Both tort law and contract law fall into the larger domain of private lawBody of law dealing with private relationships among individuals and organizations., which deals with private relationships among individuals and organizations. In addition, of course, there are numerous types of law that deal with the relationship of government to private individuals and other private entities, including businesses. This is the area of public lawBody of law dealing with the relationship of government to private individuals and other private entities., which falls into three general categories:See Nancy A. Kubasek, Bartley A. Brennan, and M. Neil Browne, The Legal Environment of Business: A Critical Thinking Approach, 5th ed. (Upper Saddle River, NJ: Pearson Education, 2009), 30–31.

Public law obviously has a major impact on the activities of both individuals and businesses in the United States, and in the following section, we’ll discuss the nature of this impact and the reasons why so many private activities are subject to the rules and principles of public law. Like most areas of the law, public law is an extremely complex field of study, and to keep things manageable we’re going to explore this field by focusing on three less-than-glamorous legal issues: why cigarette littering is against the law, why cigarettes cost so much, and why businesses ban smoking in the workplace.

Having sold the Stratford Inn in 1991, former senator George McGovern didn’t have to worry about the Connecticut Clean Indoor Air Act of 2004, which banned smoking in such places as the bar of his hotel.Saul Spigel, “Statewide Smoking Ban,” OLR Research, June 9, 2003, http://cga.ct.gov/2003/rpt/2003-R-0466.htm (accessed November 12, 2011). Like similar statutes in many states, the Connecticut law was enacted in response to the health hazards of secondary smoke in closed environments (an estimated three thousand nonsmokers die from smoke-related lung cancer every year).

Interestingly, shortly after the new statewide antismoking law went into effect, officials in Connecticut noticed a curious phenomenon: cigarette litter—packaging, lighting materials, and, especially, butts—had begun to accumulate at an unprecedented rate in outdoor areas surrounding drinking establishments, exacerbating an already serious environmental problem. Unless you’ve lived your entire life indoors, you have undoubtedly noticed that cigarette butts are a fixture of the great American outdoors: Americans smoke about 360 billion cigarettes a year and discard 135 million pounds of butts, much of which ends up as litter.“How Many Discarded Cigarette Butts Are There?” Cigarette Butt Litter (Clean Virginia Waterways, Longwood University, 2008), http://www.longwood.edu/cleanva/cigbutthowmany.htm (accessed November 12, 2011). In fact, cigarettes account for 20 percent of all the litter in the United States, 18 percent of which ends up in local streams and other waterways.

In 2006, U.S. Senator Joseph Lieberman of Connecticut introduced the Cigarette Litter Prevention Act, a federal statute that would require cigarette producers to attach environmental warnings to their packaging.“Lieberman Lauds Legislation to Eradicate Tobacco Trash,” news release, May 8, 2006, http://lieberman.senate.gov/index.cfm/news-events/news/2006/5/lieberman-lauds-legislation-to-eradicate-tobacco-trash (accessed November 12, 2011). In Connecticut itself, however, statewide antilittering law covers only state property, land, and waters.Paul Frisman, “Connecticut’s Littering Law,” OLR Research Report, May 20, 2008, http://www.cga.ct.gov/2008/rpt/2008-R-0314.htm (accessed November 12, 2011). When it comes to private property, such as most areas adjacent to restaurants and bars, it’s left to local communities to police littering violations. The town council of Wallingford, for example, recently took action on a proposed ordinance to fine business owners who fail to clean up the litter on their doorsteps and in their parking lots. The law also targets proprietors who continue to sweep cigarette and other litter into storm drains—a major source of waterway pollution. “I’m not a big fan of making laws to do stuff like this,” admitted one town councilor, “but if people don’t do it, then they have to be told to do it.”“Litter Law Would Target Smokers outside Bars,” The Record-Journal, August 22, 2008, http://forums.ctrecord.com/showthread.php?t=2181 (accessed November 12, 2011).

The Wallingford ordinance calls for a written warning followed by a fine of $90 for each day that the offending litter isn’t removed. Connecticut state law carries a maximum fine of $199 plus a surcharge of half the fine. As for litter “thrown, blown, scattered, or spilled” from a motor vehicle, Connecticut law regards it as evidence that the driver has in fact littered, but the statute applies only to state land and waters. The issue of litterbug drivers, however, is a much bigger concern to lawmakers in certain other states. In California, for example, Vehicle Code Section 23111 states that “no person in any vehicle and no pedestrian shall throw or discharge from or upon any road or highway or adjoining area, public or private, any lighted or nonlighted cigarette, cigar, match, or any flaming or glowing substance.” The statute carries a fine of $380 but could run as high as $1,000. In addition, you may spend eight hours picking up roadside trash, and because the violation goes on your driving record, your insurance premiums may increase.California Department of Motor Vehicles, “Throwing Substances on Highways or Adjoining Areas” (2007), http://www.dmv.ca.gov/pubs/vctop/d11/vc23111.htm (accessed November 12, 2011). Despite such vigorous preventive measures, the state of California spends $62 million a year of the taxpayers’ money to clean up roadside litter.“The High Cost of Litter—Millions of Taxpayer $$$$,” Green Eco Services, September 7, 2008, http://www.greenecoservices.com/the-high-cost-of-litter-millions-of-taxpayer (accessed November 12, 2011).

Besides the cleanup cost, there’s another reason why California law regarding motor vehicles and cigarette litter is so stiff: at certain times of the year and under certain conditions, much of the state is a tinderbox. In January 2001, for example, a cigarette tossed from a car onto a grassy highway median near San Diego sparked a brush fire that soon spread across eleven thousand acres of rural forestland. As columns of acrid, ash-filled smoked billowed some thirty thousand feet into the air, officials closed down a twelve-mile stretch of Interstate highway and evacuated 350 homes. Suffering from eye, nose, and lung irritation, hundreds of residents rushed to safety with no time to rescue personal possessions, and before an army of two thousand federal, state, and local emergency workers had contained the blaze a week later, the firefighting effort had cost California taxpayers $10 million.“Viejas Fire Almost 100 Percent Contained,” 10News.com, January 7, 2001, http://www.10news.com/news/407147/detail.html (accessed November 12, 2011); “Crews Work Overnight against Wind-Fueled Fire near San Diego,” CNN.com, January 3, 2001, http://archives.cnn.com/2001/US/01/03/wildfire.04 (accessed October 23, 2008); “Brush Fire Burns Homes in S. California,” USAToday.com, January 3, 2001, http://www.usatoday.com/weather/news/2001/scalifire0103.htm (accessed October 23, 2008).

Clearly the problem of cigarette litter has attracted the attention of lawmakers at every level. All the laws that we mentioned in this section are current or proposed statutory laws—laws made by legislative bodies. Enacted by the Connecticut General Assembly, the Clean Indoor Air Act of 2004 and Littering Law (amended 2005) are state statutes, as is California’s Vehicle Code, which was enacted by the California State Legislature. The antilittering law in Wallingford is a local law, or municipal ordinance, passed by the Town Council, whose authority derives from the state General Assembly. If Senator’s Lieberman’s proposed Cigarette Litter Prevention Act is passed by the U.S. Congress, it will become a federal statute. Note, by the way, that each of these laws is a criminal statute designed to prohibit and punish wrongful conduct (usually by fine).

As any smoker will tell you, cigarette littering, and smoking itself, isn’t cheap. The cost of a pack of cigarettes varies depending on where you live, but they’re higher than they used to be everywhere in the United States. A pack of cigarettes today ranges from $11.90 in New York State (and $14.00 in New York City) to $4.74 in West Virginia.Nate Hopper, “What a Pack of Cigarettes Costs, State by State,” The Awl, June 15, 2011, http://www.theawl.com/2011/06/what-a-pack-of-cigarettes-costs-state-by-state (accessed November 11, 2011). If you’re a pack-a-day smoker who lives in New York City, $5,000 of your money goes up in smoke each year. Even if you’re lucky enough to be paying the lower West Virginia price, you’re still laying out more than $1,700 a year (roughly a nice house payment). Prices vary in large part because of taxes. On top of state taxes, the federal government levies a tax of $1.01 and some municipalities add on their own taxes. New York City, for example, charges $1.50 per pack in addition to the New York State levy of $4.35 (the nation’s highest) for a total tax rate of $6.86 per pack (in contrast to a tax rate of $1.56 in West Virginia).Campaign for Tobacco-Free Kids, “State Cigarette Excise Tax Rates and Rankings,” Campaign for Tobacco-Free Kids, http://tobaccofreekids.org/research/factsheets/pdf/0267.pdf (accessed November 11, 2011); Wendy Koch, “Biggest U.S. Tax Hike on Tobacco Takes Effect,” USA Today, April 3, 2009, http://www.usatoday.com/money/perfi/taxes/2009-03-31-cigarettetax_N.htm#table (accessed November 11, 2011).

These taxes are excise taxes, a rather vague term that refers to taxes placed on “goods” produced within a country. Traditionally, excise taxes have been levied on a wide variety of products, and today they’re often placed on items and activities with which people may harm themselves (such as cigarettes), those around them (alcohol when overused), or the general environment (activities that pollute the air we all breathe).

In talking about taxes, we’re talking about one means of covering the costs of these items and activities, and economists have a word for such costs: externalitiesCost that doesn’t show up as part of the market price for a product. are costs that don’t show up as part of the market price for a product.See Robert S. Pindyck and Daniel L. Rubinfeld, Microeconomics, 7th ed. (Upper Saddle River, NJ: Pearson Education, 2009), 315–16. Actually, externalities can be either bad (i.e., costs) or good (i.e., benefits), but in detailing the negative effects of cigarette littering, we’re obviously focusing on negative externalities. Think of externalities as spillover effects: they’re costs or benefits that result from marketplace transactions—payments of certain prices for certain products—but that aren’t borne by the sellers or buyers of the products exchanged in those transactions. The price of a pack of cigarettes, for example, doesn’t include the cost of cigarette-litter cleanup or the cost of extinguishing wildfires. These costs are borne by other people—people who are outside or external to the basic transactions.See Daniel H. Cole and Peter Z. Grossman, Principles of Law and Economics (Upper Saddle River, NJ: Pearson Education, 2005), 14–15.

Because these costs don’t affect the seller’s total cost in making the product available, they don’t affect the price that the seller charges the buyer. And because the smoker doesn’t pay these costs when he or she pays the price of a pack of cigarettes, the product is, in effect, cheaper than it would be otherwise. How much cheaper? As we’ve just seen, the answer to that question depends on the total cost of externalities. We can’t pretend to trace every penny required to cover the total cost of having cigarettes for sale in the United States, but we can draw some conclusions from a few well-researched estimates. It’s estimated, for example, that the total cost of public and private cigarette-related health care in the United States is approximately $96 billion annually; it’s also estimated that the total cost to U.S. businesses in cigarette-related lost productivity is another $97 billion per year.Campaign for Tobacco-Free Kids, “Toll of Tobacco in the United States of America,” Campaign for Tobacco-Free Kids, http://www.tobaccofreekids.org/research/factsheets/pdf/0072.pdf (accessed November 11, 2011). According to the U.S. Centers for Disease Control and Prevention, the combined cost of cigarette-related health care and lost productivity comes to $10.47 per pack.“Economic Costs Associated with Smoking, Economic Facts about U.S. Tobacco Production and Use,” Centers for Disease Control and Prevention, http://www.cdc.gov/tobacco/data_statistics/fact_sheets/economics/econ_facts/index.htm (accessed November 12, 2011).

If you’re a smoker, in other words, it could be (and from an economic standpoint, should be) worse. Why isn’t it worse? Because the taxes attached to cigarette prices are, as we’ve explained, excise taxes, and excise taxes cover only a part of external costs.

These costs aren’t simply figments of the economist’s imagination: if you suspect that nobody actually pays them, ask the taxpayers of Connecticut and California. Or consider your own tax bill: even if you’re a nonsmoker in an average American household, you pay $630 a year in smoking-related federal and state taxes.Hilary Smith, “The High Cost of Smoking,” MSN Money, September 3, 2008, http://money.bundle.com/article/the-high-cost-of-smoking-7269 (accessed November 12, 2011). Taxation is obviously one means by which governments collect money to defray the costs to the taxpayers of an undesirable activity. In many instances, the tax bill is shared by sellers and buyers, but in the cigarette market, sellers merely pass along the added cost to the price paid by buyers. Thus, most of the money raised by the excise tax on cigarettes is paid by smokers.

This brings us to a crucial question among political theorists, economists, policymakers, business owners, and consumers—just about every member of society who has social and economic activities to pursue: Why does government intervene in marketplace transactions? Or, perhaps more accurately, Why have most of us come to expect and accept government intervention in our economic activities?

There is, of course, no single answer to this question, but our discussion of the negative externalities of smoking leads us to one of the more important explanations: government may intervene in economic activity to “correct” market failure. Recall, for example, our discussion of economic competition in Chapter 1 "The Foundations of Business", where we explained that, under conditions of perfect competition, all prices would be determined by the rules of supply and demand. If the market for cigarettes were perfectly competitive, cigarettes would cost $10.47 per pack, not $3.11—the average cost of a pack of cigarettes if we subtract the federal tax of $1.01 and the average state tax of $1.46 from the average cost per pack of $5.58.Campaign for Tobacco-Free Kids, “State Cigarette Excise Tax Rates & Rankings,” Campaign for Tobacco-Free Kids, http://www.tobaccofreekids.org/research/factsheets/pdf/0097.pdf (accessed November 11, 2011). Clearly the market for cigarettes isn’t as efficient as it might be. We can tell, for example, that it doesn’t operate at minimal cost because some of its costs—its negative externalities—spill outside the market and have to be borne by people who don’t buy or sell cigarettes.See Daniel H. Cole and Peter Z. Grossman, Principles of Law and Economics (Upper Saddle River, NJ: Pearson Education, 2005), 13.

Here’s another way of looking at the issue.See Robert S. Pindyck and Daniel L. Rubinfeld, Microeconomics, 7th ed. (Upper Saddle River, NJ: Pearson Education, 2009), 337–38. In theory—that is, according to the principle of supply and demand—the demand for cigarettes will go down as added taxes drive up the price. In reality, however, it takes a fairly large increase in price to reduce demand by even a small amount. Moreover, because cigarettes are addictive, demand for the product pays relatively less attention to price than does demand for most products—smokers continue to buy cigarettes regardless of the price. Thus it takes a 10 percent hike in prices to cut cigarette consumption by 4 percent, while the same increase will cut consumption by young people—who presumably aren’t yet addicted—by 7 percent.Campaign for Tobacco-Free Kids, “Higher Cigarette Taxes” (2008), http://www.tobaccofreekids.org/reports/prices (accessed November 12, 2011).

In the United States, the principle that government intervention is the best means of correcting market failure supported most government regulation of economic activity during the twentieth century.See Daniel H. Cole and Peter Z. Grossman, Principles of Law and Economics (Upper Saddle River, NJ: Pearson Education, 2005), 19. As the response to the subprime crisis makes clear, it continues to support government economic intervention into the twenty-first century.

Perhaps this fact should come as no surprise. In a very real sense, economics is the basic business of law and the legal system. How so? Arguably, we establish laws and legal systems because all resources are not equally available to everybody. If they were, we wouldn’t need rules for allocating them—rules for determining who possesses them and how they should be transferred. In using taxation, for example, to allocate economic resources in order to pay for the negative externalities of smoking, the legal system—the set of institutions that enforce our rules of efficient resource allocation—is basically performing a modern version of one of its oldest functions.

Efficiency, therefore, is one foundation of law: the rule of law encourages “efficiency” in the sense that it requires us to act within certain well-defined limits. It prohibits activities that take place outside those limits—such as stealing resources—because they make the process of allocating resources more wasteful and expensive.

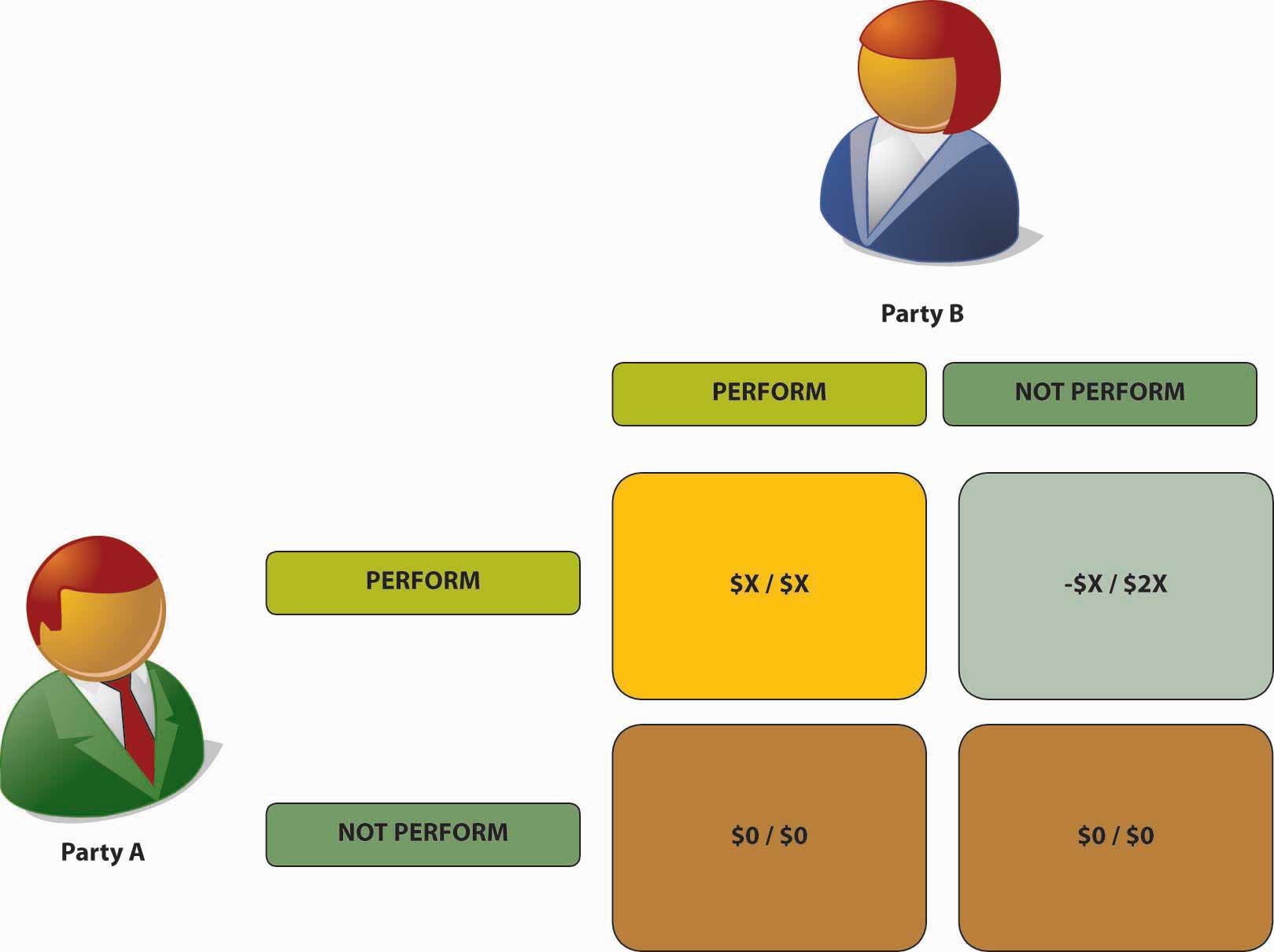

Let’s say, for example, that you (hereinafter “Party A”) enter into a contract with Party B.This section is based on Daniel H. Cole and Peter Z. Grossman, Principles of Law and Economics (Upper Saddle River, NJ: Pearson Education, 2005), 156. The grid in Figure 16.8 "Contract Game" shows all the possible outcomes of this agreement. If you both perform as contracted, you both benefit from the bargain, each realizing a profit of $X. This is the result in the upper-left–hand box of the grid. Let’s say, however, that Party B takes your money but fails to live up to her end of the bargain. In that case, we get the outcome in the upper-right–hand box: because you’ve lost your money, you end up with –$X, and because Party B got your money without spending hers, she ends up with $2X. Understandably, you don’t intend for this to happen and so stipulate that Party B must perform her end of the bargain before you hand over your money. Fearing that you might not pay after she’s lived up to her part of the contract, Party B demands payment before she performs her part. The inevitable result of the contract is now displayed in both lower boxes of the grid: no one does anything and no one earns any profit. In completely wasting the value of every resource committed to the agreement by Party A and Party B, the business process has reached the ultimate level of inefficiency; it’s actually ground to a halt.

Figure 16.8 Contract Game

The only thing that prevents this scenario from playing out in any (or every) contractual situation is the existence of a legal system that can enforce contractual agreements. When such a system is in place, nonperformance makes very little sense. Had Party B taken your money and then failed to perform, the legal system would have required her either to pay back your $X or to live up to the contract, whereby you would earn your expected $X in profit. As a matter of fact, because she would also have been required to pay court costs, she’d end up with less than her original $X—in which case, she’d be worse off than had she performed her part of the bargain in the first place.

As this illustration suggests, contractual relationships are the building blocks of a modern economy. Just about every activity that we pursue in the business environment is based on a contract, and as we’ve seen throughout this chapter, producers of goods and services make contracts with consumers, other producers, and the government. Moreover, there’s often only a very fine line between the business environment and one’s private life: you enter into a contract when you take a job, rent an apartment, get a bank loan, use a credit card, and even when you get married.

All these relationships are possible because our legal system provides for the reliable enforcement of contracts. There are countries where the legal system fails to provide reliable contract enforcement, and it should come as no surprise that economic growth in these countries has been severely hampered.

“Efficiency,” of course, isn’t the only foundation of law. We don’t punish murder because it wastes human resources. Law has an essentially ethical underpinning as well. We regard some activities, such as killing another human being, as mala per se (inherently bad). Other activities, such as filling the air with secondary cigarette smoke, we regard as mala prohibita (bad because we declare them to be bad).See Henry R. Cheesman, Contemporary Business and Online Commerce Law: Legal, Internet, Ethical, and Global Environments, 5th ed. (Upper Saddle River, NJ: Pearson Education, 2006), 126.

Naturally, the distinction between what’s inherently bad and what’s bad because we declare it bad isn’t always clear. We may, for example, punish failure to remove certain chemical compounds (including those in secondhand smoke) from workplace air because they’re hazardous to human health and life: according to the American Lung Association, people exposed to smoke in the workplace are 17 percent more likely to develop lung cancer than people who aren’t. We may also punish the same failure because we regard certain consequences to be bad—economically inefficient, for example: research shows that secondhand-smoke exposure in the United Sates costs $10 billion a year, $5 billion in direct medical costs.American Lung Association, “Smoking Policies in the Workplace Fact Sheet,” July 2008, http://no-smoke.org/document.php?id=209 (accessed November 25, 2008).

A closer look at the ways in which the U.S. legal system approaches the problem of secondhand smoke in the workplace will allow us to focus on some important aspects of that system that we haven’t yet encountered. In particular, we’ll learn something about the difference between federal statutory law and administrative law, and we’ll see how the judiciary branch of the legal system—the courts—may affect the enforcement of law.

As most of us learned if we studied American government in high school, Article I, Section 1 of the U.S. Constitution gives “all legislative powers granted herein”—that is, all lawmaking powers set aside for the federal government—to Congress.This section is based on John Jude Moran, Employment Law: New Challenges in the Business Environment (Upper Saddle River, NJ: Pearson Education, 2008), 450–53. See also “Occupational Safety and Health Administration (OSHA),” Encyclopedia of Small Business, 2nd ed. (2002), http://findarticles.com/p/articles/mi_gx5201/is_/ai_n19121420 (accessed November 26, 2008). So that’s where we’ll start—with a specific law enacted by Congress under its constitutional powers. Congress passed the Occupational Safety and Health Act (OSHAct) in 1970 to establish standards of safety and health for American workers. In particular, the statute requires employers to keep workplaces free from occupational hazards.

The OSHAct created three administrative agenciesBody created by legislative act to carry out specific duties.—bodies created by legislative act to carry out specific duties. The most important agency established by the OSHAct is the Occupational Health and Safety Administration (OSHA)Federal administrative agency empowered to set workplace safety and health standards and to ensure that employers take appropriate steps to meet them., which is empowered to set workplace safety and health standards and to ensure that employers take appropriate steps to meet them. OSHA was among a number of agencies created during the so-called rights revolution of 1960–1980, in which government acted to protect workplace, consumer, and environmental rights in addition to rights against discrimination based on race, sex, age, and national origin.

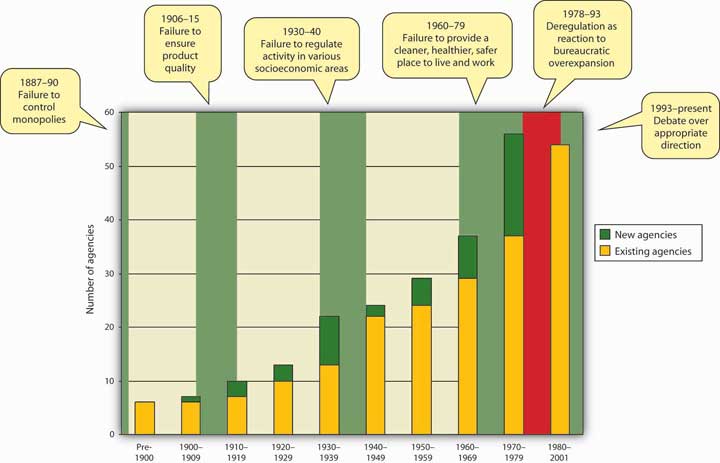

Responsibility for implementing the OSHAct is delegated to the Department of Labor, making OSHA one of more than fifty agencies managed by the executive branch of the federal government. Figure 16.9 "Administrative Agencies" shows the growth of federal administrative agencies from the end of the nineteenth century to the present. As you can see, periods of significant increase in the creation of such agencies tend to correspond to eras of perceived market failure—that is, the failure of unregulated market activity to maintain certain levels of fairness or social responsibility.See Kenneth F. Warren, Administrative Law in the Political System, 4th ed. (Boulder, CO: Westview Press, 2004), 41-43, http://books.google.com/books?id=AZVD_QM1QlYC&ie=ISO-8859-1&output=html (accessed November 12, 2011).

Figure 16.9 Administrative Agencies

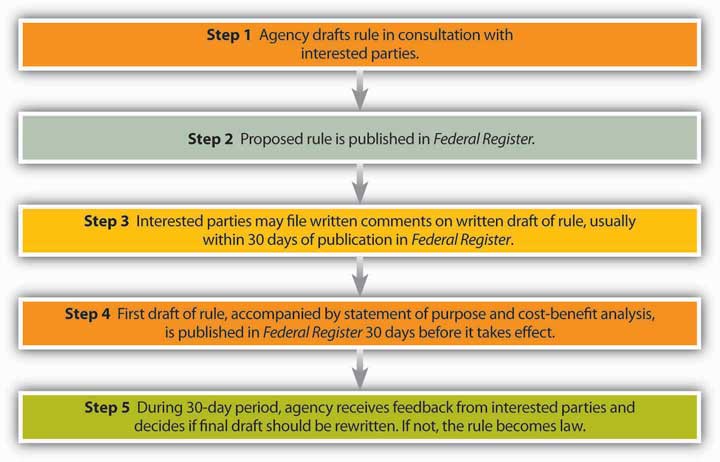

In passing the OSHAct, Congress didn’t determine appropriate standards of safety and health, nor did it designate specific occupational hazards. It stipulated only a so-called General Duty Clause requiring an employer to provide “employment and a place of employment which are free from recognized hazards that are causing or are likely to cause death or serious physical harm to his employees.”Occupational Safety and Health Administration, “SEC. 5 Duties” (U.S. Dept. of Labor, 2008), http://www.osha.gov/pls/oshaweb/owadisp.show_document?p_table=OSHACT&p_id=3359 (accessed November 12, 2011). In setting more specific standards for satisfying this “general duty,” OSHA may choose to adopt those of recognized industry groups or it may set its own standards, usually relying on research conducted by a sister agency, the National Institute of Occupational Safety and Health (NIOSH). In either case, proposed regulations must go through the five-step process summarized in Figure 16.10 "Administrative Rulemaking Procedure". When a regulation has passed through this process, it becomes administrative law, which, as we’ve seen, refers generally to statutes and regulations related to the activities of such agencies as OSHA.

Figure 16.10 Administrative Rulemaking Procedure

OSHA Regulation 29 CFR 1910.1000 deals with air contaminants but doesn’t address cigarette smoke itself. Rather, it limits exposure to some of the forty-seven thousand chemical compounds contained in environmental tobacco smoke. Based in part on NIOSH studies, OSHA has set permissible exposure limits for such compounds and stipulated that employee exposure to them shall not exceed designated permissible exposure limits.Occupational Safety and Health Administration, “Air Contaminants—1910.1000” (U.S. Dept. of Labor, 2008), at http://www.osha.gov/pls/oshaweb/owadisp.show_document?p_id=9991&p_table=STANDARDS (accessed November 12, 2011). OSHA continues to use permissible exposure limits to assess levels of specific contaminants, and up until the early 1990s, it also relied on the General Duty Clause to deal with cases involving the hundreds of substances not covered by specific permissible exposure limits. Since then, however, the agency has been forced to restrict its use of both the General Duty Clause and permissible exposure limits in enforcing air-contaminant standards.See Occupational Safety and Health Administration, “Reiteration of Existing OSHA Policy on Indoor Air Quality” (U.S. Dept. of Labor, 2003), at http://www.osha.gov/pls/oshaweb/owadisp.show_document?p_table=INTERPRETATIONS&p_id=24602 (accessed November 12, 2011). What’s responsible for this change in policy? What could possibly prevent a federal executive agency from enforcing authority explicitly granted to it by Congress?

To answer this question, we must understand an extremely important source of law known as case lawBody of law resulting from judicial interpretations of statutory and other forms of law.—law resulting from judicial interpretations of statutory and other forms of law. The business of the courts is resolving disputes, and when a dispute involves an interpretation of law, the court’s decision in the case may establish a precedentRule of case law that must be used by lower courts in deciding future cases.—a rule of law that must be used by lower courts in deciding future cases. The principle behind case law is known as judicial review, and it permits the judicial branch of government to “check and balance” the actions both of the legislative branch in making laws and of the executive branch in enforcing them.

At what point may judicial review affect the process of enforcing administrative law? After an agency rule has passed through the rulemaking process outlined in Figure 16.10 "Administrative Rulemaking Procedure", it usually becomes law. Typically, the courts accept these rules as law by upholding actions taken by agencies to enforce them. But not automatically. In a 1973 case involving a fine based on OSHA’s General Duty Clause, a federal court carefully translated the terms of the clause into three “necessary elements of a violation” and ruled that OSHA could win such cases only if it showed that a violation met all three requirements. A fourth requirement was later added, and OSHA now cites these four requirements in its official interpretation the General Duty Clause, issuing violations only “when the four components of this provision are present.”See National Realty and Construction v. OSHRC (1973), http://cases.justia.com/us-court-of-appeals/F2/489/1257/152788 (accessed November 12, 2011); OSHA, “Reiteration of Existing OSHA Policy on Indoor Air Quality”; OSHA, “Elements Necessary for a Violation of the General Duty Clause” (U.S. Dept. of Labor, 2003), at http://www.osha.gov/pls/oshaweb/owadisp.show_document?p_table=INTERPRETATIONS&p_id=24784 (accessed November 25, 2008).

In another case, the U.S. Supreme Court confirmed the opinion of a lower court that the OSHAct did not give OSHA “the unbridled discretion to adopt standards designed to create absolutely risk-free workplaces regardless of costs.” In this 1980 case involving workplace exposure to a cancer-causing substance, the Court set down much stricter requirements for the validity of OSHA-issued permissible exposure limits and other standards.Industrial Union v. American Petroleum Institute (1980), http://biotech.law.lsu.edu/cases/adlaw/benzene.htm (accessed November 12, 2011). See Mark Robson and William Toscano, Risk Assessment for Environmental Health (Hoboken, NJ: John Wiley & Sons, 2007), 209–12, http://books.google.com/books?id=s_ih18SnrvcC&pg=PA212&lpg=PA208&ots=aiV5C-1chP&dq=Industrial+ Union%2BPELs&ie=ISO-8859-1&output=html (accessed November 12, 2011); Randy Rabinowitz, Occupational Safety and Health Law (Washington, DC: BNA Books, 2004), 387, http://books.google.com/books?id=11e2Q2zABmIC&pg=PA91&lpg=PA91&dq=National+Realty+and+ Construction+Co,+Inc+v+Occupational+Safety+and+Health+Review+Commission& source=web&ots=G8vrviG6JB&sig=_p1-watPer8eovM6o3hKLjy2Ask&hl=en&sa=X& oi=book_result&resnum=9&ct=result (accessed November 12, 2011).

Today, therefore, because it’s difficult to meet the stringent requirements set by judicial precedent, OSHA rarely resorts either to the General Duty Clause or to permissible exposure limits established later than the 1970s.OSHA, “Enforcement Policy for Respiratory Hazards Not Covered by OSHA Permissible Exposure Limits” (U.S. Dept. of Labor, 2003), http://www.osha.gov/pls/oshaweb/owadisp.show_document?p_table=INTERPRETATIONS&p_id=24749 (accessed November 12, 2011). In the case of cigarette smoke, OSHA rules are applied only in rare and extreme cases, usually when cigarette smoke combines with some other contaminant produced by a manufacturing process.Nolo’s Encyclopedia of Everyday Law: Answers to Your Most Frequently Asked Legal Questions, ed. Shea Irving (Berkeley, CA: Nolo Press, 2007), 63, http://books.google.com/books?id=mvlXStpeSVEC&dq=%22OSHA+rules+apply+to+tobacco+smoke+only+in +rare+and+extreme+circumstances%22&ie=ISO-8859-1&output=html& source=gbs_summary_s&cad=0 (accessed November 12, 2011).

And yet, if you’ve spent much time recently around American workplaces, you’ve no doubt observed that a lot of employers have instituted complete or partial restrictions on smoking. In 1985, for example, 27 percent of U.S. worksites with fifty or more employees either were smoke free or limited smoking to separately ventilated areas. According to recent data, the number had risen to nearly 90 percent by 2000.Nell H. Gottlieb, “Workplace Smoking Policies and Programs,” Encyclopedia of Public Health (New York: Macmillan Reference USA, 2002), http://www.answers.com/topic/workplace-smoking-policies-and-programs (accessed November 12, 2011); Jon Jenney, “Clean Indoor Air Ordinances,” Encyclopedia of Public Health (New York: Macmillan Reference USA, 2002), http://www.novelguide.com/a/discover/eph_01/eph_01_00186.html (accessed November 12, 2011). If OSHA standards aren’t responsible for this trend toward smoke-free worksites, to what can we attribute it?

For one thing, of course, national attitudes toward smoking have undergone significant changes in the last three or four decades. Few people would be surprised to find that the percentage of U.S. adults who smoke declined from just over 42 percent in 1965 to 22 percent in 2009.Campaign for Tobacco-Free Kids, “Number of Smokers and Number of Smokers Who Have Quit,” Campaign for Tobacco-Free Kids, http://www.cdc.gov/tobacco/quit_smoking/how_to_quit/you_can_quit/alone/ (accessed November 11, 2011). In addition, more and more American workers are aware of the effects of secondhand smoke. In one study, 76.5 percent of respondents said they believed that secondhand smoke causes heart damage, and 84.5 percent said they believed that it causes lung cancer.“Smoking Prevalence among U.S. Adults, 1955–2007” (2007), Information Please Database, http://www.infoplease.com/ipa/A0762370.html (accessed November 12, 2011); data from Centers for Disease Control and Prevention. Ellen Striebel, “Marion County Residents’ Attitudes toward Secondhand Smoke in Public Places,” December 8, 2005, http://www.bowenresearchcenter.iupui.edu/brc_lectures/BowenLecture2005-12-08.pdf (accessed November 12, 2011). (Interestingly, the conviction that secondhand smoke harms nonsmokers doubles the likelihood that a smoker will succeed in quitting.Stanton A. Glantz and Patrick Jamieson, “Attitudes toward Secondhand Smoke, Smoking, and Quitting among Young People,” Pediatrics 106:6 (December 2000), http://pediatrics.aappublications.org/cgi/content/full/106/6/e82 (accessed November 12, 2011).)

Naturally, public attitudes show up in public policy. In the legal environment of business, we can identify at least two areas that reflect public policy toward smoke-free workplaces:

Other federal statutes. In particular, two federal laws support civil suits against employers that fail to take action against environmental tobacco smoke or secondhand smoke:

State laws. Currently, twenty-four states have laws governing smoke-free workplaces (up from just two states in 2002), and these and related laws in many states have become more stringent in the past few years. According to the Centers for Disease Control, between 2004 and 2007, the following statistics were true:

Connecticut law, for example, restricts smoking in most workplaces with at least five employees to specially ventilated smoking rooms.Saul Spigel, “Statewide Smoking Ban,” OLR Research, June 9, 2003, http://cga.ct.gov/2003/rpt/2003-R-0466.htm (accessed November 12, 2011).

In addition, we shouldn’t underestimate the role played by business itself in the campaign to curb workplace smoking. In Connecticut, for example, the workplace smoking ban applies only to indoor areas, but many companies in the state take advantage of a provision allowing them to ban smoking anywhere on their properties. Businesses, of course, aren’t motivated strictly by civic responsibility. Workplace smoking increases employer costs in numerous ways. Smokers are absent from work 50 percent more often than nonsmokers, and they have twice as many accidents. Smoke-free firms often pay 25 percent to 35 percent less for health and fire insurance, and one government report calculates that U.S. businesses could save from $4 billion to $8 billion annually in building operations and maintenance costs if workplace smoking bans were enforced nationwide.“Smoking in the Workplace Costs Employers Money” (Washington, DC: Action on Smoking and Health, 2005), http://www.ash.org/papers/h100.htm (accessed November 12, 2011); American Lung Association, “Smoking Policies in the Workplace Fact Sheet.” http://no-smoke.org/document.php?id=209, (accessed November 11, 2011).

And last but not least, both for-profit and nonprofit organizations must always contend with lawsuits:See E. L. Sweda Jr., “Lawsuits and Secondhand Smoke,” Tobacco Control (London: BMJ Publishing Group, 2004), http://tobaccocontrol.bmj.com/cgi/content/full/13/suppl_1/i61 (accessed November 12, 2011).

It’s probably tempting to see the current status of public policy and law on both environmental tobacco smoke and secondhand smoke as a logical convergence of private and public interest.This section is based on David P. Baron, Business and Its Environment, 5th ed. (Upper Saddle River, NJ: Pearson Education, 2006), 158–59, 199–200. Many political scientists and economists, however, argue that the idea of “the public interest” is difficult to pin down. Is there really a set of underlying principles reflecting what society regards as good or right? Can a society actually come to any general agreement about what these principles are? And who speaks for these principles? We hear lawmakers talk about “the public interest” all the time, but we suspect that they’re often motivated by private interests and cite “the public interest” for rhetorical purposes.

Now, we’re not necessarily criticizing politicians, whose job description includes an ability to balance a bewildering array of private interests. According to many people who are skeptical of the term “public interest,” public policy and law reflect not an imaginary consensus about what’s good or right but rather a very real interplay among competing interests. Public policy and law on environmental tobacco smoke and secondhand smoke, for example, reflect the long-term interaction of interest groups as diverse as the American Lung Association and the Tobacco Institute. Likewise, the record of OSHA’s shifting policy on how to address environmental tobacco smoke as a workplace hazard reflects an interplay of competing interests within the U.S. political and legal systems.

As for businesses, they must, of course, negotiate the resulting shifts in the political and legal environment. In addition, a firm’s response to such a problem as air contamination in the workplace will reflect an interplay of competing fiscal demands. On the one hand, a company must consider the losses in productivity that result from smoking and secondhand smoke in its workplace; on the other hand, it must consider the cost of controlling air contaminants and other hazards in its workplace. Every company, therefore, must participate more or less actively in the interplay of competing interests that shape public policy and law. After all, its own interests are inherently bound up with the diverse, often conflicting interests of groups that have a stake in its performance: namely, its stakeholders—employees, shareholders, customers, suppliers, and the communities in which they do business.

Private law deals with private relationships among individuals and organizations. Public law, which concerns the relationship of government to private individuals and other private entities, including businesses, falls into three general categories:

(AACSB) Analysis

If you were able to set the price of a pack of cigarettes, how much would you charge? Would your price include excise taxes? What other costs would your price cover?

Do you think it’s right to ban smoking in the workplace? Why, or why not?