Joe isn’t old enough to qualify, but if his grandfather had deposited $1,000 in an account paying 7 percent interest in 1945, it would now be worth $64,000. That’s because money invested at 7 percent compounded will double every ten years. Now, $64,000 may or may not seem like a significant return over fifty years, but after all, the money did all the heavy lifting, and given the miracle of compound interest, it’s surprising that Americans don’t take greater advantage of the opportunity to multiply their wealth by saving more of it, even in modest, interest-bearing accounts. Ironically, with $790 billion in credit card debt, it’s obvious that a lot of American families are experiencing the effects of compound interest—but in reverse.Robert H. Frank, “Americans Save So Little, but What Can Be Done to Change That?” New York Times, March 17, 2005, http://www.robert-h-frank.com/PDFs/ES.3.17.05.pdf (accessed November 11, 2011).

As a matter of fact, though Joe College appears to be on the right track when it comes to saving, many people aren’t. A lot of Americans, it seems, do indeed set savings goals, but in one recent survey, nearly 70 percent of the respondents reported that they fell short of their monthly goals because their money was needed elsewhere. About one-third of Americans say that they’re putting away something but not enough, and another third aren’t saving anything at all. Almost one-fifth of all Americans have net worth of zero—or less.Don Taylor, “Two-Thirds of Americans Don’t Save Enough,” Bankrate.com, October 2007, http://www.bankrate.com/brm/news/retirement/Oct_07_retirement_poll_results_a1.asp (accessed November 11, 2011); Robert H. Frank, “Americans Save So Little, but What Can Be Done to Change That?” New York Times, March 17, 2005, http://www.robert-h-frank.com/PDFs/ES.3.17.05.pdf (accessed November 11, 2011).

As we indicated in the opening section of this chapter, this shortage of savings goes hand in hand with a surplus in spending. “My parents,” says one otherwise gainfully employed American knowledge worker, “are appalled at the way I justify my spending. I think, ‘Why work and make money unless you're going to enjoy it?’ That’s a fine theory,” she adds, “until you’re sixty, homeless, and with no money in the bank.”Quoted by Marilyn Gardner, “Why Can’t Americans Save a Dime?” Christian Science Monitor (2008), http://www.mrshultz.com/webpages/whycantamericanssave.htm (accessed November 11, 2011). And indeed, if she doesn’t intend to alter her personal-finances philosophy, she has good reason to worry about her “older adult” years. Sixty percent of Americans over the age of sixty-five have less than $100,000 in savings, and only 30 percent of this group have more than $25,000; 45 percent have less than $15,000. As for income, 75 percent of people over age sixty-five generate less than $35,000 annually, and 30 percent are in the “poverty to near-poverty” range of $10,000 to $20,000 (as compared to 12 percent of the under-sixty-five population).Rose M. Rubin, Shelley I. White-Means, and Luojia Mao Daniel, “Income Distribution of Older Americans,” Monthly Labor Review, November 2000, http://www.bls.gov/opub/mlr/2000/11/art2full.pdf (accessed November 11, 2011).

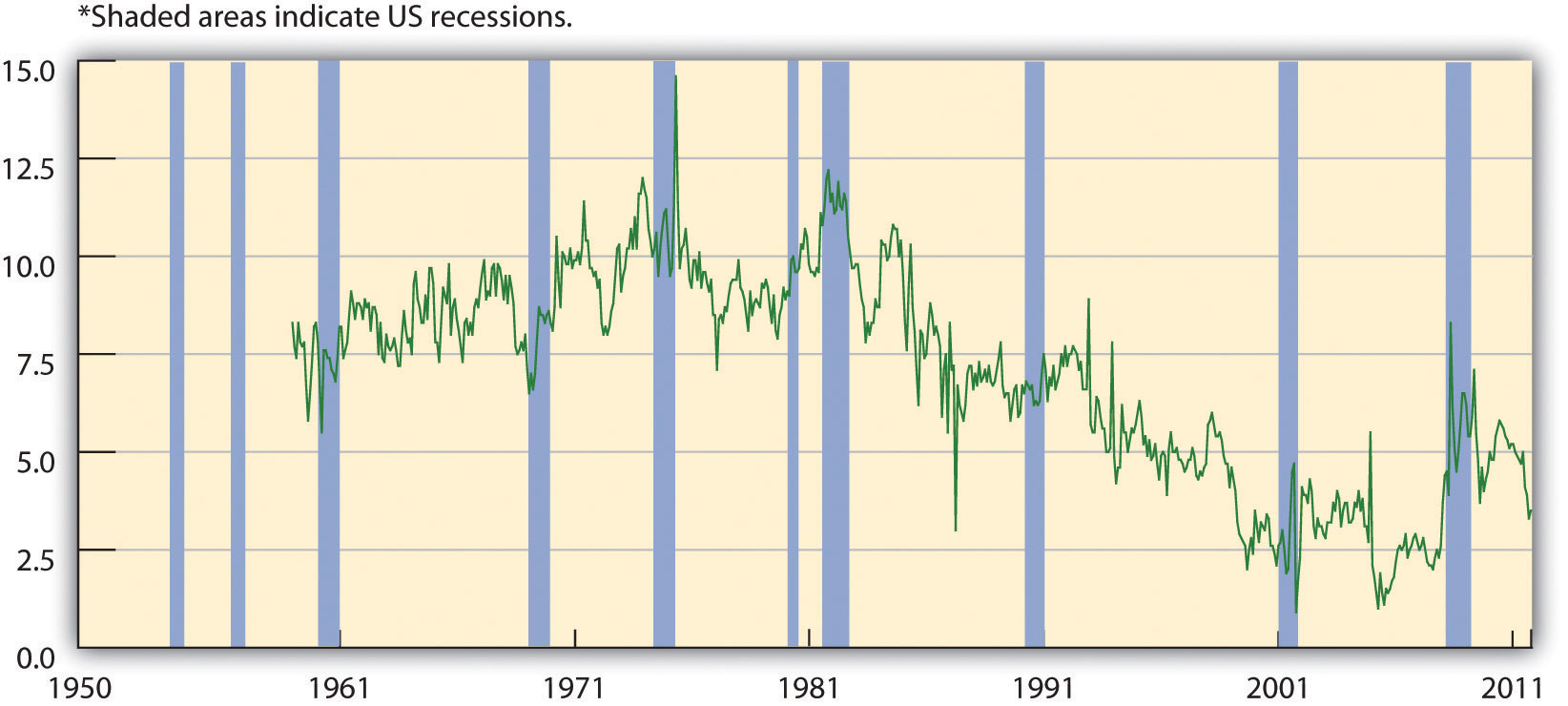

Figure 14.11 "U.S. Savings Rate" shows the U.S. savings rate—which measures the percentage of disposable income devoted to savings for the period 1960 to 2010. As you can see, it suffered a steep decline from 1980 to 2005 and remained at this negligible savings rate until it started moving up in 2008. The recent increase in the savings rate, however, is still below the long-term average of 7 percent.“Personal Savings Rate (PSAVERT),” Economic Research, Federal Reserve Bank of St. Louis, August 28, 2008, http://research.stlouisfed.org/fred2/series/PSAVERT (accessed November 10, 2011); Andrea Dickson, “U.S. Personal Savings Rate Close to Depression-Era Rates,” Wisebread, February 2, 2007, http://www.wisebread.com/u-s-personal-savings-rate-close-to-depression-era-rates (accessed November 11, 2011).

Figure 14.11 U.S. Savings Rate

Now, a widespread tendency on the part of Americans to spend rather than save doesn’t account entirely for the downward shift in the savings rate. In late 2005, the Federal Reserve cited at least two other (closely related) factors in the decline of savings:Federal Reserve Bank of San Francisco, “Spendthrift Nation,” Economic Research and Data, November 10, 2005, http://www.frbsf.org/publications/economics/letter/2005/el2005-30.html (accessed November 11, 2011).

Assume, for example, that, in addition to your personal savings, you own some stock and have a mortgage on a home. Both your stock and your home are (supposedly) appreciable assets—their value used to go up over time. (In fact, if you had taken out your mortgage in 2000, by the end of 2005 your home would have appreciated at double the rate of your disposable personal income.) The decline in the personal savings rate during the mid-2000s, suggested the Fed, resulted in part from people’s response to “long-lived bull markets in stocks and housing”; in other words, a lot of people had come to rely on the appreciation of such assets as stocks and residential property as “a substitute for the practice of saving out of wage income.”

Let’s assume that you weren’t ready to take advantage of the boom in mortgage loans in 2000 but did set your sights on 2005. You may not have been ready to buy a house in 2005 either, but there’s a good chance that you got a loan anyway. In particular, some lender might have offered you a so-called subprime mortgage loanMortgage loans made to borrowers who don’t qualify for market-set interest rates because of one or more risk factors.. Subprime loans are made to borrowers who don’t qualify for market-set interest rates because of one or more risk factors—income level, employment status, credit history, ability to make only a very low down payment. As of March 2007, U.S. lenders had written $1.3 trillion in mortgages like yours.Associated Press, “How Severe Is Subprime Mess?” MSNBC.com, March 13, 2007, http://www.msnbc.msn.com/id/17584725/ns/business-real_estate/t/will-subprime-mess-ripple-through-economy/#.Tr2hFvKul2I (accessed November 11, 2011).

Granted, your terms might not have been very good. For one thing, interest rates on subprime loans may run from 8 percent to 10 percent and higher.“Subprime Mortgage Pricing Varies Greatly among U.S. Cities, consumeraffairs.com, September 13, 2005, http://www.consumeraffairs.com/news04/2005/subprime_study.html (accessed November 11, 2011). In addition, you probably had to settle for an adjustable-rate mortgage (ARM)Mortgage that’s pegged to the increase or decrease of certain interest rates that your lender has to pay.—one that’s pegged to the increase or decrease of certain interest rates that your lender has to pay. When you signed your mortgage papers, you knew that if those rates went up, your mortgage rate—and your monthly payments—would go up, too. Fortunately, however, you had a plan B: with the value of your new asset appreciating even as you enjoyed living in it, it wouldn’t be long before you could refinance it at a more manageable and more predictable rate.

Now imagine your dismay when housing prices started to go down in 2006 and 2007. As a result, you weren’t able to refinance, your ARM was set to adjust upward in 2008, and foreclosures were already happening all around you—1.3 million in 2007 alone.Justin Lahart, “Egg Cracks Differ in Housing, Finance Shells,” Wall Street Journal, July 13, 2008. By April 2008, one in every 519 American households had received a foreclosure notice.RealtyTrac Inc., “Foreclosure Activity Increases 4 Percent in April According to RealtyTrac(R) U.S. Foreclosure Market Report,” PR Newswire, May 14, 2008, http://www.prnewswire.com/news-releases/foreclosure-activity-increases-4-percent-in-april-according-to-realtytracr-us-foreclosure -market-report-57244677.html (accessed November 11, 2011). By August, 9.2 percent of the $12 trillion in U.S. mortgage loans was delinquent or in foreclosure.Mortgage Bankers Association, “Delinquencies and Foreclosures Increase in Latest MBA National Delinquency Survey,” September 5, 2008, http://www.mbaa.org/NewsandMedia/PressCenter/64769.htm (accessed November 11, 2011); Charles Duhigg, “Loan-Agency Woes Swell from a Trickle to a Torrent,” nytimes.com, July 11, 2008, http://www.nytimes.com/2008/07/11/business/11ripple.html?ex=1373515200&en=8ad220403fcfdf6e&ei=5124&partner=permalink &exprod=permalink.

The repercussions? Banks and other institutions that made mortgage loans were the first sector of the financial industry to be hit. Largely because of mortgage-loan defaults, profits at more than 8,500 U.S. banks dropped from $35 billion in the fourth quarter of 2006 to $650 million in the corresponding quarter of 2007 (a decrease of 89 percent). Bank earnings for the year 2007 declined 31 percent and dropped another 46 percent in the first quarter of 2008.Federal Deposit Insurance Corporation, Quarterly Banking Profile (Fourth Quarter 2007), http://www.2.fdic.gov/qbp/2007dec/qbp.pdf (accessed September 25, 2008); FDIC, Quarterly Banking Profile (First Quarter 2008), http://www.2.fdic.gov/qbp/2008mar/qbp.pdf (accessed September 25, 2008).

Losses in this sector were soon felt by two publicly traded government-sponsored organizations, the Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage Corporation (Freddie Mac). Both of these institutions are authorized to make loans and provide loan guarantees to banks, mortgage companies, and other mortgage lenders; their function is to make sure that these lenders have enough money to lend to prospective home buyers. Between them, Fannie Mae and Freddie Mac backed approximately half of that $12 trillion in outstanding mortgage loans, and when the mortgage crisis hit, the stock prices of the two corporations began to drop steadily. In September 2008, amid fears that both organizations would run out of capital, the U.S. government took over their management.

Freddie Mac also had another function: to increase the supply of money available for mortgage loans and new home purchases, Freddie Mac bought mortgages already written by lenders, pooled them, and sold them as mortgage-backed securities to investors on the open market. Many major investment firms did much the same thing, buying individual subprime mortgages from original lenders (such as small banks), pooling the projected revenue—payments made by the original individual home buyers—and selling securities backed by the pooled revenue.

But when their rates went too high and home buyers couldn’t make these payments, these securities plummeted in value. Institutions that had invested in them—including investment banks—suffered significant losses.Shawn Tully, “Wall Street’s Money Machine Breaks Down,” Fortune, CNNMoney.com, November 12, 2007, http://money.cnn.com/magazines/fortune/fortune_archive/2007/11/26/101232838/index.htm (accessed November 11, 2011). In September 2008, one of these investment banks, Lehman Brothers, filed for bankruptcy protection; another, Merrill Lynch, agreed to sell itself for $50 billion. Next came American International Group (AIG), a giant insurance company that insured financial institutions against the risks they took in loaning and investing money. As its policyholders buckled under the weight of defaulted loans and failed investments, AIG, too, was on the brink of bankruptcy, and when private efforts to bail it out failed, the U.S. government stepped in with a loan of $85 billion.See Greg Robb et al., “AIG Gets Fed Rescue in Form of $85 Billion Loan,” MarketWatch, September 16, 2008, http://www.marketwatch.com/News/Story/aig-gets-fed-rescue-form/story.aspx?guid=%7BE84A4797%2D3EA6%2D40B1%2D9DB5%2DF07B5A7F5BC2%7D (accessed November 11, 2011). The U.S. government also agreed to buy up risky mortgage-backed securities from teetering financial institutions at an estimated cost of “hundreds of billions.”Mortgage Bankers Association, “Delinquencies and Foreclosures Increase in Latest MBA National Delinquency Survey,” Press Release, September 5, 2008, http://www.mbaa.org/NewsandMedia/PressCenter/64769.htm (accessed November 11, 2011).

If you were one of the millions of Americans who took out subprime mortgages in the years between 2001 and 2005, you probably have some pressing financial problems. If you defaulted on your subprime ARM, you may have suffered foreclosure on your newly acquired asset, lost any equity that you’d built up in it, and taken a hit in your credit rating. (We’ll assume that you’re not one of the people whose eagerness to get on the subprime bandwagon caused fraudulent mortgage applications to go up by 300 percent between 2002 and 2006.)Financial Crimes Enforcement Network, Mortgage Loan Fraud: An Industry Assessment Based upon Suspicious Activity Report Analysis, November 2006, http://www.fincen.gov/news_room/rp/reports/pdf/MortgageLoanFraud.pdf (accessed November 11, 2011).

On the other hand, you’ve probably learned a few lessons about financial planning and strategy. Let’s conclude with a survey of three lessons that you should have learned from your hypothetical adventure in the world of subprime mortgages.

Lesson 1: All mortgages are not created equal. Despite (or perhaps because of) the understandable enticement of home ownership, your judgment may have been faulty in this episode of your financial life cycle. Generally speaking, you’re better off with a fixed-rate mortgageA mortgage on which the interest rate remains the same regardless of changes in market interest rates.—one on which the interest rate remains the same regardless of changes in market interest rates—than with an ARM.See Arthur J. Keown, Personal Finance: Turning Money into Wealth, 4th ed. (Upper Saddle River, NJ: Pearson Education, 2007, 253–54. As we’ve explained at length in this chapter, planning is one of the cornerstones of personal-finances management, and ARMs don’t lend themselves to planning. How well can you plan for your future mortgage payments if you can’t be sure what they’re going to be?

In addition, though interest rates may go up or down, planning for them to go down and to take your mortgage payments with them doesn’t make much sense. You can wait around to get lucky, and you can even try to get lucky (say, by buying a lottery ticket), but you certainly can’t plan to get lucky. Unfortunately, the only thing you can really plan for is higher rates and higher payments. An ARM isn’t a good idea if you don’t know whether you can meet payments higher than your initial payment. In fact, if you have reason to believe that you can’t meet the maximum payment entailed by an ARM, you probably shouldn’t take it on.

Lesson 2: It’s risky out there. You now know—if you hadn’t suspected it already—that planning your personal finances would be a lot easier if you could do it in a predictable economic environment. But you can’t, of course, and virtually constant instability in financial markets is simply one economic fact of life that you’ll have to deal with as you make your way through the stages of your financial life cycle.

In other words, any foray into financial markets is risky. Basically, risk is the possibility that cash flows will be variable.See esp. Arthur J. Keown et al., Foundations of Finance: The Logic and Practice of Financial Management, 6th ed. (Upper Saddle River, NJ: Pearson Education, 2008), 174. Unfortunately, volatility in the overall economy is directly related to just one category of risks. There’s a second category—risks related to the activities of various organizations involved in your financial transactions. You’ve already been introduced to the effects of these forms of financial risk, some of which have affected you directly, some of which have affected you indirectly, and some of which may affect you in the future:This section is based on Bernard J. Winger and Ralph R. Frasca, Personal Finance: An Integrated Planning Approach, 6th ed. (Upper Saddle River, NJ: Prentice Hall, 2003), 250–51.

In your own small way, of course, you, too, underestimated the pitfalls of all three of these forms of risk.

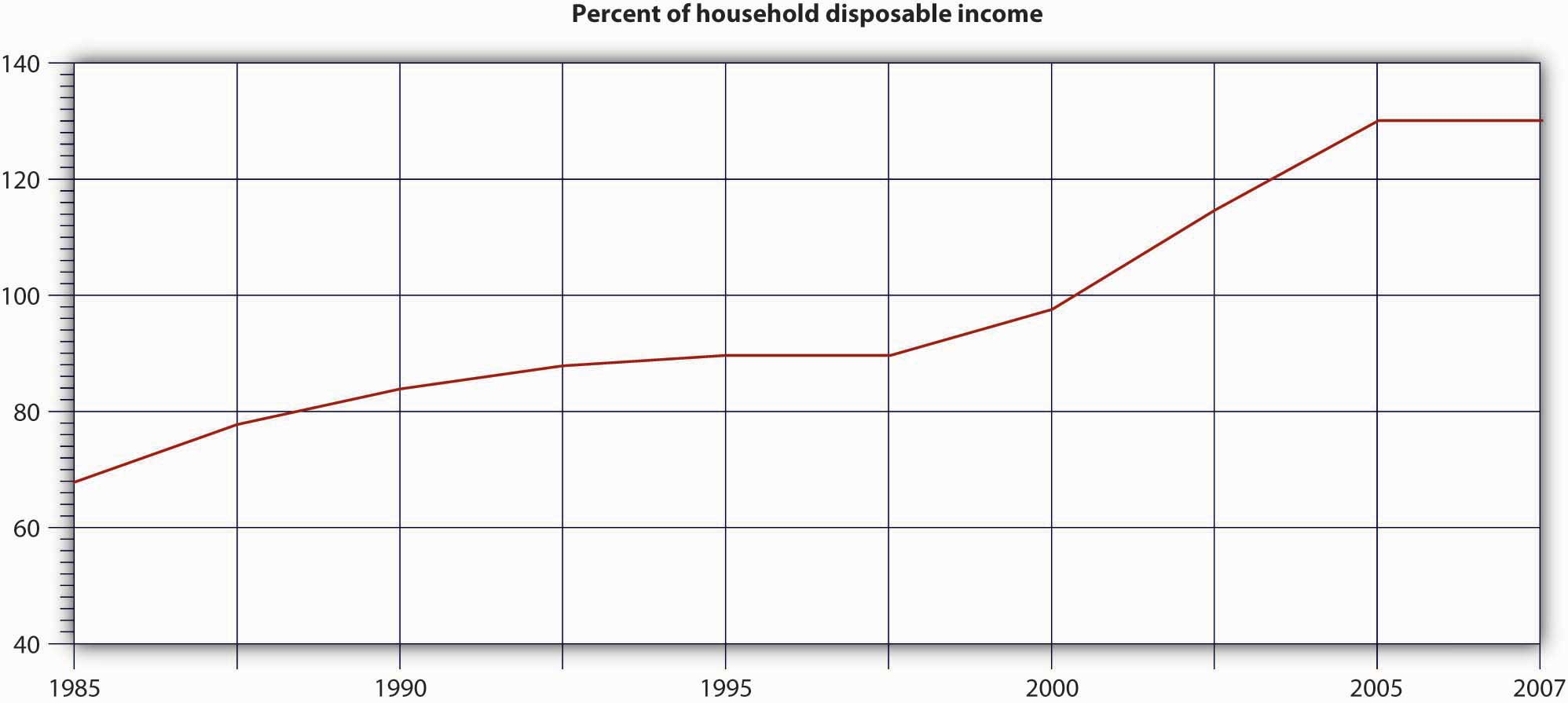

Lesson 3: Not all income is equally disposable. Figure 14.13 "Debt-Income Ratio" shows the increase in the ratio of debt to disposable income among American households between 1985 and 2007. As you can see, the increase was dramatic—from 80 percent in the early 1990s to about 130 percent in 2007.“Getting Worried Downtown,” Economist.com, November 15, 2007, http://www.economist.com/world/unitedstates/displaystory.cfm?story_id=10134077 (accessed November 11, 2011). This rise was made possible by greater access to credit—people borrow money in order to spend it, whether on consumption or on investments, and the more they can borrow, the more they can spend.

In the United States, greater access to credit in the late 1990s and early 2000s was made possible by rising housing prices: the more valuable your biggest asset, the more lenders are willing to lend you, even if what you’re buying with your loan—your house—is your biggest asset. As the borrower, your strategy is twofold: (1) Pay your mortgage out of your wage income, and (2) reap the financial benefits of an asset that appreciates in value. On top of everything else, you can count the increased value of your asset as savings: when you sell the house at retirement, the difference between your mortgage and the current value of your house is yours to support you in your golden years.

Figure 14.13 Debt-Income Ratio

As we know, however, housing prices had started to fall by the end of 2006. From a peak in mid-2006, they had fallen 8 percent by November 2007, and by April 2008 they were down from the 2006 peak by more than 19 percent—the worst rate of decline since the Great Depression. And most experts expected it to get worse before it gets better, and unfortunately they were right. Housing prices have declined by 33 percent from the mid-2006 peak to the end of 2010.David Streitfeld, “Bottom May Be Near for Slide in Housing,” The New York Times, May 31, 2011, http://www.nytimes.com/2011/06/01/business/01housing.html (accessed November 10, 2011); Nadeem Walayat, “U.S. House Prices Forecast 2008-2010,” Market Oracle, June 29, 2008, http://www.marketoracle.co.uk/Article5257.html (accessed November 11, 2011).

So where do you stand? As you know, your house is worth no more than what you can get for it on the open market; thus the asset that you were counting on to help provide for your retirement has depreciated substantially in little more than a decade. If you’re one of the many Americans who tried to substitute equity in property for traditional forms of income savings, one financial specialist explains the unfortunate results pretty bluntly: your house “is a place to live, not a brokerage account.”Sherman L. Doll, of Capital Performance Advisors, quoted by Amy Hoak, “Why a House Is Not a Piggy Bank to Tap Into for Your Retirement,” Wall Street Journal, July 19, 2006, http://homes.wsj.com/buysell/markettrends/20060719-hoak.html (accessed September 27, 2008). If it’s any consolation, you’re not alone: a recent study by the Security Industries Association reports that, for many Americans, nearly half their net worth is based on the value of their home. Analysts fear that many of these people—a significant proportion of the baby-boom generation—won’t be able to retire with the same standard of living that they’ve been enjoying during their wage-earning years.Amy Hoak, “Why a House Is Not a Piggy Bank to Tap Into for Your Retirement,” Wall Street Journal, July 19, 2006, http://homes.wsj.com/buysell/markettrends/20060719-hoak.html (accessed September 27, 2008).

Risk is the possibility that cash flows will be variable. Three types of risk are related to the activities of various organizations that may be involved in your financial transactions:

(AACSB) Analysis

Write a report giving your opinion on how we got into the subprime mortgage crisis and how we’ll get out of it