Larry Levine helped a client prepare divorce papers a few years ago. He was paid in mackerel.

“It’s the coin of the realm,” his client, Mark Bailey told the Wall Street Journal. The two men were prisoners at the time at the federal penitentiary at Lompoc, California.

By the time his work on the case was completed, he had accumulated “a stack of macks,” Mr. Levine said. He used his fishy hoard to buy items such as haircuts at the prison barber shop, to have his laundry pressed, or to have his cell cleaned.

The somewhat unpleasant fish emerged as the currency of choice in many federal prisons in 1994 when cigarettes, the previous commodity used as currency, were banned. Plastic bags of mackerel sold for about $1 in prison commissaries. Almost no one likes them, so the prison money supply did not get eaten. Prisoners knew other prisoners would readily accept macks, so they were accepted in exchange for goods and services. Their $1 price made them convenient as a unit of account. And, as Mr. Levine’s experience suggests, they acted as a store of value. As we shall see, macks served all three functions of money—they were a medium of exchange, a unit of account, and a store of value.Justin Scheck, “Mackerel Economics in Prison Leads to Appreciation for Oily Fish,” Wall Street Journal, October 2, 2008, p. A1.

In this chapter and the next we examine money and the way it affects the level of real GDP and the price level. In this chapter, we will focus on the nature of money and the process through which it is created.

As the experience of the prisoners in Lompoc suggests, virtually anything can serve as money. Historically, salt, horses, tobacco, cigarettes, gold, and silver have all served as money. We shall examine the characteristics that define a good as money.

We will also introduce the largest financial institution in the world, the Federal Reserve System of the United States. The Fed, as it is commonly called, plays a key role in determining the quantity of money in the United States. We will see how the Fed operates and how it attempts to control the supply of money.

If cigarettes and mackerel can be used as money, then just what is money? MoneyAnything that serves as a medium of exchange. is anything that serves as a medium of exchange. A medium of exchangeAnything that is widely accepted as a means of payment. is anything that is widely accepted as a means of payment. In Romania under Communist Party rule in the 1980s, for example, Kent cigarettes served as a medium of exchange; the fact that they could be exchanged for other goods and services made them money.

Money, ultimately, is defined by people and what they do. When people use something as a medium of exchange, it becomes money. If people were to begin accepting basketballs as payment for most goods and services, basketballs would be money. We will learn in this chapter that changes in the way people use money have created new types of money and changed the way money is measured in recent decades.

Money serves three basic functions. By definition, it is a medium of exchange. It also serves as a unit of account and as a store of value—as the “mack” did in Lompoc.

The exchange of goods and services in markets is among the most universal activities of human life. To facilitate these exchanges, people settle on something that will serve as a medium of exchange—they select something to be money.

We can understand the significance of a medium of exchange by considering its absence. BarterWhen goods are exchanged directly for other goods. occurs when goods are exchanged directly for other goods. Because no one item serves as a medium of exchange in a barter economy, potential buyers must find things that individual sellers will accept. A buyer might find a seller who will trade a pair of shoes for two chickens. Another seller might be willing to provide a haircut in exchange for a garden hose. Suppose you were visiting a grocery store in a barter economy. You would need to load up a truckful of items the grocer might accept in exchange for groceries. That would be an uncertain affair; you could not know when you headed for the store which items the grocer might agree to trade. Indeed, the complexity—and cost—of a visit to a grocery store in a barter economy would be so great that there probably would not be any grocery stores! A moment’s contemplation of the difficulty of life in a barter economy will demonstrate why human societies invariably select something—sometimes more than one thing—to serve as a medium of exchange, just as prisoners in federal penitentiaries accepted mackerel.

Ask someone in the United States what he or she paid for something, and that person will respond by quoting a price stated in dollars: “I paid $75 for this radio,” or “I paid $15 for this pizza.” People do not say, “I paid five pizzas for this radio.” That statement might, of course, be literally true in the sense of the opportunity cost of the transaction, but we do not report prices that way for two reasons. One is that people do not arrive at places like Radio Shack with five pizzas and expect to purchase a radio. The other is that the information would not be very useful. Other people may not think of values in pizza terms, so they might not know what we meant. Instead, we report the value of things in terms of money.

Money serves as a unit of accountA consistent means of measuring the value of things., which is a consistent means of measuring the value of things. We use money in this fashion because it is also a medium of exchange. When we report the value of a good or service in units of money, we are reporting what another person is likely to have to pay to obtain that good or service.

The third function of money is to serve as a store of valueAn item that holds value over time., that is, an item that holds value over time. Consider a $20 bill that you accidentally left in a coat pocket a year ago. When you find it, you will be pleased. That is because you know the bill still has value. Value has, in effect, been “stored” in that little piece of paper.

Money, of course, is not the only thing that stores value. Houses, office buildings, land, works of art, and many other commodities serve as a means of storing wealth and value. Money differs from these other stores of value by being readily exchangeable for other commodities. Its role as a medium of exchange makes it a convenient store of value.

Because money acts as a store of value, it can be used as a standard for future payments. When you borrow money, for example, you typically sign a contract pledging to make a series of future payments to settle the debt. These payments will be made using money, because money acts as a store of value.

Money is not a risk-free store of value, however. We saw in the chapter that introduced the concept of inflation that inflation reduces the value of money. In periods of rapid inflation, people may not want to rely on money as a store of value, and they may turn to commodities such as land or gold instead.

Although money can take an extraordinary variety of forms, there are really only two types of money: money that has intrinsic value and money that does not have intrinsic value.

Commodity moneyMoney that has value apart from its use as money. is money that has value apart from its use as money. Mackerel in federal prisons is an example of commodity money. Mackerel could be used to buy services from other prisoners; they could also be eaten.

Gold and silver are the most widely used forms of commodity money. Gold and silver can be used as jewelry and for some industrial and medicinal purposes, so they have value apart from their use as money. The first known use of gold and silver coins was in the Greek city-state of Lydia in the beginning of the seventh century B.C. The coins were fashioned from electrum, a natural mixture of gold and silver.

One disadvantage of commodity money is that its quantity can fluctuate erratically. Gold, for example, was one form of money in the United States in the 19th century. Gold discoveries in California and later in Alaska sent the quantity of money soaring. Some of this nation’s worst bouts of inflation were set off by increases in the quantity of gold in circulation during the 19th century. A much greater problem exists with commodity money that can be produced. In the southern part of colonial America, for example, tobacco served as money. There was a continuing problem of farmers increasing the quantity of money by growing more tobacco. The problem was sufficiently serious that vigilante squads were organized. They roamed the countryside burning tobacco fields in an effort to keep the quantity of tobacco, hence money, under control. (Remarkably, these squads sought to control the money supply by burning tobacco grown by other farmers.)

Another problem is that commodity money may vary in quality. Given that variability, there is a tendency for lower-quality commodities to drive higher-quality commodities out of circulation. Horses, for example, served as money in colonial New England. It was common for loan obligations to be stated in terms of a quantity of horses to be paid back. Given such obligations, there was a tendency to use lower-quality horses to pay back debts; higher-quality horses were kept out of circulation for other uses. Laws were passed forbidding the use of lame horses in the payment of debts. This is an example of Gresham’s law: the tendency for a lower-quality commodity (bad money) to drive a higher-quality commodity (good money) out of circulation. Unless a means can be found to control the quality of commodity money, the tendency for that quality to decline can threaten its acceptability as a medium of exchange.

But something need not have intrinsic value to serve as money. Fiat moneyMoney that some authority, generally a government, has ordered to be accepted as a medium of exchange. is money that some authority, generally a government, has ordered to be accepted as a medium of exchange. The currencyPaper money and coins.—paper money and coins—used in the United States today is fiat money; it has no value other than its use as money. You will notice that statement printed on each bill: “This note is legal tender for all debts, public and private.”

Checkable depositsBalances in checking accounts., which are balances in checking accounts, and traveler’s checks are other forms of money that have no intrinsic value. They can be converted to currency, but generally they are not; they simply serve as a medium of exchange. If you want to buy something, you can often pay with a check or a debit card. A checkA written order to a bank to transfer ownership of a checkable deposit. is a written order to a bank to transfer ownership of a checkable deposit. A debit card is the electronic equivalent of a check. Suppose, for example, that you have $100 in your checking account and you write a check to your campus bookstore for $30 or instruct the clerk to swipe your debit card and “charge” it $30. In either case, $30 will be transferred from your checking account to the bookstore’s checking account. Notice that it is the checkable deposit, not the check or debit card, that is money. The check or debit card just tells a bank to transfer money, in this case checkable deposits, from one account to another.

What makes something money is really found in its acceptability, not in whether or not it has intrinsic value or whether or not a government has declared it as such. For example, fiat money tends to be accepted so long as too much of it is not printed too quickly. When that happens, as it did in Russia in the 1990s, people tend to look for other items to serve as money. In the case of Russia, the U.S. dollar became a popular form of money, even though the Russian government still declared the ruble to be its fiat money.

The term money, as used by economists and throughout this book, has the very specific definition given in the text. People can hold assets in a variety of forms, from works of art to stock certificates to currency or checking account balances. Even though individuals may be very wealthy, only when they are holding their assets in a form that serves as a medium of exchange do they, according to the precise meaning of the term, have “money.” To qualify as “money,” something must be widely accepted as a medium of exchange.

The total quantity of money in the economy at any one time is called the money supplyThe total quantity of money in the economy at any one time.. Economists measure the money supply because it affects economic activity. What should be included in the money supply? We want to include as part of the money supply those things that serve as media of exchange. However, the items that provide this function have varied over time.

Before 1980, the basic money supply was measured as the sum of currency in circulation, traveler’s checks, and checkable deposits. Currency serves the medium-of-exchange function very nicely but denies people any interest earnings. (Checking accounts did not earn interest before 1980.)

Over the last few decades, especially as a result of high interest rates and high inflation in the late 1970s, people sought and found ways of holding their financial assets in ways that earn interest and that can easily be converted to money. For example, it is now possible to transfer money from your savings account to your checking account using an automated teller machine (ATM), and then to withdraw cash from your checking account. Thus, many types of savings accounts are easily converted into currency.

Economists refer to the ease with which an asset can be converted into currency as the asset’s liquidityThe ease with which an asset can be converted into currency.. Currency itself is perfectly liquid; you can always change two $5 bills for a $10 bill. Checkable deposits are almost perfectly liquid; you can easily cash a check or visit an ATM. An office building, however, is highly illiquid. It can be converted to money only by selling it, a time-consuming and costly process.

As financial assets other than checkable deposits have become more liquid, economists have had to develop broader measures of money that would correspond to economic activity. In the United States, the final arbiter of what is and what is not measured as money is the Federal Reserve System. Because it is difficult to determine what (and what not) to measure as money, the Fed reports several different measures of money, including M1 and M2.

M1The narrowest of the Fed’s money supply definitions that includes currency in circulation, checkable deposits, and traveler’s checks. is the narrowest of the Fed’s money supply definitions. It includes currency in circulation, checkable deposits, and traveler’s checks. M2A broader measure of the money supply than M1 that includes M1 and other deposits. is a broader measure of the money supply than M1. It includes M1 and other deposits such as small savings accounts (less than $100,000), as well as accounts such as money market mutual funds (MMMFs) that place limits on the number or the amounts of the checks that can be written in a certain period.

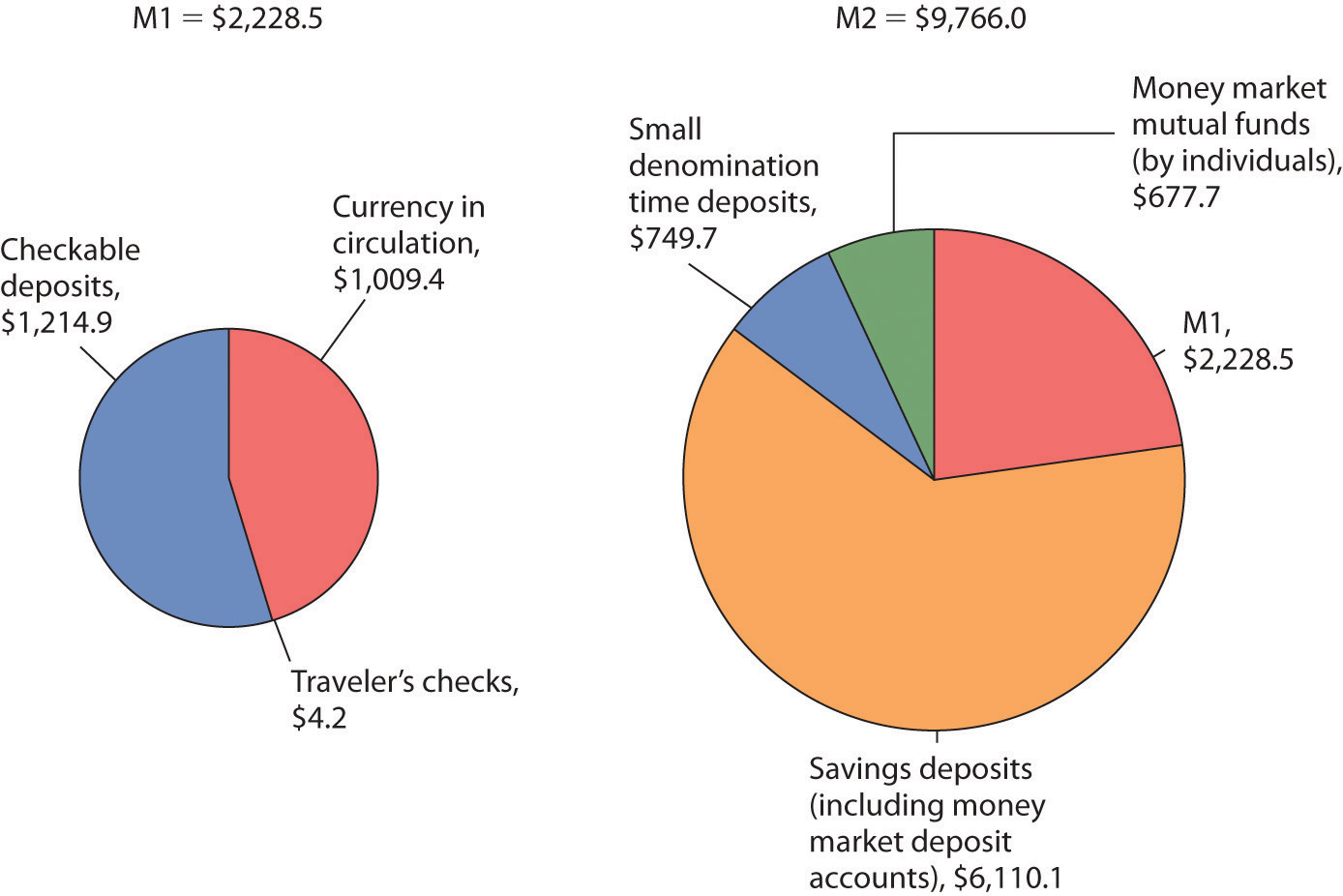

M2 is sometimes called the broadly defined money supply, while M1 is the narrowly defined money supply. The assets in M1 may be regarded as perfectly liquid; the assets in M2 are highly liquid, but somewhat less liquid than the assets in M1. Even broader measures of the money supply include large time-deposits, money market mutual funds held by institutions, and other assets that are somewhat less liquid than those in M2. Figure 9.1 "The Two Ms: January 2012" shows the composition of M1 and M2 in October 2010.

Figure 9.1 The Two Ms: January 2012

M1, the narrowest definition of the money supply, includes assets that are perfectly liquid. M2 provides a broader measure of the money supply and includes somewhat less liquid assets. Amounts represent money supply data in billions of dollars for January 2012, seasonally adjusted.

Source: Federal Reserve Statistical Release H.6, Tables 3 and 4 (February 16, 2012). Amounts are in billions of dollars for January 2012, seasonally adjusted.

Credit cards are not money. A credit card identifies you as a person who has a special arrangement with the card issuer in which the issuer will lend you money and transfer the proceeds to another party whenever you want. Thus, if you present a MasterCard to a jeweler as payment for a $500 ring, the firm that issued you the card will lend you the $500 and send that money, less a service charge, to the jeweler. You, of course, will be required to repay the loan later. But a card that says you have such a relationship is not money, just as your debit card is not money.

With all the operational definitions of money available, which one should we use? Economists generally answer that question by asking another: Which measure of money is most closely related to real GDP and the price level? As that changes, so must the definition of money.

In 1980, the Fed decided that changes in the ways people were managing their money made M1 useless for policy choices. Indeed, the Fed now pays little attention to M2 either. It has largely given up tracking a particular measure of the money supply. The choice of what to measure as money remains the subject of continuing research and considerable debate.

Which of the following are money in the United States today and which are not? Explain your reasoning in terms of the functions of money.

“We don’t have a currency of our own,” proclaimed Nerchivan Barzani, the Kurdish regional government’s prime minister in a news interview in 2003. But, even without official recognition by the government, the so-called “Swiss” dinar certainly seemed to function as a fiat money. Here is how the Kurdish area of northern Iraq, during the period between the Gulf War in 1991 and the fall of Saddam Hussein in 2003, came to have its own currency, despite the pronouncement of its prime minister to the contrary.

After the Gulf War, the northern, mostly Kurdish area of Iraq was separated from the rest of Iraq though the enforcement of the no-fly-zone. Because of United Nations sanctions that barred the Saddam Hussein regime in the south from continuing to import currency from Switzerland, the central bank of Iraq announced it would replace the “Swiss” dinars, so named because they had been printed in Switzerland, with locally printed currency, which became known as “Saddam” dinars. Iraqi citizens in southern Iraq were given three weeks to exchange their old dinars for the new ones. In the northern part of Iraq, citizens could not exchange their notes and so they simply continued to use the old ones.

And so it was that the “Swiss” dinar for a period of about 10 years, even without government backing or any law establishing it as legal tender, served as northern Iraq’s fiat money. Economists use the word “fiat,” which in Latin means “let it be done,” to describe money that has no intrinsic value. Such forms of money usually get their value because a government or authority has declared them to be legal tender, but, as this story shows, it does not really require much “fiat” for a convenient, in-and-of-itself worthless, medium of exchange to evolve.

What happened to both the “Swiss” and “Saddam” dinars? After the Coalition Provisional Authority (CPA) assumed control of all of Iraq, Paul Bremer, then head of the CPA, announced that a new Iraqi dinar would be exchanged for both of the existing currencies over a three-month period ending in January 2004 at a rate that implied that one “Swiss” dinar was valued at 150 “Saddam” dinars. Because Saddam Hussein’s regime had printed many more “Saddam” dinars over the 10-year period, while no “Swiss” dinars had been printed, and because the cheap printing of the “Saddam” dinars made them easy to counterfeit, over the decade the “Swiss” dinars became relatively more valuable and the exchange rate that Bremer offered about equalized the purchasing power of the two currencies. For example, it took about 133 times as many “Saddam” dinars as “Swiss” dinars to buy a man’s suit in Iraq at the time. The new notes, sometimes called “Bremer” dinars, were printed in Britain and elsewhere and flown into Iraq on 22 flights using Boeing 747s and other large aircraft. In both the northern and southern parts of Iraq, citizens turned in their old dinars for the new ones, suggesting at least more confidence at that moment in the “Bremer” dinar than in either the “Saddam” or “Swiss” dinars.

Sources: Mervyn A. King, “The Institutions of Monetary Policy” (lecture, American Economics Association Annual Meeting, San Diego, January 4, 2004), available at http://www.bankofengland.co.uk/publications/Documents/speeches/2004/speech208.pdf; Hal R. Varian, “Paper Currency Can Have Value without Government Backing, but Such Backing Adds Substantially to Its Value,” New York Times, January 15, 2004, p. C2.

Where does money come from? How is its quantity increased or decreased? The answer to these questions suggests that money has an almost magical quality: money is created by banks when they issue loans. In effect, money is created by the stroke of a pen or the click of a computer key.

We will begin by examining the operation of banks and the banking system. We will find that, like money itself, the nature of banking is experiencing rapid change.

An institution that amasses funds from one group and makes them available to another is called a financial intermediaryAn institution that amasses funds from one group and makes them available to another.. A pension fund is an example of a financial intermediary. Workers and firms place earnings in the fund for their retirement; the fund earns income by lending money to firms or by purchasing their stock. The fund thus makes retirement saving available for other spending. Insurance companies are also financial intermediaries, because they lend some of the premiums paid by their customers to firms for investment. Mutual funds make money available to firms and other institutions by purchasing their initial offerings of stocks or bonds.

Banks play a particularly important role as financial intermediaries. Banks accept depositors’ money and lend it to borrowers. With the interest they earn on their loans, banks are able to pay interest to their depositors, cover their own operating costs, and earn a profit, all the while maintaining the ability of the original depositors to spend the funds when they desire to do so. One key characteristic of banks is that they offer their customers the opportunity to open checking accounts, thus creating checkable deposits. These functions define a bankA financial intermediary that accepts deposits, makes loans, and offers checking accounts., which is a financial intermediary that accepts deposits, makes loans, and offers checking accounts.

Over time, some nonbank financial intermediaries have become more and more like banks. For example, brokerage firms usually offer customers interest-earning accounts and make loans. They now allow their customers to write checks on their accounts.

The fact that banks account for a declining share of U.S. financial assets alarms some observers. We will see that banks are more tightly regulated than are other financial institutions; one reason for that regulation is to maintain control over the money supply. Other financial intermediaries do not face the same regulatory restrictions as banks. Indeed, their relative freedom from regulation is one reason they have grown so rapidly. As other financial intermediaries become more important, central authorities begin to lose control over the money supply.

The declining share of financial assets controlled by “banks” began to change in 2008. Many of the nation’s largest investment banks—financial institutions that provided services to firms but were not regulated as commercial banks—began having serious financial difficulties as a result of their investments tied to home mortgage loans. As home prices in the United States began falling, many of those mortgage loans went into default. Investment banks that had made substantial purchases of securities whose value was ultimately based on those mortgage loans themselves began failing. Bear Stearns, one of the largest investment banks in the United States, required federal funds to remain solvent. Another large investment bank, Lehman Brothers, failed. In an effort to avoid a similar fate, several other investment banks applied for status as ordinary commercial banks subject to the stringent regulation those institutions face. One result of the terrible financial crisis that crippled the U.S. and other economies in 2008 may be greater control of the money supply by the Fed.

Bank finance lies at the heart of the process through which money is created. To understand money creation, we need to understand some of the basics of bank finance.

Banks accept deposits and issue checks to the owners of those deposits. Banks use the money collected from depositors to make loans. The bank’s financial picture at a given time can be depicted using a simplified balance sheetA financial statement showing assets, liabilities, and net worth., which is a financial statement showing assets, liabilities, and net worth. AssetsAnything of value. are anything of value. LiabilitiesObligations to other parties. are obligations to other parties. Net worthAssets less liabilities. equals assets less liabilities. All these are given dollar values in a firm’s balance sheet. The sum of liabilities plus net worth therefore must equal the sum of all assets. On a balance sheet, assets are listed on the left, liabilities and net worth on the right.

The main way that banks earn profits is through issuing loans. Because their depositors do not typically all ask for the entire amount of their deposits back at the same time, banks lend out most of the deposits they have collected—to companies seeking to expand their operations, to people buying cars or homes, and so on. Banks keep only a fraction of their deposits as cash in their vaults and in deposits with the Fed. These assets are called reservesBank assets held as cash in vaults and in deposits with the Federal Reserve.. Banks lend out the rest of their deposits. A system in which banks hold reserves whose value is less than the sum of claims outstanding on those reserves is called a fractional reserve banking systemSystem in which banks hold reserves whose value is less than the sum of claims outstanding on those reserves..

Table 9.1 "The Consolidated Balance Sheet for U.S. Commercial Banks, January 2012" shows a consolidated balance sheet for commercial banks in the United States for January 2012. Banks hold reserves against the liabilities represented by their checkable deposits. Notice that these reserves were a small fraction of total deposit liabilities of that month. Most bank assets are in the form of loans.

Table 9.1 The Consolidated Balance Sheet for U.S. Commercial Banks, January 2012

| Assets | Liabilities and Net Worth | ||

|---|---|---|---|

| Reserves | $1,592.9 | Checkable deposits | $8,517.9 |

| Other assets | $1,316.2 | Borrowings | 1,588.1 |

| Loans | $7,042.0 | Other liabilities | 1,049.4 |

| Securities | $2,546.1 | ||

| Total assets | $12,497.2 | Total liabilities | $11,155.4 |

| Net worth | $1,341.8 | ||

This balance sheet for all commercial banks in the United States shows their financial situation in billions of dollars, seasonally adjusted, in January 2012.

Source: Federal Reserve Statistical Release H.8 (February 17, 2012).

In the next section, we will learn that money is created when banks issue loans.

To understand the process of money creation today, let us create a hypothetical system of banks. We will focus on three banks in this system: Acme Bank, Bellville Bank, and Clarkston Bank. Assume that all banks are required to hold reserves equal to 10% of their checkable deposits. The quantity of reserves banks are required to hold is called required reservesThe quantity of reserves banks are required to hold.. The reserve requirement is expressed as a required reserve ratioThe ratio of reserves to checkable deposits a bank must maintain.; it specifies the ratio of reserves to checkable deposits a bank must maintain. Banks may hold reserves in excess of the required level; such reserves are called excess reservesReserves in excess of the required level.. Excess reserves plus required reserves equal total reserves.

Because banks earn relatively little interest on their reserves held on deposit with the Federal Reserve, we shall assume that they seek to hold no excess reserves. When a bank’s excess reserves equal zero, it is loaned upWhen a bank’s excess reserves equal zero.. Finally, we shall ignore assets other than reserves and loans and deposits other than checkable deposits. To simplify the analysis further, we shall suppose that banks have no net worth; their assets are equal to their liabilities.

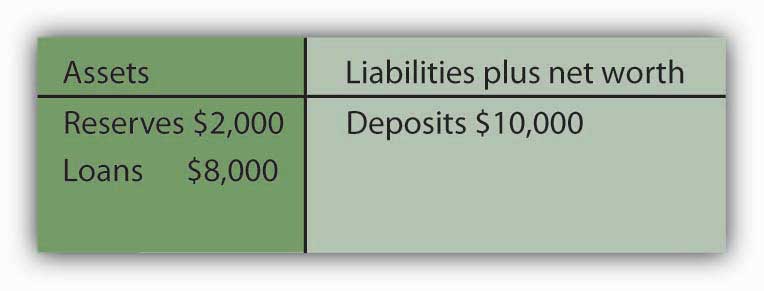

Let us suppose that every bank in our imaginary system begins with $1,000 in reserves, $9,000 in loans outstanding, and $10,000 in checkable deposit balances held by customers. The balance sheet for one of these banks, Acme Bank, is shown in Table 9.2 "A Balance Sheet for Acme Bank". The required reserve ratio is 0.1: Each bank must have reserves equal to 10% of its checkable deposits. Because reserves equal required reserves, excess reserves equal zero. Each bank is loaned up.

Table 9.2 A Balance Sheet for Acme Bank

| Acme Bank | |||

|---|---|---|---|

| Assets | Liabilities | ||

| Reserves | $1,000 | Deposits | $10,000 |

| Loans | $9,000 | ||

We assume that all banks in a hypothetical system of banks have $1,000 in reserves, $10,000 in checkable deposits, and $9,000 in loans. With a 10% reserve requirement, each bank is loaned up; it has zero excess reserves.

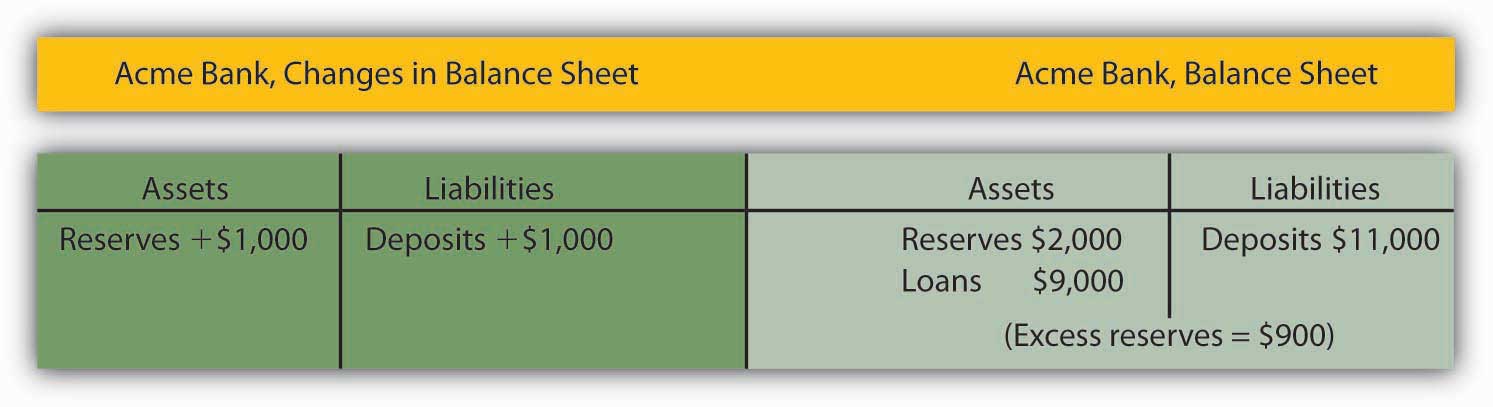

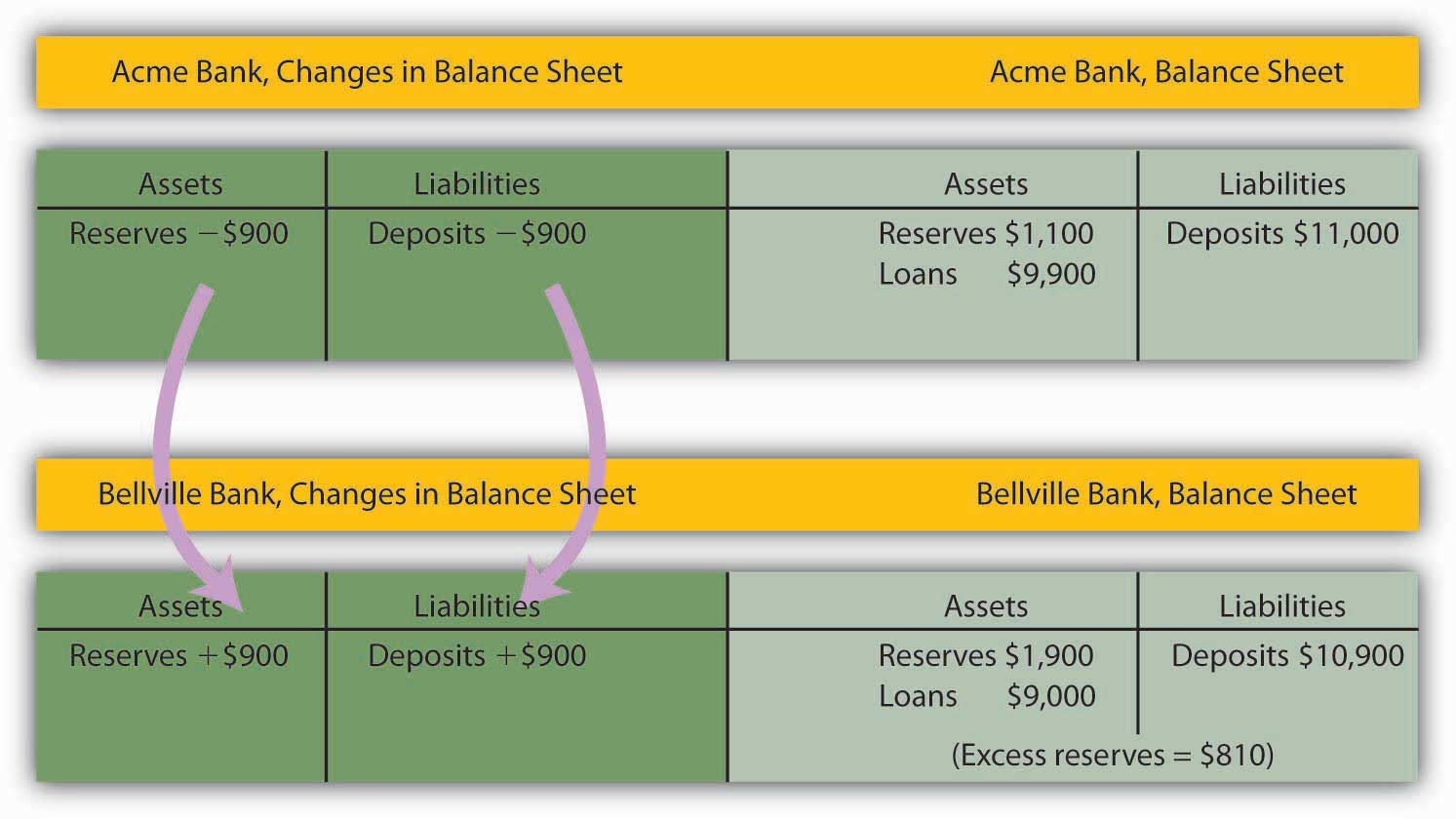

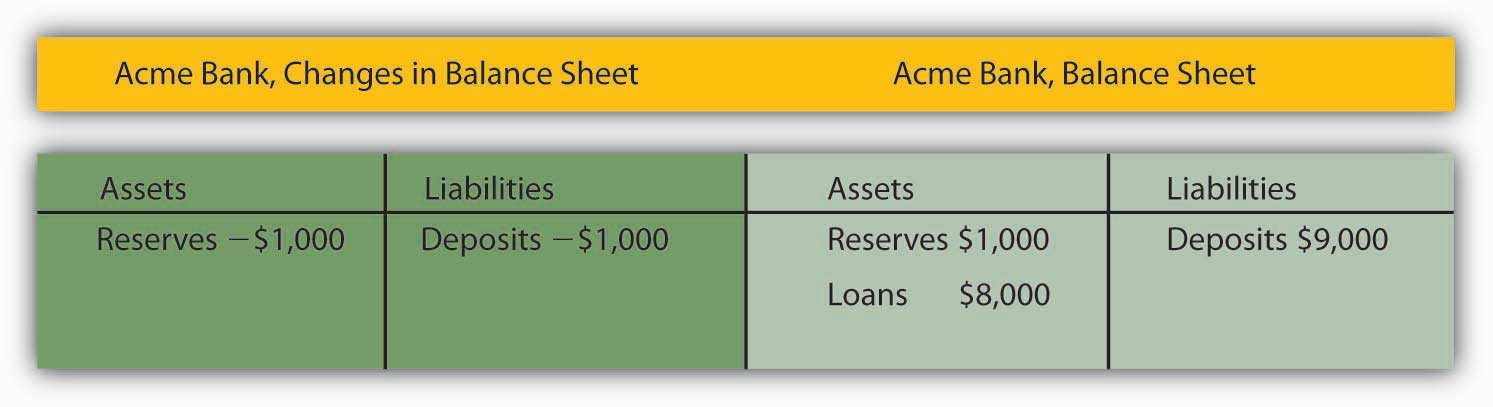

Acme Bank, like every other bank in our hypothetical system, initially holds reserves equal to the level of required reserves. Now suppose one of Acme Bank’s customers deposits $1,000 in cash in a checking account. The money goes into the bank’s vault and thus adds to reserves. The customer now has an additional $1,000 in his or her account. Two versions of Acme’s balance sheet are given here. The first shows the changes brought by the customer’s deposit: reserves and checkable deposits rise by $1,000. The second shows how these changes affect Acme’s balances. Reserves now equal $2,000 and checkable deposits equal $11,000. With checkable deposits of $11,000 and a 10% reserve requirement, Acme is required to hold reserves of $1,100. With reserves equaling $2,000, Acme has $900 in excess reserves.

At this stage, there has been no change in the money supply. When the customer brought in the $1,000 and Acme put the money in the vault, currency in circulation fell by $1,000. At the same time, the $1,000 was added to the customer’s checking account balance, so the money supply did not change.

Figure 9.2

Because Acme earns only a low interest rate on its excess reserves, we assume it will try to loan them out. Suppose Acme lends the $900 to one of its customers. It will make the loan by crediting the customer’s checking account with $900. Acme’s outstanding loans and checkable deposits rise by $900. The $900 in checkable deposits is new money; Acme created it when it issued the $900 loan. Now you know where money comes from—it is created when a bank issues a loan.

Figure 9.3

Presumably, the customer who borrowed the $900 did so in order to spend it. That customer will write a check to someone else, who is likely to bank at some other bank. Suppose that Acme’s borrower writes a check to a firm with an account at Bellville Bank. In this set of transactions, Acme’s checkable deposits fall by $900. The firm that receives the check deposits it in its account at Bellville Bank, increasing that bank’s checkable deposits by $900. Bellville Bank now has a check written on an Acme account. Bellville will submit the check to the Fed, which will reduce Acme’s deposits with the Fed—its reserves—by $900 and increase Bellville’s reserves by $900.

Figure 9.4

Notice that Acme Bank emerges from this round of transactions with $11,000 in checkable deposits and $1,100 in reserves. It has eliminated its excess reserves by issuing the loan for $900; Acme is now loaned up. Notice also that from Acme’s point of view, it has not created any money! It merely took in a $1,000 deposit and emerged from the process with $1,000 in additional checkable deposits.

The $900 in new money Acme created when it issued a loan has not vanished—it is now in an account in Bellville Bank. Like the magician who shows the audience that the hat from which the rabbit appeared was empty, Acme can report that it has not created any money. There is a wonderful irony in the magic of money creation: banks create money when they issue loans, but no one bank ever seems to keep the money it creates. That is because money is created within the banking system, not by a single bank.

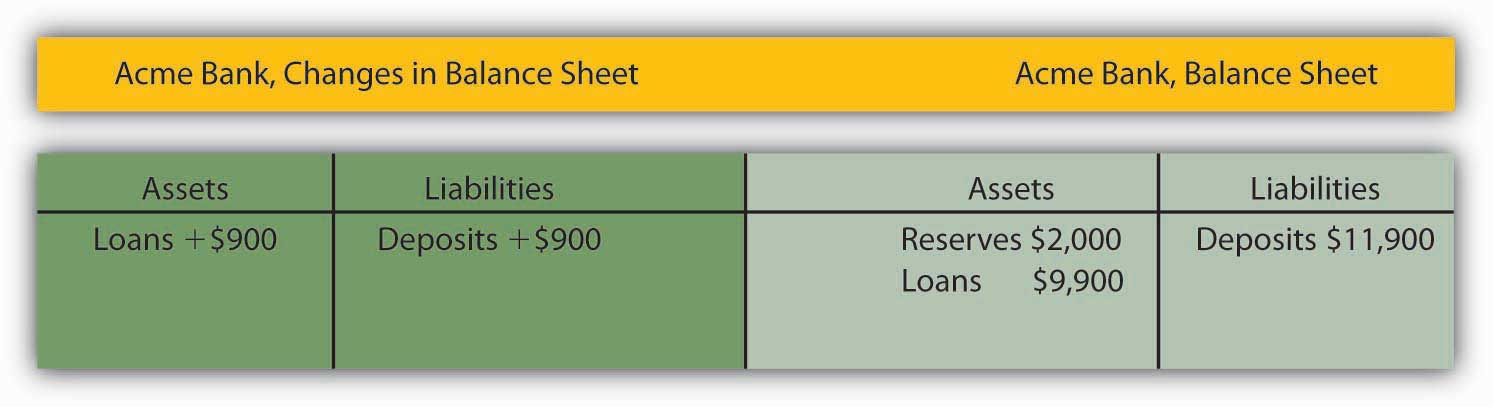

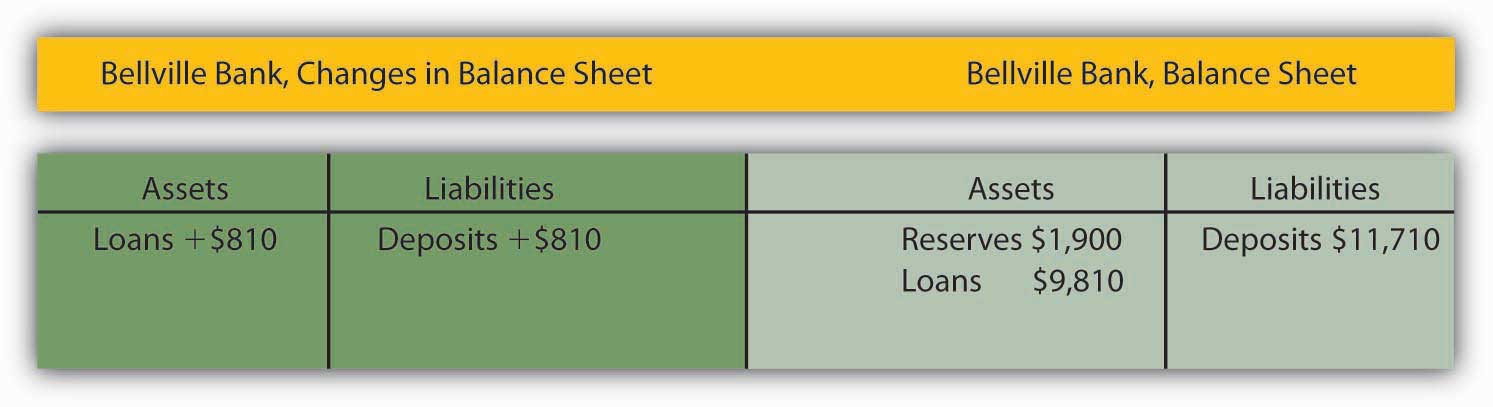

The process of money creation will not end there. Let us go back to Bellville Bank. Its deposits and reserves rose by $900 when the Acme check was deposited in a Bellville account. The $900 deposit required an increase in required reserves of $90. Because Bellville’s reserves rose by $900, it now has $810 in excess reserves. Just as Acme lent the amount of its excess reserves, we can expect Bellville to lend this $810. The next set of balance sheets shows this transaction. Bellville’s loans and checkable deposits rise by $810.

Figure 9.5

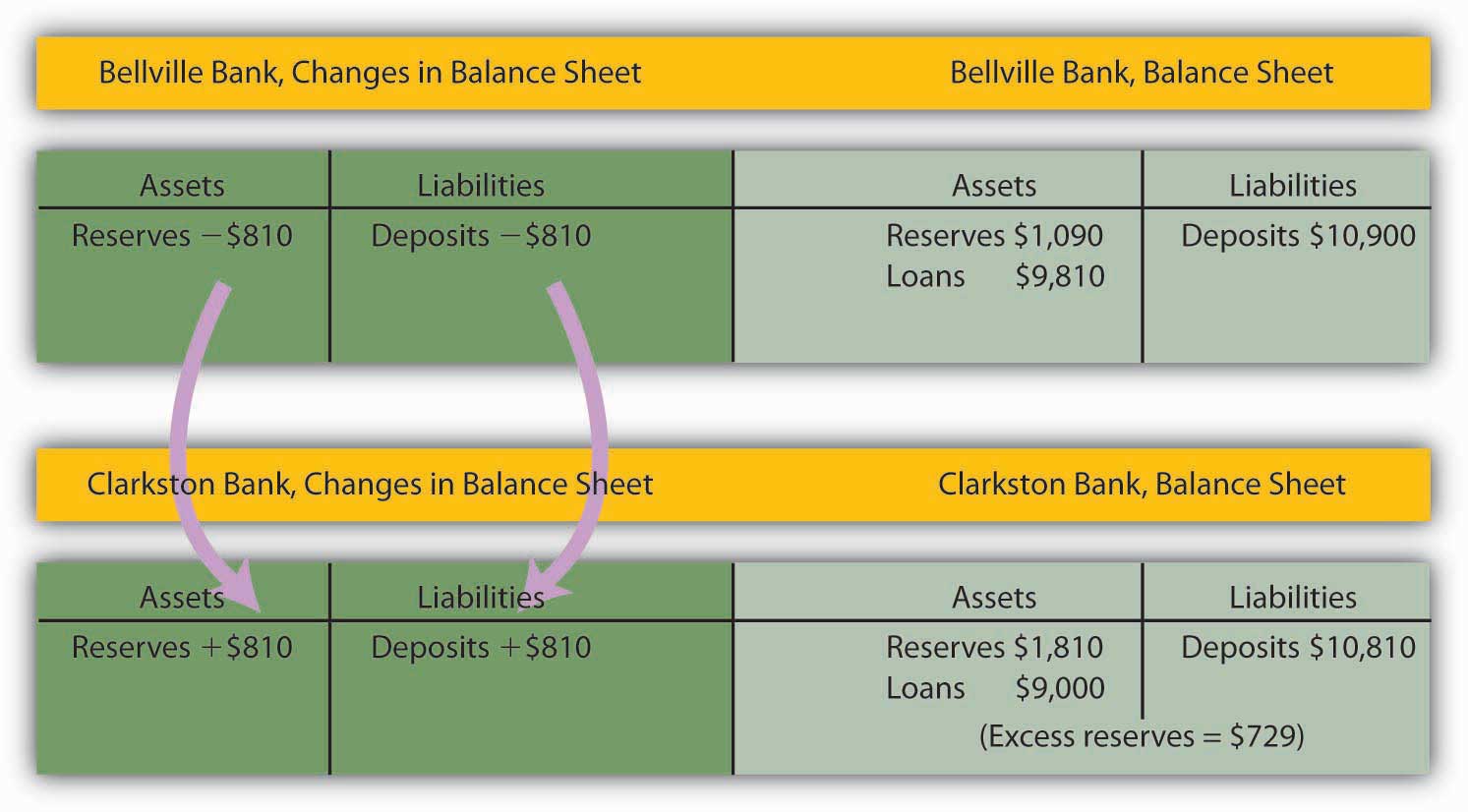

The $810 that Bellville lent will be spent. Let us suppose it ends up with a customer who banks at Clarkston Bank. Bellville’s checkable deposits fall by $810; Clarkston’s rise by the same amount. Clarkston submits the check to the Fed, which transfers the money from Bellville’s reserve account to Clarkston’s. Notice that Clarkston’s deposits rise by $810; Clarkston must increase its reserves by $81. But its reserves have risen by $810, so it has excess reserves of $729.

Figure 9.6

Notice that Bellville is now loaned up. And notice that it can report that it has not created any money either! It took in a $900 deposit, and its checkable deposits have risen by that same $900. The $810 it created when it issued a loan is now at Clarkston Bank.

The process will not end there. Clarkston will lend the $729 it now has in excess reserves, and the money that has been created will end up at some other bank, which will then have excess reserves—and create still more money. And that process will just keep going as long as there are excess reserves to pass through the banking system in the form of loans. How much will ultimately be created by the system as a whole? With a 10% reserve requirement, each dollar in reserves backs up $10 in checkable deposits. The $1,000 in cash that Acme’s customer brought in adds $1,000 in reserves to the banking system. It can therefore back up an additional $10,000! In just the three banks we have shown, checkable deposits have risen by $2,710 ($1,000 at Acme, $900 at Bellville, and $810 at Clarkston). Additional banks in the system will continue to create money, up to a maximum of $7,290 among them. Subtracting the original $1,000 that had been a part of currency in circulation, we see that the money supply could rise by as much as $9,000.

Notice that when the banks received new deposits, they could make new loans only up to the amount of their excess reserves, not up to the amount of their deposits and total reserve increases. For example, with the new deposit of $1,000, Acme Bank was able to make additional loans of $900. If instead it made new loans equal to its increase in total reserves, then after the customers who received new loans wrote checks to others, its reserves would be less than the required amount. In the case of Acme, had it lent out an additional $1,000, after checks were written against the new loans, it would have been left with only $1,000 in reserves against $11,000 in deposits, for a reserve ratio of only 0.09, which is less than the required reserve ratio of 0.1 in the example.

We can relate the potential increase in the money supply to the change in reserves that created it using the deposit multiplierThe ratio of the maximum possible change in checkable deposits (∆D) to the change in reserves (∆R). (md), which equals the ratio of the maximum possible change in checkable deposits (∆D) to the change in reserves (∆R). In our example, the deposit multiplier was 10:

Equation 9.1

To see how the deposit multiplier md is related to the required reserve ratio, we use the fact that if banks in the economy are loaned up, then reserves, R, equal the required reserve ratio (rrr) times checkable deposits, D:

Equation 9.2

A change in reserves produces a change in loans and a change in checkable deposits. Once banks are fully loaned up, the change in reserves, ∆R, will equal the required reserve ratio times the change in deposits, ∆D:

Equation 9.3

Solving for ∆D, we have

Equation 9.4

Dividing both sides by ∆R, we see that the deposit multiplier, md, is 1/rrr:

Equation 9.5

The deposit multiplier is thus given by the reciprocal of the required reserve ratio. With a required reserve ratio of 0.1, the deposit multiplier is 10. A required reserve ratio of 0.2 would produce a deposit multiplier of 5. The higher the required reserve ratio, the lower the deposit multiplier.

Actual increases in checkable deposits will not be nearly as great as suggested by the deposit multiplier. That is because the artificial conditions of our example are not met in the real world. Some banks hold excess reserves, customers withdraw cash, and some loan proceeds are not spent. Each of these factors reduces the degree to which checkable deposits are affected by an increase in reserves. The basic mechanism, however, is the one described in our example, and it remains the case that checkable deposits increase by a multiple of an increase in reserves.

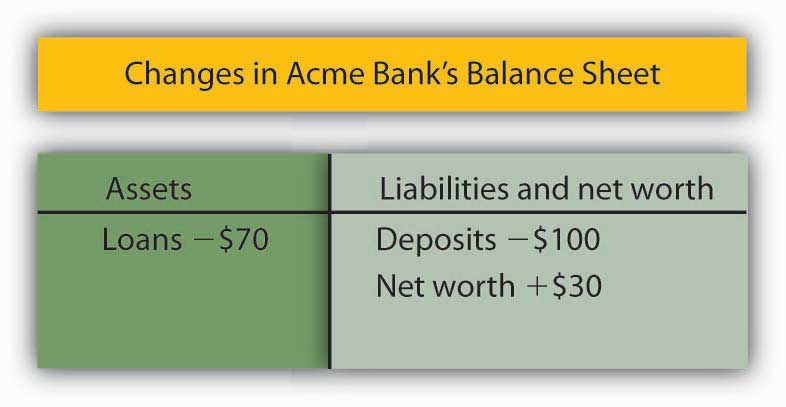

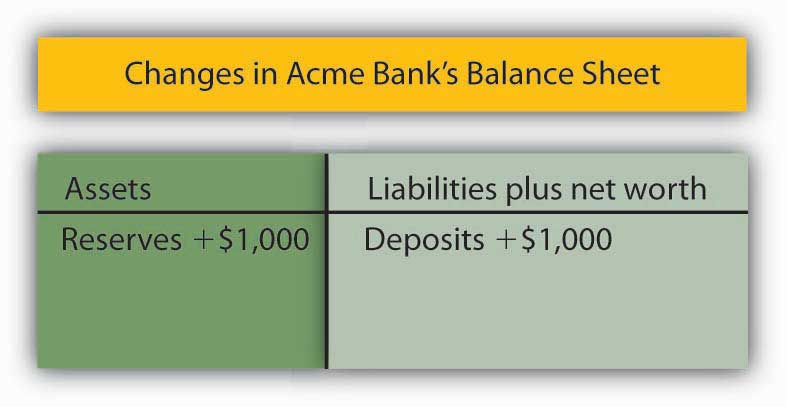

The entire process of money creation can work in reverse. When you withdraw cash from your bank, you reduce the bank’s reserves. Just as a deposit at Acme Bank increases the money supply by a multiple of the original deposit, your withdrawal reduces the money supply by a multiple of the amount you withdraw. And just as money is created when banks issue loans, it is destroyed as the loans are repaid. A loan payment reduces checkable deposits; it thus reduces the money supply.

Suppose, for example, that the Acme Bank customer who borrowed the $900 makes a $100 payment on the loan. Only part of the payment will reduce the loan balance; part will be interest. Suppose $30 of the payment is for interest, while the remaining $70 reduces the loan balance. The effect of the payment on Acme’s balance sheet is shown below. Checkable deposits fall by $100, loans fall by $70, and net worth rises by the amount of the interest payment, $30.

Similar to the process of money creation, the money reduction process decreases checkable deposits by, at most, the amount of the reduction in deposits times the deposit multiplier.

Figure 9.7

Banks are among the most heavily regulated of financial institutions. They are regulated in part to protect individual depositors against corrupt business practices. Banks are also susceptible to crises of confidence. Because their reserves equal only a fraction of their deposit liabilities, an effort by customers to get all their cash out of a bank could force it to fail. A few poorly managed banks could create such a crisis, leading people to try to withdraw their funds from well-managed banks. Another reason for the high degree of regulation is that variations in the quantity of money have important effects on the economy as a whole, and banks are the institutions through which money is created.

From a customer’s point of view, the most important form of regulation comes in the form of deposit insurance. For commercial banks, this insurance is provided by the Federal Deposit Insurance Corporation (FDIC). Insurance funds are maintained through a premium assessed on banks for every $100 of bank deposits.

If a commercial bank fails, the FDIC guarantees to reimburse depositors up to $250,000 (raised from $100,000 during the financial crisis of 2008) per insured bank, for each account ownership category. From a depositor's point of view, therefore, it is not necessary to worry about a bank's safety.

One difficulty this insurance creates, however, is that it may induce the officers of a bank to take more risks. With a federal agency on hand to bail them out if they fail, the costs of failure are reduced. Bank officers can thus be expected to take more risks than they would otherwise, which, in turn, makes failure more likely. In addition, depositors, knowing that their deposits are insured, may not scrutinize the banks’ lending activities as carefully as they would if they felt that unwise loans could result in the loss of their deposits.

Thus, banks present us with a fundamental dilemma. A fractional reserve system means that banks can operate only if their customers maintain their confidence in them. If bank customers lose confidence, they are likely to try to withdraw their funds. But with a fractional reserve system, a bank actually holds funds in reserve equal to only a small fraction of its deposit liabilities. If its customers think a bank will fail and try to withdraw their cash, the bank is likely to fail. Bank panics, in which frightened customers rush to withdraw their deposits, contributed to the failure of one-third of the nation’s banks between 1929 and 1933. Deposit insurance was introduced in large part to give people confidence in their banks and to prevent failure. But the deposit insurance that seeks to prevent bank failures may lead to less careful management—and thus encourage bank failure.

To reduce the number of bank failures, banks are limited in what they can do. Banks are required to maintain a minimum level of net worth as a fraction of total assets. Regulators from the FDIC regularly perform audits and other checks of individual banks to ensure they are operating safely.

The FDIC has the power to close a bank whose net worth has fallen below the required level. In practice, it typically acts to close a bank when it becomes insolvent, that is, when its net worth becomes negative. Negative net worth implies that the bank’s liabilities exceed its assets.

When the FDIC closes a bank, it arranges for depositors to receive their funds. When the bank’s funds are insufficient to return customers’ deposits, the FDIC uses money from the insurance fund for this purpose. Alternatively, the FDIC may arrange for another bank to purchase the failed bank. The FDIC, however, continues to guarantee that depositors will not lose any money.

In the aftermath of the Great Depression and the banking crisis that accompanied it, laws were passed to try to make the banking system safer. The Glass-Steagall Act of that period created the FDIC and the separation between commercial banks and investment banks. Over time, the financial system in the United States and in other countries began to change, and in 1999, a law was passed in the United States that essentially repealed the part of the Glass-Steagall Act that had created the separation between commercial and investment banking. Proponents of eliminating the separation between the two types of banks argued that banks could better diversify their portfolios if allowed to participate in other parts of the financial markets and that banks in other countries operated without such a separation.

Similar to the reaction to the banking crisis of the 1930s, the financial crisis of 2008 and the Great Recession led to calls for financial market reform. The result was the Dodd-Frank Wall Street Reform and Consumer Protection Act, usually referred to as the Dodd-Frank Act, which was passed in July 2010. More than 2,000 pages in length, the regulations to implement most provisions of this act were set to take place over a nearly two-year period, with some provisions expected to take even longer to implement. This act created the Consumer Financial Protection Agency to oversee and regulate various aspects of consumer credit markets, such as credit card and bank fees and mortgage contracts. It also created the Financial Stability Oversight Council (FSOC) to assess risks for the entire financial industry. The FSOC can recommend that a nonbank financial firm, such as a hedge fund that is perhaps threatening the stability of the financial system (i.e., getting “too big to fail”), become regulated by the Federal Reserve. If such firms do become insolvent, a process of liquidation similar to what occurs when the FDIC takes over a bank can be applied. The Dodd-Frank Act also calls for implementation of the Volcker rule, which was named after the former chair of the Fed who argued the case. The Volcker rule is meant to ban banks from using depositors’ funds to engage in certain types of speculative investments to try to enhance the profits of the bank, at least partly reinstating the separation between commercial and investment banking that the Glass-Steagall Act had created. There are many other provisions in this wide-sweeping legislation that are designed to improve oversight of nonbank financial institutions, increase transparency in the operation of various forms of financial instruments, regulate credit rating agencies such as Moody’s and Standard & Poor’s, and so on. Given the lag time associated with fully implementing the legislation, it will probably be many years before its impact can be fully assessed.

It was the darling of Wall Street—it showed rapid growth and made big profits. Washington Mutual, a savings and loan based in the state of Washington, was a relatively small institution whose CEO, Kerry K. Killinger, had big plans. He wanted to transform his little Seattle S&L into the Wal-Mart of banks.

Mr. Killinger began pursuing a relatively straightforward strategy. He acquired banks in large cities such as Chicago and Los Angeles. He acquired banks up and down the east and west coasts. He aggressively extended credit to low-income individuals and families—credit cards, car loans, and mortgages. In making mortgage loans to low-income families, WaMu, as the bank was known, quickly became very profitable. But it was exposing itself to greater and greater risk, according to the New York Times.

Housing prices in the United States more than doubled between 1997 and 2007. During that time, loans to even low-income households were profitable. But, as housing prices began falling in 2007, banks such as WaMu began to experience losses as homeowners began to walk away from houses whose values suddenly fell below their outstanding mortgages. WaMu began losing money in 2007 as housing prices began falling. The company had earned $3.6 billion in 2006, and swung to a loss of $67 million in 2007, according to the Puget Sound Business Journal. Mr. Killinger was ousted by the board early in September of 2008. The bank failed later that month. It was the biggest bank failure in the history of the United States.

The Federal Deposit Insurance Corporation (FDIC) had just rescued another bank, IndyMac, which was only a tenth the size of WaMu, and would have done the same for WaMu if it had not been able to find a company to purchase it. But in this case, JPMorgan Chase agreed to take it over—its deposits, bank branches, and its troubled asset portfolio. The government and the Fed even negotiated the deal behind WaMu’s back! The then chief executive officer of the company, Alan H. Fishman, was reportedly flying from New York to Seattle when the deal was finalized.

The government was anxious to broker a deal that did not require use of the FDIC’s depleted funds following IndyMac’s collapse. But it would have done so if a buyer had not been found. As the FDIC reports on its Web site: “Since the FDIC’s creation in 1933, no depositor has ever lost even one penny of FDIC-insured funds.”

Sources: Eric Dash and Andrew Ross Sorkin, “Government Seizes WaMu and Sells Some Assets,” New York Times, September 25, 2008, p. A1; Kirsten Grind, “Insiders Detail Reasons for WaMu’s Failure,” Puget Sound Business Journal, January 23, 2009; and FDIC Web site at https://www.fdic.gov/edie/fdic_info.html.

Acme Bank is loaned up, since $2,000/$10,000 = 0.2, which is the required reserve ratio. Acme’s balance sheet is:

Acme Bank’s balance sheet after losing $1,000 in deposits:

Required reserves are deficient by $800. Acme must hold 20% of its deposits, in this case , as reserves, but it has only $1,000 in reserves at the moment.

The contraction in checkable deposits would be

∆D = (1/0.2) × (−$1,000) = −$5,000The Federal Reserve System of the United States, or Fed, is the U.S. central bank. Japan’s central bank is the Bank of Japan; the European Union has established the European Central Bank. Most countries have a central bank. A central bankA bank that acts as a banker to the central government, acts as a banker to banks, acts as a regulator of banks, conducts monetary policy, and supports the stability of the financial system. performs five primary functions: (1) it acts as a banker to the central government, (2) it acts as a banker to banks, (3) it acts as a regulator of banks, (4) it conducts monetary policy, and (5) it supports the stability of the financial system.

For the first 137 years of its history, the United States did not have a true central bank. While a central bank was often proposed, there was resistance to creating an institution with such enormous power. A series of bank panics slowly increased support for the creation of a central bank. The bank panic of 1907 proved to be the final straw. Bank failures were so widespread, and depositor losses so heavy, that concerns about centralization of power gave way to a desire for an institution that would provide a stabilizing force in the banking industry. Congress passed the Federal Reserve Act in 1913, creating the Fed and giving it all the powers of a central bank.

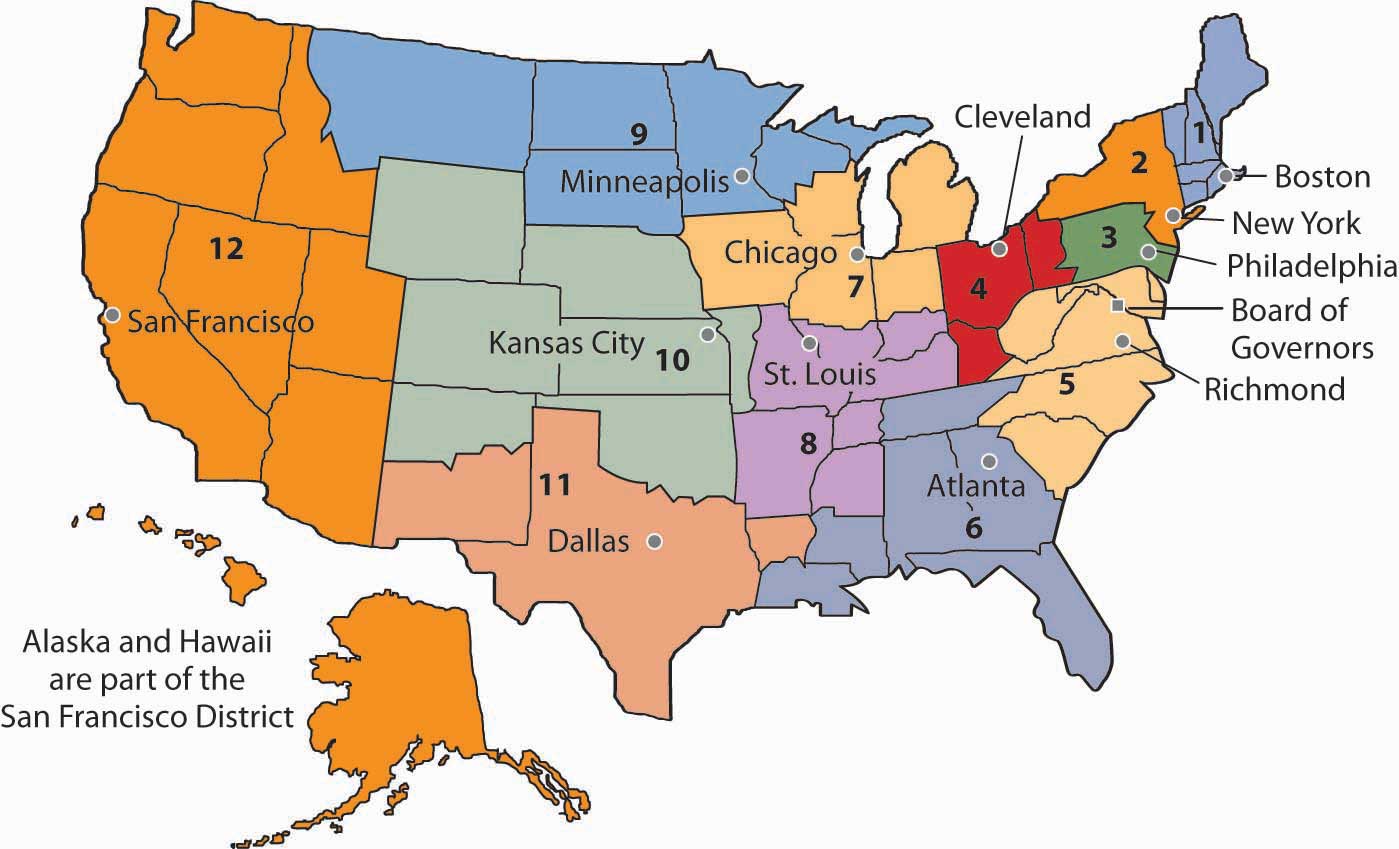

In creating the Fed, Congress determined that a central bank should be as independent of the government as possible. It also sought to avoid too much centralization of power in a single institution. These potentially contradictory goals of independence and decentralized power are evident in the Fed’s structure and in the continuing struggles between Congress and the Fed over possible changes in that structure.

In an effort to decentralize power, Congress designed the Fed as a system of 12 regional banks, as shown in Figure 9.8 "The 12 Federal Reserve Districts and the Cities Where Each Bank Is Located". Each of these banks operates as a kind of bankers’ cooperative; the regional banks are owned by the commercial banks in their districts that have chosen to be members of the Fed. The owners of each Federal Reserve bank select the board of directors of that bank; the board selects the bank’s president.

Figure 9.8 The 12 Federal Reserve Districts and the Cities Where Each Bank Is Located

Several provisions of the Federal Reserve Act seek to maintain the Fed’s independence. The board of directors for the entire Federal Reserve System is called the Board of Governors. The seven members of the board are appointed by the president of the United States and confirmed by the Senate. To ensure a large measure of independence from any one president, the members of the Board of Governors have 14-year terms. One member of the board is selected by the president of the United States to serve as chairman for a four-year term.

As a further means of ensuring the independence of the Fed, Congress authorized it to buy and sell federal government bonds. This activity is a profitable one that allows the Fed to pay its own bills. The Fed is thus not dependent on a Congress that might otherwise be tempted to force a particular set of policies on it. The Fed is limited in the profits it is allowed to earn; its “excess” profits are returned to the Treasury.

It is important to recognize that the Fed is technically not part of the federal government. Members of the Board of Governors do not legally have to answer to Congress, the president, or anyone else. The president and members of Congress can certainly try to influence the Fed, but they cannot order it to do anything. Congress, however, created the Fed. It could, by passing another law, abolish the Fed’s independence. The Fed can maintain its independence only by keeping the support of Congress—and that sometimes requires being responsive to the wishes of Congress.

In recent years, Congress has sought to increase its oversight of the Fed. The chairman of the Federal Reserve Board is required to report to Congress twice each year on its monetary policy, the set of policies that the central bank can use to influence economic activity.

The Fed’s principal powers stem from its authority to conduct monetary policy. It has three main policy tools: setting reserve requirements, operating the discount window and other credit facilities, and conducting open-market operations.

The Fed sets the required ratio of reserves that banks must hold relative to their deposit liabilities. In theory, the Fed could use this power as an instrument of monetary policy. It could lower reserve requirements when it wanted to increase the money supply and raise them when it wanted to reduce the money supply. In practice, however, the Fed does not use its power to set reserve requirements in this way. The reason is that frequent manipulation of reserve requirements would make life difficult for bankers, who would have to adjust their lending policies to changing requirements.

The Fed’s power to set reserve requirements was expanded by the Monetary Control Act of 1980. Before that, the Fed set reserve requirements only for commercial banks that were members of the Federal Reserve System. Most banks are not members of the Fed; the Fed’s control of reserve requirements thus extended to only a minority of banks. The 1980 act required virtually all banks to satisfy the Fed’s reserve requirements.

A major responsibility of the Fed is to act as a lender of last resort to banks. When banks fall short on reserves, they can borrow reserves from the Fed through its discount window. The discount rateThe interest rate charged by the Fed when it lends reserves to banks. is the interest rate charged by the Fed when it lends reserves to banks. The Board of Governors sets the discount rate.

Lowering the discount rate makes funds cheaper to banks. A lower discount rate could place downward pressure on interest rates in the economy. However, when financial markets are operating normally, banks rarely borrow from the Fed, reserving use of the discount window for emergencies. A typical bank borrows from the Fed only about once or twice per year.

Instead of borrowing from the Fed when they need reserves, banks typically rely on the federal funds market to obtain reserves. The federal funds marketA market in which banks lend reserves to one another. is a market in which banks lend reserves to one another. The federal funds rateThe interest rate charged when one bank lends reserves to another. is the interest rate charged for such loans; it is determined by banks’ demand for and supply of these reserves. The ability to set the discount rate is no longer an important tool of Federal Reserve policy.

To deal with the recent financial and economic conditions, the Fed greatly expanded its lending beyond its traditional discount window lending. As falling house prices led to foreclosures, private investment banks and other financial institutions came under increasing pressure. The Fed made credit available to a wide range of institutions in an effort to stem the crisis. In 2008, the Fed bailed out two major housing finance firms that had been established by the government to prop up the housing industry—Fannie Mae (the Federal National Mortgage Association) and Freddie Mac (the Federal Home Mortgage Corporation). Together, the two institutions backed the mortgages of half of the nation’s mortgage loans.Sam Zuckerman, “Feds Take Control of Fannie Mae, Freddie Mac,” The San Francisco Chronicle, September 8, 2008, p. A-1. It also agreed to provide $85 billion to AIG, the huge insurance firm. AIG had a subsidiary that was heavily exposed to mortgage loan losses, and that crippled the firm. The Fed determined that AIG was simply too big to be allowed to fail. Many banks had ties to the giant institution, and its failure would have been a blow to those banks. As the United States faced the worst financial crisis since the Great Depression, the Fed took center stage. Whatever its role in the financial crisis of 2007–2008, the Fed remains an important backstop for banks and other financial institutions needing liquidity. And for that, it uses the traditional discount window, supplemented with a wide range of other credit facilities. The Case in Point in this section discusses these new credit facilities.

The Fed’s ability to buy and sell federal government bonds has proved to be its most potent policy tool. A bondA promise by the issuer of the bond to pay the owner of the bond a payment or a series of payments on a specific date or dates. is a promise by the issuer of the bond (in this case the federal government) to pay the owner of the bond a payment or a series of payments on a specific date or dates. The buying and selling of federal government bonds by the Fed are called open-market operationsThe buying and selling of federal government bonds by the Fed.. When the Fed buys or sells government bonds, it adds or subtracts reserves from the banking system. Such changes affect the money supply.

Suppose the Fed buys a government bond in the open market. It writes a check on its own account to the seller of the bond. When the seller deposits the check at a bank, the bank submits the check to the Fed for payment. The Fed “pays” the check by crediting the bank’s account at the Fed, so the bank has more reserves.

The Fed’s purchase of a bond can be illustrated using a balance sheet. Suppose the Fed buys a bond for $1,000 from one of Acme Bank’s customers. When that customer deposits the check at Acme, checkable deposits will rise by $1,000. The check is written on the Federal Reserve System; the Fed will credit Acme’s account. Acme’s reserves thus rise by $1,000. With a 10% reserve requirement, that will create $900 in excess reserves and set off the same process of money expansion as did the cash deposit we have already examined. The difference is that the Fed’s purchase of a bond created new reserves with the stroke of a pen, where the cash deposit created them by removing $1,000 from currency in circulation. The purchase of the $1,000 bond by the Fed could thus increase the money supply by as much as $10,000, the maximum expansion suggested by the deposit multiplier.

Figure 9.9

Where does the Fed get $1,000 to purchase the bond? It simply creates the money when it writes the check to purchase the bond. On the Fed’s balance sheet, assets increase by $1,000 because the Fed now has the bond; bank deposits with the Fed, which represent a liability to the Fed, rise by $1,000 as well.

When the Fed sells a bond, it gives the buyer a federal government bond that it had previously purchased and accepts a check in exchange. The bank on which the check was written will find its deposit with the Fed reduced by the amount of the check. That bank’s reserves and checkable deposits will fall by equal amounts; the reserves, in effect, disappear. The result is a reduction in the money supply. The Fed thus increases the money supply by buying bonds; it reduces the money supply by selling them.

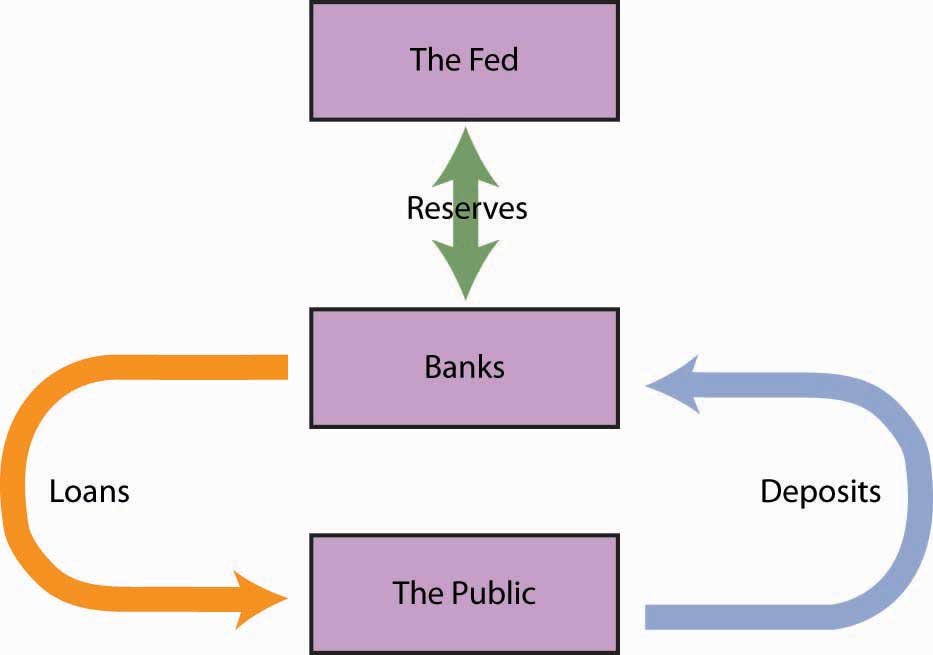

Figure 9.10 "The Fed and the Flow of Money in the Economy" shows how the Fed influences the flow of money in the economy. Funds flow from the public—individuals and firms—to banks as deposits. Banks use those funds to make loans to the public—to individuals and firms. The Fed can influence the volume of bank lending by buying bonds and thus injecting reserves into the system. With new reserves, banks will increase their lending, which creates still more deposits and still more lending as the deposit multiplier goes to work. Alternatively, the Fed can sell bonds. When it does, reserves flow out of the system, reducing bank lending and reducing deposits.

Figure 9.10 The Fed and the Flow of Money in the Economy

Individuals and firms (the public) make deposits in banks; banks make loans to individuals and firms. The Fed can buy bonds to inject new reserves into the system, thus increasing bank lending, which creates new deposits, creating still more lending as the deposit multiplier goes to work. Alternatively, the Fed can sell bonds, withdrawing reserves from the system, thus reducing bank lending and reducing total deposits.

The Fed’s purchase or sale of bonds is conducted by the Open Market Desk at the Federal Reserve Bank of New York, one of the 12 district banks. Traders at the Open Market Desk are guided by policy directives issued by the Federal Open Market Committee (FOMC). The FOMC consists of the seven members of the Board of Governors plus five regional bank presidents. The president of the New York Federal Reserve Bank serves as a member of the FOMC; the other 11 bank presidents take turns filling the remaining four seats.

The FOMC meets eight times per year to chart the Fed’s monetary policies. In the past, FOMC meetings were closed, with no report of the committee’s action until the release of the minutes six weeks after the meeting. Faced with pressure to open its proceedings, the Fed began in 1994 issuing a report of the decisions of the FOMC immediately after each meeting.

In practice, the Fed sets targets for the federal funds rate. To achieve a lower federal funds rate, the Fed goes into the open market buying securities and thus increasing the money supply. When the Fed raises its target rate for the federal funds rate, it sells securities and thus reduces the money supply.

Traditionally, the Fed has bought and sold short-term government securities; however, in dealing with the condition of the economy in 2009, wherein the Fed has already set the target for the federal funds rate at near zero, the Fed has announced that it will also be buying longer term government securities. In so doing, it hopes to influence longer term interest rates, such as those related to mortgages.

Suppose the Fed sells $8 million worth of bonds.

Well before most of the public became aware of the precarious state of the U.S. financial system, the Fed began to see signs of growing financial strains and to act on reducing them. In particular, the Fed saw that short-term interest rates that are often quite close to the federal funds rate began to rise markedly above it. The widening spread was alarming, because it suggested that lender confidence was declining, even for what are generally considered low-risk loans. Commercial paper, in which large companies borrow funds for a period of about a month to manage their cash flow, is an example. Even companies with high credit ratings were having to pay unusually high interest rate premiums in order to get funding, or in some cases could not get funding at all.

To deal with the drying up of credit markets, in late 2007 the Fed began to create an alphabet soup of new credit facilities. Some of these were offered in conjunction with the Department of the Treasury, which had more latitude in terms of accepting some credit risk. The facilities differed in terms of collateral used, the duration of the loan, which institutions were eligible to borrow, and the cost to the borrower. For example, the Primary Dealer Credit Facility (PDCF) allowed primary dealers (i.e., those financial institutions that normally handle the Fed’s open market operations) to obtain overnight loans. The Term Asset-Backed Securities Loan Facility (TALF) allowed a wide range of companies to borrow, using the primary dealers as conduits, based on qualified asset-backed securities related to student, auto, credit card, and small business debt, for a three-year period. Most of these new facilities were designed to be temporary. Starting in 2009 and 2010, the Fed began closing a number of them or at least preventing them from issuing new loans.

The common goal of all of these various credit facilities was to increase liquidity in order to stimulate private spending. For example, these credit facilities encouraged banks to pare down their excess reserves (which grew enormously as the financial crisis unfolded and the economy deteriorated) and to make more loans. In the words of Fed Chairman Ben Bernanke:

“Liquidity provision by the central bank reduces systemic risk by assuring market participants that, should short-term investors begin to lose confidence, financial institutions will be able to meet the resulting demands for cash without resorting to potentially destabilizing fire sales of assets. Moreover, backstopping the liquidity needs of financial institutions reduces funding stresses and, all else equal, should increase the willingness of those institutions to lend and make markets.”

The legal authority for most of these new credit facilities came from a particular section of the Federal Reserve Act that allows the Board of Governors “in unusual and exigent circumstances” to extend credit to a wide range of market players.

Sources: Ben S. Bernanke, “The Crisis and the Policy Response” (Stemp Lecture, London School of Economics, London, England, January 13, 2009); Richard DiCecio and Charles S. Gascon, “New Monetary Policy Tools?” Federal Reserve Bank of St. Louis Monetary Trends, May 2008; Federal Reserve Board of Governors Web site at http://www.federalreserve.gov/monetarypolicy/default.htm.

In this chapter we investigated the money supply and looked at how it is determined. Money is anything that serves as a medium of exchange. Whatever serves as money also functions as a unit of account and as a store of value. Money may or may not have intrinsic value. In the United States, the total of currency in circulation, traveler’s checks, and checkable deposits equals M1. A broader measure of the money supply is M2, which includes M1 plus assets that are highly liquid, but less liquid than those in M1.

Banks create money when they issue loans. The ability of banks to issue loans is controlled by their reserves. Reserves consist of cash in bank vaults and bank deposits with the Fed. Banks operate in a fractional reserve system; that is, they maintain reserves equal to only a small fraction of their deposit liabilities. Banks are heavily regulated to protect individual depositors and to prevent crises of confidence. Deposit insurance protects individual depositors. Financial reform legislation was enacted in response to the banking crisis during the Great Depression and again in response to the financial crisis in 2008 and the Great Recession.

A central bank serves as a bank for banks, a regulator of banks, a manager of the money supply, a bank for a nation’s government, and a supporter of financial markets generally. In the financial crisis that rocked the United States and much of the world in 2008, the Fed played a central role in keeping bank and nonbank institutions afloat and in keeping credit available. The Federal Reserve System (Fed) is the central bank for the United States. The Fed is governed by a Board of Governors whose members are appointed by the president of the United States, subject to confirmation by the Senate.

The Fed can lend to banks and other institutions through the discount window and other credit facilities, change reserve requirements, and engage in purchases and sales of federal government bonds in the open market. Decisions to buy or sell bonds are made by the Federal Open Market Committee (FOMC); the Fed’s open-market operations represent its primary tool for influencing the money supply. Purchases of bonds by the Fed initially increase the reserves of banks. With excess reserves on hand, banks will attempt to increase their loans, and in the process the money supply will change by an amount less than or equal to the deposit multiplier times the change in reserves. Similarly, the Fed can reduce the money supply by selling bonds.

A smart card, also known as an electronic purse, is a plastic card that can be loaded with a monetary value. Its developers argue that, once widely accepted, it could replace the use of currency in vending machines, parking meters, and elsewhere. Suppose smart cards came into widespread use. Present your views on the following issues:

Which of the following items is part of M1? M2?

Consider the following example of bartering:

| 1 10-ounce T-bone steak can be traded for 5 soft drinks. |

| 1 soft drink can be traded for 10 apples. |

| 100 apples can be traded for a T-shirt. |

| 5 T-shirts can be exchanged for 1 textbook. |

| It takes 4 textbooks to get 1 VCR. |

Suppose the Fed sells $5 million worth of bonds to Econobank.

Suppose a bank with a 10% reserve requirement has $10 million in reserves and $100 million in checkable deposits, and a major corporation makes a deposit of $1 million.

Suppose a bank with a 25% reserve requirement has $50 million in reserves and $200 million in checkable deposits, and one of the bank’s depositors, a major corporation, writes a check to another corporation for $5 million. The check is deposited in another bank.

Now consider an economy in which the central bank has just purchased $8 billion worth of government bonds from banks in the economy. What would be the effect of this purchase on the money supply in the country, assuming reserve requirements of:

Now consider the same economy, and the central bank sells $8 billion worth of government bonds to local banks. State the likely effects on the money supply under reserve requirements of: