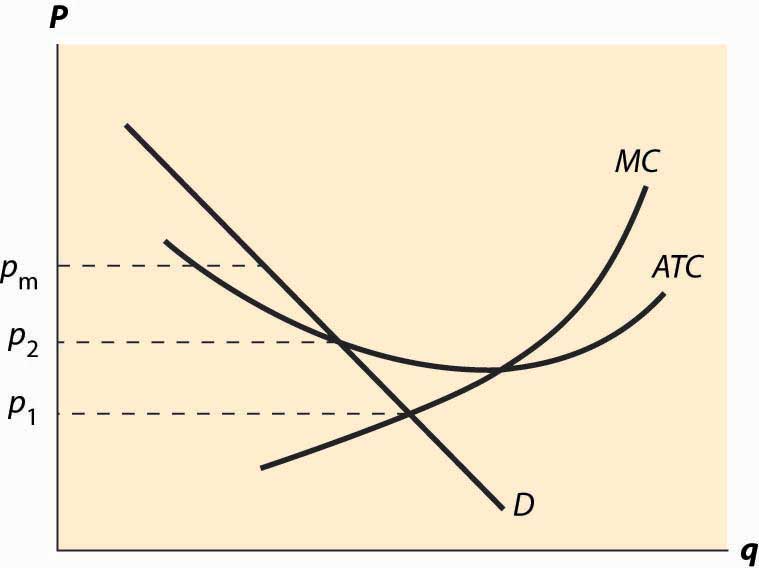

A natural monopolySituation that arises when a single firm can efficiently serve the entire market because average costs are lower with one firm than with two firms. arises when a single firm can efficiently serve the entire market because average costs are lower with one firm than with two firms. An example is illustrated in Figure 15.3 "Natural monopoly". In this case, the average total cost of a single firm is lower than if two firms were to split the output between them. The monopolist would like to price at pm, which maximizes profits.The monopoly price may or may not be sustainable. A monopoly price is not sustainable if it were to lead to entry, thereby undercutting the monopoly. The feasibility of entry, in turn, depends on whether the costs of entering are not recoverable (“sunk”) and how rapidly entry can occur. If the monopoly price is not sustainable, the monopoly may engage in limit pricing, which is jargon for pricing to deter (limit) entry.

Historically, the United States and other nations have regulated natural monopoly products and supplies such as electricity, telephony, and water service. An immediate problem with regulation is that the efficient price—that is, the price that maximizes the gains from trade—requires a subsidy from outside the industry. We see the need for a subsidy in Figure 15.3 "Natural monopoly" because the price that maximizes the gains from trade is p1, which sets the demand (marginal value) equal to the marginal cost. At this price, however, the average total cost exceeds the price, so that a firm with such a regulated price would lose money. There are two alternatives. The product could be subsidized: Subsidies are used with postal and passenger rail services in the United States and historically for many more products in Canada and Europe, including airlines and airplane manufacture. Alternatively, regulation could be imposed to limit the price to p2, the lowest break-even price. This is the more common strategy used in the United States.

Figure 15.3 Natural monopoly

There are two strategies for limiting the price: price-cap regulationPrice-limiting strategy that directly imposes a maximum price., which directly imposes a maximum price, and rate of return regulationPrice-limiting strategy that limits the profitability of firms., which limits the profitability of firms. Both of these approaches induce some inefficiency of production. In both cases, an increase in average cost may translate into additional profits for the firm, causing regulated firms to engage in unnecessary activities.