Commercial paper is the collective term for a variety of instruments—including checks, certificates of deposit, and notes—that are used to pay for goods; commercial paper is basically a contract to pay money. The key to the central role of commercial paper is negotiability, the means by which a person is empowered to transfer to another more than what the transferor himself possesses. The law regulating negotiability is Article 3 of the Universal Commercial Code.

Commercial paper can be divided into two basic types: the draft and the note. A draft is a document prepared by a drawer ordering the drawee to remit a stated sum of money to the payee. Drafts can be subdivided into two categories: sight drafts and time drafts. A note is a written promise to pay a specified sum of money on demand or at a definite time.

A special form of draft is the common bank check, a draft drawn on a bank and payable on demand. A special form of note is the certificate of deposit, a written acknowledgment by a bank that it has received money and agrees to repay it at a time specified in the certificate.

In addition to drawers, makers, drawees, and payees, one can deal with commercial paper in five other capacities: as indorsers, indorsees, holders, holders in due course, and accommodation parties.

A holder of a negotiable instrument must be able to ascertain all essential terms from its face. These terms are that the instrument (1) be in writing, (2) be signed by the maker or drawer, (3) contain an unconditional promise or order to pay (4) a sum certain in money, (5) be payable on demand or at a definite time, and (6) be payable to order or to bearer. If one of these terms is missing, the document is not negotiable, unless it is filled in before being negotiated according to authority given.

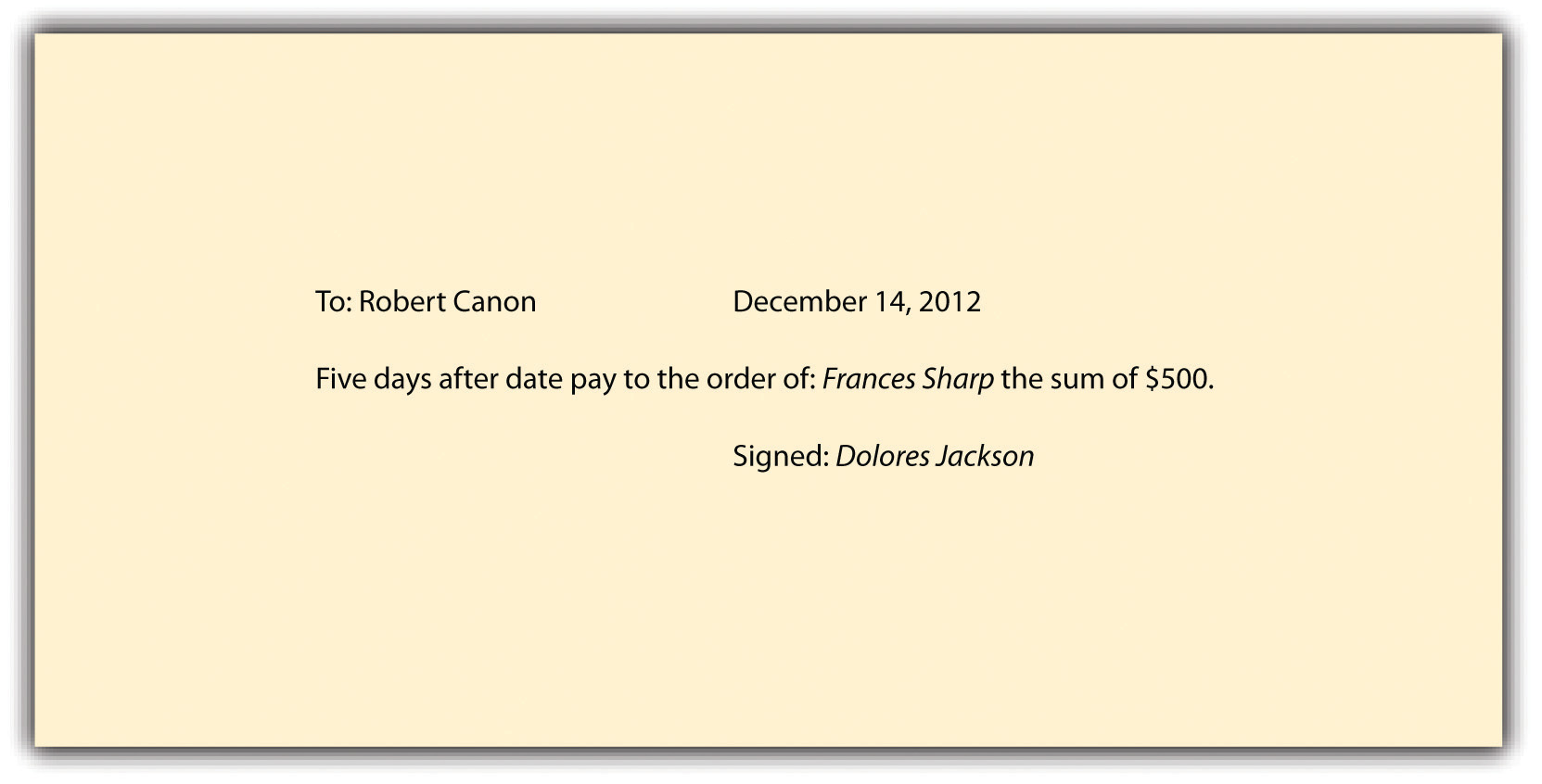

Is the following instrument a note, check, or draft? Explain.

Figure 13.7

State whether the following provisions in an instrument otherwise in the proper form make the instrument nonnegotiable and explain why:

A negotiable instrument must

The law governing negotiability is found in

A sight draft

A note reads, “Interest hereon is 2% above the prime rate as determined by First National Bank in New York City.” Under the UCC,

A “maker” in negotiable instrument law does what?