Practical use of supply and demand generally requires quantifying effects. If a hurricane wipes out a gasoline refinery, by how much will the price rise, and for how long will it stay high? When the price of energy efficient light bulbs falls, how long does it take to replace 50% of our incandescent stock of bulbs? This chapter introduces the basic tools of quantification, the elasticities of demand and supply. Economists use elasticityThe percentage change in one variable for a small percentage change in another., the percentage change in one variable for a small percentage change in another, in many different settings.

Let x(p) represent the quantity purchased when the price is p, so that the function x represents demand. How responsive is demand to price changes? One might be tempted to use the derivative, , to measure the responsiveness of demand, since it measures how much the quantity demanded changes in response to a small change in price. However, this measure has two problems. First, it is sensitive to a change in units. If I measure the quantity of candy in kilograms rather than in pounds, the derivative of demand for candy with respect to price changes even if the demand itself is unchanged. Second, if I change price units, converting from one currency to another, again the derivative of demand will change. So the derivative is unsatisfactory as a measure of responsiveness because it depends on units of measure. A common way of establishing a unit-free measure is to use percentages, and that suggests considering the responsiveness of demand to a small percentage change in price in percentage terms. This is the notion of elasticity of demandThe percentage change in one variable for a small percentage change in another..The concept of elasticity was invented by Alfred Marshall (1842–1924) in 1881 while sitting on his roof. The elasticity of demand is the percentage decrease in quantity that results from a small percentage increase in price. Formally, the elasticity of demand, which is generally denoted with the Greek letter epsilon, ε, (chosen mnemonically to indicate elasticity) is

The minus sign is included in the expression to make the elasticity a positive number, since demand is decreasing. First, let’s verify that the elasticity is, in fact, unit free. A change in the measurement of x doesn’t affect elasticity because the proportionality factor appears in both the numerator and denominator. Similarly, a change in the measure of price so that p is replaced by r = ap, does not change the elasticity, since as demonstrated below,

the measure of elasticity is independent of a, and therefore not affected by the change in units.

How does a consumer’s expenditure, also known as (individual) total revenue, react to a change in price? The consumer buys x(p) at a price of p, and thus total expenditurePrice times the quantity purchased., or total revenue, is TR = px(p). Thus,

Therefore,

In other words, the percentage change of total revenue resulting from a 1% change in price is one minus the elasticity of demand. Thus, a 1% increase in price will increase total revenue when the elasticity of demand is less than one, which is defined as an inelastic demandWhen the elasticity of demand is less than one.. A price increase will decrease total revenue when the elasticity of demand is greater than one, which is defined as an elastic demandWhen the elasticity of demand is less than one.. The case of elasticity equal to one is called unitary elasticityWhen elasticity is equal to one., and total revenue is unchanged by a small price change. Moreover, that percentage increase in price will increase revenue by approximately 1 – ε percent. Because it is often possible to estimate the elasticity of demand, the formulae can be readily used in practice.

Table 3.1 "Various Demand Elasticities" provides estimates on demand elasticities for a variety of products.

Table 3.1 Various Demand Elasticities

| Product | ε | Product | ε |

|---|---|---|---|

| Salt | 0.1 | Movies | 0.9 |

| Matches | 0.1 | Shellfish, consumed at home | 0.9 |

| Toothpicks | 0.1 | Tires, short-run | 0.9 |

| Airline travel, short-run | 0.1 | Oysters, consumed at home | 1.1 |

| Residential natural gas, short-run | 0.1 | Private education | 1.1 |

| Gasoline, short-run | 0.2 | Housing, owner occupied, long-run | 1.2 |

| Automobiles, long-run | 0.2 | Tires, long-run | 1.2 |

| Coffee | 0.25 | Radio and television receivers | 1.2 |

| Legal services, short-run | 0.4 | Automobiles, short-run | 1.2-1.5 |

| Tobacco products, short-run | 0.45 | Restaurant meals | 2.3 |

| Residential natural gas, long-run | 0.5 | Airline travel, long-run | 2.4 |

| Fish (cod) consumed at home | 0.5 | Fresh green peas | 2.8 |

| Physician services | 0.6 | Foreign travel, long-run | 4.0 |

| Taxi, short-run | 0.6 | Chevrolet automobiles | 4.0 |

| Gasoline, long-run | 0.7 | Fresh tomatoes | 4.6 |

From http://www.mackinac.org/archives/1997/s1997-04.pdf; cited sources: James D. Gwartney and Richard L. Stroup,, Economics: Private and Public Choice, 7th ed., 1995; 8th ed., 1997; Hendrick S. Houthakker and Lester D. Taylor, Consumer Demand in the United States, 1929–1970 (1966; Cambridge: Harvard University Press, 1970); Douglas R. Bohi, Analyzing Demand Behavior (Baltimore: Johns Hopkins University Press, 1981); Hsaing-tai Cheng and Oral Capps, Jr., "Demand for Fish," American Journal of Agricultural Economics, August 1988; and U.S. Department of Agriculture.

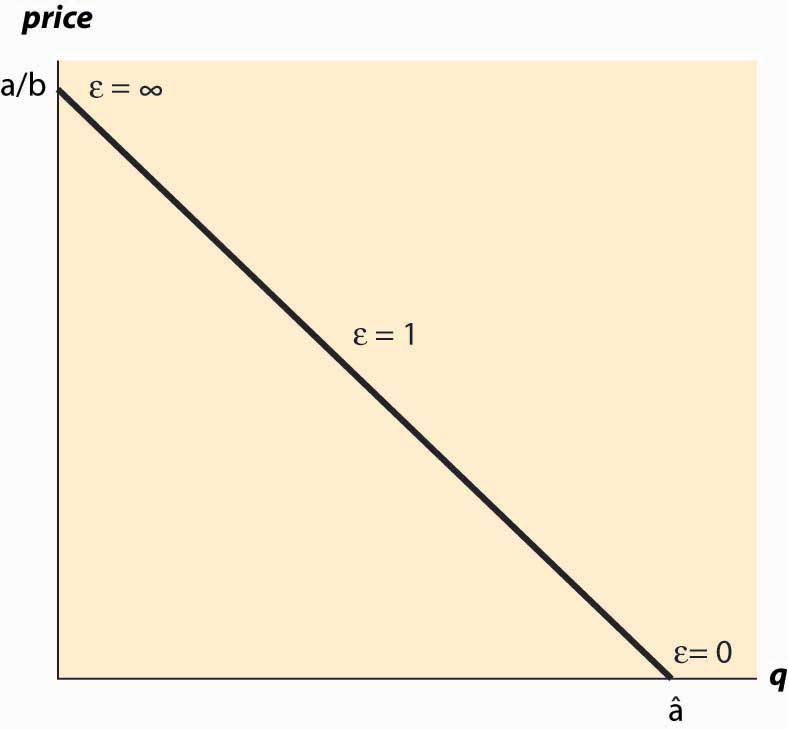

When demand is linear, x(p) = a – bp, the elasticity of demand has the form

This case is illustrated in Figure 3.1 "Elasticities for linear demand".

Figure 3.1 Elasticities for linear demand

If demand takes the form x(p) = a * p−ε, then demand has constant elasticityCondition in which the elasticity remains at the same level while the underlying variables change., and the elasticity is equal to ε. In other words, the elasticity remains at the same level while the underlying variables (such as price and quantity) change.

The elasticity of supplyThe percentage increase in quantity supplied resulting from a small percentage increase in price. is analogous to the elasticity of demand in that it is a unit-free measure of the responsiveness of supply to a price change, and is defined as the percentage increase in quantity supplied resulting from a small percentage increase in price. Formally, if s(p) gives the quantity supplied for each price p, the elasticity of supply, denoted by η (the Greek letter “eta,” chosen because epsilon was already taken) is

Again, similar to demand, if supply takes the form s(p) = a * pη, then supply has constant elasticity, and the elasticity is equal to η. A special case of this form is linear supply, which occurs when the elasticity equals one.

When the price of a complement changes—what happens to the equilibrium price and quantity of the good? Such questions are answered by comparative statics, which are the changes in equilibrium variables when other things change. The use of the term “static” suggests that such changes are considered without respect to dynamic adjustment; instead, one just focuses on the changes in the equilibrium level. Elasticities will help us quantify these changes.

How much do the price and quantity traded change in response to a change in demand? We begin by considering the constant elasticity case, which allows us to draw conclusions for small changes for general demand functions. We will denote the demand function by qd(p) = a * p−ε and supply function by qs(p) = bpη. The equilibrium price p* is determined at the point where the quantity supplied equals to the quantity demanded, or by the solution to the following equation:

Substituting the constant elasticity formulae,

Thus,

or

The quantity traded, q*, can be obtained from either supply or demand, and the price:

There is one sense in which this gives an answer to the question of what happens when demand increases. An increase in demand, holding the elasticity constant, corresponds to an increase in the parameter a. Suppose we increase a by a fixed percentage, replacing a by a(1 + ∆). Then price goes up by the multiplicative factor and the change in price, as a proportion of the price, is Similarly, quantity rises by

These formulae are problematic for two reasons. First, they are specific to the case of constant elasticity. Second, they are moderately complicated. Both of these issues can be addressed by considering small changes—that is, a small value of ∆. We make use of a trick to simplify the formula. The trick is that, for small ∆,

The squiggly equals sign ≅ should be read, “approximately equal to.”The more precise meaning of ≅ is that, as ∆ gets small, the size of the error of the formula is small even relative to δ. That is, means Applying this insight, we have the following:

For a small percentage increase ∆ in demand, quantity rises by approximately percent and price rises by approximately percent.

The beauty of this claim is that it holds even when demand and supply do not have constant elasticities because the effect considered is local and, locally, the elasticity is approximately constant if the demand is “smooth.”