. It is true that the dates were completed in pen and ink subsequent to the date of issue. However, this was not known by defendant. Defendant had a right to rely on the dates appearing on the checks as being correct. [UCC 3-113] provides in part as follows:

(a) An instrument may be antedated or postdated.

Also, [UCC 3-114] provides in part as follows:

[T]ypewritten terms prevail over printed terms, handwritten terms prevail over both…

Without notice to the contrary, defendant was within its rights to assume that the dates were proper and filled in by plaintiff or someone authorized by him.…

Plaintiff admitted at trial that defendant acted in good faith in honoring the two checks of plaintiff’s in question, and therefore defendant’s good faith is not in issue.

In order to determine if defendant bank’s action in honoring plaintiff’s two checks under the facts present herein constituted an exercise of proper procedure, we turn to article 4 of the UCC.…[UCC 4-401(d)] provides as follows:

A bank that in good faith makes payment to a holder may charge the indicated account of its customer according to:

(1) the original tenor of his altered item; or

(2) the tenor of his completed item, even though the bank knows the item has been completed unless the bank has notice that the completion was improper.

…[W]e conclude it was shown that two checks were issued by plaintiff in 1955, filled out but for the dates which were subsequently completed by the payee or someone else to read April 16, 1964, and presented to defendant bank for payment, April 22, 1964. Applying the rules set forth in the UCC as quoted herein, the action of the defendant bank in honoring plaintiff’s checks was in good faith and in accord with the standard of care required under the UCC.

Since we have determined that there was no liability under the UCC, plaintiff cannot succeed on this appeal.

Affirmed.